Moneta Markets, a South Africa-based Forex broker, offers 3 primary accounts, including Direct, Prime, and Ultra, with a maximum leverage of 1:1000 and a minimum deposit of $50. This broker provides trading services for over 1,000 markets and instruments on 4 trading platforms, including Pro Trader, MT4, MT5, and App Trader.

Moneta Markets Company Info and Regulation

Moneta Markets is a dynamic financial services company that has quickly made a name for itself in the competitive world of online trading. Founded with the vision of providing traders with a seamless and secure trading experience, Moneta Markets has become a go-to platform for both novice and experienced traders.

Key points about Moneta Markets:

- Founded in2020

- Based in Johannesburg, South Africa

- Regulated by FSCA (no. 47490)

- Registered in the Saint Lucia Registry of International Business Companies (no. 2023-00068)

The company previously operated as a subsidiary of Vantage International Group Limited until 2020, when it became a separate entity.

Entity Parameters/Branches | VIBHS Financial Ltd | Moneta Markets |

Regulation | FCA | FSCA |

Regulation Tier | 1 | 2 |

Country | United Kingdom, London | South Africa |

Investor Protection Fund/ Compensation Scheme | Up to £85,000 Under FSCS | Up to €20,000 under Financial Commission |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | 1:2000 | 1:2000 |

Client Eligibility | Only United Kingdom | Only South Africa |

Moneta Markets Broker Specifications

Moneta Markets offers a comprehensive suite of trading services designed to cater to the diverse needs of modern traders. Here's a quick overview of what this forex broker brings to the table:

Broker | Moneta Markets |

Account Types | Direct, Prime, Ultra |

Regulating Authorities | FSCA, FSRA |

Based Currencies | $AUD, $USD, £GBP €EUR, $SGD, $CAD $NZD, ¥JPY, $HKD ,$BRL |

Minimum Deposit | $50 |

Deposit Methods | Wire transfer, Visa/MasterCard, Fasapay, Stickpay, JCB |

Withdrawal Methods | Wire transfer, Visa/MasterCard, Fasapay, Stickpay, JCB |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:1000 |

Investment Options | Copy trading |

Trading Platforms & Apps | MT4, MT5, Pro Trader, App Trader |

Markets | Forex, bonds, shares, cryptocurrencies, indices, commodities |

Spread | Floating from 0.0 |

Commission | From $0 |

Orders Execution | STP, ECN |

Margin Call/Stop Out | 80%/50% |

Trading Features | Demo account, Forex calculator, copy trading |

Affiliate Program | Yes |

Bonus & Promotions | Deposit bonus, cashback bonus |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24/5 |

Restricted Countries | Albania, Australia, Bulgaria, Hong Kong, and more |

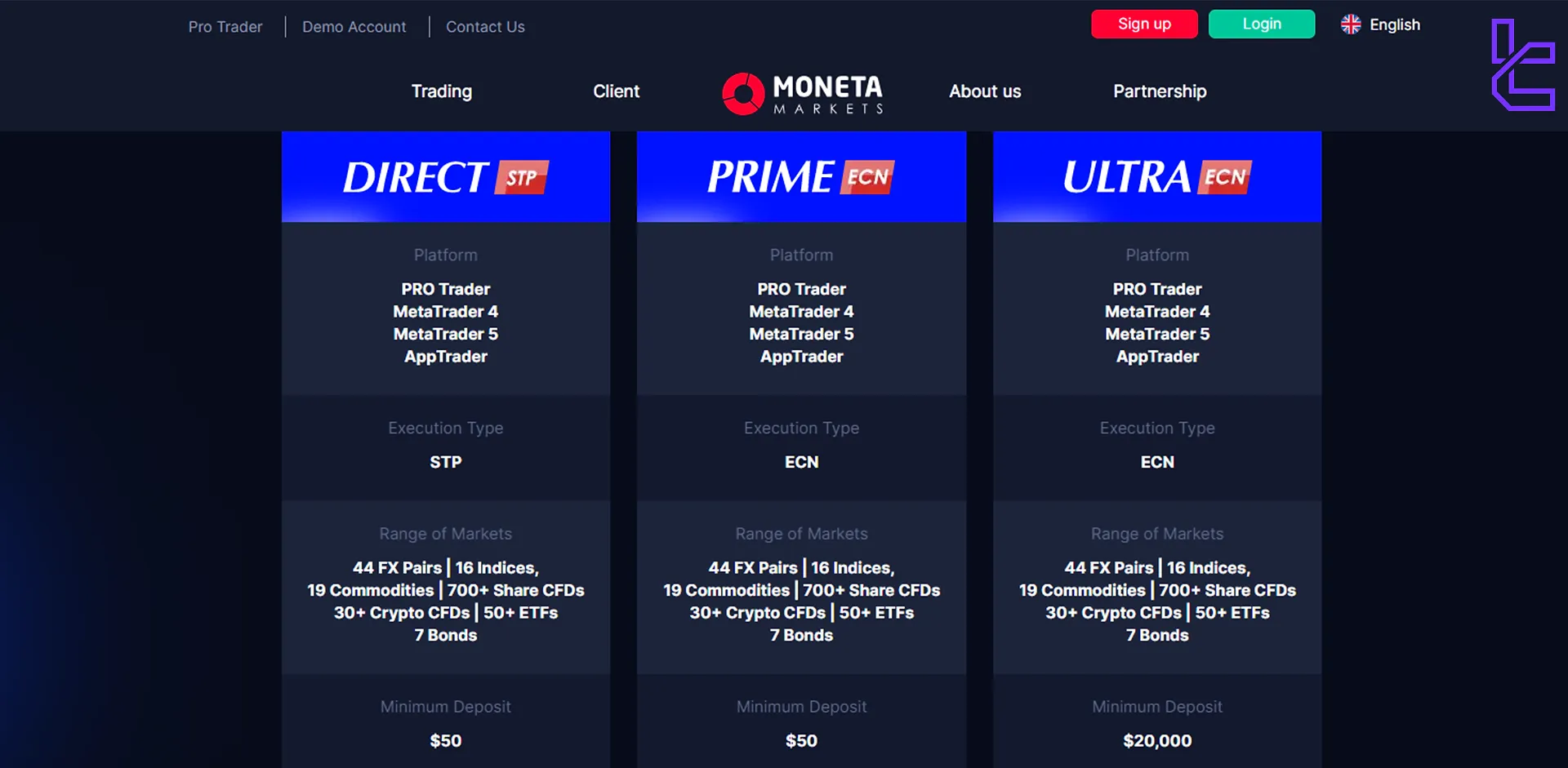

Moneta Markets Accounts

Moneta Markets offers a variety of account types to suit different trading styles and experience levels. Each account type is designed to provide traders with the tools and conditions they need to succeed in the markets.

Account types | Direct | Prime | Ultra |

Minimum deposit | $50 | $50 | $20000 |

Minimum trading volume | 0.01 Lot | 0.01 Lot | 0.01 Lot |

Maximum Leverage | 1:1000 | 1:1000 | 1:1000 |

Spreads | Floating from 1.2 pips | Floating from 0.0 pips | Floating from 0.0 pips |

Commission | $0 | $3 per lot per side | $1 per lot per side |

Trading platform | PRO Trader MetaTrader 4 MetaTrader 5 App Trader | PRO Trader MetaTrader 4 MetaTrader 5 App Trader | PRO Trader MetaTrader 4 MetaTrader 5 App Trader |

Execution type | STP | ECN | ECN |

Each account type is designed to cater to specific trading needs, ensuring that traders of all levels can find a suitable option at Moneta Markets.

Moneta Markets offers accessibility to global traders by maintaining a low minimum deposit of just $50. This low entry requirement enablesretail traders, particularly those new to the forex space, to test the platform with minimal risk capital.

It is also worth mentioning that Moneta Markets offers demo account and swap-free Islamic accounts.

Moneta Markets Islamic Account

Moneta Markets supports Islamic finance principles by offering swap-free accounts upon request.

Available on both STPand ECNaccount types, these accounts eliminate overnight interest (swap) charges, allowing Muslim traders to participate in forex and CFD markets in compliance with Sharia law.

Benefits and Drawbacks of Moneta Markets

Like any broker, Moneta Markets has its strengths and weaknesses. Here's a balanced look at what this broker offers:

Advantages | Disadvantages |

Wide range of tradable instruments (over 1000) | Low regulatory oversight by financial authorities |

Competitive spreads and low fees | Relatively new brand in the market |

Various trading platforms, including MT4, MT5, App Trader, and Pro Trader | Not available to US traders |

Various passive income and investment opportunities | - |

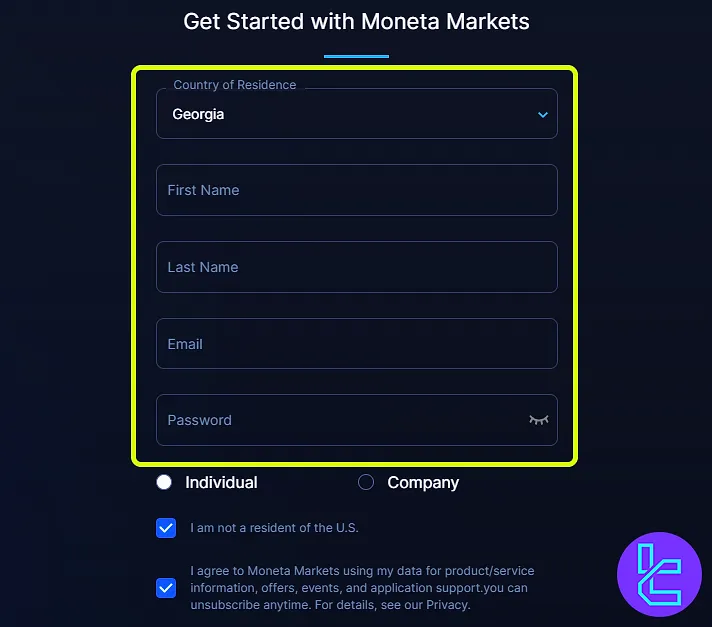

Registration and Verification Process in Moneta Markets

Joining Moneta Markets opens the door to over 1,000 instruments and flexible leverage options up to 1:1000. Whether you prefer MT4, MT5, or Pro Trader, Moneta Markets registration takes less than five minutes and equips you with access to Direct STP or Prime ECN accounts.

#1 Start from the Official Website

Head to the Moneta Markets homepage and hit the "Sign Up" button to begin.

#2 Provide Basic Details

Fill out the registration form with the following details:

- Country of residence

- Full name

- Email address

- Strong password

#3 Complete Your Personal Profile

Fill in the personal information form with your details, including:

- Full name

- Gender

- Date of Birth

- Phone number

- Residency country

- Nationality

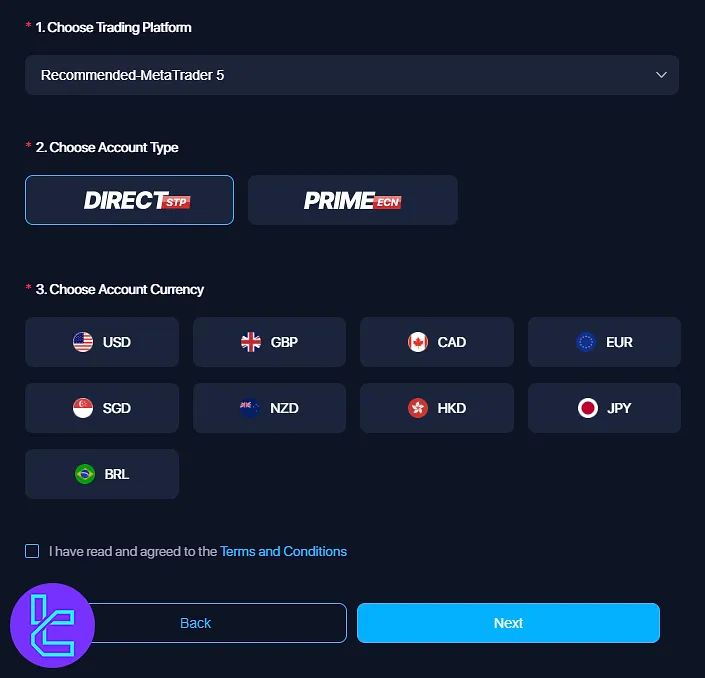

#4 Finalize Account Preferences

Adjust your trading account settings on the next page:

- Trading platform (MT4, MT5, or Pro Trader)

- Account type (Direct STP, Prime ECN, or Ultra ECN)

- Base currency (more than nine options, such as USD, GBP, CAD, EUR, and more)

At the end, you must agree to the broker's terms & conditions to finalize your application.

#5 Moneta Markets KYC Documents

Complete the verification process by providing supporting documents through the Moneta Markets dashboard, including:

- Proof of Identity: Passport or Driver's license

- Proof of Address: Utility bill or Bank statement

Moneta Markets Trading Platforms

Moneta Markets offers a suite of powerful trading platforms to cater to different trader preferences and needs. These platforms are designed to provide a seamless and efficient trading experience across various devices.

MetaTrader 4 (MT4)

The industry-standard platform is known for its reliability and extensive features. Key features:

- User-friendly interface suitable for beginners and experienced traders

- Advanced charting tools and technical indicators

- Supports automated trading through Expert Advisors (EAs)

Links:

- MT4 Android

- MT4 iOS

- Windows

- Mac

MetaTrader 5 (MT5)

The next-generation platform with enhanced features and capabilities. Main features if this trading platform include:

- Improved charting capabilities with more timeframes and graphical objects

- Enhanced backtesting for trading strategies

- Access to a wider range of markets

Links:

- MT5 Android

- MT5 iOS

- Windows

- Mac

TradingFinder has developed various MT4 indicators and MT5 indicators that you can use for free.

Pro Trader

Pro Trader is a browser-based platform for traders who prefer not to download software and it has a seamless integration with TradingView.

- Accessible from any device with an internet connection;

- Over 100 indicators and 12 chart types;

- Various risk management tools, including stop loss and take profit;

- Intuitive interface with essential trading tools.

App Trader

Monet Markets also offers trading through its mobile platform, App Trader. Key features of this trading platform:

- Powerful trading tools, including real-time signals, watchlist, AI market buzz, and more;

- Seamless integration with MT4 and MT5;

- Fast and secure deposit and withdrawal;

- Various charts and technical analysis tools.

Links:

Moneta Markets Spreads and Commissions

Traders on the Raw ECN accounts benefit from ultra-tight spreads beginning at 0.0 pips, plus a competitive commission from $1 per lot per side.

Meanwhile, those using the STP account enjoy commission-free trading with slightly wider spreads, making it a good fit for long-term or swing traders. This dual-pricing model provides both transparency and flexibility.

Account types | Spread | Commission |

Direct | From 1.2 Pips | No commission |

Prime | From 0.0 Pips | $3 per lot per side |

Ultra | From 0.0 Pips | $1 per lot per side |

It's important to note that spreads may vary depending on market conditions and the specific instrument being traded.

Moneta Markets other fees:

- No deposit or withdrawal fees

- No inactivity fee

- Low swap/overnight fees

- Low currency conversion fees

Swap Fees

The method of calculating swap at Moneta broker varies depending on the asset type. Based on an analysis conducted by the TradingFinder team, the swap values for some commonly traded assets have been identified below.

These figures are based on positions opened with a trade size of 1 lot and a leverage of 1:100.

- EUR/USD: 1161.9

- XAU/USD: 3363.86 USD

- CL-OIL: 132.43 USD

- NAS100: 46.1548 USD

- SP500: 12.6309 USD

Deposit & Withdrawal in Moneta Markets

There is a range of Moneta Markets deposit and withdrawal options to suit different trader preferences. The broker prioritizes fast and securetransactions to ensure a smooth trading experience.

- Credit/Debit Cards (Visa, Mastercard)

- Bank Wire Transfer

- Fasapay

- Stickpay

- JCB

Key points:

- Minimum deposit varies by account type, starting from $50;

- No fees charged by Moneta Markets for deposits or withdrawals;

- Withdrawals are processed within 24 hours, subject to account verification.

Moneta Markets emphasizes security in all financial transactions, employing advanced encryption technologies to protect client funds and personal information.

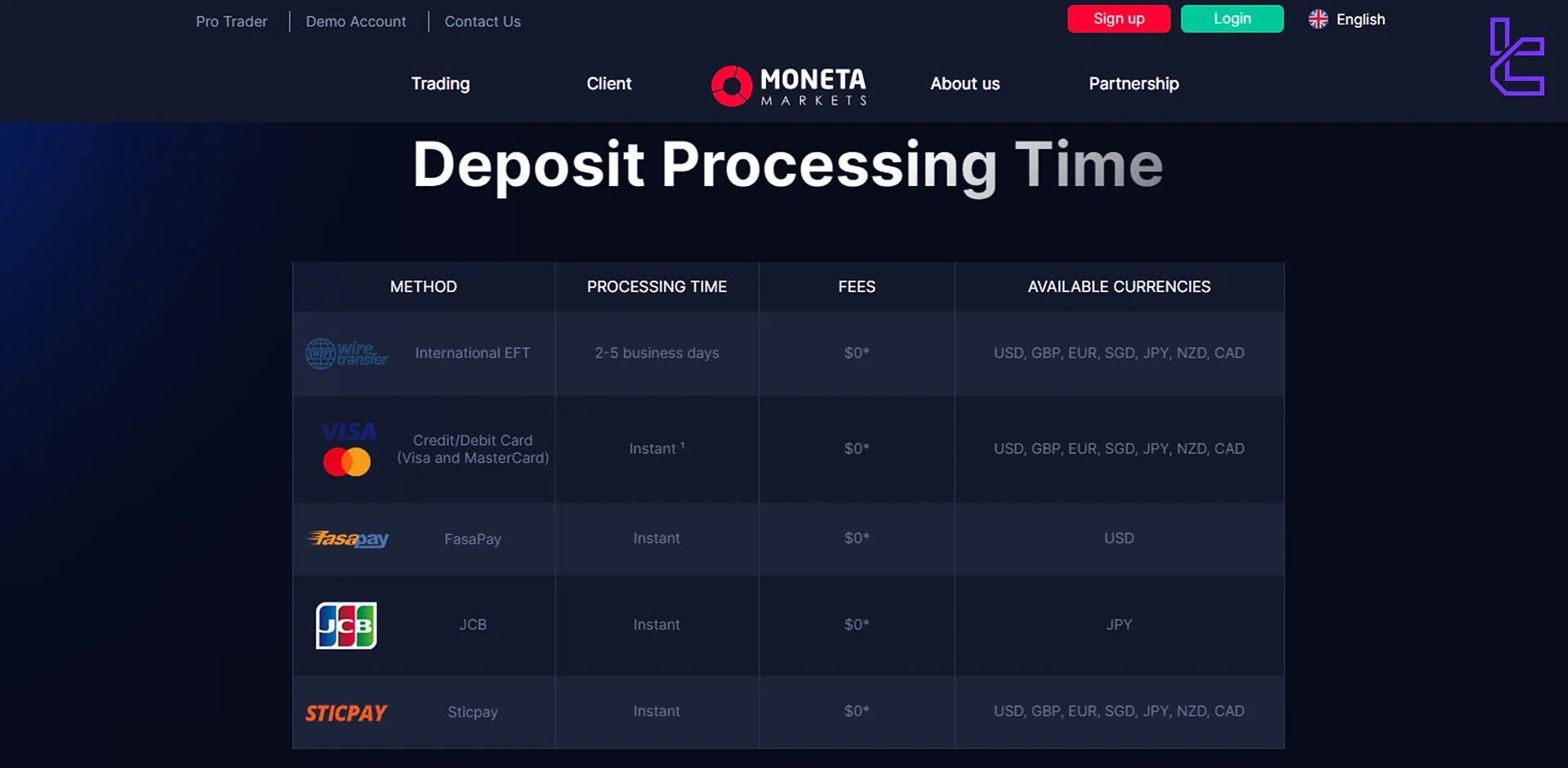

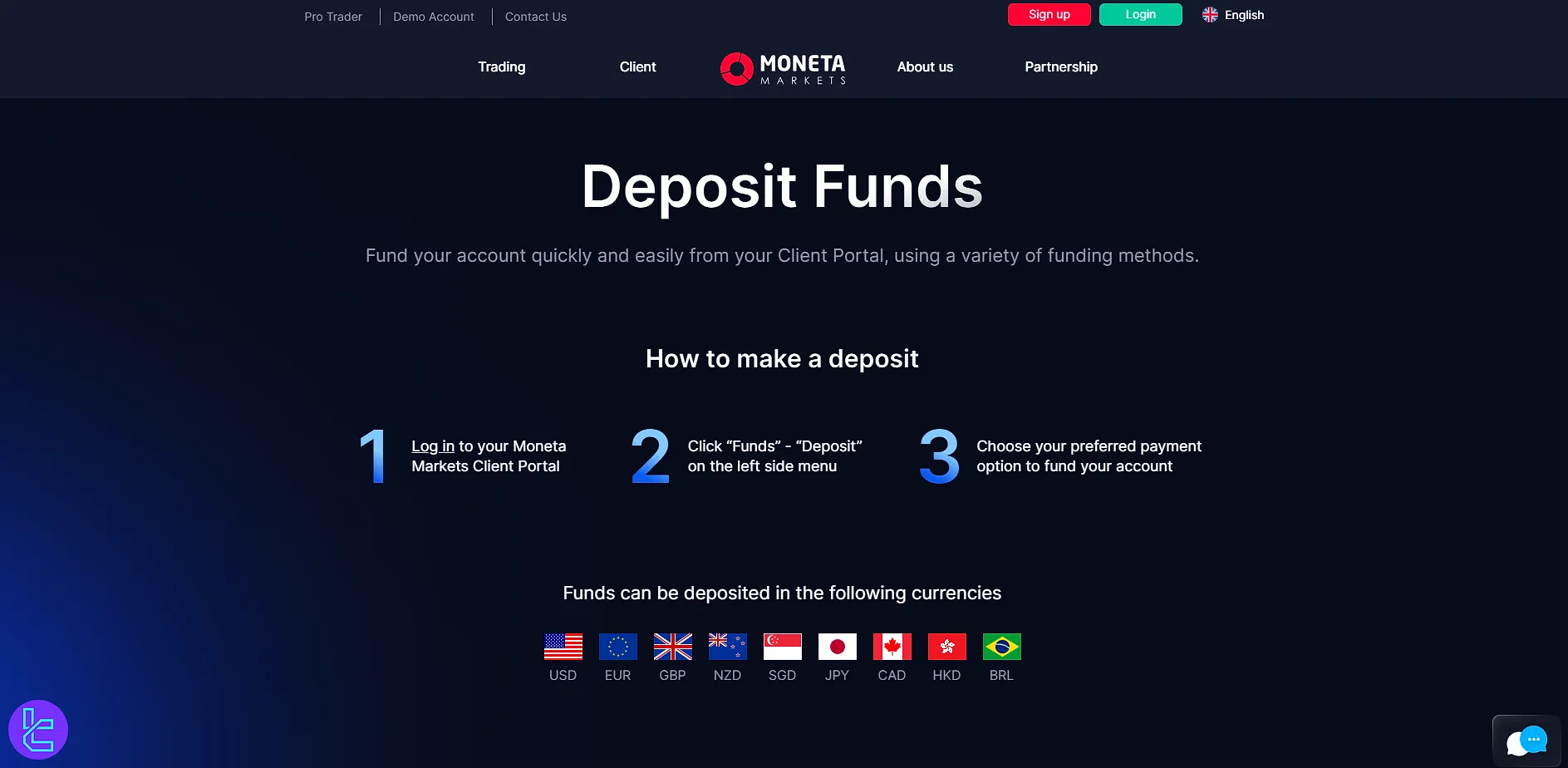

Deposit

Moneta Markets provides traders with a wide selection of electronic payment systems and international banking options, ensuring flexibility and accessibility for different regions and preferences.

Available funding and withdrawal methods include International EFT for traditional bank transfers and Credit/Debit Cards (Visa and MasterCard), which offer instant and secure transactions. Traders can also use the online payment service FasaPay, the JCB card payment option popular in Japan, and the e-wallet SticPay.

For those preferring digital assets, Moneta Markets supports cryptocurrency deposits in Tether (USDT), Bitcoin (BTC), Ethereum (ETH), and USD Coin (USDC), providing a fast and borderless payment alternative.

Moneta Markets provides a broad selection of secure and efficientdeposit and withdrawal methods, catering to traders in various markets. These options range from traditional bank transfers to modern e-wallets and cryptocurrency transactions, ensuring flexibility in account funding and management.

Each payment method is designed with trader convenience in mind, offering different processing times, security measures, and accessibility levels. Below is an overview of the main available options, along with their key features for funding and withdrawing from trading accounts.

Method | Processing Time | Fees | Available Currencies |

International EFT | 2-5 business days | 0 | USD, GBP, EUR, SGD, JPY, NZD, CAD |

Credit/Debit Card | Instant | 0 | USD, GBP, EUR, SGD, JPY, NZD, CAD |

FasaPay | Instant | 0 | USD |

Sticpay | Instant | 0 | USD, GBP, EUR, SGD, JPY, NZD, CAD |

This payment structure ensures speed, flexibility, and broad accessibility for funding trading accounts across the forex market and other financial instruments.

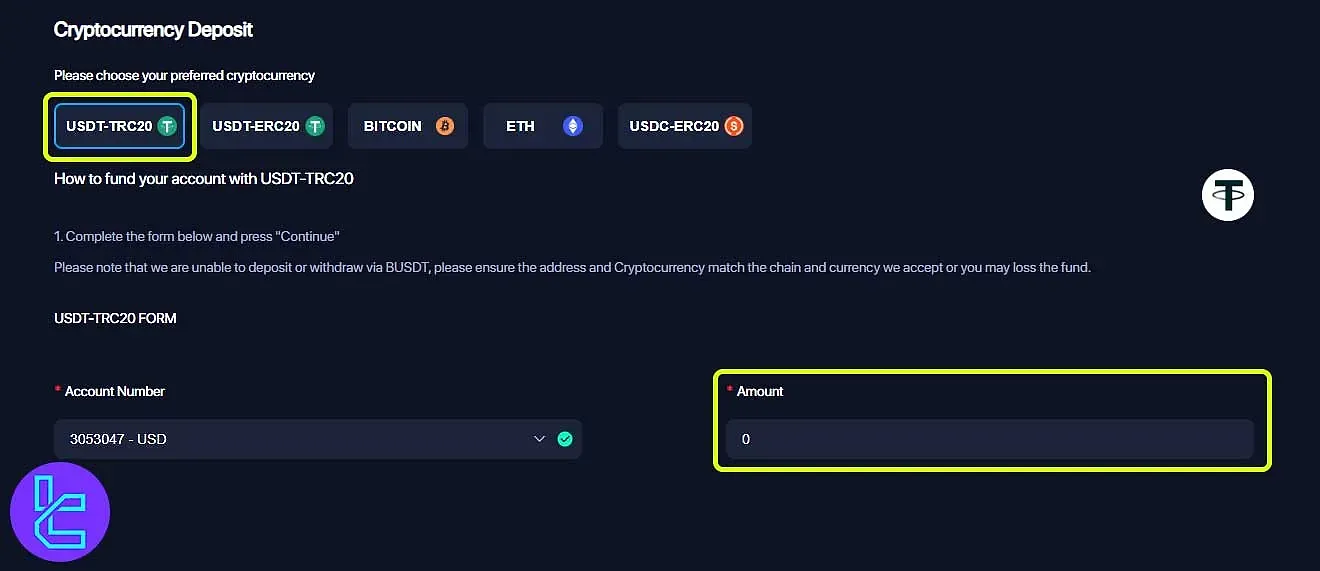

Moneta Markets TRC20Deposit

Funding your Moneta Markets account with Tether (USDT-TRC20) is a fast, commission-free process requiring just three steps. Log in and access the Deposit section, selecting Cryptocurrency Deposit. Choose USDT (TRC20), select the trading account, enter an amount (minimum $50), and continue.

The platform will display a QR code and wallet address—use your e-wallet to transfer funds. After sending, click “I Have Made the Payment” to notify the broker. Deposits are generally credited within minutes, making TRC20 a cost-effective and efficient funding method.

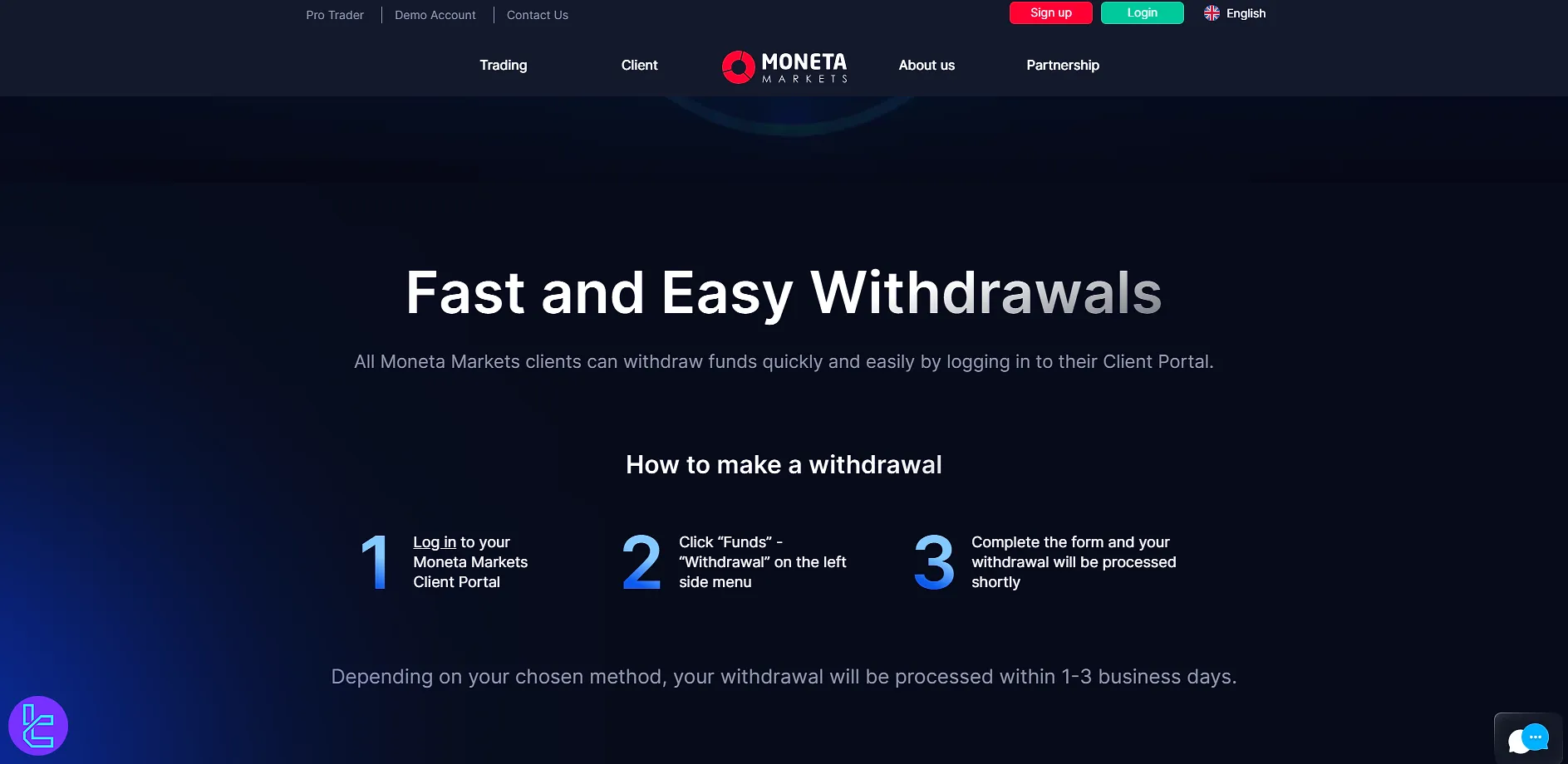

Withdrawal

Moneta Markets ensures secure withdrawal processing and aims to keep costs minimal. While most methods are free, international bank wire transfers carry a fixed fee of 20 units of the account’s base currency (e.g., USD 20), with potential additional charges from intermediary banks.

Requests are typically approved within 24 hours, but the final receipt time depends on the payment method:

Withdrawal Method | Processing Time |

Credit/Debit Cards (Visa, MasterCard) | 1–5 business days |

International EFT | 3–7 business days |

FasaPay | 1–3 business days |

JCB | 1–3 business days |

SticPay | 1–3 business days |

Cryptocurrencies | 1–3 business days |

Supported Currencies by Method:

- International EFT: USD, GBP, EUR, SGD, JPY, NZD, CAD

- Visa/MasterCard: USD, GBP, EUR, SGD, JPY, NZD, CAD

- FasaPay: USD

- JCB: JPY

- SticPay: USD, GBP, EUR, SGD, JPY, NZD, CAD

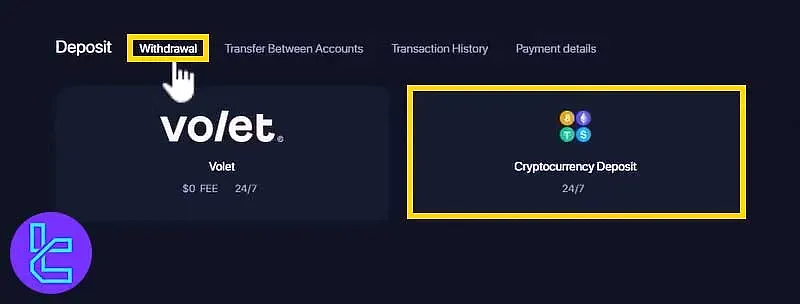

Moneta Markets TRC20 Withrawal

The USDT (TRC20) withdrawal on Moneta Markets follows a secure three-step process. First, log in and navigate to Funding, then select Withdrawal and choose Cryptocurrency as the method. Next, specify the withdrawal amount, choose USDT (TRC20), and proceed.

Finally, verify the request via your Authenticator app (2FA) and confirm. The request is typically processed in minutes, with zero fees, though completion time can vary based on security checks. Once approved, the funds are deducted from your trading account and sent to your chosen TRC20 wallet.

Moneta Markets Copy Trading & Investment Options

Moneta Markets offers various investment options, including copy trading and PAMM accounts.

Moneta CopyTrader

Moneta CopyTrader is an innovative copy trading platform, allowing traders to replicate the strategies of successful investors. This feature is particularly beneficial for beginners or those looking to diversify their trading approach.

Key aspects of copy trading on Moneta Markets:

- Access to a pool of experienced traders with proven track records

- Ability to customize risk levels and investment amounts

- Real-time updates on copied trades

- Option to manually close positions or stop copying at any time

Moneta Markets PAMM Account

Moneta PAMM (Percentage Allocation Management Module) accounts allow investors to allocate funds to skilled traders who manage multiple accounts simultaneously.

Investors benefit from the trader's expertise, while traders earn commissions based on performance. Moneta's PAMM system offers transparency, risk management, and an opportunity for passive income.

Moneta Markets Broker Tradable Instruments

Moneta Markets offers an extensive range of tradable markets and symbols, from the Forex market to Cryptocurrencies, catering to diverse trading preferences and strategies.

Category | Types of Instruments | Number of Symbols | Competitor Average |

Forex | CFD Currency Pairs (Majors, Minors, Exotics) | 45+ | ≈ 63 |

Stocks | Share CFDs (US, UK, EU) | 700–844 | ≈ 1,082 |

Indices | Index CFDs (S&P 500, FTSE, DAX, Nikkei, etc.) | ~28 | ≈ 19 |

Commodities | CFDs on Energy, Metals, Agricultural Products (spot & Some Futures) | ~20 | ≈ 23 |

Cryptocurrencies | Crypto CFDs (BTC, ETH, XRP, etc.) | ~43 | ≈ 15 |

ETF | ETF CFDs | 50+ | N/A |

Bonds | Bond CFDs / Futures (Selected Government Bonds) | 7 | ≈ 5 |

With over 1000 tradable instruments, Moneta Markets provides ample opportunities for traders to diversify their portfolios and capitalize on various market conditions.

Moneta Markets Bonuses

Moneta Markets offers attractive bonuses and promotions to enhance the trading experience for both new and existing clients. These incentives are designed to provide additional value and trading opportunities.

Moneta Markets currently offers a 50% cashback bonus and a 20% deposit bonus for over $100 deposits. It's important to note that deposits over $499 aren't eligible to receive this bonus.

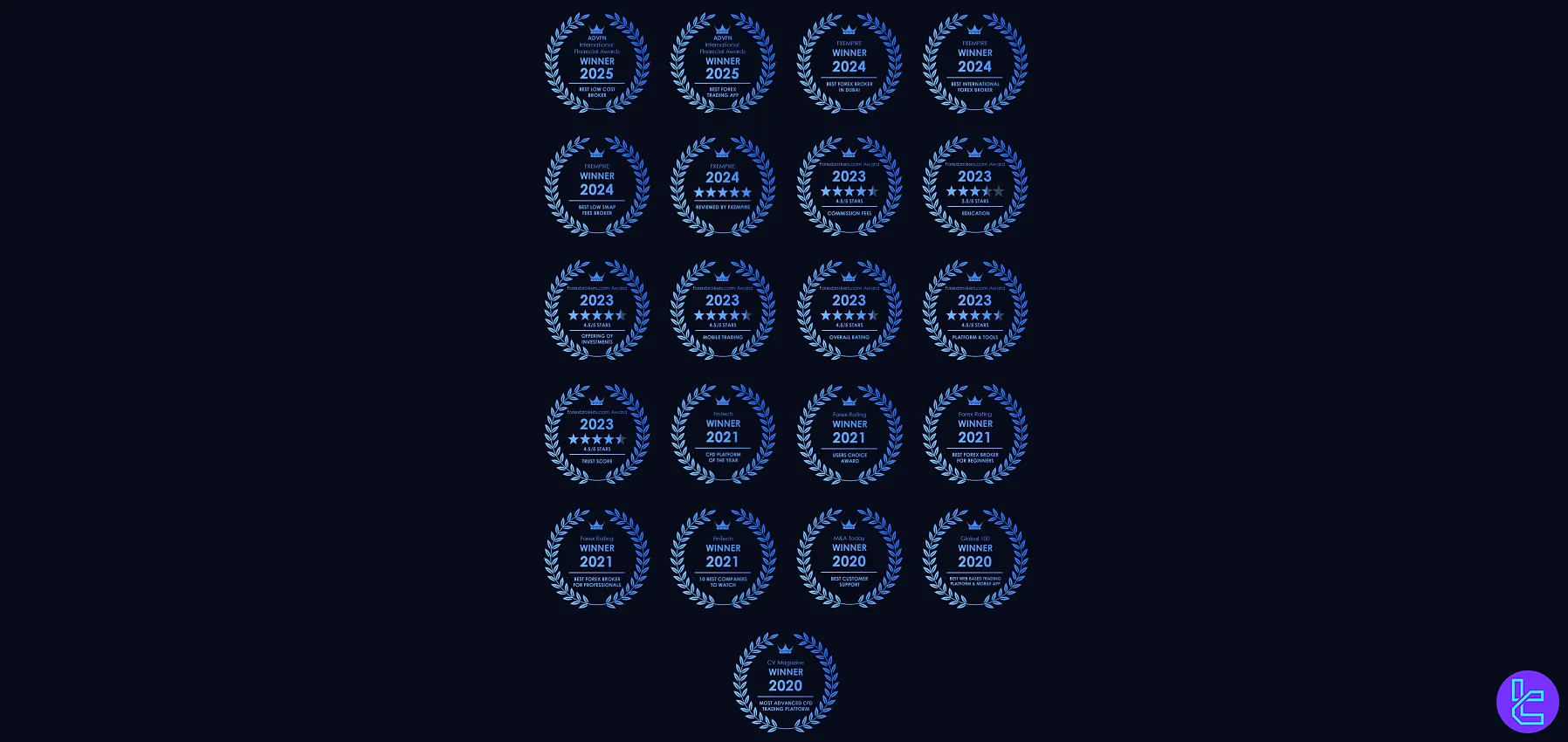

Moneta Markets Awards

The Moneta Markets awards include recognition from M&A Today for the Most Advanced Web-Based CFD Trading Platform and from CV Magazine’s Corporate Excellence Awards for Best Customer Support. These reflect the broker’s role in developing platform capabilities and client service systems that meet professional standards.

By integrating advanced technology with responsive customer support, the company has maintained a competitive presence in the CFD market. It continues to refine its platform and services to ensure consistent operational quality in line with evolving industry requirements.

Moneta Markets Support overview

Moneta Markets provides comprehensive and responsive customer support to ensure a smooth trading experience for all clients. The broker offers multiple channels for assistance, catering to different preferences and needs.

Support options include:

- Live Chat: Available 24/5 for instant assistance

- Email Support: support@monetamarkets.com

- Phone Support: +44 (113) 3204819

- FAQ Section: Comprehensive resource for common questions

Moneta Markets emphasizes the importance of client satisfaction and strives to resolve all inquiries efficiently and effectively, contributing to a positive overall trading experience.

oneta Markets Banned Countries

While Moneta Markets serves global clients, it has restrictions on certain countries due to regulatory requirements and company policies. Potential clients must be aware of these restrictions before attempting to open an account. List of restricted countries:

- Congo

- Afghanistan

- Canada

- USA

- Cuba

- Australia

- Croatia

- Crimea

- Bulgaria

- North Korea

- Puerto Rico

- Serbia

- Romania

- United Kingdom

For the most up-to-date information on country restrictions, it's advisable to check the Moneta Markets website or contact their customer support directly.

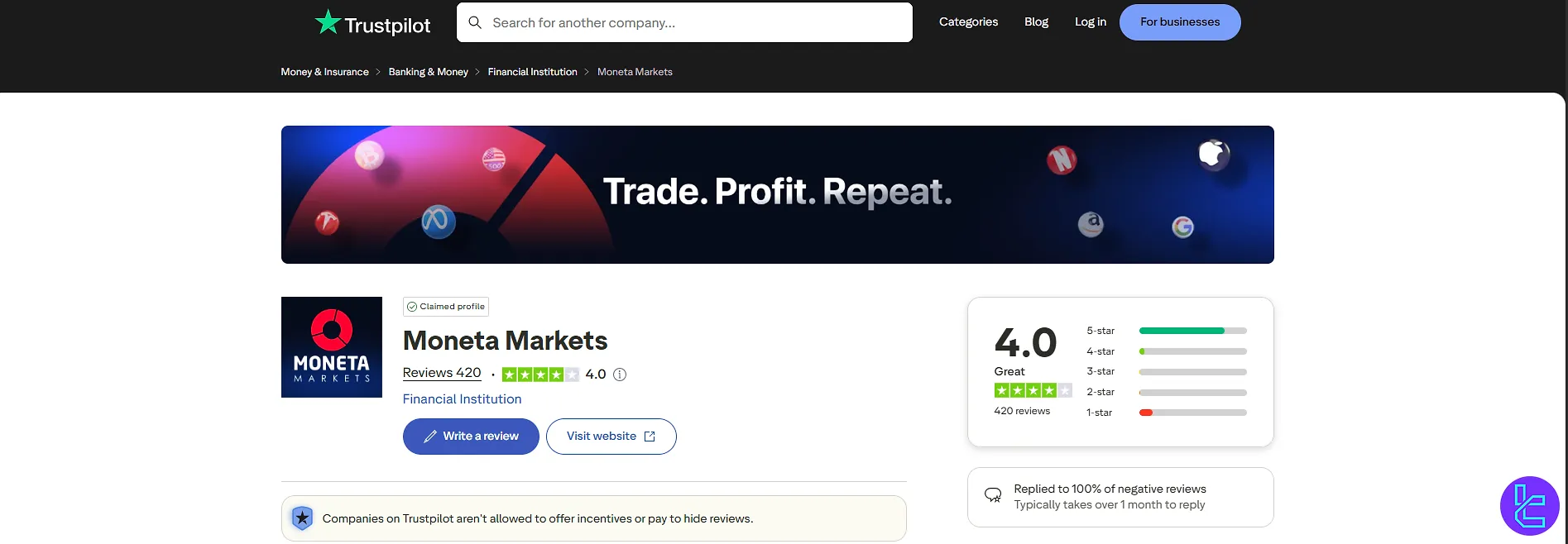

Moneta Markets Ratings and Trust Scores

Moneta Markets has built credibility through trust scores and feedback from various sources in the trading community. On Moneta Markets Reviews.io, it holds an impressive rating of4.7 out of 5, while on Moneta Markets Trustpilot, the broker maintains a solid 4.0 out of 5.

Overall, Moneta Markets has received positive recognition for its trading conditions and platform features, though some users have reported concerns related to withdrawal procedures and PAMM account managers.

As with any broker, prospective clients should conduct comprehensive due diligence and review information from multiple reputable sources before opening an account.

Moneta Markets Educational Resources for Traders

Moneta Markets is committed to trader education, offering a range of resources to help clients enhance their trading knowledge and skills. These educational materials cater to traders of all experience levels, from beginners to advanced. Key educational offerings include:

- Video tutorials covering platform usage and trading strategies

- Webinars hosted by industry experts on various trading topics

- Comprehensive trading guides and e-books

- Economic calendar and daily market analysis

Moneta Markets' educational resources are designed to empower traders with the knowledge and tools needed to make informed trading decisions and develop effective strategies in the dynamic financial markets.

You can also check TradingFinder's Forex education section and crypto tutorials for additional resources.

Moneta Markets Comparison with Other Brokers

The table below compares Moneta Markets with some of the most popular Forex brokers in terms of features and services.

Parameter | Moneta Markets Broker | |||

Regulation | FSCA, FSRA | FSA, CySEC, ASIC | None | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | From 0.0 pips | 0.0 Pips | 0.1 Pips | From 0.0 pips |

Commission | From $0 | Average $1.5 | None | From $0 |

Minimum Deposit | $50 | $200 | $10 | From $0 |

Maximum Leverage | 1:1000 | 1:500 | 1:3000 | 1:2000 |

Trading Platforms | MT4, MT5, Pro Trader, App Trader | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5 | MT4, MT5, Mobile App |

Account Types | Direct, Prime, Ultra | Standard, Raw Spread, Islamic | Standard, Premium, VIP, CIP | Cent, Zero, Pro, Premium |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 1,000+ | 2,250+ | 50+ | 1,000+ |

| Trade Execution | Market | Market | Market, Instant | Market, Instant |

TF Expert Suggestion

Moneta Markets' main advantages include low spreads starting from 0.0 pips, low trading commissions ($3 on Prime and $1 on Ultra accounts), and Moneta CopyTrader and PAMM accounts.

Despite that, the main disadvantages of this broker are the lack of regulatory oversight by top-tier financial authorities such as FCA, SEC, CFTC, and CySEC and the broker's unavailability for US clients.