XTrend is a brokerage company sponsoring AFA (Argentine Football Association). The company provides access to CFD trading on Forex, Crypto, and Metals with a minimum deposit of $50.

The broker operates under the regulation of CySEC with a Tier1 license, ensuring high standards of compliance and investor protection. XTrend offers leverage of up to 1:30 for Forex currency pairs and 1:20 for Gold, providing traders with flexible exposure across key markets.

XTrend; An Introduction to the Company and Its Regulatory Status

XTrend is a brand name of Rynat Trading Limited, which is registered in Cyprus as an investment firm. The broker is authorized and regulated by CySEC with license No. 303/16.

Key features of XTrend:

Entity Parameter / Branch | XTrend (Rynat Trading Ltd) |

Regulation | CySEC, License No303/16 |

Regulation Tier | 1 |

Country | Cyprus |

Investor Protection Fund / Compensation Scheme | ICF; up to € 20,000 per client |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:30 |

Client Eligibility | Not offered to residents of certain jurisdictions (USA, Canada, Cuba, DPRK, Iran, Iraq, Syria, etc.) |

With full CySEC authorization, investor protection up to €20,000, and advanced risk safeguards, XTrend offers a secure and regulated trading environment for eligible clients.

XTrend Broker Table of Specifications

XTrend is a Cypriot Investment Firm primarily focused on providing a safe trading environment with the moto “The Client comes first." Let’s take a quick look at what the Forex Broker has to offer.

Broker | XTrend |

Account Types | Real |

Regulating Authorities | CySEC |

Based Currencies | USD |

Minimum Deposit | $50 |

Deposit Methods | Visa, MasterCard, Neteller, Skrill, PayPal, Bank Transfer |

Withdrawal Methods | Bank Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 |

Investment Options | None |

Trading Platforms & Apps | Proprietary App/WebTrader |

Markets | Forex, Indices, Metals, Energy, Stocks, Crypto |

Spread | Variable based on the instrument |

Commission | From $5 per lot |

Orders Execution | Market |

Margin Call / Stop Out | N/A / 50% |

Trading Features | Mobile Trading, Default Stop Loss at 80% (Customizable), Negative Balance Protection, Bi-Directional Trading |

Affiliate Program | N/A |

Bonus & Promotions | None |

Islamic Account | N/A |

PAMM Account | No |

Customer Support Ways | Email, Tel, Fax |

Customer Support Hours | N/A |

XTrend Account Offerings

XTrend provides a streamlined account structure, focusing on delivering a tailored trading experience through its live account with the following features.

Min Deposit | $50 |

Min Order Size | From $5 per lot |

Leverage | Up to 1:30 |

Max No. of Lots | 200 |

Demo | No |

Hedging | Yes |

XTrend Advantages and Disadvantages

Trading with no re-quotes or hidden fees is one of the broker's advantages.

When considering XTrend as your forex and CFD broker, it's crucial to weigh its strengths and weaknesses.

Pros | Cons |

User-friendly mobile app | No support for advanced platforms like MetaTrader |

Strong regulatory framework (CySEC) | Limited trading instruments |

Tight spreads from 0.00001 pips | Limited leverage options (up to 1:30) |

Low investment requirements (from $5) | No promotional programs |

XTrend Broker Registration and Verification

XTrend registration is fast, requiring just a few simple steps. You'll need to provide personal and employment details, verify your phone, and confirm your residence.

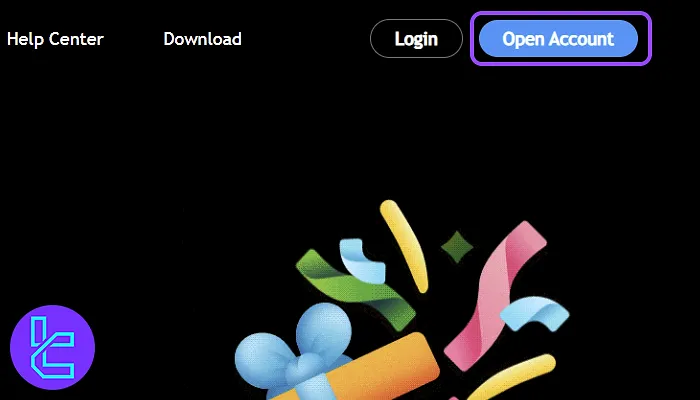

#1 Start from the Official XTrend Page

After navigating to the website, click on “Open Account” to begin the sign-up.

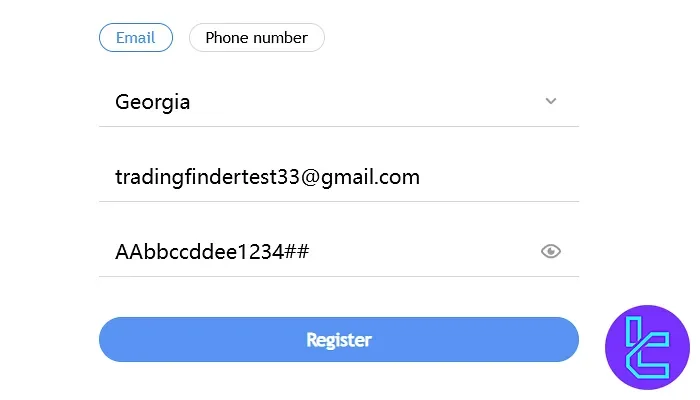

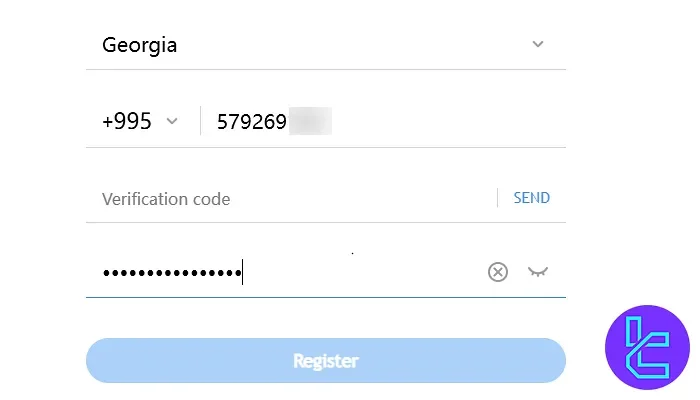

#2 Submit Basic Credentials

Enter your country, a valid email address, and create a secure password for account access.

#3 Verify Your Phone Number

Input your mobile number with the correct country code. A verification code will be sent for confirmation.

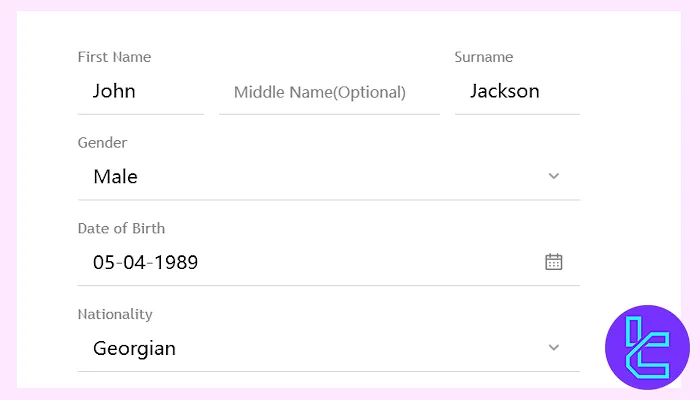

#4 Provide Personal Information

Include these personal details of yours:

- Full name

- Gender

- Date of birth

- Nationality

These mentioned above must match your ID.

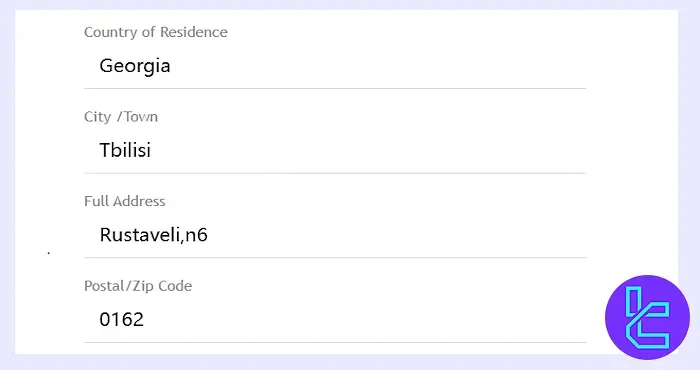

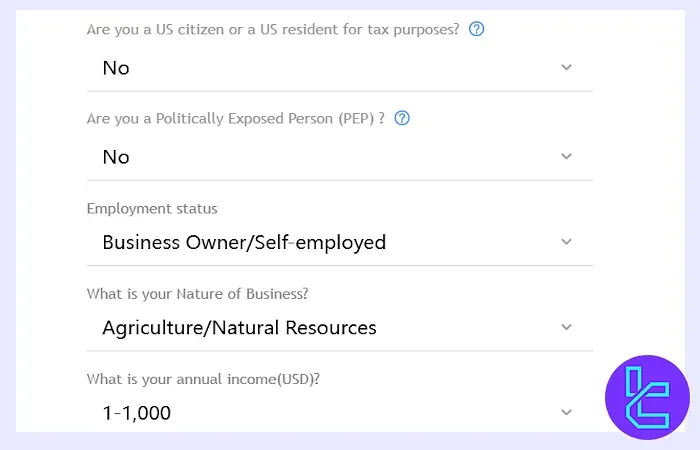

#5 Fill Out Residence and Employment Data

Add your residential details, including:

- Country of residence

- City

- Residential address

- postal code

Then, answer questions about employment status, income, and citizenship.

#6 Claim Your Free Stock

Choose one of the listed stocks to finalize the process and activate your trading account, including:

- Xiaomi Corp

- Hang Seng Bank

- Kunlun Energy

#7 Verify Your Identity

For a complete account verification, provide proof of ID (Passport or National ID), proof of address (utility bill or bank statement), and proof of payment.

XTrend Apps and Platforms

We must discuss the trading platform in this XTrend review. The broker offers a proprietary platform for mobile devices in addition to a dedicated WebTrader.

XTrend App download links:

- XTrend Android

- iOS (Removed from App Store)

XTrend Fees and Commissions

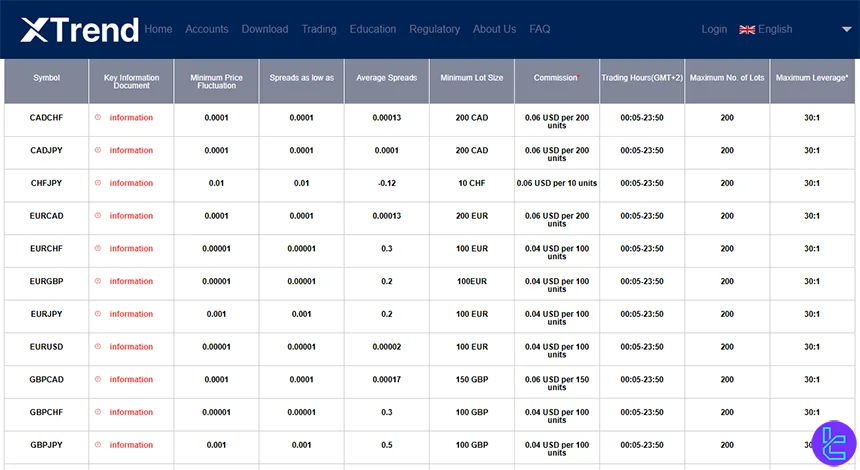

The company’s fee structure mainly consists of trading spreads, commissions, and swap rates (for holding positions overnight).

While swap is calculated based on traded volume, instrument, and number of nights, commission and spreads vary based on the asset.

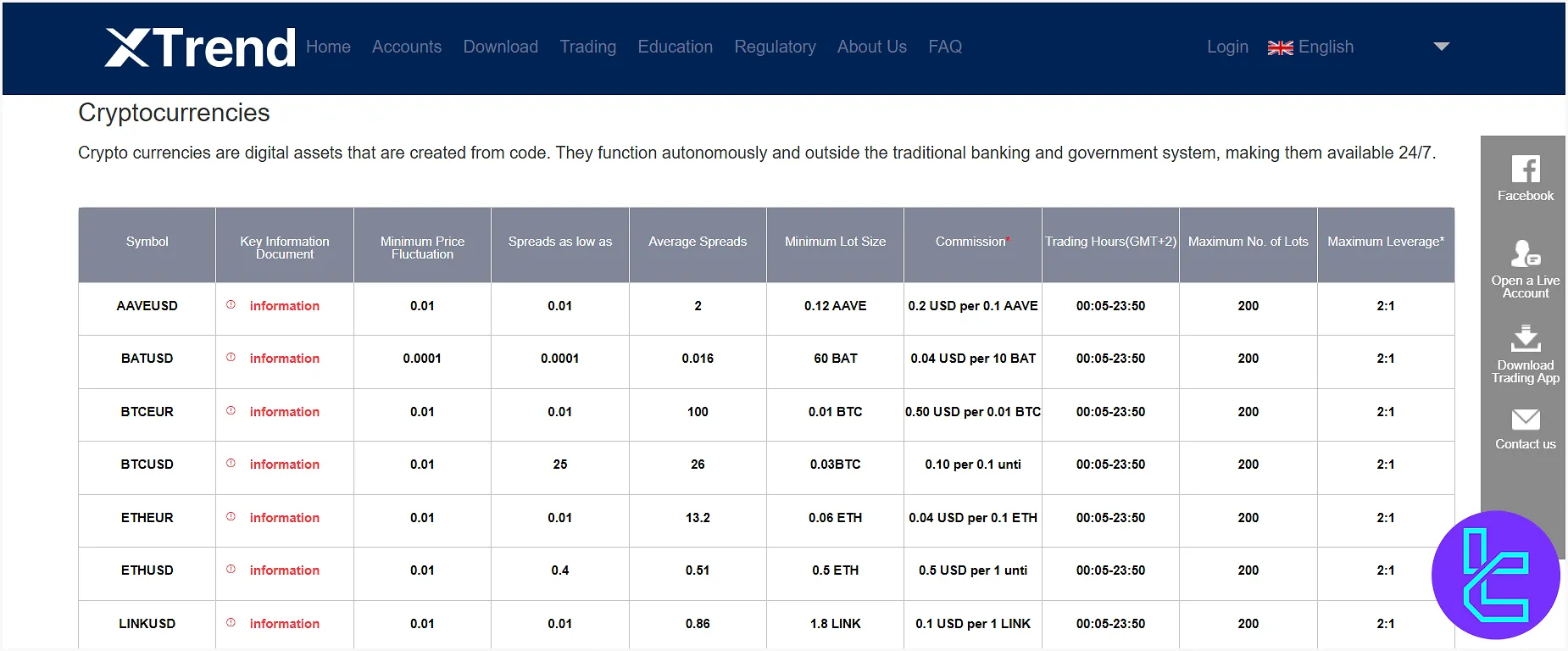

XTrend trading costs for some of the most popular markets:

Instrument | Commission (USD) per Min lot Size | Average Spreads (Pips) |

EURUSD | 0.04 | 0.00002 |

GBPUSD | 0.04 | 0.00004 |

XAUUSD | 0.4 | 0.07 |

BTCEUR | 0.05 | 100 |

USOIL | 0.6 | 0.024 |

SPX500 | 0.8 | 0.4 |

AAPL | 0.08 | 0.045 |

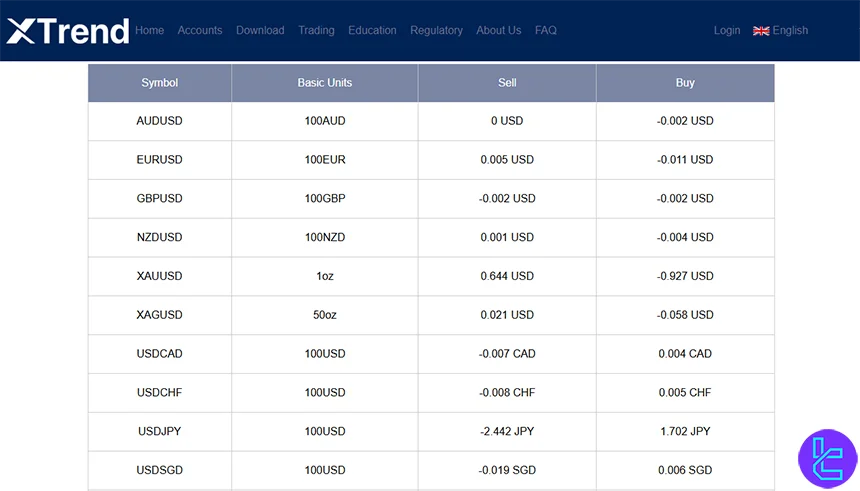

Swap Fee at XTrend

Overnight swap costs at XTrend are charged on positions held past the trading day, with exact rates varying by instrument. For example, holding a long EUR/USD position of 100 EUR overnight incurs a swap of –0.011 USD.

These charges are calculated automatically based on trade size and direction, and reflect the financing cost of holding a position overnight.

Here are the key points you should know regarding swaps at XTrend:

- Swap is applied at server time 23:50 (GMT+2) for all instruments, including forex and metals;

- Friday positions incur triple swap charges to account for the weekend rollover;

- Swap depends on trade size and instrument; for example, holding a short XAU/USD (1 oz) position overnight costs –0.927 USD.

Non-Trading Fees at XTrend

XTrend does not charge any inactivity fees, deposit fees, or account maintenance costs. However, all withdrawal methods incur a 3.5 % processing fee. Traders are otherwise only exposed to standard trading costs such as spreads, commissions and overnight swaps.

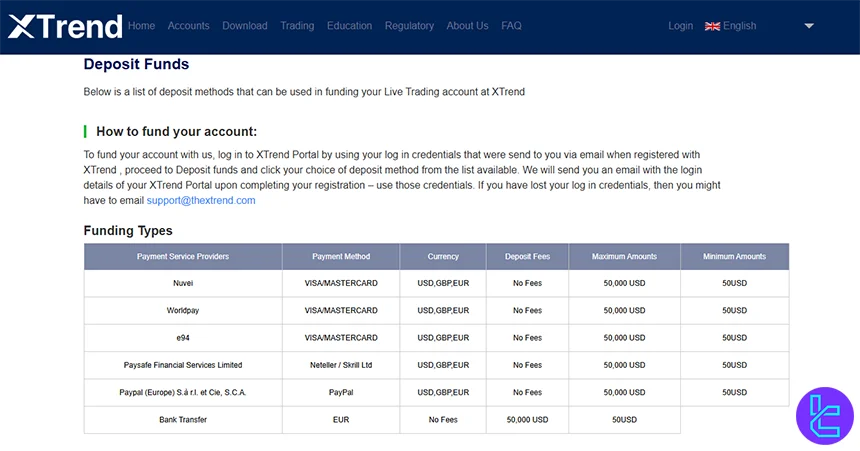

XTrend Deposit and Withdrawal

While the broker only offers Card Transfers for withdrawals, it provides multiple options for account funding, including:

- Visa / MasterCard

- Neteller

- Skrill

- PayPal

- Bank Wire

Deposit Methods at XTrend

Funding your XTrend account is straightforward and flexible, offering a variety of deposit methods. The broker accepts major payment options including credit/debit cards, e-wallets, and bank transfers, all processed without additional deposit fees.

Minimum deposit amounts are clearly defined, and all funds are converted to USD if deposited in other currencies, ensuring consistency across trading accounts.

Here is a detailed overview of the available deposit methods and their key parameters:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Visa/Master Cards | USD, GBP, EUR | 50 USD | No Fees | N/A |

e-Wallets (Neteller / Skrill) | USD, GBP, EUR | 50 USD | No Fees | N/A |

Pay Pal | USD, GBP, EUR | 50 USD | No Fees | N/A |

Bank Transfer | EUR | 50 USD | No Fees | N/A |

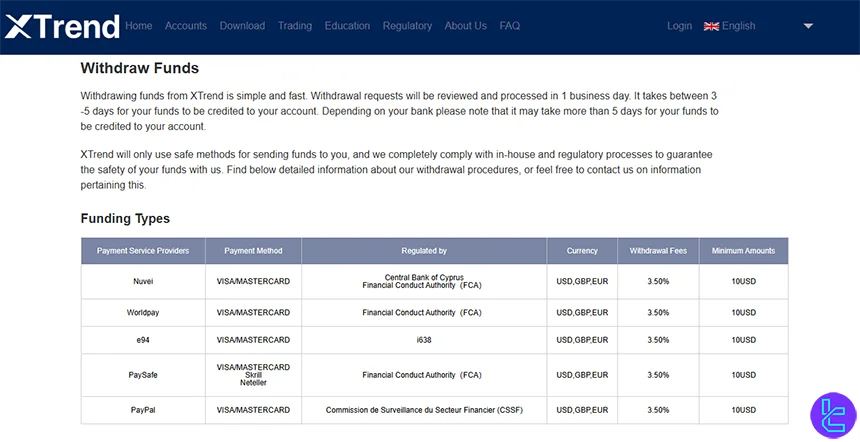

Withdrawal Methods at XTrend

Withdrawing funds from XTrend is simple, secure and processed quickly. Withdrawal requests are reviewed and completed within 1 business day, while funds are typically credited to your account within 3–5 business days depending on your bank.

XTrend strictly follows compliance procedures to ensure your funds remain safe. So, the broker does not permit third party payments.

Below is a detailed overview of withdrawal methods and their key parameters:

Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Visa/Master Cards | USD, GBP, EUR | 10 USD | 3.50% | 3–5 Business Days |

e-Wallets (e.g. Neteller / Skrill) | USD, GBP, EUR | 10 USD | 3.50% | 3–5 Business Days |

Does XTrend Broker Offer Copy Trading?

The company doesn’t provide any wealth management, investment, or copy trading services. The lack of methods for earning passive income can be a letdown for potential investors who to seek to earn money on their free assets.

XTrend Trading Assets

The broker offers a diverse range of trading instruments across 6 asset classes, from Forex to Crypto.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, minors, exotic currency pairs | 60+ | 40-70 | 1:30 |

Precious Metals | Metals CFDs (Gold, Silver, etc.) | 5 | 2-10 | 1:20 |

Crypto‑asset CFDs | 28 | 5-20 | 1:2 | |

Energy | Energy CFDs (e.g., Oil, Gas) | 3 | 2-5 | 1:10 |

Indices | Global stock indices | 17 | 10-15 | 1:20 |

Shares | CFDs on US, HK and EU stocks | 500+ | 300-1000 | 1:5 |

XTrend provides traders with a comprehensive trading environment, offering over 600 instruments. Leverage ranges from 1:2 on cryptocurrencies up to 1:30 on Forex, catering to both novice and experienced investors.

XTrend Bonuses

Promotion is one of the most attractive topics in this XTrend review. However, the company is a CySEC-regulated broker and doesn’t offer any traditional bonuses due to the strict regulatory requirements.

The broker doesn’t even offer the traditional affiliate program for public and retail clients.

XTrend Broker Awards

Currently, XTrend’s official website does not provide any information regarding awards or industry recognitions. No verified accolades or honors are publicly documented on their official platform for reference.

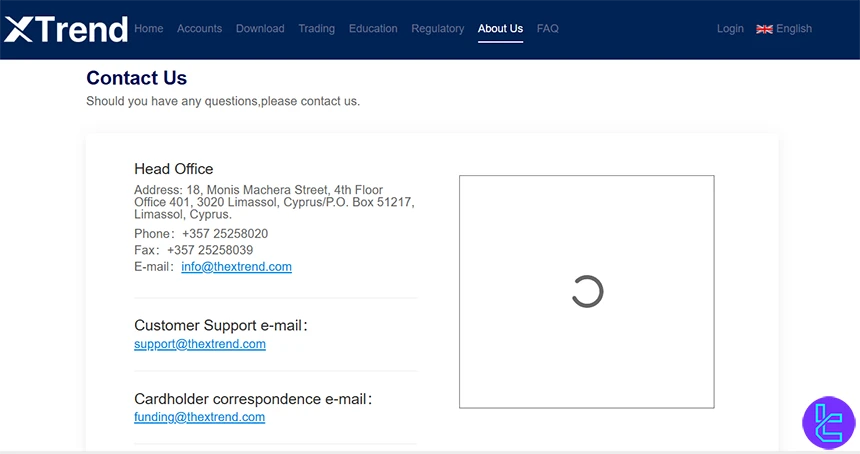

How to Reach XTrend Broker Support?

The company provides multiple channels for customer support, ensuring that traders can get assistance when needed. However, the lack of live chat feature is a serious weakness of XTrend.

support@thextrend.com | |

Tel | +357 25258020 |

Fax | +357 25258039 |

There are some negative reviews submitted on evaluation sources regarding the broker's customer service quality.

Restricted Countries on XTrend

While the company strives to serve a global clientele, its regulatory framework prevents it from providing services in certain jurisdictions, including:

- United States of America

- Cuba

- Canada

- Israel

- Belgium

- Bahamas

- Botswana

- Democratic People's Republic of Korea

- Ethiopia

- Ghana

- Iran

- Pakistan

- Serbia

- Sri Lanka

- Syria

- Trinidad and Tobago

- Tunisia

- Yemen

- Afghanistan

- Bosnia and Herzegovina

- Guyana

- Iraq

- Lao PDR

- Vanuatu

Note that the broker has only listed 20+ countries on its registration page. Traders from other countries can use the broker’s South African branch, XTrend Speed.

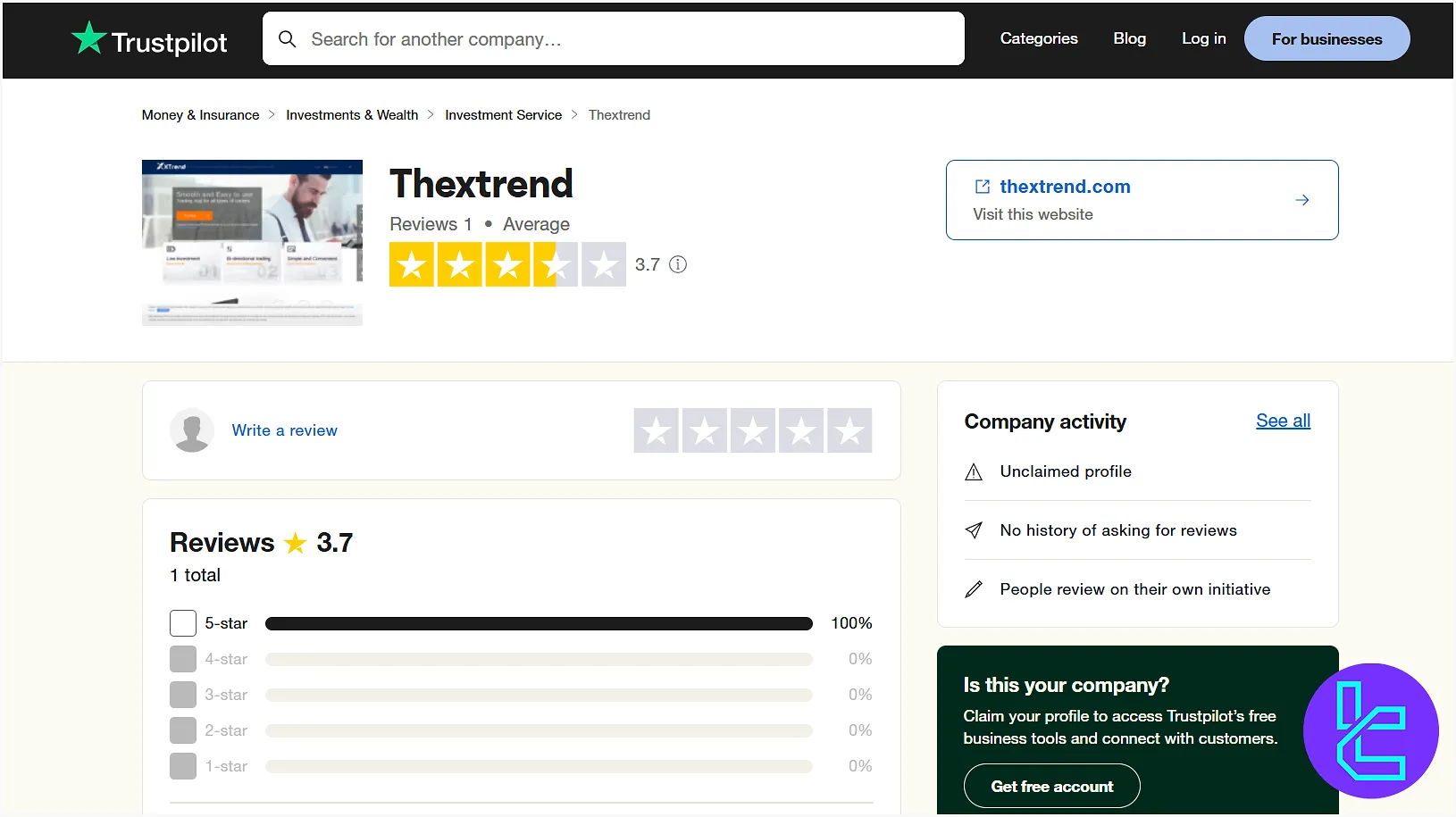

XTrend User Satisfaction

The trust score is one of the most important topics in this XTrend review.

The broker hasn’t received many reviews from users on reputable review platforms like Forex Peace Army and TrustPilot.

3.7/5 based on 1 rating | |

Forex Peace Army | Not rated (only a 1-star review) |

XTrend Broker Educational Resources

The company doesn’t take traders’ education seriously, since it only offers a trading glossary for traders to find terms, meanings, and definitions.

XTrend in Comparison to Others

This table demonstrates the brokerage's performance in comparison to its peers:

Parameter | XTrend Broker | XM Broker | Exness Broker | HFM Broker |

Regulation | CySEC | ASIC, FSC, DFSA, CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | Floating from 0.0 pips | From 0.6 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0.04 | $0 (except on Shares account) | From $0.2 to USD 3.5 | From $0 |

Minimum Deposit | $50 | $5 | $10 | From $0 |

Maximum Leverage | 1:30 | 1:1000 | Unlimited | 1:2000 |

Trading Platforms | Proprietary App/WebTrader | MT4, MT5, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App |

Account Types | Real | Micro, Standard, Ultra Low, Shares | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 1400+ | 200+ | 1,000+ |

| Trade Execution | Market | Market, Instant | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and Final Words

XTrend allows for Bi-Directional trading (Hedging) with a minimum investment requirement of $5. XTrend broker is regulated by CySEC, and implements a compensation scheme of €20,000 per client.

However, the lack of live chat support and limited leverage options (1:30 for amateur clients) are the main weaknesses in this XTrend review.