ICT Unicorn trading style is one of the advanced models in technical analysis. It combines two key concepts of Breaker Blocks (BB) and Fair Value Gaps (FVG). This style helps to identify optimal areas for price direction changes.

Also, the Unicorn model (ICT Unicorn) often appears at key liquidity points and allows the trader to have more precise entries with lower risk.

To study and use the ICT Unicorn indicator, refer to the following links:

- ICT Unicorn indicator for MetaTrader 4

- ICT Unicorn indicator for MetaTrader 5

- ICT Unicorn indicator for TradingView

Key Concepts in the ICT Unicorn Style

The ICT Unicorn strategy is a trading pattern in the ICT price action style, consisting of three main components: Breaker Block, FVG, and valid Order Block.

With this combination, traders can identify optimal entry points, achieve better risk management, and predict market reversal or continuation trends with greater accuracy.

Main components of the Unicorn:

- Breaker Block: A Breaker Block represents broken order blocks that lead to structural changes (MSS or CHoCH) and price direction shifts. These areas are created when the price breaks through a significant level (support or resistance) and establishes a new trajectory;

- FVG (Fair Value Gap): A Fair Value Gap is a region on the chart created due to rapid price movements, leaving gaps between candlesticks. These gaps reflect imbalances between supply and demand;

- Order Block: In the ICT style, it refers to a zone of candles where banks and financial institutions have placed their large orders.

Also, for video training, the YouTube channel TTrades can be used:

Advantages and Disadvantages of the Unicorn Setup in ICT Style

The Unicorn pattern in Inner Circle Trader (ICT) is always known for its high accuracy in signal generation and alignment with market structure and Daily Bias, but executing it without sufficient understanding of its advantages and disadvantages can be risky.

Table of advantages and disadvantages of the Unicorn setup:

Advantages | Disadvantages |

Combination of three key elements Breaker Block, Order Block, and FVG for higher entry accuracy | Requires high experience and skill to correctly identify the components of the pattern |

Provides optimal entry points with reasonable risk | Possibility of false signals in lower timeframes or highly volatile markets |

Compatible with key ICT concepts such as OTE and Liquidity Grab | Complexity in learning for beginner traders |

Helps in risk management and setting logical stop loss behind the Order Block | Risk of missing opportunities if waiting too long for confirmation of all conditions |

Increases probability of trade success by filtering out weak signals | Requires multi-timeframe analysis and more time spent on analysis |

What Are the Benefits of ICT Unicorn Style?

- High Precision: Combining Breaker Blocks and FVGs provides effective signals to enter positions;

- Identifying Support and Resistance Levels: This style helps to locate key support and resistance areas;

- Applicable to Various Markets: ICT Unicorn model is effective in forex, stocks, commodities, and cryptocurrencies.

Types of ICT Unicorn Models

The ICT Unicorn style includes identifying bullish and bearish patterns in price movements, which are designed based on the principles of liquidity and institutional order flow.

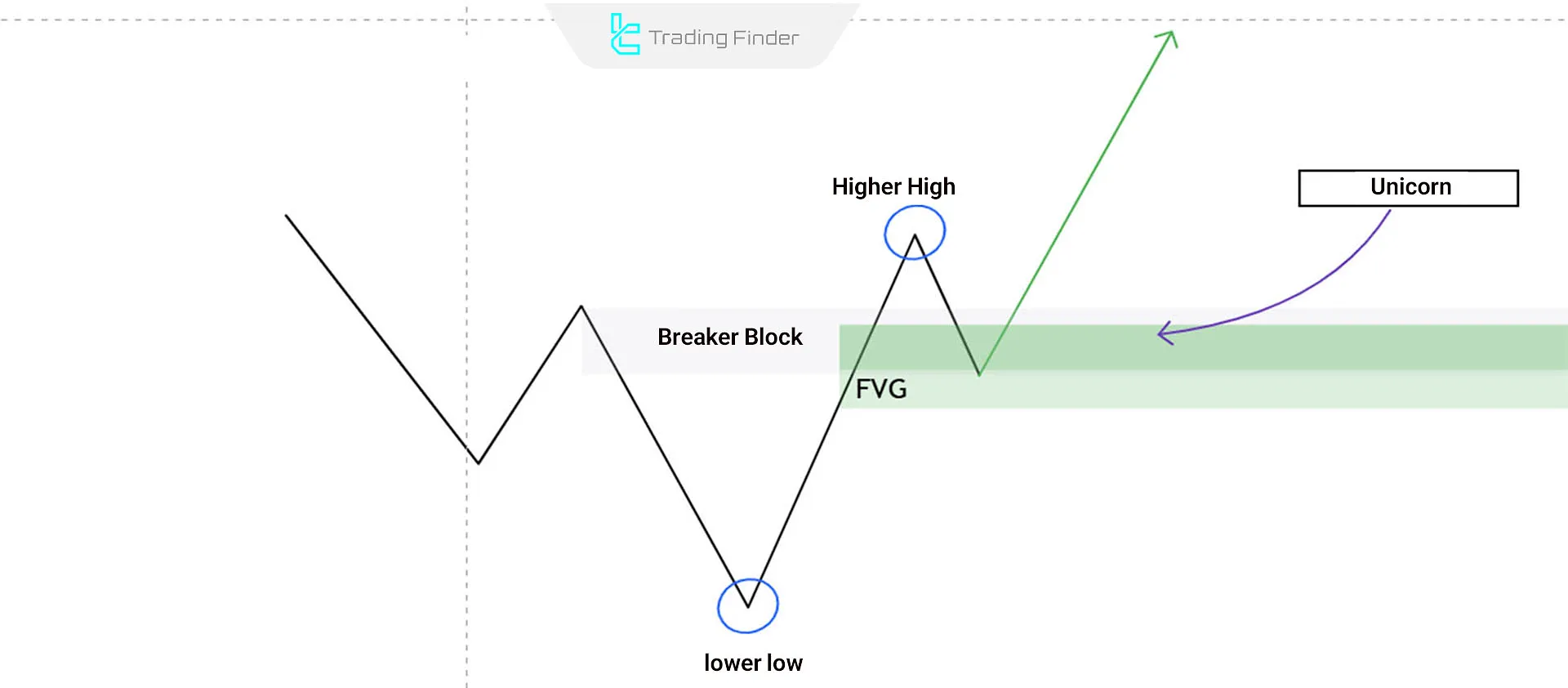

#1 Bullish ICT Unicorn Setup

This pattern forms at the end of a bearish trend, starting with a Lower Low (LL) and a Higher High (HH). In this scenario, a bullish Breaker Block overlaps with a bullish FVG.

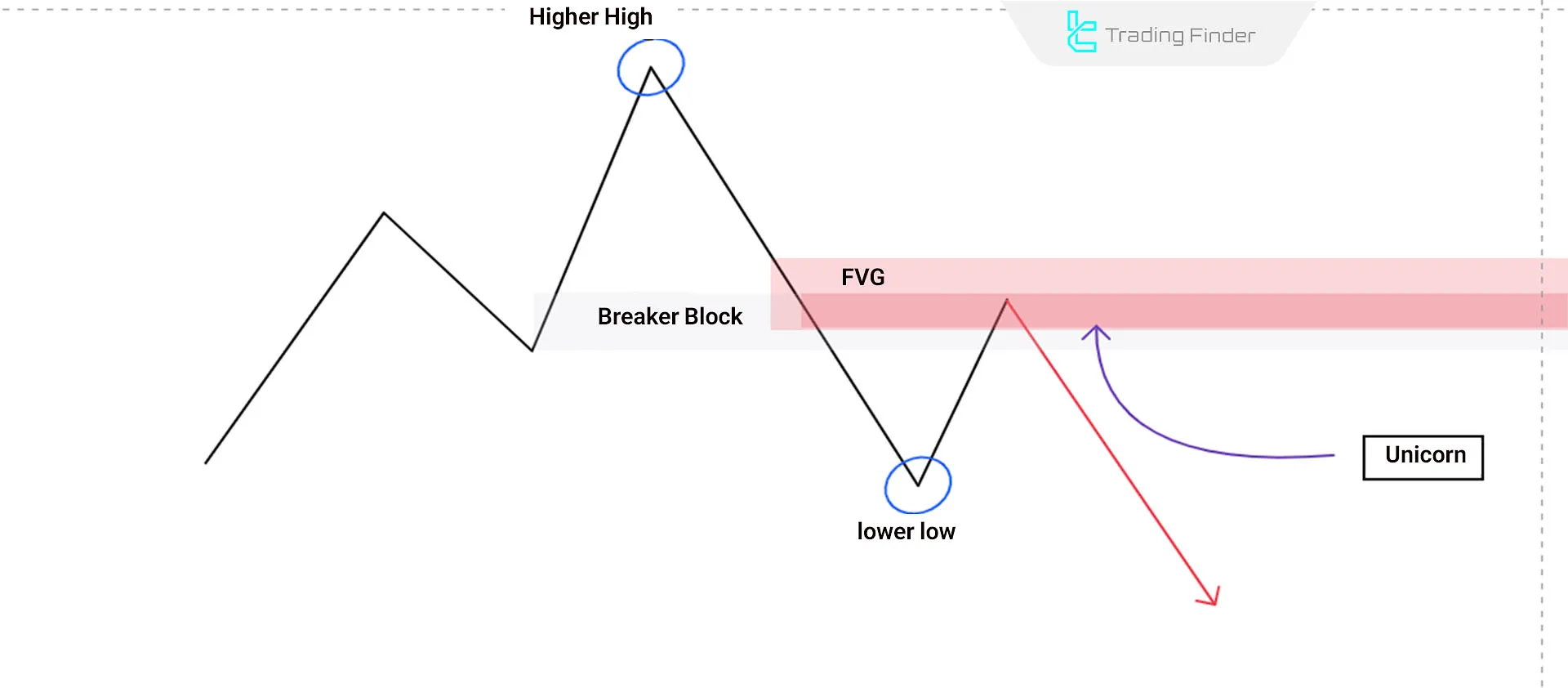

#2 Bearish ICT Unicorn Setup

This pattern forms at the end of a bullish trend, starting with a Higher High and a Lower Low. In this scenario, a bearish Breaker Block overlaps with a bearish FVG.

Common Mistakes of Traders in Identifying the Unicorn

Many traders make mistakes due to misinterpretation of the Breaker Block, hasty entry into the FVG, or ignoring the validity of the Order Block.

Neglecting confluence with levels such as OTE and liquidity zones is also one of the main causes of errors in identifying this pattern.

Common mistakes in using the Unicorn in ICT:

- Misidentifying the Breaker Block and relying on weak breaks;

- Entering on the first Fair Value Gap (FVG) without checking Higher Timeframe Confirmation;

- Ignoring the validity of the Order Block and trading in low-volume areas;

- Failing to consider Unicorn confluence with other important levels (such as OTE or liquidity zones).

How can the ICT Unicorn model be identified?

The ICT Unicorn pattern is formed by the overlap of Breaker Block and FVG. This overlap creates a zone with a high probability of price reversal. Identification guide table for the Unicorn strategy:

Step | Description |

Break of swing high or swing low | Start of movement by price breaking through a key market level |

Formation of Breaker Block | Creation of an order block that forms after being broken and followed by trend reversal |

Overlap with FVG | Formation of the Unicorn zone from the combination of Breaker Block and Fair Value Gap (FVG) as the probable price reversal area |

How to trade using the ICT Unicorn Style?

This style helps traders leverage market price movements with greater precision.

#1 Focus on Timeframes

Start by identifying the overall Market trend and key levels on higher timeframes (e.g., 1-hour or daily); then determine entry and exit points on lower timeframes.

#2 Identify Market Structure

Identify liquidity points (highs, lows, and gaps) and utilize order blocks to anticipate price reversal zones.

#3 Entry and Exit Points

In the Unicorn setup, precision in determining entry and exit points is highly important, as these zones are directly derived from the confluence of liquidity, order block, and FVG.

- Entry: when the price approaches key zones such as order blocks or FVGs;

- Exit: before the price reaches major resistance or support levels.

Which Timeframes Are Best for the Unicorn Style?

Shorter timeframes are better for using Unicorn style. Therefore, timeframes of 15 minutes or less are suitable for analysis and identifying entry points.

Best Assets for the Unicorn Style

The ICT Unicorn pattern was introduced in 2022 and was initially focused on the Dow Jones and Nasdaq indices.

Over time, this pattern also proved its effectiveness in the forex market and, particularly in forex pairs such as EUR/USD and GBP/USD, recorded remarkable results.

Traders have also applied this model to metals XAU/USD (gold), XAG/USD (silver), and the dollar index, achieving remarkable results. Additionally, the Unicorn model has shown outstanding performance in the cryptocurrency market.

ICT unicorn model indicator

The ICT Unicorn indicator is designed based on ICT trading style and Smart Money concepts. This indicator is used to identify liquidity zones and helps traders determine probable price reversal points with greater accuracy.

The Unicorn zone is formed when two key concepts Breaker Block and Fair Value Gap (FVG) overlap.

This overlap usually creates a high-liquidity area where the probability of price reaction and direction change is high. Therefore, the Unicorn can be considered one of the key zones for trade entry or exit.

At a glance, the Unicorn indicator falls under ICT, Smart Money, and liquidity indicators. Its type is reversal, and it can be used in multi-timeframe analysis.

This tool is mostly applied in intraday trading styles, but it can also be used in various markets such as forex, cryptocurrencies, stocks, commodities, and indices.

In terms of settings, the Unicorn indicator provides multiple features. These include defining the detection period of order blocks, their validity duration, mitigation level for Breaker Block, FVG, and Unicorn, enabling or disabling supply and demand zones, filtering FVGs, adjusting colors, and activating alerts.

This flexibility allows traders to customize the indicator according to their personal strategy. Tutorial videos for the Unicorn Strategy Indicator:

In summary, the Unicorn indicator is a specialized tool for professional traders working with ICT style and liquidity-based methods.

By combining Breaker Block and FVG, it identifies key market zones and helps users recognize potential reversal points, optimize entries, and improve trade management.

- ICT Unicorn Setup Indicator in MetaTrader 4

- ICT Unicorn Setup Indicator in MetaTrader 5

- ICT Unicorn Setup Indicator in TradingView

Example of Buy Trades in Unicorn Style

When market structure changes and a bullish Breaker Block overlaps with a bullish FVG, it creates a suitable opportunity for a buy trade.

Upon the price returning to the bullish FVG zone, a buy position can be opened to reach significant resistance levels.

Example of Sell Trades in Unicorn Style

When market structure changes, and a bearish Breaker Block overlaps with a bearish FVG, it creates a suitable opportunity for a sell trade.

Upon the price Retracement to the bearish FVG zone, a sell position can be opened to reach significant support levels.

Another example of a bearish Unicorn Trading Tutorial provided by Flux Charts can be seen:

Conclusion

The ICT Unicorn is a popular strategy in trading. It is specifically designed to identify trading opportunities based on liquidity, order blocks, and price action.

This style is applicable to various assets, including indices, forex, metals, and cryptocurrencies. It focuses on shorter timeframes and precise market structure analysis.