Win Rate in Trading represents the percentage of successful trades out of the total number of trades. By analyzing and calculating this metric, traders can evaluate the long-term performance of different trading strategies. This metric can easily be calculated on the MetaTrader 4 and Meta Trader 5 platforms.

However, the win rate alone is not considered a definitive metric for evaluating the quality of a strategy in win rate trading and must be analyzed within the context of trade structure, risk management methodology, and consistency of plan execution.

A strategy may exhibit a high win rate over a short period, including in markets that rely on crypto win rate statistics, yet in the absence of proper loss control, it may fail to deliver sustainable performance in the long term.

For this reason, assessing the win rate becomes meaningful only when it is accompanied by a precise analysis of trade results and actual price behavior.

What is Win Rate?

Win Rate refers to the percentage of profitable trades within a trading strategy compared to all executed trades. By calculating the number of winning trades relative to the total, traders can estimate the probability of success before entering a position.

Each trading strategy, depending on various conditions, has a different Win Rate. To evaluate and calculate this rate, the chosen strategy must be tested over a specific period and all relevant observations recorded in a trading journal.

Why Is Win Rate Important?

If the Win Rate of a trading strategy is unknown, it indicates that the strategy hasn’t been thoroughly backtested. Using a strategy without testing it in advance involves an illogical level of risk.

Furthermore, when a trader is unaware of their strategy’s Win Rate, it weakens their trust in it, often leading to poor execution in real-time markets. Conversely, having a reliable Win Rate helps control emotions and enhances trading performance.

In the win rate training article on the Investopedia website, this concept has been taught in a comprehensive manner.

Why is Win Rate Alone Not an Accurate Metric for Performance Evaluation?

The success rate in Forex, when examined within the framework of win rate in trading, if analyzed independently, can create a misleading perception of a strategy’s true performance.

According to the win rate trading definition, a high winning percentage does not necessarily indicate sustainable profitability, because the size of profits from winning trades and the amount of losses from losing trades play a decisive role in the final outcome.

In many strategies, including those applied to winrate in crypto trading, focusing solely on increasing the win rate causes winning trade profits to shrink or hidden risk to increase. Under such conditions, a few losing trades can eliminate a significant portion of previous gains.

For this reason, win rate analysis becomes meaningful only when it is evaluated alongside entry and exit structure and risk management.

How to Calculate the Win Rate of a Trading Strategy

To calculate the Win Rate of a strategy, you should perform at least 20 trades. However, the Win Rate calculated from just 20 trades won’t be highly accurate, and the value may shift significantly as more trades are added.

Generally, it’s necessary to calculate the average win ratio over a larger sample size to ensure the result is valid and reliable.

Formula to calculate Win Rate:

On the ClayTrader YouTube channel, this concept has been taught in video format:

Example of Calculating Trading Win Rate

To better understand the concept of win rate forex, examining it through a simple numerical example is essential. In this example, only the number of winning and losing trades is considered, and no other factor is included in the calculation.

Assume that a trader has executed 50 trades within a specific period. Out of these, 30 trades were closed with profit and 20 trades ended in loss.

Under these conditions, the win rate formula trading is applied as follows:

- Number of winning trades: 30

- Total number of trades: 50

As a result, this trader’s trading win rate equals 60%. This figure indicates that during this period, 60% of the trades achieved a positive outcome.

However, this value alone does not represent the complete quality of performance and must be analyzed alongside trade structure, risk management, and the sustainability of results.

How to View Win Rate in MetaTrader

Various trading platforms allow users to download performance reports to help identify and resolve issues within their trading strategies. In most cryptocurrency exchanges, there is an option in the account's reporting section that, when enabled, downloads detailed transaction reports for review.

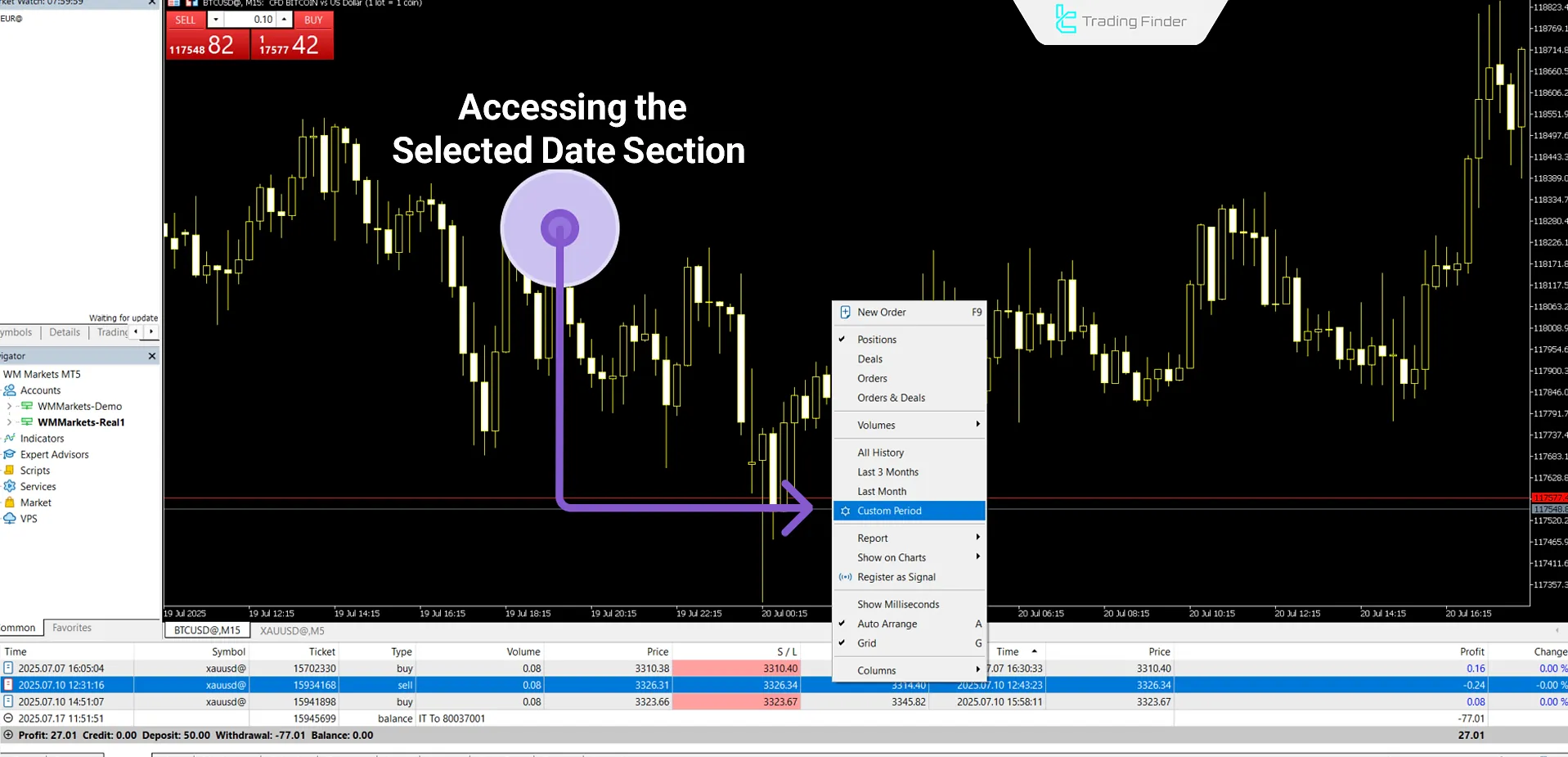

In MetaTrader, downloading such reports must be done manually by the trader using the steps below:

- Open the History section from the Terminal window;

- Right-click on any trade and choose “Custom Period”;

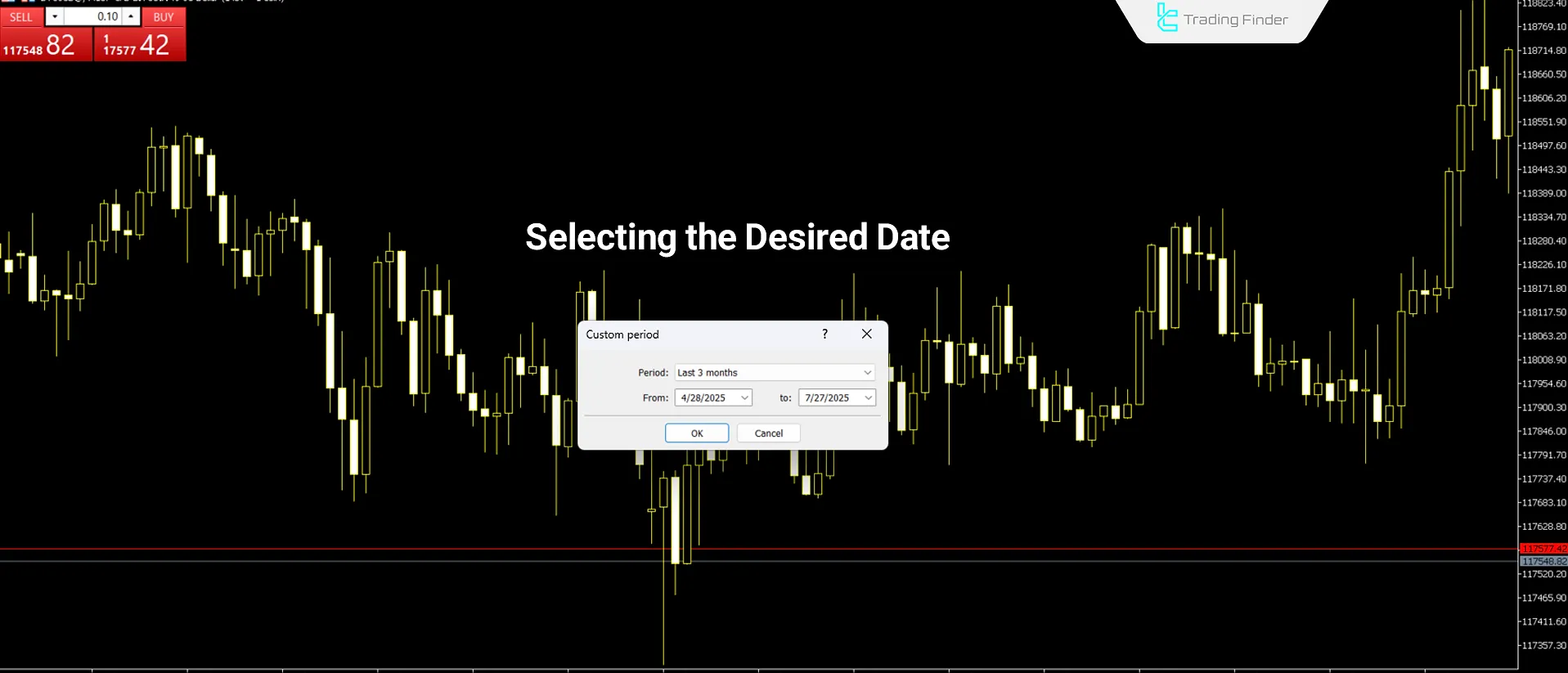

- Select the specific time period for which you want the report and confirm;

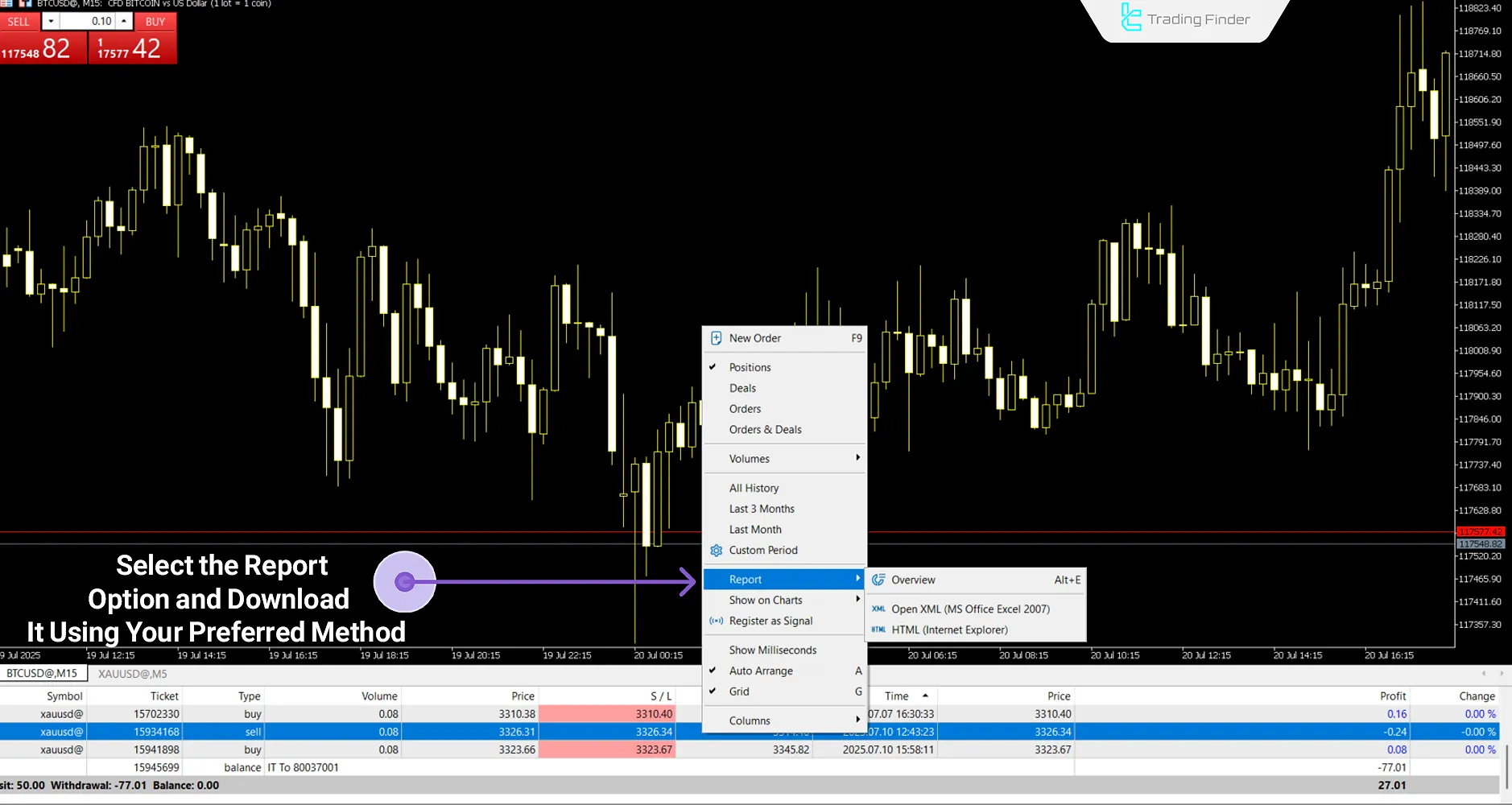

- Right-click again on a trade, select “Report,” then choose a report format.

Report Format Options in MetaTrader

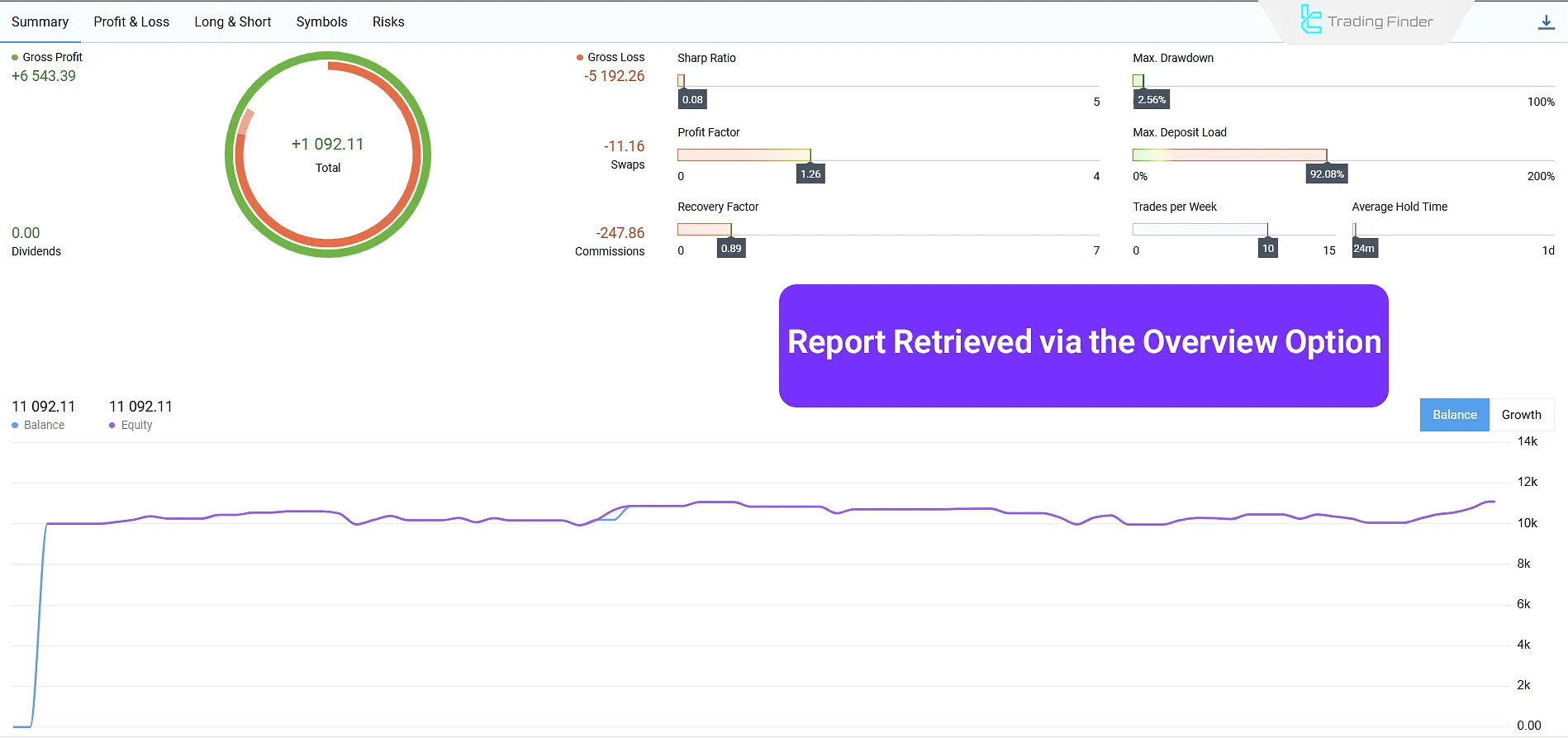

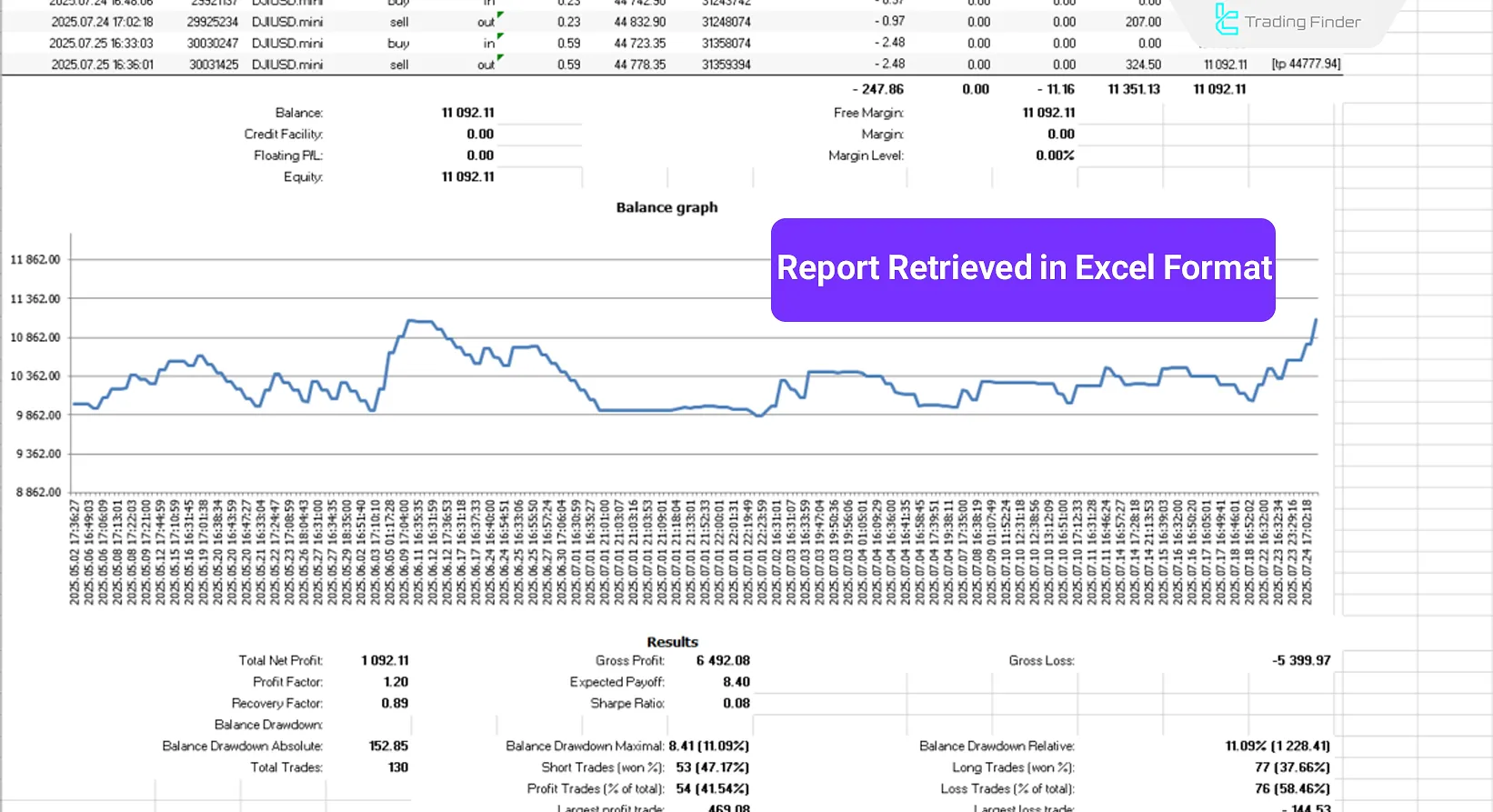

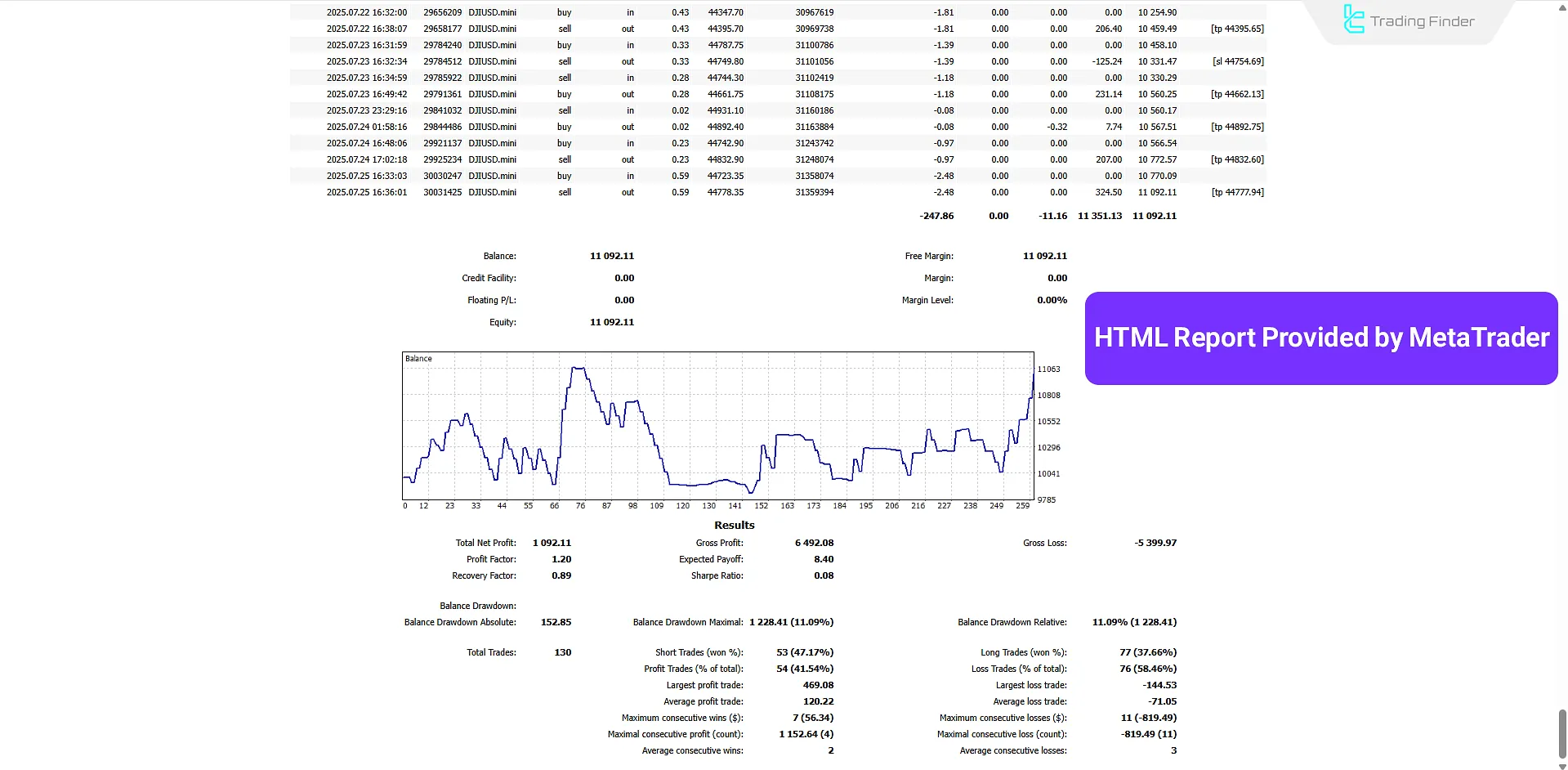

- Overview: This option adds a panel next to the charts pinned by the trader. It dynamically calculates and displays all trading activity. The various sections of this report can be downloaded as PDF files;

- XML: Generates an Excel-compatible (.xls) report containing detailed activity and strategy performance;

- HTML: Displays the report in the user’s default browser as a tab.

The Importance of the Sequence of Winning and Losing Trades in Win Rate Chart Trading

Two strategies may have the same win rate ratio, yet they can create completely different experiences for the trader. The reason for this difference lies in the way winning and losing trades are distributed.

If losing trades occur consecutively, psychological pressure increases and the likelihood of deviating from the trading plan becomes higher, even when applying a high win rate forex strategy.

Analyzing the sequence of trades alongside the win rate provides a more accurate perspective on the practical executability of a strategy and is not limited solely to the numerical winning percentage.

The Relationship Between Win Rate and Risk-to-Reward Ratio

You cannot determine whether a strategy is profitable based solely on the Win Rate. The first factor to evaluate is the Risk-to-Reward Ratio. For example, imagine a strategy with a Win Rate of 50% and a Risk-to-Reward Ratio of 1:1. After executing 100 trades, each with a 1% risk, your account balance will remain unchanged.

However, if the same strategy has a Risk-to-Reward Ratio of 1:2, then after 100 trades with 1% risk each, the account will grow by 25%.

The Difference Between Risk-to-Reward and Win Rate Meaning

Risk-to-reward and win rate are two independent yet complementary metrics in evaluating trading performance.

Each of these indicators reflects a different dimension of a strategy’s quality, and analyzing them separately can lead to an incomplete interpretation of trading results, even when applying the win rate trading formula.

Risk-to-Reward and Win Rate Table:

Comparison Metric | Win Rate | Risk-to-Reward |

Definition | Percentage of winning trades relative to total trades | Ratio of potential profit to potential loss |

Main Focus | Number of wins and losses | Size of profit versus amount of risk |

Direct Impact on Trader Psychology | High | Moderate |

Dependency on Trading Style | Very high | Dependent on trade structure |

Possibility of Being High While Still Losing | Exists | Less likely |

Role in Performance Sustainability | Limited on its own | Effective in controlling outcomes |

Primary Application | Statistical evaluation of trades | Designing entry and exit points |

Logical Win Rate Across Different Trading Styles

Win rate behaves differently in each trading style, and no single number can serve as a universal benchmark for all strategies. Market structure, trading timeframe, and profit objectives within each style directly influence the winning percentage.

- Scalping: The win rate is usually higher, because trades are executed over short timeframes and small profit targets are prioritized;

- Swing trading: The win rate is more balanced, with primary focus on holding profitable trades and capturing medium-term price movements;

- Trend following: The win rate is often lower, but winning trades account for the majority of total profits;

- Range market: The win rate can be high, but the strategy becomes more sensitive to price range breakouts.

Ways to Improve the Win Rate of a Trading Strategy

Numerous trading strategies have been developed by combining elements of technical analysis and fundamental analysis. No strategy can ever guarantee a 100% Win Rate, and the possibility of losses always exists.

Also, the actual outcome of a strategy depends on how well the trader executes it. Two different traders using the same approach may experience different Win Rates, depending on factors such as personality, market selection, trading hours, and more.

Several methods can be used to improve the Win Rate in Trading, including maintaining a trading journal, customizing the strategy, incorporating additional indicators, and more:

- Trading Journal: Documenting trade details over time allows traders to identify weak points and fix them, thereby increasing the strategy’s effectiveness;

- Supporting Indicators: Various indicators, depending on the trading strategy, help filter false signals, Risk Mnagement, and increase the trade success rate;

- Combining Strategies: Using concepts from multiple strategies together may create a new strategy with a different Win Rate. However, this requires experience otherwise, it may backfire;

- Strategy Customization: Tweaking or modifying existing strategies can result in a personalized system with a higher success rate;

- Having a Trading Plan: A clear trading plan enhances emotional control and risk management, which helps avoid unnecessary losses that could reduce the Win Rate.

The Relationship Between Win Rate and Drawdown in Account Sustainability

A high win rate does not always mean lower capital decline. If position sizing or stop loss is not properly controlled, even strategies with a high winning percentage can generate significant drawdown.

Drawdown indicates how much pressure the account has endured and whether the strategy is reliable in terms of long-term survival. Combining win rate analysis with drawdown evaluation provides a more realistic picture of performance sustainability.

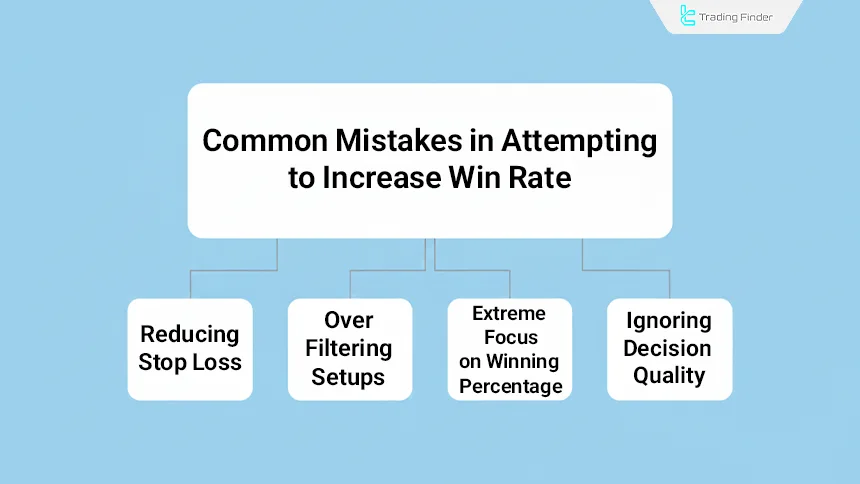

Common Mistakes in Attempting to Increase Win Rate

During the process of optimizing win rate, some decisions may appear logical on the surface but in practice weaken performance and destabilize results. Recognizing these errors prevents incorrect focus solely on the winning percentage.

- Reducing stop loss: Excessively tightening the stop loss to increase win rate is common, but it usually leads to frequent exits and the destruction of trade structure;

- Over-filtering setups: Eliminating too many trading opportunities fails to produce reliable statistical data and disrupts accurate win rate evaluation;

- Extreme focus on winning percentage: Excessive attention to win rate sometimes leads to ignoring structurally sound trades that play a critical role in long-term profitability;

- Ignoring decision quality: Focusing only on the win rate figure sidelines the analysis process, entry timing, and trading discipline.

Difference Between Win Rate in Backtesting and Live Execution

The win rate obtained from backtesting typically reflects more ideal conditions than real market environments. In historical data, factors such as slippage, execution delay, and trader psychological pressure are not taken into account.

Comparison Table of Win Rate in Backtesting and Live Execution:

Comparison Metric | Win Rate in Backtesting | Win Rate in Live Execution |

Market Conditions | Historical data with fixed structure | Live market with volatility and real-time changes |

Slippage and Execution Delay | Usually ignored | Direct impact on entries and exits |

Trader Psychological Reaction | Absent | Decisive role in decision-making |

Order Execution Quality | Ideal and error-free | Dependent on platform speed and liquidity |

Entry and Exit Accuracy | Precise and theoretical | Influenced by emotions and real conditions |

Win Rate Validity | Suitable for initial evaluation | Primary criterion for performance judgment |

Reliability for Final Decision | Limited | High and realistic |

Appropriate Win Rate for Passing Prop Firm Challenges

In prop firms, the primary focus is on performance consistency and adherence to risk rules, not merely a high winning percentage. Strategies with moderate win rates but precise risk control typically have a higher chance of passing challenges.

Attempts to raise the win rate through irrational changes in stop or target levels often result in violations of prop firm rules. Within this framework, consistency in executing the trading plan carries more importance than the raw win rate figure.

Prop Capital Protection Expert

The Prop Capital Protection Expert of TradingFinder is a specialized risk and capital management tool for traders active in Prop Firm accounts and professional trading environments, designed on the MetaTrader 5 platform.

This expert focuses on behavioral control, adherence to prop trading rules, and consistent execution of the trading plan, acting as an intelligent protective layer alongside the trader’s decision-making process.

This tool does not perform automated trade execution; rather, its structure is built on enforcing precise control limitations that prevent prop firm rule violations, excessive drawdown, and emotional decisions.

Features such as dynamic Trailing Stop, Break Even, Partial Close, and Pending Order management enable professional position management without emotional interference.

The Prop Capital Protection Expert supports various trading styles including ICT, Smart Money, and Price Action, and through a multi-section management panel provides precise settings for trade volume, permitted trading time, number of trades, profit and loss sequence, and daily and weekly loss limits. This structure is especially important for scalpers and traders who struggle with overtrading or FOMO.

The presence of the Account Protector panel with 7 separate tabs enables advanced drawdown control, trade deactivation after reaching predefined thresholds, and restriction of tradable symbols. Additionally, the News tab, by displaying major economic events, prevents market entry during high-volatility periods.

Overall, the Prop Capital Protection Expert is not merely an execution tool, but rather a professional control framework for maintaining trading discipline, performance stability, and long-term survival in the competitive prop trading environment.

Conclusion

Calculating the percentage of profitable trades compared to the total number of trades in a trading account defines the process of measuring a strategy’s Win Rate. This metric offers a clear picture of a strategy’s strengths and weaknesses, allowing traders to fix past mistakes.

There are various ways to improve the Win Rate in Trading, including maintaining a trading journal, having a solid trading plan, and more. Each method can be adapted to suit the trader’s personality. Additionally, by combining different trading strategies, traders can build new systems to use in future trades.