Trade Nation offers user-friendly platforms, such as MT4, TradingView, TN Trader, and TradeCopier, cater to both beginners and advanced traders, offering features like copy trading and commission-free trades.

Traders can choose from multiple account types, including real and demo accounts, with USD as the base currency and a minimum order size of 0.0001 lots. Islamic accounts are also available to accommodate religious beliefs.

Trade Nation’s Company Information & Regulation Status

Established in 2014, Trade Nation broker fosters an inclusive environment where both new and seasoned traders can thrive.

With low-cost fixed spreads and specializing in CFD trading, the firm prides itself on its products and services, creating a supportive atmosphere for traders to achieve their goals.

The broker operates under the oversight of several reputable financial authorities, ensuring a high level of security and compliance; Trade Nation Regulation:

Entity (Branch) | Trade Nation Ltd | Trade Nation Financial UK Ltd | Trade Nation Australia Pty Ltd | Trade Nation Financial Markets Ltd | Trade Nation Financial (Pty) Ltd |

Regulation | SCB | FCA | ASIC | FSA Seychelles | FSCA |

Regulation Tier | 4 | 1 | 1 | 4 | 2 |

Country | Bahamas | United Kingdom | Australia | Seychelles | South Africa |

Investor Protection Fund / Compensation Scheme | None | FSCS up to £85,000 | None | None | None |

Segregated Funds | Not disclosed | Yes | Yes | Not disclosed | Yes |

Negative Balance Protection | Not stated | Yes | Yes | Not stated | Yes |

Maximum Leverage | 200 | 1:30 / 1:500 (Pro) | 1:30 / 1:500 (Pro) | 200 | N/A |

Client Eligibility | Global (except restricted) | UK clients | Australian clients | Global (except restricted) | South African clients |

This wide regulatory coverage enhances its global credibility and operational transparency, positioning Trade Nation as a reliable choice for retail traders seeking both strong oversight and global reach.

Trade Nation Broker Summary of Specifics

The Forex broker has carved out a niche by offering a unique blend of features catering to a wide range of traders. Trade Nation Features:

Broker | Trade Nation |

Account Types | Real, Demo |

Regulating Authorities | FCA, ASIC, FSA, SCB, FSCA |

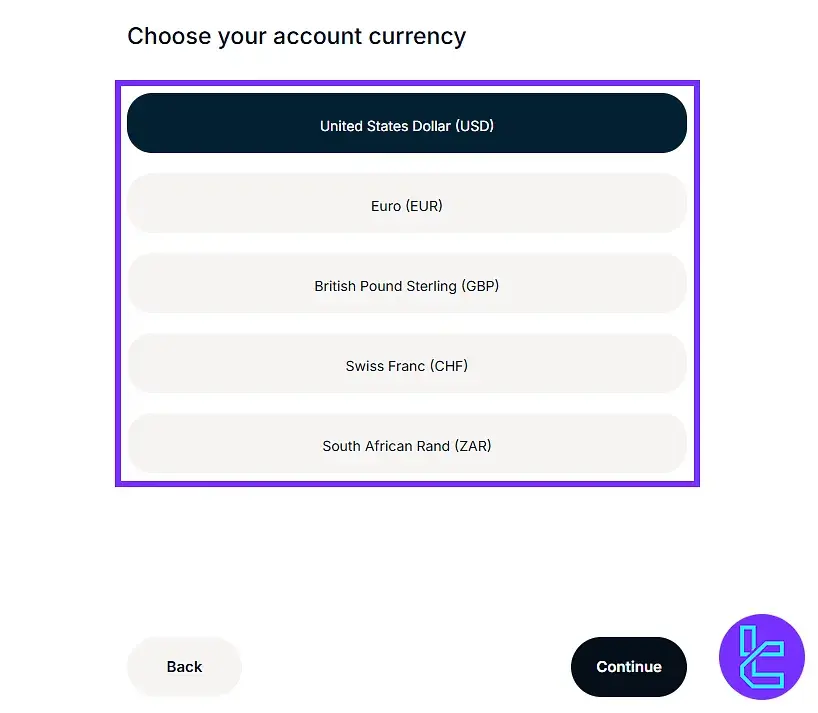

Based Currencies | USD |

Minimum Deposit | No minimum deposit |

Deposit Methods | Visa, Apple Pay, Astro Pay, Bank Transfer, Binance Pay, Skrill, Neteller, Cryptocurrencies |

Withdrawal Methods | Bank Transfer, Credit/Debit Card, E-Wallets |

Minimum Order | 0.0001 |

Maximum Leverage | 1:30 |

Investment Options | No |

Trading Platforms & Apps | TradeCopier, MT4, TradingView, TN Trader |

Markets | Forex, Indices, Commodities, Stocks, Cryptocurrencies |

Spread | 1.5 pt |

Commission | $0 |

Orders Execution | Market, Instant |

Margin Call/Stop Out | 100%/50% |

Trading Features | CFD Trading, Copy Trading, Fixed Spreads |

Affiliate Program | YES |

Bonus & Promotions | YES |

Islamic Account | YES |

PAMM Account | NO |

Customer Support Ways | Email, Live Chat, Phone |

Customer Support Hours | 24/5 |

Trade Nation's integration with TradingView is particularly noteworthy.

It allows traders to leverage powerful charting tools and a vibrant social trading community while executing trades directly through their TradeNation account.

Trade Nation Types of Account

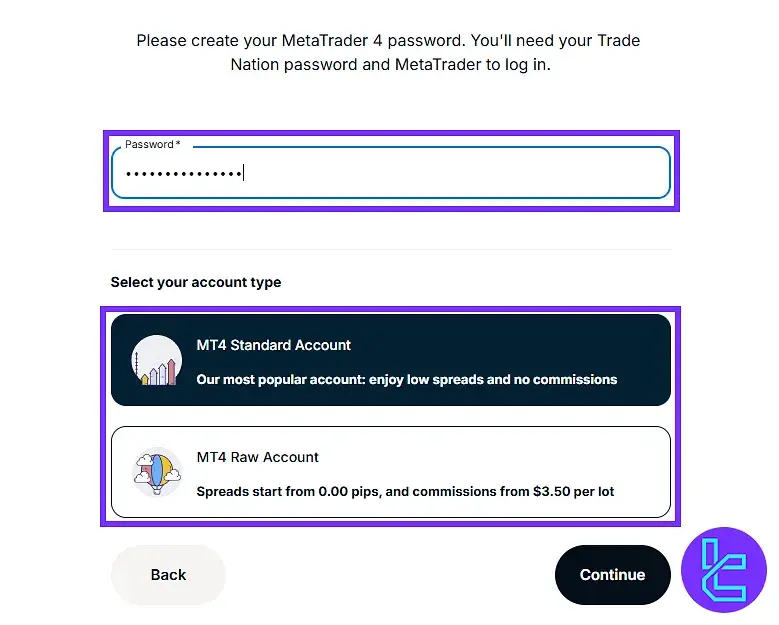

The broker primarily offers a standard account type for retail and professional traders; Standard Account Features:

- No minimum deposit for most payment methods

- Access to all available markets and instruments

- Fixed spreads across all trading sessions

- Leverage up to 1:30 for retail clients (higher for professionals, subject to regulatory restrictions)

- No commission charges on trades

Notably, the broker does not impose any minimum deposit requirement, enabling new traders to get started with any capital size.

It is worth noting that the broker provides Demo Accounts for new clients to dip their toes into the platform before creating a real account.

Trade Nation Pros and Cons

Like any broker, Trade Nation has its own pros and cons; Trade Nation Advantages and Drawbacks:

Advantages | Disadvantages |

Fixed spreads for better cost prediction | Limited advanced features for experienced traders |

Integration with TradingView | Educational content could be more comprehensive |

Well-regulated across multiple jurisdictions | Restricted range of markets on MT4 platform |

User-friendly proprietary platform (TN Trader) | - |

No commissions on trades | - |

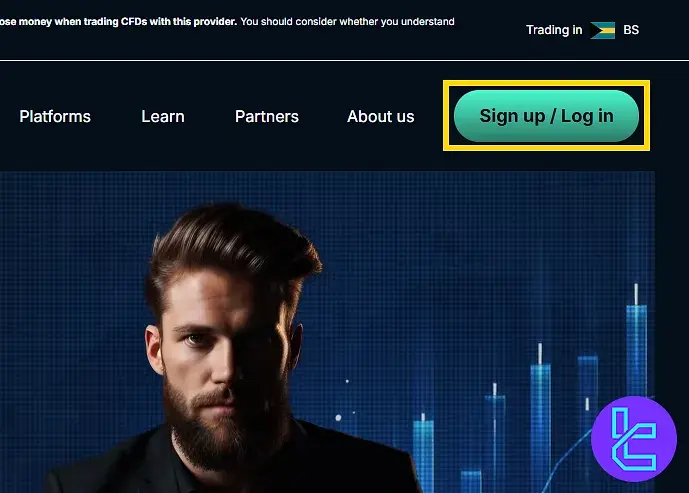

Trade Nation Signup & Verification

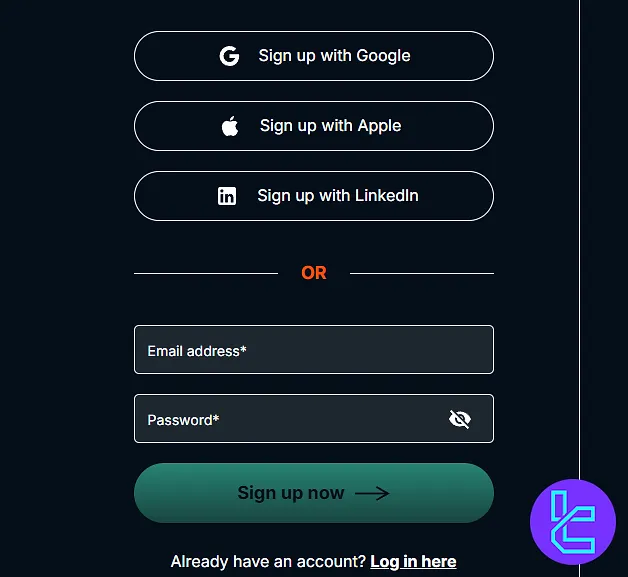

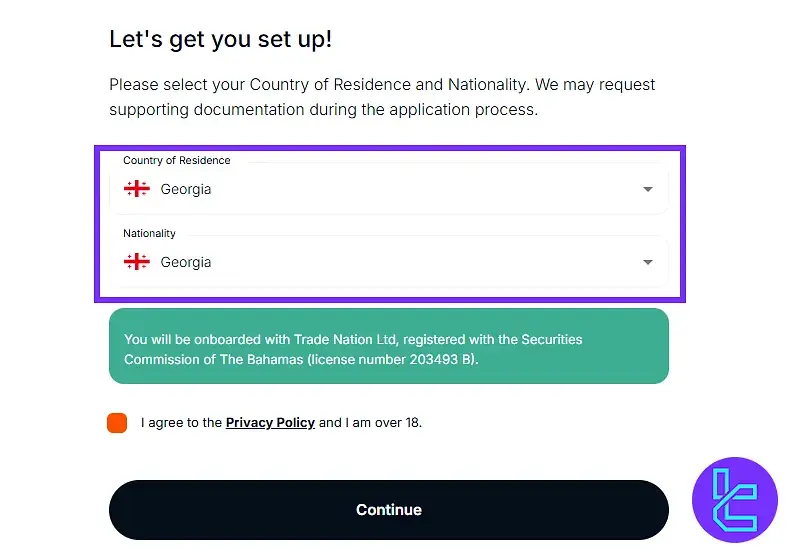

The Trade Nation registration process is streamlined to provide fast access to its trading dashboard. Traders can register manually or via Google, Apple, or LinkedIn.

The signup process collects personal, contact, and financial profile information while allowing users to customize platform and account preferences.

#1 Start the Registration Process

Visit the broker’s official website and click on “Sign Up / Log In”. You’ll be directed to the account creation page, where you can choose between manual sign-up or using third-party platforms like Google or LinkedIn.

#2 Enter Personal & Contact Information

Manually input the following information:

- Password

Press the "Sign Up Now" button to continue.

Now you need to enter your country of residence and nationality. Also Agree to the terms and conditions to proceed.

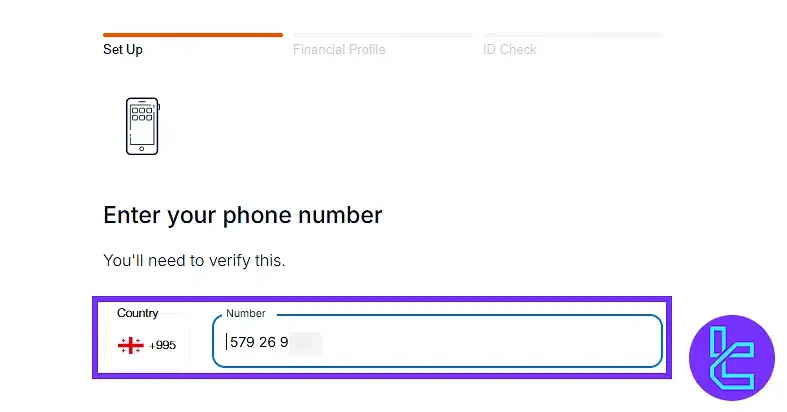

Now you must enter a valid phone number and press the “Continue” button.

#3 Set Up Platform, Account Type & Financial Profile

Adjust your trading account settings, following these steps:

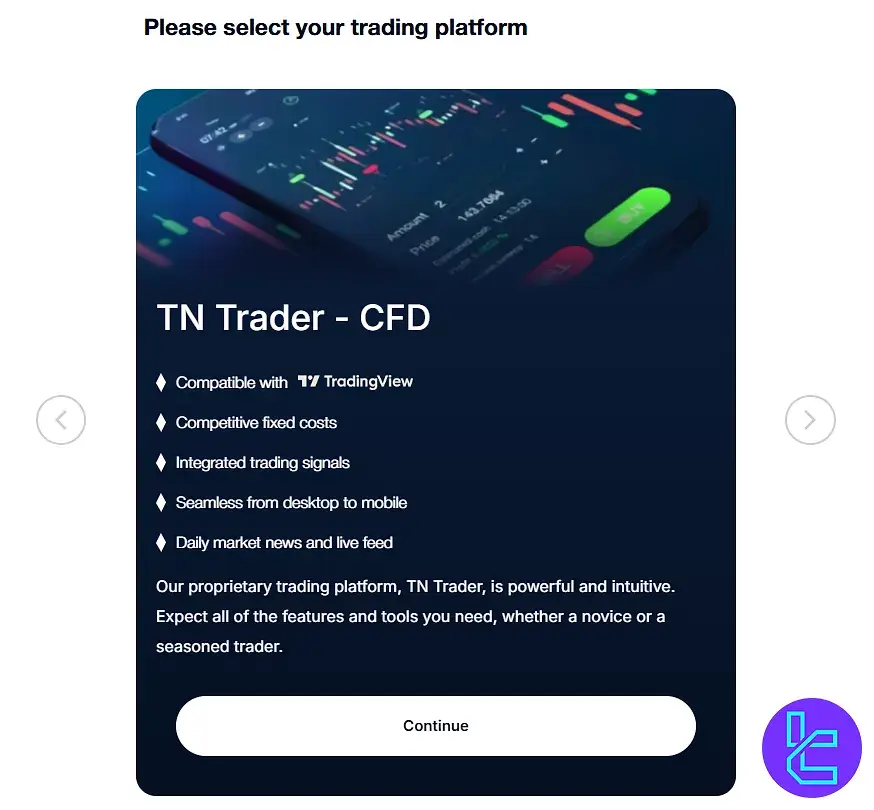

- Choose your trading interface (TN Trader, MetaTrader 4, or TradingView);

- Select your account base currency and press “Continue”;

- Then, choose your Account type (Standard or RAW) and again press “Continue”;

- Finaly complete the financial profile with your employment status, income sources, and trading experience to activate your account.

#5 Trade Nation Verification Guide

Traders can complete account verification with Trade Nation efficiently through a simple 4-step procedure.

Trade Nation verification process is designed to comply with financial regulations and typically takes around 5 minutes. It involves submitting official identification documents and a selfie to ensure secure and compliant trading.

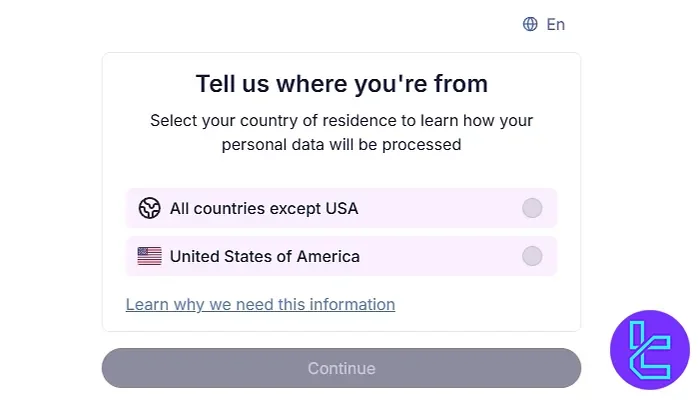

#1 Begin KYC by Selecting Citizenship

Once registration with Trade Nation is complete, start the verification by choosing your citizenship.

For U.S. citizens, select the relevant option, then click "Continue" to proceed.

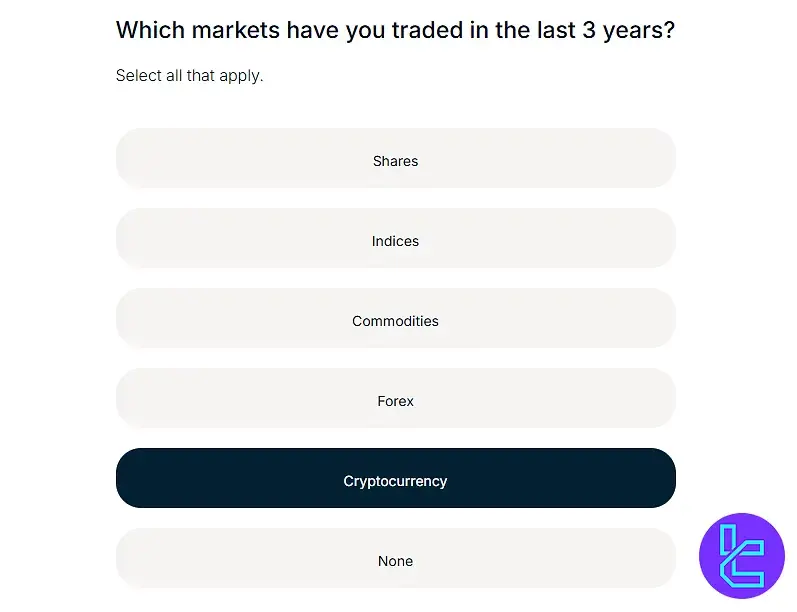

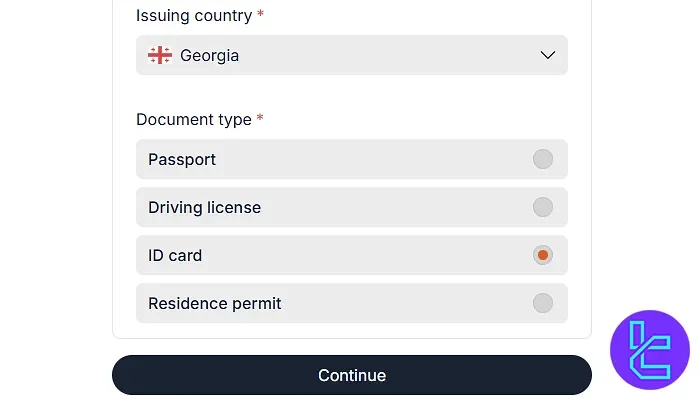

#2 Choose Your Country and Document Type

Next, indicate your country of residence and select a valid verification document, which can include:

- Passport

- National ID card

- Driver's license

- Residence permit

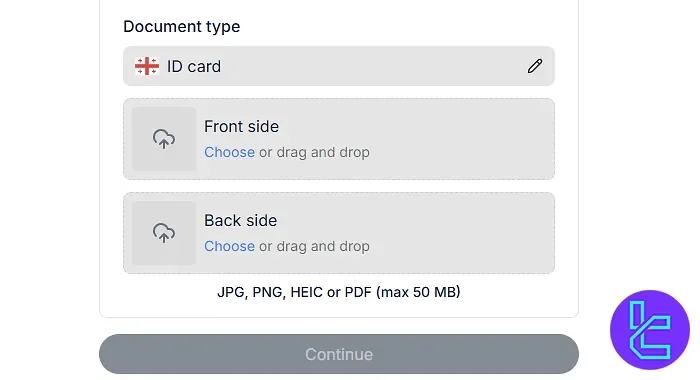

#3 Upload Your Identification Documents

Provide clear, high-resolution images of both the front and back of your selected ID. Proper lighting and image clarity are essential to avoid rejection during verification.

#4 Take a Selfie for Identity Confirmation

Finally, use your device’s camera to capture a selfie. This allows Trade Nation to confirm that your facial features match your uploaded ID, helping to prevent identity fraud.

Trade Nation Broker’s Trading Platforms

As with many Forex Brokers, TradeNation offers a diverse range of trading platforms to suit different trader preferences, including MetaTrader 4, TradingView, and TN Trader.

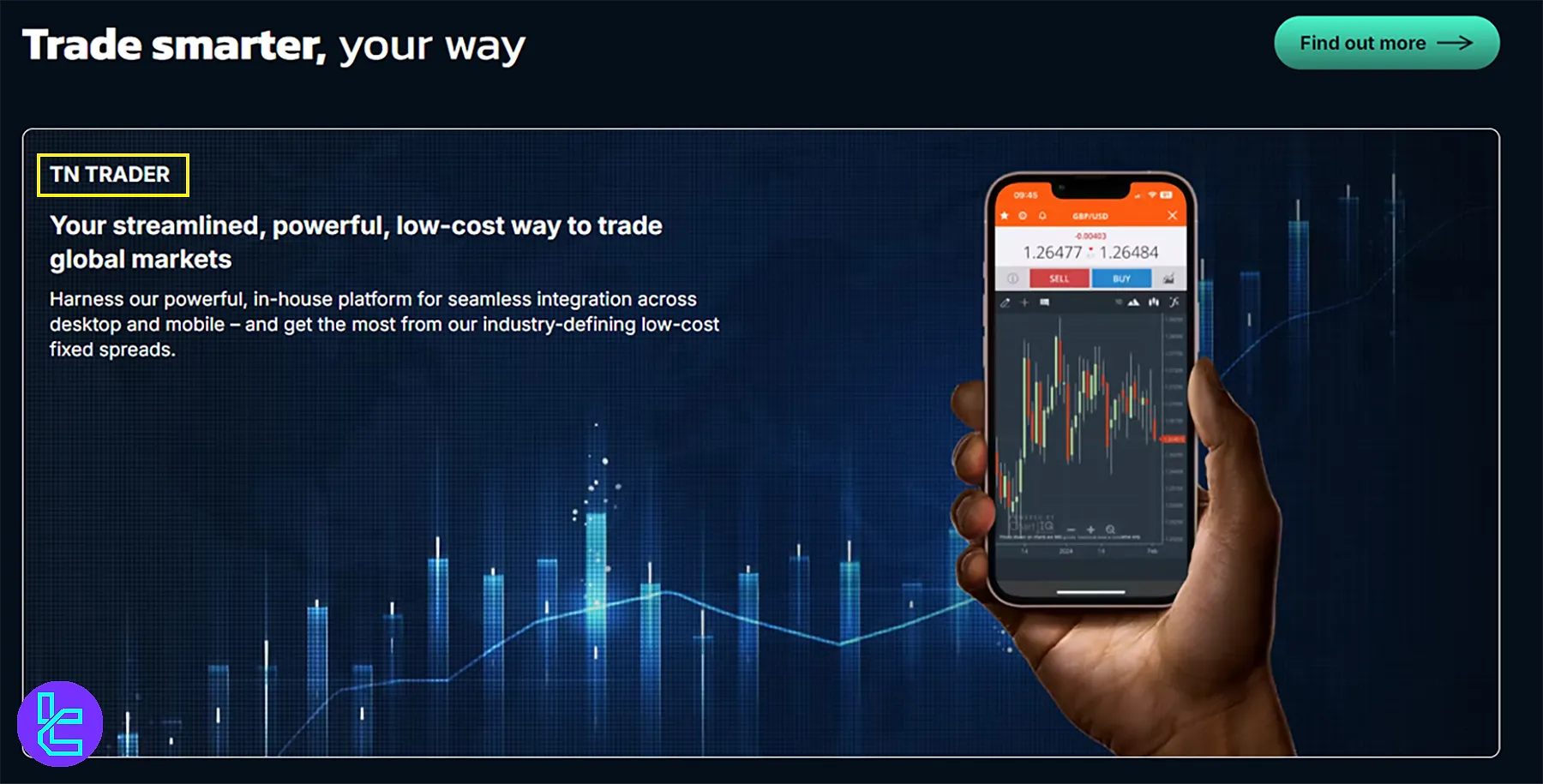

TN Trader

It is Trade Nation's proprietary platform with the following features:

- Intuitive interface for easy navigation

- Advanced charting tools and indicators for technical analysis

- Real-time market analysis

- Mobile app for on-the-go trading

MetaTrader 4 (MT4)

Here is what you should expect from MetaTrader4:

- Industry-standard platform with extensive customization options

- Advanced technical analysis tools

- Large community of traders and developers

TradingView

TradingView brings attractive options to the table, including:

- Access to TradingView's powerful charting and analysis tools

- Custom indicators and analysis tools

- Social trading features for sharing ideas and following other traders

- Execute your trades directly from TradingView

TradeCopier

TradeCopier is to facilitate copy trading for TradeNation’s customers with the following options:

- Automatically mirror the trades of expert traders

- Customize risk levels and allocation

- Monitor performance in real-time

This diverse platform ensures traders of all skill levels and preferences can find a suitable trading environment within the Trade Nation ecosystem.

TradingFinder has developed a wide range of MT4 indicators and TradingView indicators that you can access for free.

Trade Nation’s Spread and Commission Structure

One of Trade Nation's standout features is its fixed spread and no-commission model. With 1.5 pt spreads on TradeNation and trading3 times a day, your total cost will be $3,402 after 1 trading year.

This means you can save a lot of money when choosing TradeNation compared to some rivals like Pepperstone and IG brokers.

Swap Fee at Trade Nation

Overnight funding at Trade Nation is charged daily on all open CFD (Rolling Cash) positions held after 22:00 GMT, as a “swap”-style interest cost.

They calculate this cost by applying the 1-month interbank rate of the currency, plus or minus a fixed spread of 2.5%, e.g. if 1-month LIBOR is 3.5%, they charge 6.0% on long UK-100 positions.

Here are some key official points about these costs:

- Overnight financing is calculated using a 365-day year for many products (for cash-index trades);

- According to Trade Nation’s Legal Documents Hub, Trade Nation offers a Swap-Free / Islamic account.

Non-Trading Fees at Trade Nation

Trade Nation charges very few non‑trading fees. deposits and withdrawals are generally free because the broker covers 100% of funding provider costs in most regions.

While broker doesn’t impose termination or account‑closure fees, they do reserve the right to pass on certain processing costs. Importantly, there is no inactivity or dormant account fee, making this broker suitable for traders who may take breaks between positions.

Here are the key official details:

- Funding by credit card, e‑wallet or cryptocurrency has no deposit fee on Trade Nation’s side;

- Withdrawals are free (no fee) for standard methods;

- In Trade Nation Australia’s PDS, international bank transfers (withdrawals) can incur up to US$20 as a fee;

- According to their Bahamas client agreement, small‑value withdrawals may attract a small processing fee, at Trade Nation’s discretion;

- No inactivity fee is applied; dormant accounts do not incur any charges.

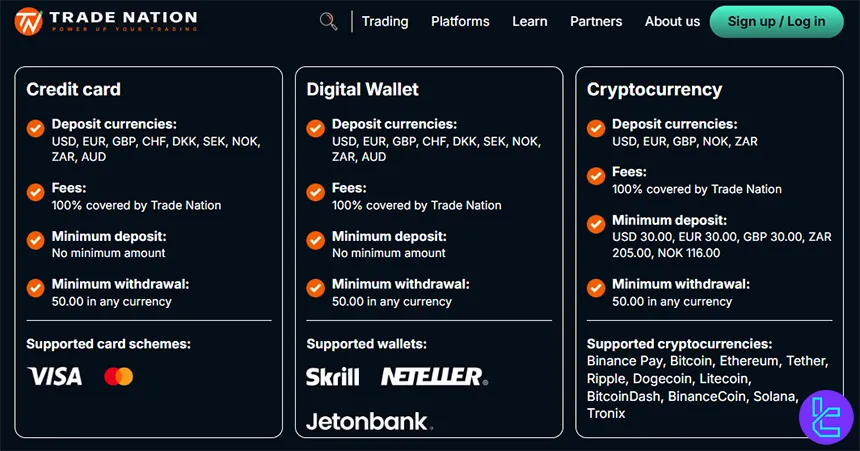

Trade Nation Deposit & Withdrawal Methods

TradeNation offers a variety of payment methods to accommodate traders from different regions; Trade Nation Payment Options:

- Credit Cards (Visa)

- Apple Pay

- AstroPay

- Bank Transfer

- Binance Pay

- E-wallets (including Skrill and Neteller)

Key points about deposits and withdrawals:

- No minimum deposit for most payment methods

- Cryptocurrency deposits have a minimum of $30 (USD)

- Minimum withdrawal of $50 in any currency

- Trade Nation covers fees for both deposits and withdrawals

The broker also offers local banking options for Southeast Asian and African clients, demonstrating its commitment to serving a global clientele.

Deposit Methods at Trade Nation

Trade Nation provides a variety of deposit options tailored for different regions, including credit cards, digital wallets, cryptocurrencies and local bank transfers in Southeast Asia.

Deposit fees are fully covered by the broker, allowing clients to fund accounts without extra costs.

Here’s an overview of the main deposit options:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Credit Card | USD, EUR, GBP, CHF, DKK, SEK, NOK, ZAR, AUD | No minimum | 0% (broker covered) | Instant |

Digital Wallet | USD, EUR, GBP, CHF, DKK, SEK, NOK, ZAR, AUD | No minimum | 0% (broker covered) | Instant |

Cryptocurrency | USD, EUR, GBP, NOK, ZAR | USD 30 / EUR 30 / GBP 30 / ZAR 205 / NOK 116 | 0% (broker covered) | Instant to 1 hours |

Bank Transfer (Southeast Asia) | Vary by the country | USD 0.5 – 40 depending on country | 0% (broker covered) | 1–3 business days |

Withdrawal Methods at Trade Nation

Trade Nation offers withdrawal options using the same methods as deposits, including credit cards, digital wallets, cryptocurrencies and local bank transfers in Southeast Asia.

Withdrawals are generally free of charge, with minimum amounts applying per method. Processing times vary depending on the chosen method and region.

Here’s an overview of the main withdrawal options:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Credit Card | USD, EUR, GBP, CHF, DKK, SEK, NOK, ZAR, AUD | 50.00 | 0% (broker covered) | p to 5 days |

Digital Wallet | USD, EUR, GBP, CHF, DKK, SEK, NOK, ZAR, AUD | 50.00 | 0% (broker covered) | up to 5 days |

Cryptocurrency | USD, EUR, GBP, NOK, ZAR | 50.00 | 0% (broker covered) | up to 5 days |

Bank Transfer (Southeast Asia) | Vary by the country | 50.00 | 0% (broker covered) | up to 5 days |

Copy Trading & Investment Options Offered on TradeNation Broker

Trade Nation offers copy trading functionality through their TradeCopier app on theMT4 platform.

While Trade Nation doesn't offer PAMM (Percentage Allocation Management Module) accounts, their copy trading feature provides a similar way for less experienced traders to leverage the expertise of successful traders.

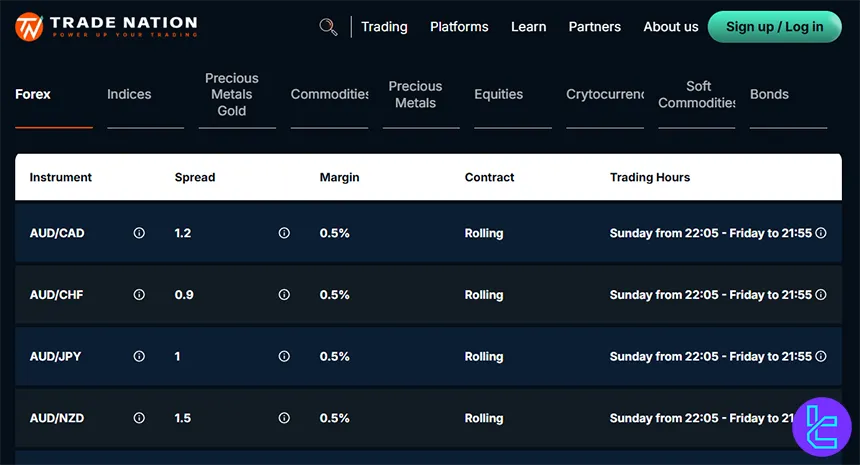

Trade Nation Tradable Markets & Symbols Overview

Trade Nation offers a diverse range of tradable instruments across several asset classes, from the Forex market to Stocks.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency pairs (CFDs) | 33 | 60–80 | 1:200 |

Indices | Major US, European and Asian Indices (CFDs) | 40 | 30–50 | 1:200 |

Metals | CFD on metals (e.g. gold) | 9 | 2–5 | 1:200 |

Commodities | Energies, Agricultural, Soft Commodities (CFDs) | 14 | 20–30 | 1:50 |

Equities | Global shares/stocks | N/A | 200–3,000 | 1:13 |

Bonds | Bonds Futures | 6 | 5–20 | 1:200 |

Crypto CFDs (e.g. BTC, ETH, LTC) | 9 | 10–20 | 1:3 |

This wide range of instruments allows clients to expand their portfolio and utilize various trading strategies.

Trade Nation Bonuses and Promotions

While TradeNation doesn’t offer traditional bonuses, there are incentives to attract and retain traders;Trade Nation Promotions:

- Loyalty Program: Earn up to 20% back in rebates based on trading volume;

- Affiliate Program: Partners can earn commissions through referring clients to the broker (Minimum of $100 commission).

You can use TradingFinder's Rebate Calculator to estimate your earnings through the loyalty program.

Trade Nation Awards

Trade Nation has consistently demonstrated excellence in technology, platform innovation and client services, earning recognition across multiple industry categories.

Their commitment to reliability, user experience, and professional support highlights their leading position in global trading.

These are some of the awards the broker has received:

- Most Reliable Tech – 2024 by TradingView

- Best Trading Platform – 2024 by Global Forex

- Best Spread Betting Platform – 2023 by ADVFN

- Best Introducing Broker Programme – 2024 by Global Forex

Trade Nation Broker Support Team

TradeNation prides itself on providing responsive and knowledgeable 24/5 customer support. TradeNation Client assistance:

- Phone: +1 844 907 8776

- Email: support@tradenation.com

- live chat

Trade Nation’s List of Restricted Countries

While Trade Nation serves a global clientele, some restrictions are based on regulatory requirements.

The broker does not accept clients from the following countries; Trade Nation Restricted Countries:

- Yemen

- Virgin Islands

- United States Minor Outlying Islands

- United States

- United Kingdom

- Syrian Arab Republic

- Sudan

- Spain

- South Sudan

- Somalia

- Seychelles

- Russian Federation

- Puerto Rico

- Myanmar

- Mali

- Libyan Arab Jamahiriya

- Lebanon

- Israel

- Iraq

- Iran

- Haiti

- Guinea-Bissau

- Democratic Republic of Congo

- Democratic People's Republic of Korea

- Central African Republic

- Canada

- Belgium

- Australia

- American Samoa

- Afghanistan

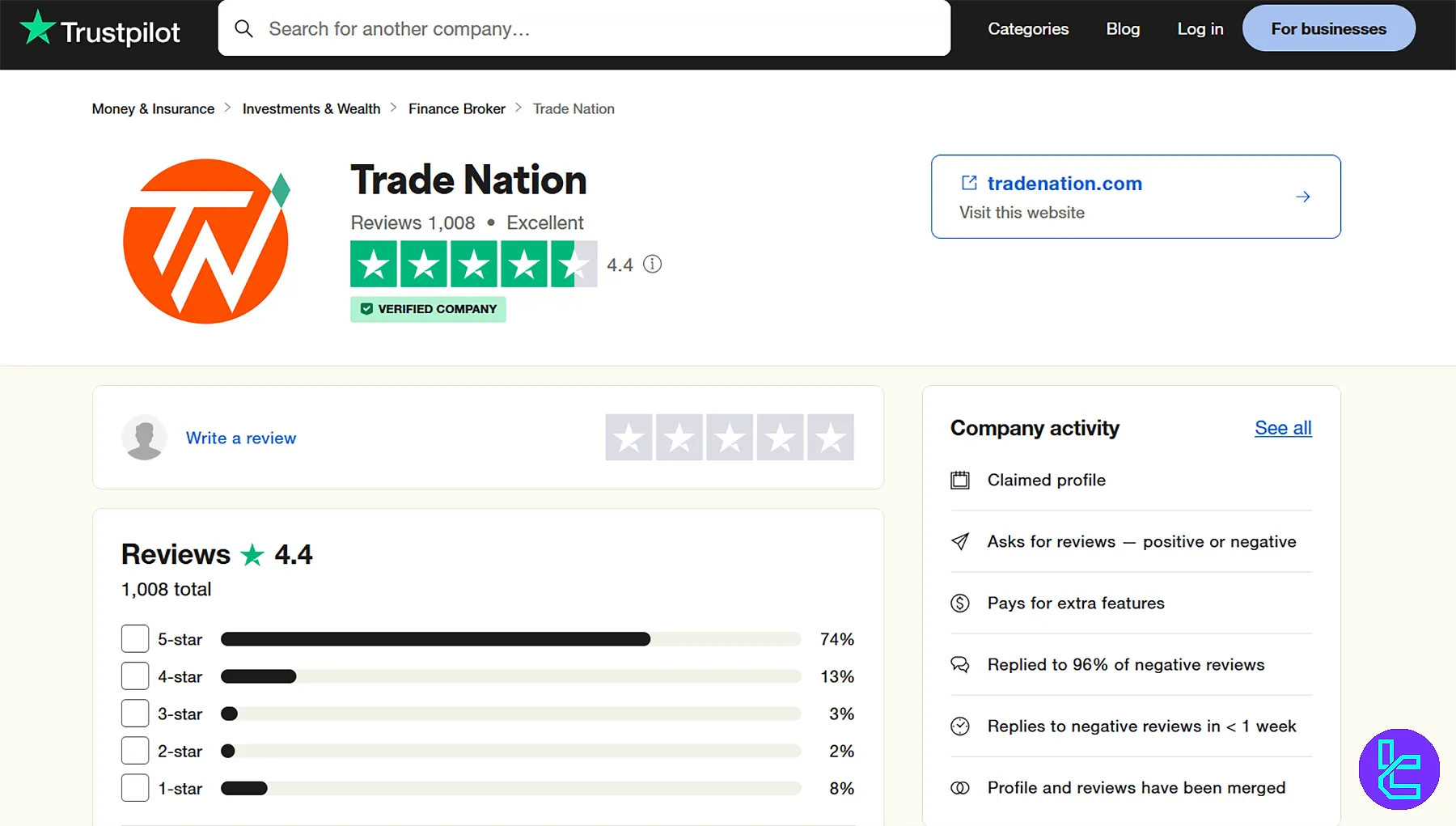

Trade Nation Trust Scores & Reviews

The roker has garnered positive reviews from traders and industry experts alike. The Trade Nation Trustpilot profile has a rating of4.4 out of 5.

Key factors contributing to this high trust score include:

- Oversight by multiple tier-1 regulators

- Fixed spreads with no hidden fees

- User-friendly proprietary platform and integration with popular third-party solutions

- Quick and helpful assistance

- Comprehensive learning materials for traders of all levels

Education on TradeNation Broker

Trade Nation offers a robust educational package to support traders in their journey. TradeNation Academy:

- Trading Glossary: Comprehensive dictionary of trading terms

- Video Tutorials: Step-by-step guides on platform usage and trading strategies

- Trading Articles: In-depth pieces on technical and fundamental analysis and trading psychology

- Webinars: Live sessions with market experts

- Demo Account: Practice trading in a risk-free environment

- Market Analysis: Daily reports and real-time news feeds

You can also check TradingFinder's Forex education section for additional resources.

TradeNation vs Other Brokers

Let's check Trade Nation's standing in the Forex trading world in comparison with other platforms:

Parameter | Trade Nation Broker | HFM Broker | FxPro Broker | FXGlory Broker |

Regulation | FCA, ASIC, FSA, SCB, FSCA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB | No |

Minimum Spread | From 1.5 pt | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | $0.0 | From $0 | From $0 | $0 |

Minimum Deposit | $0 | From $0 | $100 | $1 |

Maximum Leverage | 1:30 | 1:2000 | 1:500 | 1:3000 |

Trading Platforms | TradeCopier, MT4, TradingView, TN Trader | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Real, Demo | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 100+ | 1,000+ | 2100+ | 45 |

Trade Execution | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending | Market, Instant |

Conclusion and Final Words

Trade Nation, with no minimum deposit for most payment methods and a minimum deposit of $30 for cryptocurrencies, makes trading accessible to a broad audience.

Trustpilot reviews give it a solid score of 4.5/5. Educational resources like a demo account, webinars, and market analysis make Trade Nation an appealing choice.

However, restrictions on certain countries, including the United States, Canada, Australia, and the United Kingdom, may limit its reach.