Varchev offers 24/5 commission-free trading on Forex and ETFs and up to 1:100 leverage on Gold and Silver. It reimburses traders up to $500 on their first day losses. The minimum deposit is 400 BGN, and non-professional clients get a maximum leverage of 1:30.

Varchev Broker operates under the regulated framework of the Bulgarian Financial Supervision Commission (FSC). Professional clients can access up to 1:500 leverage on forex currency pairs.

Varchev; Introduction and Regulatory Status

Varchev, based in Bulgaria, was founded in 1992 by Biser Varchev. The company was previously regulated by the UK FCA until 2021, and by Brexit. Currently, it holds a license from the Financial Supervision Commission (FSC) - Sofia, Bulgaria (License number RG-03-02-05 / 15.03.2006).

Key features of Varchev:

Entity Parameter / Branches | Varchev Finance Ltd |

Regulation | FSC (Bulgaria) |

Regulation Tier | 1 |

Country | Bulgaria |

Investor Protection Fund / Compensation Scheme | ICF (Investor Compensation Fund) up to €20,000 |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:500 |

Client Eligibility | EU / EEA clients (via MiFID passport) |

Although it does not hold Tier-1 regulation, Varchev implements key safety protocols such as KYC verification and negative balance protection.

Varchev Broker Specification

The company offers a comprehensive suite of trading services, catering to novice and experienced traders, including:

Broker | Varchev |

Account Types | Real |

Regulating Authorities | FSC |

Based Currencies | USD, EUR, GBP, BGN |

Minimum Deposit | $200 |

Deposit Methods | Credit/Debit Card, Wire Transfer, PayPal, ePay.bg, Skrill, Neteller, Bitcoin, Giropay, uKash, Itau |

Withdrawal Methods | Credit/Debit Card, Wire Transfer, PayPal, ePay.bg, Skrill, Neteller, Bitcoin, Giropay, uKash, Itau |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:500 |

Investment Options | IPO, Investment Consulting, Social Trading |

Trading Platforms & Apps | MT4, MT5, VAT |

Markets | Forex, Crypto, Stocks, Indices, IPO, CFDs, ETFs, Metals, Commodities |

Spread | Market spread |

Commission | Variable based on the instrument and platform |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Economic Calendar, Market Analysis |

Affiliate Program | Yes |

Bonus & Promotions | New Account, Cashback, IB |

Islamic Account | N/A |

PAMM Account | No |

Customer Support Ways | Email, Phone |

Customer Support Hours | N/A |

Varchev Account Types

The broker provides a single primary account type for all traders with different styles. The lack of various account types can be a drawback for potential clients.

The Real account also has a demo version that traders can use to test strategies and practice. Varchev account features:

Min Deposit | 200 USD/EUR/GBP 400 BGN |

Min Order Size | 0.01 lots |

Max Trading Leverage | Professionals 1:500 Non-Professionals 1:30 |

Spreads | Market |

Commission | None except for Stock CFDs |

The Demo Account gives users $100,000 in virtual funds and full access to Varchev’s platforms, allowing them to practice and explore trading conditions before committing real capital.

Varchev Upsides and Downsides

To provide a balanced view of Varchev's offerings, let's examine the broker's strengths and potential drawbacks.

Pros | Cons |

Multiple trading platforms (MT4, MT5, VAT) | Limited account types |

Wide range of trading instruments | Limited support channels |

High leverage options for professional clients | Complex conditions and interface |

No commissions on trades | NO US clients accepted |

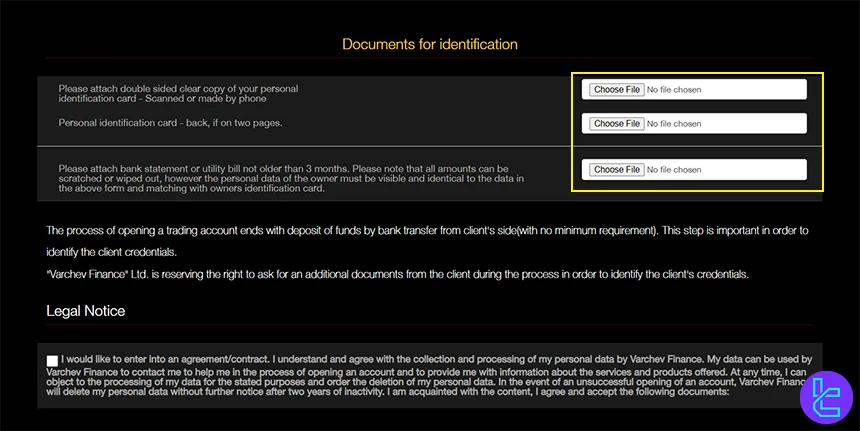

Varchev Account Opening and KYC Verification

Opening an account with Varchev is a straightforward process designed to comply with regulatory requirements while ensuring a smooth onboarding experience for new clients.

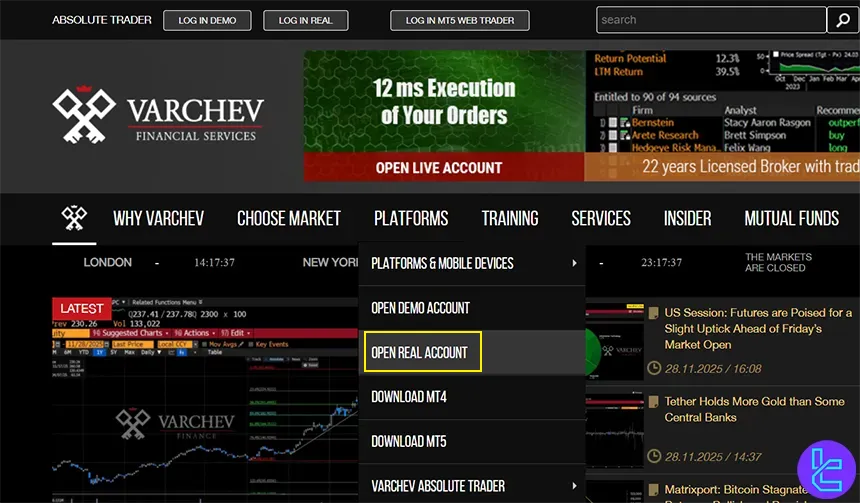

#1 Start the Application

Head to the Varchev official site, select “Platforms”, and proceed with the “Open Real Account ” option. This step initiates access to real-market conditions.

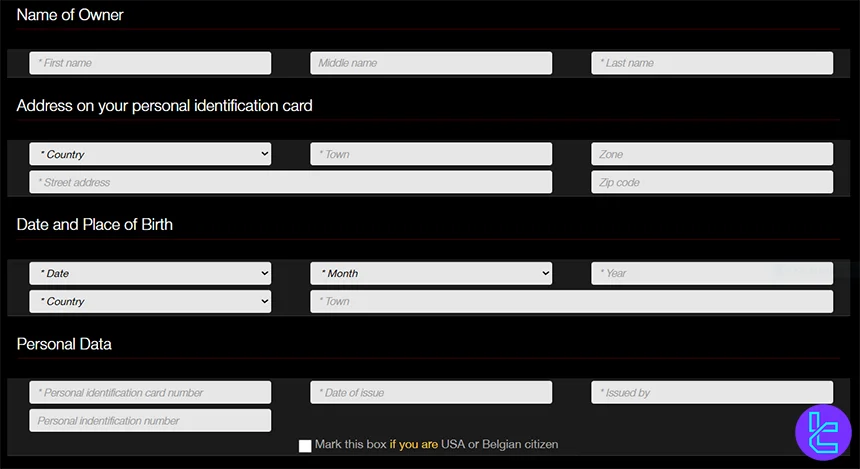

#2 Complete Registration Details

Enter your personal and contact information in the form provided. Accuracy here is essential for verification and regulatory compliance.

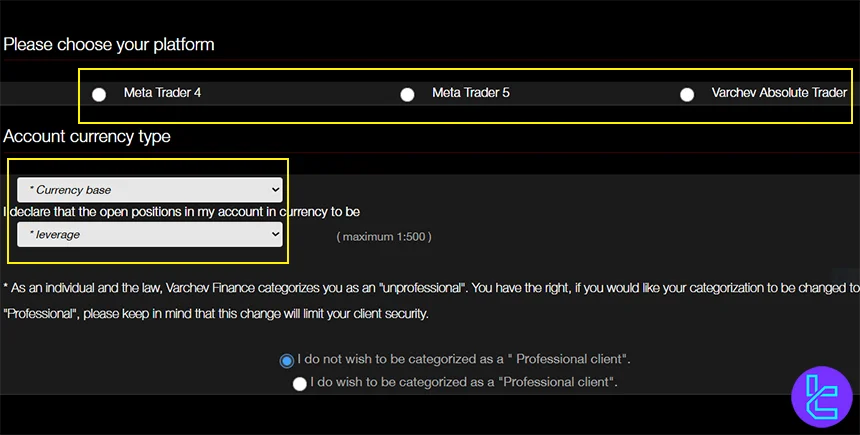

#3 Configure Trading Parameters

Select your desired platform (e.g., MetaTrader 5), preferred leverage, and the account base currency, all of which influence your trading setup.

#4 Upload Verification Documents

Submit a valid ID (passport or driver’s license) along with proof of address (like a utility bill or bank statement) to activate your account in line with anti-money laundering laws.

Varchev Broker Trading Platform Offerings

The broker provides traders with access to three powerful trading platforms [MetaTrader 4, MetaTrader 5, VAT], each catering to different trading styles and preferences.

MetaTrader 4 (MT4)

MetaTrader 5 (MT5)

Varchev Absolute Trader (VAT)

Varchev Fees Explained

All of Varchev's reviews must discuss the trading costs associated with the broker. The company provides direct access to the markets.

Thus, it offers market spreads. It also doesn’t charge commissions except for Stock CFDs. Note that commission charges differ based on your trading platform.

Platform | Stock CFDs Commission |

MT4 | $0.05 for stock |

MT5 | American $0.05 per stock, minimum $5 European 0.10% minimum €5 |

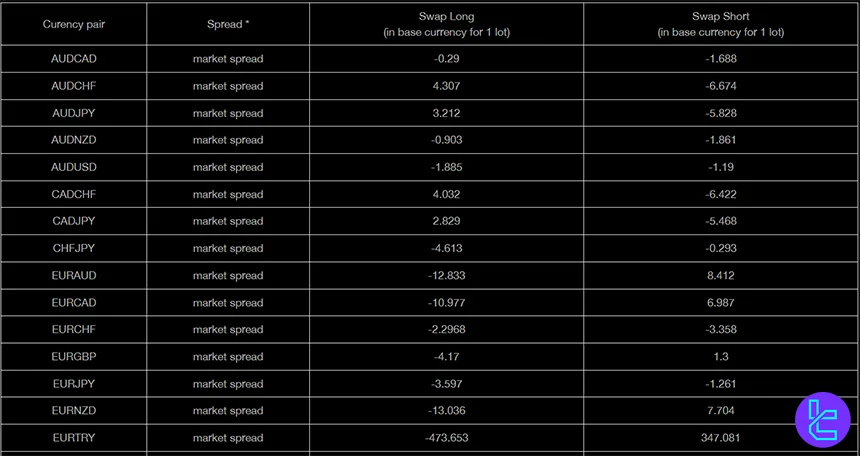

Swap Fee at Varchev Broker

Varchev charges swap (roll-over) interest automatically each night for open positions and the amount depends on the instrument, interest rates and whether the position is long or short.

For example, for cryptocurrencies (e.g. BTC) swap is −30% per year (applied / converted overnight).

Below are some key official details about swaps at Varchev:

- Swap values are updated weekly (every Monday) in line with changes in reference banking interest rates;

- Swap rates vary per instrument; e.g. for gold spot long swap is –9.797 points (≈ –0.09797 USD/oz) and short swap is +7.627 points (≈ +0.07627 USD/oz) per troy ounce per night;

- Holding 0.1 lots of Bitcoin overnight would yield approx. −0.77 USD swap (if that were the price/lot setup at that moment).

Non-Trading Fees at Varchev Broker

Varchev does not charge account maintenance or regular inactivity fees for its standard trading accounts; however, certain withdrawal and cash-handling operations can incur fees depending on method and amount.

Below are some of the most important official points to be aware of:

- Withdrawal in cash up to BGN 9,999 carries a commission of 0.40%, with a minimum of 2.00 BGN;

- Deposits by credit/debit card are accepted, but if the account currency differs from Bulgarian lev (BGN), the deposited amount is converted at prevailing exchange rate;

- For custody services, Varchev charges 0.5% per annum on client money held, although this fee is waived for professional clients under certain regulatory provisions;

- When providing certain services in relation to securities (e.g. issuing a depositary receipt) there are fixed administrative fees (e.g. 7.00 BGN for issuance, 14.00 BGN for a duplicate) rather than per-trade fees.

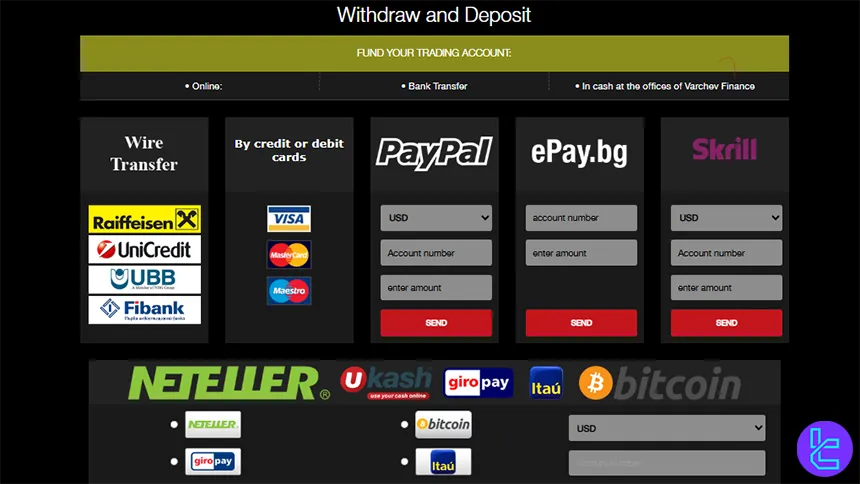

Varchev Broker Payment Methods

The company offers a wide array of deposit/withdrawal methods to cater to the diverse needs of its global clientele, including:

- Wire Transfer: Raiffeisen, UniCredit, UBB, Fibank

- Credit/Debit Cards: Visa, MasterCard, Maestro

- E-Payments: PayPal, ePay.bg, Skrill, Neteller, uKash, GiroPay, Itau, Bitcoin

Note that to request withdrawals, you must fill out a form and send it to the broker by fax or email.

Deposit Methods at Varchev

Varchev provides several funding options including bank transfers, card payments, cash deposits and a wide range of e-payment systems.

Deposits in currencies different from the account’s base currency are converted automatically at the broker’s prevailing rates.

Below is a structured summary of the available deposit methods:

Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer (wire) | USD, EUR, BGN | USD, EUR, GBP 200 or BGN 400 | No broker fee | Same day to 2 working days |

Credit / Debit Card | BGN | USD, EUR, GBP 200 or BGN 400 | No broker fee | Instant after confirmation |

Cash Deposit (Sofia and Varna office) | BGN (or equivalent) | USD, EUR, GBP 200 or BGN 400 | 0.40% fee, min 2.00 BGN | Immediate after acceptance |

E-Payments e.g. (Skrill, PayPal, Neteller, GiroPay, Bitcoin) | USD, BTC | USD, EUR, GBP 200 or BGN 400 | No broker fee | Depends on payment system |

Withdrawal Methods at Varchev

All fund transfers and withdrawals from Varchev Finance to its clients are returned to the original source of the funds, i.e., the same account or method used for the initial deposit.

Clients can use bank transfers, cash withdrawals or e‑payment systems, with fees and timing depending on the method.

Here are the key notes you need to know:

- Bank transfers have no fixed broker fee; clients cover any interbank or bank charges;

- Cash withdrawals at Varchev offices carry a 0.40% fee (minimum 2.00 BGN) and are limited to 9,999 BGN per transaction (or currency equivalent);

- E‑payments and online systems (Skrill, PayPal, Neteller, ePay.bg, uKash, GiroPay, Itau, Bitcoin) have no broker fee;

- Larger cash withdrawals or special currency requests may require bank transfer or additional arrangements with Varchev.

Does Varchev Offer Copy Trading or Investment Plans?

The company offers Social Trading services through its proprietary platform “Varchev Absolute Trader”, which enables you to copy trades of successful traders and communicate with other clients.

The company also provides investment opportunities by offering access to global stock markets and IPOs. You can also contact Varchev’s experts for investment consultations.

Varchev Trading Instruments

The broker provides access to a diverse range of trading instruments (50,000+), allowing traders to diversify their portfolios and capitalize on various market opportunities.

Category / Market Segment | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Currency pairs | 30+ | 40-70 | 1:500 | |

Indices | Stock‑market indices / Index futures | 24 | 10-15 | 1:50 |

Metals | metal CFDs | 5+ | 3-10 | 1:50 |

Energies | CFDs on Oil and Gas | 3 | 3-10 | 1:33 |

Shares | Equity CFDs (European & US stocks) | N/A | 10000+ | 1:10 |

ETFs | ETF‑based CFDs | N/A | 1000+ | 1:10 |

Crypto CFDs (e.g. BTC, ETH, LTC, XRP) | 25 | 10-30 | 1:100 |

The broker offers traders flexible leverage options and broad market coverage, enabling strategic portfolio diversification while managing risk across multiple asset classes.

Varchev Broker Bonuses and Promotions

The company’s bonus offerings are among the most attractive topics in all of the Varchev reviews. It has several promotion plans exclusive to professional clients, including:

- New Account: Up to $1,000 extra trading credits on first deposit

- Cashback Program: Reimbursements on first-day losses up to $500

- Friend: Refer a friend to the broker, and both of you will receive $100

Varchev Broker Awards

Varchev has earned international recognition for its excellence in brokerage services, platform innovation and multi-asset trading.

Its Awards demonstrate credibility and industry leadership, highlighting achievements that distinguish it in competitive markets.

Below are some of the most notable honors the broker has publicly listed.

- Best Forex Broker Bulgaria – awarded by Global Banking & Finance Awards (2022)

- Best Forex Broker Bulgaria – awarded by Global Banking & Finance Awards (2021)

- Best Forex Trading Company Bulgaria – awarded by Global Banking & Finance Awards (2019)

- Best Trading Platform (EU) – awarded by Online Personal Wealth Awards

Varchev Customer Support

The company doesn’t perform well in terms of client support. It doesn’t have a dedicated “Contact Us” page on its website, and there are no indications of service hours. Varchev support channels:

info@varchev.com | |

Phone | +359 700 17 600 |

Live Chat | Not Working |

Varchev Prohibited Countries

Varchev, as a regulated broker, must comply with various international regulations and restrictions.

While specific information about prohibited countries is not readily available, by exploring the list of countries on the registration form, we can figure out that the broker doesn’t provide services to certain countries, including:

- United States of America

- Belgium

- North Korea

- Gaza

Varchev User Satisfaction

Trust score is a crucial factor in all of the Varchev reviews. The company doesn’t have a rated profile on any reputable review websites, such as Trustpilot, Forex Peace Army, and Reviews.io.

Varchev Educational Materials

The broker recognizes the importance of trader education and provides a range of educational resources to support both novice and experienced traders, including:

- Video Tutorials: Step-by-step guides on platform usage and trading strategies

- Webinars: Live and recorded sessions on various trading topics

- Market Analysis: Regular updates on market trends and potential trading opportunities

- Economic Calendar: Real-time updates on important economic events

- Glossary: An Extensive list of trading terms and definitions

Comparison with Other Brokers

The table below goes through a comparison between Varchev and some other brokerages in the industry:

Parameter | Varchev Broker | Fusion Markets Broker | TMGM Broker | AvaTrade Broker |

Regulation | FSC | ASIC, VFSC | ASIC, VFSC, FSC, FMA | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Spread | Market Spread | From 0.0 pips | From 0.0 Pips | From 0.0 Pips |

Commission | Variable Based on the Instrument and Platform | From $0.0 | From $0.0 | $0 |

Minimum Deposit | $200 | $0 | $100 | $100 |

Maximum Leverage | 1:500 | 1:500 | 1:1000 | 1:400 |

Trading Platforms | MT4, MT5, VAT | MetaTrader 4, MetaTrader 5, TradingView, cTrader | MT4, MT5, IRESS, TMGM Mobile App | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

Account Types | Real | Zero, Classic, Swap-Free | EDGE, CLASSIC | Standard, Demo, Professional |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | 50,000+ | 250+ | 12000+ | 1250+ |

| Trade Execution | Market | Market, Instant | Market, Instant | Instant |

Conclusion and Final Words

Varchev provides access to 50,000+ instruments across various markets with leverage options of up to 1:500. Crypto trading is commission-free; however, trading Stocks on MT4 and MT5 includes a $0.05 commission.

Varchev broker offers various incentives, from $1,000 deposit bonuses to $100 referral commissions. Wire Transfer (Raiffeisen and UniCredit) and E-Payments (PayPal, Skrill, and Neteller) are the main payment methods that we mentioned in this Varchev review.