- TradingFinder

- Education

- Forex Education

- ICT (Inner Circle Trader) Education

ICT (Inner Circle Trader) Education

The ICT (Inner Circle Trader) trading style is an advanced approach to price action, focusing on analyzing the behavior of major financial institutions and the role of market makers. In the ICT method, traders aim to identify optimal entry and exit points by analyzing market structure, Break of Structure (BOS), Order Blocks, Liquidity, and Fair Value Gaps (FVG). Trading Finder offers the best ICT-style educational content across four different levels, tailored to the needs of beginner to advanced traders. These courses cover concepts such as the Market Maker Model, Power of Three, and Smart Money Techniques, providing efficient methods for traders.

Learning ICT Market Order Flow; Institutional & Smart Money Concept (SMC)

Order Flow (OF) reflects the stream of buy or sell orders from traders, investors, institutions, and other market participants....

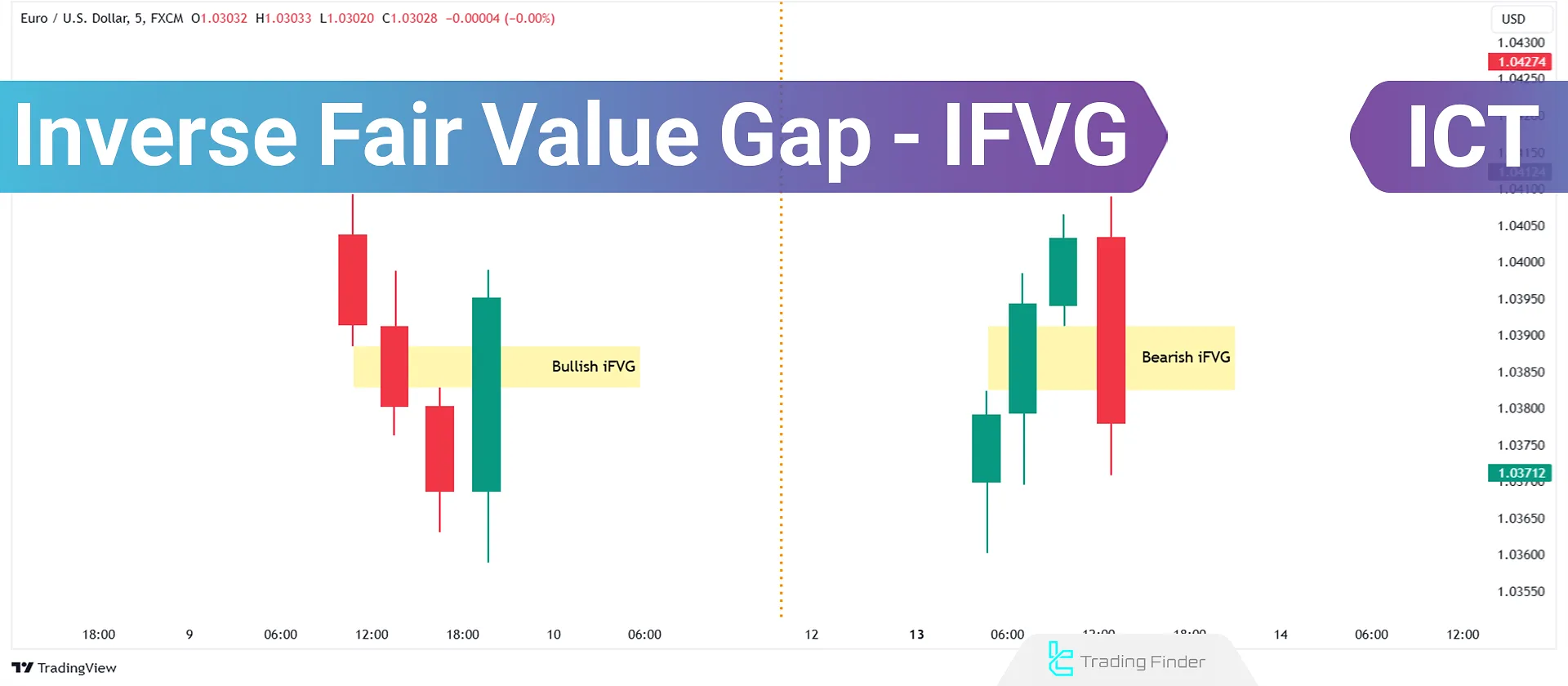

Inverse Fair Value Gap (IFVG) in ICT Trading Strategies - Guide

The Inverse Fair Value Gap (IFVG) is an advanced ICT trading concept that identifies key supply and demand zones. This gap occurs...

ICT 2022 Mentorship – The Ultimate Guide to ICT Trading Strategies

The ICT 2022 Mentorship trading strategy is uniquely designed based on the combination of market liquidity and precise timing....

What is Inducement? Liquidity inducement in Smart Money and ICT trading

Inducement in Forex and financial markets refers to a form of market manipulation by large players (including institutional...

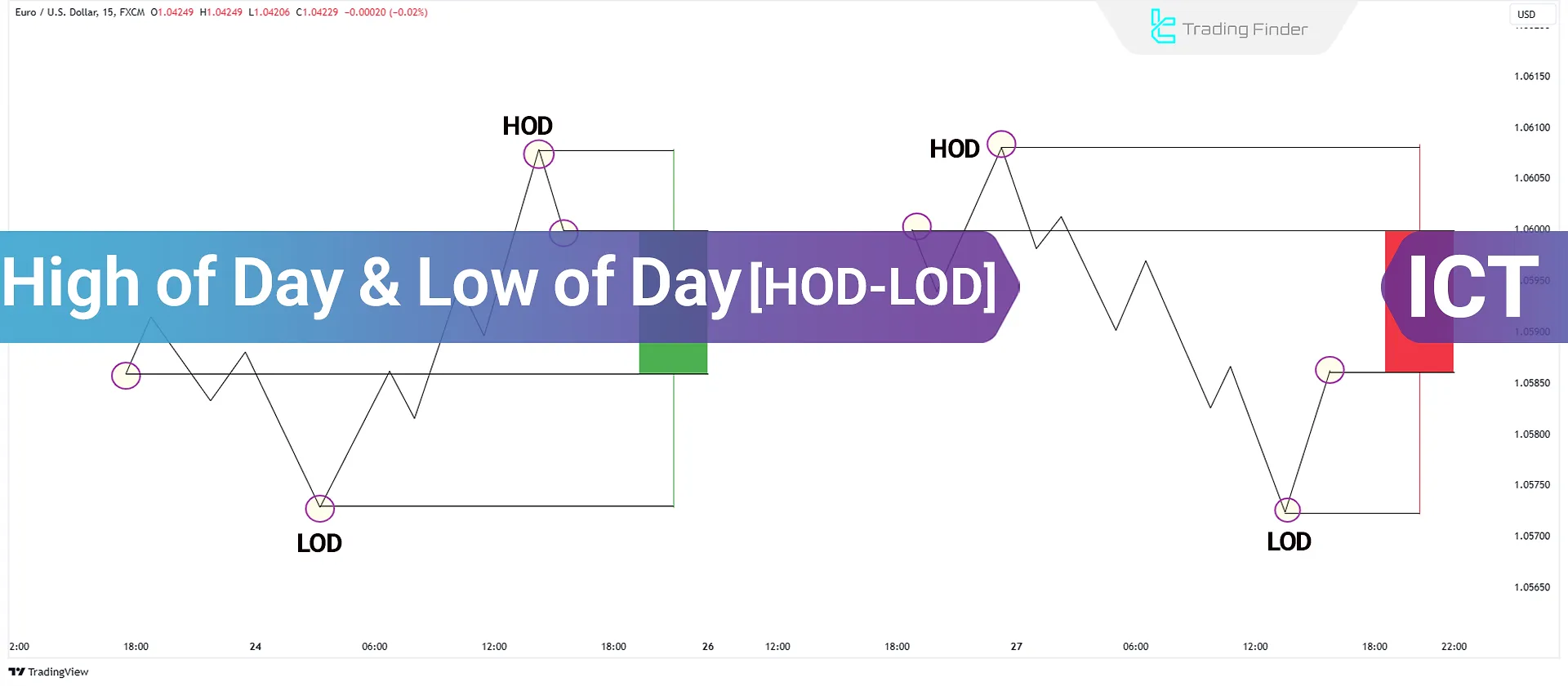

Highest and Lowest Daily Price (High of Day / HOD and Low of Day / LOD)

HOD (High of Day) and LOD (Low of Day) are fundamental concepts in technical analysis and intraday trading. They represent the...

ICT Son's Model Trading Setup in Higher Time Frames; DOL & Liquidity Sweep

The ICT Son's Model – HTF trading strategy is an optimized version of the 30-second Son's Model setup, designed for higher time...

The ICT Son's Model Trading Strategy; 30-Second Setup

TheICT Son's Model – 30-Second Setup is based on Draw On Liquidity (DOL) and Liquidity Sweep concepts. The ICT Son's Model...

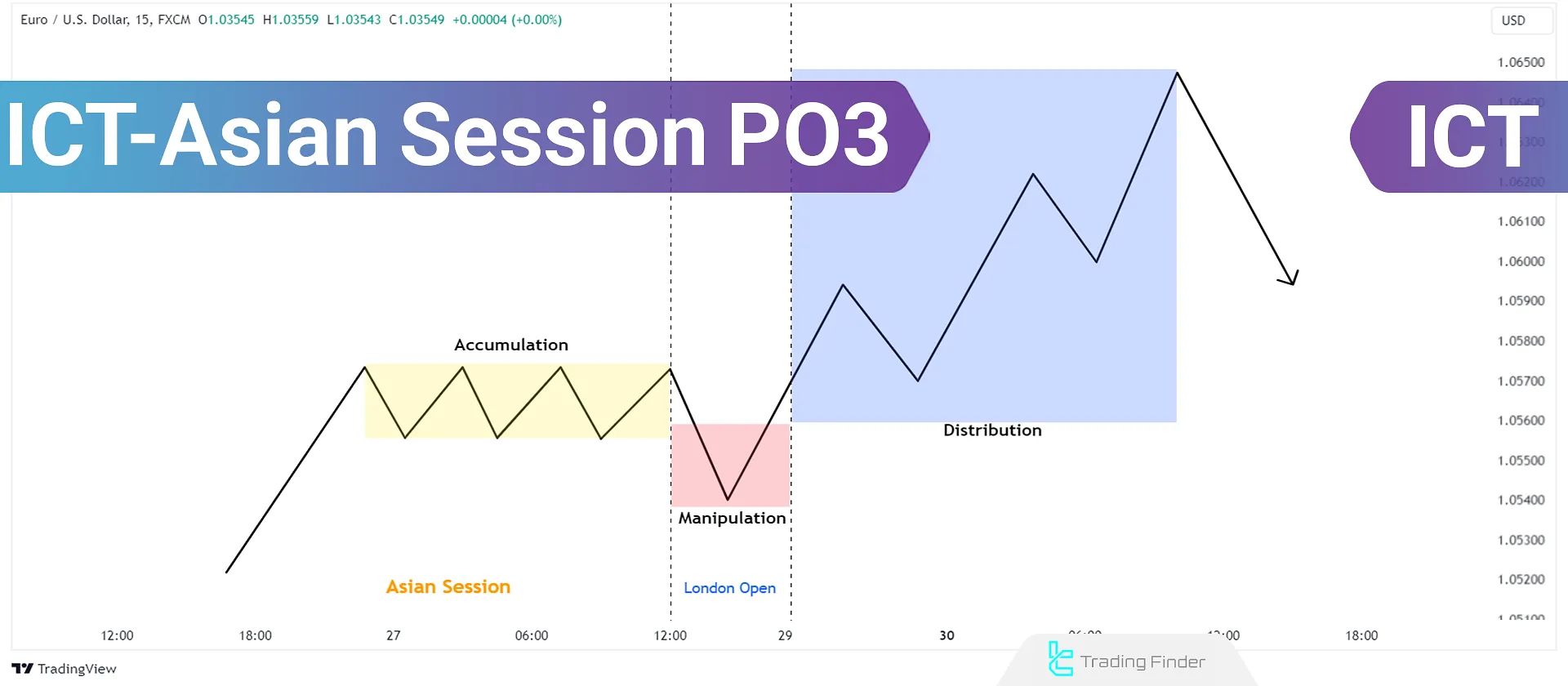

Learn to Trade Asian Session Range Using ICT PO3 (AMD); ICT Asian Session PO3

The ICT Asian Session PO3 strategy is an advanced method derived from ICT trading concepts. It specifically focuses on three key...

What Is a Rejection Block? How to Use and Identify Liquidity Accumulation Zones

A Rejection Block Trading is a price zone where the price touches but cannot break through, resulting in a reversal. This...

ICT Trading Style Abbreviations and Terminologies [FVGs, OBs, PO3 & MMXM]

The Inner Circle Trader (ICT) trading style is based on precise market structure analysis and the trading behavior...

Mastering Liquidity in Forex Trading [Buy Side and Sell Side Liquidity] - ICT

To master the liquidity trading strategy, traders must understand the concept of liquidity in Forex, which refers to the volume of...

Liquidity Void (LV): Using Liquidity Voids in ICT Trading

Liquidity Void (LV) refers to a situation where there are insufficient orders to fill a rapid price movement within a specific...

![ICT Trading Style Abbreviations and Terminologies [FVGs, OBs, PO3 & MMXM]](https://cdn.tradingfinder.com/image/257891/14-14-en-ict-smc-abbreviation-list-01.webp)

![Mastering Liquidity in Forex Trading [Buy Side and Sell Side Liquidity] - ICT](https://cdn.tradingfinder.com/image/258163/7-12-en-master-liquidity-in-forex-trading-with-3-step-guide-01.webp)