Latest investigations on the website shows that the broker has apparently ceased operations. Currently, the official domain shows a page saying "This account has been suspended". Also, the registration form page URL returns a "404 not found" error.

XLibre offers commission-free Forex trading through its Pro and VIP account types with leverage options of up to 1:2000 and spreads as low as 0.0 pips.

The broker has implemented various promotional plans, including a 100% deposit gift and a 50% tradable bonus.

XLibre: An Introduction to the Broker and Its Regulatory Status [FSCA, FSC]

XLibre is a brokerage company founded in 2024. The broker operates through two branches, one in Mauritius and the other in South Africa.

The company is authorized and regulated in both Mauritius and South Africa by:

- The Mauritius Financial Services Commission (FSC) with License NO. GB21026537

- The South African Financial Sector Conduct Authority (FSCA) with License No. 47159

While these dual regulations give traders an extra layer of confidence, potential clients may be concerned by the lack of top-tier licensing. XLibre implements a couple of industry-standard security measures:

- All platforms and dashboards are secured via SSL encryption and two-factor authentication;

- Routine financial audits are conducted to ensure compliance and transparency of funds.

XLibre Broker Table of Specifications

From tight spreads as low as 0.0 pips to leverage options of up to 1:2000, let’s take a quick look at what the Forex broker offers.

Broker | XLibre |

Account Types | Cent, Pro, Raw, VIP |

Regulating Authorities | FSCA, FSC |

Based Currencies | USD |

Minimum Deposit | $10 |

Deposit Methods | Visa, MasterCard, SWIFT |

Withdrawal Methods | Visa, MasterCard, SWIFT |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:2000 |

Investment Options | Social Trading |

Trading Platforms & Apps | MT5 |

Markets | Forex, Indices, Shares, Commodities, Crypto |

Spread | Variable based on the account type |

Commission | Variable based on the account type |

Orders Execution | Market |

Margin Call / Stop Out | 50% / variable based on the account type |

Trading Features | Commission-free Trading, Social Trading, Islamic Account, Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | 100% Welcome Bonus, 30% Tradable Bonus, 50% Tradable Bonus |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Ticket, Live Chat |

Customer Support Hours | 24/5 |

Trading Accounts

The company offers 4 main account types, each with a different fee structure and minimum deposit to suit different trading styles and experience levels.

Features | Cent | Pro | Raw | VIP |

Min Deposit | $10 | $25 | $100 | $200 |

Max Leverage | 1:2000 | 1:2000 | 1:2000 | 1:2000 |

Margin Call | 50% | 50% | 50% | 50% |

Stop Out | 30% | 30% | 20% | 20% |

Commission | Yes | No | Yes | No |

Spreads from (pips) | 1.2 | 1.2 | 0.0 | 0.7 |

Swap-Free Option | Yes | Yes | Yes | Yes |

XLibre Broker Pros and Cons

The broker prioritizes clients’ fund safety by offering segregated accounts and Negative Balance Protection (NBP).

To have a balanced view, let’s weigh XLibre’s advantages against its disadvantages.

Pros | Cons |

Low minimum deposit requirements | Short track record (less than a year) |

Diverse account options | Lack of top-tier licensing |

Copy trading solutions available | No phone support |

No transaction fees | Only offers the MetaTrader 5 platform |

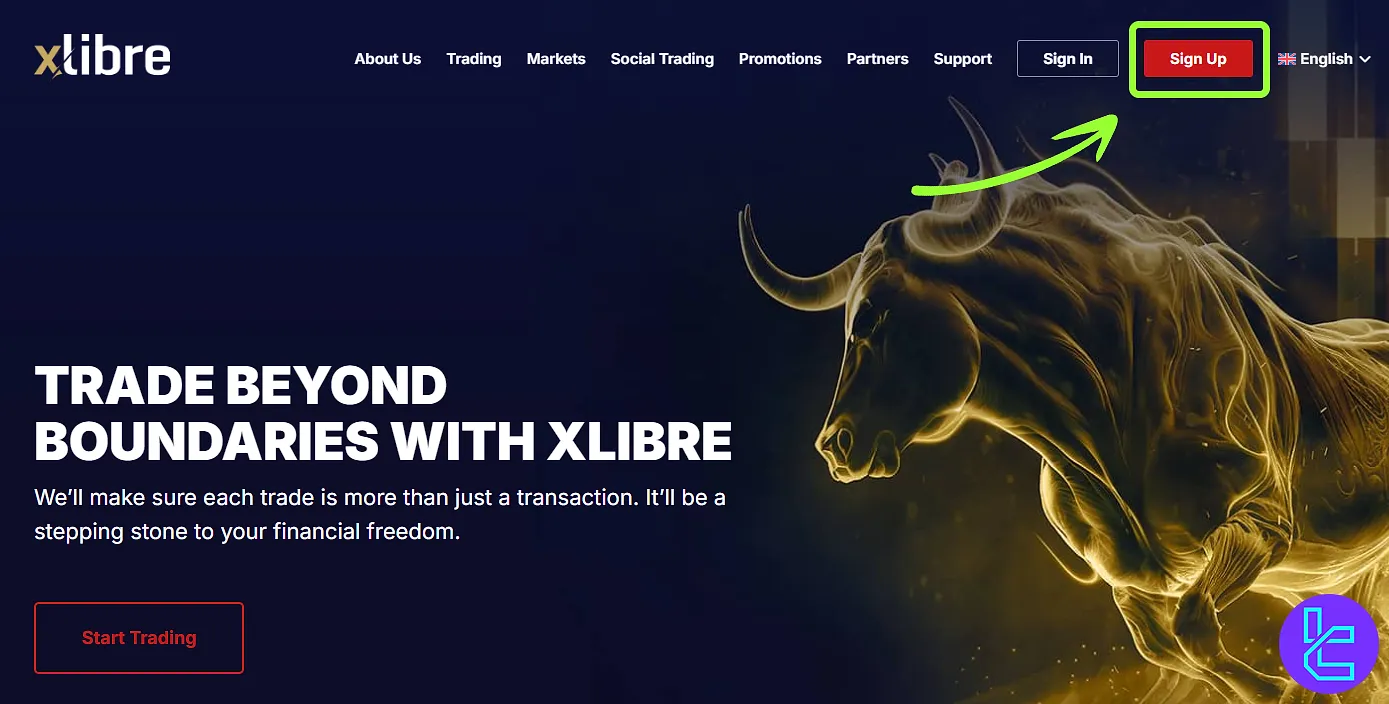

Registration and Verification Guide

In this XLibre review, we should mention that you must not be a resident of America to be able to open an account with the broker. The XLibre registration tutorial is explained in the following sections.

#1 Start on the XLibre Official Website

Go to the XLibre homepage and click on the “Sign Up” button at the top-right. You’ll be redirected to the sign-up form.

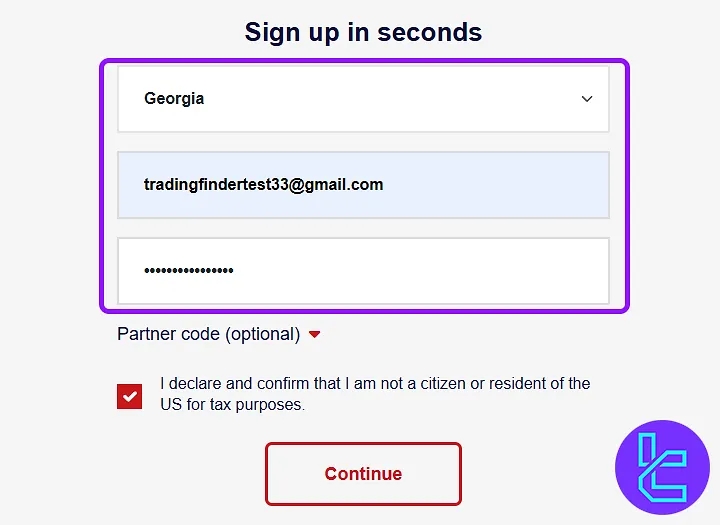

#2 Fill in the Required Information

Provide accurate details including:

- Country of residence

- Email address

- Strong password

- (Optional) Partner/IB code

- Declaration regarding U.S. citizenship status

Make sure to use an active email, as it’s essential for the next step.

#3 Confirm Your Email to Activate the Account

Access your email inbox and find the message from XLibre. Click the verification link included in the email to activate your trading account and access your user dashboard instantly.

#4 Go through the KYC

For the XLibre verification process, provide proof of identity (passport or driver’s license) and proof of address (utility bill or bank statement). Afterwards, submit the “Economic Profile” form.

XLibre Broker Trading Platforms

The company exclusively offers the MetaTrader 5 (MT5) platform, known for its robust features, user-friendly interface, and accessibility across various devices, including:

The MetaQuotes trading solution offers 21 timeframes, 38 built-in technical indicators, and support for Expert Advisors (EAs).

Trading and Non-Trading Costs

XLibre offers four account types with different fee structures. Two have no commissions and higher-than-average market spreads; two have commissions and tight spreads from 0.0 pips.

Account Type | Spreads from (pips) | Commissions |

Cent | 1.2 | Yes |

Pro | 1.2 | No |

Raw | 0.0 | Yes |

VIP | 0.7 | No |

The broker also reimburses clients for their deposit and withdrawal transaction fees. The table below gathers the commission fees for various asset classes across different XLibre account types.

Asset Class | Cent | Pro | Raw | VIP |

Forex | $0.05 | $0.0 | $4.0 | $0.0 |

Indices | Not Available | $0.0 | $4.0 | $0.0 |

Shares | Not Available | 1.0% | 1.0% | 1.0% |

Commodities | $0.05 | $0.0 | $4.0 | $0.0 |

Crypto | Not Available | 0.03% | 0.03% | 0.025% |

XLibre Withdrawal and Deposit

The broker performs poorly when it comes to supported payment methods, as it only supports Debit/Credit Cards and Bank Transfers.

- Visa

- MasterCard

- SWIFT

Note that SWIFT transactions take 2 to 7 days to be credited to your account, and the ones below $100 include fees.

While the system is reliable and transparent, the lack of support for e-wallets like Skrill or Neteller, as well as same-day payout options, may be a drawback for some users.

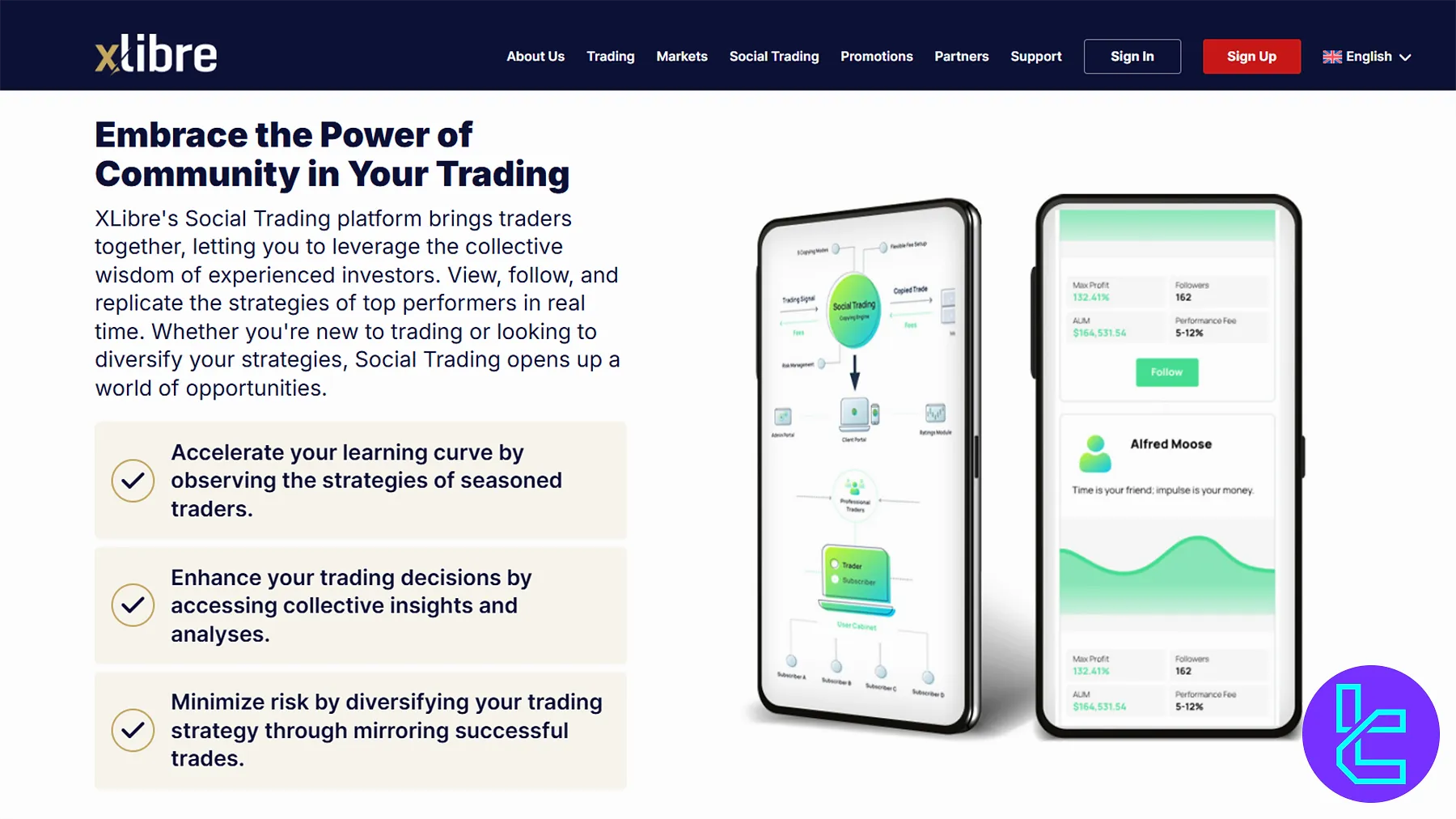

XLibre Social Trading

The broker’s Social Trading platform is a standout feature, allowing traders to connect, learn, and replicate strategies from experienced investors.

Through the client dashboard, you can register to become a follower or a strategy provider.

At the time of writing this XLibre review, the company offers 27 investment offers with the following key features:

- Performance fees: From 10% to 50%

- Minimum investment: from $20 to $2,000

- A comprehensive list of providers' profiles and ratings

Tradable Instruments

XLibre provides access to 1000+ trading instruments across 5 asset classes, from Forex pairs to Cryptocurrencies.

- Forex Market: Major, minor, and exotic currency pairs with leverage options of up to 1:2000, 1:1000, and 1:200, respectively

- Indices: Global stock indices like S&P 500, FTSE 100, DAX 30 with leverage options of up to 1:500

- Shares: CFDs on popular stocks from major exchanges across US and EU with leverage options of up to 1:50

- Commodities: Precious metals and energies, including Gold, Silver, Palladium, Platinum, BRENT, WTI, and NGAS, with leverage options of up to 1:500

- Crypto: 15 Major cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Tron, with leverage options of up to 1:10

The only available markets on XLibre Cent accounts are Forex and Gold pairs.

Bonus Offerings

XLibre entices traders with several attractive promotional programs, including traditional deposit gifts and a comprehensive trading competition.

- 50% Tradable Bonus: Up to $500 extra funding

- 30% Tradable Bonus: Available for the first 3 deposits with a $3,000 limit per transaction

- 100% Welcome Bonus: Up to $10,000 welcome gift on your first deposit

- Battle of the Trades: Trading competition with Tesla Model 3 and PlayStation 5 as prizes

- Partnership: Up to $15 commission per lot for IBs and up to $1,000 in CPAs for affiliates

Note that the Battle of the Trades trading tournament had expired at the time of writing this XLibre review. If it comes back, we’ll notify you on this page.

XLibre Broker Support Channels

Customer support is an area where the brokerage company has room for improvement. XLibre boasts 24/5 assistance through various channels, including:

support@exalibre.com | |

Ticket | Through the “Contact Us” page |

Live Chat | Available on the official website |

Registered Office | Office 306, 3rd Floor, Ebene Junction, Rue De La Democratie, Ebene 72201, Mauritius |

Business Address | 22, St Georges Street, Suite 216, Port-Louis, Mauritius |

Restricted Countries

The company doesn’t offer services to residents of certain jurisdictions due to local laws and regulatory requirements. XLibre geo-restrictions:

- United States

- Sudan

- Syria

- Iran

- North Korea

- Myanmar

- EU countries

User Satisfaction

The broker was founded in 2024 and has less than 1 year of experience. So it’s not odd that it has not been featured on reputable review websites like Forex Peace Army and Reviews.io.

Although the XLibre Trustpilot profile has been created, it currently has only four comments, resulting in a great trust score of 4 out of 5.

Educational Resources

Unfortunately, XLibre's educational offerings are limited compared to some competitors. Its website only offers an “Article” section alongside an Economic Calendar.

Note that the education section only features one “Forex Beginner’s Guide” article.

XLibre vs. Top Forex Brokers

The table below is an exhaustive comparison between XLibre and some of the best players in the industry:

Parameter | XLibre Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | FSCA, FSC | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | 0 Pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | Variable | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | $10 | $200 | $5 | $50 |

Maximum Leverage | 1:2000 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | MT5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | Cent, Pro, Raw, VIP | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | Yes | Yes | Yes | No |

Number of Tradable Assets | 1,000+ | 2,250+ | 1400+ | N/A |

Trade Execution | Market | Market | Market, Instant | Market |

Conclusion and Final Words

XLibre provides access to 1,000+ trading instruments via the MT5 platform and offers a 30% tradable bonus up to $9,000.

However, the limited payment options (only Visa, MasterCard, and SWIFT) and the lack of a support hotline are the most significant weaknesses in this XLibre review.