In binary options trading, decision-making often relies on short-term market movements. In such conditions, oscillators become highly important since these tools are capable of providing signals in short timeframes, where many traditional indicators lag.

Moreover, the proper use of oscillators helps in identifying the right time to enter or exit a position.

Oscillators in Binary Options

A binary options oscillator is a technical tool that shows momentum and overbought or oversold conditions within a fixed range. Unlike trend indicators, these tools identify potential reversal or continuation points.

Oscillators such as Stochastic, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Average Directional Index (ADX), each with different calculation methods, reveal market strength and weakness.

Combining these oscillators with tools such as moving averages or support and resistance levels enhances the accuracy of entries and exits in trades.

The Best Binary Options Oscillator

Oscillators are among the most important technical analysis tools in binary options.

By measuring momentum and overbought or oversold conditions, they allow traders to identify reversal or continuation points. The best binary options oscillators include:

Stochastic

Stochastic in binary options is one of the oldest oscillators, analyzing price movement relative to the highest and lowest values within a specified timeframe.

The scale of this indicator is defined between 0 and 100; values above 80 indicate overbought conditions, and values below 20 indicate oversold conditions.

Relative Strength Index (RSI)

The Relative Strength Index oscillator works similarly to Stochastic but focuses more on the intensity of upward and downward movements.

Readings below 30 are considered oversold, and readings above 70 are considered overbought in binary options. RSI is often used to confirm price reversals.

Average Directional Index (ADX)

The main focus of the ADX oscillator is on trend strength rather than direction. Values below 20 indicate a weak trend, while values above 50 indicate strong momentum.

Combining ADX with indicators that specify trend and Sideways marketdirection provides more reliable signals in binary options.

MACD

The MACD oscillator in binary options uses moving averages to identify trend changes.

The combination of the MACD line, signal line, and histogram enables traders to detect divergences and potential entry or exit points.

Awesome Oscillator (AO)

The Awesome Oscillator is a simplified version of MACD that displays market momentum based on the difference between 5-period and 34-period moving averages calculated at candlestick midpoints.

Strategies such as Twin Peaks, Saucer, and Crossover extend the application of this oscillator in binary options strategies.

Oscillators Role in Binary Options

A binary options oscillators is a technical tool that shows momentum and overbought or oversold conditions within a fixed range. Unlike trend indicators, these tools identify potential reversal or continuation points.

Oscillators such as Stochastic, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Average Directional Index (ADX), each with different calculation methods, reveal market strength and weakness.

Combining these oscillators with tools such as Simple moving averages or support and resistance levels enhances the accuracy of entries and exits in trades.

Advantages and Disadvantages of Oscillator Strategies in Binary Options

Oscillators in binary options are used to identify overbought, oversold conditions, and momentum changes.

These oscillators have both advantages and disadvantages that traders should be aware of in order to reduce errors in their trades.

The table below compares the most important pros and cons of oscillators in binary options:

Advantages | Disadvantages |

Quickly identify overbought and oversold conditions | Possibility of false signals in ranging or highly volatile markets |

Detect divergences and potential trend reversals | Need to be combined with other tools such as price action or support and resistance |

Provide entry and exit signals in short timeframes | Delay in signal generation for some oscillators like MACD |

Useful for risk management and timing entries in binary options | High sensitivity to small market fluctuations and price noise |

Can be used alongside indicators and other technical analysis tools | Misinterpretation by beginner traders |

Oscillator Strategy in Binary Options

In binary options, the value of oscillators becomes evident when used within strategies.

Identifying overbought and oversold levels, confirming trend strength, or detecting divergences are distinct capabilities of oscillators, which, when combined with other tools, form a trading plan.

Examples of oscillator strategies in binary options:

Trading Strategy with Awesome Oscillator (AO)

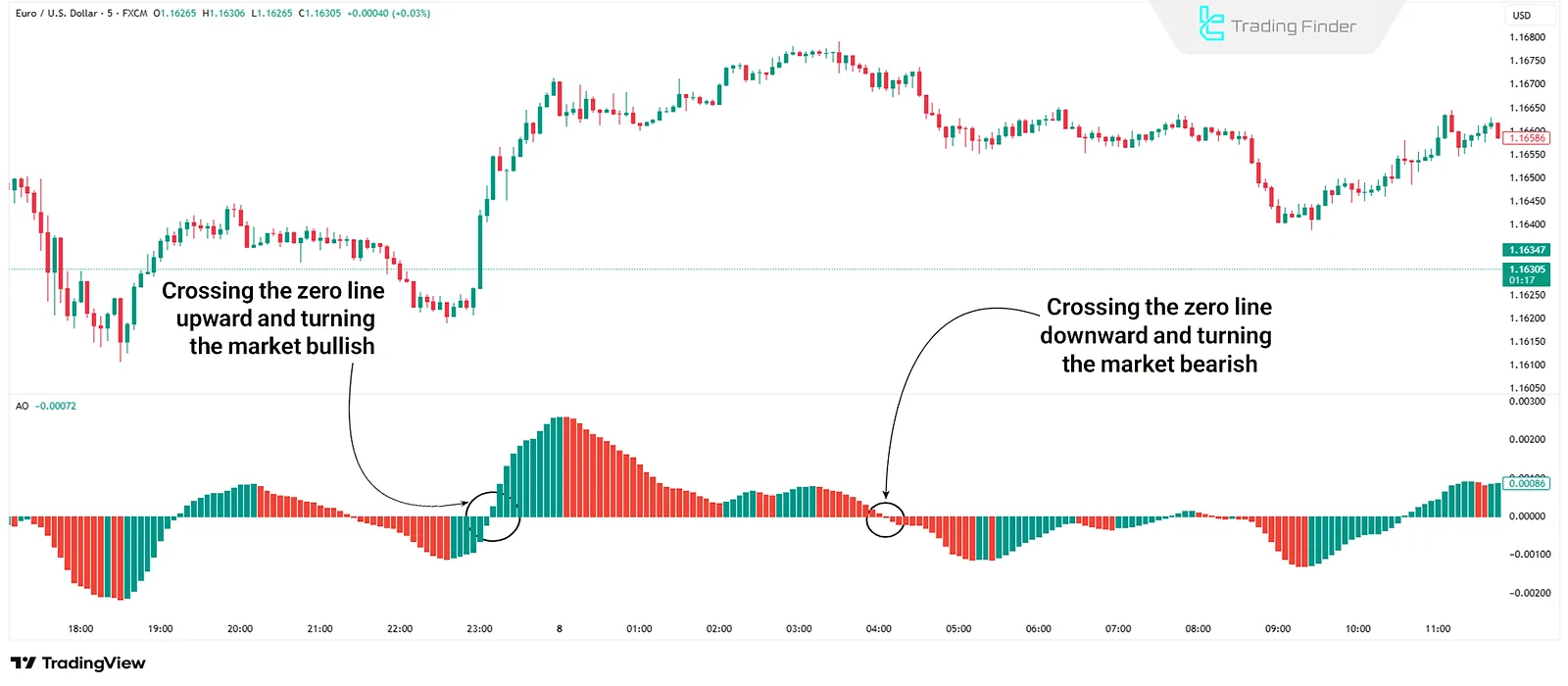

The main strategy for AO in binary options includes three common methods:

- Twin Peaks: Two consecutive peaks above the zero line signal bearish conditions, while two consecutive troughs below the zero line signal bullish conditions. The primary factor validating signals in binary options is the difference in peak heights and bar colors;

- Saucer: A faster pattern for detecting momentum changes in binary options. In a bullish setup, two consecutive red bars above zero appear after a green bar. In a bearish setup, two consecutive green bars below zero appear after a red bar;

- Crossover: Bars crossing from below zero upward signal bullish momentum in binary options, while the opposite indicates bearish momentum.

Combining Oscillators with Moving Averages

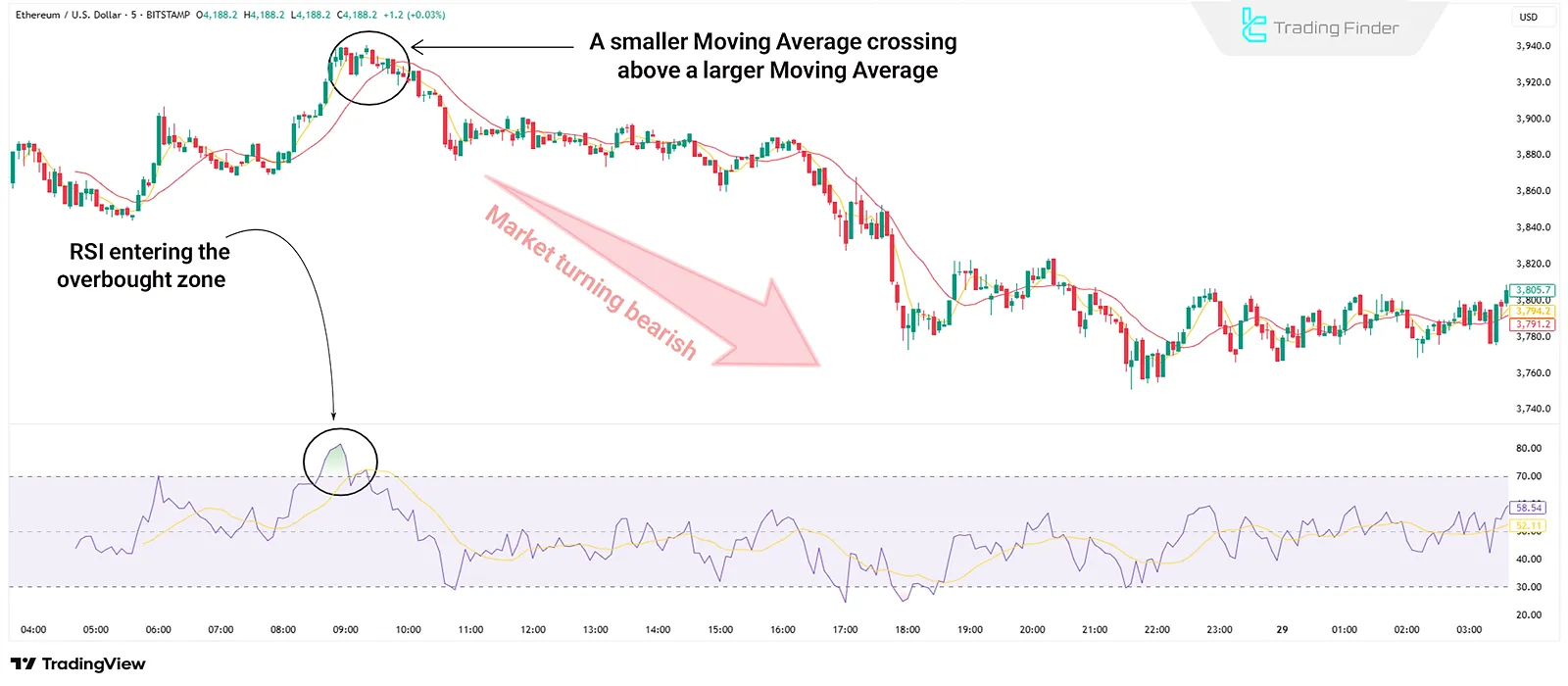

Combining AO, RSI, or MACD with moving averages (MA) increases signal strength.

For instance, when RSI is in the overbought zone and at the same time a short-term moving average crosses above a long-term moving average, the likelihood of a trend reversal increases significantly.

This overlap reduces errors from using a single binary options oscillator.

Advanced Tips in Using Oscillators in Binary Options

Oscillators in binary options are categorized as leading [RSI and Stochastic (early signals for overbought and oversold)] and lagging [MACD (trend confirmation tool with delay)].

Using them individually is highly risky since the market can remain overbought or oversold for extended periods. Combining oscillators with price action and key levels generates more reliable signals.

Conclusion

In binary options trading, oscillators are crucial tools for measuring momentum and overbought or oversold conditions.

Indicators such as Stochastic, RSI, MACD, ADX, and Awesome Oscillator, each with different calculation methods, allow traders to identify reversal or continuation points.

Oscillators are most effective when used within structured strategies. Patterns such as Twin Peaks in AO and RSI overlap with moving averages are widely applied in binary options trading.

However, relying on a single oscillator alone is highly risky. Combining them with price action and key levels improves signal reliability and reduces error probability.