ZFX requires a minimum of $1,000 as a deposit for its ECN account. Clients can trade with spreads starting from 0.2 pips on this account type. The broker's support team is available 24 hours, Monday to Friday; on Saturday and Sunday, the open hours are from 07:30 to 02:00 the next day.

ZFX operates under dual regulation, authorized by the FCA in the UK and the FSA in Seychelles, providing services to both UK and international clients. The broker offers a maximum leverage of up to 1:2000 across its trading instruments.

Company Information & Regulation

ZFX, the trading arm of Zeal Group, is a Forex market broker registered by two regulatory bodies. We investigated the Crunchbase platform and official sources and found the following data:

Entity Parameter \ Branches | Zeal Capital Market (Seychelles) Limited | Zeal Capital Market (UK) Limited |

Regulation | FSA | FCA |

Regulation Tier | 4 | 1 |

Country | Seychelles | UK |

Investor Protection Fund | None | FSCS (up to £85,000) |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | 1:2000 | 1:30 (retail) / 1:100 (pro) |

Client Eligibility | Global (except restricted countries) | UK clients |

Key Specifics and Overall Features

To give you a quick overview of what ZFX, as a Forex broker, offers to the traders, here's a summary of its key features in a table:

Broker | ZFX |

Account Types | Mini, Standard STP, ECN |

Regulating Authorities | FCA, FSA |

Based Currencies | USD |

Minimum Deposit | $50 |

Deposit Methods | Credit/Debit Card, E-Wallet, Bank Transfer |

Withdrawal Methods | Credit/Debit Card, E-Wallet, Bank Transfer |

Minimum Order | 0.01 |

Maximum Leverage | 1:2000 |

Investment Options | Copy Trading, MAM |

Trading Platforms & Apps | MetaTrader 4, Proprietary Platform |

Markets | Forex, Crypto, Indices, Commodities, Shares |

Spread | From 0.2 Pips on ECN Account |

Commission | No Data |

Orders Execution | Market |

Margin Call/Stop Out | No Data/20%-50% |

Trading Features | Economic Calendar, Glossary, Demo Account |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Live Chat, Email, Ticket System, Phone Call |

Customer Support Hours | 24/5 |

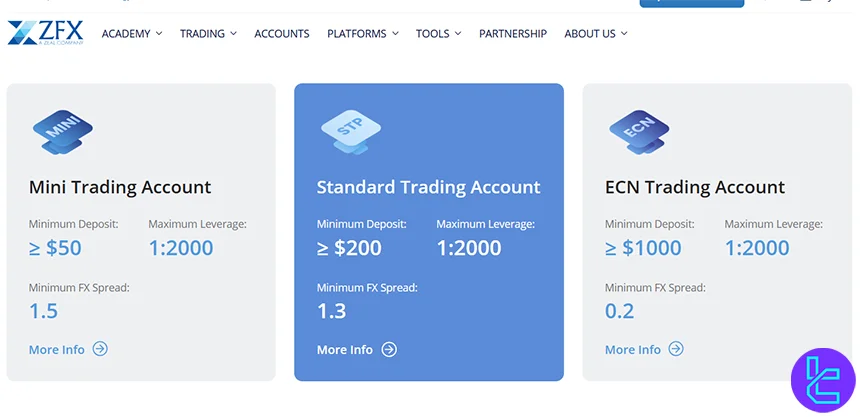

Trading Accounts + Specifications

Typically, there are various accounts with different specifics in brokers. ZFX offers a good range of account types. We will compare these accounts in the table below:

Account Type | Mini | Standard STP | ECN |

Min. Deposit | $50 | $200 | $1,000 |

Max. Leverage | 1:2000 | ||

Contract Units (Forex) | 10,000 | 100,0000 | |

Stop-Out Level | 20% | 30% | 50% |

Min. Trade Size (Lot) | 0.1 | 0.01 | 0.01 |

Additionally, ZFX enforces negative balance protection, ensuring traders cannot fall below a zero account balance.

There's also a demo account available on this broker for practice and strategy testing without risking real capital.

Benefits and Drawbacks

To create a better image of the broker, let's investigate the pros and cons of trading with ZFX:

Benefits | Drawbacks |

Regulated By Reputable Authorities | Limited Selection of Trading Platforms |

High Leverage Up To 1:2000 | No 24/7 Support |

Various Trading Accounts | - |

Copy Trading Feature | - |

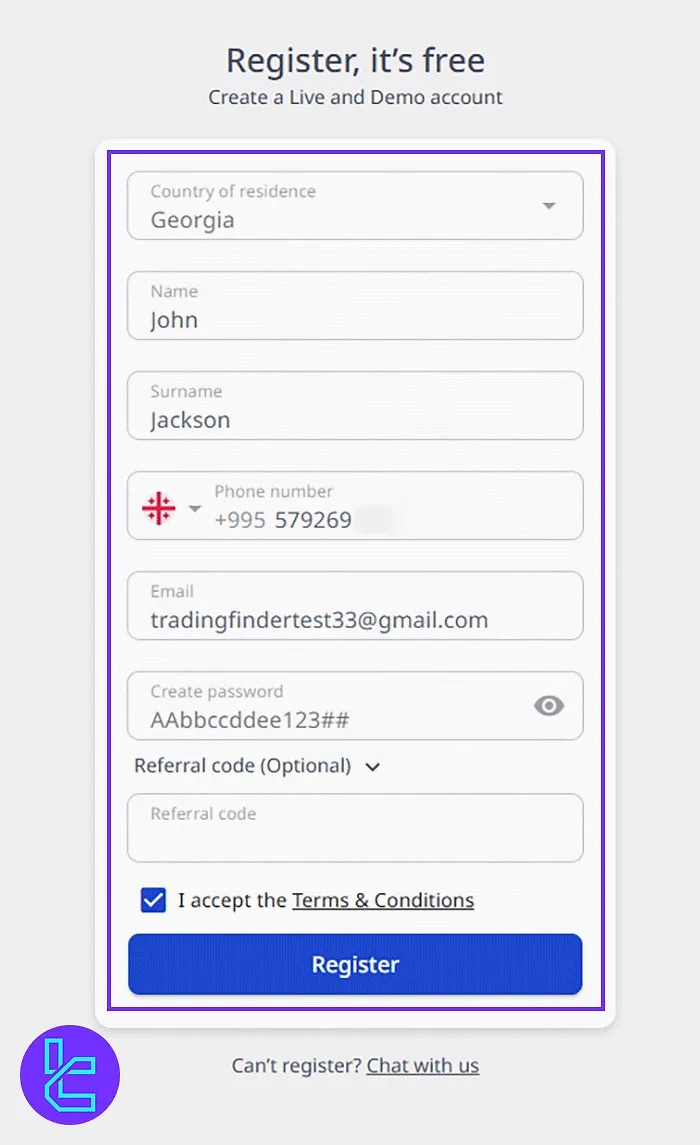

Signing Up & Verification

ZFX sign-up is straightforward and takes less than 5 minutes. You’ll need your email address, phone number, name, and a secure password.

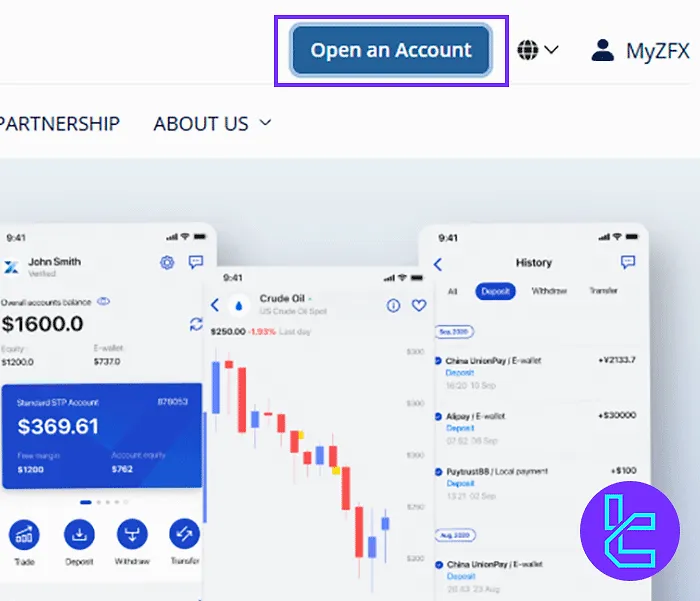

#1 Access the ZFX Registration Portal

Visit the official ZFX website and click on “Open an Account” from the homepage to begin the sign-up process.

#2 Fill in Your Details

Select your country, then provide your full name, email, and mobile number. Set a strong password (including uppercase, lowercase, numbers, and symbols). Agree to the Terms & Conditions and optionally enter a referral code.

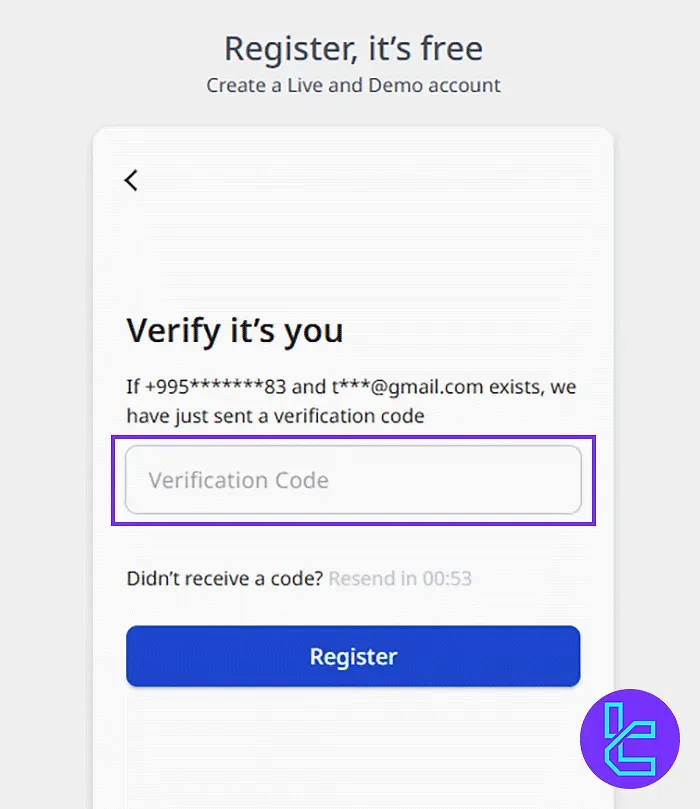

#3 Confirm Your Email

Check your email inbox for the confirmation code. Enter it on the website to verify your account and access the ZFX Dashboard.

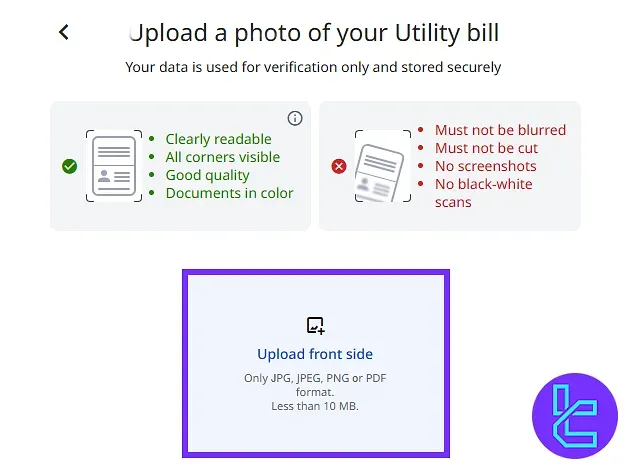

#4 ZFX Verification Guide

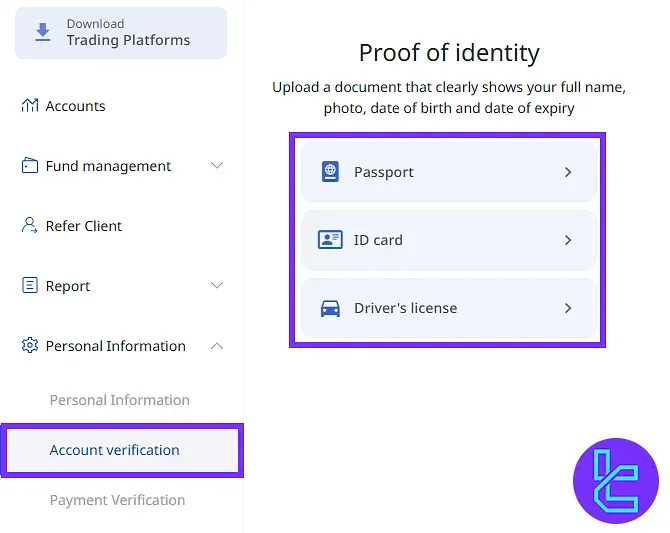

The ZFX Verification process involves a 3-step procedure that activates trading functionalities, allowing both deposits and withdrawals.

The broker reviews your proof of identity (POI) and proof of address (POA) documents typically within 1 to 2 hours.

#1 Uploading Identity Confirmation Documents

First, log in to your ZFX dashboard and navigate to the "Account Verification" option under the "Personal Information" section. Then, select the identification document you wish to upload, such as:

- National ID card

- Passport

- Driver’s license

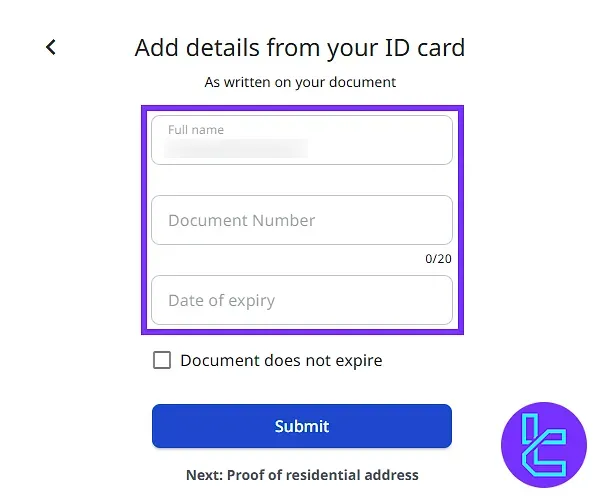

Fill in the required personal details in the provided fields:

- Full name

- Document number

- Expiration date

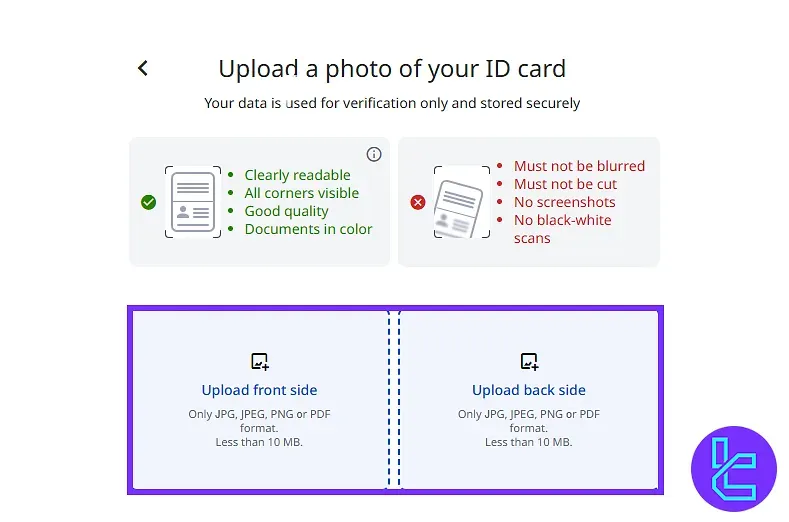

Upload clear images of both the front and back sides of the selected document, making sure all four corners are visible.

#2 Uploading Proof of Address Documents

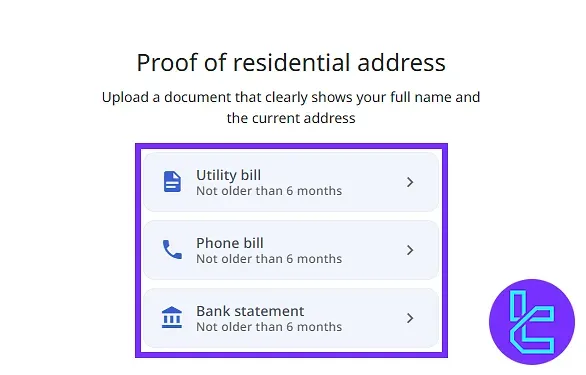

Choose the type of document to submit as your proof of address. Accepted documents include:

- Utility bill

- Bank statement

- Phone bill

Upload the document ensuring it is clear, high-resolution, and displays your full name along with your residential address.

#3 Tracking Document Review Status

Once the documents are submitted, return to your dashboard. Click on "Account Verification" to monitor the status of your document review.

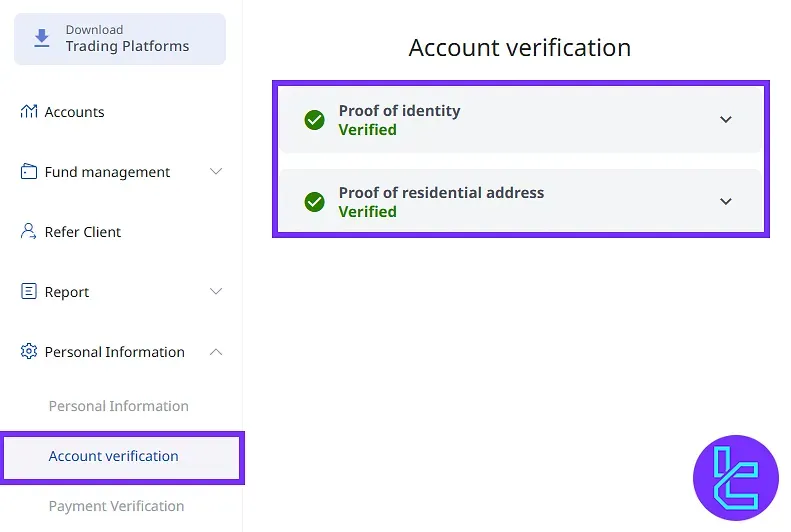

Which Platform is Available for Trading?

ZFX, like most of its competitors in the industry, supports MetaTrader 4 for trading in various markets with automated trading capabilities, customizable indicators, and essential trading tools.

However, that's not all. The broker also provides a proprietary mobile app for quick access to markets on the go. It provides real-time quotes and charts in a convenient way. You can download these platforms for your iPhone through the links below:

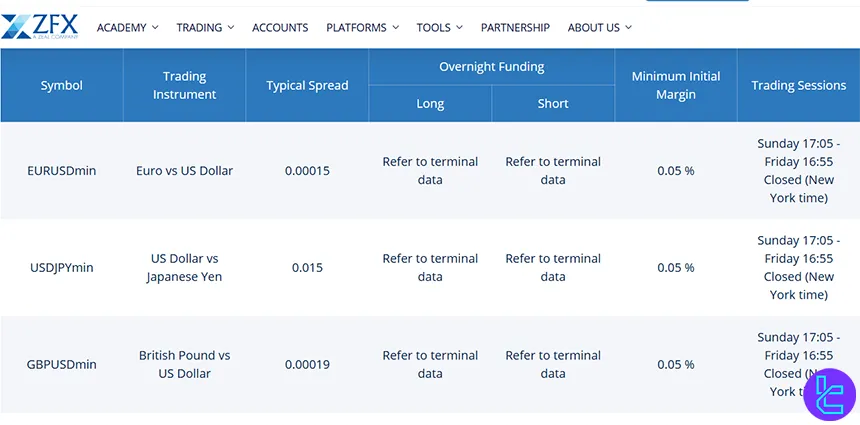

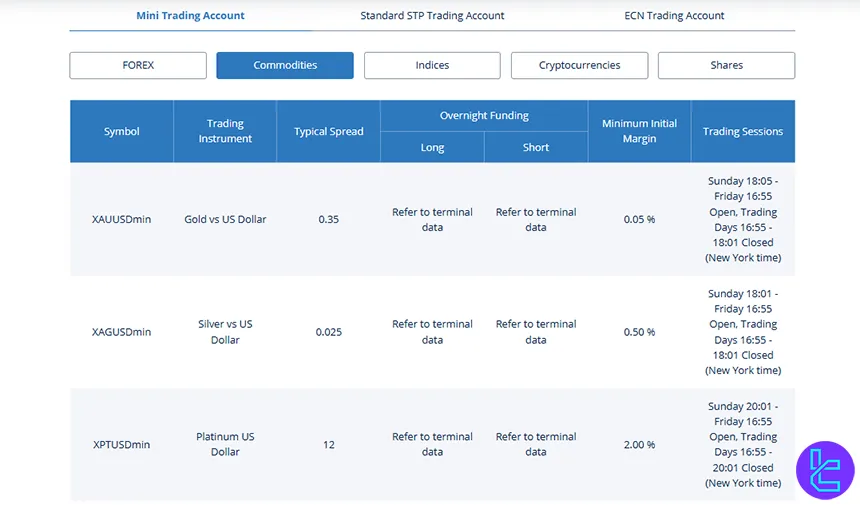

Trading Spreads And Fees

ZFX aims to provide competitive trading costs to attract traders. In this section, we will examine the spreads for each account:

Account Type | Mini | Standard STP | ECN |

Min. Spread in FX | 1.5 | 1.3 | 0.2 |

There's no data available about the trading commissions and fees on the website. Regarding inactivity or payment costs, no fees are charged in such circumstances.

Nevertheless, you may use a profit calculator tool to estimate a trading position's approximate outcome considering fees.

ZFX Swap Fees

When holding positions past 0:00 AM time in summer or 1:00 AM in winter, ZFX applies overnight interest based on the specific product.

The exact swap impact will follow the “Swap Long” and “Swap Short” values defined inside the MT4 and contract specifications.

Below are a few key points traders should know:

- Swap-free / Islamic accounts are not offered by ZFX;

- Swap rates for all instruments are visible inside MT4 (Market Watch, Right-click, Specification);

- Swap values differ by instrument and are updated directly on the trading platform.

ZFX Non-Trading Fees

Deposits and withdrawals at ZFX are handled without any fees by the broker, and all accounts are settled in US Dollars with fair and transparent currency conversions. The only possible external costs come from banks when using cross-border transfers, but the broker itself imposes no charges for account operations.

How to Deposit and Withdraw on ZFX

This broker offers a number of funding and withdrawal options to make payments easy for traders from various regions:

- Bank Wire Transfer: Ideal for large deposits, may take 3-5 business days

- Credit/Debit Cards (Visa & Mastercard): Fast funding, convenient for most traders

- E-Wallets (Skrill, Neteller, Perfect Money): Fast and secure

- Local Bank Transfers: Available in select countries for quicker processing

Deposit Methods at ZFX Broker

ZFX allows clients to fund their accounts securely using multiple methods, catering to diverse trading preferences. Deposits can be made via credit and debit cards, bank transfers, or electronic payment systems.

All accounts are settled in US Dollars, and each deposit must meet the minimum requirement, ensuring a smooth and transparent funding process for all traders.

Here are the deposit details:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Credit/Debit Card | USD | 50 | None | Generally, within 20 minutes |

Bank Transfer | USD | 50 | None | Generally, within 20 minutes |

E-payment (Neteller, Perfect Money, Skrill) | USD | 50 | None | Generally, within 20 minutes |

Withdrawal Methods at ZFX Broker

ZFX allows clients to withdraw funds using the same methods as deposits, including credit and debit cards, bank transfers, and electronic payment systems.

While the process is straightforward, clients must use their own registered accounts and be aware that timing may vary depending on banking and holidays.

Here are the withdrawal details:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Credit/Debit Card | USD | 15 | None | Within 24 hours on working days |

Bank Transfer | USD | 15 | None | Within 24 hours on working days |

E-payment (Neteller, Perfect Money, Skrill) | USD | 15 | None | Within 24 hours on working days |

Copy Trading & Investment Tools

ZFX provides typical investment options for those clients who are interested in earning passive income in addition to the profit from trading. Copy Trading and MAM in ZFX:

Copy Trading:

- Follow successful traders and automatically perform their strategies and trades

- Rankings for followed traders based on various factors and parameters

- Ideal for novice traders or those with limited time

Multi-Account Manager (MAM):

- Professional money managers can trade multiple client accounts

- Suitable for investors seeking professional management

These features allow traders to diversify their strategies and potentially benefit from the expertise of others in the market.

ZFX Broker Tradable Markets & Symbols

ZFX offers a diverse range of tradable instruments across Forex, Commodities, Indices, Cryptocurrencies, and Shares. It provides competitive leverage and a broad selection compared to industry averages for professional and retail traders.

Trading Assets in ZFX:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, minor, and exotic currency pairs | 41 | 40-70 | 1:2000 |

Commodities | Gold, silver, oil, and other raw materials | 7 | 10-20 | 1:2000 |

Indices | Major Indices | 6 | 10-15 | 1:200 |

Cryptocurrencies | Popular crypto pairs | 3 | 5-15 | 1:100 |

Shares | CFDs on leading international stocks | 26 | 100-200 | N/A |

With such a comprehensive offering, traders can explore multiple markets and create well-rounded trading strategies.

ZFX Broker Awards

ZFX has no publicly announced or officially recognized awards. There are no records of industry accolades, honors, or distinctions associated with the broker on official or review sources.

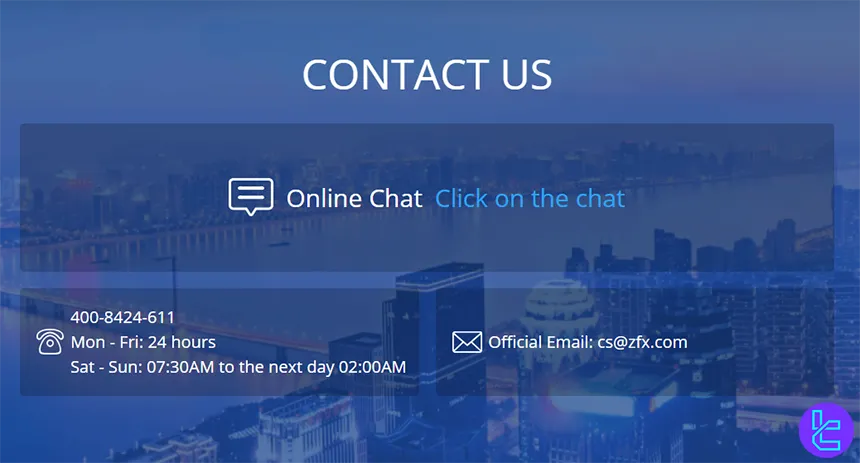

Customer Services and Support

The customer service at a company might seem insignificant at first, but when a problem or obstacle gets in the way, it matters a lot. Support Channels in ZFX:

- Live Chat: Available for everyone on the website

- Phone Support: 400-8424-611

- Email: Via cs@zfx.com

- Ticket System: On the website

Unfortunately, the broker's support department isn't available 24/7. This might be an issue because traders from different time zones work with the broker. The support is avialable 24 hours, Monday to Friday, though, and from 07:30 AM to 02:00 AM the next day on Saturday and Sunday.

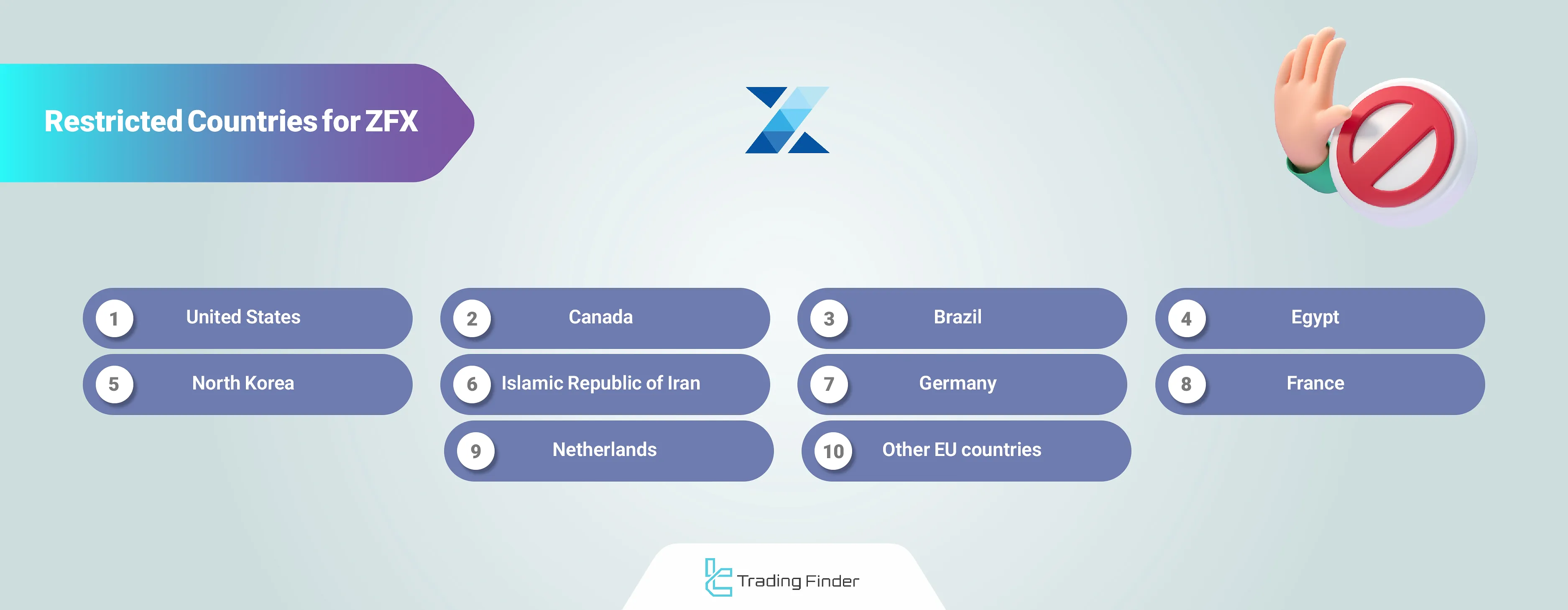

List of Banned Countries

While ZFX serves a global clientele, certain restrictions apply:

- United States

- Canada

- Brazil

- Egypt

- North Korea

- Iran

- Germany

- France

- Netherlands

- Other EU countries

Traders from these countries are currently unable to open accounts with ZFX due to regulatory constraints or company policies. It's important to check the most up-to-date information on ZFX's website or contact their support team for specific country-related queries.

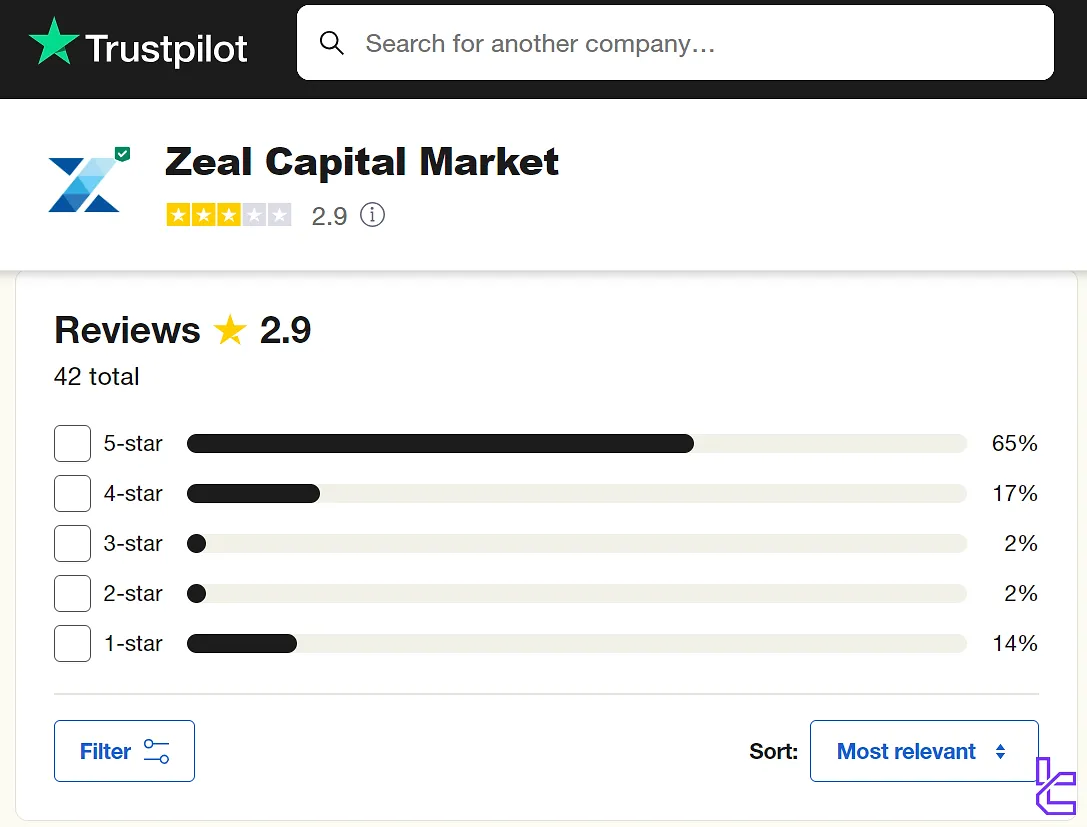

ZFX Trust Scores and Ratings

Trust scores and user reviews on reputable platforms such as ForexPeaceArmy provide valuable insights into a broker's performance and could be a useful measurement of a company's trustworthiness. Trust Ratings:

- Trustpilot: 2.9 out of 5, based on +40 reviews, with 10%+ ratings being 1-star

- ZFX FPA: 3.2/5 with less than 10 scores

While these scores indicate room for improvement, it's important to note that individual experiences may vary. Also, one of them is too low in the number of ratings. Traders should consider these reviews alongside their own research and experiences with the broker.

Education Section

We found some resources on the ZFX's website with the purpose of educating traders. We will have an overview here:

- A-to-Z Academy: Guides for beginner, intermediate, and advanced traders

- Help Center: Answers to traders' questions about verification, trading platforms, costs, etc.

- Glossary: A dictionary for terms in Forex and the financial industry with definitions

The broker also provides an economic calendar for important events, on the website. Besides, market news articles and forecasts are available.

ZFX vs. Other Brokerages

Evaluating a broker's performance in a comparison gives a better perspective into what and how it truly offers:

Parameters | ZFX Broker | Exness Broker | HFM Broker | XM Broker |

Regulation | FCA, FSA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | ASIC, FSC, DFSA, CySEC |

Minimum Spread | 0.2 Pips | From 0.0 Pips | From 0.0 Pips | From 0.6 Pips |

Commission | N/A | From $0.2 to USD 3.5 | From $0 | $0 (except on Shares account) |

Minimum Deposit | $50 | $10 | From $0 | $5 |

Maximum Leverage | 1:2000 | Unlimited | 1:2000 | 1:1000 |

Trading Platforms | MetaTrader 4, Proprietary Platform | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, Mobile App |

Account Types | Mini, Standard STP, ECN | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Micro, Standard, Ultra Low, Shares |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 100+ | 200+ | 1,000+ | 1400+ |

Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Instant |

Conclusion and final words

ZFX was reviewed on Trustpilot by more than 40 users, receiving an average trust score of 2.9/5. On the ScamAdviser platform, the user score is 3.1/5, based on +50 reviews; the trustscore released by the website itself is 1/100.