Mitrade offers commission-free trading across 5 asset classes, including Forex and ETFs, with leverage options of up to 1:200.

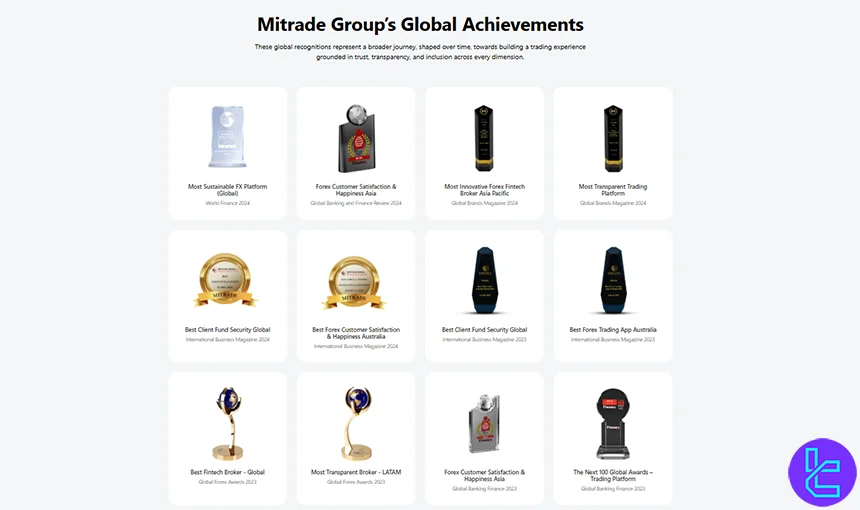

The broker has won multiple awards, includingForex Customer Satisfaction & Happiness Asia 2024 and the Best Forex Trading App Australia 2023.

Mitrade; Company Background and Regulatory Status

Mitrade is a global online trading platform founded in Melbourne, Australia, in 2011, with over 3 million users worldwide.

The company was founded by Chenxi Wang, according to CrunchBase. It operates through multiple entities regulated by various authorities in different jurisdictions, including:

Entity Parameters / Branches | Mitrade Holding (Cayman) | Mitrade Global (Australia) | Mitrade EU (Cyprus) | Mitrade International (Mauritius) |

Regulation | CIMA (SIB 1612446) | ASIC (AFSL 398528) | CySEC (CIF 438/23) | FSC Mauritius (GB20025791) |

Regulation Tier | 3 | 1 | 1 | 3 |

Country | Cayman Islands | Australia | Cyprus | Mauritius |

Investor Protection Fund / Compensation Scheme | None | None | ICF (up to EUR 20000) | None |

Segregated Funds | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:200 | 1:30 | 1:30 | 1:200 |

Client Eligibility | Global (non-EU / non-AU) | Australia + non-EU regions | EU / EEA | Global (except restricted) |

All entities maintain segregated accounts and offer negative balance protection. However, investor compensation schemes vary across jurisdictions.

Mitrade Broker Specifications

The Forex broker offers a comprehensive trading experience with a range of features designed to cater to traders of all levels.

Broker | Mitrade |

Account Types | Live, Demo |

Regulating Authorities | CIMA, CySEC, ASIC, FSC |

Based Currencies | USD, AUD |

Minimum Deposit | USD 20 |

Deposit Methods | Visa, MasterCard, PayID, Skrill, Neteller, Bank Transfer |

Withdrawal Methods | Visa, MasterCard, PayID, Skrill, Neteller, Bank Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:200 |

Investment Options | None |

Trading Platforms & Apps | Proprietary platform |

Markets | Forex, Indices, Shares, Commodities, ETFs |

Spread | Floating |

Commission | $0 |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Demo account, Mobile Trading, Trading Central Access |

Affiliate Program | Yes |

Bonus & Promotions | Referral, Welcome Bonus, Reward Campaign |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, Ticket, Live Chat |

Customer Support Hours | 24/5 |

Account Offerings

Mitrade keeps its account structure simple, focusing on providing a seamless trading experience for all users. The platform offers two main account types: Live and Demo.

Demo Account

- A USD 50,000 or AUD 50,000 balance of virtual money

- Auto replenishments on accounts below USD 200 or AUD 200

- Valid for 90 days

Live Account

- A minimum deposit requirement of $20

- A 50% stop out level

- No commissions

- Variable leverage options based on your region and the instrument

- USD and AUD as base currencies

A professional account exists for experienced traders but is not promoted actively to general retail clients.

Retail clients under CySEC and ASIC entities receive conservative leverage due to local regulation. High leverage is accessible under offshore entities.

Islamic Account in Mitrade

Mitrade does not offer Islamic accounts for swap-free trading, regardless of entity or jurisdiction. This may be a limitation for Muslim traders adhering to Sharia law.

Mitrade Advantages and Disadvantages

The company was named the Most Transparent Forex Broker Globally in 2022, the Best Mobile Trading Platform in 2021, and the Most Innovative Brokerage Firm in 2020.

However, like any other platform, Mitrade has some downsides, too.

Pros | Cons |

User-friendly proprietary platform | Geo-restrictions |

Wide range of trading instruments | No MetaTrader 4/5 support |

Competitive spreads and no commissions | No cryptocurrency offerings |

Regulated by multiple tier-1 authorities | No social/copy trading services |

Account Opening and KYC

The Mitrade registration grants access to a secure multi-asset trading platform. The process takes less than 10 minutes and includes submitting identity, financial background, and tax-related details.

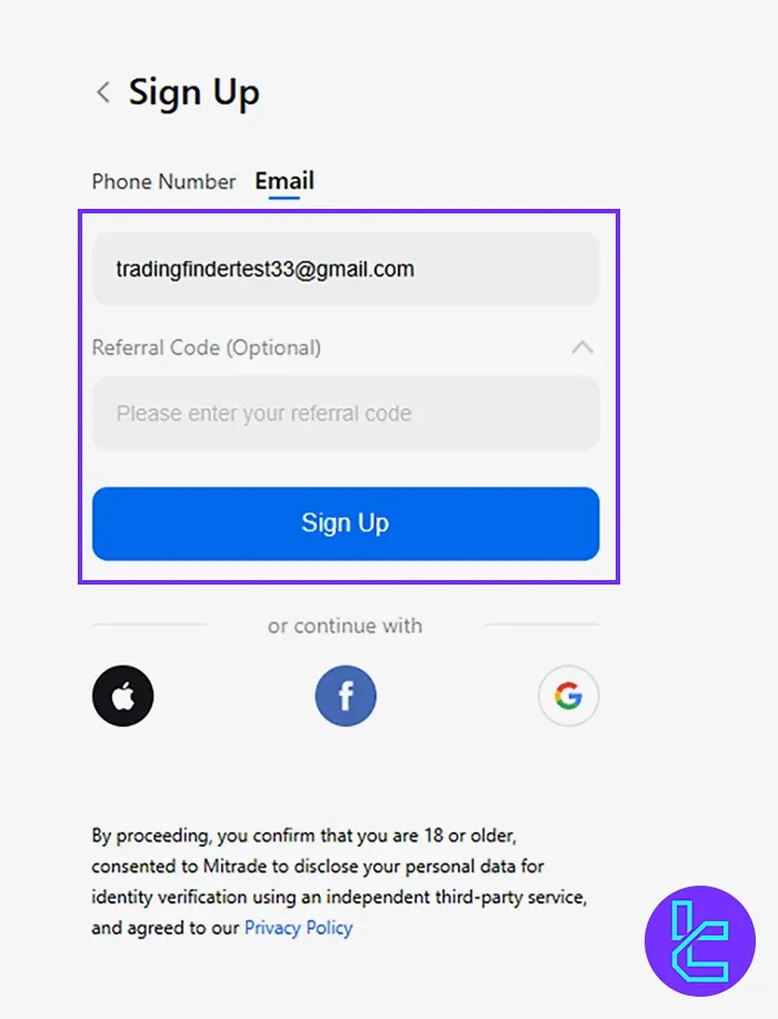

To open a live account on Mitrade, you must first sign up for a demo by providing your email address or phone number.

#1 Begin on the official website

Visit the MITrade homepage and click "Trade Now" to launch registration.

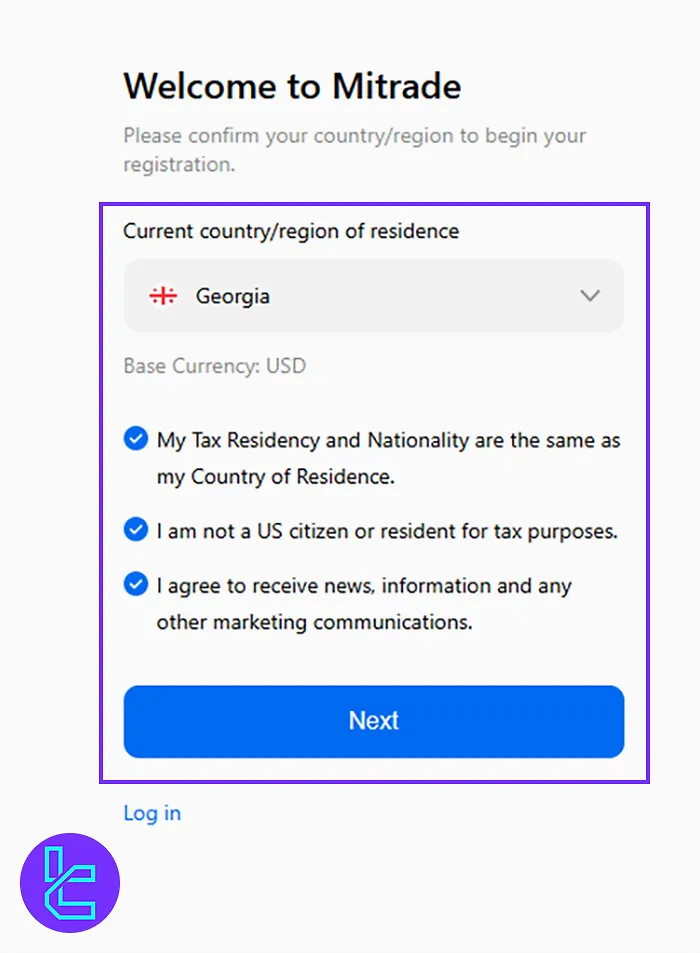

#2 Select country & accept terms

Choose your country of residence. Review and accept MITrade’s terms and conditions.

#3 Sign up via email or phone

Provide your email address or mobile number to receive the verification code.

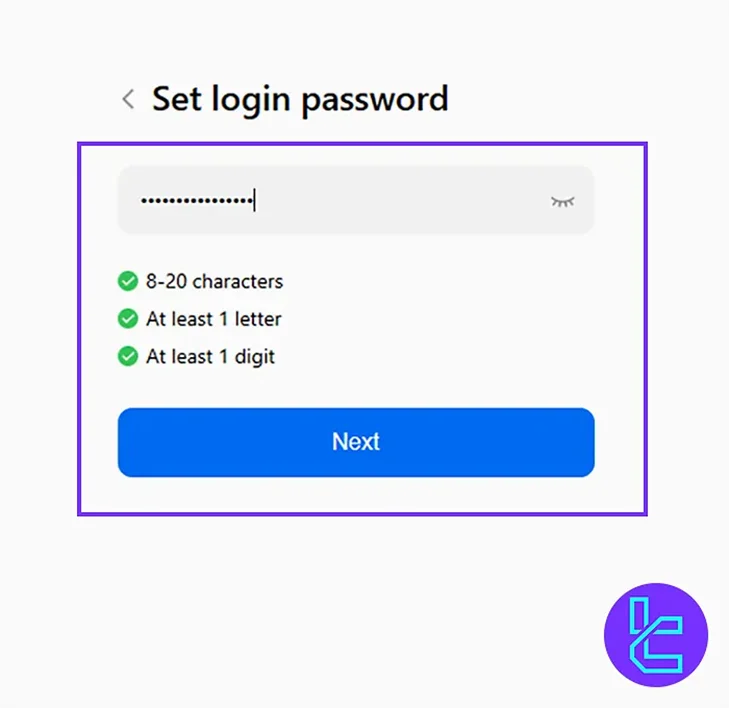

#4 Create a secure password

Set a password (8–20 characters) including symbols, numbers, uppercase, and lowercase letters.

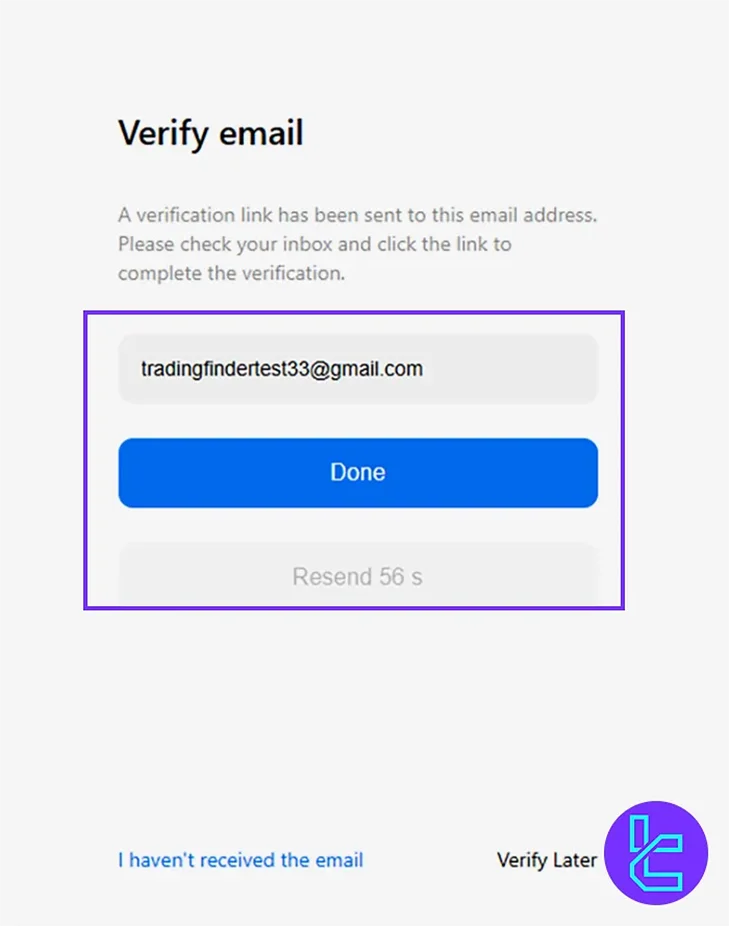

#5 Verify email

Open your email inbox, click "Verify Now", and continue to the next stage.

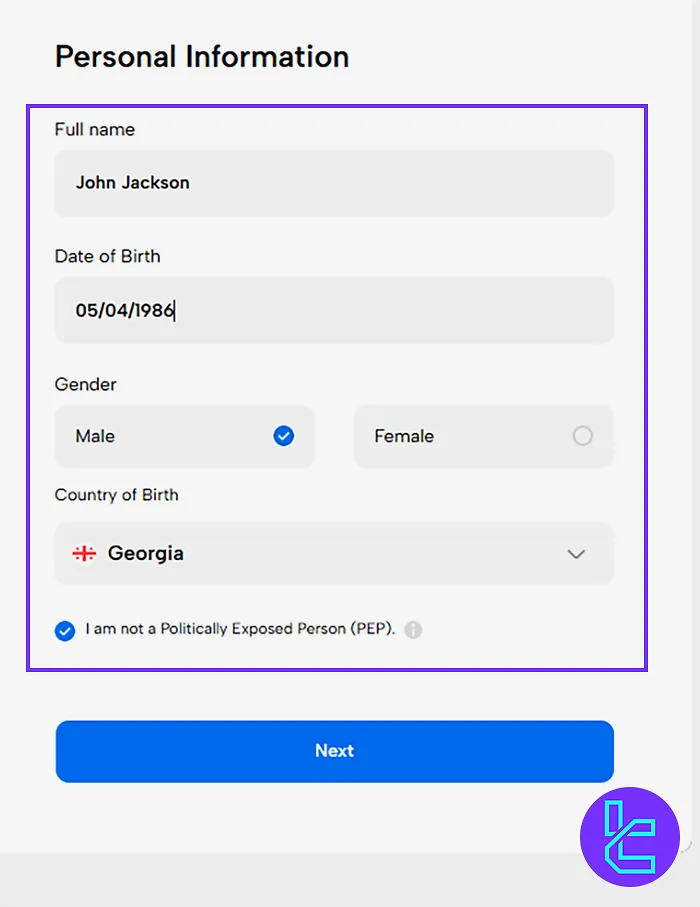

#6 Complete personal profile & tax details

Log in to the client dashboard, click “Switch to Live Account”, and fill out the application form with the following information:

- Full name

- Date of birth

- Gender

- Job title

- Industry

- Source of income

- Annual income

- Education level

Complete a questionnaire to confirm your trading experience and provide your tax identification number if applicable.

#7 Fill in Employment and Financial Information on Mitrade

Provide accurate employment and financial details to ensure your account setup complies with regulatory standards.

- Choose your occupation and specify the type of job you hold;

- Select the industry sector in which you are employed;

- Enter the name of your business, if applicable;

- Provide information about your income sources and planned investment amount;

- Indicate your annual income and total savings.

#8 Answer Education and Trading Experience Questions in Mitrade

This step helps Mitrade assess your knowledge and experience in financial markets.

- Select your highest education level achieved;

- Respond to commonly asked questions regarding trading familiarity;

- Specify your prior experience in over-the-counter (OTC) markets.

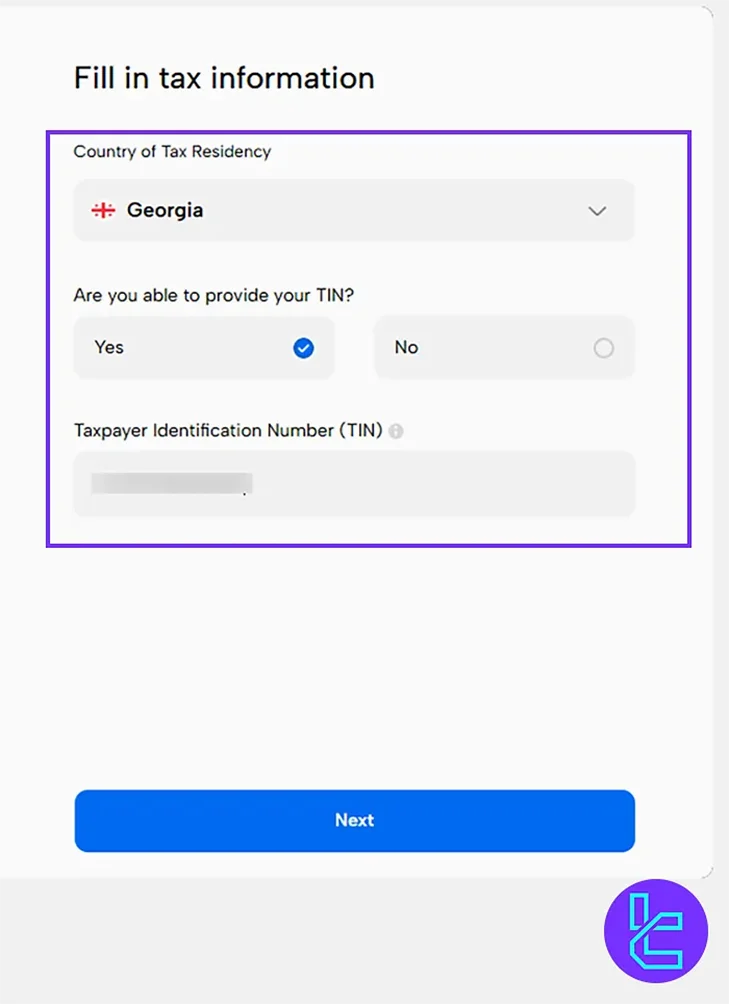

#9 Confirm Mitrade Terms and Tax Information

Review and accept the platform’s legal requirements and taxation obligations before proceeding.

- Agree to the website’s terms and conditions, then click "Next";

- Select your country of taxation from the available options;

- Enter your tax identification number if applicable, then proceed by clicking "Next".

#10 Mitrade KYC verification

Upload supporting documents to complete the KYC procedure.

- Proof of Identity: Passport or Driver’s license

- Proof of Address: Utility bill or Bank statement

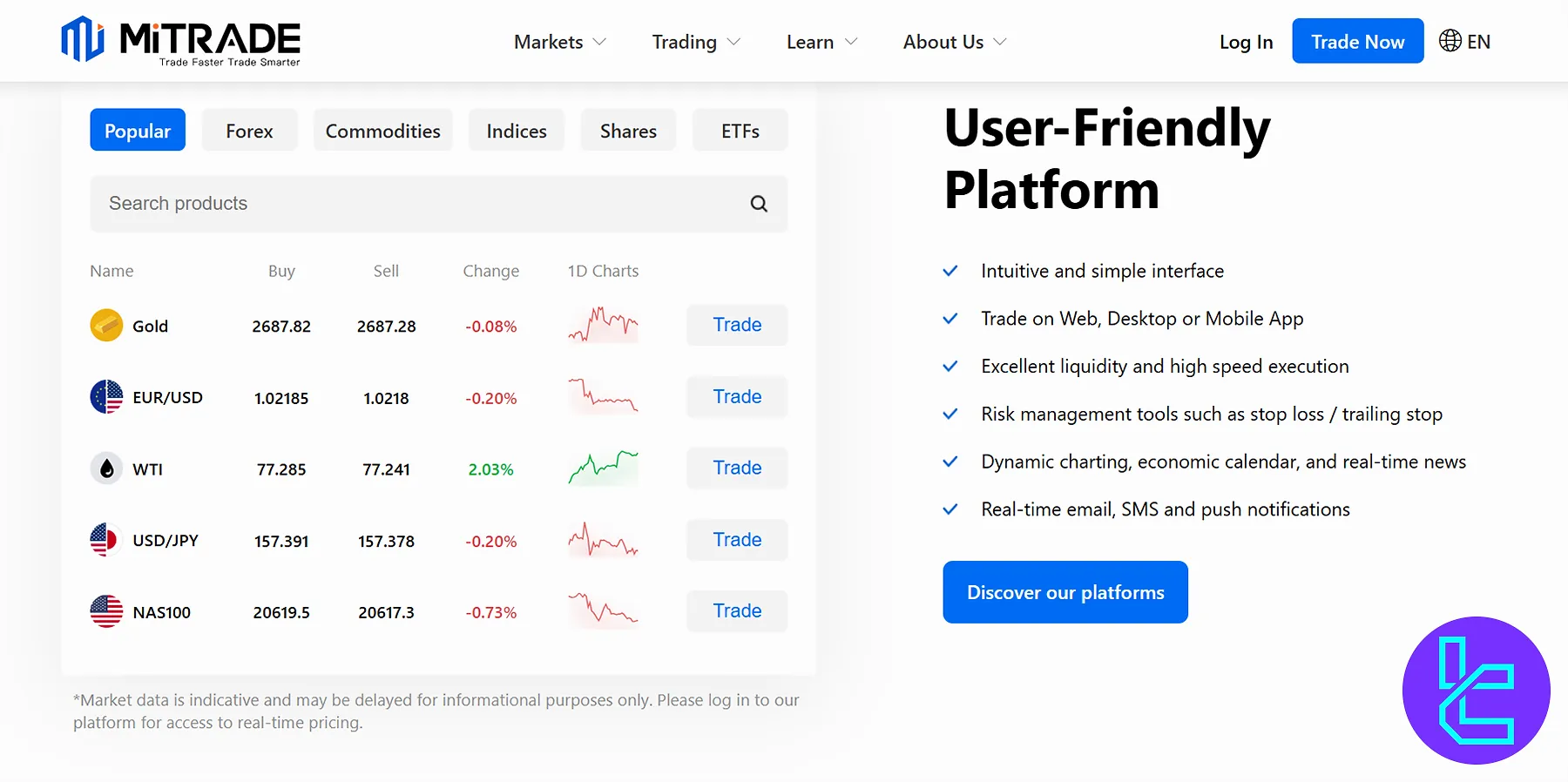

Mitrade Apps and Platforms

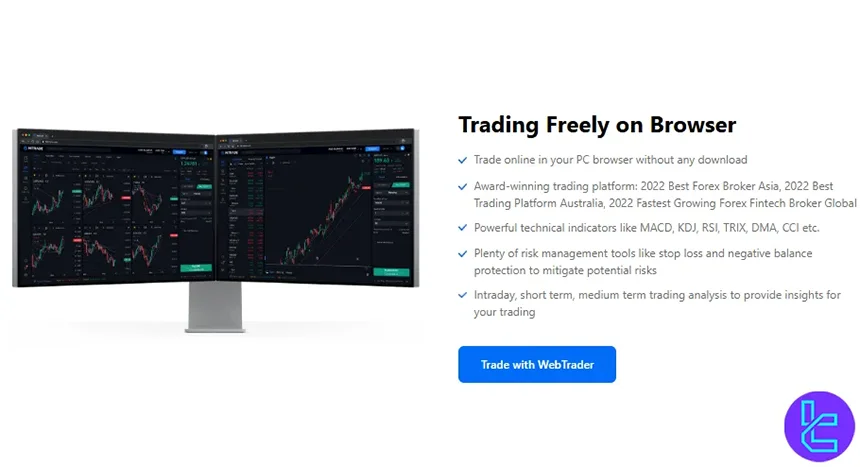

The lack of support for advanced trading solutions, such as MetaTrader, is one of the most significant downsides in this Mitrade review.

The broker only offers a proprietary trading platform powered by TradingView available across various devices, including:

- Mitrade Android

- Mitrade iOS

- Desktop

- WebTrader

Mitrade trading platforms' key features:

- Web Platform: Intuitive layout with over 150 indicators, 74 drawing tools, and multiple chart types, Ideal for price action traders and technical analysis

- Mobile App: Functional for on-the-go trading with integrated research, alerts, and real-time data

Fees and Commissions

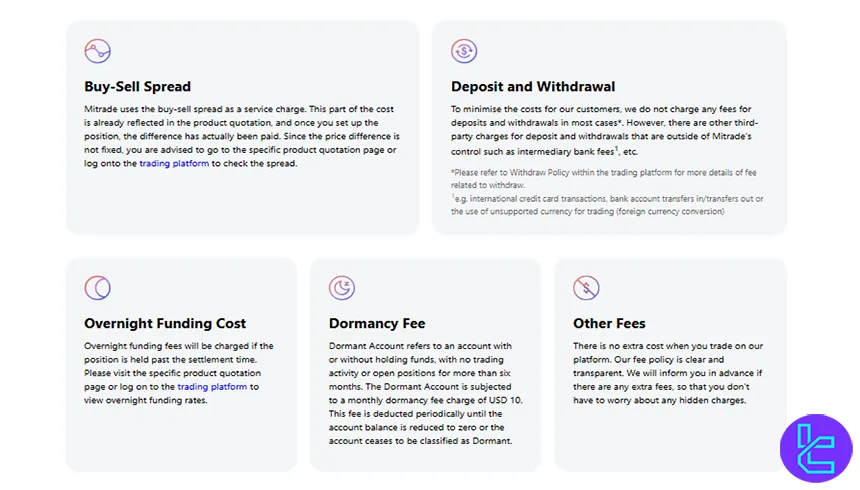

The company operates on a simple fee structure, with most costs built into the spread. Key features of Mitrade fee structure:

- No commissions

- Competitive floating spreads, variable based on the instrument

- No deposit, withdrawal, or inactivity fees

- Swap charges for overnight positions

- Gold trades with 35–37 pip spreads

- Bitcoin trading with a spread of $60

This transparent structure ensures traders understand costs upfront, making trading predictable and straightforward.

The table below gathers the spread charges for the most popular trading instruments across the Forex market.

Currency Pair | Floating Spread |

EURUSD | 0.00006 |

AUDUSD | 0.00004 |

USDJPY | 0.014 |

AUDJPY | 0.020 |

GBPUSD | 0.00008 |

USDCAD | 0.00010 |

USDCHF | 0.00014 |

Swap Fee at Mitrade Broker

Overnight (swap) costs on Mitrade are clearly disclosed on their official site: when you hold a position past GMT 22:00, a daily overnight funding adjustment is applied to your account, either debited or credited based on the current rate.

According to Mitrade’s Product Disclosure Statement, the rate could be, for example, –0.0185% for a EUR/USD long position, which on a 100,000-unit contract at 1.13588 would be charged as USD 21.01 per day.

Here are some key points to keep in mind about broker’s swap / overnight funding:

- The overnight funding rate is displayed per instrument on the Mitrade platform, not a flat rate;

- The fee is based on either the contract value or the borrowed amount (i.e. contract value minus initial margin), depending on the product;

- No overnight funding is charged if you open and close a position within the same trading session;

- Mitrade does not offer swap-free / Islamic trading accounts;

- The latest applicable overnight funding rate is available in the platform’s market data and may change – especially in volatile times.

Non-Trading Fees at Mitrade Broker

Mitrade’s non-trading fee policy is clean and mostly cost-efficient: there’s no fee for deposits or withdrawals in most cases, but they do charge for inactivity under certain conditions.

If your account is inactive (no trades, no open positions) for more than six months, Mitrade levies a USD 10 monthly dormancy fee.

Here are the key non-trading fees to be aware of:

- Deposits and withdrawals typically have no fees charged by Mitrade itself (but third-party / bank charges may apply);

- The dormancy fee continues to be deducted each month until the account balance reaches zero or the account becomes active again.

Mitrade Broker Payment Options

The company offers a variety of payment methods to cater to its global client base, from bank transfers to e-wallets.

However, the lack of support for Crypto transactions can be a letdown for potential clients.

- Credit/Debit Cards: Visa and Mastercard

- E-wallets: Skrill and Neteller

- Bank Wire Transfer

Withdrawal requests are usually processed within 24 hours. Traders should note that while Mitrade doesn't charge for transactions, third-party fees may apply depending on the chosen payment method.

Deposit Methods at Mitrade Broker

Mitrade offers a variety of convenient deposit methods, and according to its fee policy, most of them come with no direct charge from the broker itself.

Their Help Centre lists options including credit cards, e-wallets and bank transfers; however, the availability depends on your country or region.

Below is a breakdown of the main deposit methods supported by Mitrade:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Visa / Mastercard | USD, EUR, GBP, and AUD | $50 | 0% | N/A |

Skrill / Neteller (E-wallet) | USD, EUR, GBP, and AUD | $50 | 0% | Instant to few minutes |

Bank Transfer | USD, EUR, GBP, and AUD | $50 | 0% (except third-party bank fees) | N/A |

Withdrawal Methods at Mitrade Broker

Withdrawals on Mitrade are processed using the same methods as deposits, ensuring a seamless and familiar experience for traders. Typically, these include credit/debit cards, e-wallets and bank transfers, with processing times depending on the selected method.

According to Mitrade, most withdrawal requests are completed within 1 to 3 business days.

Here are the key points about withdrawals:

- Funds are returned via the same method as the original deposit whenever possible;

- Withdrawal requests can be cancelled before processing, allowing recovery of the funds;

- Processing times may vary based on bank or payment provider procedures, and security reviews can extend the timeline;

- Mitrade itself does not charge additional fees beyond the stated withdrawal fees; third-party fees may still apply.

Does Mitrade Offer Copy Trading and Investment Plans?

As of the latest update, the broker does not offer copy trading or social trading features on its platform.

This may be a drawback for traders who prefer to follow successful strategies or share their own.

Mitrade Broker Trading Assets

The company offers a diverse range of 400+ trading instruments across five asset classes, from the Forex market to ETFs and Stocks.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage (International / Retail) |

Forex | Currency pair CFDs | ~60 | 55–65 | 1:200 |

Indices | Index CFDs | 19 | 15–20 | N/A |

Commodities | Commodity CFDs (gold, oil, metals) | 14 | 10–15 | 1:200 |

Shares | Equity CFDs (individual stocks) | 250+ | 200–300 | 1:10 |

ETFs | ETF CFDs | 36 | 30–40 | N/A |

Crypto CFDs (BTC, ETH, DOGE) | 61 | 50–60 | 1:10 |

This range supports diversified trading strategies, from swing and day trading to sector-specific speculation.

Mitrade Promotional Programs

Attractive bonuses like welcome gifts and the reward campaign are among the advantages of this Mitrade review.

- Affiliate: Refer new clients and earn commissions;

- Welcome Gift: Receive up to $2,000 bonus for deposits above $10,000;

- Reward Campaign: Make at least $200 deposits within 7 days of your registration and earn trading points (TP) to receive the bonus.

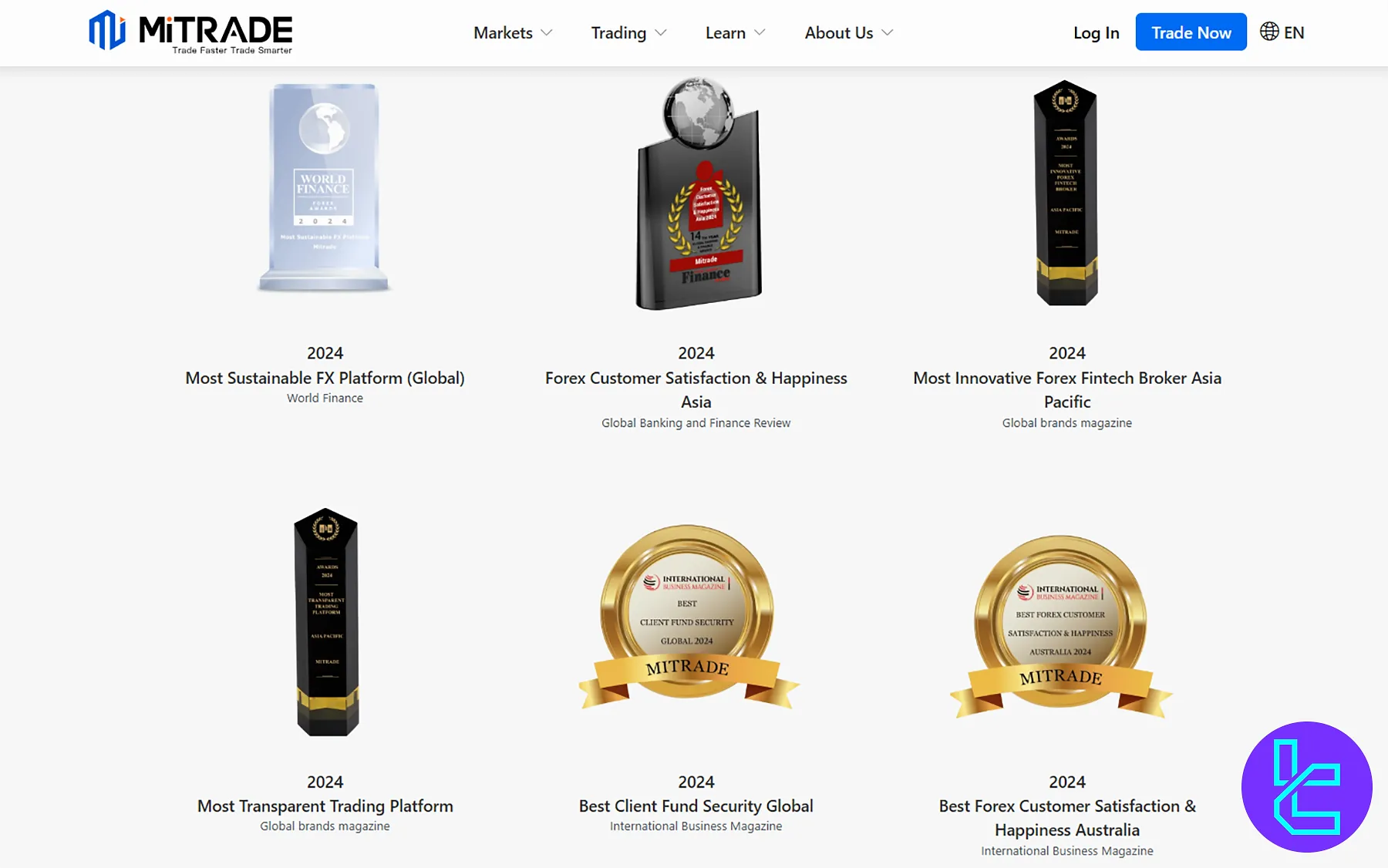

Mitrade Broker Awards

Mitrade has been honored with a variety of prestigious global recognitions, reflecting its commitment to innovation, transparency, and client satisfaction.

Among these, Mitrade awards have highlighted the broker’s achievements in sustainability, fintech innovation, and customer protection.

Here are some of the most notable awards broker has received:

- Most Sustainable FX Platform (Global) — World Finance 2024

- Forex Customer Satisfaction & Happiness Asia — Global Banking and Finance Review 2024

- Most Innovative Forex Fintech Broker Asia Pacific — Global Brands Magazine 2024

- Most Transparent Trading Platform — Global Brands Magazine 2024

- Best Client Fund Security Global — International Business Magazine 2024

- Best Forex Customer Satisfaction & Happiness Australia — International Business Magazine 2024

How to Reach Mitrade Broker Customer Support?

The company offers multilingual 24/5 support through live chat and email. It also has a ticket system and a comprehensive Help Center.

cs@mitrade.com | |

Live Chat | Available on the official website |

Ticket | Through the “Contact Us” page |

There is no phone or dedicated account manager support. The support team is helpful but may not always provide in-depth technical answers.

Mitrade in Review Websites

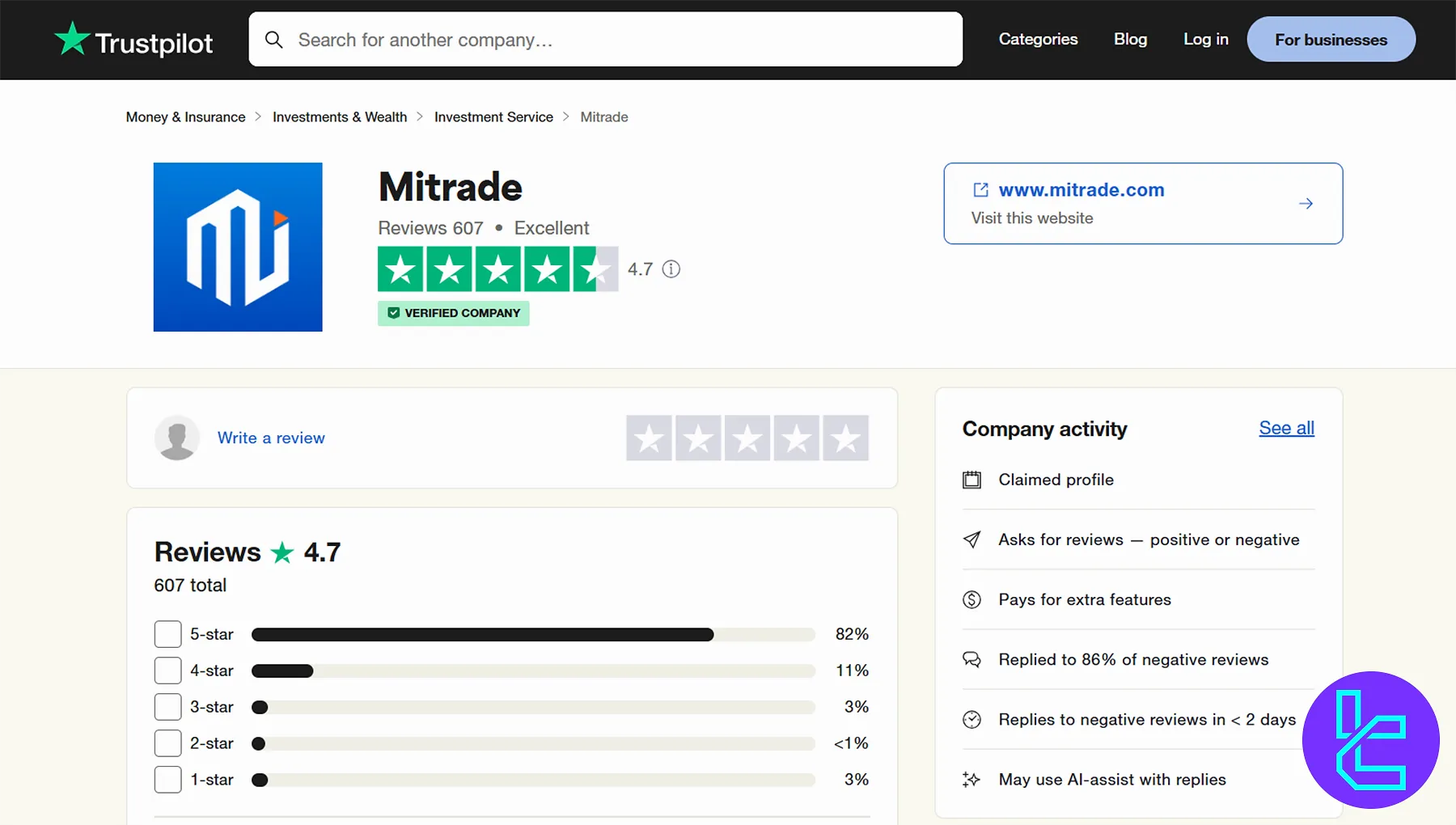

The broker has garnered numerous positive reviews on TrustPilot platform.607 users have rated Mitrade on the platform, resulting in an excellent score of 4.7 out of 5. 93% of ratings are positive (4-star and 5-star).

Geo-Restrictions

The broker services EU clients through the CySEC-regulated entity Mitrade EU Ltd. However, due to regulatory requirements, it has restricted certain jurisdictions, including:

- United States

- Canada

- Japan

- New Zealand

- Iran

- North Korea

- Yemen

- Afghanistan

Mitrade Broker Educational Materials

The company offers a comprehensive range of educational resources to support traders in their journey.

- Learn Section: Basics, Insights, and Academy

- Market Data: Analysis, forecast, news, sentiment, and risk management strategies

Mitrade vs Top Forex Brokers

Let's see Mitrade's standing in the trading world compared to other industry players.

Parameter | Mitrade Broker | |||

Regulation | CIMA, CySEC, ASIC, FSC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | None | ASIC, FSC, DFSA, CySEC |

Minimum Spread | From 0.4 pips | From 0.0 pips | 0.1 Pips | From 0.6 Pips |

Commission | $0 | From $0.2 | None | From Zero |

Minimum Deposit | $20 | $10 | $10 | $5 |

Maximum Leverage | 1:200 | Unlimited | 1:3000 | 1:1000 |

Trading Platforms | Proprietary platform | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5 | MT4, MT5, Mobile App |

Account Types | Live, Demo | Standard, Standard Cent, pro, Raw Spread, Zero | Standard, Premium, VIP, CIP | Micro, Standard, Ultra Low, Shares |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 400+ | 200+ | 50+ | 1,400+ |

| Trade Execution | Market | Market, Instant | Market, Instant | Market, Instant |

Conclusion and Final Words

Mitrade has partnered with companies such as TradingView and Trading Central, to provide competitive trading conditions like EURUSD spreads of 0.00006 and free market signals.

The broker supports Neteller and Skrill payments with no transaction fees. It has a TrustPilot score of 4.7 out of 5.