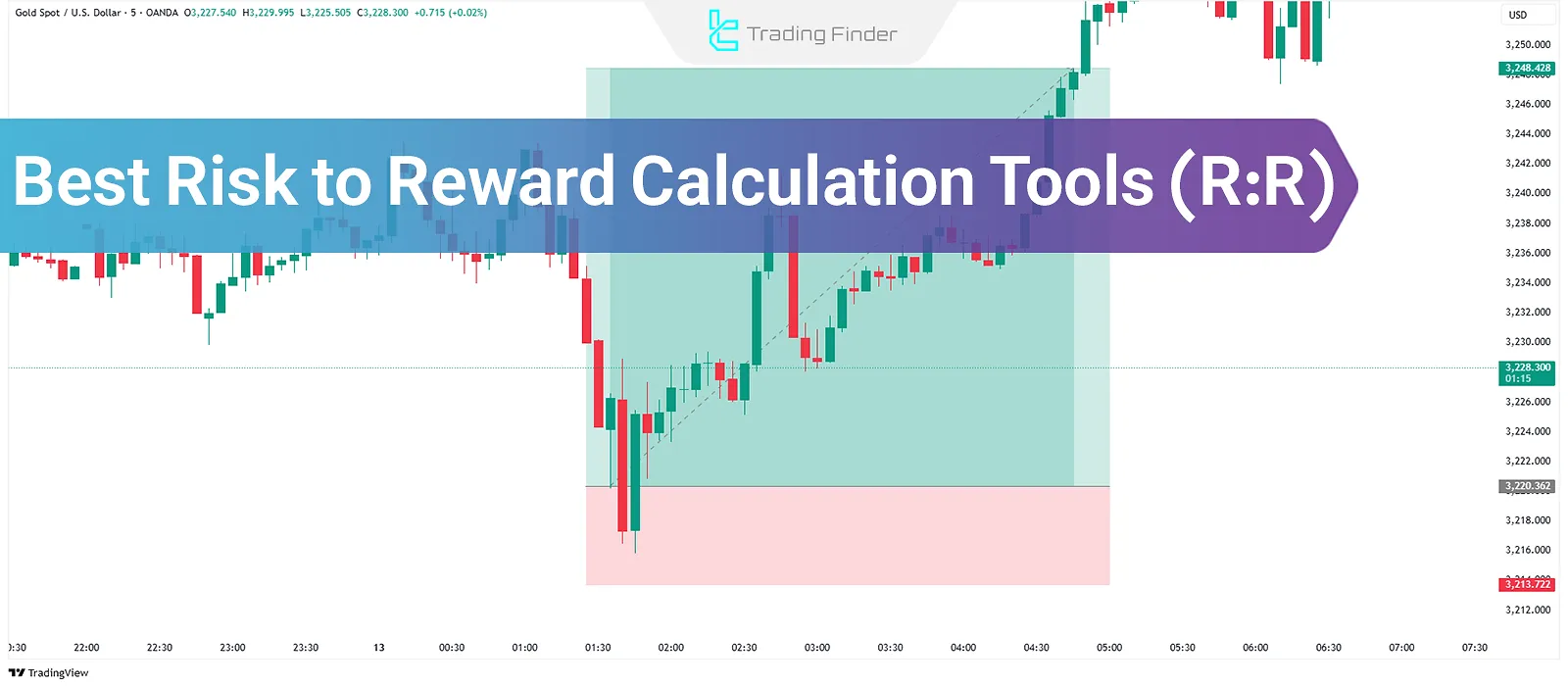

Using accurate tools for Risk to Reward Calculation (R:R) not only minimizes analytical errors but also plays a vital role in capital management and the statistical analysis of various trading strategies.

Among the most important Risk to Reward Calculation Tools are the Easy Risk to Reward Indicator, Trade Assistant Expert, Trade Manager Expert, and the Risk to Reward Calculator.

Choosing the right tool for calculating Risk to Reward depends on the trader’s style, time horizon, and level of expertise.

Scalpers use fast and visual indicators, while Swing Traders or Position Traders rely more on trade management Expert Advisors and analytical calculators.

What Is a Risk to Reward Calculation Tool?

A Risk to Reward Calculation Tool is an analytical instrument that allows a trader to assess the ratio between Stop Loss and Take Profit levels, both numerically and visually, before entering a trade.

This tool is available in various formats, including:

- As an indicator on the MetaTrader platform

- As a drawing tool on the TradingView platform

- Web-based calculators

For a better understanding of Risk to Reward calculations in trading, you can also refer to the article How to Calculate Risk to Reward Education on the website investopedia.com.

Each can be chosen depending on the trading platform and the user's needs. Why Use a Risk to Reward Calculation Tool in Trading:

- Prevents emotional trading: Defining the risk to reward ratio before entering a position leads to logical and data-driven decisions;

- Increases long-term profitability: Even with a win rate of 40% and an R:R ratio above 2, one can achieve sustainable profit over time by identifying potential profit relative to risk;

- Capital and position sizing management: Based on account size and risk percentage, the tool calculates the appropriate trade size, thus avoiding heavy losses and enabling structured risk management;

- Evaluate trading strategy performance: By consistently recording R:R ratios, traders can assess and optimize the strategy’s quality. Frequent ratios below 1 indicate a weak strategy.

Best Risk to Reward Calculation Tools in Financial Markets

Fast R:R calculation requires tools that instantly display entry point, stop loss, and take profit on the chart.

These tools visually and numerically present the profit-to-loss ratio on the chart. Here are some of the most practical Risk to Reward Calculation Tools:

- Easy RRR Expert

- RRR with Lines Indicator

- RRR with Multiple Orders Indicator

- RRR with Last Order Indicator

- R/R Ratio Calculator Expert

- Trade Manager TF Expert

- Trade Assist TF Expert

- Easy Trade Manager Expert

- Take Profit & Stop Loss Calculator Indicator

Easy RRR Expert

The Easy Risk to Reward Indicator is a practical MetaTrader tool specifically designed to calculate the reward-to-risk ratio in trades.

It visualizes two zones on the chart:

The red area represents Stop Loss, showing trade risk. The green area indicates Take Profit, displaying potential profit visually.

RRR with Lines Indicator

The Risk to Reward Ratio Indicator with Lines (RRR with Lines) is one of the practical tools in the MetaTrader platform for capital management.

This indicator, by drawing three adjustable horizontal lines, allows traders to set entry, stop-loss, and take-profit levels, and accurately defines the Risk to Reward ratio.

- Download RRR with Lines Indicator for MetaTrader 5

- Download RRR with Lines Indicator for MetaTrader 4

RRR with Multiple Orders Indicator

This analytical tool automatically calculates the R:R ratio after trade execution and SL/TP definition.

It's ideal for traders managing multiple simultaneous positions and displays the R:R ratio in a visual box on-screen.

- Download RRR with Multiple Orders Indicator for MetaTrader 5

- Download RRR with Multiple Orders Indicator for MetaTrader 4

RRR with Last Order Indicator

This MetaTrader tool calculates the R:R ratio based on the last active order, measuring the entry, stop loss, and take profit levels and displaying the result precisely on the chart’s top-left corner.

- Download RRR with Last Order Indicator for MetaTrader 5

- Download RRR with Last Order Indicator for MetaTrader 4

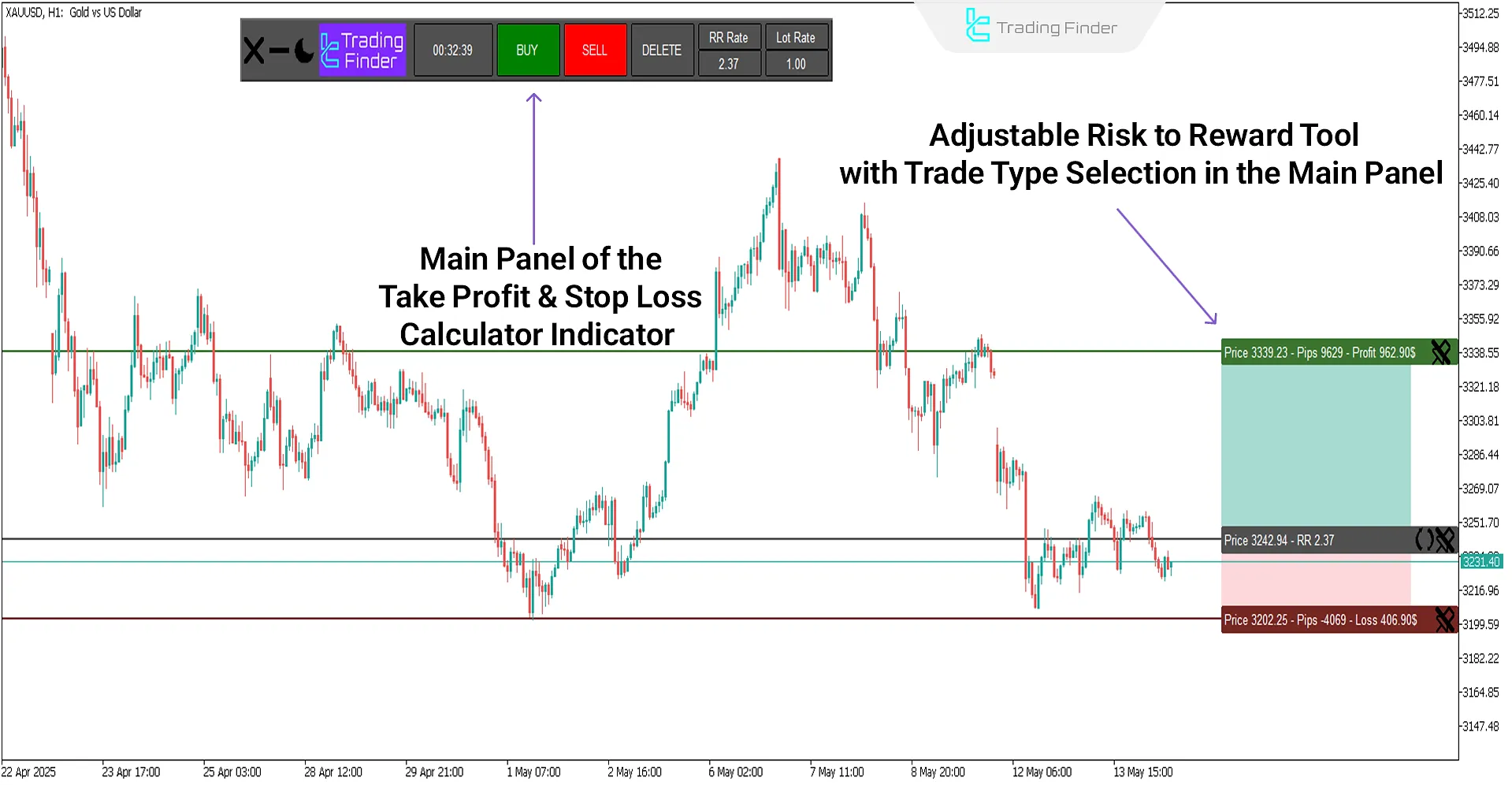

R/R Ratio Calculator Expert

The R/R Ratio Calculator Expert is a specialized MetaTrader tool for setting stop loss, take profit, and calculating the precise risk to reward ratio of each trade.

It includes a control panel and a movable box to adjust and display entry, SL, and TP either by dragging lines or defining pip values.

- Download R/R Ratio Calculator Expert for MetaTrader 5

- Download R/R Ratio Calculator Expert for MetaTrader 4

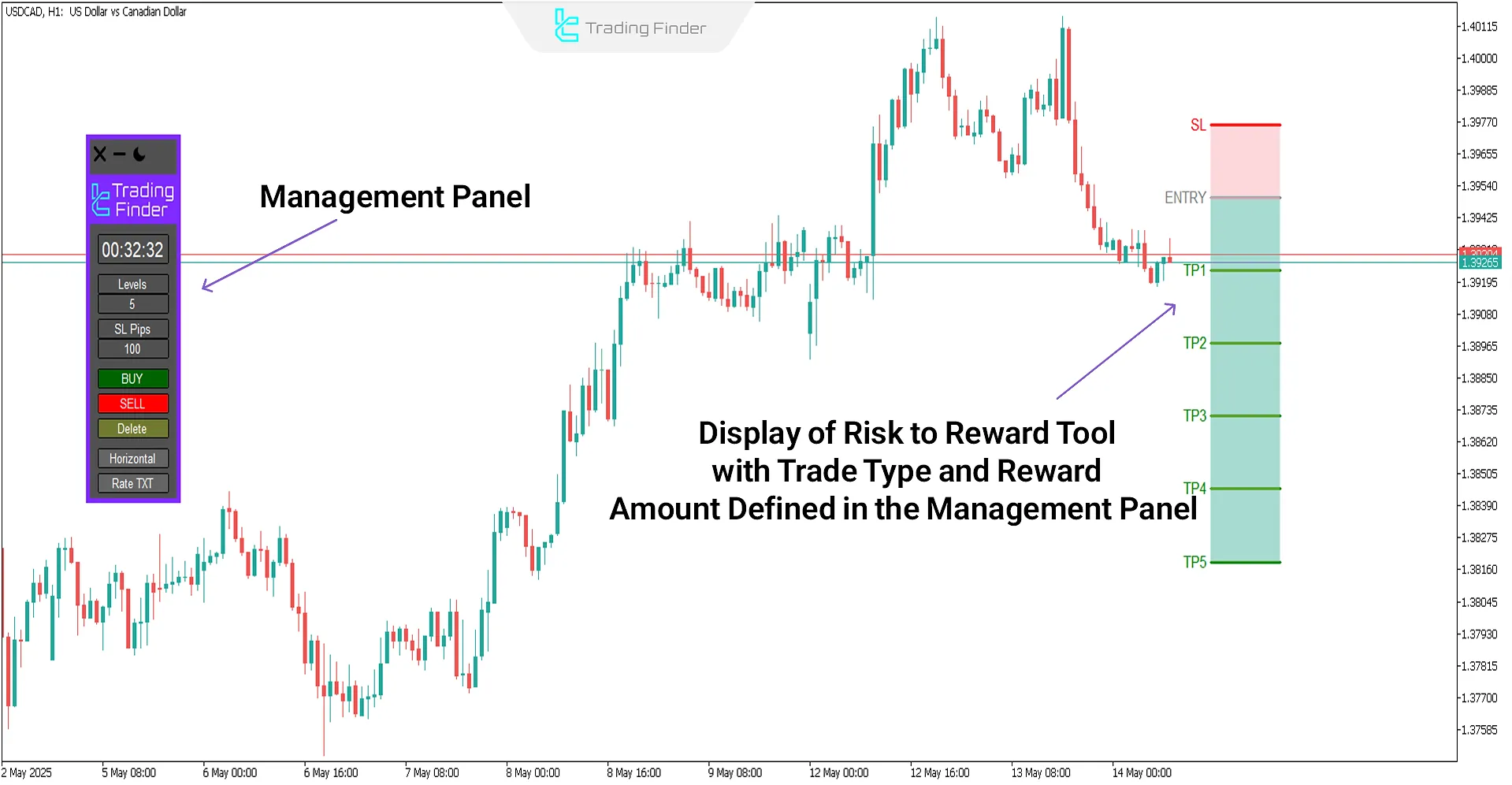

Trade Manager TF Expert

This expert provides professional trade, risk, and capital management on MetaTrader.

It offers two independent panels including Trade Manager and Magic Panel, allowing features like Partial Exit, BreakEven, Trailing Stop, accurate order execution, entry volume control, and TP setting.

Trade Assist TF Expert

The Trade Assist TF Expert Advisor, also known as the Trade Assistant, is one of the specialized tools developed by the Trading Finder team for the MetaTrader platform.

It enables traders to manage capital and risk intelligently and directly on the chart.

This Expert Advisor provides a dynamic and user-friendly panel that allows users to manage multiple positions simultaneously and accelerate their trading decision-making process.

Among the key features of this trading assistant are moving the stop loss to the entry point (Break Even), enabling a trailing stop, and displaying a candle-closing timer.

Additionally, the ability to partially close a trade (Partial Close) is one of the practical features of this tool.

The Trade Assist TF Expert Advisor is designed for various trading styles, including day trading, scalping, and short-term trading, and can be used across different markets such as Forex, Stocks, and Indices.

This tool provides three separate tabs in its panel, each offering dedicated options for order management and trade control.

In the buy or sell section, the trader can calculate lot size, stop loss (SL), and take profit (TP) before entering a trade and even choose their preferred method for setting the take profit.

This feature is particularly valuable for currency pairs like XAU/USD and AUD/JPY, as it allows for precise position control and the determination of optimal exit points.

In the risk management (MM) section, features such as closing all trades (Close All), closing pending orders (Close Pending), and collectively moving trades to Break Even status are available.

Overall, the Trade Assist TF Expert Advisor is a strategic tool for traders seeking to enhance position management quality, reduce risk, and increase execution speed in MetaTrader.

Using this Expert Advisor is especially beneficial for beginner traders who need a simple yet powerful panel, making it a professional starting point in their trading journey.

Easy Trade Manager Expert

A practical Forex tool with a simple panel to set Stop Loss, Take Profit, and calculate Risk to Reward.

It also allows users to customize the chart theme and manage advanced trading settings.

- Download Easy Trade Manager Expert for MetaTrader 5

- Download Easy Trade Manager Expert for MetaTrader 4

Take Profit & Stop Loss Calculator Indicator

This MetaTrader tool provides fast and accurate SL/TP visualization and offers:

- SL/TP settings for Buy/Sell

- Lot-based position sizing

- R:R ratio display

- Candle countdown timer

It enables precise strategy execution and effective control.

- Download Take Profit & Stop Loss Calculator Indicator for MetaTrader 5

- Download Take Profit & Stop Loss Calculator Indicator for MetaTrader 4

Using the Risk to Reward Calculation Tool

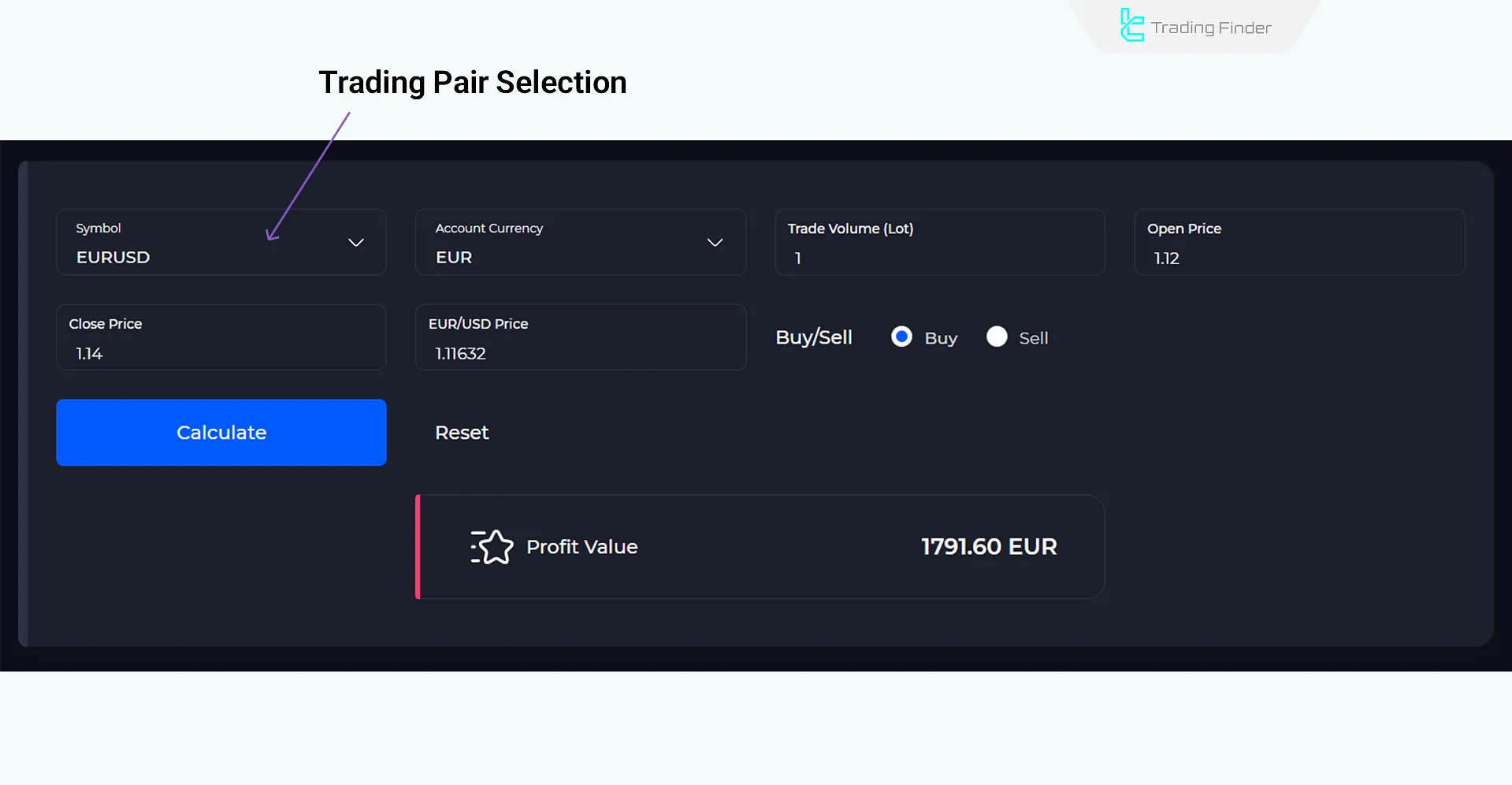

The profit calculator computes the profit by inputting five parameters:

- Currency pair

- Account currency

- Position size

- Open price

- Close price

It’s designed for Forex and is entirely free to use.

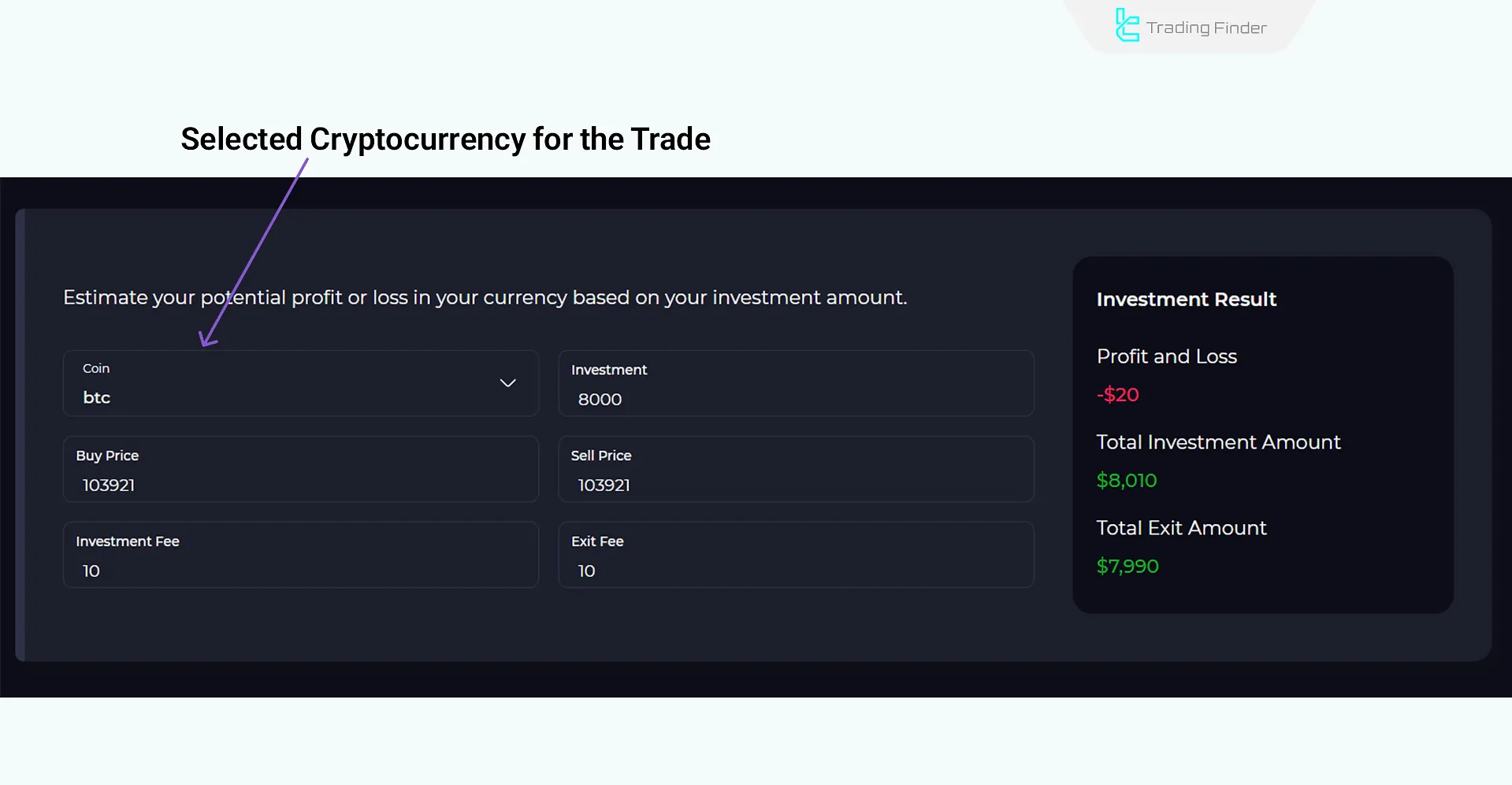

The Crypto Profit Calculator computes final profit/loss based on investment amount, entry/exit prices, and buy/sell fees.

Advantages and Disadvantages of Using Risk to Reward Calculators

Excessive reliance on Risk to Reward calculators can hinder the development of analytical skills and a deeper understanding of risk ratios.

Therefore, their use should be complemented by technical knowledge, capital management, and trading psychology.

The table below outlines some of the advantages and disadvantages of using Risk to Reward calculators:

Advantages | Disadvantages |

Time-saving | Creates dependency and reduces personal analysis |

Reduces calculation errors | Lack of deep understanding of the logic behind ratios |

Allows quick comparison of scenarios | Limitations in some free tools for certain currency pairs or assets |

Risk to Reward Calculation Formula

The calculation of risk and reward, in its simplest form, is obtained by dividing the amount of risk taken in a trade by its potential profit.

Additionally, based on the success rate or Win Rate of a trading strategy, one can calculate the minimum ratio required to reach breakeven or profitability.

Real Example of Risk to Reward Calculation

For instance, if your strategy has a 50% success rate, the minimum Risk to Reward ratio must be 1:1 to stay breakeven in the long run.

In cases where the win rate is 30%, the optimal Risk to Reward ratio should be approximately 1:2.33 to achieve a positive overall return.

Conversely, if the strategy’s success rate reaches 70%, even lower ratios such as 1:0.5 can still yield profits, since a higher win rate compensates for smaller risk exposure.

The educational video “How to Calculate Risk to Reward” from the Financial Wisdom YouTube channel helps traders better understand how to calculate Risk to Reward in trading.

Choosing the Best Risk to Reward Tool Based on Trading Style

Selecting the Best Risk to Reward Calculation Tool depends directly on the trader’s style. Each style requires different factors such as execution speed, calculation precision, visual interface, and analytical type.

Modern expert advisors now integrate functions like R:R calculation, trade sizing, SL/TP management, and order execution into centralized systems for advanced Risk to Reward Calculation Tools.

Common Mistakes in Using Risk to Reward

Incorrect use of the Risk to Reward Ratio can lead to the failure of trading strategies. The most common mistakes traders make when applying Risk to Reward are:

- Focusing solely on the numerical ratio without considering market conditions and actual volatility;

- Ignoring the probability of price reaching the take-profit level without analyzing price structure;

- Choosing unrealistic ratios, such as 1:10, in a market with insufficient volatility;

- Complete reliance on calculators, neglecting capital management and trading psychology.

Conclusion

The Risk to Reward Ratio (R:R) tools presented such as RRR with Lines, R/R Ratio Calculator, Trade Manager TF, and others are available as MetaTrader experts or web calculators and play a significant role in risk control, capital optimization, and strategy evaluation.