VOYAFX is a financial brokerage with 3 main account types [Silver, Gold, Diamond]. The minimum deposit on the Silver account is $500, and the spreads are floating from 1.0 pips.

The company has offices in 3 regions [France, United Arab Emirates, Vanuatu], with 24/5 support services available through 3 channels [ticket, email, phone call].

VOYAFX Company Information & Regulation

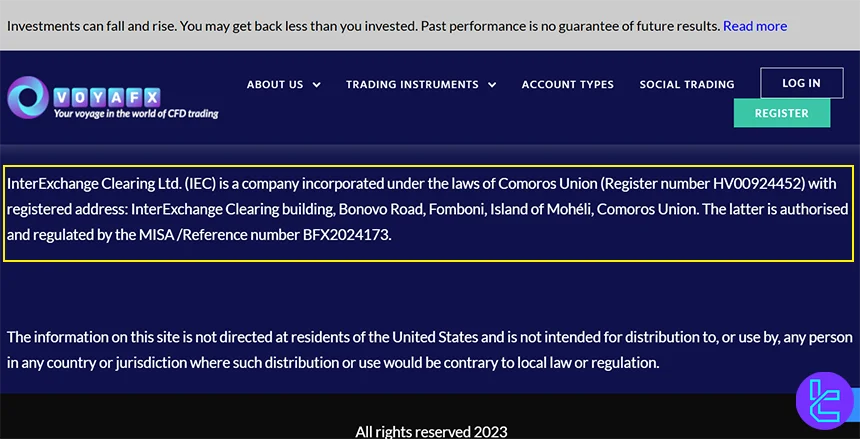

This brokerage is operated by Global Clearing House (GCH), which is incorporated under the laws of Vanuatu under the registration number 14691.

Based on the available data from reliable sources, the website's domain [www.voyafx.com] was registered on November 25, 2021.

Here are important details about the broker:

Entity Parameters / Branches | InterExchange Clearing Ltd (IEC – Comoros) |

Regulation | MISA (BFX2024173) |

Regulation Tier | N/A |

Country | Comoros |

Investor Protection Fund / Compensation Scheme | None |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:100 |

Client Eligibility | All countries except restricted jurisdictions (e.g., USA) |

Summary of Features and Specifics

Let's break down the key features that make VOYAFX a multi-asset Forex Broker. Look at the table below:

Broker | VOYAFX |

Account Types | Silver, Gold, Diamond |

Regulating Authorities | VFSC, MISA |

Based Currencies | USD, EUR, GBP |

Minimum Deposit | $500 |

Deposit Methods | Credit/Debit Cards, Bank Wire Transfer, Skrill, iDEAL |

Withdrawal Methods | Credit/Debit Cards, Bank Wire Transfer, Skrill, iDEAL |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:100 |

Investment Options | Proprietary Social Trading Platform |

Trading Platforms & Apps | Proprietary |

Markets | Forex, Commodities, Stocks, Indices |

Spread | Starting From 0.6 Pips on the Diamond Account |

Commission | No Trading Commissions No Activity/Deposit Fees |

Orders Execution | Market, Instant |

Margin Call/Stop Out | 70%/N/A |

Trading Features | Economic Calendar, Corporate Earning Calendar, Market Sentiment Visualization, Technical Analysis |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Phone Call, Email, Ticket |

Customer Support Hours | 24/5 |

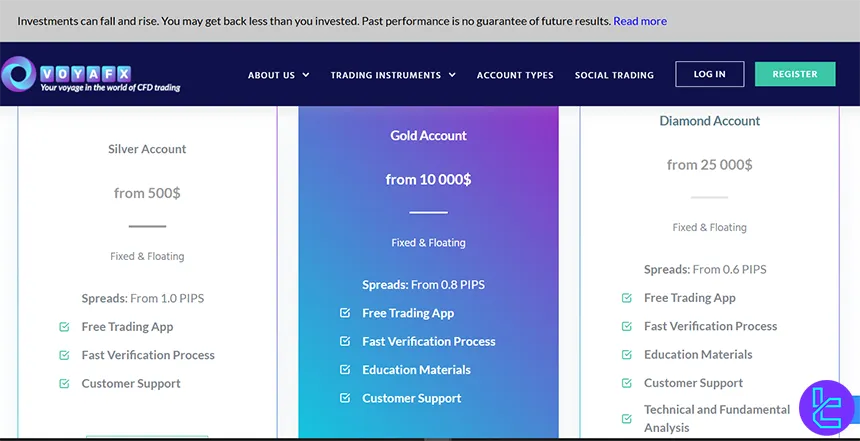

Accounts Specifics & Comparison

VOYAFX understands that one size doesn't fit all when it comes to trading accounts. That's why they offer 3 distinct account types. We will compare them in the table below:

Account Type | Silver | Gold | Diamond |

Min. Deposit | $500 | $10,000 | $25,000 |

Free Trading App | Yes | Yes | Yes |

Fast Verification | Yes | Yes | Yes |

Support Service | Yes | Yes | Yes |

Education Resources | No | Yes | Yes |

Technical and Fundamental Analysis | No | No | Yes |

The most notable difference between these accounts is the spread amount, which will be discussed later in this article. All accounts provide access to leverage of up to 1:100.

Account types are automatically assigned based on deposit size, and no demo trading is supported.

Notable Pros and Cons

Every broker has its strengths and weaknesses. Here's an honest look at what VOYAFX brings to the table:

Pros | Cons |

Wide Range of 1000+ Tradable Instruments | High Minimum Deposit of $500 |

No Separate Trading Commissions | Relatively High Spreads for Silver Account |

Proprietary Trading Platform | Not Regulated by a High-Tier Authority |

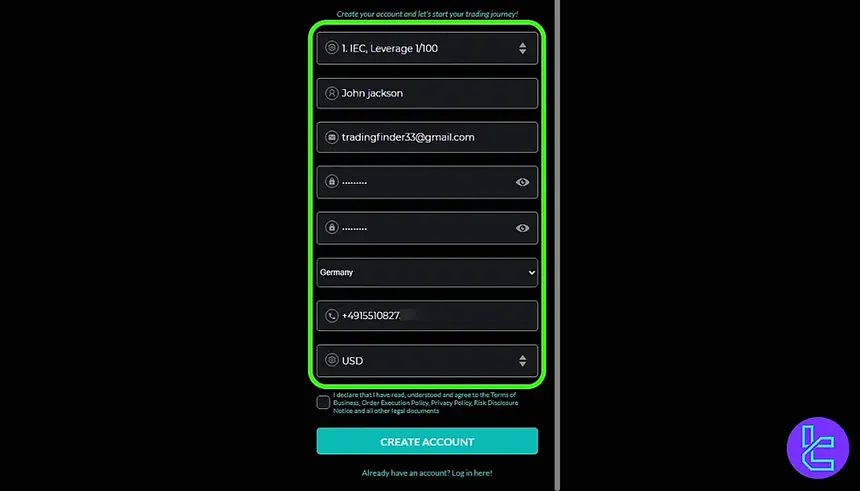

How to Register and Verify on VOYAFX

It's easy and quick to open an account with the broker. VOYAFX registration requires personal details and account preferences like trading currency, residence country, and contact information.

#1 Access the Registration Portal

Visit the broker’s official website and click on the “REGISTER” button to initiate your sign-up.

#2 Fill in Personal & Account Details

Choose your preferred dealer, then enter these details about yourself:

- Name

- Country

- Phone number

- Base currency

#3 Complete Account Creation

Accept the terms and click “Create Account”. A profile is now generated in your name. To verify, upload identity documents and any additional requested information.

Note: At the time of writing, the site showed a “Temporary problem. Try again later” message after clicking the abovementioned button.

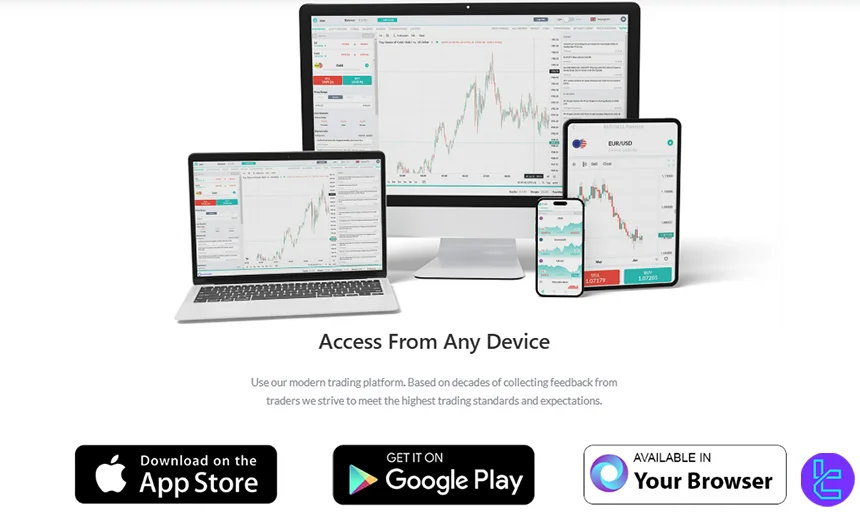

Is There a Proprietary Trading Platform?

VOYAFX offers a proprietary trading platform that is "easy-to-use" and "convenient". It supports technical analysis tools, financial charts, and other essential items for trading and analyzing the market.

Key features of the VoyaFX platform include:

- 50+ technical indicators

- 10 timeframes & 7 chart styles

- Market & pending orders (limit, stop, SL/TP)

- Real-time newsfeeds from tier-1 banks, including Barclays and JPMorgan

- Asset-specific Market Info for fundamental analysis

- Live stats showing price changes over 5-minute, 1-hour, and 24-hour windows

- Tools for profit/loss simulation, asset tracking, and trade history

The platform is accessible via 3 ways:

- Android (Currently unavailable)

- iOS (Currently unavailable)

- VOYAFX Web

Spreads and Commissions Overview

The discussed broker doesn't charge traders with any trading "commissions", and there are only market spreads in trade:

Account Type | Silver | Gold | Diamond |

Floating Spread | From 1 Pips | From 0.8 Pips | From 0.6 Pips |

Note that spreads are wider during the trading session at night. As stated on the brokerage's website, there are "no hidden fees and taxes" in its services. Also, there are no inactivity or deposit fees.

To estimate a trading position's outcome considering related commissions, use a profit calculator.

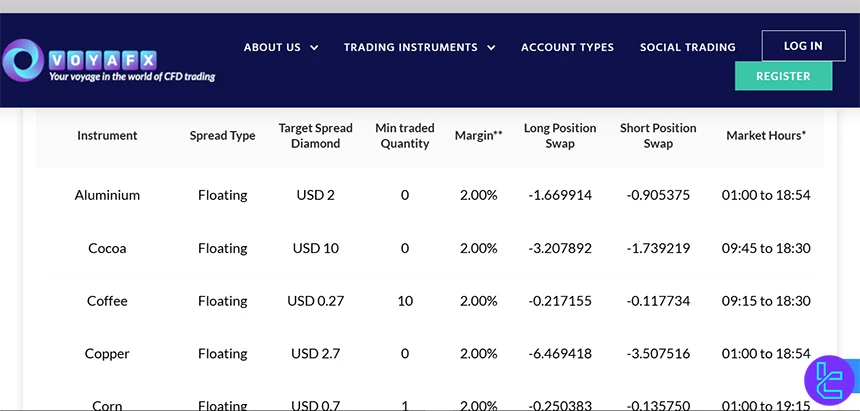

Swap Fee at VOYAFX Broker

Swap fees at VOYAFX represent the cost of holding positions overnight, calculated per instrument and trading direction. For example, holding 1 lot of EUR/USD overnight incurs a swap of -0.000133 for long positions and -0.000055 for short positions.

Swap amounts vary across instruments, account sizes, and market conditions, and are automatically applied each trading day.

These details help traders plan for overnight exposure effectively:

- Swap rates are applied daily at 00:00 server time for both long and short positions;

- Triple swaps occur on Wednesdays to cover the weekend rollover;

- Exotic or less liquid pairs like AUD/CAD have swaps of -0.000069 for long and -0.000079 for short positions;

- VOYAFX does not offer swap-free / Islamic accounts.

Non-Trading Fees at VOYAFX Broker

Although VOYAFX claims “No hidden fees & taxes”, transparency on non-trading fees remains limited. potential withdrawal, inactivity, currency-conversion, or administrative charges may still arise depending on providers or account status.

Deposits and Withdrawals: Funding Methods

The official VOYAFX website does not provide detailed public information on deposit methods. However, several independent broker review sites report that VOYAFX allows deposits via bank cards (VISA/MasterCard), bank wire transfers and e-wallets such as Skrill and Neteller.

Does VOYAFX Broker Provide Any Copy Trading or Other Investment Options?

The brokerage provides a property social trading system which allows the copying of expert traders (copy trading) in "just a click".

- Finding a professional trader

- Checking and evaluating their performance history & portfolio

- Starting following them

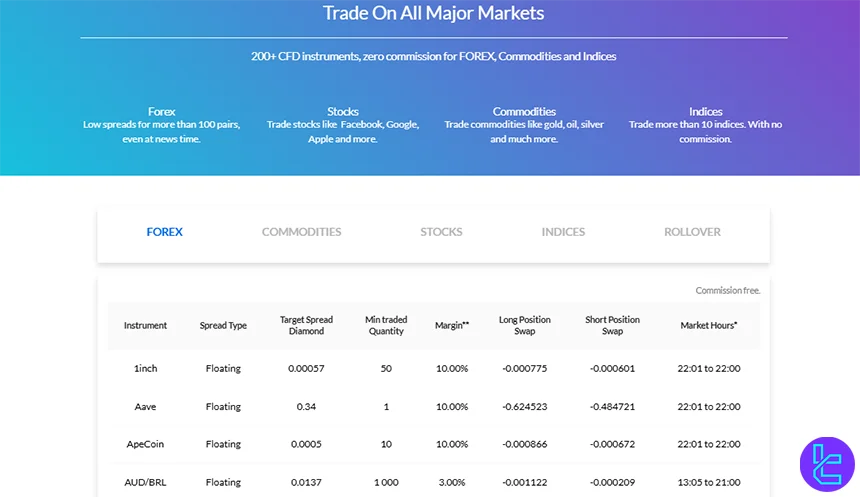

Tradable Instruments and Markets

VOYAFX shows a good performance in this regard, providing access to more than 1,000 tradable instruments for clients. Here's an overview:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Major, Minor, Exotic Pairs | 230+ | 50–90 | 1:100 | |

Commodities | Gold, Silver, Oil, etc. | 52 | 15–25 | 1:100 |

Stocks | Global Stock CFDs | 500+ | 300–1000 | 1:20 |

Indices | Global Indices | 55 | 15–30 | 1:100 |

Rollover | Contract extension / Expiry transition | 10 | N/A | 1:1 |

Overall, VOYAFX demonstrates strong market coverage and flexibility, catering to diverse trading strategies with a wide range of instruments and competitive leverage options.

Bonuses and Promotional Offers in VOYAFX

Per our latest investigations and available information, currently, there are no bonuses and promotions offered by the broker; however, some sources say that there are occasional promotions.

We will inform you on this page if any changes or updates happen regarding this matter.

VOYAFX Broker Awards

There is no verifiable public record that VOYAFX has won any recognized industry award. Claims about “award-winning broker” status are absent both on the official site and in independent analyses.

Support: Contact Channels and Schedule

VOYAFX enables traders to contact support via 3 channels that are listed below:

- Phone Support: +359 2 400 33 39

- Email: cs@voyafx.com (Customer Service), compliance@voyafx.com (Compliance), marketing@voyafx.com (Marketing)

- Ticket: Submittable via the "Contact Us" section on the website

The broker aims to respond to all inquiries 24 hours a day, Monday to Friday.

Restricted Countries and Regions

VOYAFX is an international brokerage offering its services to most countries in the world, but like many other brokers, it's restricted in some regions because of the regulations, sanctions, etc.

The company hasn't provided a list (except mentioning USA as a banned country), but these countries are most likely restricted:

- Iran

- Iraq

- Cuba

- Afghanistan

- North Korea

- Libya

Trust Scores and Evaluations

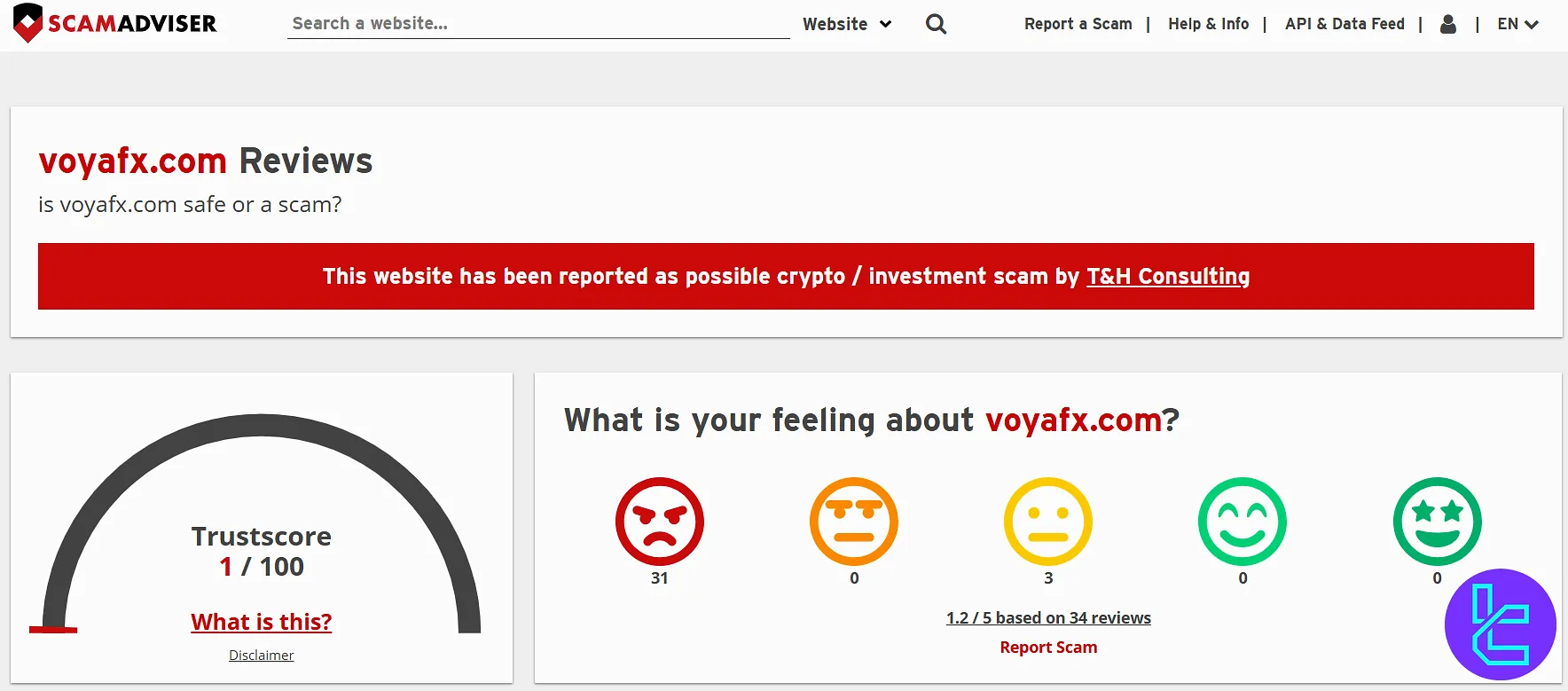

We use reputable sources such as Trustpilot and ScamAdviser to examine a financial company's trustworthiness. The rating on the former is currently unavailable due to a breach of guidelines; the platform has stated "the detection of fake reviews" as the reason for this measure.

Also, VOYAFX ScamAdviser profile has received a trust score of 1/100 and a rating of 1.2/5 based on +30 user reviews.

Educational Resources and Content

The discussed brokerage doesn't provide much detail about the education materials on its website; it just says that they provide "necessary trading tools and courses" to make clients financially literate.

The Comparison Table

Here's an exhaustive comparison table between VOYAFX and some of its competitors:

Parameter | VOYAFX Broker | HFM Broker | FxPro Broker | FXGlory Broker |

Regulation | MISA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB | No |

Minimum Spread | Starting From 0.6 Pips on the Diamond Account | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | No Trading Commissions No Activity/Deposit Fees | From $0 | From $0 | $0 |

Minimum Deposit | $500 | From $0 | $100 | $1 |

Maximum Leverage | 1:100 | 1:2000 | 1:500 | 1:3000 |

Trading Platforms | Proprietary | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Silver, Gold, Diamond | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite | Standard, Premium, VIP, CIP |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 1,000+ | 1,000+ | 2100+ | 45 |

| Trade Execution | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending | Market, Instant |

Conclusion and Final Words

VOYAFX requires a minimum deposit of $10,000 for the Gold account. There are over 1,000 tradable instruments offered by the broker, with a maximum leverage of 1:100. Also, a proprietary social trading platform is available.

The brokerage features calendars for economic events and corporate earnings. The company has received a 1.2/5 rating on ScamAdviser.