Intraday Bias, based on the ICT style, analyzes the ongoing trend in 1-hour and 4-hour timeframes.

This method operates similarly to Daily Bias but focuses on lower timeframes, utilizing market structure, liquidity zones, and Fair Value Gaps (FVGs) to identify trend direction.

What Is Intraday Bias?

Intraday Bias is a method used to predict future market trends in lower timeframes (4-hour and 1-hour).

To apply this approach effectively, one must consider concepts like displacement, liquidity zones, and Fair Value Gaps (FVGs).

How to Use Intraday Bias?

To correctly identify and utilize Intraday Bias, follow these steps:

1# Identifying Liquidity Zones

Liquidity zones exist in all timeframes, but in this model, the key liquidity areas in 4-hour and 1-hour timeframes are examined.

Liquidity may be found behind a previous high or low, equal highs/lows, or other support and resistance zones.

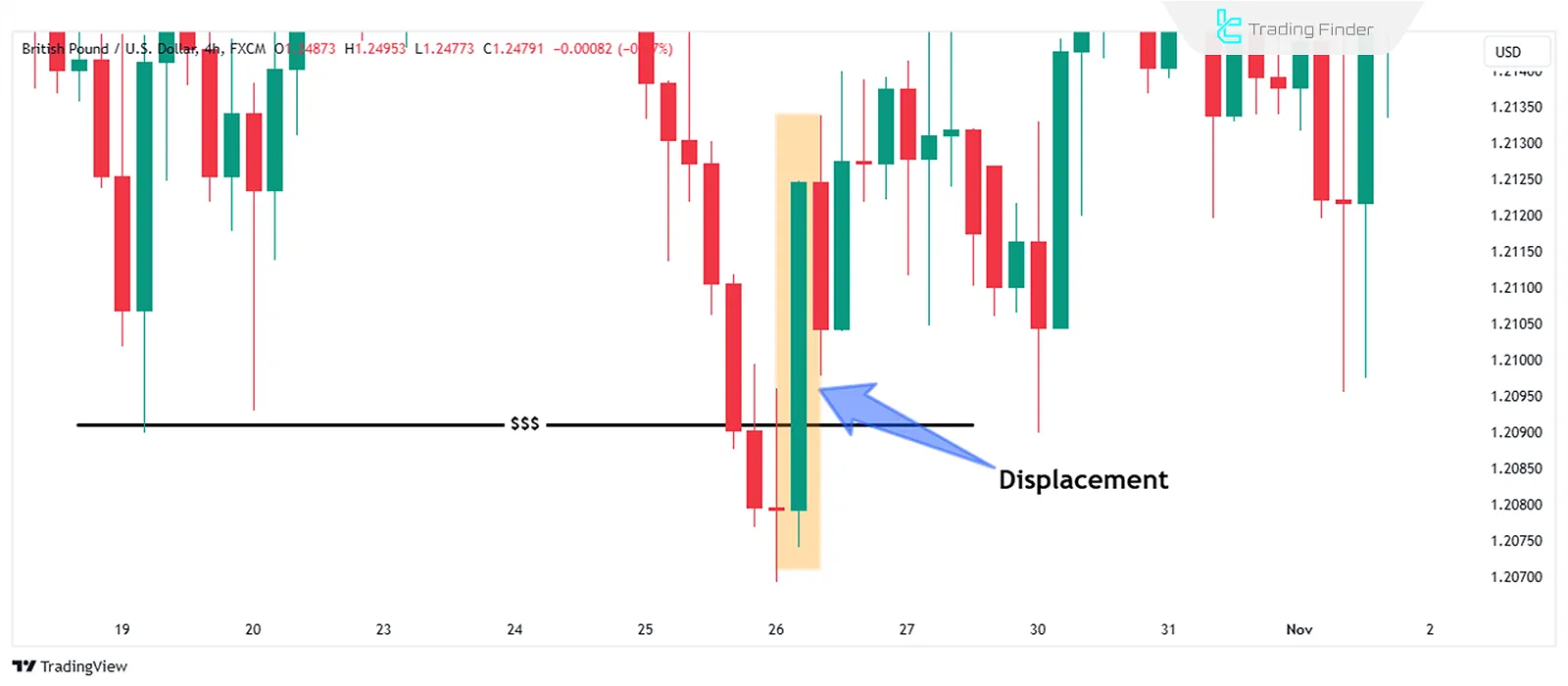

2# Finding Displacement Moves

Displacement moves typically consist of several strong candles with large bodies. They occur when a rapid market movement causes a structural shift.

These displacements indicate liquidity collection by smart money and a significant influx of orders into the market.

3# Identifying Fair Value Gaps (FVGs)

After collecting liquidity, the price moves toward an imbalance or Fair Value Gap (FVG). In other words, FVG zones play a crucial role in driving price movements.

#4 Examining Recent Price Behavior

At this stage, the most recent price movement in the 4-hour or 1-hour timeframe is analyzed. If the market has recently entered an FVG zone, its next target will be a liquidity level.

Conversely, if a liquidity sweep has happened on the price, its next target will be to move toward an FVG.

#5 Dropping to Lower Timeframes

Once the future price direction is determined, traders can find trade setups in lower timeframes (5-minute and 1-minute). For example, if the 4-hour timeframe shows price moving toward an FVG, the next target will likely be liquidity sweep on the opposite side.

Thus, stop loss (SL) and entry zones are optimally set based on lower timeframes, while take profit (TP) levels are determined using higher timeframes.

Key Points in Using Intraday Bias

To maximize success with this method, keep these in mind:

- Identify liquidity zones accurately;

- Displacement must occur after liquidity collection;

- FVGs within displacement moves hold greater significance;

- Avoid trading against the higher timeframe direction, as failure probability is too high.

Conclusion

Intraday Bias focuses on trend analysis in 1-hour and 4-hour timeframes, emphasizing market structure, liquidity, and Fair Value Gaps (FVGs) to determine price direction.

By identifying liquidity zones, displacement moves, and FVGs, this method allows traders to understand price movement dynamics effectively.