Titan FX offers 3 live account types [Zero Standard, Zero Blade, Zero Micro] with 4 base currencies [USD, EUR, JPY, SGD]. The minimum deposit starts from $1 and varies by the method. The trading commission is $3.5 per lot for the Zero Blade account.

In addition to its account options, Titan FX provides access to over 60 tradable instruments across Forex, cryptocurrencies, indices, stocks, and commodities. The broker supports a maximum leverage of up to 1:500 for most accounts, with the Zero Micro account allowing up to 1:1000.

Titan FX Company Information And Regulation

Titan FX is a multi-asset brokerage founded in 2014. The company's head office is located at Pot 564/100, Rue De Paris, Pot 5641, Centre Ville, Port Vila, Vanuatu. The broker is regulated by 4 financial authorities:

- Financial Services Commission (FSC) of Vanuatu

- Financial Services Authority (FSA) of Seychelles

- Financial Services Commission (FSC) of Mauritius

- Financial Services Commission (FSC) of the British Virgin Islands (BVI)

While offshore regulation provides operational flexibility, it may offer limited investor protection compared to tier-1 jurisdictions.

Here is an overview of regulations on different branches of Titan FX:

Entity Parameters / Branches | Titan FX Limited | Atlantic Markets Limited | Goliath Trading Limited | Titan Markets |

Regulation | Vanuatu Financial Services Commission (VFSC) | British Virgin Islands Financial Services Commission (BVIFSC) | Seychelles Financial Services Authority (SFSA) | Financial Services Commission (FSC), Mauritius |

Regulation Tier | N/A | N/A | N/A | N/A |

Country | Vanuatu | British Virgin Islands | Seychelles | Mauritius |

Investor Protection Fund / Compensation Scheme | Member of The Financial Commission (up to €20,000 per claim) | Member of The Financial Commission (shared membership) | Member of The Financial Commission (shared membership) | Member of The Financial Commission (shared membership) |

Segregated Funds | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes |

Maximum Leverage | Up to 1:1000 | N/A | N/A | N/A |

Client Eligibility | Clients from jurisdictions where Titan FX is legally permitted to operate | Clients from jurisdictions where Titan FX is legally permitted to operate | Clients from jurisdictions where Titan FX is legally permitted to operate | Clients from jurisdictions where Titan FX is legally permitted to operate |

Summary of Specifications in Titan FX Broker

To give you a quick overview of what the forex broker offers, here's a summary table of key specifics:

Broker | Titan FX |

Account Types | Zero Standard, Zero Blade, Zero Micro, Demo |

Regulating Authority | FSC Vanuatu, FSA, FSC Mauritius, BVI FSC |

Based Currencies | USD, EUR, JPY, SGD |

Minimum Deposit | $1 |

Deposit Methods | VISA, MasterCard, STICPAY, Skrill, Neteller, Perfect Money, Local Japanese Bank Transfer, bitwallet, Crypto Transactions |

Withdrawal Methods | VISA, MasterCard, STICPAY, Skrill, Neteller, Perfect Money, Local Japanese Bank Transfer, bitwallet, Crypto Transactions |

Minimum Order | 0.01 Micro Lots |

Maximum Leverage | 1:1000 |

Investment Options | Copy Trading, Social Trading |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5 |

Markets | Forex, Crypto, Indices, Stocks, Commodities |

Spread | From 0 Pips on Zero Blade Account |

Commission | None on Zero Standard and Zero Micro Account Types |

Orders Execution | Market |

Margin Call / Stop Out | N/A / 20% |

Trading Features | Trading Central, VPS, Proprietary Social Trading Platform |

Affiliate Program | Yes |

Bonus & Promotions | March Tournament, Cashback |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, Phone Call, Ticket |

Customer Support Hours | 24/7 |

Account Types Overview & Comparison

Titan FX offers 3 main account types with various specifics. Here's an overview of each with a comparison between them:

Account Type | Zero Standard | Zero Blade | Zero Micro |

Instruments | 60+ Currency Pairs, Commodities, Stocks, Indices, and Crypto | 30+ Currency Pairs, Metals, and Bitcoin | |

Base Currencies | USD, EUR, JPY, SGD | ||

Max. Leverage | 1:500 | 1:1000 | |

Trading Platforms | MetaTrader 4, MetaTrader 5, Titan FX Social | ||

All account types share common features like the Zero Point technology, One Click trading, and permission for various styles. Furthermore, a demo environment is provided for practice trading.

Note that the minimum deposit amount varies based on the funding method, starting from $1.

This structure accommodates both cost-sensitive retail traders and high-volume professionals.

Important Pros and Cons

Every forex broker comes with its own benefits and drawbacks. We will go over Titan FX's in the table below:

Pros | Cons |

High Leverage Options Up to 1:1000 | No Top-Tier Regulation |

Low Minimum Deposit | Limited Range of Tradable Symbols |

24/7 Customer Support | - |

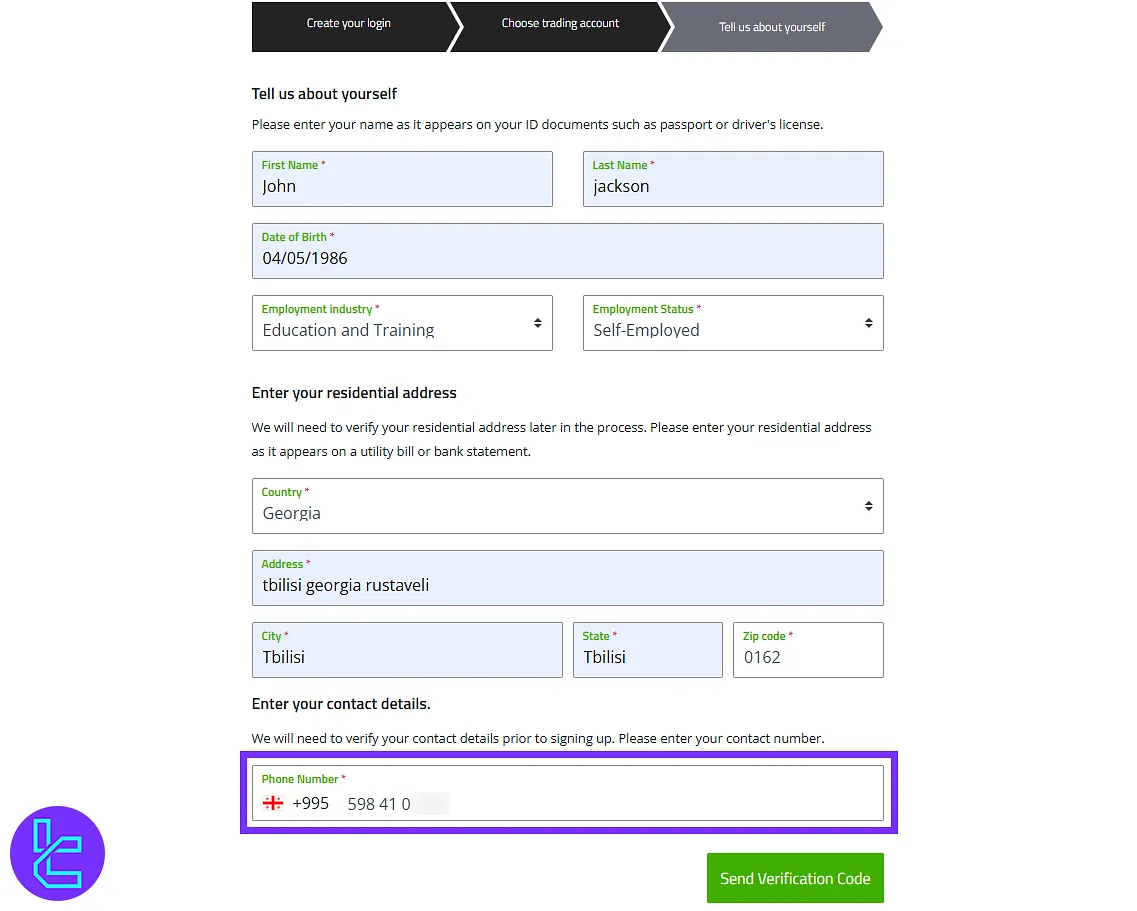

Registration and Verification on Titan FX

The Titan FX registration process is quick and compliant, offering traders full control over their trading preferences across MetaTrader 4 and MetaTrader 5 platforms. The process includes phone and email verification and supports multiple account types and leverage settings.

#1 Start on the Titan FX Website

Click “Open Live Account” on the official Titan FX homepage. Enter the following information:

- Password

- Account type

#2 Customize Trading Preferences

Choose between Standard, Blade, or Micro accounts. Define your base currency, set your leverage (up to 1:1000), and select MT4 or MT5 as your trading platform.

#3 Submit Personal Information & Verify

Fill in your personal details, including:

- Name

- Birthdate

- Address

- Employment details

Confirm your mobile number via SMS and click the email verification link to activate your account.

#4 Proceed with the KYC Procedure

Access the client dashboard to initiate the Titan FX verification process and upload supporting documents, including:

- Proof of Identity: Passport or Driving license

- Proof of Address: Utility bill or Bank statement

What Trading Platforms Are Offered by The Broker?

Titan FX provides access to 2 trading platforms that are widely used in the industry by traders from various levels.

MetaTrader 4

This option is one of the first trading terminals in the forex market with analysis tools, various order types, Expert Advisors, and more. Download or access it on these environments:

- Windows

- macOS

- MT4 Android

- MT4 iOS

MetaTrader 5

MetaTrader 5 is similar to the previous one, but with enhanced performance and more options such as a built-in economic calendar. Available versions:

- Windows

- macOS

- MT5 Android

- MT5 iOS

TradingFinder has developed a wide range of MT5 and MT4 indicators that you can use for free.

Trading Commissions, Spreads, And Other Fees

First, we will investigate Titan FX trading fees based on the account type. Look at the table below:

Account type | Zero Standard | Zero Blade | Zero Micro |

Spread | STP | Raw ECN From 0.0 Pips | STP |

Commission | Zero | $3.5 per Lot | Zero |

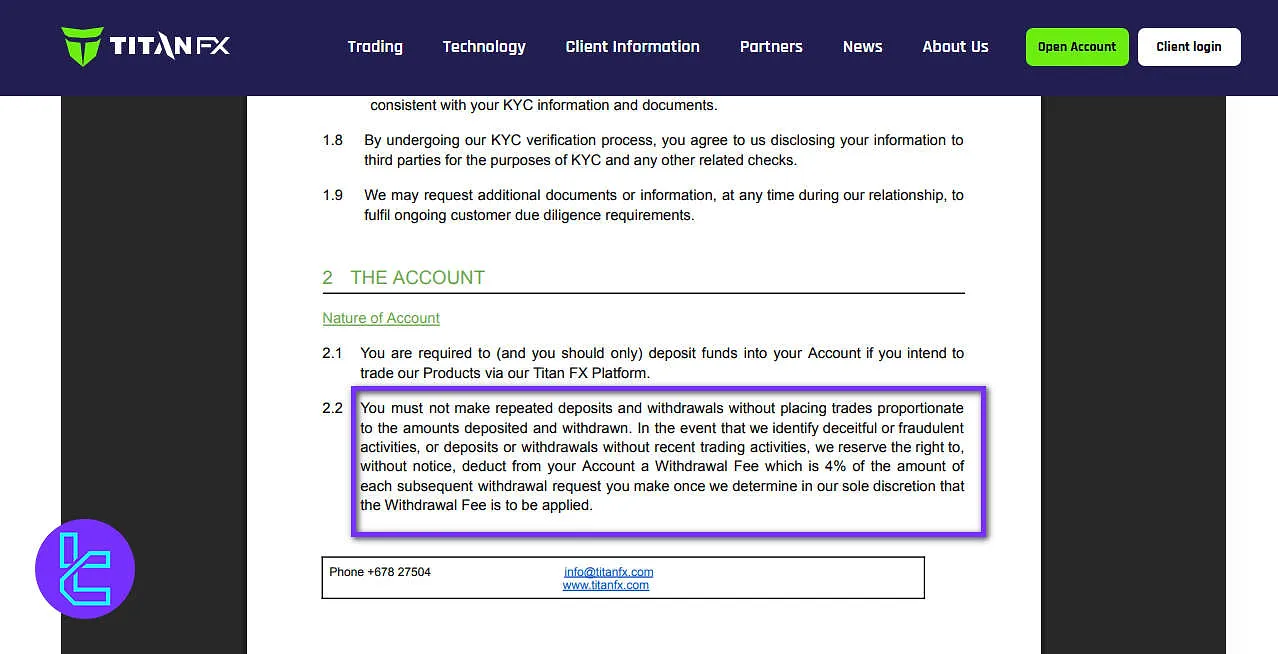

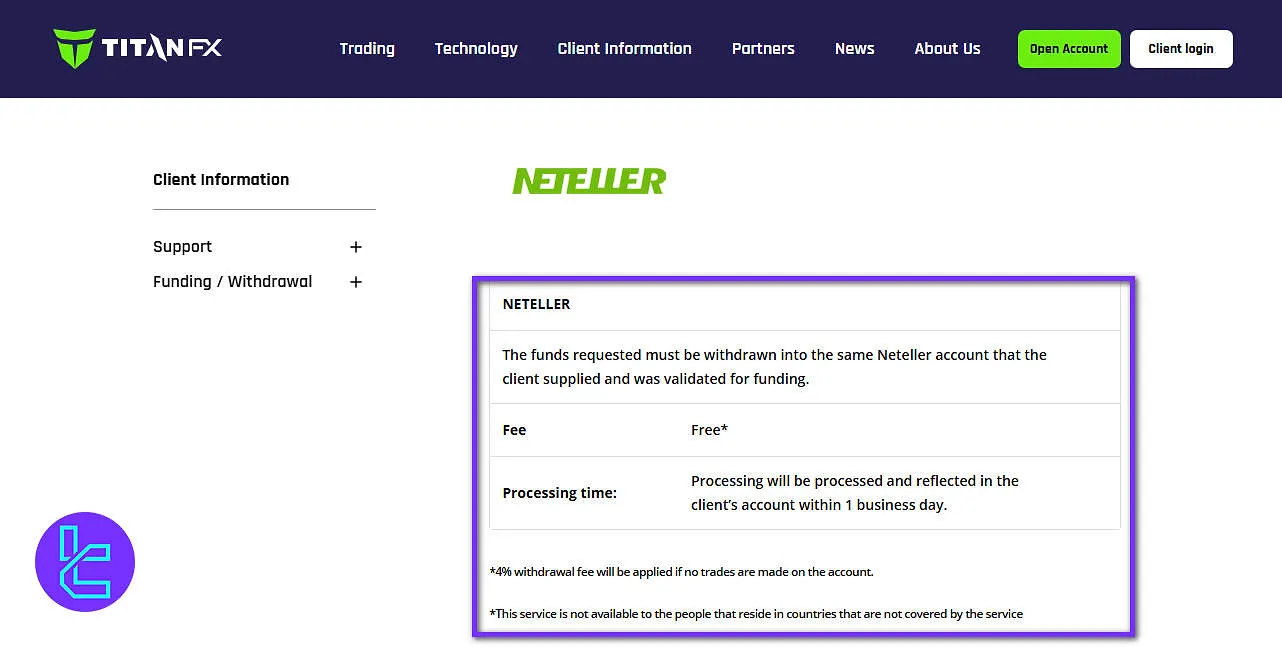

Regarding other costs, the broker claims that there are no account maintenance fees. Also, no deposit/withdrawal commissions are charged; however, a 4% fee for withdrawing funds is applied if no trades are made on the account.

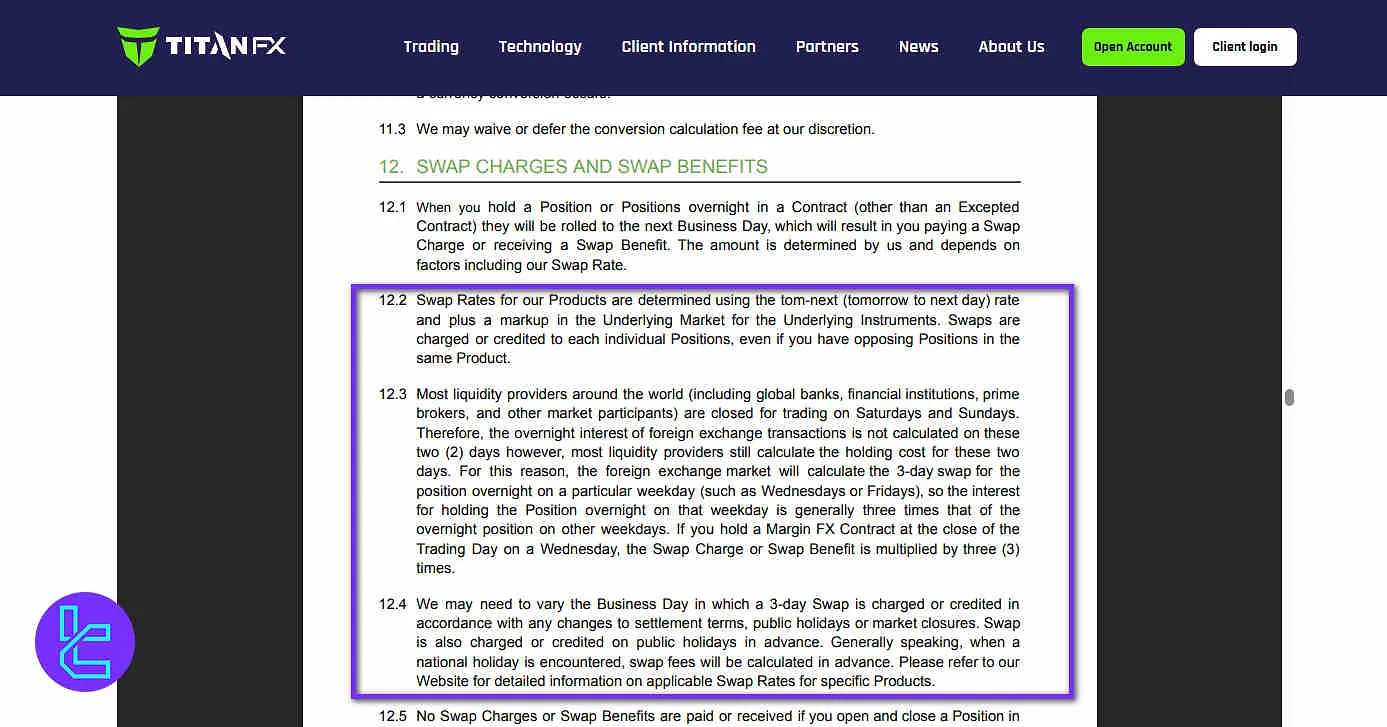

Titan FX Swap Fees

At Titan FX, swap rates are calculated based on the tom-next (tomorrow–next day) rate, adjusted with a markup derived from the underlying market of each instrument.

These overnight financing costs or credits are applied individually to every open position, regardless of whether opposing trading positions exist in the same product.

Since global liquidity providers, including major banks, prime brokers, and financial institutions, remain closed over weekends, interest for those days is still factored into the market’s pricing model.

As a result, the foreign exchange market applies a triple swap on specific weekdays (commonly Wednesdays or Fridays) to account for the two non-trading days.

Holding a margin FX position overnight on that day, therefore, results in a swap charge or benefit three times the standard daily amount.

The specific day for applying this 3-day swap may vary due to changes in settlement schedules, public holidays, or market closures.

When a national holiday occurs, swap fees are usually calculated in advance. Titan FX’s website provides detailed, up-to-date information on swap rates for each product.

No swap is applied to intraday trades that is, positions opened and closed within the same trading session nor to certain excepted contracts. All accrued swap charges or benefits are reflected in the swap value field of open positions.

Titan FX Non-Trading Fees

Titan FX does not levy any fees for deposits, allowing clients to fund their accounts without additional costs. While the broker reserves the right to close inactive accounts, no specific inactivity charges are stated.

Clients should avoid repeated deposits and withdrawals without engaging in trading activities proportional to the amounts involved.

If transactions are deemed suspicious, fraudulent, or lacking recent trading activity, Titan FX may apply a Withdrawal Fee of 4% on subsequent withdrawal requests at its sole discretion.

This framework ensures that account activity aligns with standard trading behavior while maintaining clear guidelines regarding non-trading fees.

Titan FX Broker Deposit & Withdrawal: Accepted Systems

This brokerage offers a long list of 9 payment methods to its clients. Here's a quick overview of Titan FX deposit & withdrawal methods:

- VISA

- MasterCard

- STICPAY

- Skrill

- Neteller

- Perfect Money

- Local Japanese bank transfer (only available for Japanese bank holders)

- International bank transfer

- bitwallet

- Cryptocurrency transactions

Titan FX Deposit

Titan FX provides multiple funding methods through its secure Client Cabinet, allowing clients to deposit in a range of fiat currencies and cryptocurrencies.

Deposits are generally processed instantly or within one business day, depending on the method, and no deposit or withdrawal fees are applied by the broker.

All funds are held in segregated accounts with top-tier banks, ensuring client money is never used for operational purposes and only transferred to/from accounts in the client’s name.

Supported payment options include credit/debit cards (Visa, Mastercard), e-wallets (Skrill, Neteller, Sticpay, Bitwallet), local and international bank transfers, Apple Pay, Peska, and various cryptocurrencies.

Minimum and maximum deposit limits, processing times, and available currencies vary depending on the method. Certain services are restricted based on the client’s country of residence.

Deposit Method | Minimum / Maximum Deposit | Fees | Processing Time | Currencies | Restrictions |

Visa / Mastercard | No minimum / No maximum | None | Instant | USD, JPY, SGD, EUR | International bank fees may apply |

Bitwallet | No minimum / No maximum | None | Instant | USD, JPY, EUR | None |

Sticpay | 30 USD or equivalent / No maximum | None | Instant | USD, JPY, SGD, EUR | Not available in EEA or UK |

Skrill | 10 USD / 5,000 USD per transaction | None | Instant | USD, AUD, JPY, EUR | Not available in unsupported countries |

Neteller | 10 USD / 5,000 USD per transaction | None | Instant | USD, AUD, JPY, EUR | Not available in unsupported countries |

Local Japanese Bank Transfer | 5,000 JPY / 10,000,000 JPY | None | 1 hour – 1 business day | JPY | Japanese bank holders only; bank fees may apply |

International Bank Transfer | 50 USD / 100,000 USD | None | Instant after receipt confirmation | Any currency | Bank fees may apply |

Local Asia Bank Transfer | No minimum / No maximum | None | Instant – 1 business day | Local currency | Indonesia, India, Thailand, Vietnam, Malaysia only; bank fees may apply |

Cryptocurrencies | Varies by crypto | None | Fast (blockchain dependent) | Multiple cryptocurrencies | Network fees may apply |

Peska | 5 USD / 100,000 USD | None | Instant | USD, JPY | Not available in unsupported countries |

Apple Pay (Visa/Mastercard) | 1 USD / 80,000 USD | None | Instant | Multiple currencies | None |

Titan FX Withdrawal

Titan FX processes withdrawal requests from trading accounts typically within one business day, although the time for funds to reach the client’s account depends on the chosen withdrawal method and the processing time of the payment provider.

To comply with Anti-Money Laundering (AML) regulations, withdrawals must generally be refunded to the same account used for deposits, up to the amount originally deposited.

Trading profits exceeding the deposited amount can be withdrawn using the client’s preferred payment method, subject to the broker’s policies.

If an account has not executed trades, a 4% withdrawal fee may apply to the amount requested. All withdrawals are conducted through verified funding accounts to maintain compliance and fund security.

Withdrawal Method | Processing Time | Fees | Notes / Restrictions |

Visa / Mastercard | Immediate (depends on credit card provider) | Free | Refunds to the same credit card used for funding; 4% fee if no trades executed |

Sticpay | Instant | Free | Refunds to the same Sticpay account; not available in EEA or UK; 4% fee if no trades executed |

Skrill | Within 1 business day | Free | Refunds to the same Skrill account; service not available in unsupported countries; 4% fee if no trades executed |

Neteller | Within 1 business day | Free | Refunds to the same Neteller account; service not available in unsupported countries; 4% fee if no trades executed |

Local Japanese Bank Transfer | 2–3 business days | Free | Available only to Japanese bank holders; 4% fee if no trades executed |

International Bank Transfer | 2–3 business days | Free | Refunds to same validated bank account; 4% fee if no trades executed |

Local Asia Bank Transfer | 2–3 business days | Free | Available to banks in Indonesia, India, Thailand, Vietnam, Malaysia; 4% fee if no trades executed |

Bitwallet | Instant | Free | Refunds to the same Bitwallet account; 4% fee if no trades executed |

Apple Pay | Immediate (depends on credit card provider) | Free | Refunds to same Apple Pay account; 4% fee if no trades executed |

Cryptocurrency | Immediate (blockchain dependent) | Free | Processing depends on network congestion and crypto type; 4% fee if no trades executed |

Peska | Instant | Free | Refunds to the same verified Peska account; 4% fee if no trades executed |

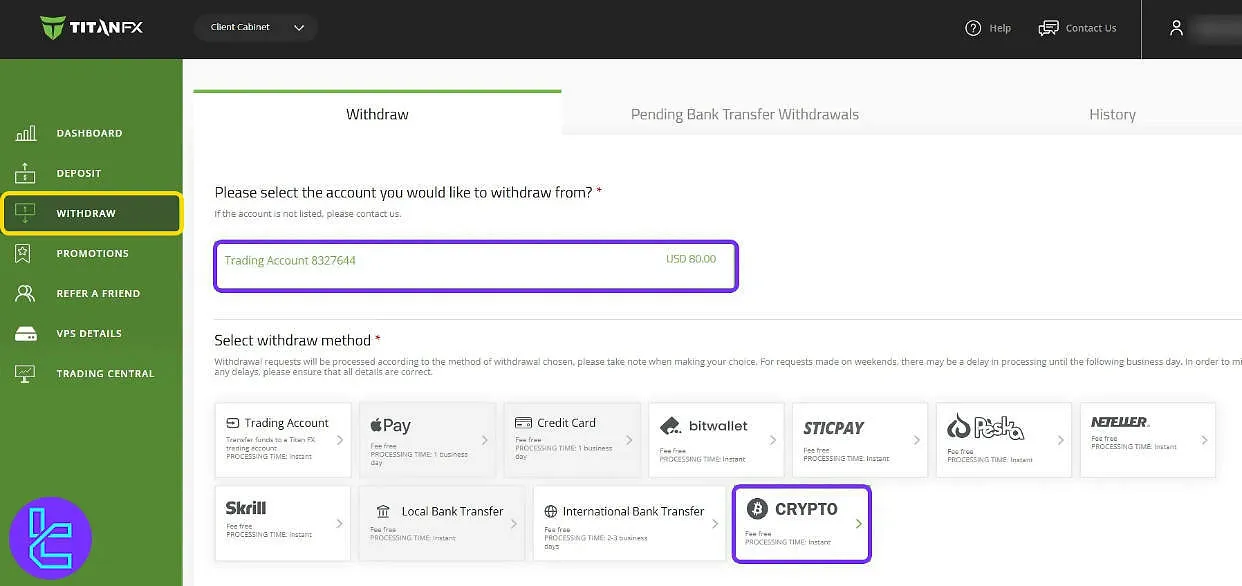

Titan FX TRC20 Withdrawal

Titan FX offers a TRC20 withdrawal method for transferring funds via the Tron network, designed to be fast, secure, and cost-efficient.

The minimum withdrawal amount is $40, and all requests require email confirmation. This process is suitable for transferring Tether (USDT) directly from a Titan FX trading account to a verified crypto wallet.

The Titan FX TRC20 withdrawal procedure involves three steps: first, accessing the payout section in the Titan FX dashboard, selecting the trading account, choosing “Crypto” and then “USDT (TRC20)”, entering the wallet address and amount, and submitting the request.

Second, confirming the transaction through the email link sent by Titan FX; and third, tracking the withdrawal status under the “History” tab. Users can transfer up to 90% of their account balance if open positions exist, and the initial request typically takes around 6 minutes to submit.

Are Any Copy Trading or Investment Options Available?

While Titan FX primarily focuses on self-directed trading, they do offer 2 investment features:

- Copy Trading

- Social Trading

These options enable traders, especially less experienced ones, to benefit from the expertise and ideas of successful investors while learning and developing their own strategies. Also, the copy trading service provides a way of earning passive income.

There is a proprietary platform developed for the mentioned features titled "Titan FX Social". Download it for your mobile phones via these links:

Trading Instruments and Markets

Titan FX performs at an average level in this regard, offering 60+ tradable symbols in 5 categories:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Major, minor, and exotic currency pairs | 60 currency pairs | 50–70 currency pairs | Up to 1:1000 |

Cryptocurrencies | Top market-cap coins/tokens | 20+ | 5–10 | Up to 1:500 |

Indices | CFDs on global indices | 20+ symbols | 10–20 indices | Up to 1:500 |

Stocks | CFDs on popular stocks from various markets | Over 1000 global stocks | 800–1200 | Up to 1:20 |

Commodities | Energies, soft commodities, and precious metals | Around 15 instruments | 10–20 instruments | Up to 1:500 |

Though it excludes bonds, options, futures markets, or ETFs, its offering is robust for active CFD traders.

Bonuses and Promotional Offers on Titan FX

The broker occasionally offers bonuses and promotions to attract new clients and reward existing ones. At the time of writing this article, they are offering 2 promotions:

- March Tournament: Demo trading competition with a minimum trading volume of 50 lots, minimum period of 5 days, and a total prize of $3,500

- Cashback: unlimited cashback up to $5 on Gold orders with a minimum deposit of $250

Titan FX Rebate

Titan FX offers a rebate program through TradingFinder IB, allowing eligible clients to earn cashbacks of up to $3.6 per standard lot across five markets: Forex, cryptocurrencies, energies, indices, and metals.

The Titan FX rebate program applies to Zero Standard, Zero Blade, and Zero Micro accounts, with rebate amounts varying depending on the account type and market.

For instance, Forex trades can earn between $0.6 and $0.9 per lot, while cryptocurrency trades offer $0.12 to $1.2 per lot. Stocks, bonds, futures, and ETFs are excluded from the rebate program.

Clients can calculate potential cashback using a rebate calculator for Forex positions. To participate, new users must open a Titan FX account, while existing clients need to register under the TradingFinder IB program by contacting Titan FX support via live chat, Telegram, or WhatsApp.

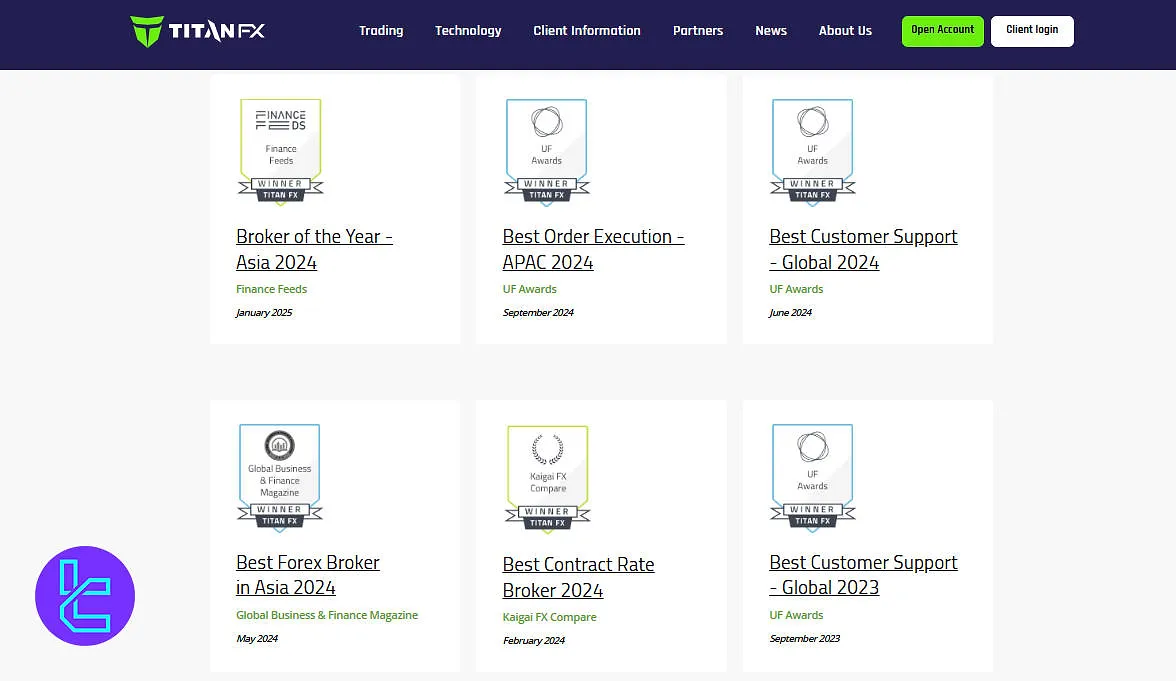

Titan FX Awards

Titan FX has received numerous industry recognitions over recent years, reflecting its performance across trading execution, customer support, and platform innovation. Key Titan FX awards include:

- Broker of the Year Asia 2024 Finance Feeds, January 2025

- Best Order Execution APAC 2024 UF Awards, September 2024

- Best Customer Support Global 2024 UF Awards, June 2024

- Best Forex Broker in Asia 2024 Global Business & Finance Magazine, May 2024

- Best Contract Rate Broker 2024 Kaigai FX Compare, February 2024

- Best Customer Support Global 2023 UF Awards, September 2023

- Exceptional Overall Broker 2023 Finance Feeds, August 2023

- Outstanding Customer Support 2023 Finance Feeds, August 2023

- Best Customer Support APAC 2023 UF Awards, June 2023

- Best Forex Customer Service Provider 2023World Economic Magazine, June 2023

Support Contact Channels and Open Hours

TitanFX provides customer services via a complete list of 4 contact options:

- Live Chat: Available via the official site

- Email: support@titanfx.com

- Phone: +678 27 502

- Ticket: Submittable on the website

The company states that the support department is available 24/7 through phone and live chat.

Banned Countries and Regions

While Titan FX serves clients from around the world, some countries are restricted due to various reasons such as international sanctions, local regulations, etc. Based on our chats with the support team, these countries are banned:

- United States

- Australia

- New Zealand

- Vanuatu

- Ethiopia

- Iran

- North Korea

- Sri Lanka

- Syria

- Tunisia

- Yemen

- Pakistan

- Serbia

- Trinidad and Tobago

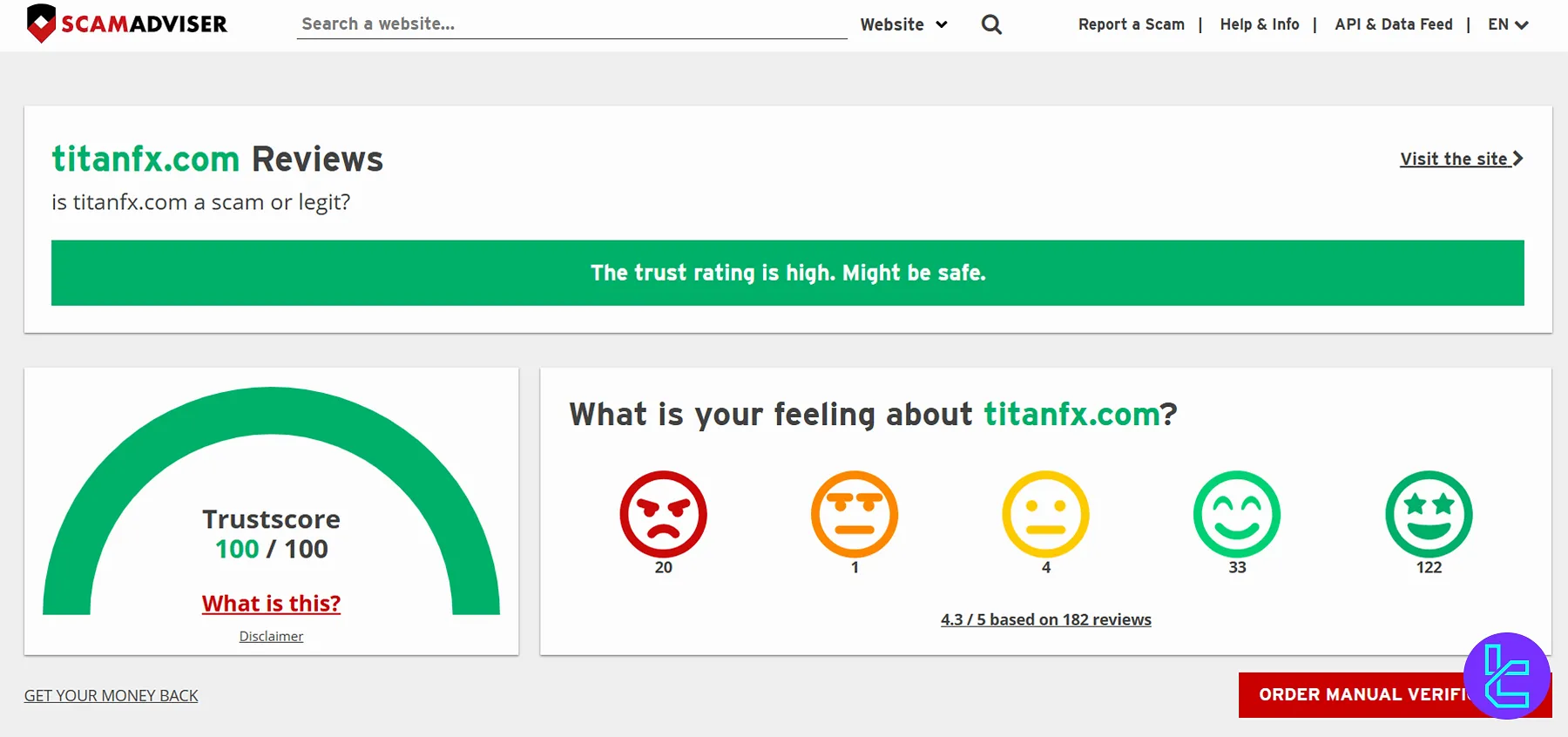

Trust Scores and User Reviews

Titan FX's ScamAdviser page and other sources show that the broker has received generally positive reviews. Let's have a quick review:

- Trustpilot: 4.6/5 stars, based on 160+ reviews

- ScamAdviser: 100/100 trust score

- ForexPeaceArmy: 3.8/5 stars, out of 4 reviews

Educational Materials On Titan FX

The company offers one type of educational resources which is blog. Traders can access educational articles on the broker's website via 2 sections [Forex Basics, Forex Lifestyle] regarding concepts, rules, risks, and other aspects of Forex trading.

You can check TradingFInder's Forex education for additional resources.

Titan FX Compared to Other Brokers

Let's compare Titan FX features and services with those of other brokers:

Parameter | Titan FX Broker | FXGT Broker | Pepperstone Broker | Moneta Markets Broker |

Regulation | FSC Vanuatu, FSA, FSC Mauritius, BVI FSC | VFSC, CySEC, FSA, FSCA | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC | FSCA, FSRA |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.0 pips | From 0.0 pips |

Commission | From $0.0 | From $0.0 | From $0.0 | From $0.0 |

Minimum Deposit | $1 | $5 | $1 | $50 |

Maximum Leverage | 1:1000 | 1:5000 | 1:500 | 1:1000 |

Trading Platforms | MetaTrader 4, MetaTrader 5 | MT4, MT5 | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 | MT4, MT5, Pro Trader, App Trader |

Account Types | Zero Standard, Zero Blade, Zero Micro, Demo | Standard+, ECN Zero, Mini Optimus, Pro | Standard, Razor | Direct, Prime, Ultra |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 60+ | N/A | 1200+ | 1000+ |

Trade Execution | Market | Market | Instant | Market |

Conclusion And Final Words

Titan FX, with a 4.6/5 score on "Trustpilot", offers a maximum leverage of 1:500 on Zero Standard and Zero Blade accounts, which goes up to 1:1000 on Zero Micro.

There are 4 channels [live chat, phone, email, ticket] available for contacting the broker's support team.