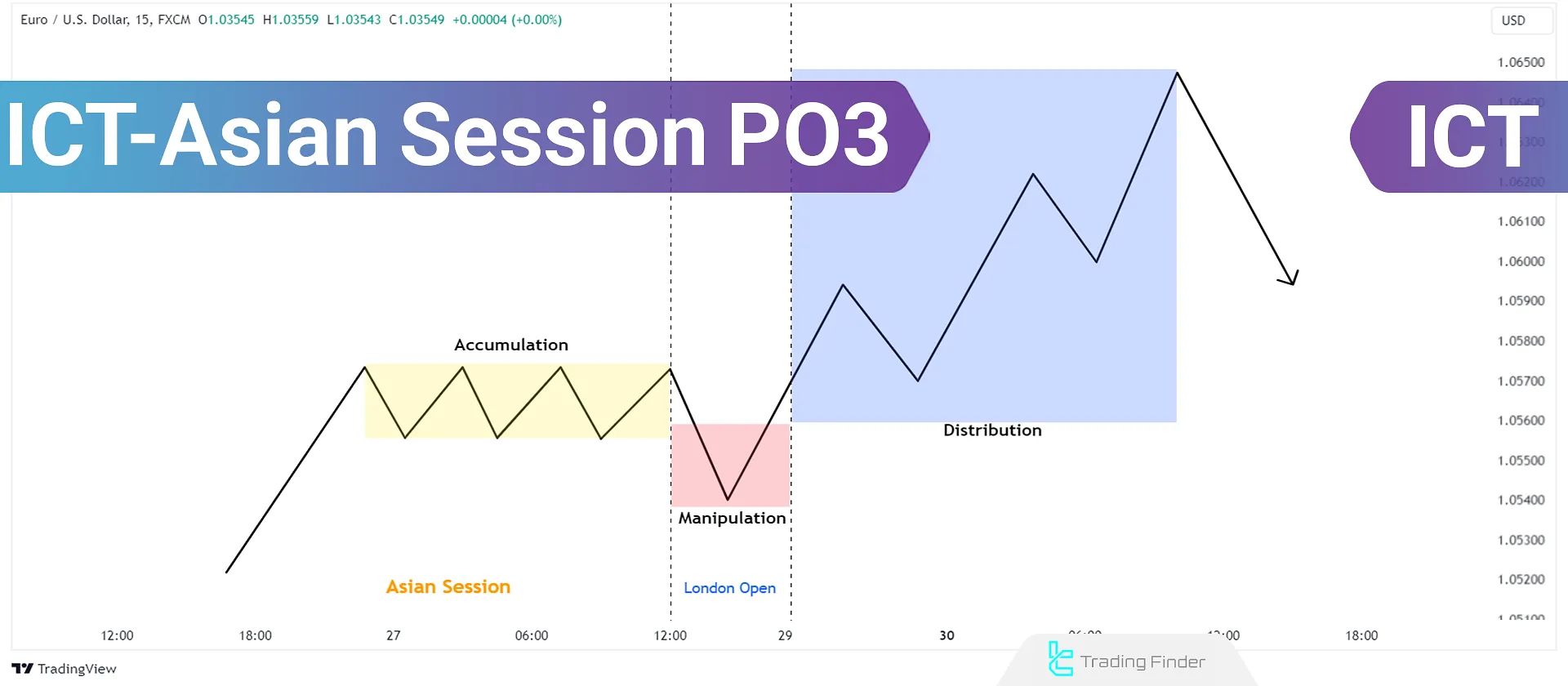

The ICT Asian Session PO3 strategy is an advanced method derived from ICT trading concepts. It specifically focuses on three key phases of The ICT PO3 Strategy During the Asian Session:

- Accumulation

- Manipulation

- Distribution

The ICT Asian Session PO3strategy emphasizes specific price movement patterns within the Asian trading session, so traders can capitalize on unique opportunities in thistimeframe.

The distinct characteristics of the Asian session, such as low volatility and price consolidation phases, make it a prime environment for identifying smart money movements.

What is Asian Trading Session?

The Asian trading session, as well as the European and North American sessions, are among the three major Forex trading sessions.

This session typically runs from 07:00 PM to 04:00 AM NY time, with the Tokyo market having the most influence.

Key Characteristics:

- Lower Volatility: Compared to the European and North American sessions, the Asian session generally exhibits lower price volatility, making it ideal for traders employing strategies that require minimal noise.

- Consolidation Phase: Many traders observe that the Asian session often acts as a consolidation phase, setting the stage for breakout opportunities in later sessions.

- Asian Kill Zone (A-KZ) refers to a specific timeframe within the Asian session where trading activity and liquidity increase, typically from 19:00 to 22:00 EST time.

Power of Three ICT Concept (PO3 - AMD)

The Power of Three Setup (PO3) is a trading strategy focused on three key phases:

- Accumulation

- Manipulation

- Distribution

Accumulation Phase

During the Asian session, smart money investors often begin accumulating positions. Stable prices and low volatility characterize this phase.

Key points to monitor:

- Range-Bound Markets: Identify currency pairs trading within anarrow range.

- Support and Resistance Levels: Mark key support and resistance zones, which may indicate potential breakout points.

Manipulation Phase

As the session progresses, market manipulation frequently occurs. Market makers often drive prices to create false breakouts, trapping retail traders into premature, incorrect decisions.

Key indicators of this phase:

- False Breakouts: Watch for temporary price movements that break support or resistance levels but quickly reverse.

- Volume Analysis: Analyzing trading volume during these manipulations can provide insights into movement strength.

Distribution Phase

The distribution phase occurs when market makers begin to offload positions. This stage typically aligns with the opening of the European session, leading to increased volatility.

Key considerations:

- Breakouts: A real breakout from the accumulation phase may signal a strong directional move.

- Trend Reversals: Be cautious of trend reversals as the market transitions from the Asian to the European session.

Implementing the ICT Asian Session PO3 Strategy

To successfully execute the ICT Asian Session PO3 strategy, traders must follow a structured, step-by-step approach. The following guidelines will help you apply this strategy effectively:

#1 Identify Market Bias Using the Daily Bias Concept

Before anything else, determine the market's daily bias—which reflects the overall market direction for the day. This helps traders understand the dominant trend.

To establish daily bias, analyze higher timeframes (e.g., daily or 4-hour charts) to identify bullish or bearish tendencies.

Key factors in determining Daily Bias:

- Market structure and direction

- Identifying key ICT order blocks or Mitigation Blocks

- Analyzing the previous day's candlestick to recognize key turning points

#2 Identify Key Levels Before the Asian Session Begins

- Support and Resistance Levels: Based on the Daily Bias, determine key zones that may influence accumulation or breakouts.

- Appropriate Timeframes: Use mid-term timeframes (1-hour or 4-hour) to pinpoint key levels.

- Asian Session Awareness: Be mindful of the Asian Kill Zone (07:00 PM to 04:00 AM NY time).

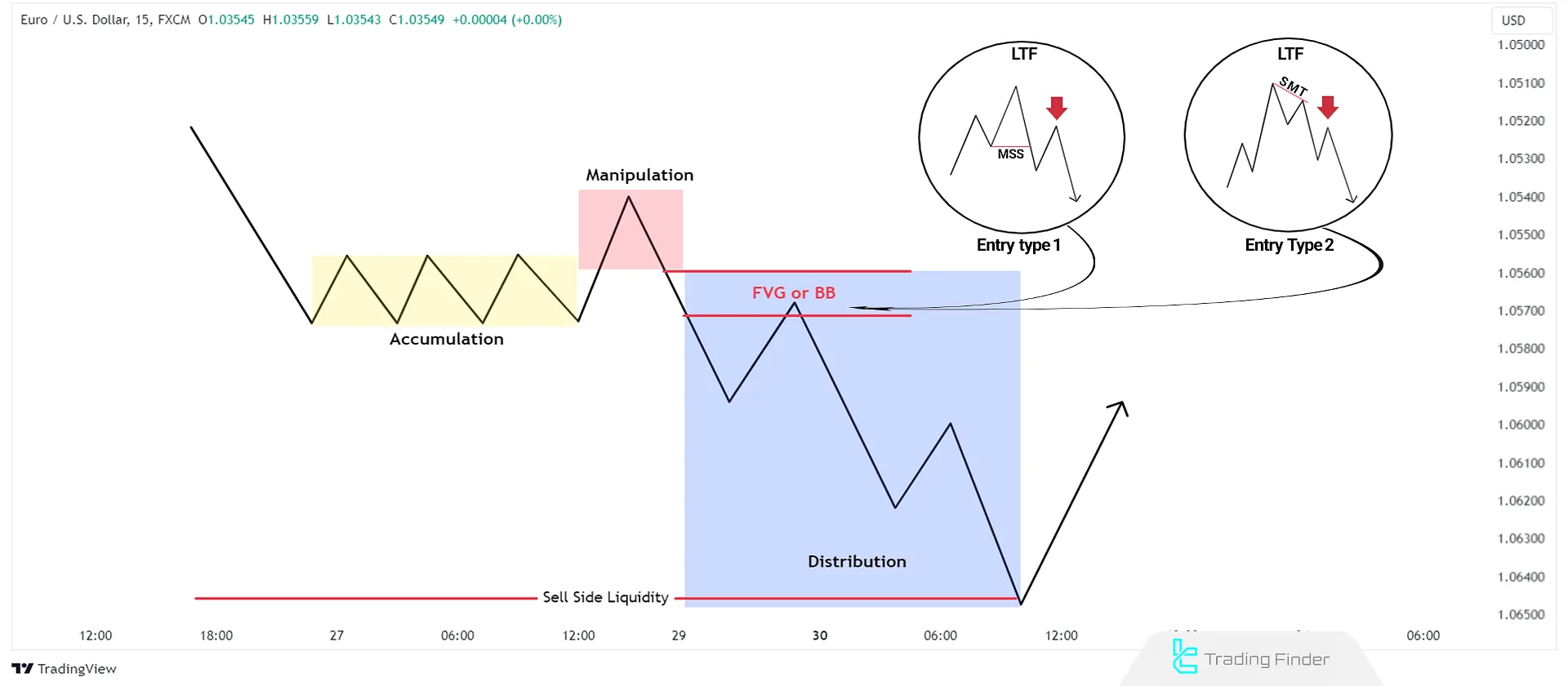

#3 Monitor Price Movements During the Asian Session

- Accumulation Phase: Identify range-bound price movements that define the consolidation zone.

- Candle Patterns: Look for formations such as Pin Bars or Engulfing Candles, which may indicate accumulation and manipulation.

- Liquidity Inducement: Check for false breakouts near support or resistance levels.

#4 Prepare for the European Session & Distribution Phase

- Breaker Block Identification: If the price exits the accumulation zone, analyze breaker block areas for trade entries.

- Trade Setup Confirmation: Verify if the price moves toward key levels, such as a Mitigation Block.

- Pullback Entries: Wait for the price to return to key levels before entering trades.

#5 Risk Management & Trade Execution

- Stop-Loss Placement: Set stops slightly below the accumulation low or above the high.

- Take-Profit Targets: Use higher timeframe support/resistance levels for TP zones.

- Trade Management: Secure partial profits or adjust stop-losses if the trend shifts.

#6 Document & Improve Strategy Execution

- Trade Logging: Record trade details, including entry, stop-loss, timeframe, and results.

- Post-Trade Analysis: Evaluate strengths and weaknesses to improve future trades.

Conclusion

The ICT Asian Session PO3 strategy is a comprehensive and structured approach for capitalizing on the opportunities available in the Asian session of the Forex and Crypto markets.

This strategy focuses on three main phases of Accumulation, Manipulation, and Distribution.