The Reversal Sequence Strategy is a method based on the ICT trading style. It aims to enter trades before the main market movement begins. This strategy is applicable across all markets, including Forex Market, cryptocurrencies, and indices, and it can be used in all Kill Zones to identify entry points.

What is the Reversal Sequence Setup?

The Reversal Sequence Strategy is a method for entering trades without a Market Structure Shift (MSS) or Break of Structure (BOS).

This strategy focuses on liquidity at key highs and lows, Fair Value Gaps (FVG), Order Blocks, and OTE Levels.

By increasing precision in entry points, the Reversal Sequence provides traders with a favorable risk-to-reward (R/R) ratio.

Key Concepts to use the Reversal Sequence Strategy

When entering trades without a market structure shift or break, focusing on Higher Time Frame (HTF) areas is essential, as price reversals often occur from these zones. The following concepts are crucial for trading in these areas:

Identifying Key Highs or Lows

To execute the Reversal Sequence Strategy, first, wait for the price to reach a key high or low in the higher time frame, as this movement usually occurs rapidly. You can pinpoint significant highs or lows by identifying and marking these areas.

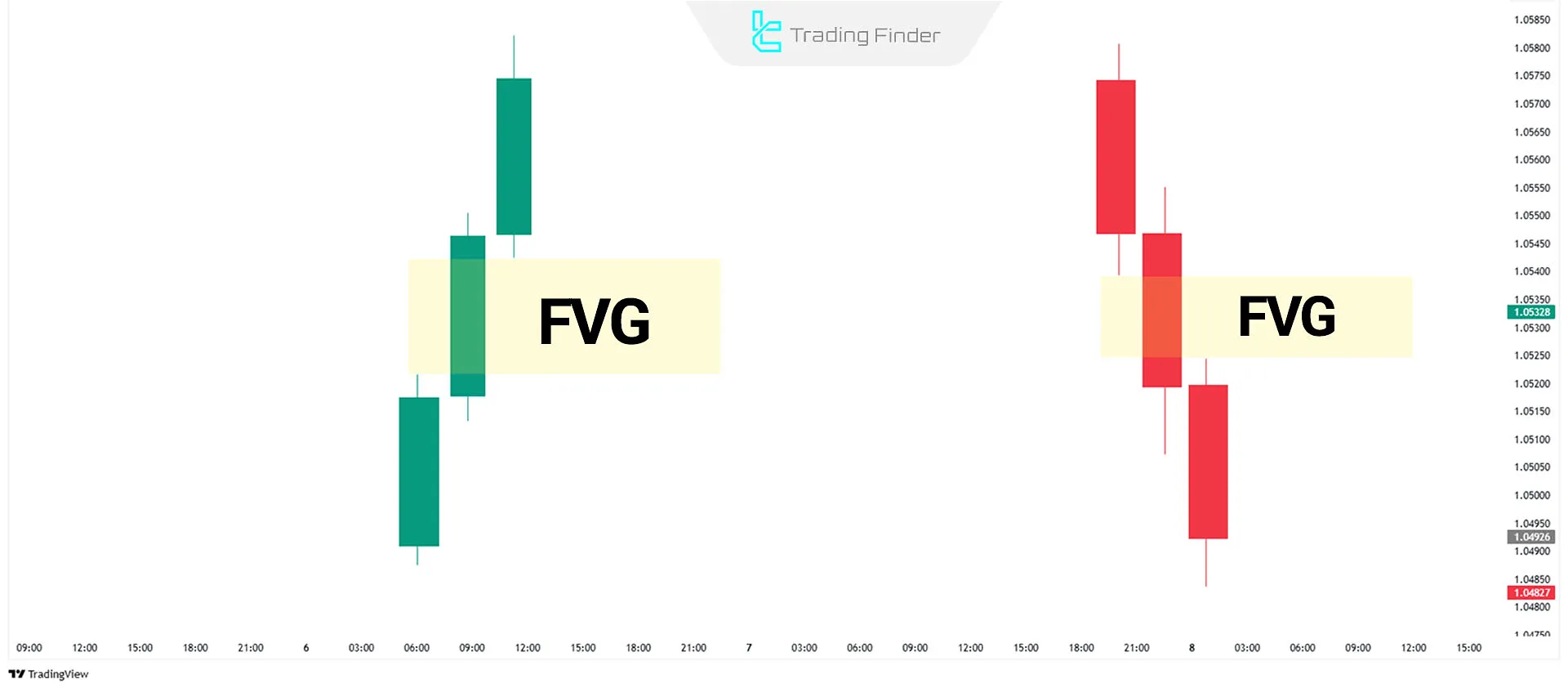

Fair Value Gap (FVG)

A Fair Value Gap is a three-candle pattern where the third candle does not overlap with the first. This strategy uses this area as a critical zone for trade entries.

Price Inversion

Price Inversion occurs when a Fair Value Gap closes and acts as a support or resistance level. This concept is typically used to confirm price reversals.

Order Block

Order Blocks are significant areas where banks and financial institutions place large orders. In the Reversal Sequence Strategy, these levels often act as price reversal points, providing excellent opportunities for trade entries.

Breaker Block

A Breaker Block is similar to an Order Block, but in this pattern, the price first makes a new high or low and then reverses. These areas are often suitable for trade entries.

OTE Levels

OTE Levels are determined using Fibonacci retracement. In the Reversal Sequence Strategy, traders look to re-enter the main trend. The 70.5% Fibonacci level is one of the most important levels in this method.

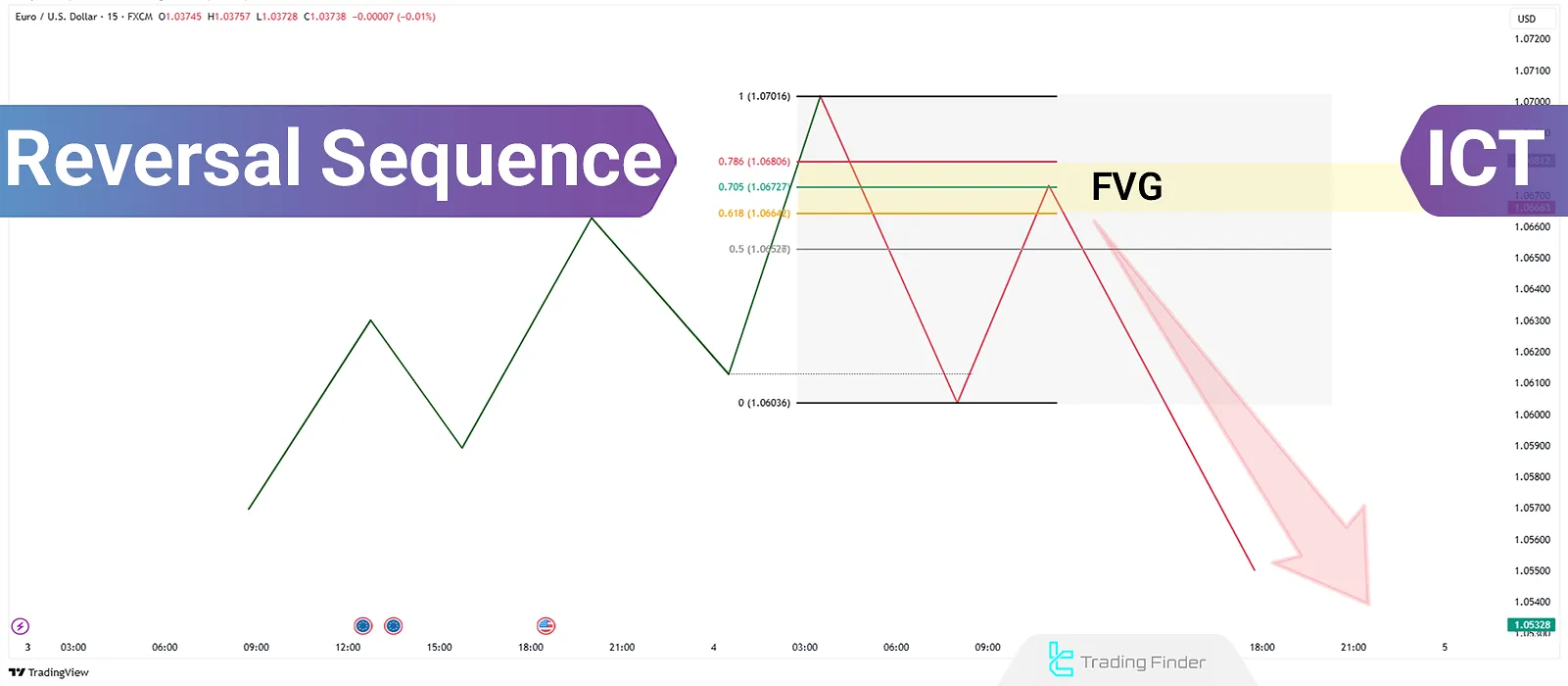

Stages of Price Reversal Formation in the Reversal Sequence Strategy

Price reversals typically form in several stages, each providing further confirmation for trade entries. These stages include:

#1 Liquidity and Stop Hunts

In this stage, the market breaks a significant high or low, triggering stop orders, and quick reverses. This movement is designed to absorb new orders and create conditions for a trend reversal called a Liquidity Sweep.

#2 Use of Premium and Discount Zones

In the Reversal Sequence Strategy, the price moves from Premium (overbought) to Discount (oversold) zones and vice versa.

Premium and Discount zones are determined using Fibonacci retracement and can be used alongside confirmations like FVG and Order Blocks for trade entries.

#3 Price Inversion and Closing of Fair Value Gap (FVG)

After absorbing liquidity, the market returns to the breakout zone and fills the Fair Value Gap (FVG). If the price stabilizes in this area, it can be considered as a sign of a trend reversal, acting as new support or resistance.

#4 Change in the State of Delivery (CISD)

In the Change in the State of Delivery (CISD) stage, a strong candle breaks the previous structure, and the price stabilizes above it, confirming new orders and the start of a fresh trend.

#5 Formation of Breaker Block or Final Confirmation via FVG

If a Breaker Block forms or a new Fair Value Gap (FVG) is filled, the final confirmation of a price reversal is achieved.

Bullish Trade in Reversal Sequence Setup

According to the chart of the USD/JPY pair in the 5-minute timeframe, the price hits a significant zone in higher time frames and absorbs liquidity.

After forming an Order Block and a Change in Character of Delivery (CISD), the trader should wait for the price to return to the Order Block. Upon price interaction with this level and receiving confirmation, a BUY trade can be entered using OTE zones.

Bearish Trade in Reversal Sequence Setup

In the USD/CHF chart, the price reaches a key zone in higher time frames, triggers pending orders, and begins absorbing sell orders.

After forming a bearish FVG and a Change in Character of Delivery (CISD), wait for the price to return to this zone. Upon confirmation of a reversal from the FVG and analysis of OTE zones, a SELL trade can be initiated.

Conclusion

The Reversal Sequence Strategy in the ICT style is a method for entering trades without requiring a Market Structure Shift (MSS) or Break of Structure (BOS).

This strategy focuses on liquidity, Fair Value Gap (FVG), Order Blocks, Breaker Blocks, and OTE Levels to provide better risk-to-reward entry points.