Markets.com charges no commission on trades, deposits, or withdrawals but applies fees like 0.6% conversion charges, inactivity costs, and overnight swaps.

Customer support, available in multiple languages, operates 24/5 via email, live chat, and phone.

Platforms include MetaTrader 4, MetaTrader 5, TradingView, and a proprietary platform with advanced trading tools.

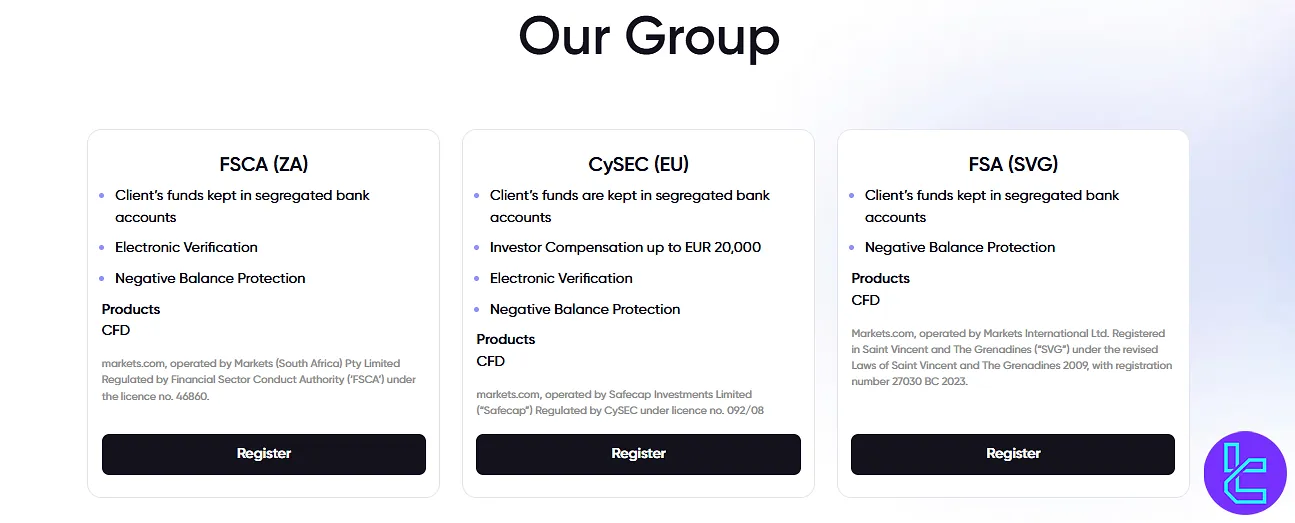

Company Information & Regulation

Markets.com is a well-established and fully regulated Forex broker with $3T+ trading volume and 7 offices around the world, according to the website. Company Information Based on Crunchbase:

- Founded Date: Oct 14, 2008

- Founders: Armando Gutierrez, Vicco von Bulow

- Headquarters: Miami, Florida, US

The broker is licensed and regulated by several top-tier financial authorities, including:

Entity Parameters | Safecap Investments Ltd | Markets (South Africa) Pty Ltd | Markets International Ltd |

Regulation | CySEC (licence 092/08) | FSCA (licence 46860) | Unregulated (FSA SVG) |

Regulation Tier | 1 | 2 | N/A |

Country | Cyprus (EU) | South Africa | St Vincent & the Grenadines |

Investor Protection Fund / Compensation Scheme | Up to EUR 20,000 (ICF) | None | None |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes |

Maximum Leverage | 1:30 | 1:300 | 1:300 |

Client Eligibility | Europe and territories, Iceland, Norway | Global applicants | Global applicants |

Markets.com maintains a strong global presence with robust regulation and investor protections where applicable. Its multi-entity structure ensures clients worldwide can trade with appropriate safeguards and leverage levels.

Important Specifics

To give you a brief overview of Markets.com's different aspects, here's a summary table of key specifications:

Broker | Markets.com |

Account Types | Retail, Professional |

Regulating Authorities | CySEC, FSCA, FSA |

Based Currencies | USD, EUR, GBP, ZAR, AUD, AED, DKK, CZK, PLN, etc. |

Minimum Deposit | $100 |

Deposit Methods | Visa, MasterCard, Bank Wire Transfer, Skrill, Neteller, PayPal, and Apple Pay |

Withdrawal Methods | Visa, MasterCard, Bank Wire Transfer, Skrill, Neteller, PayPal, and Apple Pay |

Minimum Order | 0.01 |

Maximum Leverage | 1:300 |

Investment Options | Social Trading |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, TradingView, Proprietary Platform |

Markets | CFDs on Forex, Shares, Indices, Crypto, ETFs, Bonds, and Commodities |

Spread | From 0.5 Pips |

Commission | None on Trading, Withdrawal and Deposits Inactivity Costs and Swap Fees Applied |

Orders Execution | Market, Instant |

Margin Call/Stop Out | 50% |

Trading Features | Negative Balance Protection, Client Funds in Segregated Accounts |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, Phone Call, Contact Form |

Customer Support Hours | 24/5 |

Which Account Types Are Available on Markets.com?

The broker offers 2 main account types, which is a drawback compared to many other brokers with various trading accounts. We will discuss each account below:

- Standard (Retail): With trading leverage up to 1:30 and negative balance protection

- Professional: For experienced traders meeting specific criteria, higher leverage (up to 1:300) and more flexible trading conditions, but reduced regulatory protections

The brokerage also offers a demo account with $10,000 in virtual funds for practice. Besides, an Islamic account is available for Muslim traders.

Advantages and Disadvantages

To help you have a clear and balanced image of Markets.com, let's weigh the pros and cons of trading with this broker:

Disadvantages | Advantages |

Inactivity Fees | Regulated By Multiple Top-Tier Authorities |

No Bonus Or Promotion Programs | User-Friendly Proprietary Platform And Popular MT4/MT5 Options |

Weekend Support Is Not Provided | Negative Balance Protection For Retail Clients |

Account Opening and Verification

Getting started with Markets.com is a simple process, but it takes time and patience. Here's a quick guide to Markets.com registration.

#1 Begin on the Broker’s Official Page

Access the registration through the official broker page or partner portals. Hit "Sign Up" to start.

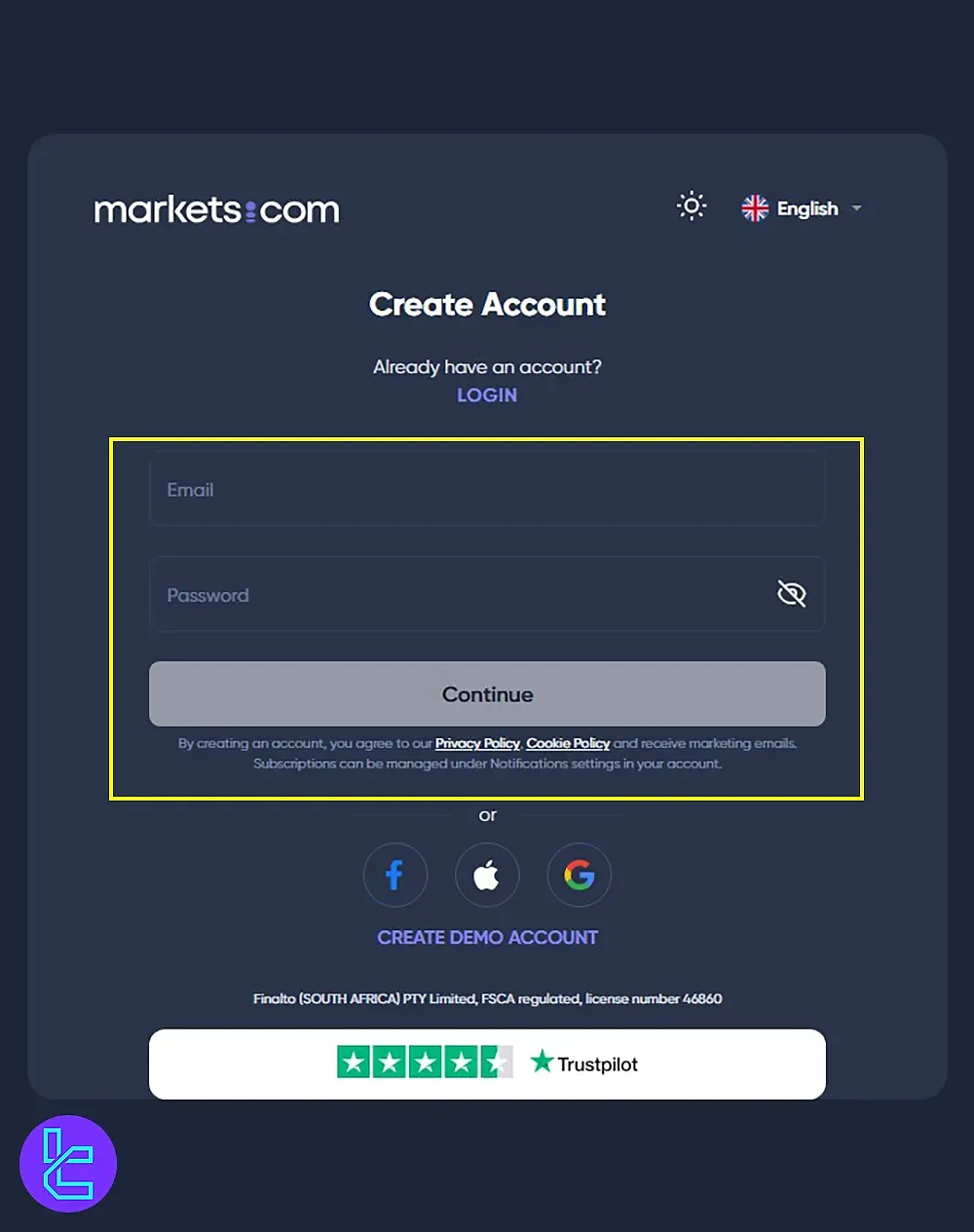

#2 Create Login Credentials

Enter a valid email address, set a strong password (uppercase, numbers, symbols), and proceed.

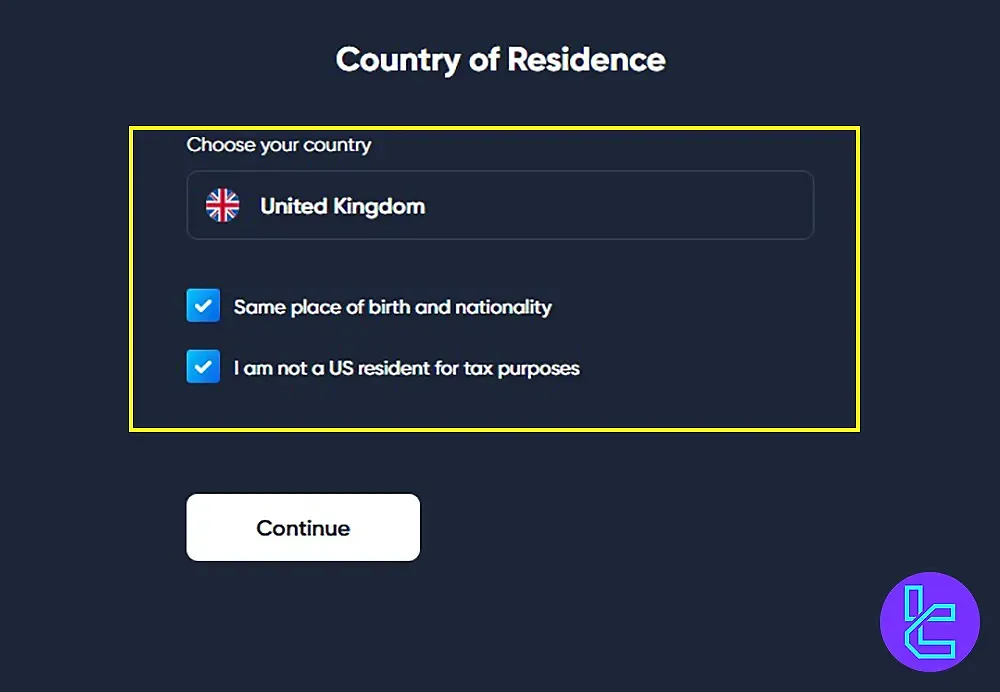

#3 National Eligibility Confirmation

Select your residency country, confirm you are not a U.S. citizen, and validate your nationality.

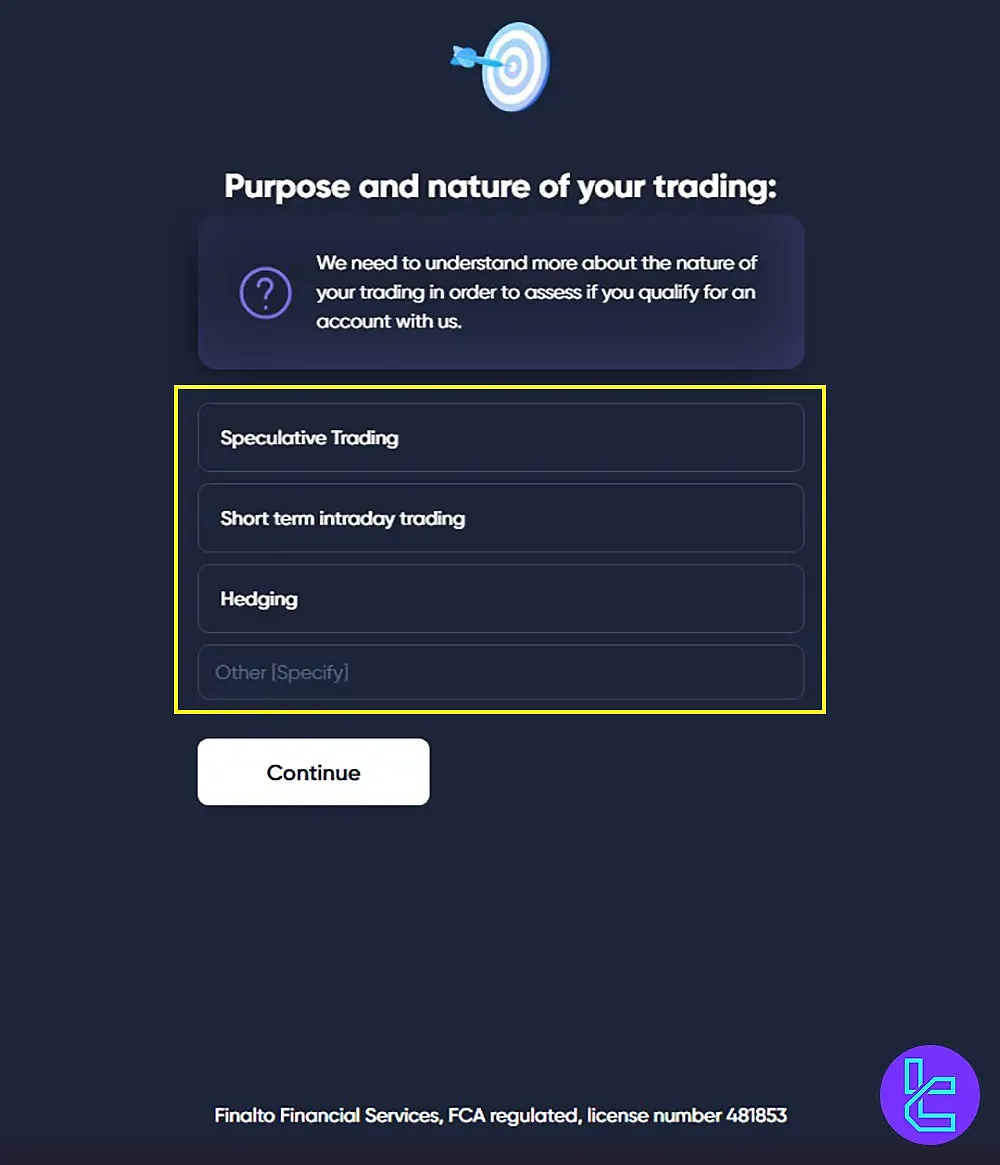

#4 Define Trading Objectives

Specify trading styles such as hedging, scalping, or intraday trading to tailor your account setup.

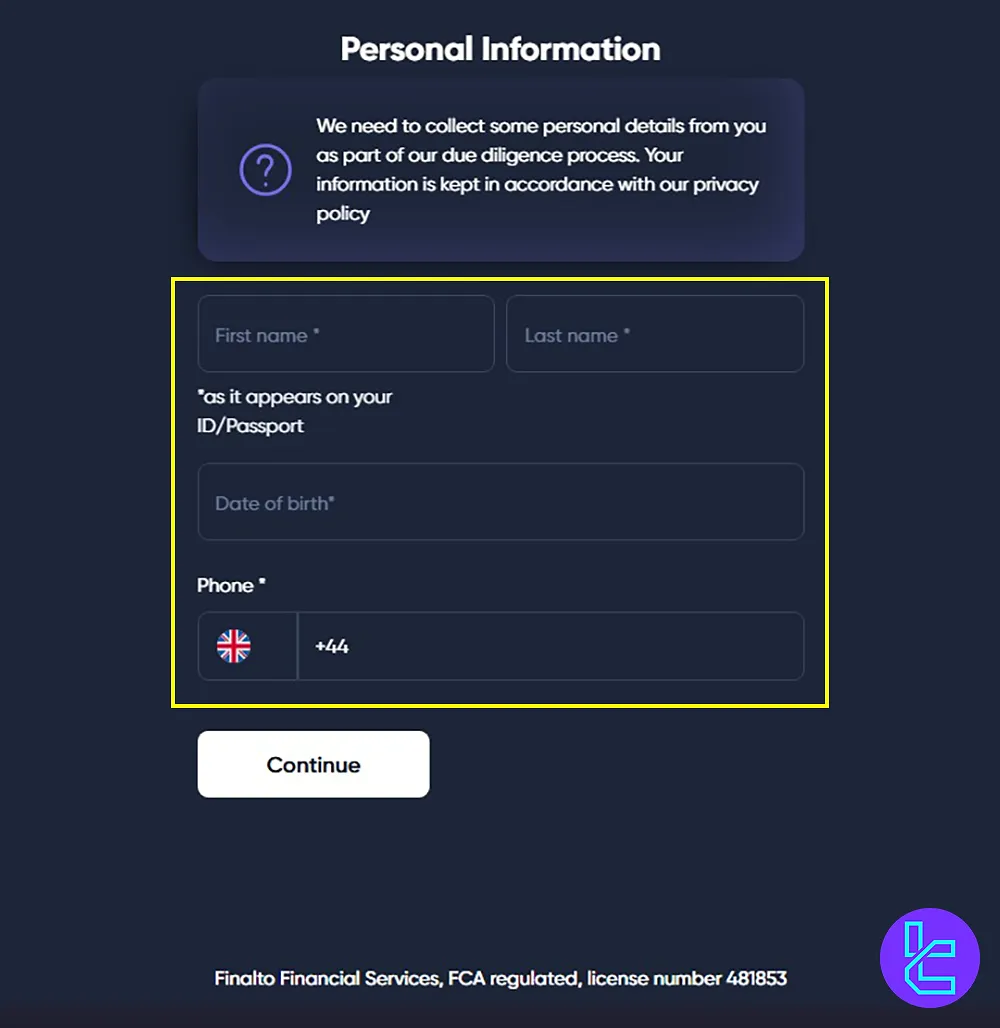

#5 Submit Identity & Contact Information

Provide these details for account identification:

- Full name

- Birth date

- Phone number

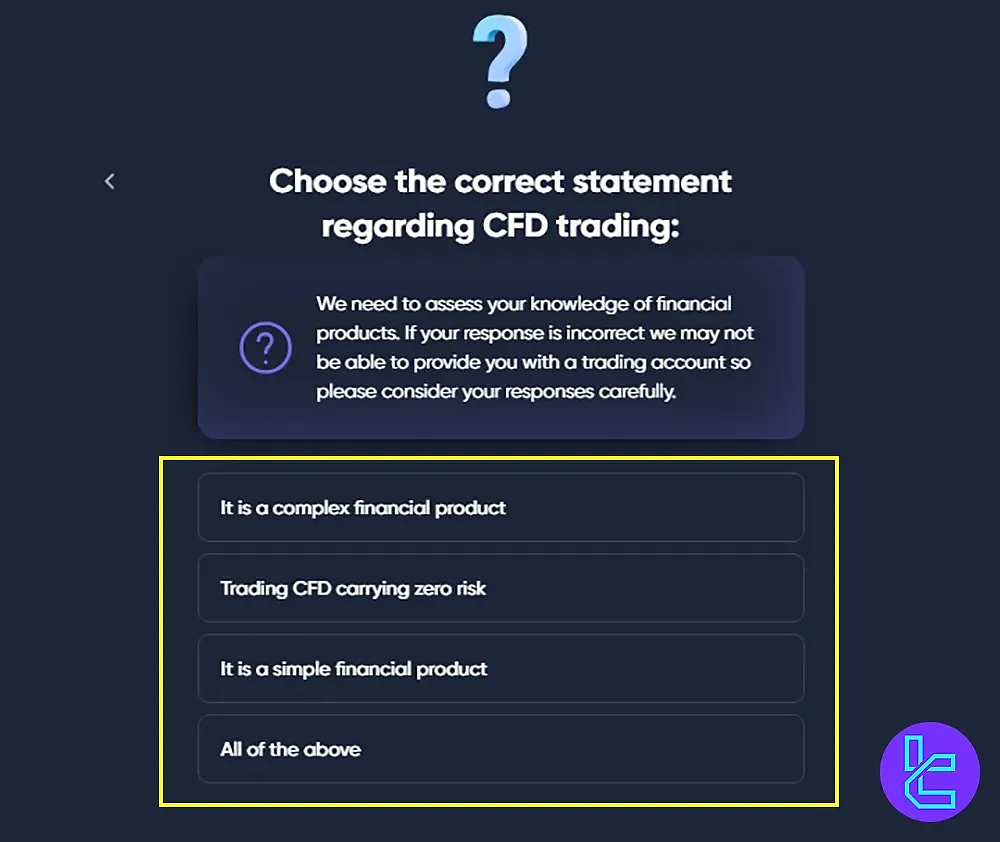

#6 Add Financial Profile

Answer questions related to these topics about yourself:

- Trading History

- Education

- Employment

- Income

- Planned Capital

A brief knowledge assessment on trading concepts is included.

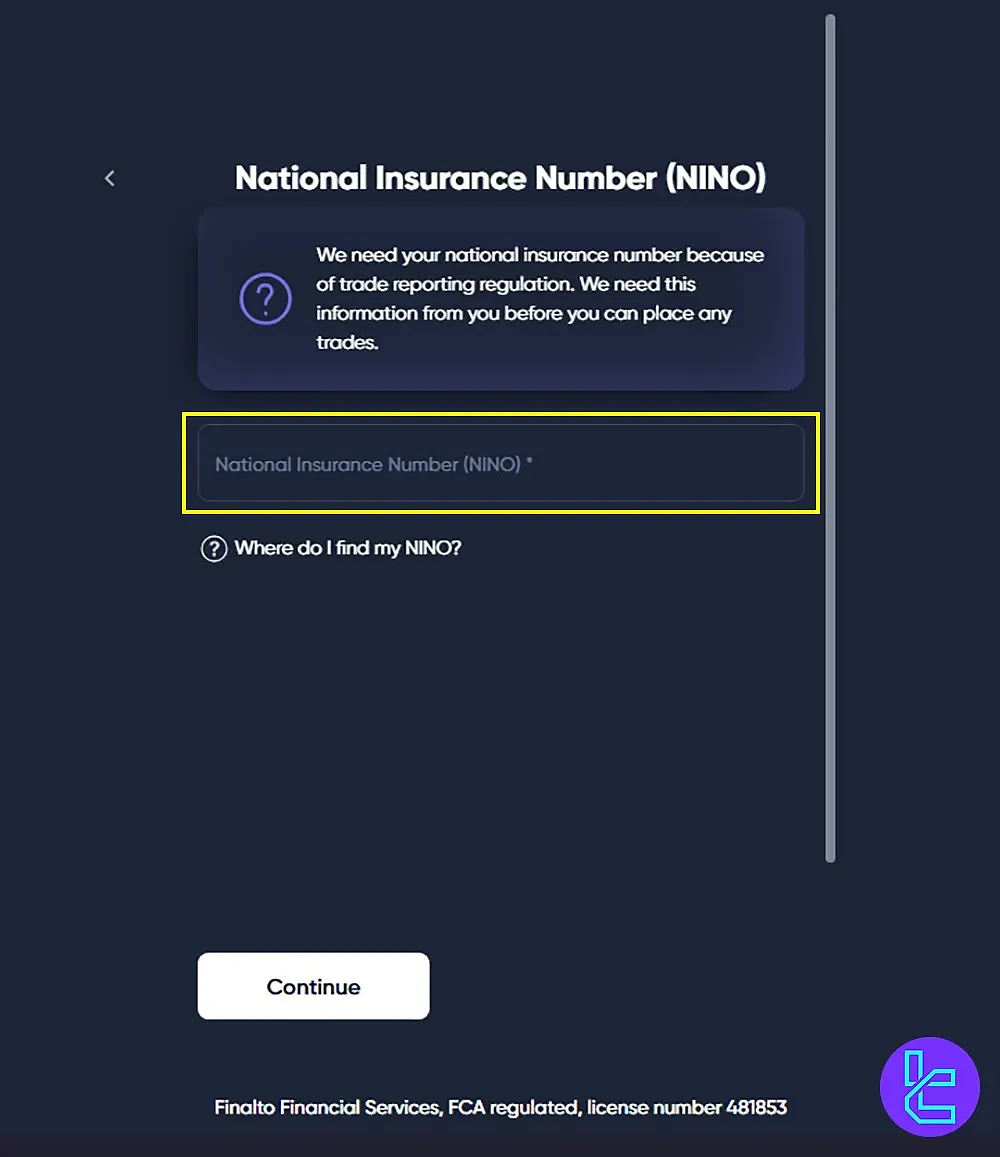

#7 Address & National ID

Input your physical address and enter your national insurance number or equivalent.

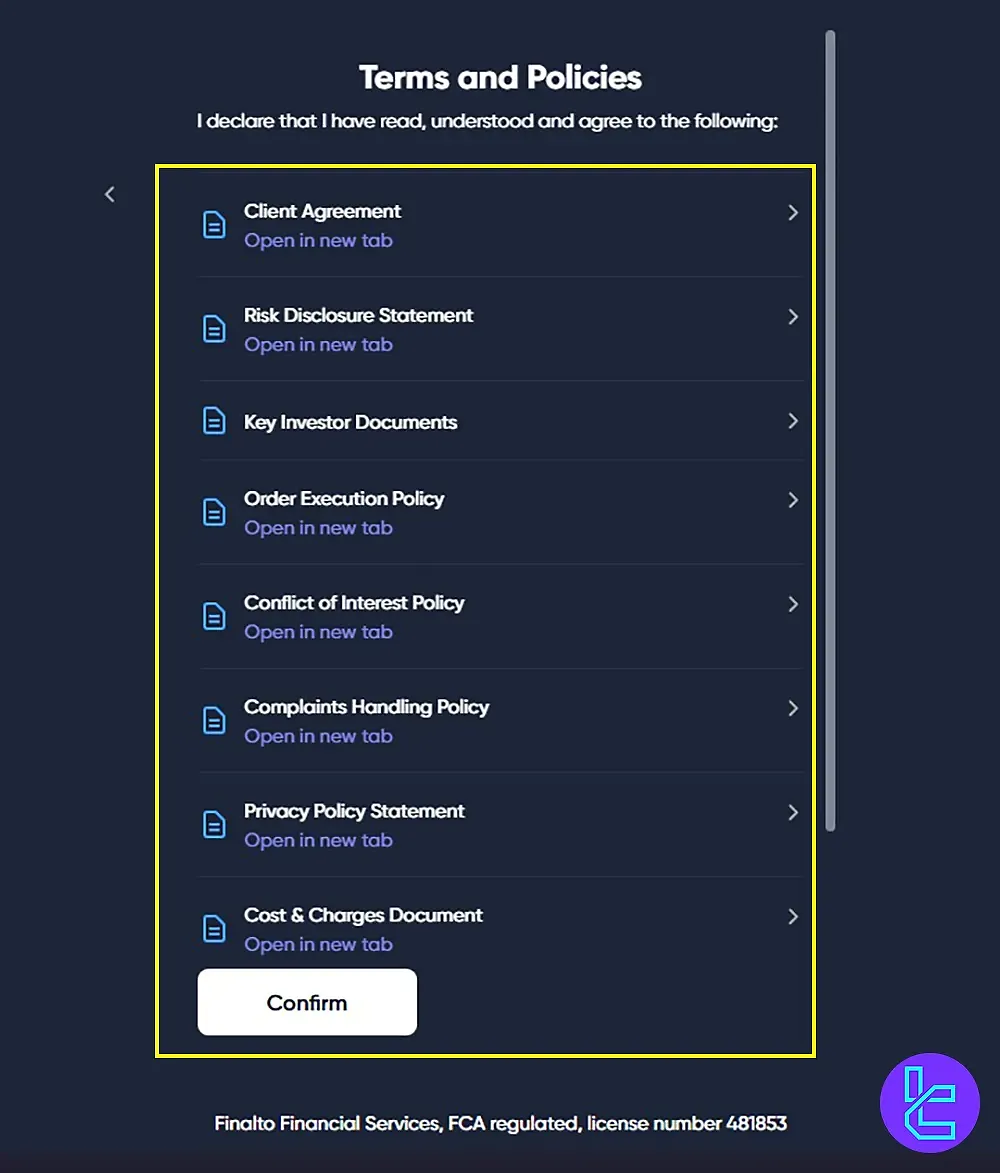

#8 Accept Legal Disclosures

Agree to the Client Agreement, Risk Disclosure, Execution Policy, and other key regulatory documents. At last, click Confirm.

#9 Finalize by Verifying Your Identity

Now, your account is created. For verification, upload proof of identity (e.g., passport, driver's license) and proof of residence (e.g., utility bill, bank statement).

Trading Platforms and Applications

Markets.com offers a diverse range of trading platforms with various features and specifics. In this section, we will take a look at each of them:

- TradingView: a popular trading platform with advanced visual analysis and a vibrant community

- MetaTrader 4: An easy-to-use platform offering expert advisors, one-click trading, etc.

- MetaTrader 5: An upgraded version of MT4 and the most advanced online platform developed by MetaQuotes Software

- Proprietary Platform: a user-friendly facility with powerful tools and without any hidden fees

TradingFinder has developed a wide range of advanced MT5 and MT4 indicators that you can use for free.

Each platform offers its unique strengths, allowing traders to choose the one that best fits their trading style and needs. You can download these platforms via the links in the table below:

OS | Proprietary app Download Link |

Android | |

iOS |

How Is The Structure of Spreads and Commissions?

Markets.com offers an average level of pricing for its traders. However, it does not charge any commission on trading. Here's a breakdown of its fee structure:

- Inactivity Fee: A fee charged by the broker when the client's account has been inactive for a certain period

- Conversion Fee: 0.6% cost when converting between currencies

- Overnight Swap: A fee charged for positions that are open overnight

- Trading Spreads: Variable spreads starting from 0.5 pips on major currency pairs. The exact spread depends on market conditions and the specific instrument being traded.

It's worth noting that Markets.com does not charge fees for deposits or withdrawals, although your payment provider might have its own fees.

Swap Fee at Markets.com

At Markets.com, the overnight swap fee is explicitly defined that each position carried past the daily rollover (21:00/22:00 GMT) incurs interest-differential plus a fixed markup, and it’s set out per instrument in the “Key Statistics” section.

The daily swap varies by asset and is clearly displayed for each symbol.

Here are the key points to keep in mind regarding swaps and related conditions:

- The swap is charged every day a position is held open past rollover time, and for FX pairs the rate is listed under “Buy” and “Sell” swap values;

- Instruments have different base swap rates (depending on underlying interest differentials + markup) which you can view under each instrument’s “Key Statistics”;

- For swap-free / Islamic accounts, no standard overnight swap is applied; instead a daily administration fee is charged to exempt swap interest.

Non-Trading Fees at Markets.com

Non-trading fees at Markets.com are clearly defined that a fixed inactivity fee per month applies to dormant accounts after 90 days of no trading or funding activity.

Also a small conversion charge is added when trades occur in a currency different from the account’s base currency. These costs are transparent and outlined in the broker’s “Costs and Charges” documentation.

Below are the key details to note:

- The inactivity fee is USD 10 per month once an account remains inactive for over 90 days;

- The inactivity fee is only deducted if the account has a positive balance; zero-balance accounts are unaffected;

- A currency conversion fee of 0.6% applies when your trade currency differs from the account’s base currency;

- No deposit or withdrawal fees are charged for most payment methods;

- The broker reserves the right to adjust administrative fees following prior notification to clients.

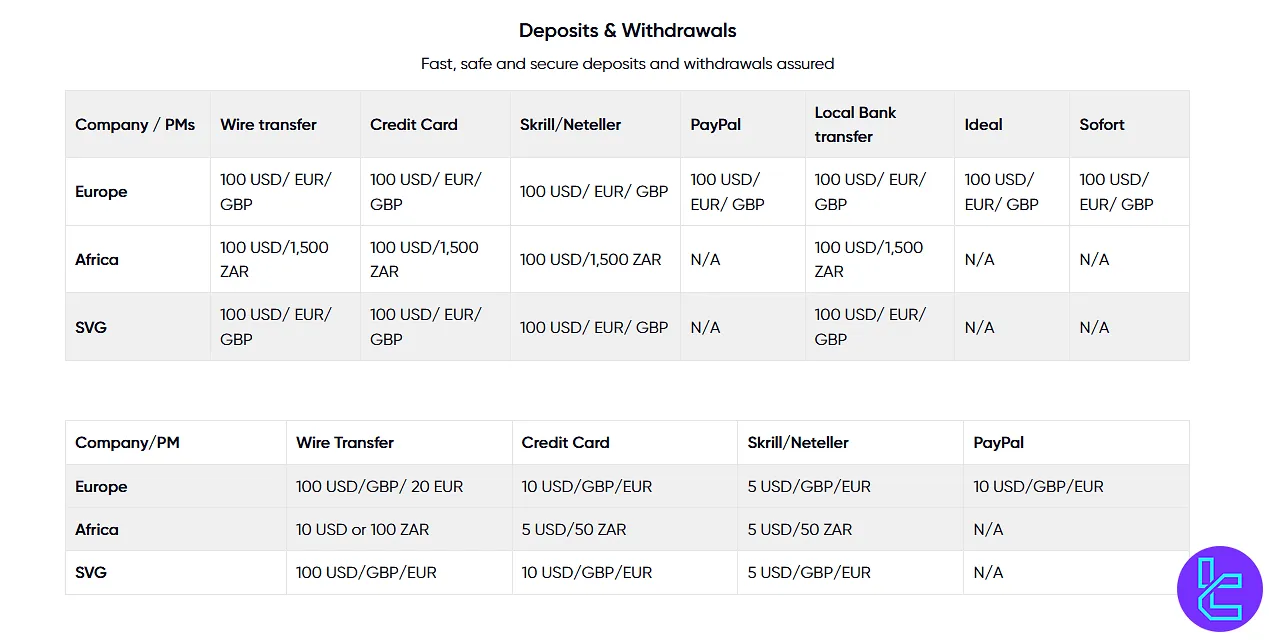

Deposit & Withdrawal Options

There are different platforms and providers for processing payments in brokers. Markets.com offers a variety of them:

- Credit/Debit Cards (Visa, MasterCard)

- Bank Wire Transfer

- E-wallets, including Skrill, Neteller, and PayPal

- Apple Pay

Always check the most up-to-date information on the Markets.com website, as payment methods and processing times may vary depending on your location and current regulations.

Deposit Methods at Markets.com

Markets.com offers a wide range of deposit options designed for fast and secure funding of trading accounts. All deposit methods are fee-free and typically processed instantly or within one business day, depending on the provider.

Minimum deposit amounts generally start from USD 100 (or equivalent), though this can vary slightly depending on the method and client jurisdiction.

Below is an overview of all supported deposit methods and their key parameters:

Deposit Method | Currency Options | Minimum Amount | Deposit Fee | Funding Time |

Wire Transfer | USD, EUR, GBP, ZAR | 100 USD / 1,500 ZAR | Free | 1–3 business days |

Credit / Debit Card | USD, EUR, GBP, ZAR | 100 USD / 1,500 ZAR | Free | Instant / Same day |

Skrill / Neteller | USD, EUR, GBP, ZAR | 100 USD / 1,500 ZAR | Free | Instant |

Pay Pal | USD, EUR, GBP | 100 USD / EUR / GBP | Free | Instant |

Local Bank Transfer | USD, EUR, GBP, ZAR | 100 USD / 1,500 ZAR | Free | 1–2 business days |

iDEAL | EUR | 100 EUR | Free | Instant |

Sofort | EUR | 100 EUR | Free | Instant |

Withdrawal Methods at Markets.com

Markets.com offers several secure withdrawal options aligned with its deposit methods, allowing traders to access funds securely and efficiently.

Withdrawals are typically processed within one business day by the broker, while the total time depends on the payment provider. No withdrawal fees are charged by Markets.com.

Below is an overview of all supported Withdrawal methods and their key parameters:

Withdrawal Method | Currency Options | Minimum Amount | Withdrawal Fee | Funding Time |

Wire Transfer | USD, EUR, GBP, ZAR | 100 USD / GBP / 20 EUR / 100 ZAR | Free | 2–5 business days |

Credit / Debit Card | USD, EUR, GBP, ZAR | 10 USD / GBP / EUR / 50 ZAR | Free | 2–7 business days |

Skrill / Neteller | USD, EUR, GBP, ZAR | 5 USD / GBP / EUR / 50 ZAR | Free | Up to 24 hours |

Pay Pal | USD, EUR, GBP | 10 USD / GBP / EUR | Free | Up to 24 hours |

Copy Trading & Investment Options

Actually, the broker offers only 1 investment method beyond traditional trading, and it has dedicated a special platform for it. Social Trading in Markets.com:

- Provided in partnership with Pelican Exchange Europe

- Ability to follow more experienced traders and copy their strategies

- Access to real-time signals

- Rankings for master traders

Download the social trading platform via the links below:

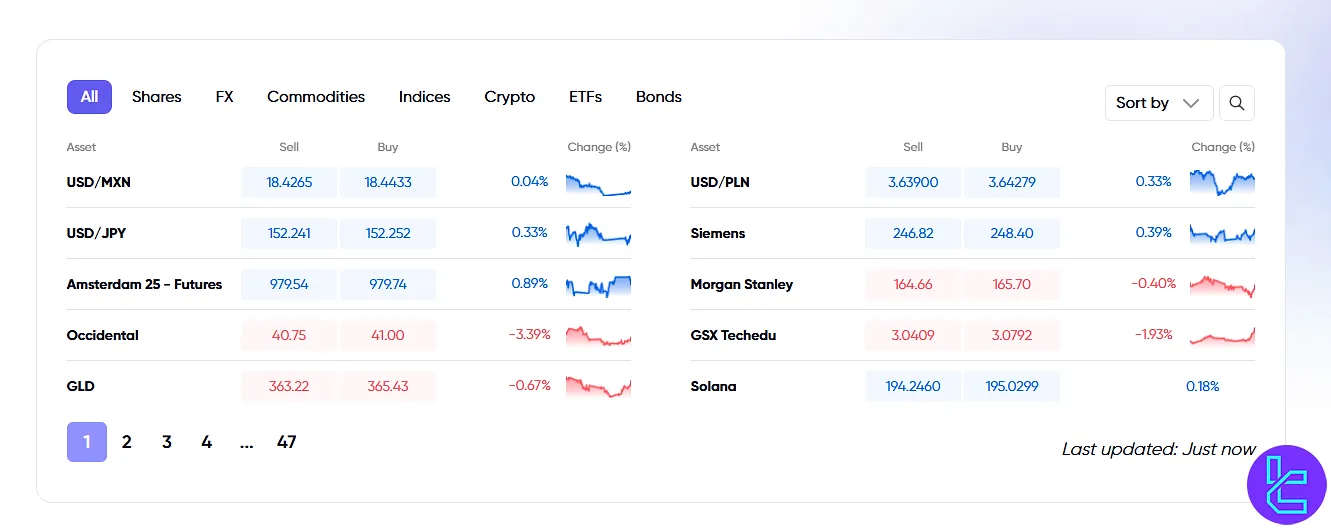

Tradable Markets and Instruments

Markets.com performs well in terms of market offerings, as it provides CFDs on a good range of tradable instruments across various asset classes:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Currency pairs (majors, minors, exotics) | 54 | ~60 pairs | 1:300 | |

Shares/Stocks | Equity CFDs across multiple exchanges | 257 | ~200–500 | 1:10 |

Commodities | Metals, energy, agricultural CFDs | 19 | ~20–40 | 1:200 |

Indices | Index CFDs (global market benchmarks) | 25 | ~20–30 | 1:200 |

Crypto CFDs (major tokens) | 40 | ~30–50 | 1:5 | |

ETFs | ETF CFDs | 67 | ~50 ETFs | 1:100 |

Bonds | Bond CFDs | 4 | ~5 | 1:100 |

Overall, there are over 350 trading symbols and assets available for clients on the broker.

Markets.com Broker Bonuses and Promotions

As of the time of writing, Markets.com does not offer any bonuses or promotional offers to new or existing clients.

While the lack of bonuses might seem disappointing at first, it's worth noting that many reputable brokers have moved away from offering bonuses due to regulatory constraints and a desire to promote responsible trading practices.

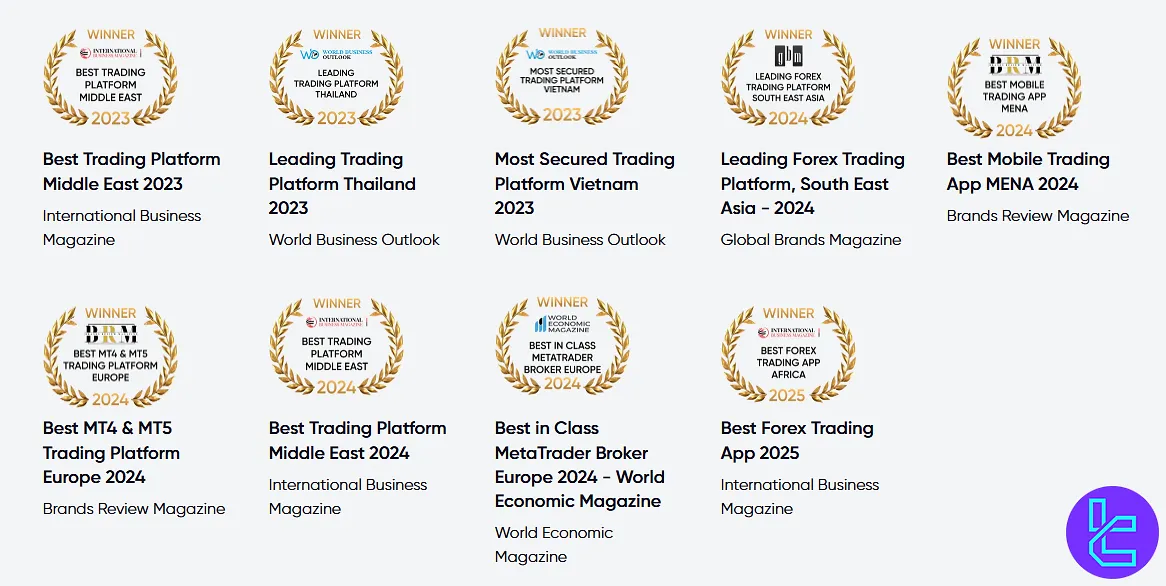

Markets.com Broker Awards

Markets.com has built a strong reputation in the trading industry by consistently delivering high-quality platforms, secure environments, and innovative tools for traders worldwide.

Its commitment to excellence is reflected in numerous Market.com awards received over the years, highlighting both technological innovation and user experience.

Below are some of the most notable recognitions:

- Best Trading Platform Middle East 2023

- Leading Trading Platform Thailand 2023

- Most Secured Trading Platform Vietnam 2023

- Leading Forex Trading Platform, South East Asia 2024

- Best Mobile Trading App MENA 2024

- Best MT4 & MT5 Trading Platform Europe 2024

- Best Trading Platform Middle East 2024

- Best in Class MetaTrader Broker Europe 2024

- Best Forex Trading App 2025

How and When Can I Contact Support?

Markets.com, just like other forex brokers, provides multiple channels for customer support to ensure traders can get help when they need it:

- Live Chat: Available on the Markets.com website or through WhatsApp via +97145429158

- Phone Call: 24/5 global support line at +27 104470539.

- Email: Send inquiries to support@markets.com

- Online Form: Submit detailed queries through the website's contact form.

Support is available in multiple languages, including English, Arabic, French, Italian, and Spanish. Unfortunately, the support team is available 24/5.

List of Restricted Countries and Regions

While Markets.com serves clients from many countries worldwide, there are some restrictions due to regulatory limitations and international sanctions. The list of restricted countries includes, but is not limited to:

- United States

- Canada

- China

- Japan

- North Korea

- Iran

- Iraq

- Sudan

- Syria

- Somalia

It's important to note that this list can change based on evolving regulations and company policies.If you're residing in or a citizen of a restricted country, you'll need to look for alternative brokers that are licensed to operate in your jurisdiction.

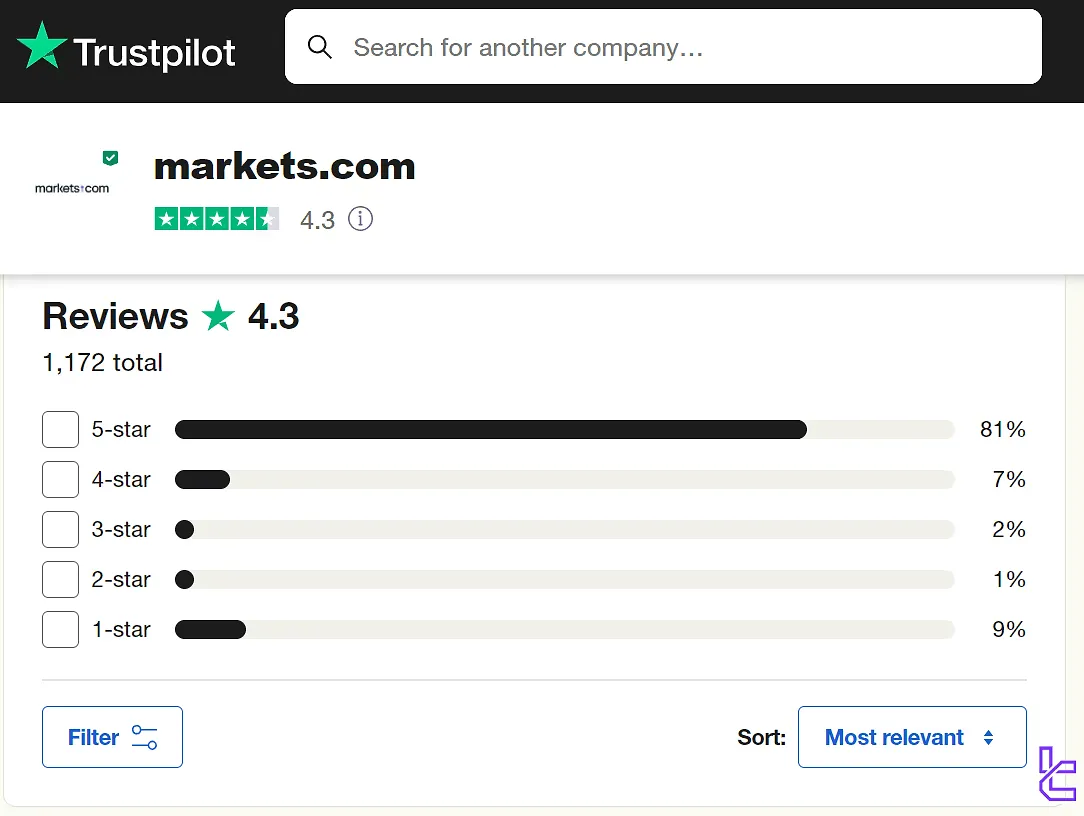

Trust Scores & User Ratings

Trust and reputation are crucial factors when choosing a broker. Usually, these parameters are observable on websites such as Trustpilot. Let's look at how Markets.com fares in online reviews and trust scores:

- Markets.com Trustpilot: Markets.com has a score of 4.3/5 based on over 1,000 reviews. This indicates a generally positive sentiment among users.

- ForexPeaceArmy: The broker has a lower score of 1.9/5 on this platform, with only around 50 ratings.

While online reviews can provide insights into user experiences, it's important to approach them critically. Consider the overall picture, including regulation and company history.

Does Markets.com Provide Any Educational Content?

The broker tries to help traders improve and perform better by providing some educational resources on its official website. These resources include:

- Webinars on trading and financial markets

- Glossary for technical terms in finance and trading

- News & analysis articles

Markets.com might not offer a comprehensive broker on Forex trading, but it does a better job than some of its competitors in teaching and guiding clients.

How Markets.com Fares Compared to the Industry Players

This section is dedicated to a comprehensive comparison between the mentioned brokerage and its competitors:

Parameter | Markets.com Broker | FBS Broker | Alpari Broker | FXGT Broker |

Regulation | CySEC, FCA, ASIC, FSCA, BVI FSC, FSA | FSC, CySEC | MISA | VFSC, CySEC, FSA, FSCA |

Minimum Spread | 0.5 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | None | From $0.0 | From $0.0 | From $0.0 |

Minimum Deposit | $100 | $5 | $50 | $5 |

Maximum Leverage | 1:300 | 1:3000 | 1:3000 | 1:5000 |

Trading Platforms | Metatrader 4, Metatrader 5, TradingView, Proprietary Platform | MT4, MT5, Mobile App | MetaTrade 4, MetaTrade 5, Mobile App, Web Trader | MT4, MT5 |

Account Types | Retail, Professional | Standard | Standard, ECN, Pro ECN, Demo | Standard+, ECN Zero, Mini Optimus, Pro |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 350+ | 550+ | 120+ | N/A |

| Trade Execution | Market, Instant | Market | Market | Market |

Conclusion and Final Words

Markets.com is suitable for beginner and professional traders. The broker offers a demo account with $10,000 in virtual funds, a minimum order size of 0.01, and negative balance protection.

Its innovative social trading feature, provided in partnership with Pelican Exchange Europe, allows users to follow experienced traders.

Payment methods include Visa, MasterCard, Skrill, Neteller, PayPal, and Apple Pay, with no broker-imposed fees on deposits or withdrawals.