Analyzing price corrections in binary options begins with identifying the market trend and interpreting price behavior within its cyclical structure.

The market never moves in a straight line. Every bullish or bearish wave consists of advance, pause, correction, and continuation. The Buy the Dip strategy is a structural technique designed for logical entries during bullish trends.

This method targets the moment when the market, after a temporary decline, gathers fresh energy for continuation and resumes its main upward movement as buying pressure returns.

This behavior is especially important in trending markets, allowing a binary options analyst to use it for selecting an“UP” option within a defined timeframe.

What Is the Buy the Dip Strategy in Binary Options Trading?

When the Buy the Dip strategy activates in Binary Options trading, a bullish trend enters a temporary corrective phase and price pulls back to a logical zone. This short-term decline does not indicate structural weakness; instead, it serves as a breathing stage within the main directional movement.

In this area, the behavior of candlesticks and volume shows diminishing selling pressure and the potential return of buyers. Under these conditions, choosing an “UP” trade with an expiry aligned to the depth of the correction results in a precise and purposeful approach.

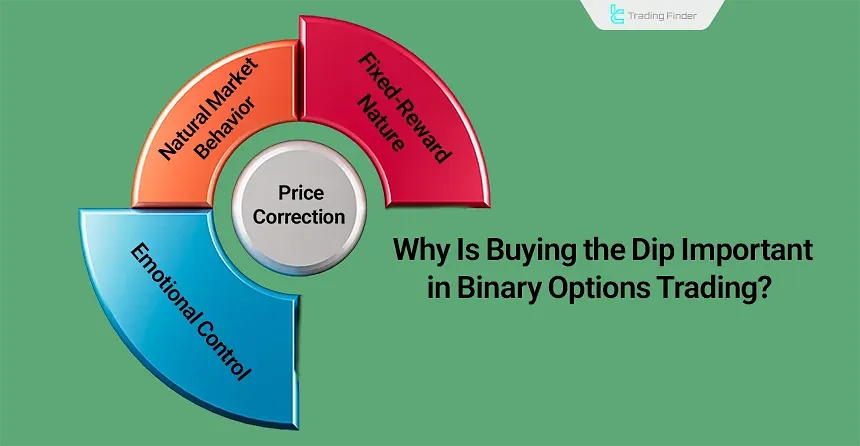

Price corrections are part of the natural market cycle, reflecting temporary reductions in demand or the short-term exit of initial buyers. In binary options, the significance of this point increases because the Fixed-Reward model relies on correctly predicting price direction within a limited timeframe.

This time frame ensures that entering during a correction aligns the trade with the dominant trend and keeps the trader synchronized with market rhythm within that specific timeframe.

Advantages and Disadvantages of Buying the Dip in Binary Options

Buying the dip provides a structural entry point, separating decision-making from emotional reactions. The advantages and disadvantages are:

Advantages of Buying the Dip | Disadvantages of Buying the Dip |

Ability to enter at a lower price in alignment with trend direction | Requires patience and mental discipline to identify reversal zones |

Reduced risk of emotional entry during bullish rallies | Analysis becomes difficult in ranging markets |

Increased analytical accuracy when selecting expiry | Risk of misinterpreting a correction and entering a bearish structure |

Better alignment with real market structure | Delay in entry due to excessive caution |

Higher probability of price reversal from a logical zone | – |

Why Buy the Dip Matters in Binary Options Trading?

The importance of this strategy comes from the binary options model and its Fixed-Reward structure. The trader only needs to determine the direction for a limited time window.

During a correction, the distance between price and entry level is reduced, while the probability of continuation in the trend direction increases. This improves outcome reliability because the correction forms on a logical basis.

Corrections are also a vital part of natural market behavior. A bullish trend cannot sustain itself without corrections and eventually enters fatigue if they do not occur.

Corrections refresh trend momentum, enabling continuation with renewed strength. This process creates a low-risk entry zone, helping the analyst capture the next bullish wave.

Market Behavior Logic During Corrections in Binary Options

The market operates through wave-like price cycles. A full price cycle includes:

- Accumulation phase for gathering early orders

- Expansion phase driving bullish or bearish movement

- Correction phase for reducing trading pressure and restoring trend momentum

- Trend continuation phase for extending the main movement

Corrections emerge naturally as part of the market structure. During this phase, early traders take partial profits, leading to short-term declines. If volume decreases during this decline, the probability of a rebound increases significantly.

Thus, a correction is not a sign of trend weakness. Instead, it signals market health and sustainability. Without corrections, trends become exhausted and vulnerable to reversals.

Role of Corrections in Bullish Trends in Binary Options

Higher highs and higher lows define a bullish trend, and such a structure cannot continue without corrections. The role of corrections includes:

- Creating new energy for continuation

- Attracting fresh liquidity

- Removing emotional traders

- Activating buy orders at support zones

A corrective move shows that the market has an accurate perception of value and only prepares for the next move after reducing buying pressure.

Difference Between Buying the Dip and Buying a Rally

The difference between buying the dip and buying a rally comes from the behavioral logic and structural formation of the market trend, and it directly affects the quality of entry.

Buying the dip is considered a structural entry, executed when price is positioned in a low-risk zone and demand flow is activated.

This type of entry is based on analyzing the trend, the depth of the correction, and volume behavior, establishing a direct relationship with the stability of the upcoming movement.

In contrast, buying during a rally occurs when price is already at its peak, and the trader enters the market without considering structure. This emotional entry typically happens near the beginning of a new correction and exposes the trade to immediate decline.

The difference between these two approaches plays a decisive role in trading success, shifting the decision-making process from emotional reaction to analytical selection.

Position of the Strategy in Binary Options Considering the Fixed-Reward Model

In binary options, the success of a trade is determined by selecting an “UP” or “DOWN” option. When price enters the correction zone, the probability of a return in the direction of the main trend increases.

This behavior allows the trader to achieve favorable results within a short timeframe.

Price corrections serve as a golden entry point in this market, enhancing the performance of a trading strategy.

For more information on the Buy the Dip strategy in binary options, you can also refer to the educational article of Dip in Binary on the website avatrade.com.

Components of the Buy the Dip Strategy in Binary Options

To identify a valid correction, the analyst must evaluate four core elements and interpret price movement structure based on these components:

Trend Direction

Trend direction is identified through the structure of higher highs and higher lows. Therefore, an uptrend is valid when higher peaks and higher bottoms form consecutively.

The moving average also determines trend direction; if the chart is above the moving average, the trend is active.

This forms the foundation of the Buy the Dip strategy, and without determining the trend, no correction is worth analyzing.

Dip Strength

Dip strength is assessed by the speed of decline, angle of descent, and the distance between the recent high and the corrective low.

A shallow correction indicates strong buyer presence, and the decline simply reflects natural market behavior.

A deep correction, however, builds more energy, often producing a stronger rebound.

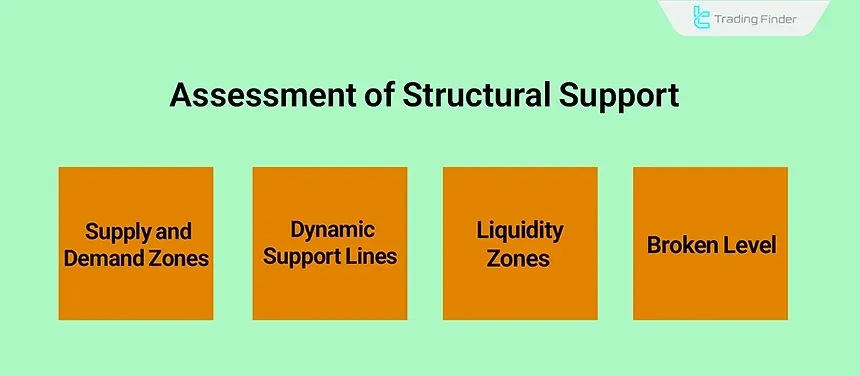

Structural Support

Structural support is a level where price has previously reacted, reversed, and regained its bullish flow.

This level may appear in the form of Supply & Demand zones, dynamic support lines, liquidity areas, or broken structural levels:

- Supply & Demand zones

- Dynamic support lines

- Liquidity zones

- Broken structural levels

Volume

Low volume during the correction reveals weak selling flow and shifts selling pressure to a limited level.

When price begins to rebound while volume increases, buyer dominance strengthens and momentum shifts toward the main trend.

This volume pattern is one of the most accurate indicators of the end of a correction and the beginning of a new bullish wave, enabling structural evaluation of the next directional move.

Combining volume with candlestick behavior provides deeper insight into momentum and the balance of forces.

Introduction to the Buy the Dip Indicator in Binary Options

The Triple Exponential Moving Average (TEMA) is an advanced trend-analysis tool designed to reduce signal lag in volatile environments.

Developed based on the concept introduced by Patrick Mulloy, this tool addresses the limitations of the Simple Moving Average and Exponential Moving Average in highly volatile markets.

The TEMA calculation involves three stages of smoothing, allowing the indicator to respond more quickly to recent price changes. The main indicator line appears in blue and red, providing a visually clear representation of the dominant trend.

This feature gives the trader a structured view of the trend across multiple timeframes on MetaTrader platforms.

The TEMA indicator belongs to the categories of signal tools,bands & channels, and multi-timeframe analysis, and it aligns well with trading structures in Forex, cryptocurrency, indices, commodities, and stocks.

This alignment comes from its reactive behavior toward buying and selling flow across various market structures.

The indicator’s settings panel includes professional options such as:

- Applying close price

- Setting calculation periods

- Line displacement

- Number of evaluated candles

- Color display

- Sound alerts

- Email notifications

- Push notifications

This level of control enables the indicator to adapt to different trading styles.

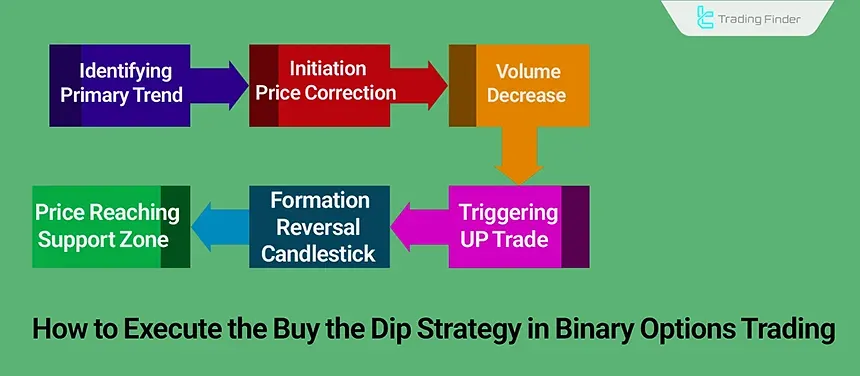

How to Execute the Buy the Dip Strategy in Binary Options

Executing the Buy the Dip strategy in binary options is based on trend analysis and identifying a valid correction.

This method requires understanding the precise behavior of price during the reversal phase.

Execution starts when an uptrend forms through the structure of higher highs and higher lows as follows:

- Identifying the main trend

- Beginning of the correction

- Decrease in volume

- Price reaching support

- Formation of a reversal candlestick

- Activating an UP trade with suitable expiry

Psychology of the Buy the Dip Strategy in Binary Options

Executing the Buy the Dip strategy is impossible without emotional control.

The trader must avoid entering during price peaks and only engage when a correction forms.

This entry style eliminates impulsive behavior and transforms the decision-making process into analytical thinking.

Patience plays a crucial role in this strategy; the trader must wait for the reversal zone to form and enter only after structural confirmation.

Traders interested in learning the Buy the Dip strategy in binary options can watch the educational video from the “Humbled Trader” channel on YouTube:

Common Mistakes in Buying the Dip in Binary Options

Errors occur when the trader fails to correctly identify the trend structure, correction position, and volume behavior.

Analytical mistakes at this stage shift the entry point away from the logical zone and increase the chance of choosing an improper expiry.

These mistakes collectively reduce decision accuracy and increase trading risk:

- Incorrect identification of the main trend

- Entering during a rally instead of the correction phase

- Ignoring volume behavior

- Choosing inappropriate expiry

- Relying on one tool instead of a combined analysis

- Trading during ranging structures

- Ignoring structural support zones

Scenarios of Buying the Dip in Binary Options

Price corrections in bullish trends have three primary forms, each creating different timing structures for the reversal:

- Shallow Correction: Limited decline with quick reaction to dynamic support, indicating seller weakness;

- Deep Correction: Declines to major support and builds more energy for a stronger rebound;

- Breakout Correction: After a breakout, resistance forms and the pullback to the broken level creates a structural pullback pattern.

Example of How to Buy the Dip in Binary Options

In the Bitcoin price chart, the Buy the Dip strategy appears within a fully trending structure.

After forming a new high, the main bullish movement enters a short-term corrective phase, and price pulls back to a logical zone.

This zone, highlighted in the image, represents the intersection between seller weakness and the beginning of buyer strength recovery.

Candlestick behavior in this area shows diminishing selling pressure, and once a series of bullish candles forms, a new trend momentum activates—creating a suitable zone for entering buy positions.

Conclusion

The Binary Options Buy the Dip Strategy is a precise, trend-oriented approach.

This method shifts the entry location to a zone where price, after a temporary decline, shows the capacity to return in the direction of the dominant structure.

The Buy the dip Binary Options strategy is built on recognizing the prevailing trend, evaluating correction strength, and aligning it with dynamic and static support levels.

It relies on psychological and structural harmony between price flow and the trading decision.

Additionally, the behavior of buyers and sellers during the correction determines the quality of the entry.

Weak selling pressure accompanied by low volume indicates favorable conditions for a bullish reversal.

As a result, this analysis model aligns perfectly with the Fixed-Reward structure of binary options, ensuring that the trader avoids entering during emotional price peaks and instead selects zones with higher probability of movement in the main trend direction.