MultiBank is known for features such as maximum leverage of 1:500, zero commission, and minimum deposits starting at $50.

Using platforms such as MetaTrader 4, MetaTrader 5, and its proprietary MultiBank-Plus, traders benefit from a streamlined, high-tech trading experience.

Restricted countries for services include North Korea, Ukraine, the UK, the USA, Iran, Russia, and Myanmar, highlighting its focus on compliant jurisdictions.

Company Information & Regulation Status

Established in 2005, MultiBank Group has rapidly ascended the ranks to become a formidable player in the global financial services industry.

With its headquarters nestled recently in the bustling financial hub of Dubai, the Forex broker has strategically expanded its operations across multiple continents, boasting offices in Australia, Germany, Austria, Germany, Cyprus, and the United Arab Emirates.

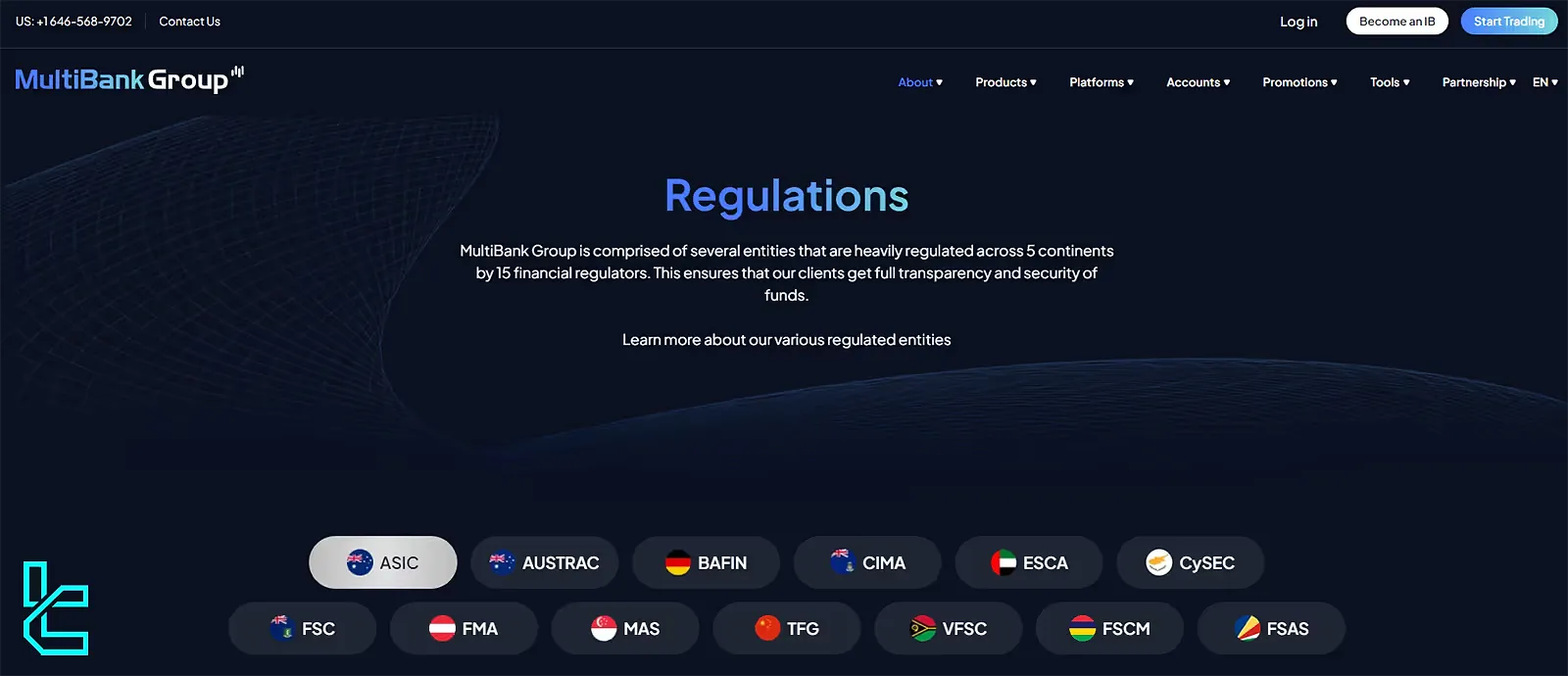

MultiBank's unwavering commitment to regulatory compliance and financial security sets it apart. The broker operates under the watchful eyes of several top-tier financial authorities, including:

- Australian Securities and Investments Commission (ASIC): Mex Australia Pty Ltd – License No. 416279

- Cyprus Securities and Exchange Commission (CySEC): MEX Europe Ltd – License No. 430/23

- UAE Securities and Commodities Authority (SCA): MEX GLOBAL FINANCIAL SERVICES – License No. 20200000045

- Monetary Authority of Singapore (MAS): MEX GLOBAL MARKETS PTE. LTD – License No. CMS101174

- Securities and Commodities Authority of the UAE (ESCA)

- German Federal Financial Supervisory Authority (BaFin)

- Tianjin Financial Government (TFG)

- Financial Markets Authority (FMA)

- Financial Services Commission of the British Virgin Islands (FSC)

- Cayman Islands Monetary Authority (CIMA)

- AUSTRAC

- FSAS

- FSCM

This multi-jurisdictional regulatory framework underscores MultiBank's dedication to transparency and client protection and provides traders with peace of mind when dealing with a globally recognized and regulated entity.

Client protection mechanisms include segregated accounts, negative balance protection, and a substantial $1 million excess loss insurance per user.

Funds are securely held with Tier 1 global banks, and the firm is rated “B” by Standard & Poor’s, signaling a strong capital structure and regulatory adherence.

Entity Parameters / Branches | MEX Atlantic Corporation | MEX Australia Pty Ltd | MEX Digital Pty Ltd | MEX Asset Management GmbH | MEX Global Financial Services LLC | MEX Digital FZE | Mex Europe LTD | MultiBank FX International | MEX Asset Management GmbH-Austria | MEX Global Markets PTE. LTD | Ikon Financial Services Corporation Ltd | MEX Pacific (V) Ltd | MEXFM Securities (Mauritius) Ltd | MB Group (Seychelles) Limited | MEXD WORLDWIDE PRIVATE LIMITED |

Regulation | CIMA | ASIC | AUSTRAC | BaFin | ESCA | VARA | CySEC | BVI FSC | FMA | MAS | TFG | VFSC | FSCM | FSAS | FIU |

Regulation Tier | N/A | 1 | 1 | 1 | 2 | 2 | 1 | N/A | 1 | 2 | N/A | N/A | N/A | N/A | N/A |

Country | Cayman Islands | Australia | Australia | Germany | UAE | UAE | Cyprus | British Virgin Islands | Austria | Singapore | International | Vanuatu | Mauritius | Seychelles | India |

Investor Protection Fund / Compensation Scheme | Up to $1,000,000 per account | No | No | Up to EUR 20,000 under ICF | No | No | Up to EUR 20,000 under ICF | No | Up to EUR 20,000 under ICF | No | No | No | No | No | No |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | N/A | N/A | N/A | N/A | N/A | N/A |

Negative Balance Protection | No | Yes | Yes | Yes | No | No | Yes | Yes | Yes | N/A | N/A | N/A | N/A | N/A | N/A |

Maximum Leverage | 1:250 | 1:30 | N/A | 1:30 | N/A | N/A | 1:30 | 1:500 | 1:30 | 1:20 | 1:500 | 1:500 | 1:500 | 1:500 | N/A |

Client Eligibility | Intl | Residents of Australia + intl | Australia + intl | Germany/EU + intl | UAE + intl | UAE + intl | EU/EE | Intl | New Zealand + intl | Singapore + intl | Intl | Vanuatu + intl | Intl | Intl | Fiji + intl |

MultiBank Broker Summary of Specifics

MultiBank isn't just another run-of-the-mill broker; it's a comprehensive financial ecosystem designed to cater to traders of all stripes.

From forex enthusiasts to commodity traders, MultiBank offers a smorgasbord of financial instruments to make even the most discerning trader's head spin.

But don't take our word for it – let's break it down in a neat little table that'll give you the lowdown on what MultiBank brings to the table:

Broker | MultiBank |

Account Types | Standard, Pro, ECN |

Regulating Authorities | FSAS, FSCM, VFS, TFG, MAS, FMA, FSC, CySEC, ESCA, CIMA, BAFIN, AUSTRAC, ASIC |

Base Currencies | AUD, NZD, CAD, USD, GBP, EUR, CHF |

Minimum Deposit | $200 |

Deposit Methods | credit or debit card, Bank Transfer, Crypto, SEPA |

Withdrawal Methods | bank wire, credit cards, Neteller |

Minimum Order | N/A |

Maximum Leverage | 1:500 |

Investment Options | N/A |

Trading Platforms & Apps | MultiBank-Plus, MT4 Platform, MT5 Platform, Web Trader MT4 |

Markets | Spot, Futures |

Spread | From 0.0 |

Commission | Zero |

Orders Execution | Market, Pending |

Margin Call/Stop Out | 50% |

Trading Features | ECN account, Copy Trading |

Affiliate Program | YES |

Bonus & Promotions | 20% Deposit Bonus, Win an iPhone (Trade 15 lots) |

Islamic Account | YES |

PAMM Account | YES |

Customer Support Ways | Live Chat, WhatsApp, Call back form, Call |

Customer Support Hours | 24/7 |

As you can see, MultiBank doesn't skimp on the goods. With a diverse range of tradable assets, competitive spreads, and leverage, MultiBank has become a go-to choice for traders worldwide.

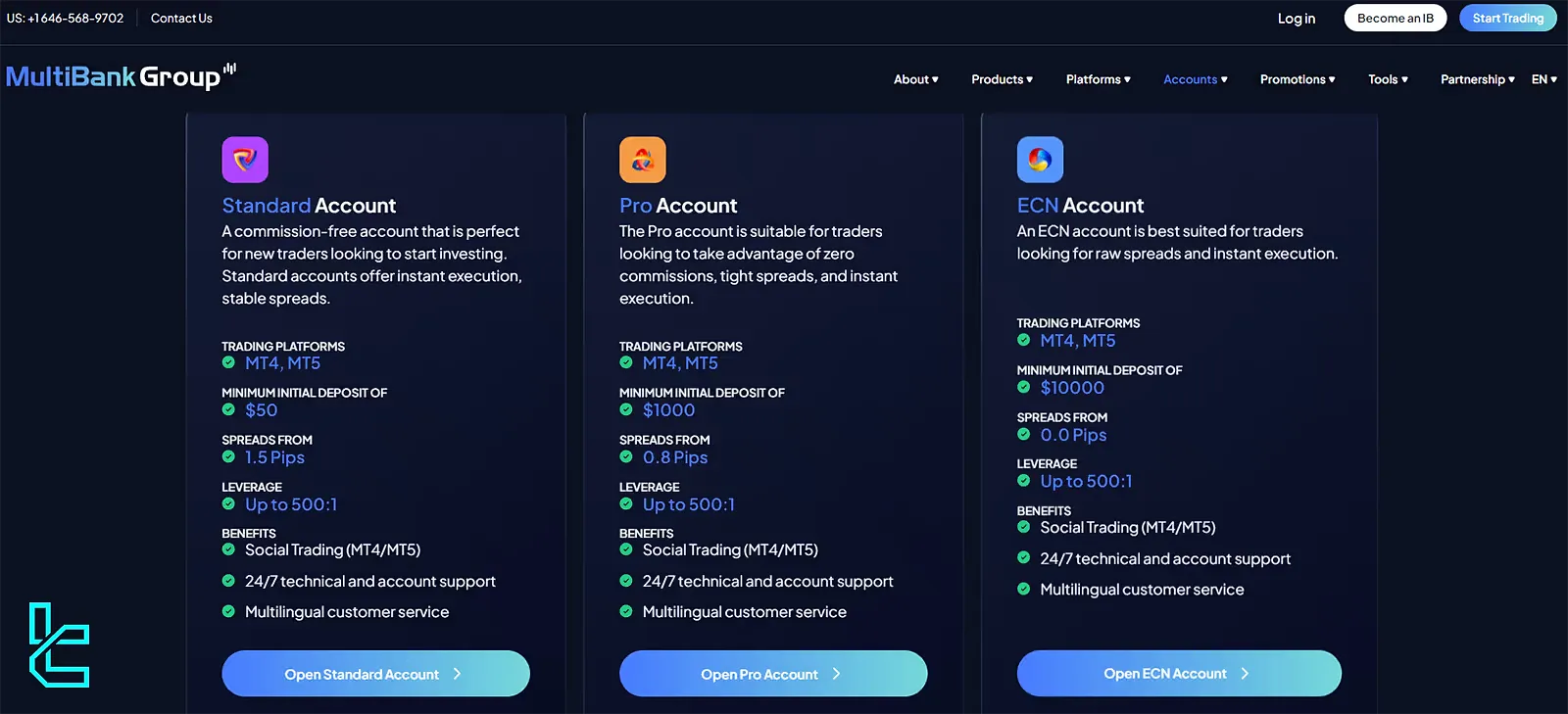

MultiBank Forex Broker Account Types

Regarding account types, MultiBank doesn't believe in a one-size-fits-all approach. Instead, they've crafted a suite of account options to cater to traders of all experience levels and trading strategies. Let's break down the main account types on offer:

- Standard Account: The entry-level option, perfect for beginners or those looking to test the waters. It offers wider spreads with leverage up to 1:500

- Pro Account: Designed for more experienced traders, this account type provides tighter spreads (from 0.08 pips), the same leverage (up to 1:500), and a social trading option

- ECN Account: For the pros who demand lightning-fast execution and spreads from 0.0 pips, featuring Social Trading and multilingual customer support

MultiBank Account Comparison

Features | Standard | Pro | ECN |

Min Deposit | $200 | $1,000 | $10,000 |

Spreads from (Pips) | 1.5 | 0.8 | 0.0 |

Max Leverage | 1:500 | 1:500 | 1:500 |

Commission | $0 | $0 | $0 |

Trading Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 |

Each account type has its perks and features, allowing traders to choose the one that best aligns with their trading goals and risk appetite.

Islamic (swap-free) accounts are available for Standard and Pro users in eligible regions. MultiBank also supports demo accounts.

MultiBank Forex Broker Advantages and Disadvantages

Like any broker, MultiBank comes with its strengths and weaknesses. Let's take an honest look at what makes the company shine and where it might fall short:

Advantages | Disadvantages |

Robust regulatory framework | Limited educational resources |

Wide range of tradable instruments | No proprietary trading platform |

Competitive spreads and leverage | Lack of trading signals |

Multiple trading platforms | The high minimum deposit for some account types |

24/7 customer support | - |

While MultiBank excels in providing a secure and diverse trading environment, it may not be the ideal choice for absolute beginners or those seeking extensive educational resources.

However, for traders who prioritize regulatory compliance, competitive trading conditions, and a wide range of instruments, MultiBank stands out as a solid choice.

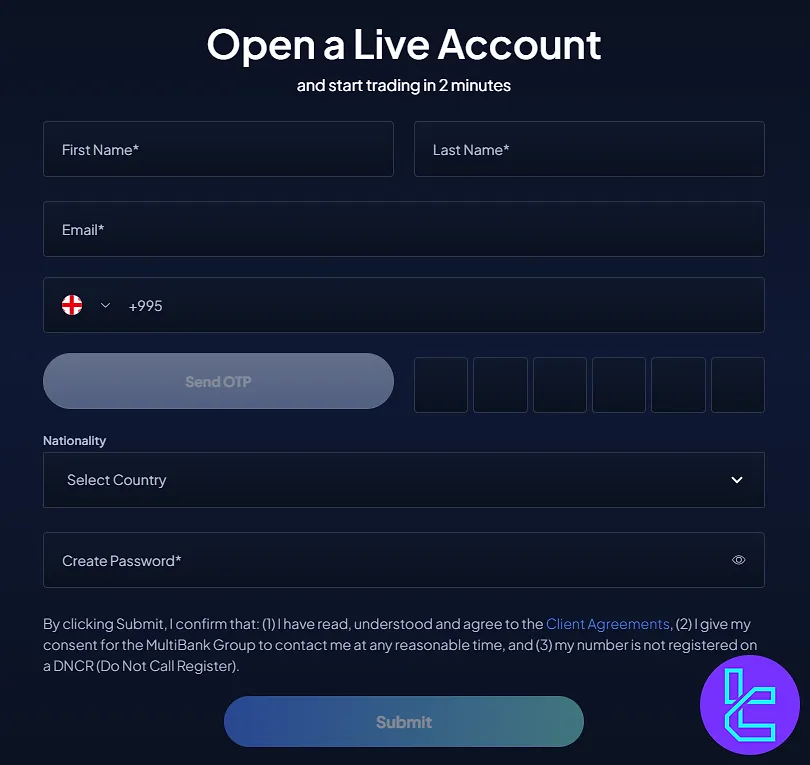

MultiBank Broker Signing Up & Verification: Complete Guide

MultiBank registration is a quick 2-step process that includes submitting your personal information and verifying your phone via OTP SMS. Users can choose from Standard, Pro, or ECN account types right from the start.

#1 Access the Website and Start Registration

Visit the official Multi Bank website and click on “Start Trading”. Fill out the sign-up form with the following details:

- Full name

- Email address

- Mobile number

Click “Send OTP” to receive your SMS verification code.

#2 Complete Details and Verify OTP

Enter the received OTP code, set a secure password, and select your nationality. Submit the form to finalize registration.

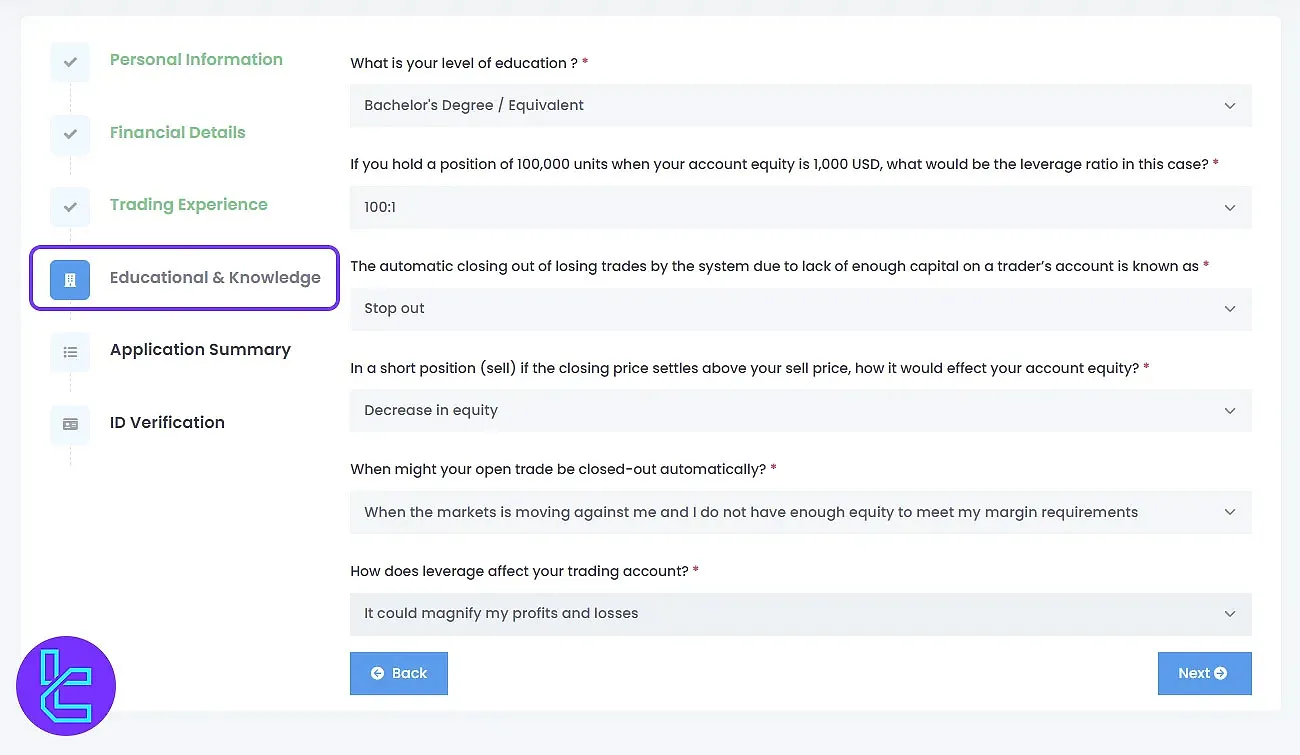

#3 Verify Your Identity

Log in to the MultiBank dashboard, click "Real Account", and proceed to complete your financial profile. You must upload supporting documents to complete the MultiBank verification procedure.

- Proof of Identity: Passport or Driving license

- Proof of Residency: Utility bill or Bank statement

The verification process usually takes 1 business day but may take longer during peak times. To avoid any delays, it's crucial to provide accurate information and clear, legible documents.

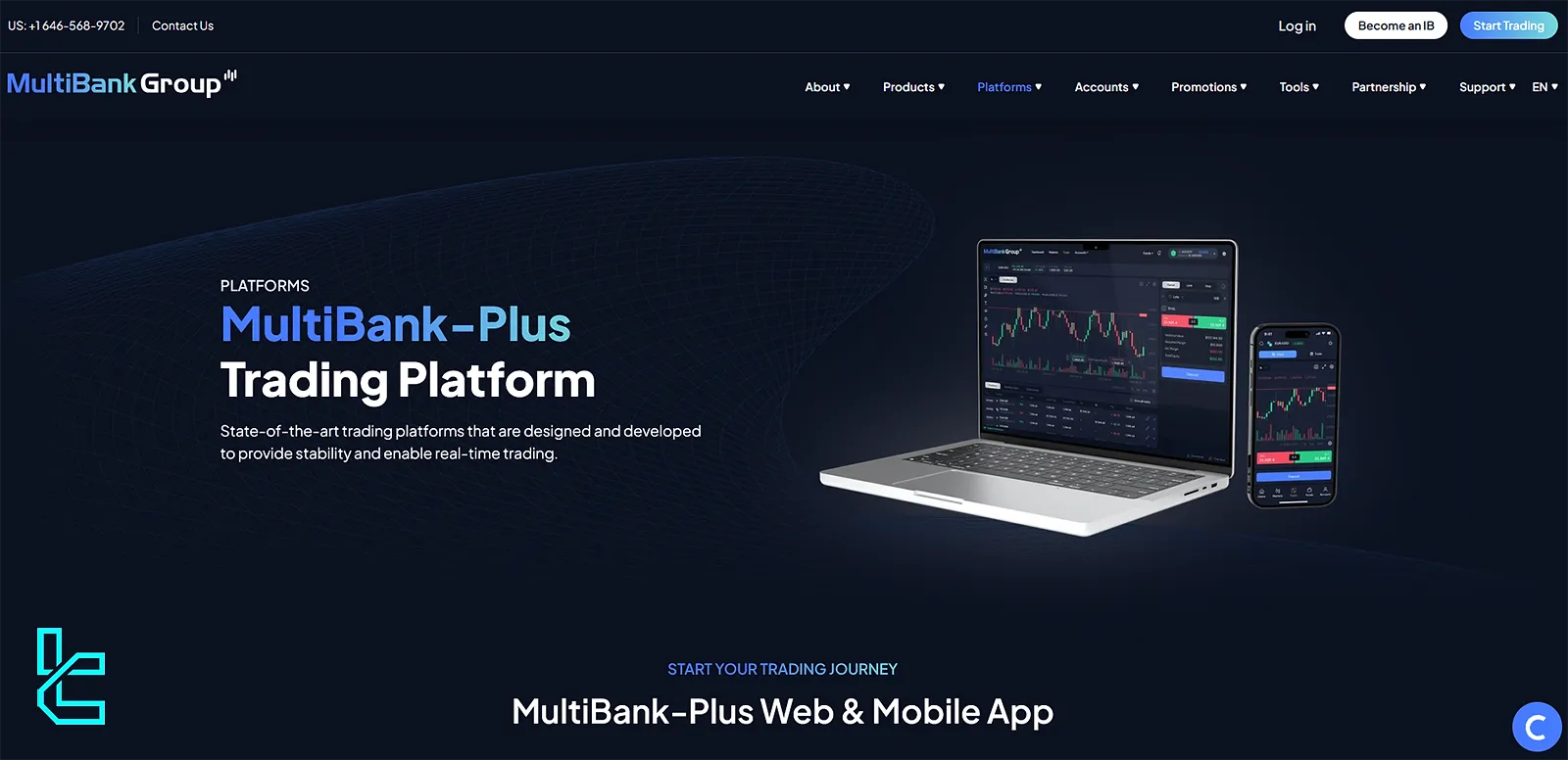

MultiBank Forex Broker Trading Platforms

When it comes to trading platforms, MultiBank offers a trifecta of powerful options designed to cater to traders of all skill levels and preferences, including MetaTrader 4, MT5, and a proprietary platform.

MetaTrader 4 (MT4)

The industry standard, MT4, is beloved for its user-friendly interface and powerful charting tools. It offers:

- Advanced charting capabilities

- Expert Advisors (EAs) for automated trading

- Customizable indicators

- One-click trading

MetaTrader 5 (MT5)

The next-generation platform MetaTrader 5 is built on MT4's success with additional features:

- More timeframes and charting tools

- Improved backtesting capabilities

- Access to a broader range of markets

- Economic calendar integration

MultiBank Plus

MultiBank's platform, designed for seamless trading across devices:

- Over 20,000 instruments

- Investment diversification opportunities

- Advanced trading tools and features for optimal trading

- Access to global financial markets

All platforms are available on desktop and mobile devices, ensuring you can trade on the go or from the comfort of your home office. Here are the download links:

The choice of platform often comes down to personal preference and trading style, so it's worth exploring each option to find the one that best suits your needs.

Traders can access tools such as free VPS hosting, economic calendars, and FIX API connectivity. While the MultiBank-Plus platform has a modern interface, some areas could benefit from UX improvements and deeper research tool integration.

MultiBank Forex Broker Spreads and Commissions

MultiBank’s fee structure varies by account type:

- Standard Account: Spreads from 1.5 pips, commission-free

- Pro Account: Spreads from 0.8 pips, also commission-free

- ECN Account: Raw spreads from0.0 pips, commission-free

Swap-free trading is available on select accounts and regions. There are no internal fees for deposits or withdrawals, although external fees may apply.

Traders should note that a $60 monthly inactivity fee applies after 90 days of inactivity. Also, guaranteed stop-loss orders are not available, which means slippage may occur during fast-moving markets.

It's worth noting that spreads can widen during high market volatility or low liquidity periods. Always check the current trading conditions before placing trades, especially during major economic events or news releases.

Swap Fee at MultiBank

MultiBank charges overnight financing (swap) on standard accounts, varying by instrument and position size. For example, EURUSD swap fee for long positions is $4.99 and for short positions is -8.76 for 100000 (1 lot).

On the other hand, Swap-Free / Islamic accounts eliminate these fees for eligible traders, offering transparent costs and compliance with Islamic trading principles.

To understand the key details, consider the following points:

- Standard account swaps are calculated daily based on the interest differential of the underlying currencies;

- XAUUSD long positions include a long swap equal to $40.56 and a short swap equal to -65.75 for 100oz;

- Traders should regularly check the Swap Policy page for current rates and market adjustments;

- Swap-Free accounts are available to residents in UAE, Saudi Arabia, Malaysia, and select countries;

- Eligible instruments for Swap-Free trading include major forex, commodities and indices.

Non-Trading Fees at MultiBank

MultiBank Group maintains a transparent non-trading fee policy designed to minimize unnecessary costs for traders.

While deposits and withdrawals are generally free of internal charges, specific administrative or inactivity fees may still apply under certain conditions. For instance, the broker enforces a fixed inactivity fee after a defined period without trading activity.

To clarify the most relevant non-trading costs, consider the following key points:

- An inactivity fee of USD 60 per month applies after three consecutive months without trading;

- No internal deposit fees are charged, though external payment provider costs may occur;

- Withdrawals are free from broker-side charges, ensuring seamless fund access;

- A currency conversion mark-up applies if deposits or withdrawals are made in non-base currencies;

- Account maintenance remains free of recurring administrative costs, except inactivity-related charges.

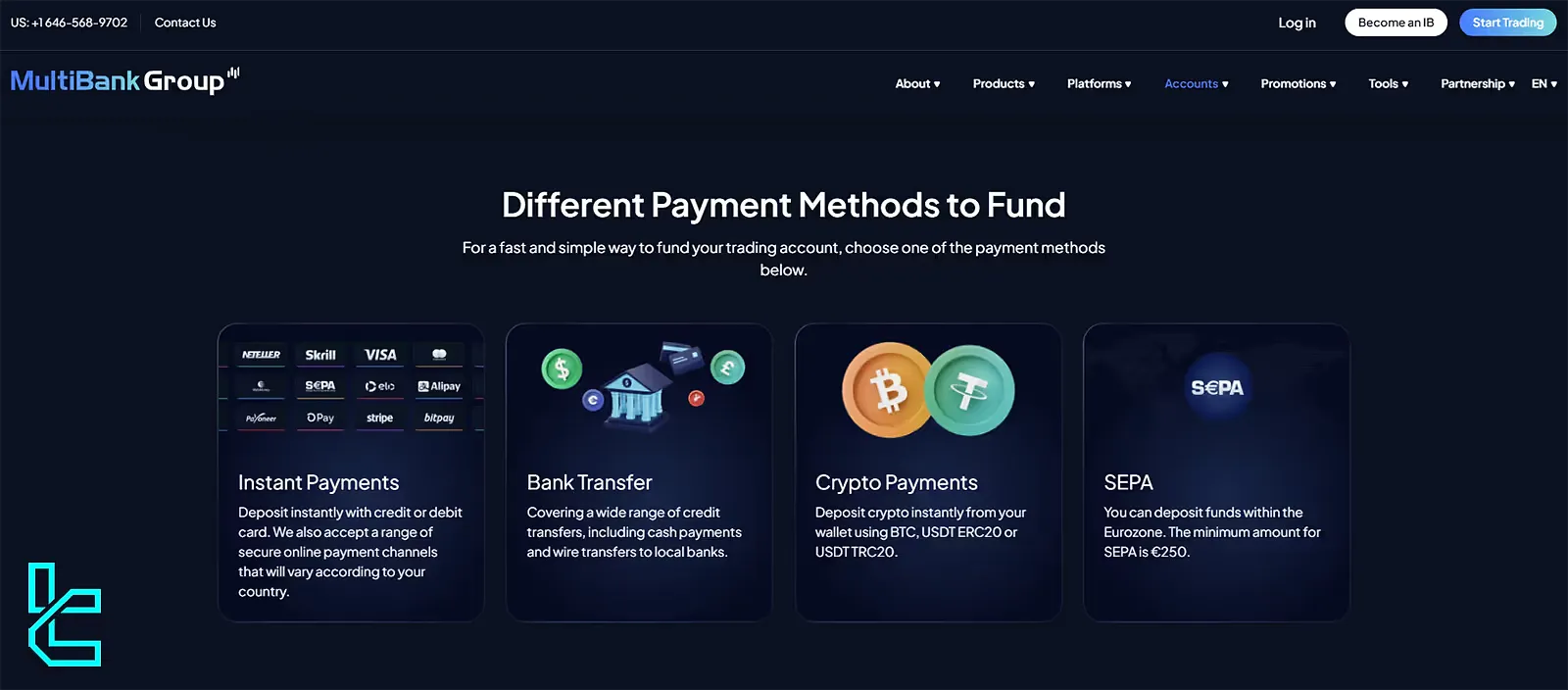

MultiBank Broker Deposit & Withdrawal

MultiBank supports a broad range of global deposit and withdrawal methods:

- Deposit Options: Credit/Debit Cards (Visa, Mastercard), Bank Wire, and Cryptocurrency

- Withdrawal Methods: Credit/Debit Cards (Visa, Mastercard), Bank Wire, and E-Wallet (Neteller)

Key Points about MultiBank deposit & withdrawal:

- The minimum deposit varies by account type, starting from $50;

- No fees charged by MultiBank for deposits or withdrawals (third-party fees may apply);

- Withdrawal processing time is typically 1-5 business days, depending on the method;

- Strict AML and KYC policies are in place to ensure security.

To avoid any delays or complications, always ensure that your account is fully verified before attempting to make a withdrawal.

Deposit Methods at MultiBank

MultiBank Group provides traders with multiple deposit options designed for speed, flexibility, and security. Clients can fund their accounts instantly through cards or crypto wallets, or choose traditional transfers for larger transactions.

For SEPA users, a minimum of €250 applies, ensuring efficient fund transfers across the Eurozone.

Below is an overview of the key deposit methods available through MultiBank Group:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Wire | Various | N/A | $0 | 3–5 business days |

Credit/Debit Cards | Various | N/A | $0 | Instant |

SEPA | EUR | €250 | $0 | N/A |

Skrill | EUR, USD | N/A | $0 | Instant |

Neteller | EUR, USD | N/A | $0 | Instant |

Pagsmile | BRL | N/A | $0 | Instant |

my Fatoorah | KWD, SAR | N/A | $0 | Instant |

Plus Wallets | Varied | N/A | $0 | Instant |

Thai QR Payment | THB | N/A | $0 | Instant |

Pay Trust | IDR, MYR, VND, THB | N/A | $0 | Instant |

Pay Retailers | Varied | N/A | $0 | Instant |

Korapay | NGN, KES, GHS, ZAR, XAF, XOF | N/A | $0 | Instant |

Payment Asia | HKD, CNY, USD | N/A | $0 | Instant |

Boleto | BRL | N/A | $0 | Instant |

Pix | BRL | N/A | $0 | Instant |

G Cash | PHP | N/A | $0 | Instant |

Dragonpay | PHP | N/A | $0 | Instant |

Globepay | USD, GBP, INR, RMB | N/A | $0 | Instant |

Cryptocurrencies | BTC, USDT (ERC20/TRC20) | N/A | $0 | Instant |

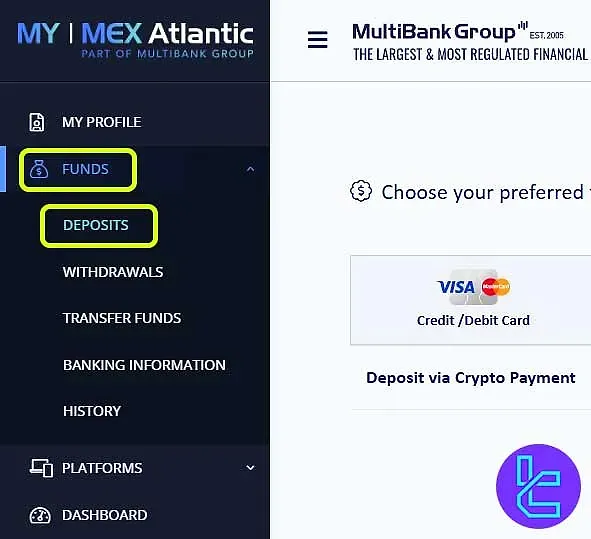

MultiBank ERC20 deposit

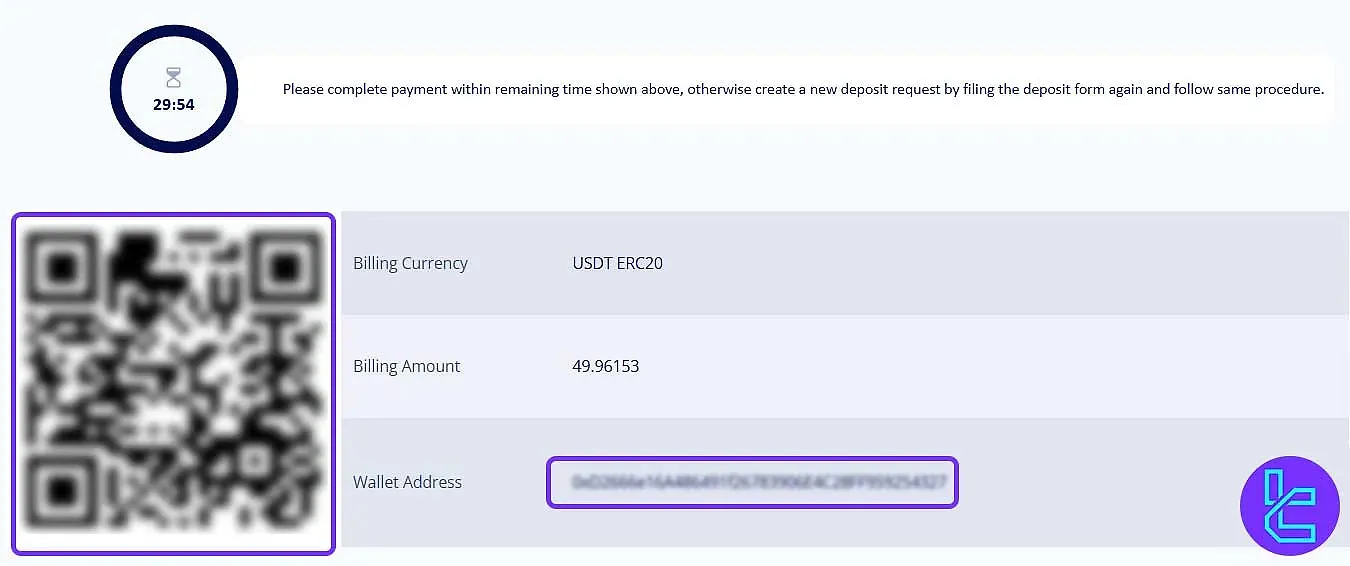

The MultiBank ERC20 deposit allows traders to fund accounts instantly, with funds appearing immediately. Each transaction requires a minimum of $50, and the full process typically takes less than five minutes.

Deposits using Tether (USDT) on the Ethereum network follow a simple three-step workflow.

Here is an overview of the MultiBank ERC20 deposit process:

#1 Accessing the Deposit Section

To start, navigate to the account funding area inside MultiBank:

- Log in to your MultiBank Forex account;

- Go to "Funds", then select "Deposits" to continue.

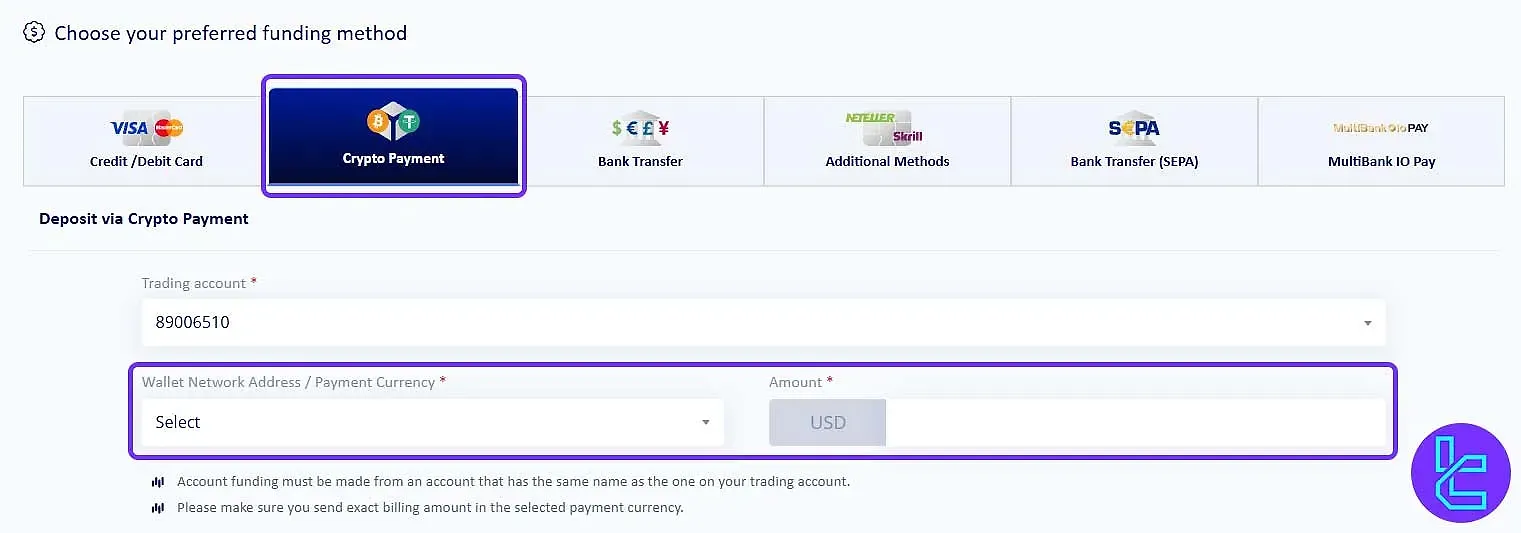

#2 Selecting ERC20 & Entering Transaction Details

Next, provide account details and specify the deposit amount carefully:

- Choose Cryptocurrency as your deposit method;

- Select ERC20 as the network;

- Enter your account information and the deposit amount (minimum $50);

- Click "Fund" to proceed.

#3 Transfer Funds to the Destination Wallet

A QR code and ERC20 wallet address will be displayed. Scan the QR code with your crypto wallet and complete the payment.

After processing, the funds will reflect in your account. Verify the transaction under "Funds" → "History".

Withdrawal Methods at MultiBank

MultiBank Group provides traders with a diverse range of secure, fast, and cost-efficient withdrawal solutions. All withdrawal transactions are processed without internal broker fees, allowing clients to retain the full value of their funds.

Processing times vary depending on the selected method, with most e-wallet and card withdrawals completed within 24 hours.

Below is a summary table outlining the available withdrawal methods and their key parameters:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Bank Wire | Various | N/A | $0 | 3-7 business days |

Credit/Debit Cards | Various | N/A | $0 | Up to 24 hours |

Skrill | EUR, USD | N/A | $0 | Up to 24 hours |

Neteller | EUR, USD | N/A | $0 | Up to 24 hours |

Pagsmile | BRL | N/A | $0 | Up to 24 hours |

my Fatoorah | KWD, SAR | N/A | $0 | Up to 24 hours |

Plus Wallets | Varied | N/A | $0 | Up to 24 hours |

Thai QR Payment | THB | N/A | $0 | Up to 24 hours |

Pay Trust | IDR, MYR, VND, THB | N/A | $0 | Up to 24 hours |

Pay Retailers | Varied | N/A | $0 | Up to 24 hours |

Korapay | NGN, KES, GHS, ZAR, XAF, XOF | N/A | $0 | Up to 24 hours |

Payment Asia | HKD, CNY, USD | N/A | $0 | Up to 24 hours |

Boleto | BRL | N/A | $0 | Up to 24 hours |

Pix | BRL | N/A | $0 | Up to 24 hours |

G Cash | PHP | N/A | $0 | Up to 24 hours |

Dragonpay | PHP | N/A | $0 | Up to 24 hours |

Globepay | USD, GBP, INR, RMB | N/A | $0 | Up to 24 hours |

Cryptocurrencies | BTC, USDT ERC20, USDT TRC20 | N/A | $0 | Instant to 24 hours |

MultiBank ERC20 withdrawal

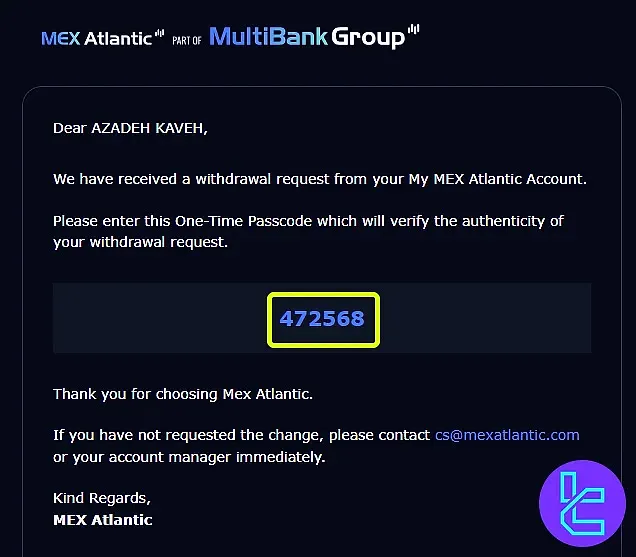

The MultiBank ERC20 withdrawal offers a secure and efficient way to access funds, with a minimum withdrawal of $50 per transaction. Users must provide a valid wallet address, select the appropriate network, and verify the request via email.

This method is entirely commission-free, making it a fast and reliable option for cryptocurrency payouts.

Here is an overview of the MultiBank ERC20 withdrawal process:

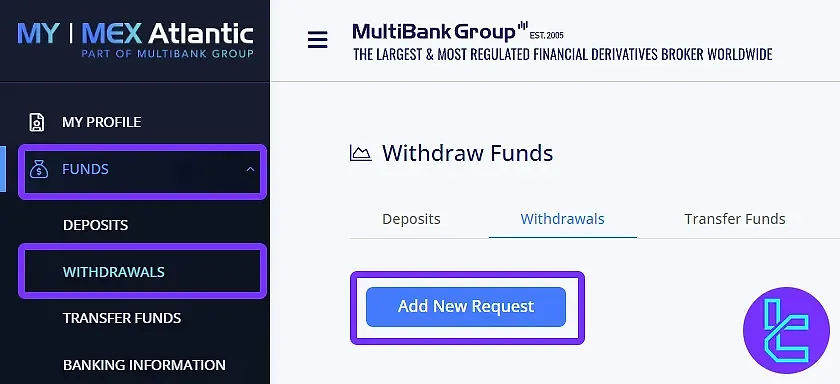

#1 Accessing the Withdrawal Section

Begin by navigating to the withdrawal options inside MultiBank:

- Log in to your MultiBank Forex broker account;

- Go to the "Funds" section;

- Click "Withdraw" and select "Add New Request".

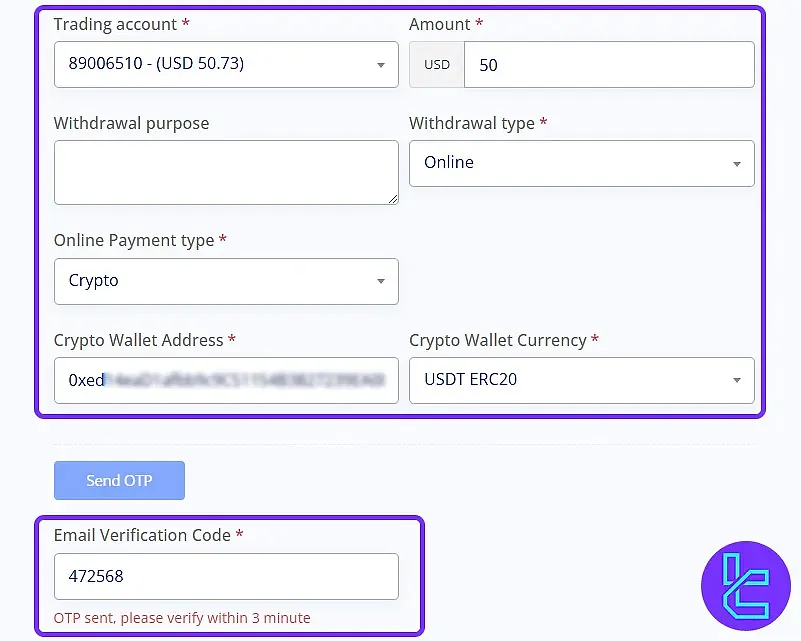

#2 Entering Transaction Details & Verifying the Transaction

Next, input withdrawal details and complete the email verification:

- Enter the desired withdrawal amount (minimum $50);

- Choose ERC20 as the payout method and select the correct blockchain network;

- Input your “wallet address” to receive funds;

- Click "Send OTP" to receive a verification code via email;

- Copy the OTP from your inbox and paste it into the verification field;

- Click "Submit" to finalize the withdrawal request.

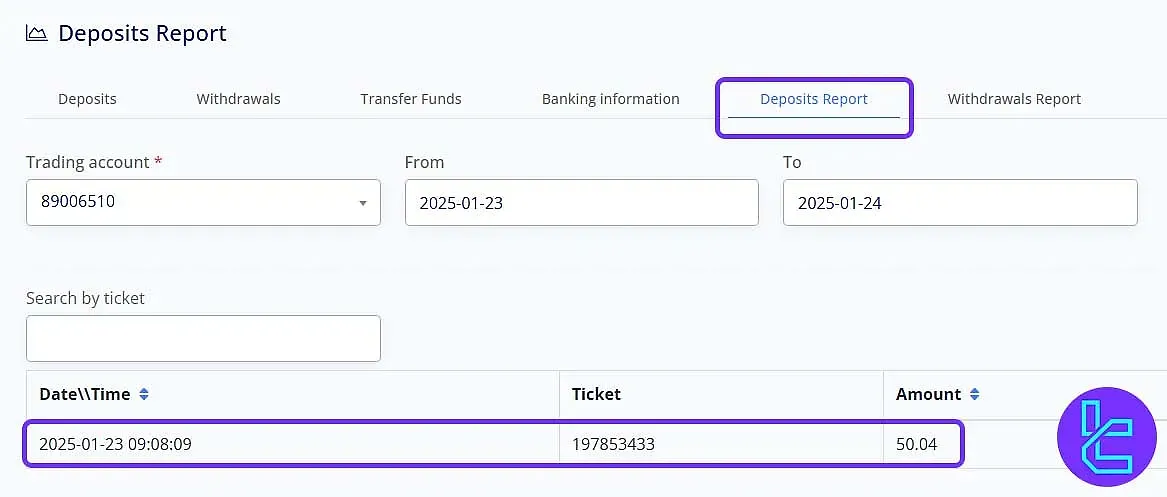

#3 Submitting and Tracking the Payout Request

After submitting the OTP, your request will be under review. Due to check the MultiBank ERC20 withdrawal status:

- Go to the "History" tab in the "Funds" section to track it;

- Filter by date to locate the transaction;

- Once the status shows "Completed", the funds have been successfully withdrawn.

Copy Trading & Investment Options Offered on MultiBank Broker

For traders looking to diversify their strategies or those new to the game, MultiBank offers some interesting copy trading and investment options:

- MAM/PAMM Accounts: Allows professionalmoney managers to manage investors' funds;

- Social Trading: Connect with and copy trades from successful traders within the MultiBank community;

- Automated Trading: This feature supports the use ofExpert Advisors (EAs) for algorithmic trading on the MT4 and MT5 platforms.

These options provide flexibility for traders who want to leverage the expertise of others or automate their trading strategies.

However, always remember that past performance doesn't guarantee future results, and it's crucial to understand the risks involved in copy trading and managed accounts.

MultiBank Forex Broker Tradable Markets & Symbols Overview

Like many forex brokers, MultiBank offers a vast array of over 20,000 tradable instruments across six asset classes, ranging from the Forex market to Share CFDs.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, Minor & Exotic Pairs | ~55 | 30 – 75 | 1:500 |

Metals | Gold, Silver, Platinum, Palladium | ~6 | 5 – 10 | 1:500 |

Commodities | Energies & Soft Commodities (Oil, Gas, Coffee) | ~11 | 5 – 10 | 1:200 |

Shares | Global Stocks (Tech, Finance, Retail, etc.) | 14,000+ | 100 – 500 | 1:20 |

Indices | Major Global Indices (US, EU, Asia) | 23 | 10 – 20 | 1:100 |

Major & Minor Crypto CFDs (BTC, ETH, etc.) | 13 | 10 – 20 | 1:20 |

With over 20,000 tradable symbols, MultiBank provides ample opportunities for diversification and exploring various market sectors.

Always check the specific trading conditions for each instrument, as they may vary in terms of spreads, leverage, and trading hours.

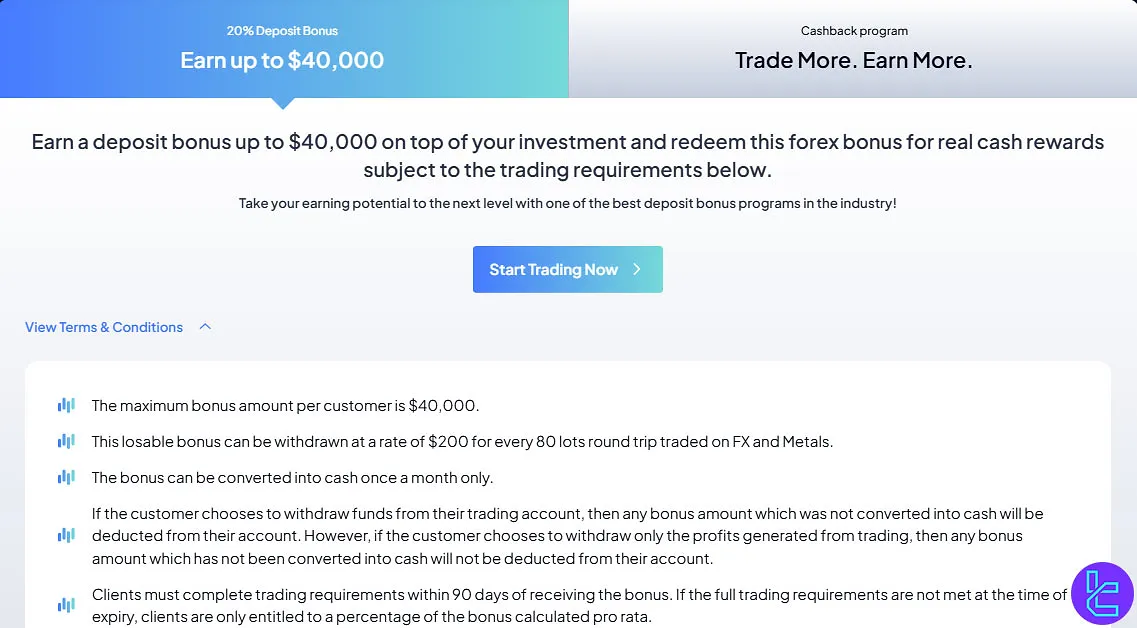

MultiBank Forex Broker Bonuses and Promotions

MultiBank occasionally offers bonuses and promotions to attract new clients and reward existing ones. However, it's important to note that these offers are subject to change and may vary by region due to regulatory restrictions. Some common types of promotions include:

- Deposit Bonus: You can receive up to a20% bonus on your deposit, with a maximum bonus amount of $40,000;

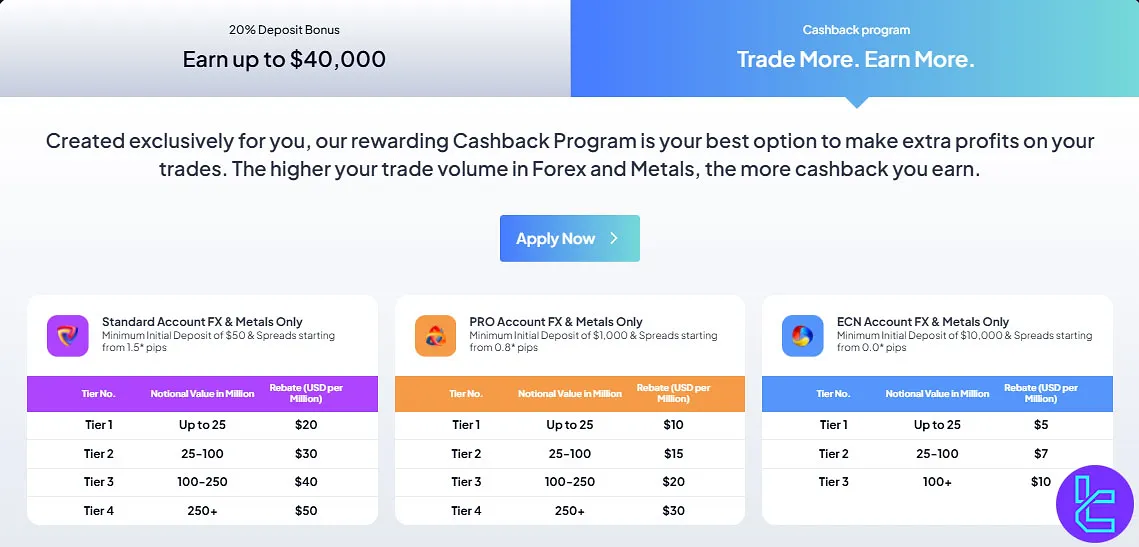

- Cashback Program: This program rewards you with cashback based on the volume of your trades;

- Referral Bonus: Earn bonuses by referring friends who then open and fund their accounts.

These promotions are designed to help traders enhance their trading experience and benefits.

You can get an accurate estimate of your cashback earnings using TradingFinder's Forex Rebate Calculator.

MultiBank Broker Awards

MultiBank has consistently garnered industry recognition through its compelling awards, underscoring its commitment to trader services and technological innovation.

With a strong focus on transparency and client-centric offerings, the firm’s Awards roster highlights standout achievements in brokerage performance and asset protection. MultiBank awards reflect the firm’s dedication to excellence across multiple dimensions of the trading experience.

Below are some of the notable awards the company has earned:

- Best Forex Introducing Broker Program 2025

- Most Valuable Asset-Backed Token 2025

- Best Global ECN Broker 2025

- Best Social Trading Solution 2025

- Best Client Funds Protection 2025

MultiBank Broker Support team

Quality customer support is crucial in the fast-paced world of trading, and MultiBank strives to provide responsive and helpful assistance [24/7] to its clients. Here's what you can expect:

- Live Chat: Available on the home page of the website

- Email: Use for non-urgent questions or detailed requests

- Phone: Multiple regional numbers for direct support

- Multilingual Support: Assistance available in multiple languages to cater to a global clientele

The quality of customer support can make or break a trading experience, especially during critical moments.

MultiBank Broker List of Restricted Countries

Due to regulatory requirements and internal policies, MultiBank, like many international brokers, cannot offer its services to residents of certain countries. While the exact list may change over time, some typically restricted regions include:

- North Korea

- Ukraine

- UK

- USA

- Iran

- Russia

- Myanmar

It's important to note that this list is not exhaustive and may be subject to change. Always check the most up-to-date information on MultiBank's website or contact customer support for the latest details on country restrictions.

Additionally, even if your country is not on the restricted list, local regulations may impact your services.

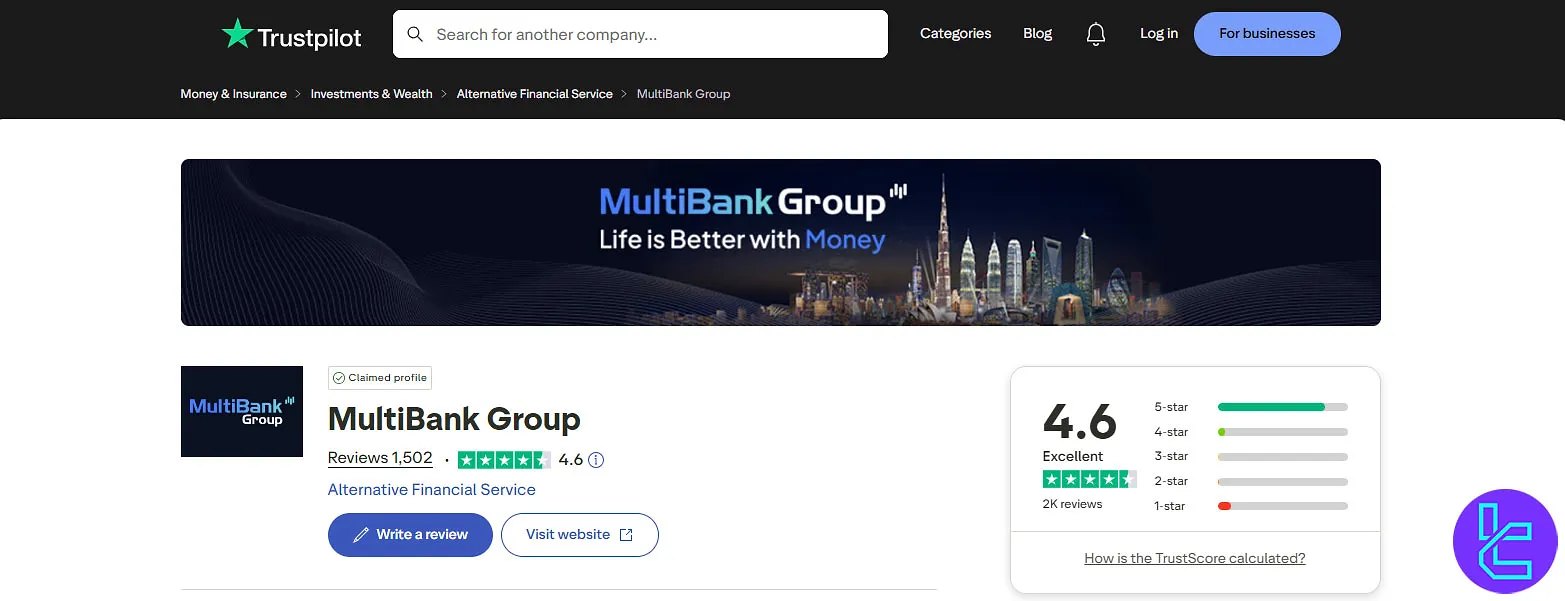

MultiBank Broker Trust Scores & Reviews

Trust is paramount in online trading, and MultiBank has worked hard to establish a solid reputation. Let's take a look at how they stack up in terms of trust scores and user reviews:

Reviews.io | 4.1 out of 5 |

4.6 out of 5 |

While these scores paint a generally positive picture, it's important to note that individual experiences may vary. Common praises in user reviews include the broker's wide range of tradable instruments and competitive spreads.

Criticisms sometimes mention withdrawal processing times and the complexity of some account features for beginners.

Education on MultiBank Broker

MultiBank’s educational content is basic and better suited for beginners. Resources include:

- Introductory videos and eBooks

- Platform tutorials (MT4/MT5, MultiBank-Plus)

- Social trading walkthroughs

- Mobile app guidance

The research offering is similarly limited, primarily consisting of Dow Jones headlines within the platforms. MultiBank does not offer webinars, Autochartist, or deep fundamental/technical analysis.

While the foundation exists, significant expansion is needed to compete with research leaders. You can check TradingFinder's Forex education section for additional resources.

MultiBank Comparison Table

Here is a detailed comparison between MultiBank and the top forex brokers:

Parameter | MultiBank Broker | AMarkets Broker | FXTM Broker | Tickmill Broker |

Regulation | FSAS, FSCM, VFS, TFG, MAS, FMA, FSC, CySEC, ESCA, CIMA, BAFIN, AUSTRAC, ASIC | FSA, FSC, Misa, FinaCom | FSC | FSA, FCA, CySEC, LFSA, FSCA |

Minimum Spread | From 0.0 Pips | From 0.0 pips | From 0.0 pips | From 0.0 Pips |

Commission | $0.0 | From $0.0 | Variable | From $0.0 |

Minimum Deposit | $50 | $100 | $200 | $100 |

Maximum Leverage | 1:500 | 1:3000 | 1:3000 | 1:1000 |

Trading Platforms | MultiBank-Plus, MT4, MT5, WebTrader | MetaTrade 4, MetaTrade 5, Mobile App | MT4, MT5, FXTM Trader App | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App |

Account Types | Standard, Pro, ECN | Standard, ECN, Fixed, Crypto, Demo | Advantage, Stocks Advantage, Advantage Plus | Classic, Raw |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 20,000+ | 550+ | 1000+ | 620+ |

Trade Execution | Market, Instant | Instant, Market | Market, Instant | Market |

Conclusion and final words

About MultiBank, the trust ratings of 4.5/5 on Trustpilot and 4.6/5 on Reviews.io underscore its reputation.

The firm’s offerings, such as copy trading and Islamic accounts, alongside promotions including a 20% deposit bonus (up to $40,000) and incentives like winning an iPhone for trading 15 lots, make it an attractive choice.

Deposits can be made through several methods, including credit/debit cards, bank transfers, cryptocurrency, and SEPA. Withdrawal processing times can be as quick as 1 day up to 5 business days.