The broker does not impose any inactivity fees, allowing clients to keep their accounts dormant without incurring additional costs. In contrast, some brokers apply such charges to promote regular trading activity or offset account maintenance expenses.

OneRoyal offers a range of account types—Classic, ECN, VIP, ECN Elite, Cent, and Demo—to cater to varying trading needs. Minimum deposits range from $10 for Cent accounts to $10,000 for VIP and ECN Elite accounts.

The broker’s platforms like MT4, MT5, and the MT4 Accelerator, provide features such as automated trading, one-click trading, and extensive analytical tools.

OneRoyal Company Information & Regulation Status

Founded in 2006, OneRoyal is a multi-licensed CFD and Forex broker operating under the Royal Group. The broker maintains regulatory status with several financial authorities, including:

- ASIC (Australia): Royal Financial Trading Pty Ltd, AFSL 420268

- VFSC (Vanuatu): Royal CM Limited, License 700284

- FSA (St. Vincent & the Grenadines): Royal ETP LLC, registered as 149LLC2019

This regulatory structure enables OneRoyal to serve clients globally, offering a diverse range of account features and leveraging its profiles. However, only the ASIC-regulated entity provides a higher tier of investor protection through regulatory compliance frameworks.

With regional offices in Sydney, Beirut, Limassol, Lagos, Cairo, and Florida, OneRoyal serves a diverse global client base.

Initially launched with a focus on providing optimized forex trading conditions, the broker has since expanded its offerings to include CFDs on over 45 forex pairs, commodities such as oil and metals, global indices, and shares.

The firm is known for its long-standing presence in theMiddle East and Africa and continues to invest in regional development, most recently marked by the opening of its Lagos office in 2022.

OneRoyal positions itself as a technologically robust and education-driven broker, catering to both retail and professionalclients worldwide.

| Entity Parameters/Branches | Royal Financial Trading Pty Ltd | Royal CM Limited | Royal ETP LLC |

Regulation | ASIC | VFSC | SVGFSA |

Regulation Tier | 1 | 3 | 3 |

Country | Australia | Vanuatu | St. Vincent & the Grenadines |

Investor Protection Fund/Compensation Scheme | No | No | No |

Segregated Funds | Yes | Yes | No |

Negative Balance Protection | Yes | No | No |

Maximum Leverage | 1:30 | 1:1000 | 1:1000 |

Client Eligibility | Australia | Global | Global |

OneRoyal Broker Summary of Specifics

OneRoyal Broker stands out in the crowded forex market with its comprehensive offerings and commitment to trader success. Here's a quick summary of what sets OneRoyal apart:

Broker | OneRoyal |

Account Types | Classic, ECN, VIP, ECN Elite, Cent, Demo |

Regulating Authorities | ASIC, FSA, VFSC |

Based Currencies | USD, EUR, GBP, PLN |

Minimum Deposit | $10 |

Deposit/Withdrawal Methods | Visa, Mastercard, Bank Wire Transfer, Skrill, Neteller, Cryptocurrencies |

Minimum Order | 0.01 |

Maximum Leverage | 1:1000 |

Investment Options | PAMM |

Trading Platforms & Apps | MT4, MT5, MT4 Accelerator |

Markets | Forex, Metals, Oil, Indices, ETFs, Stocks, Cryptocurrencies |

Spread | From 0.0 |

Commission | From $0 |

Orders Execution | Market |

Margin Call/Stop Out | N/A |

Trading Features | Copy Trading, VPS Hosting, AI Trading Tools |

Affiliate Program | YES |

Bonus & Promotions | YES |

Islamic Account | YES |

PAMM Account | YES |

Customer Support Ways | Live Chat, WhatsApp, Telegram, Call Back, Messenger, Email |

Customer Support Hours | 24/5 |

OneRoyal caters to various trader profiles with its range of account types, providing access to powerful trading tools and resources. Their global licenses and regulations ensure a secure trading environment, while their quick deposit and withdrawal processes add to the overall positive trading experience.

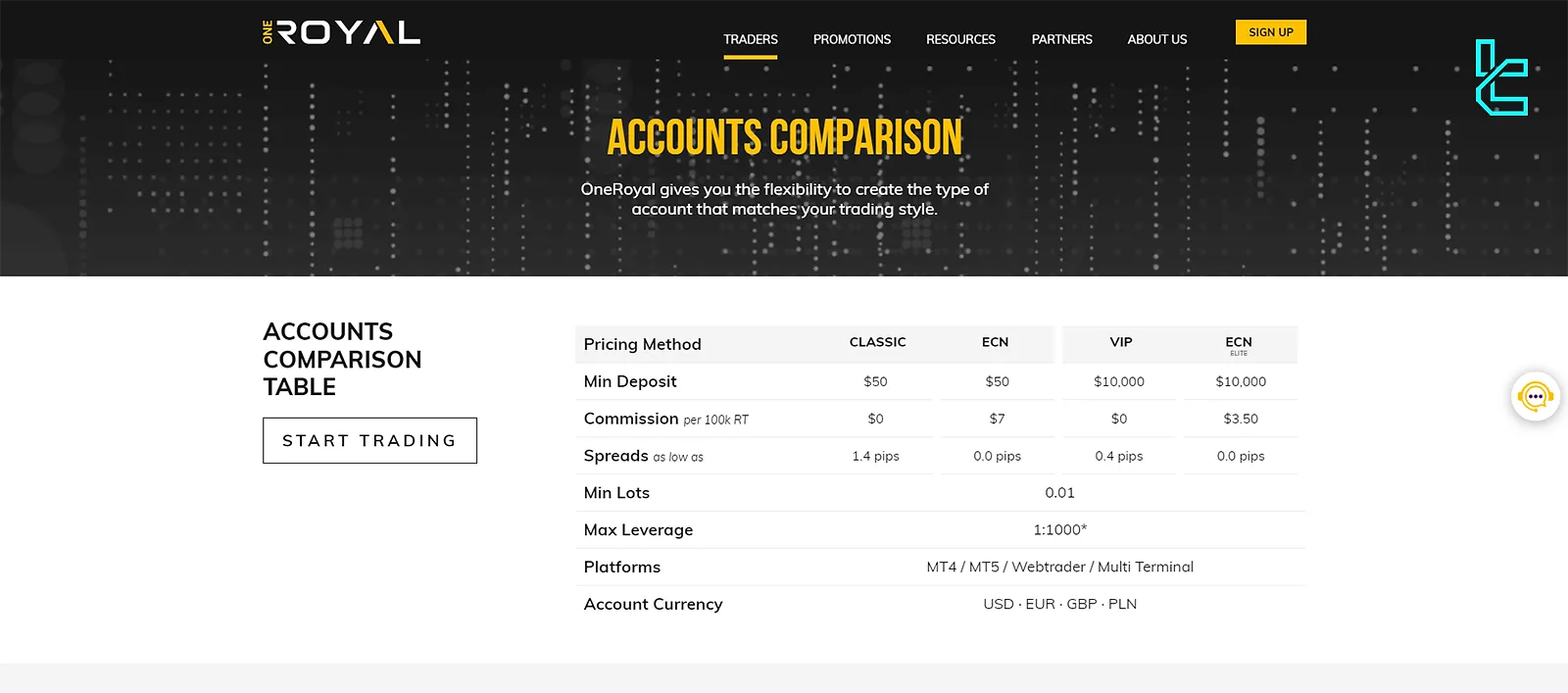

OneRoyal Types of Accounts

OneRoyal broker offers a variety of account types to suit different trading styles and investment levels. Here's a breakdown of their main account types:

- Classic: $50 minimum deposit, spreads from 1.4 pips, zero commission

- ECN: $50 deposit, raw spreads from 0.0 pips, $7 per lot commission

- VIP: $10,000 deposit, spreads from 0.4 pips, no commission

- ECN Elite: $10,000 deposit,raw spreads, $3.5 per lot commission

- Cent Account: $10 deposit, standard trading conditions

- Demo: Unlimited practice environment with real-market conditions

All account types offer leverage options of up to 1:1000 (subject to regulatory restrictions), various base currencies (USD, EUR, GBP, and PLN), access to a wide range of tradable instruments, and advanced trading platforms, including MetaTrader 4 and MT5.

The choice between these accounts depends on your trading volume, preferred trading style, and capital availability.

OneRoyal Advantages and Disadvantages

Like any broker, OneRoyal has its strengths and potential drawbacks. Here's a balanced view of what you can expect:

Pros | Cons |

Multi-licensed and regulated | high minimum deposit for VIP accounts |

Competitive spreads starting from 0.0 pips | Limited range of tradable assets (compared to some competitors) |

High leverage up to 1:1000 | No US clients accepted |

Overall, OneRoyal positions itself as a reliable broker with a strong focus on trader education and support, making it particularly attractive for beginners and intermediatetraders.

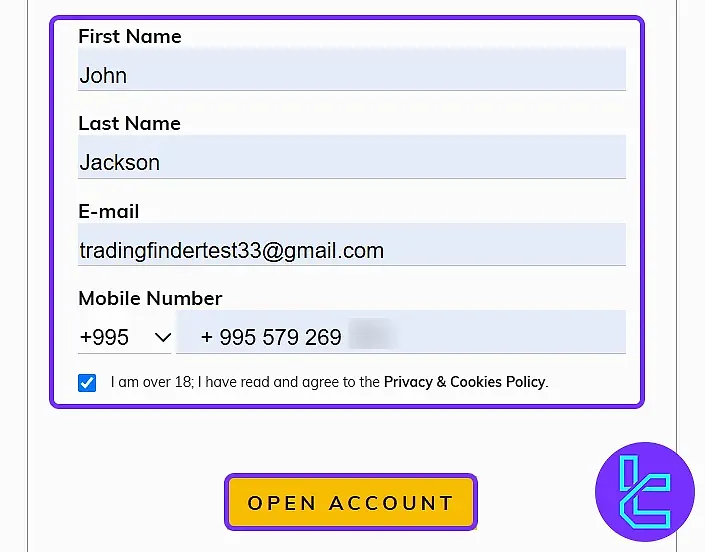

OneRoyal Broker Signing Up & Verification Process

Creating an account on OneRoyal is a seamless process that takes just a few minutes and includes essential verification to ensure security.

With a streamlined 3-step flow, traders can quickly gain access to the broker’s dashboard and trading services. Steps to OneRoyal registration:

#1 Visit OneRoyal and Start Registration

Click on “Open Account” from the official website to access the registration page where you’ll begin the sign-up procedure.

#2 Fill in the Form

Enter your personal information, including:

- First and last name

- Email address

- Mobile number

Accept the platform’s terms and conditions, then submit the form. A verification link will be sent immediately.

#3 Confirm Your Email

Go to your inbox and verify your email address by clicking the confirmation link sent by OneRoyal. This finalizes your registration and activates your access.

After this step, completing the full identity verification is required to unlock all trading features and access to the OneRoyal platform environment.

#4 OneRoyal Verification

Navigate to the KYC menu through the client dashboard and upload supporting documents, including:

- Proof of ID: Passport or Driver's license

- Proof of Residence: Utility bill or Bank statement

The verification process usually takes 1-2 business days.

OneRoyal’s Trading Platforms

OneRoyal offers a range of powerful trading platforms to suit different trader preferences:

- MetaTrader 4 (MT4): The industry-standard platform known for its user-friendly interface and extensive analytical tools

- MT4 Accelerator: OneRoyal's enhanced version of MT4 with 12 advanced features, including automated and one-click trading

- MetaTrader 5 (MT5): The next-generation platform offering more timeframes, order types, and analytical tools

These platforms and tools are designed to cater to traders of all experience levels, from beginners to advanced professionals. They are available on the web, desktop, and mobile, with the following links:

OneRoyal’s Spread and Commission Structure

OneRoyal offers competitive pricing across its account types:

Account | Spreads from | Commission |

Classic | 1.4 pips | $0 |

ECN | 0.0 pips | $7 |

VIP | 0.4 pips | $0 |

ECN Elite | 0.0 pips | $3.5 |

Cent | 1.4 pips | $0 |

The choice between spread-based and commission-based accounts depends on your trading style and volume.

High-volume traders may benefit more from the ECN accounts with raw spreads and commissions, while occasional traders might prefer the simplicity of spread-only Classic or VIP accounts.

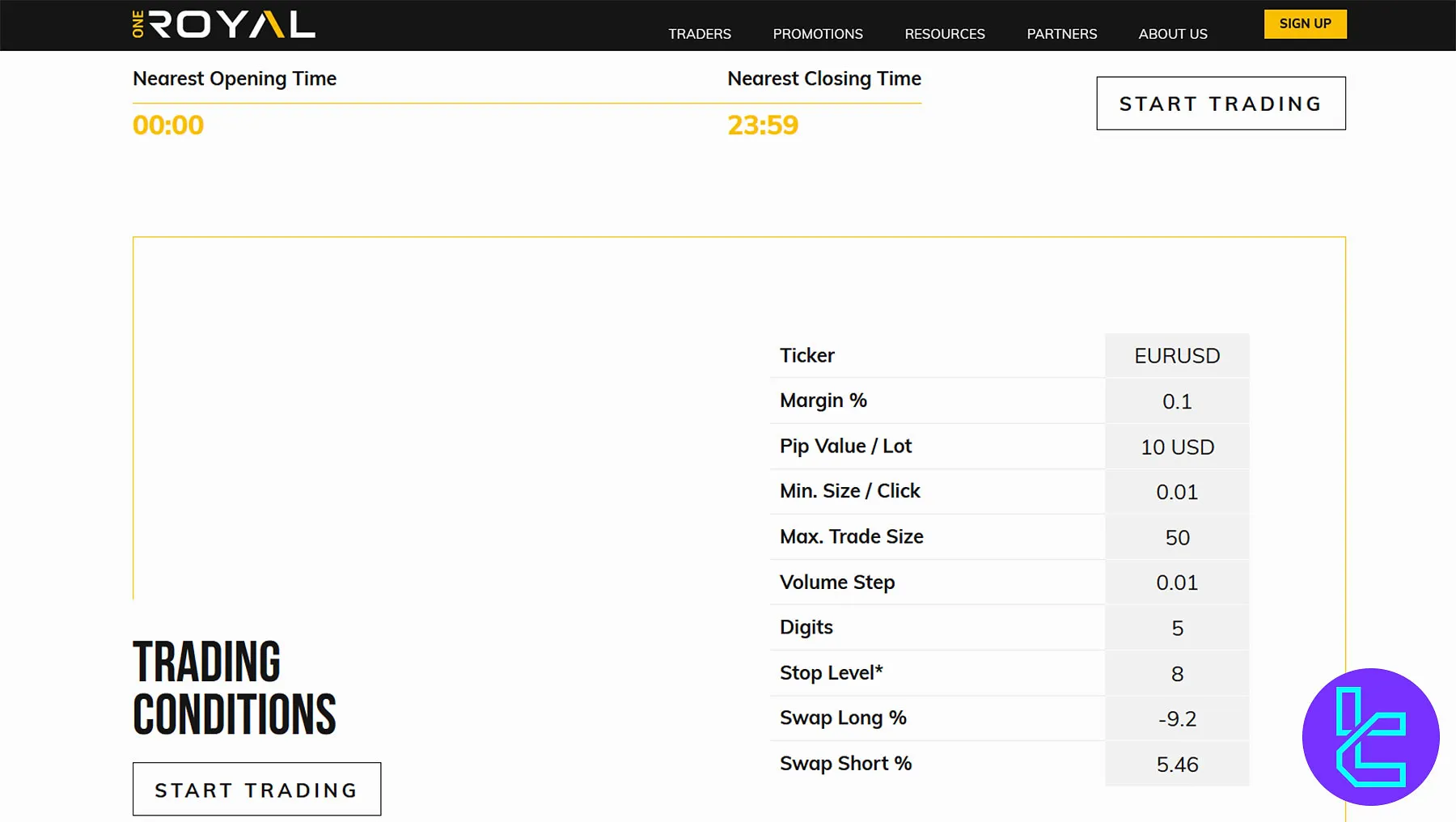

OneRoyal Swap Fees

A swap is the overnight financing cost that reflects the interest rate differential between the currencies involved in a trade. These rates can change in line with market interest rate movements.

A triple swap applies on Wednesdays due to the T+2 settlement cycle for most instruments. Positions rolled from Wednesday to Thursday include the weekend financing, resulting in the triple rate. Here are some examples of OneRoyal swap rates:

Instrument | Swap Long % | Swap Short % |

EURUSD | -9.2 | 5.46 |

GBPUSD | -5.45 | 1.15 |

USDJPY | 10.83 | -16.96 |

USDCAD | -2.27 | -5.93 |

AUDUSD | -2.57 | 0.28 |

USDCHF | 5.22 | -10.79 |

XAGUSD | -0.19 | 0.06 |

XAUUSD | -17.39 | 11.15 |

OneRoyal Inactivity Fee

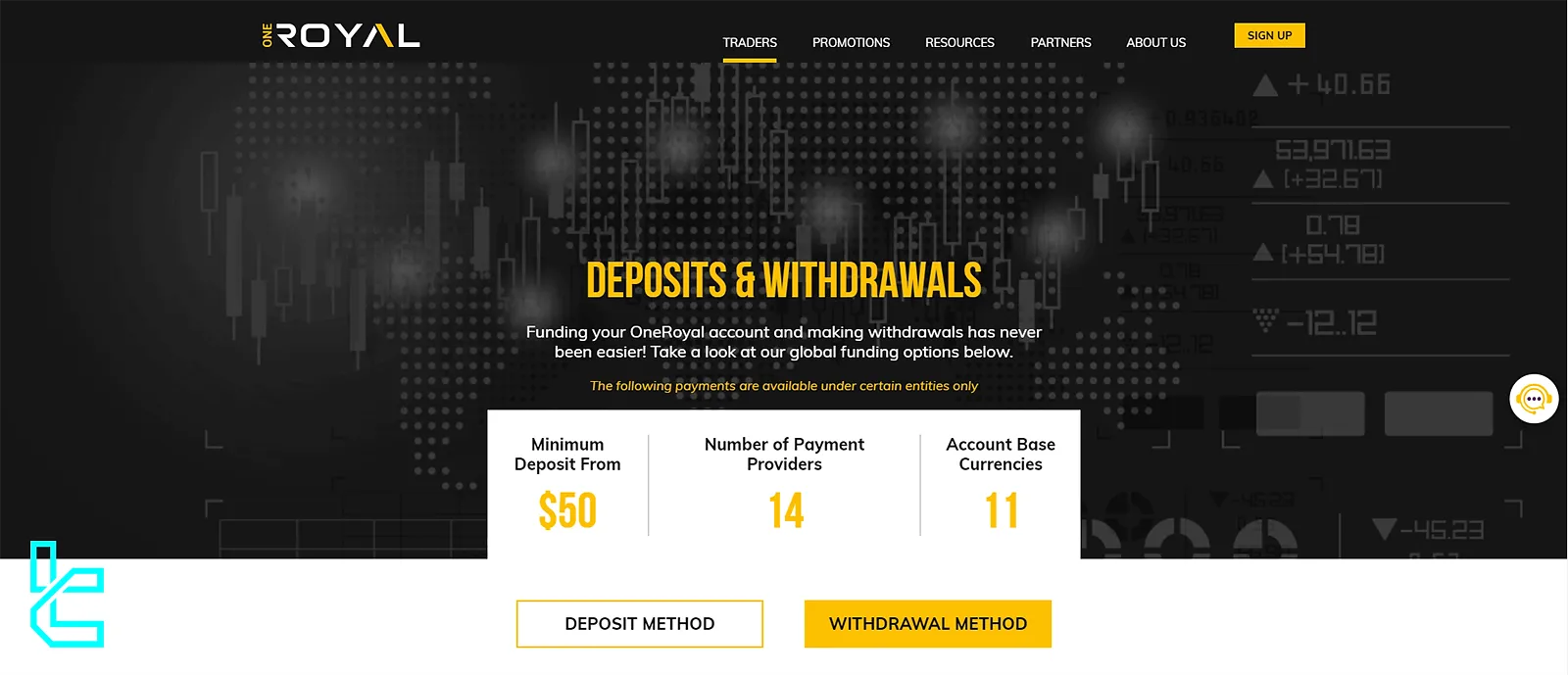

OneRoyal Broker Deposit & Withdrawal Methods

OneRoyal offers a variety of deposit and withdrawal methods to cater to traders worldwide:

- Credit/Debit Cards: Visa and Mastercard

- Bank Wire Transfer

- E-wallets: Skrill, Neteller, etc.

- Cryptocurrencies

OneRoyal Deposits

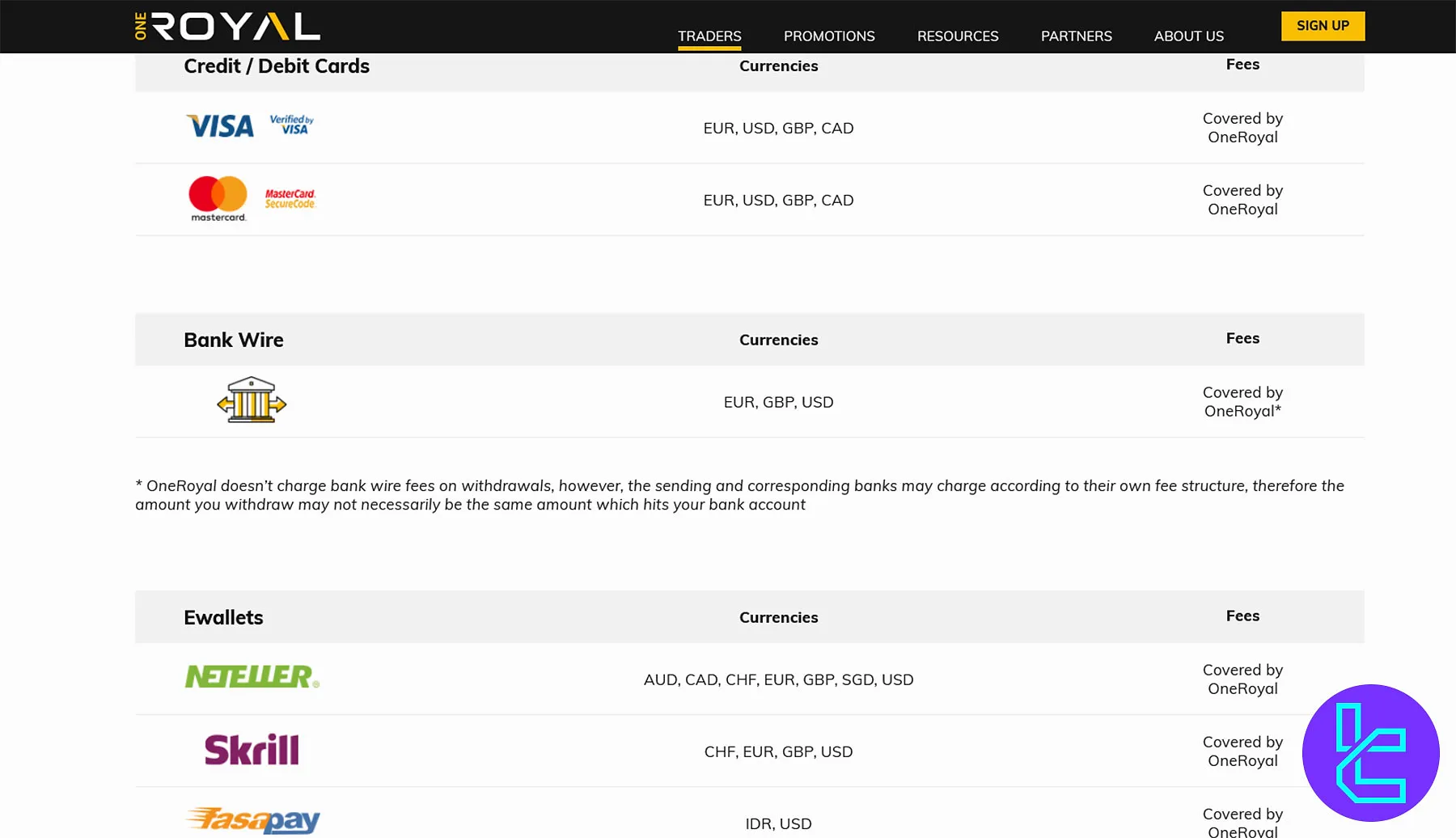

The minimum deposit starts from $50 with 11 base currencies and 14 payment providers, including:

| Deposit Methods | Currencies | Fees |

VISA / MasterCard | EUR, USD, GBP, CAD | Covered by OneRoyal |

Bank Wire | EUR, GBP, USD | Covered up to $30 on deposits over $500 |

Neteller | AUD, CAD, CHF, EUR, GBP, SGD, USD | Covered by OneRoyal |

Skrill | CHF, EUR, GBP, USD | Covered by OneRoyal |

Nganluong.vn | VND | Covered by OneRoyal |

UnionPay | CNY | Covered by OneRoyal |

Asia Banks | PHP, IDR, MYR, VND | Covered by OneRoyal |

WhishMoney | USD | Covered by OneRoyal |

UPI / IMPS | INR | Covered by OneRoyal |

Cryptocurrencies | BTC, ETH, XRP, USDT | 0% |

Note: Crypto transactions may incur blockchain network fees.

OneRoyal Withdrawals

OneRoyal also covers all transaction fees for withdrawal requests. The available methods for payouts are the same as the funding options.

Copy Trading & Investment Options Offered on OneRoyal Broker

OneRoyal offers several options for traders who want to leverage the expertise of others:

- Copy Trading: Through HokoCloud, traders can automatically copy the trades of successful investors. This allows novice traders to benefit from the strategies of experienced traders without needing extensive market knowledge;

- PAMM Accounts: Percentage Allocation Management Module accounts allow investors to allocate their funds to be managed by professional traders. This option suits those who want to invest in forex but lack the time or expertise to trade independently.

These options allow beginner investors to participate in financial markets, but it's important to remember that all trading carries risk, and past performance doesn't guarantee future results.

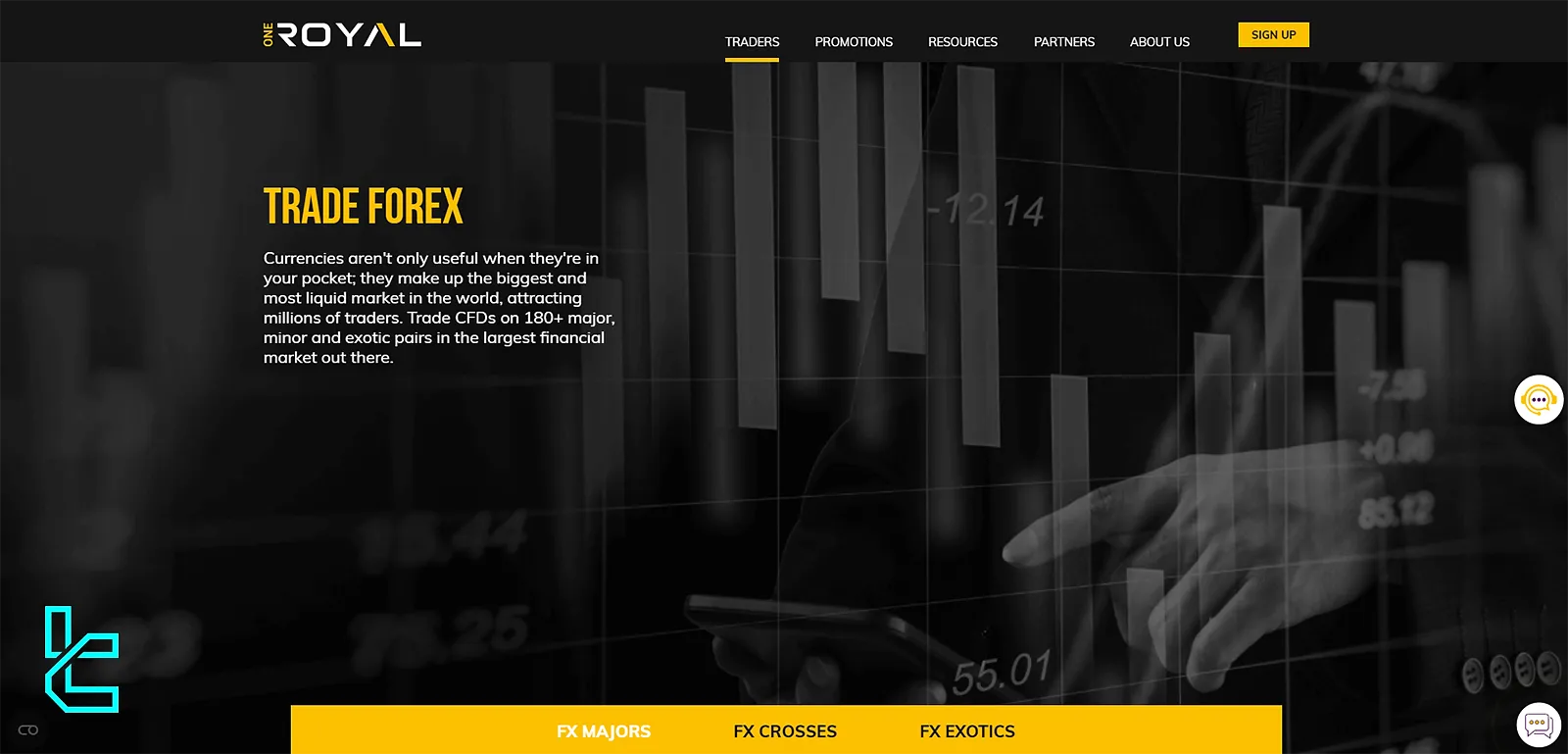

OneRoyal Tradable Markets & Symbols Overview

OneRoyal offers access to a diverse set of financial markets through CFDs, including the Forex market and Cryptocurrencies.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs | Over 180 | 50 - 70 currency pairs | 1:1000 |

Indices | CFDs | 14 | 10 - 20 instruments | 1:200 |

Stocks | CFDs | 2,000+ | 800 - 1200 | N/A |

ETFs | CFDs | 12 | 20 - 30 | N/A |

Metals | CFDs | 5 instruments (e.g., Gold, Silver, Platinum, and Palladium) | 3 - 10 | 1:500 |

Energies | CFDs | 2 instruments (WTI and BRENT) | 15 - 30 instruments | 1:100 |

Cryptocurrencies | CFDs | 5 symbols (e.g., Bitcoin, Ethereum, Litecoin, Dash, Bitcoin Cash) | 20 - 30 instruments | 1:2 |

This range of instruments allows traders to diversify their portfolios and exploit opportunities across different markets.

Trade Forex, Stocks, Indices, Metals, Oil, Cryptocurrencies, ETFs on OneRoyal

Trade Forex, Stocks, Indices, Metals, Oil, Cryptocurrencies, ETFs on OneRoyal

OneRoyal Bonus and Promotion offerings

OneRoyal offers an attractive bonus for traders and partners. With the 100% deposit bonus, new traders can potentially double their initial deposit, subject to terms and conditions. Here is the step-by-step guide to receiving the OneRoyal 100% deposit bonus:

- Create and verify your account;

- Make a deposit;

- Find your balance doubled and start trading.

It’s worth noting that OneRoyal's Introducing Broker (IB) program allows partners to earn up to 75% of the spread and commission when referring traders.

OneRoyal Awards

OneRoyal has earned multiple accolades across global financial industry events, reflecting strengths in forex brokerage, MetaTrader 4 services, and AI-powered trading solutions.

- Best Forex Broker 2025: The Trading Show Morocco

- Best Global MT4 Broker 2025: FXDailyInfo

- Best AI Tools Award 2025: TradeBrains Awards

- Best IB Program in Asia 2024: Global Banking & Finance Awards

- Best Broker Middle East 2023: UF AWARDS MEA

- Top Trusted Broker 2023: Middle East Financial Markets Awards (MEFM)

- Best Retail Forex Broker 2023: Smart Vision

OneRoyal Broker Support

OneRoyal prides itself on providing comprehensive, multilingual support to its clients. Support channels include:

- Live Chat: Available directly on their website for instant assistance

- WhatsApp: For quick, mobile-friendly communication

- Telegram: Another instant messaging option for traders

- Call Back: Request a call from the support team at your convenience

- Messenger: Support through Facebook Messenger

- Email: For detailed questions

Support is available 24/5, aligning with forex market hours. OneRoyal has offices in multiple locations, includingAustralia, Lebanon, Vanuatu, St. Vincent & the Grenadines, the United States, and Nigeria, ensuring global coverage and local support where possible.

OneRoyal Broker List of Restricted Countries

While OneRoyal serves traders from many countries worldwide, some restrictions exist due toregulatory requirements. The broker does not accept clients from the following:

- United States

- EU countries

- North Korea

- China

- Japan

- Iran

It's important to note that this list may change over time due to evolving regulatory landscapes.

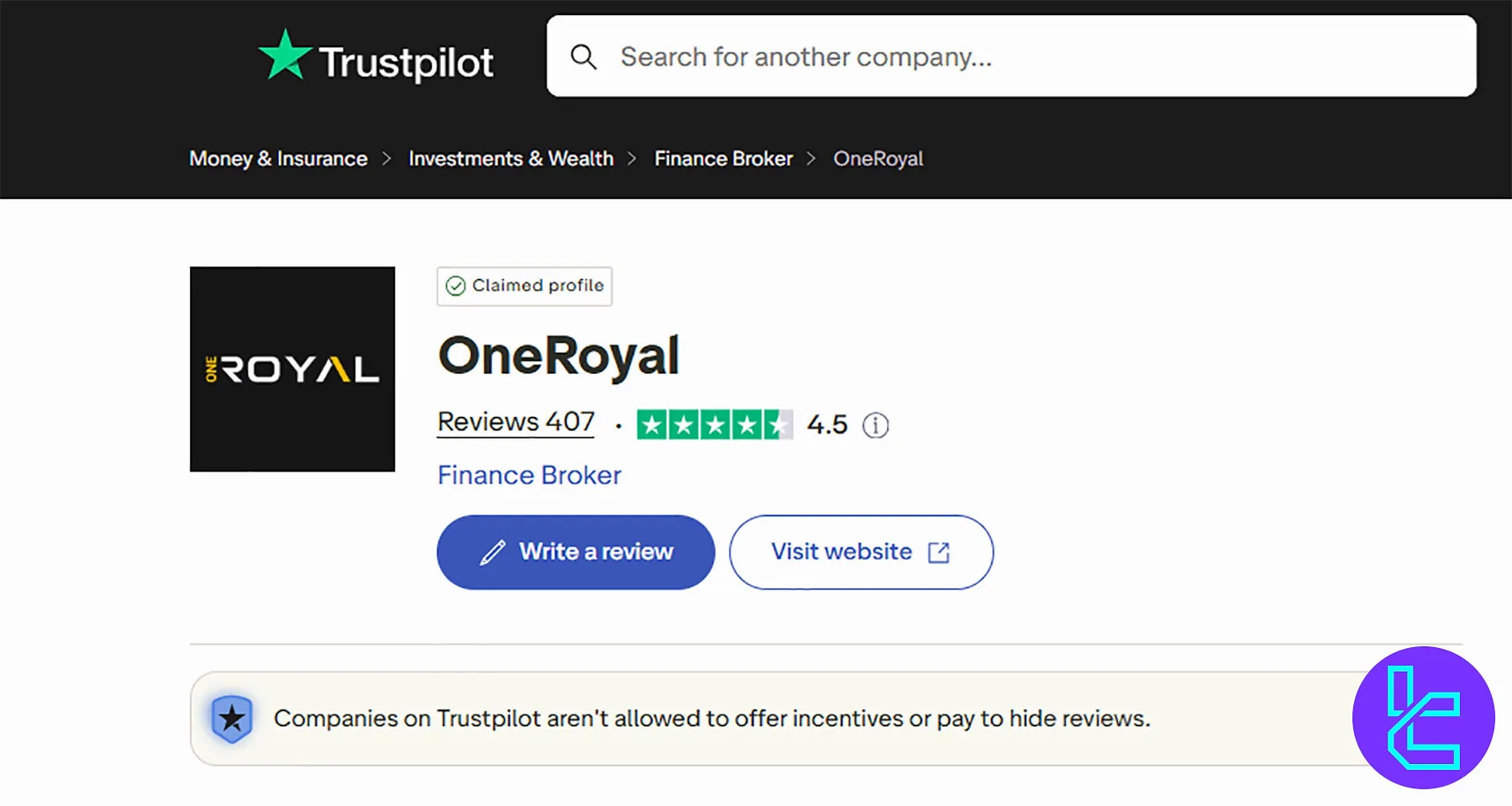

OneRoyal Broker Trust Scores & Reviews

The broker has established a strong reputation in the forex trading community, reflected in its trust scores and user reviews.

The OneRoyal Trustpilot profile holds an average rating of 4.5 out of 5 stars based onover 407 reviews. Here's a breakdown of the key points from these reviews:

Positive Aspects | Areas for Improvement |

Low spreads and fast execution | Some reports of deposit/withdrawal delays |

Responsive and helpful customer service | Concerns about transparency in some areas |

Wide range of trading instruments | Restrictive terms and conditions for some promotions |

User-friendly platforms and tools | - |

It's worth noting that OneRoyal actively responds to user reviews, addressing concerns and offering to resolve any issues. This commitment to customer satisfaction contributes to their overall positive reputation in the industry.

Education on OneRoyal Broker

OneRoyal places a strong emphasis on trader education, offering a comprehensive range of resources to help both novice and experienced traders enhance their skills:

- Blog: Regular articles covering market analysis, trading strategies, and industry news

- Webinars: Live, interactive sessions with expert traders and analysts

- Knowledge Hub: A series of educational videos covering topics such as Candlestick patterns, Market movements, etc.

- Roy & AI show: Ananimated series of forex-related videos

These educational resources, combined with OneRoyal's range of trading tools like Economic Calendar, MT4 Accelerator, and Copy Trading, provide a comprehensive learning environment for traders at all levels.

OneRoyal vs Other Brokers

Let's check OneRoyal features and services in comparison with popular brokers:

Parameter | OneRoyal Broker | Exness Broker | HFM Broker | FxPro Broker |

Regulation | ASIC, FSA, VFSC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.0 pips | 0.0 Pips | 0.0 Pips | 0.0 Pips |

Commission | From $0.0 | From $0.2 to USD 3.5 | From Zero | From $0 |

Minimum Deposit | $10 | $10 | From $0 | $100 |

Maximum Leverage | 1:1000 | Unlimited | 1:2000 | 1:500 |

Trading Platforms | MT4, MT5, MT4 Accelerator | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Classic, ECN, VIP, ECN Elite, Cent, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 2,000+ | 200+ | 1,000+ | 2,100+ |

| Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Instant |

Conclusion and final words

With no deposit or withdrawal fees, OneRoyal stands as a competitive choice.

Traders can benefit from copy trading via HokoCloud, PAMM accounts, and a 100% deposit bonus.

Offices in Australia, Lebanon, Vanuatu, St. Vincent & Grenadine, the United States, and Nigeria ensure a global presence.

With a TrustPilot rating of 4.4/5 from over 190 reviews, OneRoyal demonstrates a commitment to client satisfaction.