Trive Invest provides 3 account types [Classic, Classic Gold, Premium] in addition to swap-free and demo features. These accounts come with an initial deposit requirement starting from $200 and a maximum forex leverage of 1:1000.

All mentioned trading accounts charge a trading commission at a minimum of $1 per lot. Also, the broker lets you to trade with a high leverage of 1:1000.

Trive Invest Company Information and Regulation

Trive Invest, operating under the name PT Trive Invest Futures, is a Jakarta-based broker and a subsidary to Trive, established in 2005 and regulated by Indonesia's BAPPEBTI. Initially focused on local markets, the company has since expanded its footprint to more than 10 countries, offering diversified financial services across regions.

The broker supports trading in forex, indices, stocks, metals, and energies via the MetaTrader 5 platform and provides a choice between fixed and floating spreads. Clients benefit from negative balance protection, localized customer support, and data from respected analytical providers such as TradingView and Trading Central.

Here is some key information about the broker:

Entity Features / Branches | PT Trive Invest Futures |

Regulation | BAPPEBTI |

Tier | 2 |

Country | Indonesia |

Compensation Scheme | No |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:1000 |

Client Eligibility | Indonesian residents |

Trive Invest has built its presence on the pillars of regulatory compliance, strategic research, and tailored account structures, including swap-free options and promotional rewards.

Trive Invest Broker Important Specifications

To give you a quick overview of what this Forex broker offers, here's a summary table:

Broker | Trive Invest |

Account Types | Classic, Classic Gold, Premium, Swap Free, Demo |

Regulating Authority | BAPPEBTI |

Based Currencies | USD |

Minimum Deposit | $200 |

Deposit Methods | Local Bank Transfers |

Withdrawal Methods | Local Bank Transfers |

Minimum Order | 0.01 |

Maximum Leverage | 1:1000 |

Investment Options | Copy Trading via MT5 |

Trading Platforms & Apps | MetaTrader 5 |

Markets | Forex, Commodities, Indices, Stocks |

Spread | Fixed in Classic and Classic Gold Accounts Floating in Premium Accounts |

Commission | From $1 per Lot |

Orders Execution | Market, Instant |

Margin Call / Stop Out | N/A |

Trading Features | Market Screener, Technical Sentiment, Forex Heatmap, Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | Cashback on Spreads and Commissions, Staycation Rewards, VIP Clients |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Phone, Live Chat, Ticket |

Customer Support Hours | 24/5 |

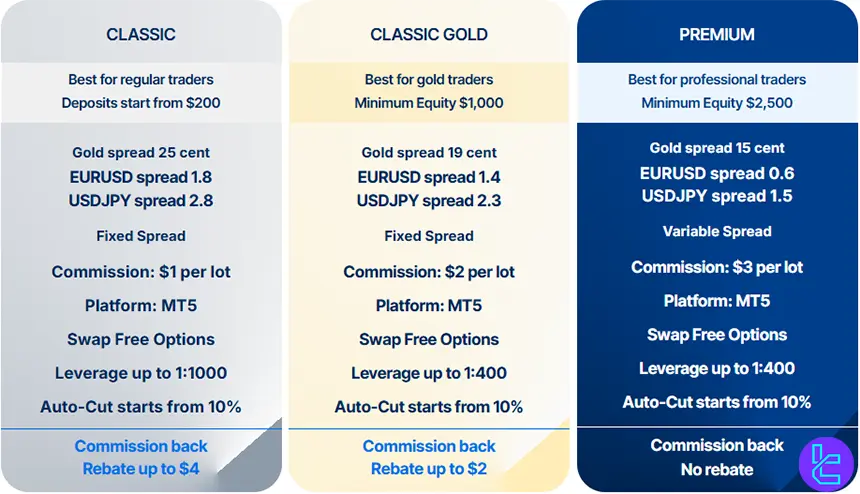

Account Types Features

Trive Invest provides traders with 3 account options, differentiating in spreads, commissions, leverage, and minimum deposit. Table of Comparison:

Account Type | Classic | Classic Gold | Premium |

Min. Deposit | $200 | $1,000 | $2,500 |

Trading Platform | MT5 | ||

Swap-Free Account | Yes | ||

Max. Leverage | 1:1000 | 1:400 | |

Auto-Cut from | 10% | ||

All account types are denominated in USD, provide access to the MetaTrader 5 platform, and include negative balance protection. A 30-day demo account is also available for practice or testing strategies.

Also, you can create a Demo account for practice and strategy testing in Trive Invest.

Trive Invest Pros and Cons

The discussed brokerage has its strengths and weaknesses, like any other company. The table below offers a neutral perspective at the advantages and disadvantages:

Pros | Cons |

Regulated by BAPPEBTI | No 24/7 Support |

Choice Between Fixed and Floating Spreads | Relatively Narrow Range of Instruments |

Decent Variety in Account Types | - |

Trive Invest Broker Account Opening and Verification Guide

Opening an account with this broker is designed to be fast and straightforward. Trive Invest registration process involves a few simple steps to get you started promptly.

#1 Access the Trive Invest Website

Begin your registration by navigating to the Trive Invest homepage. Use the "Open an Account" option at the bottom of the page. From there, decide whether to open a demo account or a live account; in this guide, we proceed with opening a live account.

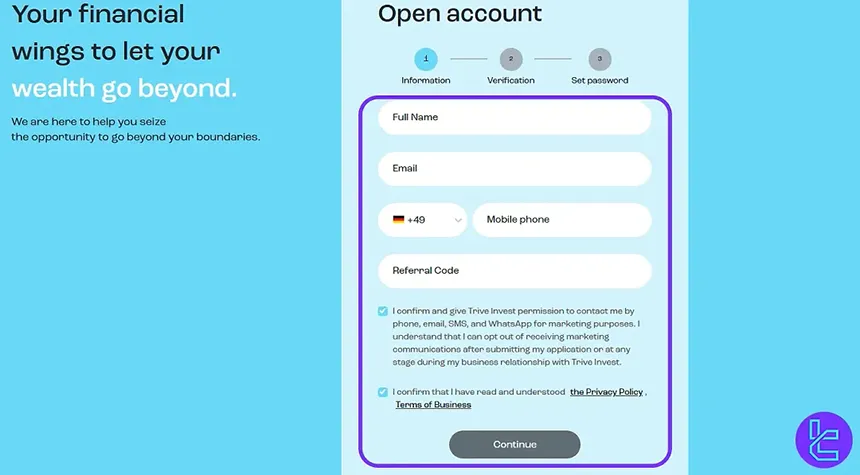

#2 Enter Initial Signup Details

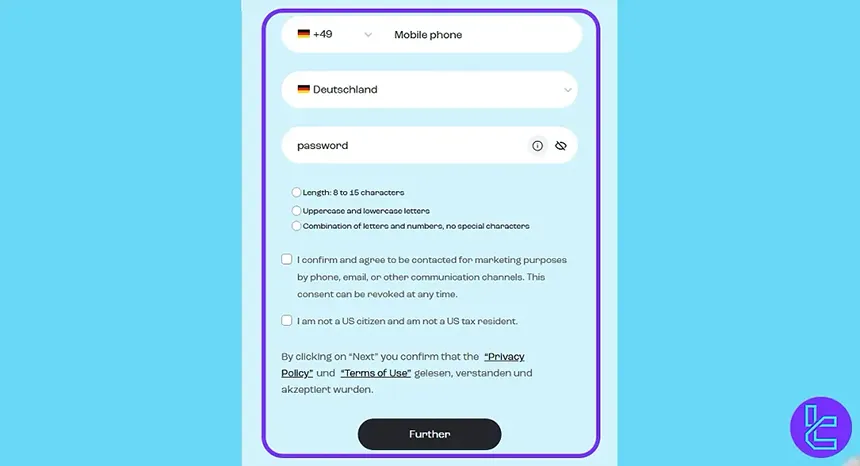

Provide your personal details, including:

- First and last name

- Email address

- Country of residence

- Referral code (if available, to apply any associated benefits)

Create a secure password combining uppercase, lowercase, and numeric characters. Make sure to select your country and accept the platform’s terms and conditions.

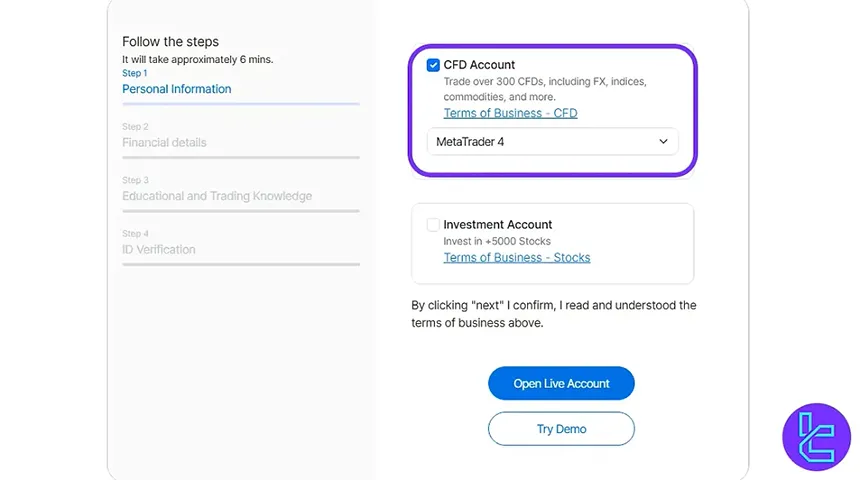

#3 Select Trading Platform

Choose the trading interface that suits your preferences, such as MetaTrader 4, MetaTrader 5, or Trive Trader.

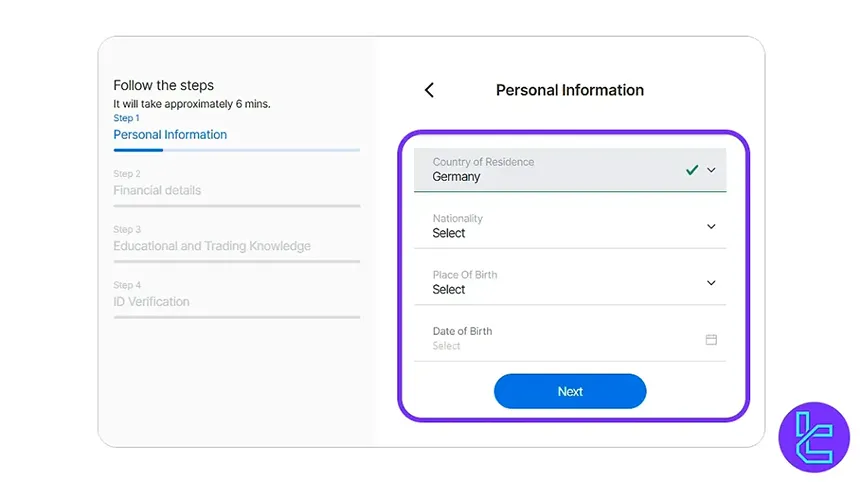

#4 Provide Personal Information and Residential Address

Enter your personal profile information, including nationality, country of residence, place of birth, and date of birth.

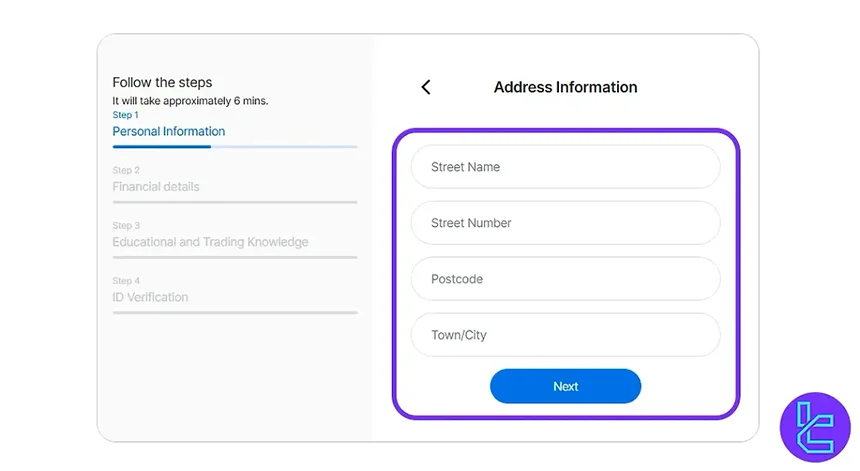

Then, supply your full residential address, including street name, number, postal code, and city.

#5 Complete Financial Information

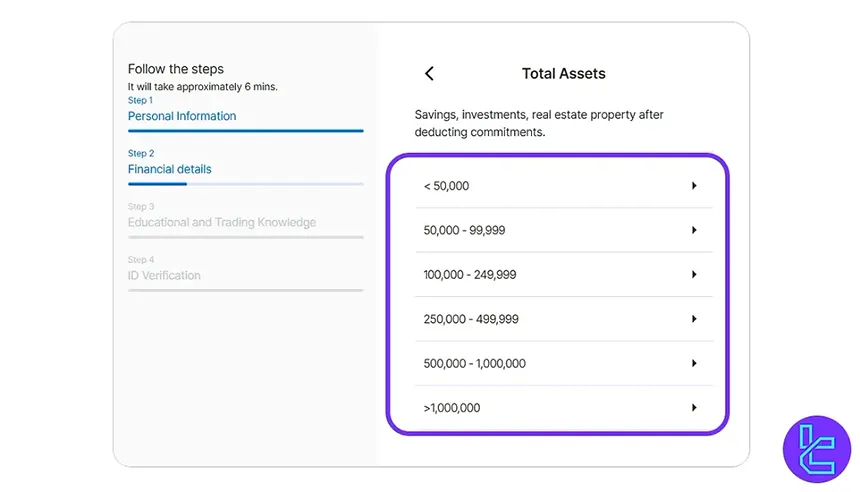

Detail your financial profile to comply with regulatory requirements:

- Employment status and type of business

- Annual income

- Total assets

- Source of wealth

- Trading objectives

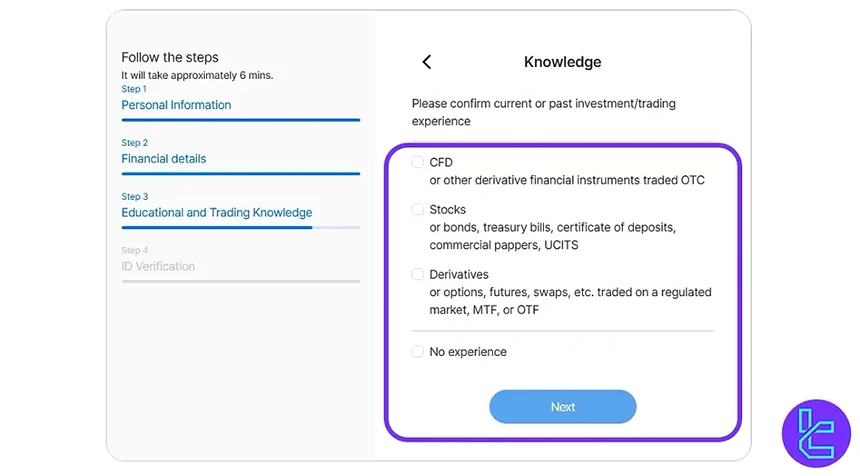

#6 Answer Trading Knowledge Questions

Complete the trading experience questionnaire to verify your market knowledge and trading proficiency. This step ensures adherence to standard trading compliance measures.

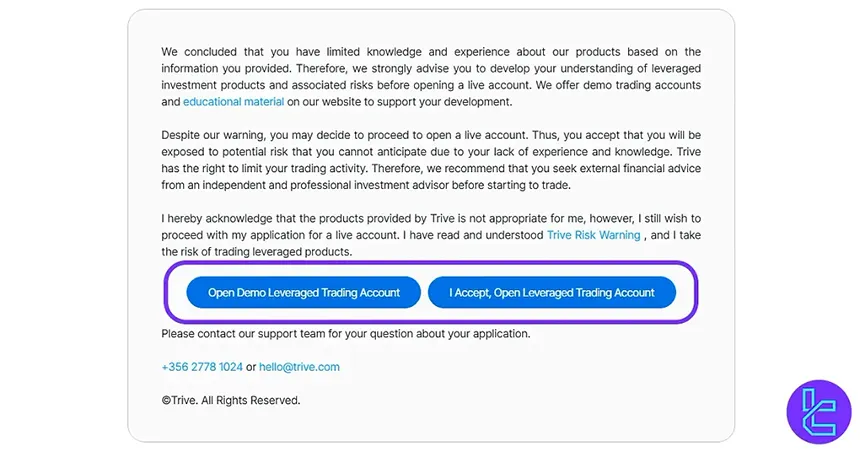

Finalize your account by confirming it as a live account. Once confirmed, you can access your trading dashboard and begin using your account for live market activities.

#7 Trive Invest Verification

After completing the registration process, you must verify your identity and address to activate your live account.

Submit the required documents, such as a government-issued ID and proof of residence, to comply with KYC regulations. Once verified, you will have full access to your trading dashboard and can begin trading.

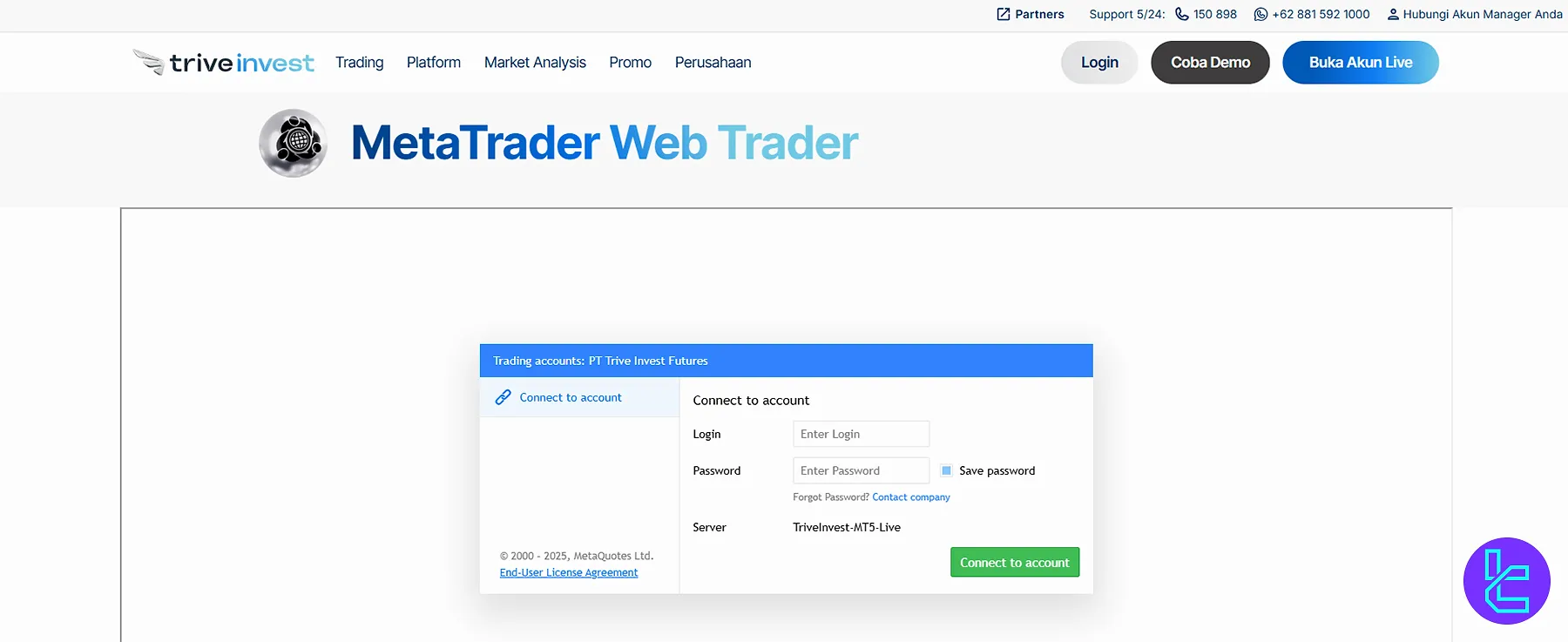

Trading Platform

Trive Invest offers trading through the powerful MetaTrader 5 (MT5) platform, which is accessible via desktop, web browser, and mobile apps. MT5 equips traders with 38+ built-in technical indicators, 44 drawing tools, over 22 timeframes, and multiple order types making it ideal for advanced technical analysis and strategic execution.

While the global Trive brand supports both MT4 and MT5, Indonesian clients under Trive Invest are limited to MT5 only. The platform supports:

- One-click order execution

- Customizable chart layouts

- Real-time economic calendar and news feeds

- Expert Advisor (EA) integration for algorithmic trading

- Access to Trading Central tools and VPS hosting (via partners)

Trive’s platform stack is geared toward both manual and automated trading workflows, offering flexibility for a wide range of strategies.

While MT5 is a powerful platform, some traders might criticize the broker for offering only one option.

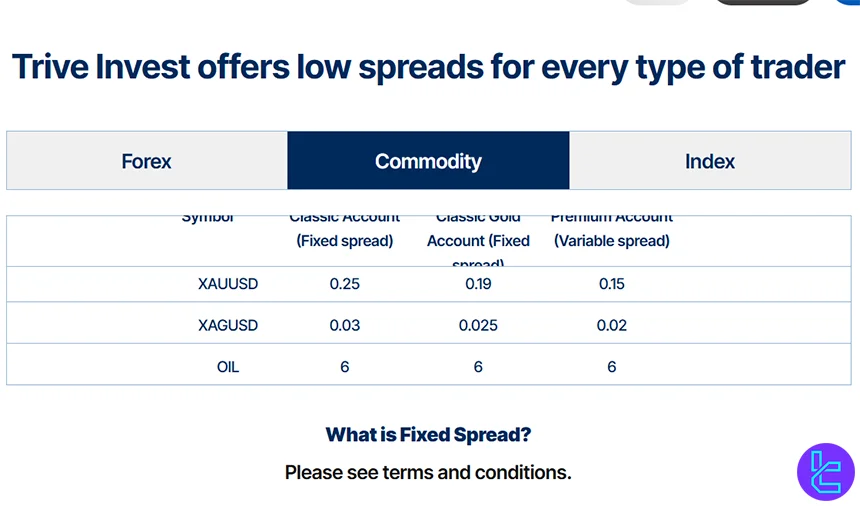

What Are the Spreads and Commissions on Trive Invest?

Trive Invest applies a combination of spread-based and commission-based fee structures depending on the account type. For standard accounts, the EUR/USD spread ranges between 0.5 to 1.2 pips, while GBP/USD sits between 0.7 and 1.5 pips competitive by market standards.

On RAW/ECN-style accounts, Trive charges a low commission of $2.5 per lot, with typical spreads averaging 0.1 pips for EUR/USD and 0.2 pips for GBP/USD during peak hours.

In terms of non-trading fees, the broker charges between 0% and 1.5% on deposits and withdrawals, depending on the payment method. Additionally, there is an inactivity fee of $10 per month for dormant accounts.

Trive's cost structure strikes a balance between affordability and access to tighter spreads for high-volume or experienced traders.

Account Type | Classic | Classic Gold | Premium |

Spread Type | Fixed | Fixed | Floating |

EURUSD Spread (Pips) | 1.8 | 1.4 | 0.6 |

USDJPY Spread (Pips) | 2.8 | 2.3 | 1.5 |

Gold Spread (Pips) | 0.25 | 0.19 | 0.15 |

Trading Commission per Lot | $1 | $2 | $3 |

Per our investigations, the broker itself does not charge any fees on deposits and withdrawals. However, the bank may incur commissions.

Swap Fee at Trive Invest

Trive Invest applies overnight swap fees on positions held past rollover; for example, on gold (XAUUSD) they cite an approximate daily swap cost of US $40 per 1 lot, meaning a 30-day hold can reach about US $1,200 per lot.

These swap costs depend on instrument, direction, lot size, and holding duration, and can significantly impact longer-term positions.

With that context, here are the key points about swap costs:

- Swap rates are not fixed and may change at any time without prior notice;

- Certain days apply a triple-swap charge, which increases the effective cost for longer holding periods;

- Trive Invest also offers a Swap-Free / Islamic account option in which overnight swap fees are removed for eligible clients and instruments.

Non-Trading Fees at Trive Invest

Trive Invest ensures account funding and withdrawals are simple and cost‑effective, with no standard broker-imposed fees.

Accounts are maintained without inactivity charges, and currency conversion is handled transparently at fixed rates, making non-trading costs minimal for clients.

Key points about non-trading fees:

- Deposits via supported banks have no broker commission;

- Withdrawals via supported banks are free of broker fees;

- Currency conversion between IDR and USD is at a fixed rate with no separate fee.

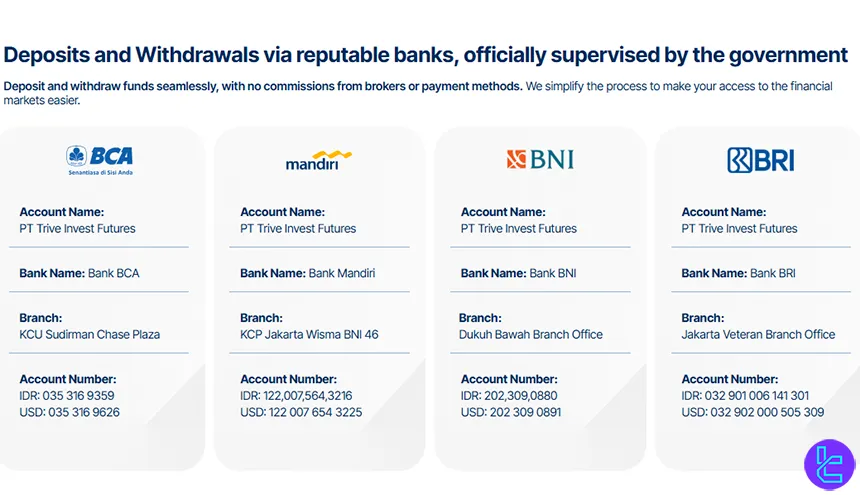

Funding and Withdrawal Options

Trive Invest supports several local Indonesian banks for deposits and withdrawals, including:

- Bank Central Asia (BCA)

- Bank Mandiri

- Bank Negara Indonesia (BNI)

- Bank Rakyat Indonesia (BRI)

There are no other payment options such as E-payment systems, cryptocurrency, etc.

Deposit Methods at Trive Invest

Trive Invest supports funding accounts via approved Indonesian banks and accepts deposits in Indonesian Rupiah (IDR), which are converted into the account’s base currency (USD) at a fixed rate. All deposit methods carry no internal commission from Trive Invest, making deposits essentially free for users.

Below is a breakdown of their deposit method and associated parameters:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Local bank transfer | IDR (converted to USD) | $200 | None (broker does not charge) | Usually instant to a few hours |

Withdrawal Methods at Trive Invest

Trive Invest allows clients to withdraw funds using the same channels as deposits, primarily through approved Indonesian banks.

Withdrawals are designed to be simple and cost‑effective. Clients typically receive their funds within a short timeframe, depending on bank processing.

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Local bank transfer | IDR or USD (depending on account) | $10 | None (broker does not charge) | Processed same‑day; may take 1-2 business days |

Investment Options: Can You Copy Trade on Trive Invest?

Trive Invest offers copy trading functionality through the MT5 platform, allowing clients to replicate the strategies and ideas of professionals. This feature is provided through a Signal Centre.

Tradable Instruments and Markets

Trive Invest offers access to a total of 78 trading instruments, which, while not extremely numerous, cover four key asset classes from Forex to US Stock CFD contracts.

The key details can be seen in the table below for clarity and quick reference:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Currency pairs | 25 | 40-60 | 1:1000 | |

Commodities | Gold, silver, oil | 3 | 10-20 | 1:1000 |

Indices | Major global stock‑market indices | 6 | 10-15 | 1:1000 |

CFD Stocks | US stock CFDs | N/A | 200-500 | 1:1000 |

This concise yet diversified offering allows traders to efficiently manage risk while leveraging global market opportunities.

Any Bonuses/Promotions?

Trive Invest provides various promotions to its clients:

- Cashback on Spreads and Commissions: up to $4 per lot monthly for spreads and 1 lot commission return for every $1 deposit

- Staycation Rewards: Receive a IDR 500,000 staycation budget for trading every 25 side lots in indices market

- VIP Clients: Dinners, flight tickets, vouchers, and more

Trive Invest Awards

Trive Invest has built a strong reputation in the financial industry through reliable services and consistent performance.

Trive Invest awards highlight the broker’s achievements and recognition from both regional and global industry bodies.

Here are some of the awards has achieved by the broker:

- Best Broker of the Year - 2021 (awarded by ICDX)

- Best Broker of the Year - 2022 (awarded by ICDX)

- Best Broker of the Year - 2024 (awarded by ICDX)

- Most Transparent Forex Broker Asia - 2022 (awarded by Global Forex Awards)

- Best Brokerage Services for Beginners Asia - 2023 (awarded by Global Forex Awards)

Support Contact Options and Working Hours in Trive Invest

This broker offers customer support services through 3 channels:

- Email: info@triveinvest.co.id

- Phone: +62 150 898

- Live Chat: Available through the site and on WhatsApp

The company states that the customer support is available 24/5.

Trive Invest Broker List of Restricted Countries

This broker has indicated that it does not provide services to parties related to sanctioned countries or other specific regions, including but not limited to:

- Iran

- Myanmar

- Afghanistan

- North Korea

- United States

- United Kingdom

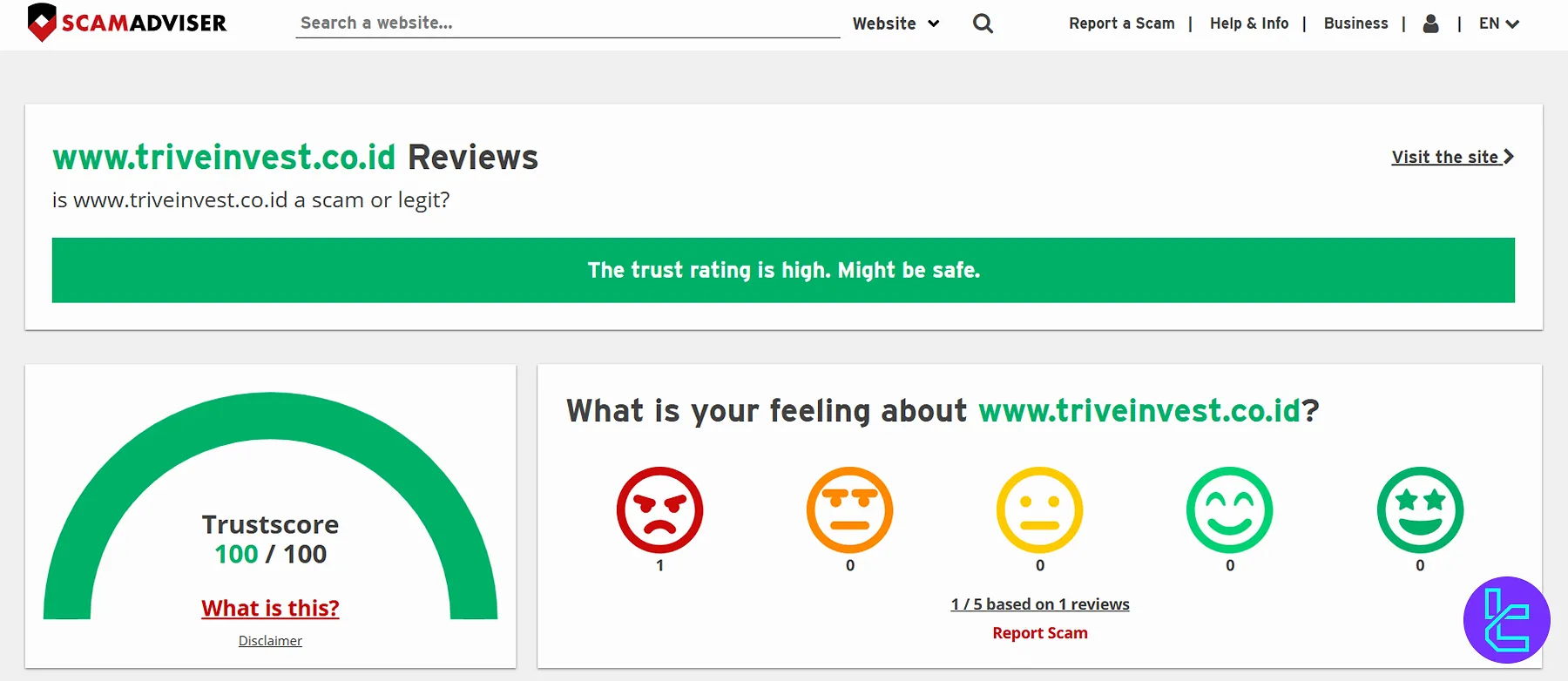

Trive Invest Trust Scores & Reviews

This broker hasn't received a high number of ratings from review sites and users; Trive Invest's profile on ScamAdviser, which indicates a "Trustscore" of 100/100, is the only source in this regard.

Educational Resources and Materials

Trive Invest offers some educational resources for traders, including a YouTube channel containing videos on trading concepts and strategies, in addition to analysis tools and products on the website, such as an economic calendar, market screener, Heatmap, and more.

Trive Invest Comparison with Other Brokers

Trive Invest is subsidary of Trive broker, but that doesn't mean we can't compare it with other brokers:

Parameters | Trive Invest Broker | |||

Regulation | BAPPEBTI | ASIC, FSC, DFSA, CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FSC, CySEC |

Minimum Spread | Fixed in Classic and Classic Gold Accounts Floating in Premium Accounts | From 0.6 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $1 per Lot | $0 (except on Shares account) | From $0.2 to USD 3.5 | From $0.0 |

Minimum Deposit | $200 | $5 | $10 | $5 |

Maximum Leverage | 1:1000 | 1:1000 | Unlimited | 1:3000 |

Trading Platforms | MetaTrader 5 | MT4, MT5, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App |

Account Types | Classic, Classic Gold, Premium, Swap Free, Demo | Micro, Standard, Ultra Low, Shares | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 70+ | 1400+ | 200+ | 550+ |

Trade Execution | Market, Instant | Market, Instant | Market, Instant | Market |

Conclusion And Final Words

Trive Invest has 2 types of spreads [floating, fixed] across its trading accounts; the amount is 1.8 pips in the EURUSD pair on the Classic account.

The brokerage has only received a rating from one source; it has a 100/100 "Trustscore" on the ScamAdviser website.