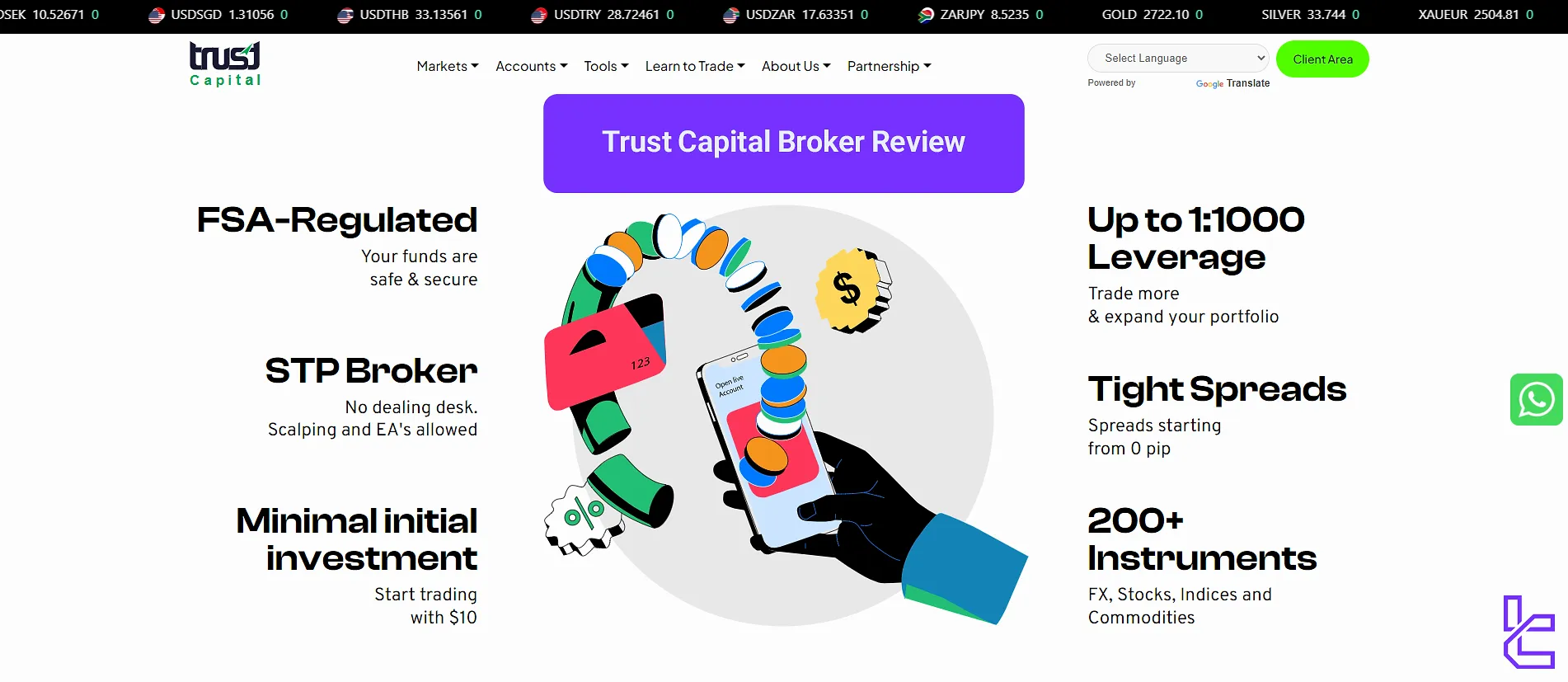

Trust Capital is a multi-asset brokerage with 6 payment options [bank transfers, VISA, MasterCard, SticPay, Maestro, Mada.] You will be required to make a minimum deposit of $10 via one of these methods. This company claims that it processes more than 500,000 transactions per day.

Trust Capital offers maximum leverage of up to 1:1000. In addition to its Solo, Together and Professional account types, the broker also provides an Islamic (swap-free) account option for Sharia-compliant trading.

Company Specifics & Regulating Bodies

Trust Capital is a relatively new player in the forex industry, having been founded in 2019. Here are some key points about the company's regulations and company information:

Entity Parameters / Branches | Trust Capital Ltd | Trust Capital S.A.L. | Trust Capital TC Ltd |

Regulation | FSA Licence SD122 | BDL/CMA Licence No. 20 | CySEC Licence 369/18 |

Regulation Tier | 4 | 2 | 1 |

Country | Seychelles | Lebanon | Cyprus |

Investor Protection Fund / Compensation Scheme | No | No | No |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | N/A | Yes | N/A |

Maximum Leverage | 1:1000 | N/A | 1:30 |

Client Eligibility | Global (outside EU) | Lebanese region / selected jurisdictions | EEA residents & others |

Important Features and Specifics

Here's a quick overview of Trust Capital's key features in a table:

Broker | Trust Capital |

Account Types | Solo, Together, Professional |

Regulating Authorities | CySEC, CMA, FSA |

Based Currencies | USD, EUR |

Minimum Deposit | $10 |

Deposit Methods | Wire Transfer, Credit/Debit Cards, SticPay, Maestro, Mada |

Withdrawal Methods | Wire Transfer, Credit/Debit Cards, SticPay, Maestro, Mada |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:1000 |

Investment Options | None |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5 |

Markets | Forex, Indices, Commodities, Shares, Energies, Metals |

Spread | From 0 Pips |

Commission | $6 Per Round Per Lot on the Professional Account |

Orders Execution | Not Specified |

Margin Call/Stop Out | 100%/50% |

Trading Features | Demo Account |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Phone Call, Ticket System, Live Chat |

Customer Support Hours | 24/5 |

Account Types: Features and Comparison

Trust Capital offers three main account types to satisfy the needs of traders with various preferences and trading strategies. Accounts in Trust Capital:

Account Type | Solo | Together | Professional |

Min. Deposit | $10 | $250 | $1,000 |

Max. Leverage | 1:1000 | 1:400 | 1:100 |

Trading Platform | MT5 | MT4/5 | MT5 |

Also, there's a practice account with virtual funds for risk-free trading practice. Besides, you have the option to trade swap-free on Solo and Together accounts.

Note: The Together account includes educational features with 1-on-1 sessions.

Strengths and Flaws

Every Forex broker has its own upsides and downsides in its services. We will mention some of the key advantages and disadvantages of Trust Capital in the table below:

Strengths | Flaws |

High Leverage Up To 1:1000 | No Copy Trading Or Other Investment Options |

Low Minimum Deposit ($10 For Solo Account) | No Crypto Offerings |

Regulated By A Top-Tier Authority | - |

Wide Range Of Trading Instruments | - |

Trust Capital Broker Signing Up & Verification: Step-By-Step Guide

The Trust Capital registration takes just a few minutes. Traders are asked to provide key personal details, select their account type (e.g., Standard, Premium), choose their preferred platform (MT4 or MT5), and verify their email address using a one-time code.

This ensures account security and access to a regulated trading platform. At the end, you must complete the Trust Capital verification procedure.

#1 Start Registration on the Official Site

Visit the Trust Capital website and click "Start Trading Now" to begin.

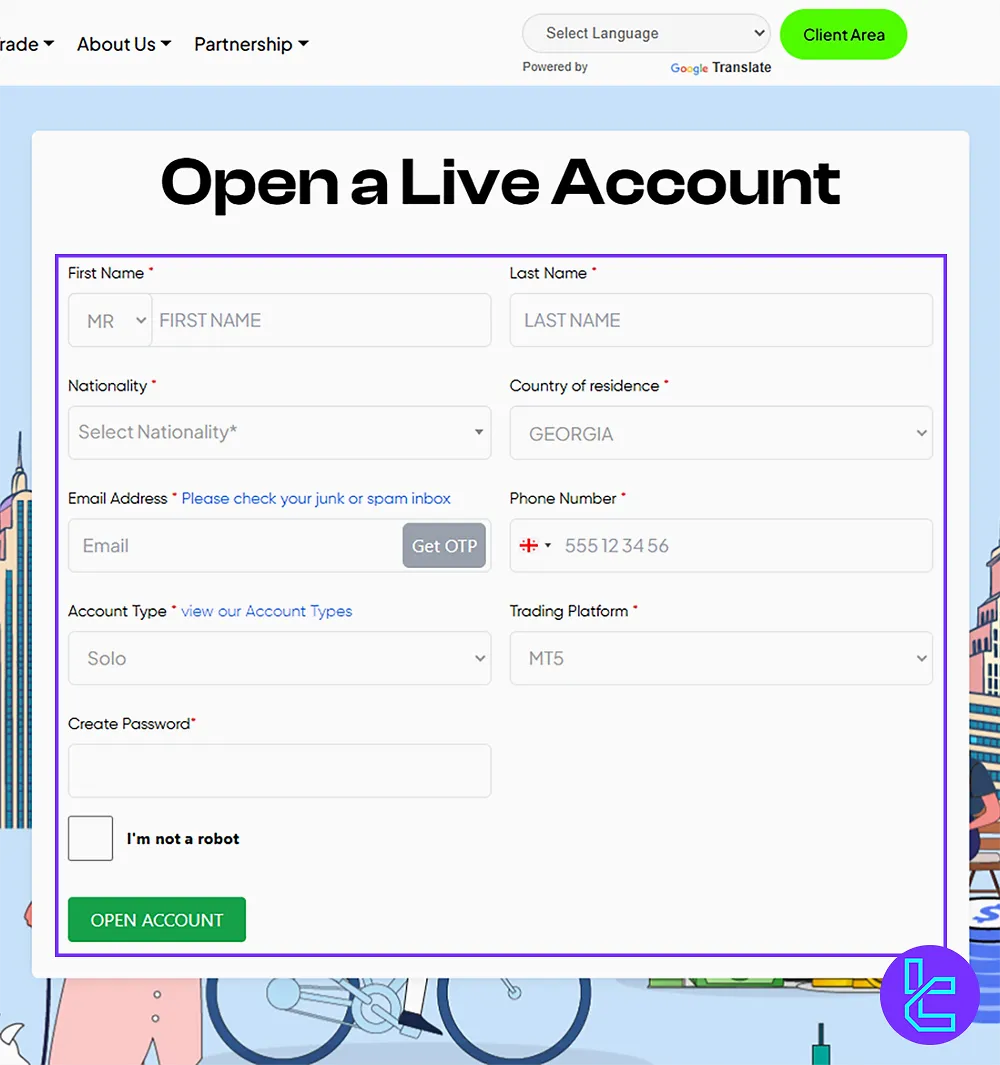

#2 Complete the Signup Form

Fill out the registration form with the following details:

- Full name

- Gender

- Phone number

- Nationality

Choose an account type and trading platform (MT4/MT5), then create a secure password.

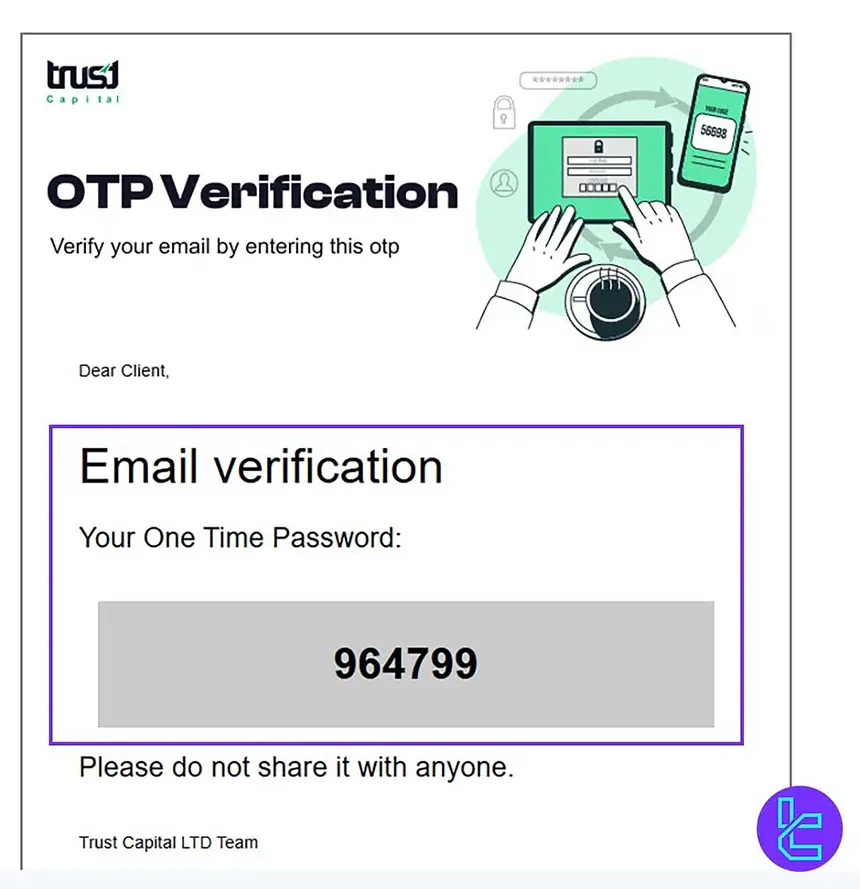

#3 Verify via OTP

Click "Get OTP", retrieve the code from your inbox, enter it, and click "Open Account" to complete registration.

#4 Proceed with the KYC Process

For authorization, navigate to the Trust Capital dashboard, and complete the KYC (Know Your Customer) process by uploading the required documents, including:

- Proof of ID: National ID or Passport

- Proof of Address: Utility bill or Bank statement

What Platforms Are Available for Trading on Trust Capital?

The broker offers two of the most popular trading platforms in the forex industry: MetaTrader 4 and MetaTrader 5.

- MetaTrader 4 (MT4):

- 3 types of charts for optimized trading

- Advanced and interactive Forex charts with control options

- Expert Advisors (EAs) for automated trading

- 9 different timeframes

- MetaTrader 5 (MT5):

- More advanced version of MetaTrader 4

- Additional timeframes and order types

In the table below, you can access the links to download the platforms for your mobile devices:

- | Android | iOS |

MT4 | ||

MT5 |

Also, you can download MT4 indicators via the related page on the website.

Spreads And Commissions in Trading and Working with Trust Capital

We investigated the website for trading commissions and spreads on different accounts, and there's not much information available.

The only data is for the Professional account, with spreads starting from 0.0 pips and$6 commission per lot per side. Regarding fees in other operations:

- No inactivity fees

- 5% per transaction on deposits and withdrawals

The lack of clear and sufficient data for trading commissions is a negative point for the website.

Swap Fees at Trust Capital

Trust Capital applies swap charges as part of its overnight financing for open positions. These fees vary by instrument and are calculated as a debit or credit in the “Swap” field, based on the price difference between expiring and new contracts.

For example, during rollover, if the new Crude Oil contract trades higher, long positions incur a negative swap adjustment while short positions receive a positive one.

Here are the key operational points about swap and rollover handling at Trust Capital:

- Swap is adjusted only once per rollover to reflect price differences between expiring and new contracts;

- The platform updates the new price level within one hour of rollover to restore client equity balance;

- Margin call notifications may occur temporarily but are auto-corrected after price updates;

- Trust Capital offers swap-free / Islamic accounts upon client request.

Non-Trading Fees at Trust Capital

Trust Capital keeps its non-trading fees transparent and limited, focusing on fairness and clarity for all clients. Based on its official Terms & Conditions and Deposit & Withdrawal policy, there are no internal charges for account funding or maintenance.

However, specific administrative or third-party costs may apply in certain cases such as inactivity or low trading activity before withdrawal.

Here are the main non-trading fee highlights every trader should know:

- No internal deposit or withdrawal fees are charged by Trust Capital;

- A withdrawal commission of 2%–5% applies when trading activity is low 2% for 1–3 months, 3% for 3–6 months, and 4.5% for over 6 months of inactivity;

- Third-party payment processors or banks may apply external transaction costs;

- Accounts inactive for at least 90 calendar days with a balance of ≤ 10 EUR (or equivalent) are archived and disabled automatically;

- Currency conversion fees may apply when deposits or trades are made in currencies other than the account’s base currency.

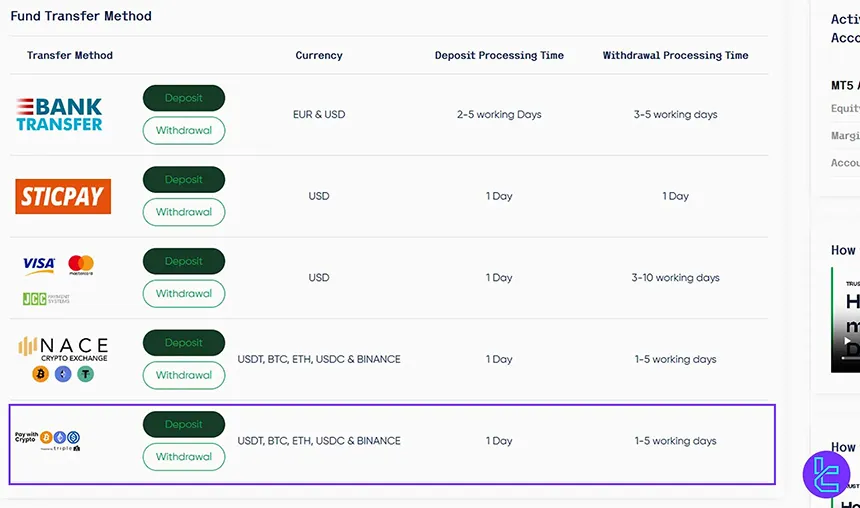

Funding & Withdrawal Methods

The broker provides a variety of payment options to suit different preferences. Trust Capital deposit & withdrawal options:

- Wire Transfer: Via bank accounts

- Credit/Debit Cards: Visa and Mastercard

- Other Methods: SticPay, Maestro, and Mada

The minimum time required for processing payments on the broker is 1 day. It varies based on the chosen method.

Withdrawals follow similar timelines, with credit/debit card withdrawals taking 3–10 days, and e-wallets are typically processed within 1 day.

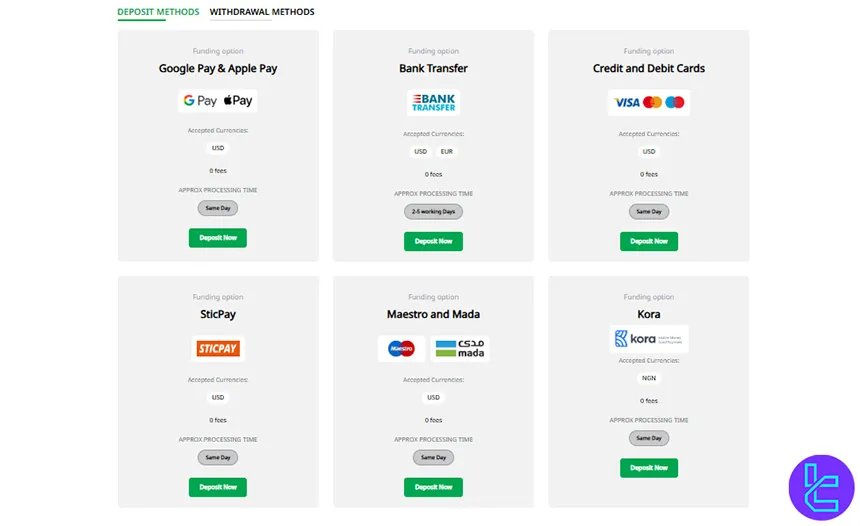

Deposit Methods at Trust Capital

Trust Capital provides clients with a secure, transparent, and cost-efficient set of deposit options. All funding channels are processed through trusted global and regional payment providers, ensuring both speed and reliability.

The broker does not charge any internal deposit fees, and most payment methods are credited instantly. The minimum deposit requirement is 10 USD or equivalent, making it accessible for traders at every level.

Below is a summary of the available deposit methods and their key parameters:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Google Pay / Apple Pay | USD | 10 USD | 0 % | Same day |

Credit & Debit Cards | USD | 10 USD | 0 % | Same day |

Bank Transfer | USD, EUR | 10 USD or equivalent | 0 % | 2 – 5 business days |

Stic Pay | USD | 10 USD | 0 % | Same day |

Maestro / Mada | USD | 10 USD | 0 % | Same day |

Kora | NGN | 10 USD or equivalent | 0 % | Same day |

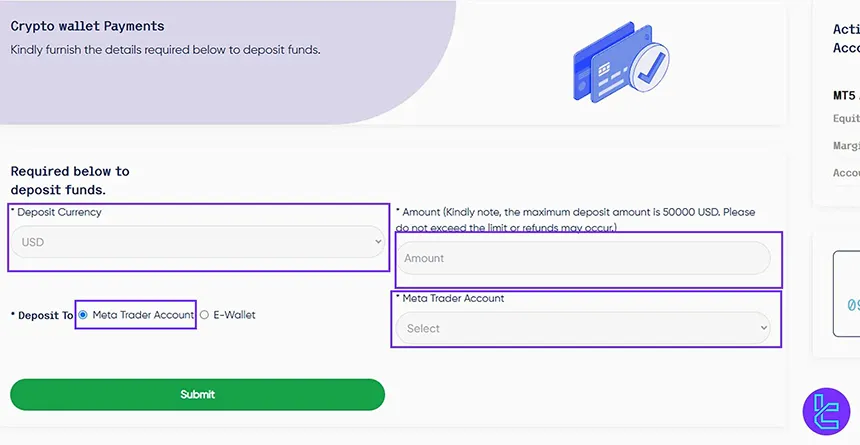

Trust Capital TRC20 Deposit

Trust Capital TRC20 deposits with Tether (USDT-TRC20) on the Tron network are completed quickly, usually within 2 minutes.

Funding your account involves:

- Selecting the trading account

- Specifying the deposit amount and currency

- Scanning a one-time QR code

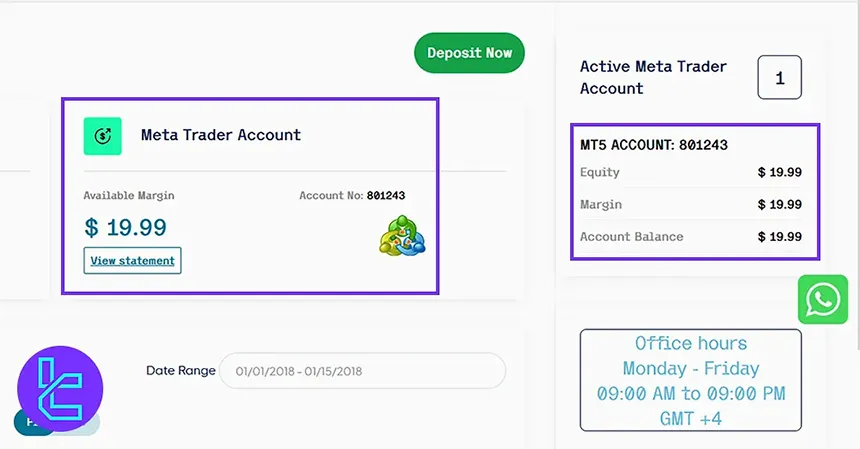

- Confirming the transaction through MetaTrader 5

After successfully depositing USDT-TRC20, traders can access over 400 instruments with leverage up to 1:1000 and a minimum trade size of $10.

The process for Tether TRC20 deposits at Trust Capital includes the following steps:

#1 Access the Deposit Section

Begin by logging into your Trust Capital trading cabin and opening the “Deposit Now” option.

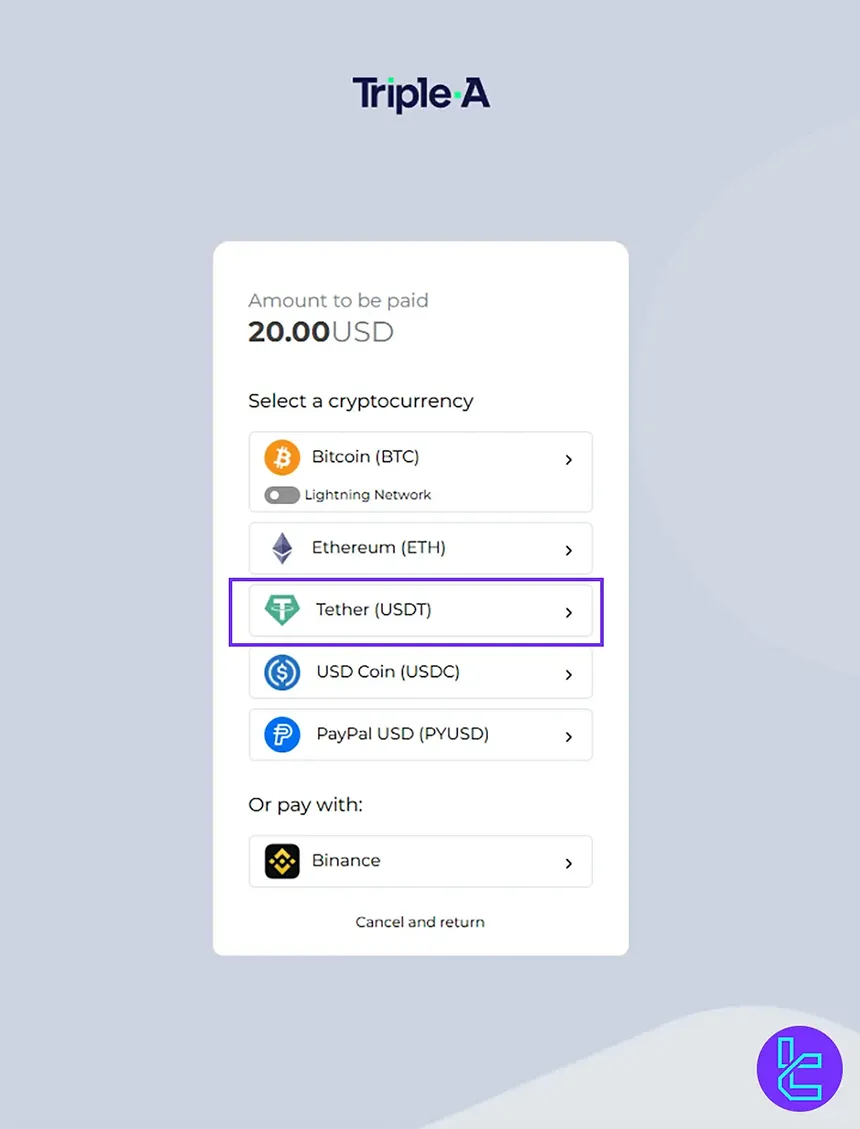

#2 Choose the Crypto Deposit Method

Select “Pay with Crypto” as your deposit method and proceed by clicking “Deposit”.

#3 Specify Deposit Amount and Account

Now simply follow these steps:

- Enter the desired deposit amount in USD;

- Select the MetaTrader account;

- Confirm your trading account before submission.

#4 Complete Deposit with Tether TRC20

Select Tether (TRC20) as the currency.

then either scan the one-time QR code or copy the wallet address into your wallet to finalize the transfer.

If an “insufficient payment received” error occurs, pay the remaining balance and continue.

Deposits are reflected in your MetaTrader 5 account balance once processed.

Weekend deposits will appear on Monday. Also, Minimum deposits generally start at $10, depending on your Trust Capital account type.

Withdrawal Methods at Trust Capital

Withdrawals at Trust Capital are processed through the same channels used for deposits, ensuring consistency and transparency in your fund flows.

According to the broker’s official disclosures, no internal withdrawal fees are charged by the company itself, though processing times vary widely across methods.

Below you’ll find a clear breakdown of each withdrawal method and its key parameters:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Google Pay & Apple Pay | USD | N/A | 0 % | Same day |

Bank Transfer | USD, EUR | N/A | 0 % | 3‑5 working days |

Credit & Debit Cards | USD | N/A | 0 % | 3‑10 working days |

Stic Pay | USD | N/A | 0 % | Same day |

Maestro & Mada | USD | N/A | 0 % | 3‑10 working days |

Kora | NGN | N/A | 0 % | Same day |

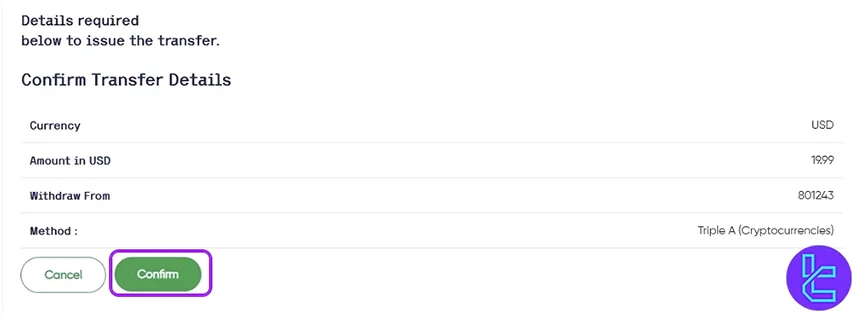

Trust Capital TRC20 Withdrawal

Trust Capital supports quick TRC20 withdrawals, allowing Tether (USDT-TRC20) transfers directly. Initiating a Trust Capital TRC20 withdrawal usually takes about 5 minutes. Simply select USDT-TRC20, enter the amount, and confirm the request.

Follow these steps to withdraw USDT on the Tron network:

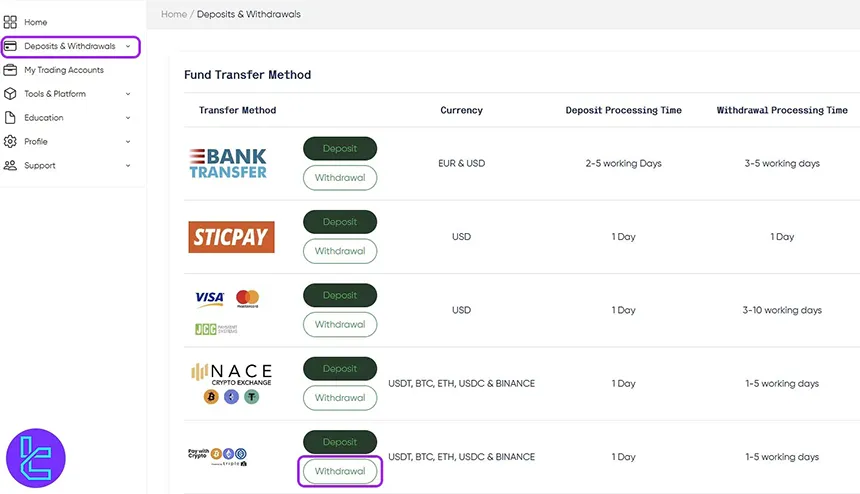

#1 Login and Access Deposit and Withdrawal

Start by accessing your Trust Capital account dashboard securely.

- Sign in to your Trust Capital dashboard;

- Open the “Deposit and Withdrawal” section;

- Locate the cryptocurrency row and select “Withdrawal”, then choose Tether (USDT-TRC20).

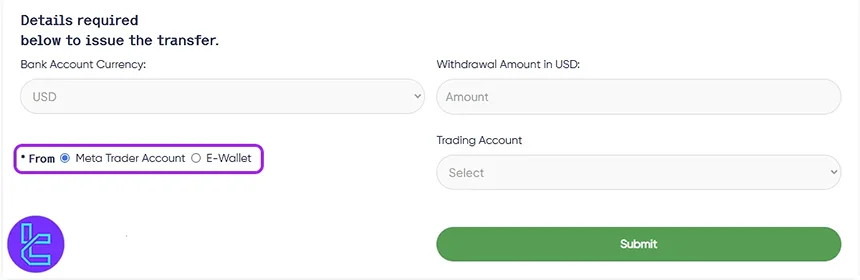

#2 Specify Withdrawal Information

Provide the necessary withdrawal details for your chosen account.

- Enter the currency and withdrawal amount;

- Select the source of funds, either your MetaTrader account or electronic wallet;

- Confirm the trading account to process the withdrawal.

#3 Confirm and Submit Request

Review all entered details carefully; Then Click “Confirm” to submit the withdrawal request.

A notification confirms that the cash-out is being processed. Funds typically arrive within 1–5 business days.

Copy Trading & Investment Options: Can I Earn Passive Income on Trust Capital Broker?

Unfortunately, Trust Capital does not currently offer copy trading or investment options. This may be a drawback for traders who prefer to follow and copy successful traders' strategies and earn passive income.

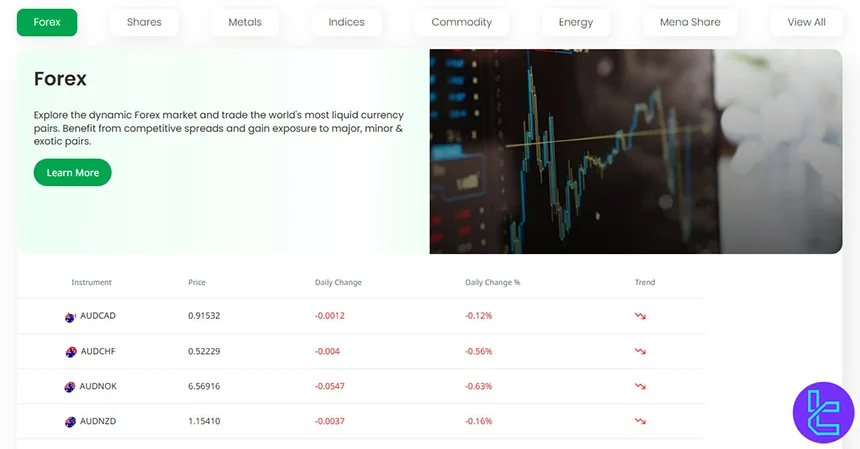

Tradable Markets & Assets

Trust Capital offers a diverse range of tradable markets and symbols. It provides a total of 200+ instruments in 6 markets.

The table below summarizes each category:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Spot currency pairs | 100+ | ~80–100 | 1:1000 | |

Metals | Precious & base metals (CFDs) | 10+ | ~8–15 | 1:500 |

Commodities | Agricultural & other commodities | 30+ | ~20–40 | N/A |

Energies | Energy futures & CFDs | 10+ | ~8–15 | 1:400 |

Indices | Global index futures/CFDs | 20+ | ~15–25 | 1:400 |

Shares | Global stock CFDs | 100+ | ~50–150 | N/A |

These instruments are available as CFDs, allowing leveraged exposure without direct ownership.

Available Bonuses and Promotions

At the time of writing, Trust Capital does not offer any bonuses or promotions. This is likely due to regulatory restrictions in some of the jurisdictions where the broker operates. Nevertheless, always check the official sources for any updates or changes regarding this matter.

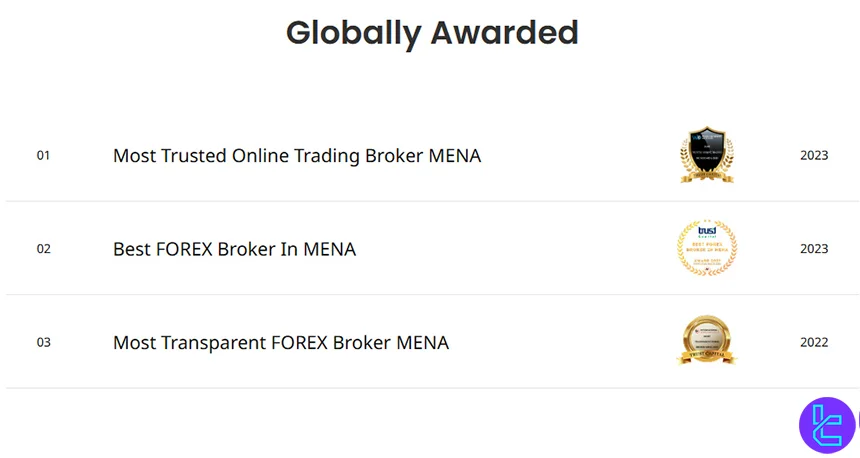

Trust Capital Awards

Trust Capital has been recognised with multiple industry awards that highlight its reliability, transparency, and leadership in the trading sector.

The broker’s Awards emphasise its commitment to providing high-quality trading services across the MENA region and globally.

Below are some of the most notable accolades and their awarding institutions:

- Most Trusted Online Trading Broker MENA 2023 - awarded by World Business Outlook

- Best Forex Broker MENA 2023 - awarded by Forex Daily Info

- Most Transparent Forex Broker MENA 2022 - awarded by International Business Magazine

How and When to Contact the Support Team

When you are deciding among a few brokers, customer service is one of the most critical factors. Trust Capital provides comprehensive customer support through various channels:

- Live Chat: Available on the website and through Trust Capital WhatsApp

- Phone Call: +248 255 97 92

- Email: cs@trustcapital.com

- Ticket System: Available via the "Contact Us" section on the website

The broker claims that the multilingual support team is ready to answer your queries 24/5.

Which Regions and Countries Are Restricted?

International brokers cannot offer their services to clients from all regions. This is because of regulatory restrictions or international sanctions. Based on the information available on the official website, Trust Capital has restricted users from these countries:

- United States of America

- Democratic Republic of Korea

- United Kingdom

- Islamic Republic of Iran

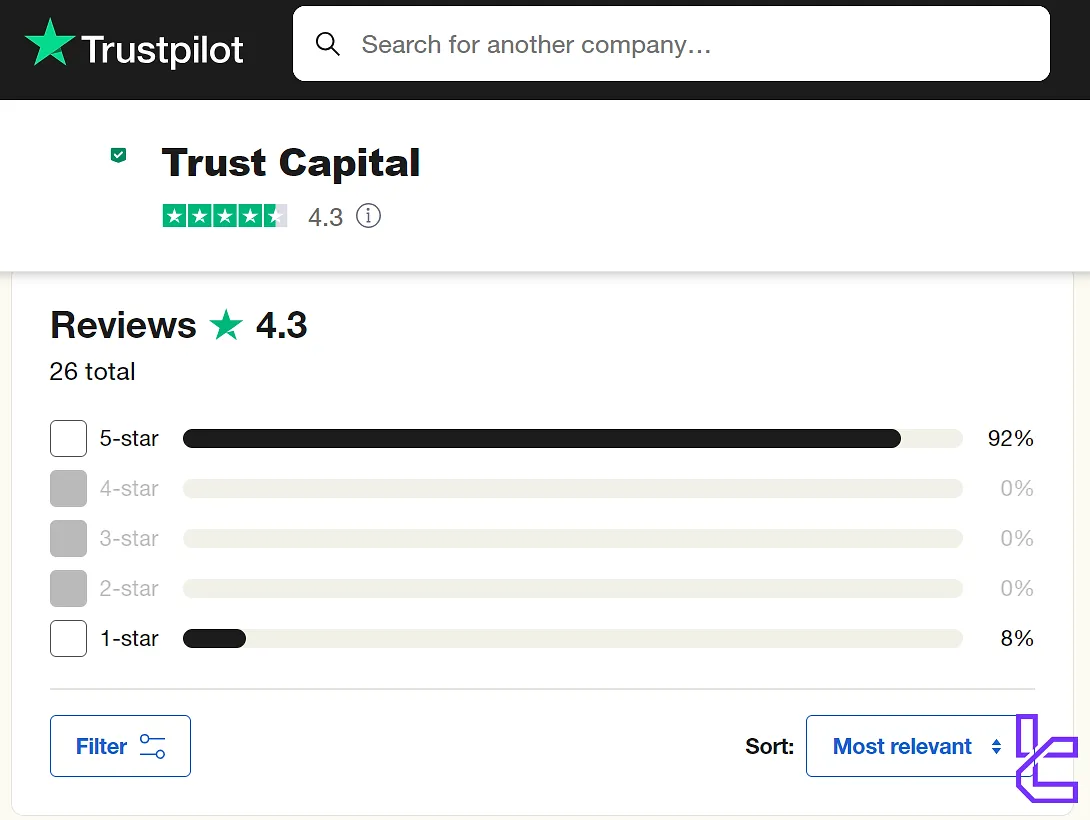

Trust Scores on Reputable Platforms

Trust Capital has received generally positive reviews from traders, as evidenced by its Trustpilot score. Let's discuss the Trust Capital Trustpilot rating in detail:

- 4.3 out of 5

- Based on more than 20 reviews

- Verified profile on the website

Unfortunately, the number of scores is too low; therefore, these ratings cannot be reliable enough. Also, there are no other scores on other platforms and websites.

Education Content and Resources

Trust Capital offers a decent educational section called "Learn to Trade" to help traders improve their skills and knowledge:

- Video Tutorials: Step-by-step guides on using the platforms and understanding trading concepts

- Financial Glossary: Extensive list of trading terms and definitions

- Forex Seminar: Free seminar for registered users

- Forex Mentor: One-on-one training sessions with experts

- Economic calendar: Up-to-date information on important economic events

You can also check TradingFinder's Forex education section for additional resources.

Trust Capital Comparison with Other Brokers

The table below compares Trust Capital features and services with other popular brokers:

Parameter | Trust Capital Broker | |||

Regulation | CySEC, CMA, FSA | No | FSC | ASIC, FSC, DFSA, CySEC |

Minimum Spread | From 0.0 pips | 0.1 Pips | 0.0 Pips | From 0.6 Pips |

Commission | $6 | $0 | $0 | From Zero |

Minimum Deposit | $10 | $1 | $200 | $5 |

Maximum Leverage | 1:1000 | 1:3000 | 1:3000 | 1:1000 |

Trading Platforms | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5, FXTM Trader App | MT4, MT5, Mobile App |

Account Types | Solo, Together, Professional | Standard, Premium, VIP, CIP | ADVANTAGE, STOCKS, ADVANTAGE, ADVANTAGE PLUS | Micro, Standard, Ultra Low, Shares |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 200+ | 45 | 1000+ | 1,400+ |

| Trade Execution | N/A | Market, Instant | Market | Market, Instant |

Conclusion and Final Words

Trust Capital provides trading with spreads starting from 0 pips and a$12 commission per round lot on its professional account. The mentioned account type requires a minimum deposit of $1,000 with a maximum leverage of 1:100. The minimum deposit amount is lower at $250 for "Together."