Vantage Markets is a brokerage with a 4.3 out of 5 score on Google. Five trading platforms [Metatrader 4, Metatrader 5, ProTrader, TradingView, proprietary] are provided by the broker.

Vantage FX enables access to 3 options for investment and passive income purposes [ZuluTrade, DupliTrade, Myfxbook AutoTrade].

Vantage Markets Forex Broker - Company Information & Regulation

Vantage Markets, founded in 2009 and headquartered in Sydney, Australia, has grown to become a major player in the online trading space. The company's impressive global presence is evident through its network of over 30 offices worldwide.

Vantage Markets offers a diverse range of trading instruments, including forex, CFDs on indices, commodities, stocks, and cryptocurrencies.

One of the critical strengths of Vantage Markets is its robust regulatory framework. The broker holds licenses from several reputable financial authorities and branches, including:

Entity Parameters / Branch | Vantage Global Limited (Vanuatu) | Vantage Global Prime LLP (UK) | Vantage Global Prime Pty Ltd (Australia) | Vantage International Group Ltd (Cayman) | Vantage Markets (Pty) Ltd (South Africa) |

Regulation | VFSC | FCA (UK) | ASIC | CIMA | FSCA |

Regulation Tier | Tier-3 | Tier-1 | Tier-1 | Tier-3 | Tier-2 |

Country | Vanuatu | United Kingdom | Australia | Cayman Islands | South Africa |

Investor Protection / Compensation | Up to EUR 20,000 (FC) + Up to $1,000,000 (Lloyd’s insurance) | Up to GBP 85,000 (FSCS) + Lloyd’s insurance | Up to $1,000,000 (Lloyd’s insurance) | Up to $1,000,000 (Lloyd’s insurance) | Up to $1,000,000 (Lloyd’s insurance) |

Segregated Funds | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | No | Yes |

Maximum Leverage | 1:1000 | 1:30 | 1:30 | 1:1000 | 1:1000 |

Client Eligibility | Global (except restricted countries, e.g., US) | UK residents | Australian clients | Global (except restricted countries, e.g., US) | South Africa clients |

Broker Summary Table

Here's a summary of the broker's key features and specifications that lets you have a glance at them:

Broker | Vantage Markets |

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free |

Regulating Authorities | ASIC, FSCA, VFSC, FCA, CIMA |

Based Currencies | USD, EUR, GBP, AUD, NZD, SGD, JPY, CAD, HKD |

Minimum Deposit | $20 |

Deposit Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, local payment options |

Withdrawal Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, local payment options |

Minimum Order | 0.01 lot |

Maximum Leverage | Up to 1:1000 |

Investment Options | Copy Trading, Social Trading |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, ProTrader, TradingView, proprietary application |

Markets | Forex, Indices, Commodities, Shares, ETFs |

Spread | From 0.0 pips |

Commission | From $0 |

Orders Execution | Market Execution |

Margin Call/Stop Out | 50/80 |

Trading Features | Negative Balance Protection |

Affiliate Program | Yes |

Bonus & Promotions | Deposit Bonus, Trading Championship, Vantage Rewards |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, ticket, phone, live chat |

Customer Support Hours | 24/7 |

Forex Broker Account Types

An important part of the Vantage Markets review is the accounts overview. This broker offers a range of account types to cater to traders of varying experience levels and trading styles:

- Standard STP: ideal for beginners and those who prefer a straightforward trading experience

- Standard Cent: best for traders who want to start with minimal investment

- Raw ECN: designed for more experienced traders seeking tighter spreads and faster execution

- Pro ECN: tailored for professional traders and money managers

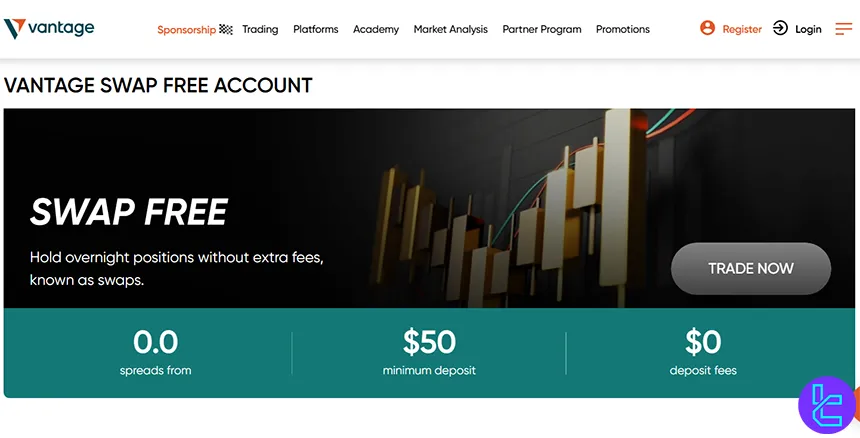

- Swap Free: suitable for Muslim traders and those who cannot receive or pay swaps

Let's explore the main features of the account types available in the table below:

| Account Type | Standard STP | Standard Cent | Raw ECN | Pro ECN | Swap Free |

Minimum deposit | $50 | $20 | $50 | $10,000 | $50 |

Up to 1:1000 | |||||

Commission | $0 | $0 | From $6 per lot round turn | From $1.5 per lot round turn | varies |

From 1 pip | From 1 pip | From 0 pips | From 0 pips | From 0 pips | |

Base currency options include major global currencies such as USD, EUR, GBP, AUD, SGD, CAD, and more.

Vantage Markets Pros & Cons

This broker, like any other platform or firm, brings up some benefits and risks for traders. In the table below, you will see its significant advantages and disadvantages:

Pros | Cons |

Regulated by a tier-1 financial authority | High minimum deposit for Pro ECN account |

Competitive spreads, especially on ECN accounts | No proprietary desktop trading platform |

Advanced & popular trading platforms (MT4, MT5) | Some countries restricted (e.g., US, Canada) |

Social/copy trading options available | - |

Fast execution speeds | - |

Account Registration and Verification Guide

The Vantage registration procedure is beginner-friendly and takes less than 10 minutes, requiring basic KYC data and email verification.

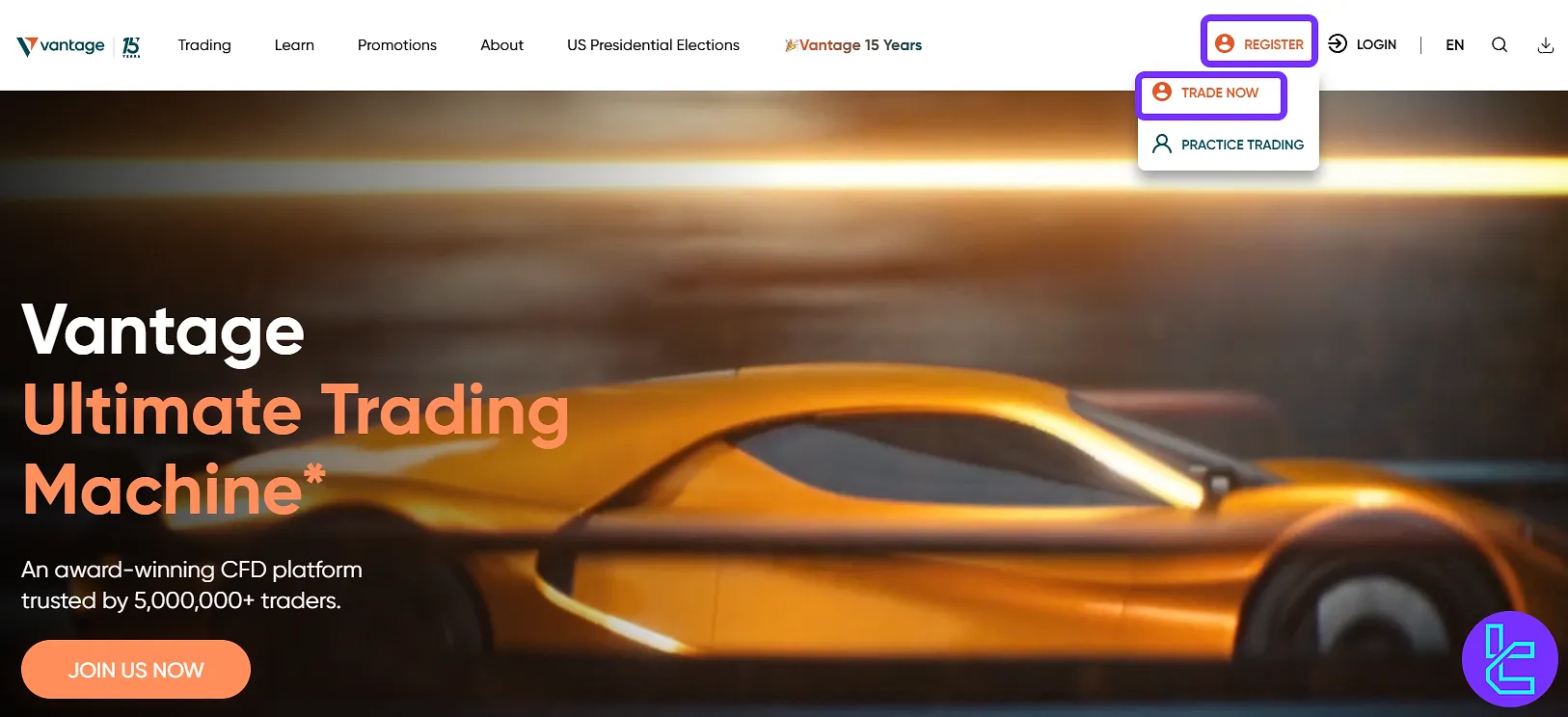

#1 Visit the Vantage Markets Website

Head to the Vantage Markets page via TradingFinder’s “Forex Brokers” section, then click on “Register” followed by “Trade Now”.

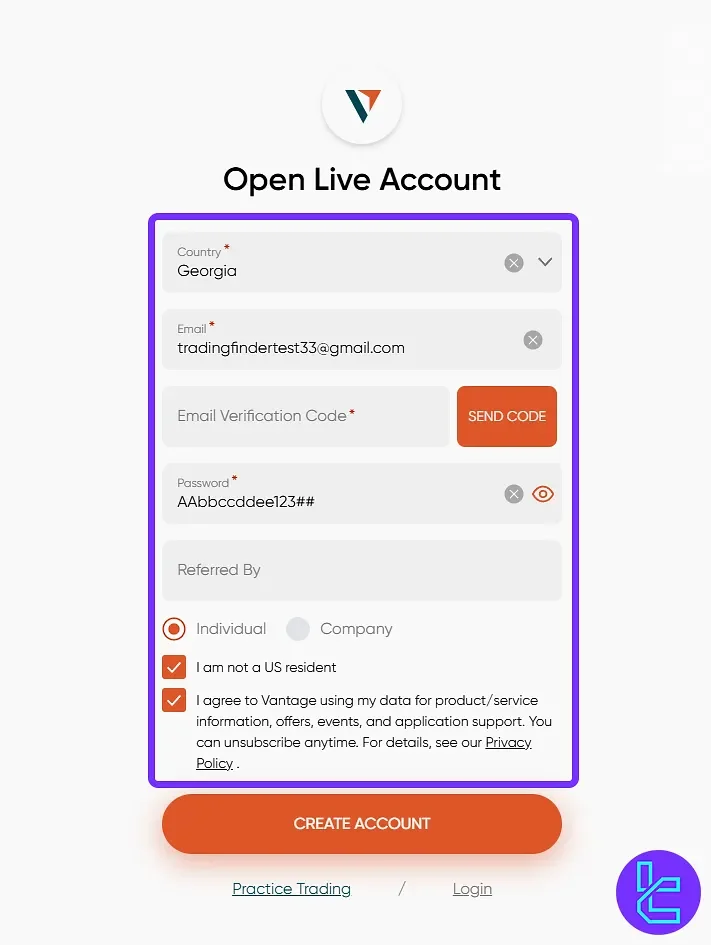

#2 Fill Out the Sign-Up Form

Enter your country, email, and a secure password. Confirm that you're not a US citizen and accept the platform’s terms.

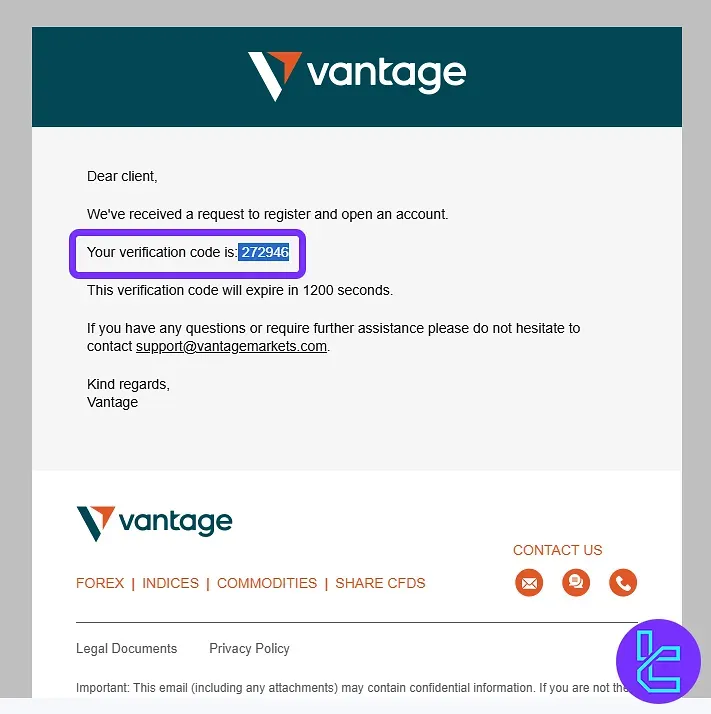

#3 Verify Your Email

Click “Send Code” and check your inbox for the verification code. Copy and paste it to confirm your email.

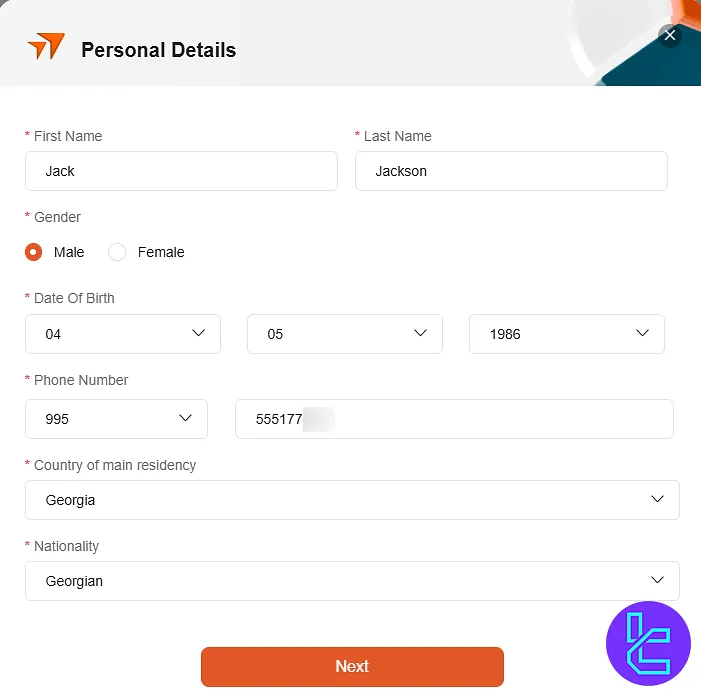

#4 Enter Personal Details

Provide these details of yours:

- Full name

- Gender

- Date of birth

- Nationality

- Phone number

- Country of residence

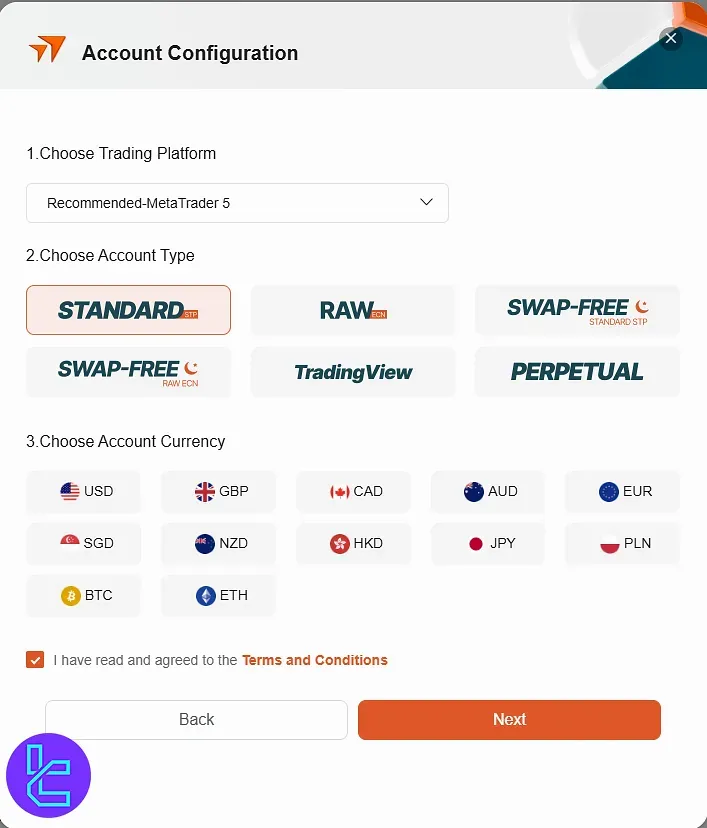

#5 Customize Trading Preferences

Select your desired platform (MT4, MT5, or ProTrader), account type (e.g., Pro ECN), and base currency. Agree to the terms to complete registration.

#6 Go Through KYC

After completing the related forms, click the "Verification" button to upload the required documents.

What Platforms and Applications Does Vantage Markets Provide?

Vantage Markets offers a comprehensive suite of trading platforms and applications to suit various trading styles and preferences:

MetaTrader 4 (MT4):

- Industry-standard platform

- Advanced charting and analysis tools

- Expert Advisors (EAs) for automated trading

- Available for windows, mac, and Linux

MetaTrader 5 (MT5):

- Next-generation platform with enhanced features

- More timeframes and analytical objects

- Economic calendar integration

- Available for different OSs on desktops

Vantage App:

- Proprietary mobile trading application

- User-friendly interface

- Real-time market news and analysis

- Copy Trading

ProTrader:

- Over 100 technical indicators and oscillators available on charts

- Up to 8 different time frames

- 12 different chart types for different approaches

- educational resources and real-time analysis of the market

- Economic calendar covering data from +30 countries

- Buzz meter for social media signals and insights

Commissions and Spreads

Vantage Markets offers mediocre pricing across its account types:

- Standard Accounts: Spreads from 1.0 pips, no commission

- Raw ECN Account: Spreads from 0.0 pips, $6 commission per lot

- Pro ECN Account: Spreads from 0.0 pips, $1.5 commission per lot per side

It's worth noting that spreads can vary depending on market conditions and the specific instrument being traded.

On the bright side, Vantage shines when it comes to non-trading fees:

- There are no deposit or withdrawal fees for credit cards or e-wallets;

- The first international bank withdrawal each month is free;

- There is no inactivity fee.

Swap Fee at Vantage Markets

The Swap Rate at Vantage Markets refers to the rollover interest applied to positions held overnight. It represents either a cost or a gain, depending on the interest differential of the traded instrument, such as currency pairs or gold.

Traders can see these adjustments reflected directly in their accounts, allowing precise management of overnight positions

Here are the essential points to know:

- Swap-Free / Islamic Account: Vantage provides swap-free accounts for traders who cannot pay or receive swaps due to religious reasons;

- Automatic Account Adjustment: The broker either credits or debits the swap amount to your account at the end of each trading day.

Non-Trading Fees at Vantage Markets

According to official information, Vantage Markets does not charge any inactivity fees, and deposits via all supported methods are free of charge.

Beyond these points, Vantage has not publicly provided further details regarding other non-trading fees such as currency conversion or account maintenance.

Deposit and Withdrawal Methods

Vantage Markets provides a variety of deposit and withdrawal options. Pick the best one for you, considering your region and conditions:

- Bank Wire Transfer

- Credit/Debit Cards (Visa, Mastercard)

- E-wallets (Skrill, Neteller, FasaPay)

- Local payment methods (depending on your region)

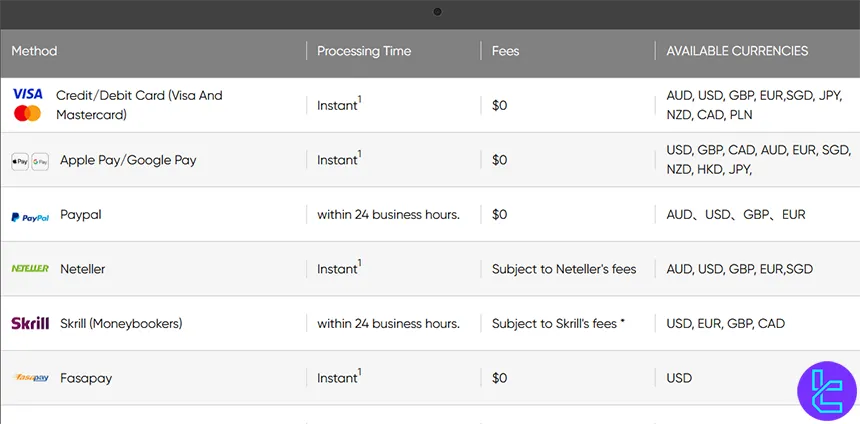

Deposit Methods at Vantage Markets

Vantage Markets supports a variety of deposit options from instant card and e-wallet payments to traditional bank transfers or broker-to-broker transfers.

All methods are designed to be flexible and accessible, allowing traders worldwide to fund their accounts easily.

Below is a table summarizing the available deposit methods:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Credit/Debit Card (Visa & Mastercard) | AUD, USD, GBP, EUR, SGD, JPY, NZD, CAD, PLN | USD 50 | $0 | Instant |

Apple Pay / Google Pay | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY | USD 50 | $0 | Instant |

Pay Pal | AUD, USD, GBP, EUR | USD 50 | $0 | Within 24 business hours |

Neteller | AUD, USD, GBP, EUR, SGD | USD 50 | N/A | Instant |

Skrill | USD, EUR, GBP, CAD | USD 50 | N/A | Within 24 business hours |

Fasapay | USD | USD 50 | $0 | Instant |

Perfect Money | EUR, USD | USD 50 | $0 | Within 24 business hours |

JCB | JPY | USD 50 | $0 | Instant |

bitwallet | JPY, EUR, USD | USD 50 | $0 | Within 24 business hours |

Sticpay | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY | USD 50 | $0 | Within 24 business hours |

India UPI | USD, INR | USD 50 | $0 | Within 24 business hours |

Bank Transfer | USD, JPY | USD 50 | $0 | Within 24 business hours |

International EFT | AUD, USD, GBP, EUR, SGD, JPY, NZD, CAD, PLN | USD 50 | $0 | 2–5 business days |

Domestic Fast Transfer (Australia only) | AUD | USD 50 | $0 | Up to a few hours (AEST business hours) |

Astro Pay | USD + most local currencies | USD 50 | $0 | Instant |

Broker-to-Broker Transfer | AUD, USD, GBP, EUR, SGD, JPY, NZD, CAD | USD 50 | $0 | 3–5 business days |

Withdrawal Methods at Vantage Markets

Vantage Markets does not publish a fixed public list of withdrawal methods and instead directs clients to view the available options inside their secure client portal.

The exact methods vary by region and may change over time, depending on availability and regulatory or payment-provider restrictions.

Key points regarding withdrawals:

- The minimum withdrawal amount is $30 or 3000 JPY, or the full balance if below this;

- Withdrawal requests may be rejected due to insufficient margin or incorrect details;

- Processing times vary depending on method, typically 1–5 business days;

- Priority is given to the credit card method when multiple deposit methods were used;

- Supported blockchain for USDT withdrawals is TRC20 (Tron).

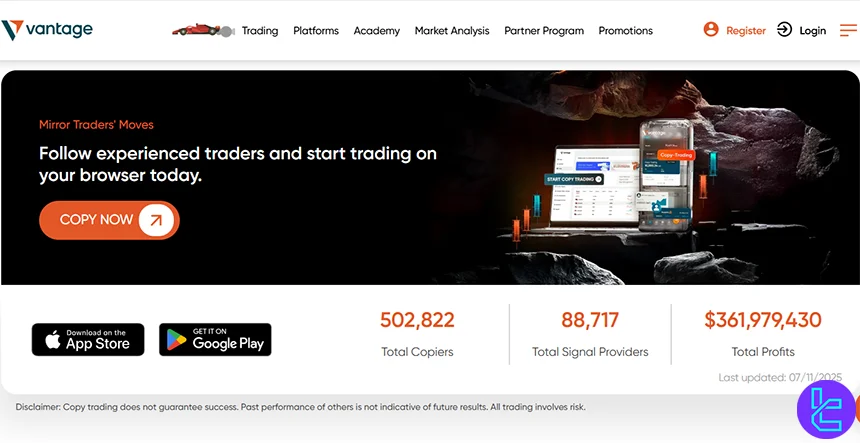

Copy Trade and Investment Options in Vantage Markets

Vantage Markets offers several copy trading and social investment options:

- ZuluTrade: Copy from over 10,000 high-level forex traders with ZuluGuard's advanced risk management

- DupliTrade: Use analysis tools alongside copying from experienced traders

- Myfxbook AutoTrade: Copy trades from successful signal providers with access from browsers

Additionally, you can also start copying trades on the Vantage app on mobile.

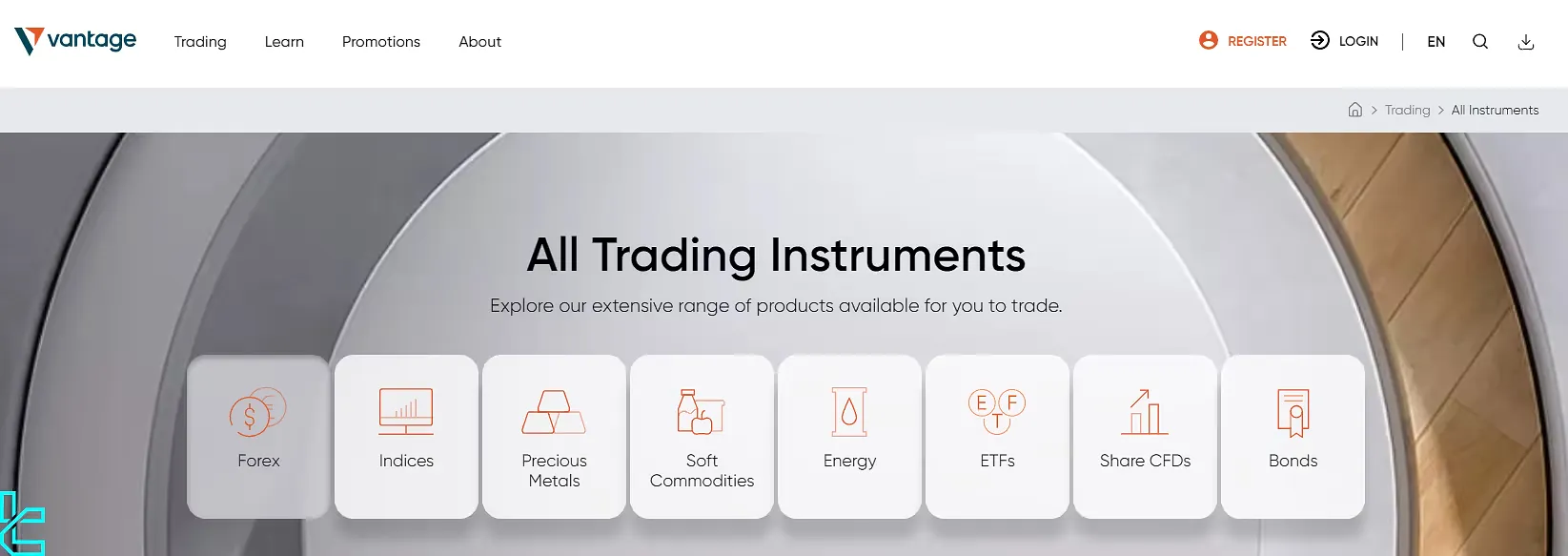

Tradable Markets and Symbols

Vantage Markets offers a diverse range of trading instruments across multiple asset classes, from global currencies and stock indices to precious metals, energy, ETFs, shares, and bonds.

This table summarizes the main categories, available symbols, and maximum leverage for each market:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Malor, minor and exotic currencies | 60+ | 50-70 | 1:1000 | |

Indices | Global stock indices | 33 | 10-15 | 1:500 |

Precious Metals | Gold | 8 | 3-5 | 1:1000 |

Soft Commodities | Agricultural commodities | 8 | 5-10 | 1:20 |

Energy | Oil, gas & energy products | 7 | 2-5 | 1:500 |

ETFs | Exchange-traded funds | 60+ | 30-80 | 1:50 |

Share | CFDs on Stock | 300+ | 200-500 | 1:20 |

Bonds | Government & corporate bonds | 7 | 5-10 | 1:100 |

Bonus and Promotions

Bonuses could be considered an important part of the Vantage FX review. This broker occasionally offers bonuses and promotions to attract new clients and reward existing ones. Some of their recent offerings include:

- Deposit Bonuses: Percentage-based bonuses on deposits (subject to specific terms and conditions)

- Trading Contests: Periodic competitions (such as Trading Championship 2024) with cash prizes,typically based on trading performance or volume

- Vantage Rewards: Missions and Challenges with vouchers as rewards, based on a tier system for reward levels

- Referral Programs: Up to $100 for introducing new clients to Vantage Markets

It's important to note that bonus offerings may change over time and are subject to specific terms and conditions. Traders should always read the full terms before participating in any promotional offer.

Vantage Markets Awards

Vantage Markets has been recognized as an award-winning broker for its excellence across multiple areas of trading and client service.

The broker’s awards reflect its commitment to innovation, customer satisfaction, and reliable trading platforms.

Here are some of the most notable awards earned by Vantage Markets:

- Best Multi-Asset Broker – Online Money Awards 2025

- Best Customer Service – Online Money Awards 2025

- Best Trading Platform – Wealth Expo Argentina 2025

- Best Trade Execution (Vantage Connect) – Global Forex Awards B2B 2025

- Best Affiliate Program – Money Expo Colombia 2025

- Best Mobile Trading App LATAM – Ultimate Fintech Awards LATAM 2025

Support and Customer Services

Vantage Markets provides customer support through various channels:

- 24/7 Live Chat: Available directly on the website

- Email Support: support@vantagemarkets.com for non-urgent inquiries

- Phone Support: Local numbers available in multiple countries

- FAQ Section: Comprehensive answers to common questions

- Ticket System: Claimed response time within 1 working day

Restricted countries

Let's examine the banned countries list as part of the Vantage FX review. The broker does not offer its services to residents of certain countries due to regulatory restrictions. As of the latest information, the following countries are restricted:

- United States

- Canada

- China

- Romania

- Singapore

- Poland

- Ukraine

- Iran

- Iraq

- Russia

- Cuba

- North Korea

- Australia

- Afghanistan

It's important to note that this list may change over time, and traders should always check the most up-to-date information on the Vantage Markets website or contact customer support for clarification.

Trading and Analysis Tools

Vantage Markets provides a range of trading and analysis tools to support traders:

- Economic Calendar: Real-time updates on important economic events

- Client Sentiment: Works as a gauge for traders and shows the percentage of buyers vs. sellers for each instrument

- Trading Central: Technical analysis and trading signals, free daily signals

- Risk Management Tools: Stop-loss and take-profit orders, trailing stops, and guaranteed stop-loss orders (on select instruments)

- VPS Hosting: Virtual Private Server for stable automated trading, faster execution, and reduced latency for trades

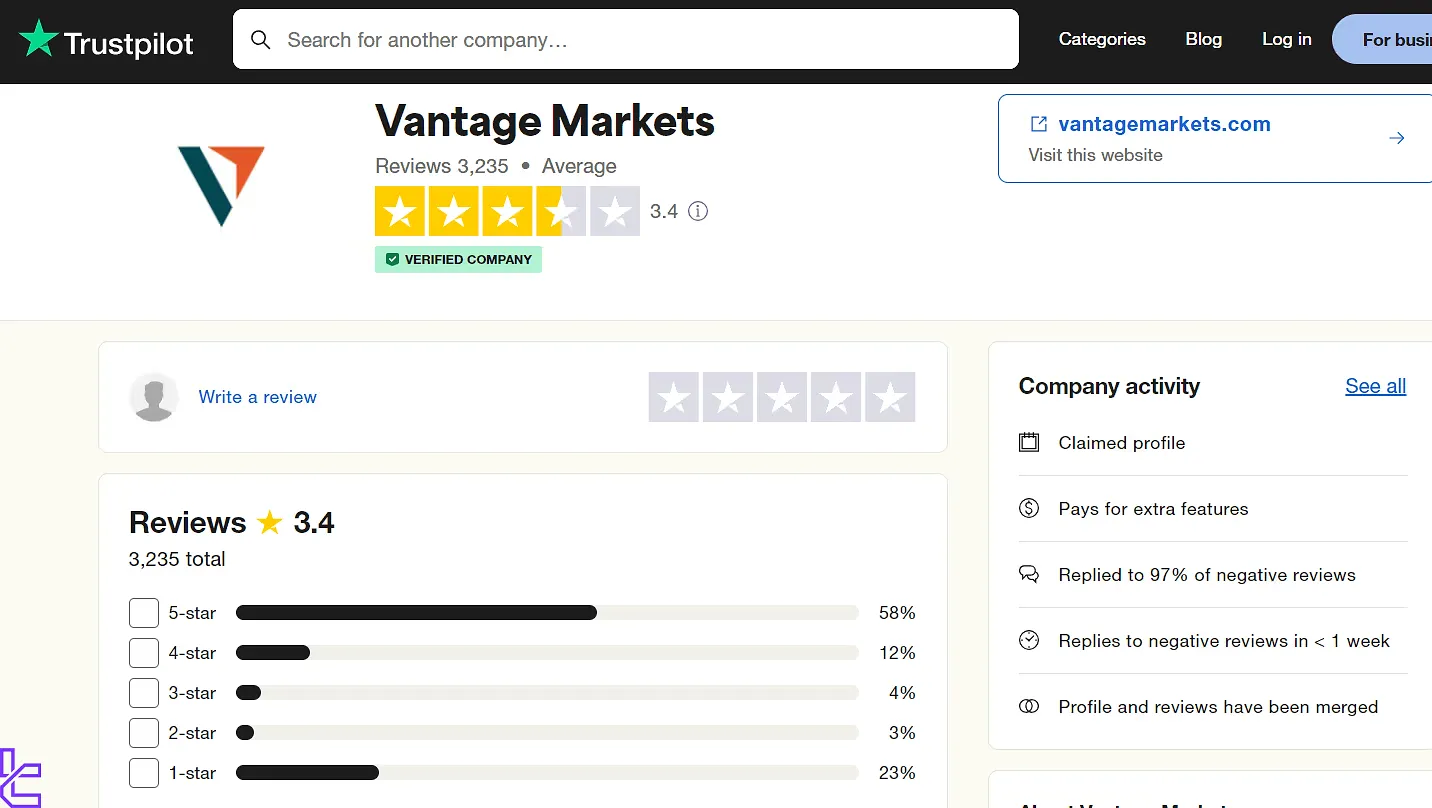

Trust Scores

Trust scores for the mentioned broker vary across different review platforms:

- Vantage Trustpilot Profile: 3.4/5 stars, 23% 1-star reviews (based on over 3,200 reviews)

- REVIEWS.io User Rating: 4.9 out of 5

Users have mentioned the low spreads, the high quality of customer services, and fast deposit and withdrawal as its strong points.

Vantage Markets Education

You can find a decent range of resources and materials for education from this broker:

- Articles: Comprehensive articles on various trading topics, suitable for beginners and intermediate traders

- YouTube Videos: News and analysis on financial markets

- Webinars: Live and recorded sessions with market experts, covering topics from basic concepts to advanced strategies

- Glossary: Extensive list of trading terms and definitions

- eBook: Educational books on financial markets with the goal to help users start trading

For traders looking to improve their skills, Vantage Markets Education offers a variety of resources to enhance knowledge and trading expertise.

Vantage Markets in Comparison to Other Brokers

Here is a table demonstrating a comparison between Vantage and its peers:

Parameter | Vantage Markets Broker | XM Broker | LiteForex Broker | Exness Broker |

Regulation | ASIC, FSCA, VFSC, FCA, CIMA | ASIC, FSC, DFSA, CySEC | CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Spread | 0.0 Pips | From 0.6 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0 | $0 (except on Shares account) | From $0.0 | From $0.2 to USD 3.5 |

Minimum Deposit | $20 | $5 | $50 | $10 |

Maximum Leverage | 1:1000 | 1:1000 | 1:30 | Unlimited |

Trading Platforms | Metatrader 4, Metatrader 5, ProTrader, TradingView, proprietary application | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | No | Yes |

Number of Tradable Assets | 1,000+ | 1400+ | N/A | 200+ |

Trade Execution | Market | Market, Instant | Market | Market, Instant |

Conclusion and Final Words

Vantage Markets company has three main offices in Vanuatu, South Africa, and Australia. In recent years, it has received several awards, including Best Trading Experience, awarded by the Ultimate Fintech Awards 2024, and Most Trusted Broker, awarded by the Professional Trader Awards 2023.