- TradingFinder

- Education

- Forex Education

- ICT (Inner Circle Trader) Education

ICT (Inner Circle Trader) Education

The ICT (Inner Circle Trader) trading style is an advanced approach to price action, focusing on analyzing the behavior of major financial institutions and the role of market makers. In the ICT method, traders aim to identify optimal entry and exit points by analyzing market structure, Break of Structure (BOS), Order Blocks, Liquidity, and Fair Value Gaps (FVG). Trading Finder offers the best ICT-style educational content across four different levels, tailored to the needs of beginner to advanced traders. These courses cover concepts such as the Market Maker Model, Power of Three, and Smart Money Techniques, providing efficient methods for traders.

Higher Highs and Higher Lows: SMC Guide to Trading Bullish Trends

Higher Highs (HH) and Higher Lows (HL) are fundamental components of trend analysis in bullish markets. These structures...

ICT One Shot One Kill: Guide to Identifying and Trading the OSOK Model Introduction

The ICT One Shot One Kill trading strategy is developed based on institutional trading concepts; this approach is used to identify...

Implied Fair Value Gap (IFVG) - Guide to Understanding & Trading IFVG

Implied Fair Value Gap (IFVG) is a significant imbalance area in ICT Style, indicating potential price trend reversals in financial...

ICT Breakaway Gaps: How to Identify & Trade the Strategy Introduction

An ICT Breakaway Gap is a fair value gap (FVG) that remains unmitigated following a strong price movement. This gap is unique...

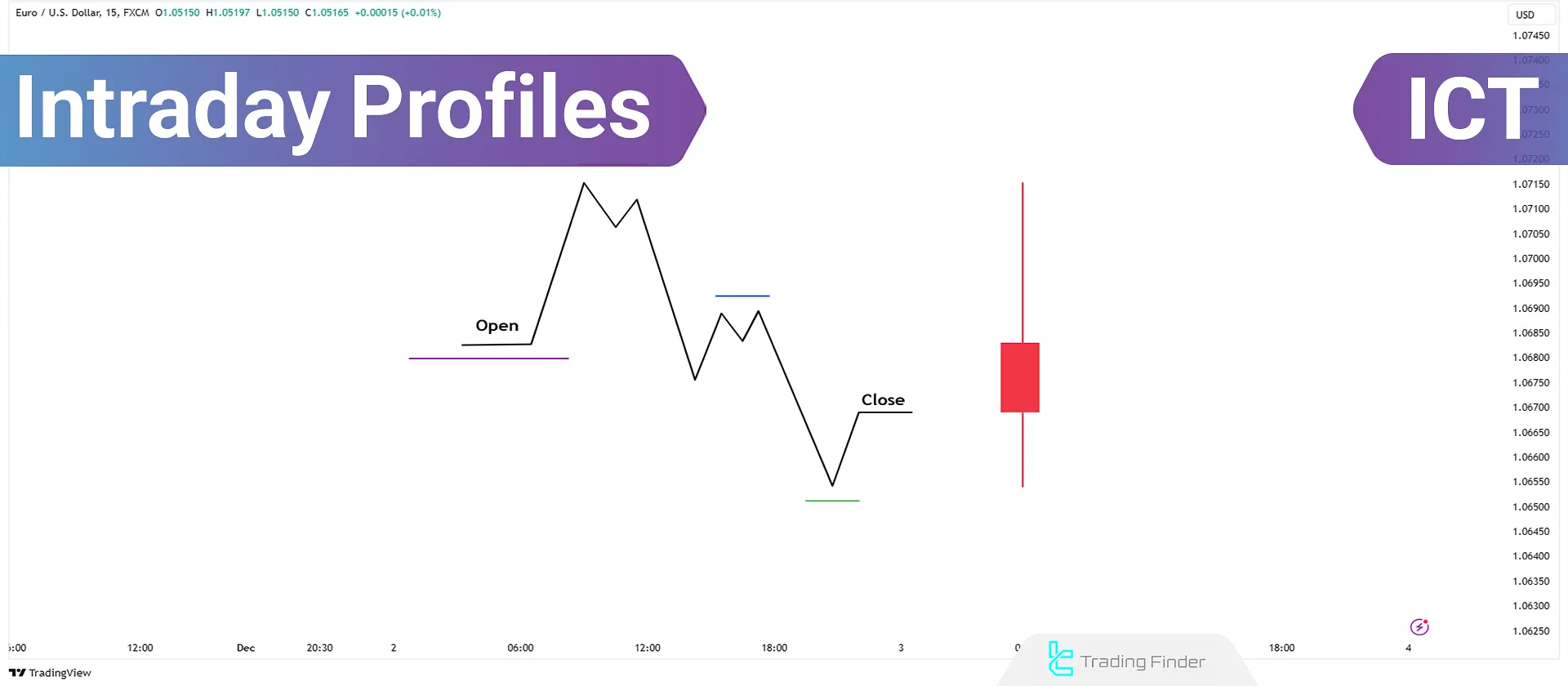

ICT Intraday Profiles for London Session – High-Probability SMC Trading Strategy

ICT intraday profiles represent a comprehensiveday trading methodology grounded in the ICT Central Bank Dealers Range (CBDR) andICT...

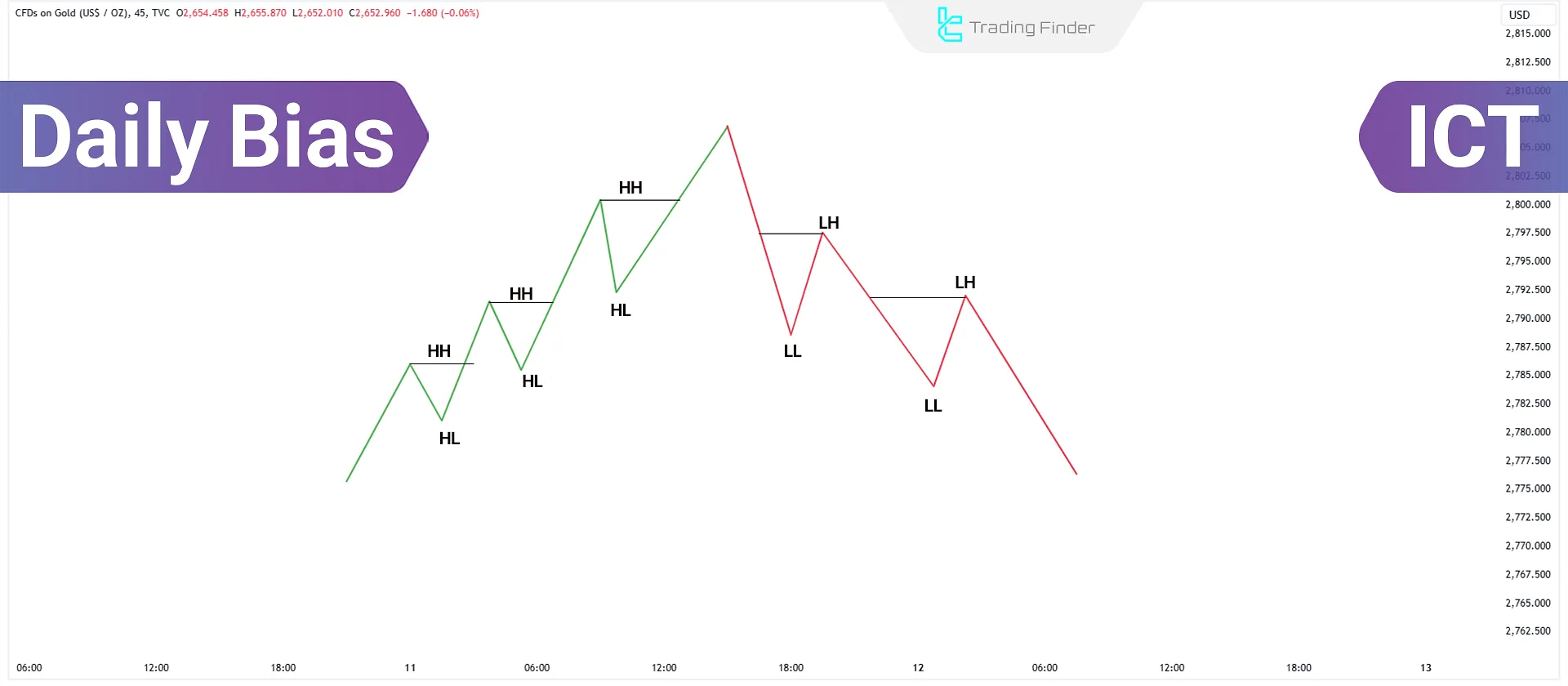

Daily Bias Training (ICT Daily Bias): Identify and Apply Market Trend in ICT

ICT Daily Bias refers to predicting price movement within a single trading day. This prediction indicates whether the price tends...

ICT Silver Bullet Strategy Training – A Liquidity-Based Scalping Strategy

ICT Silver Bullet strategy is a time-based trading approach designed for scalping. Its primary focus is on liquidity and Fair...

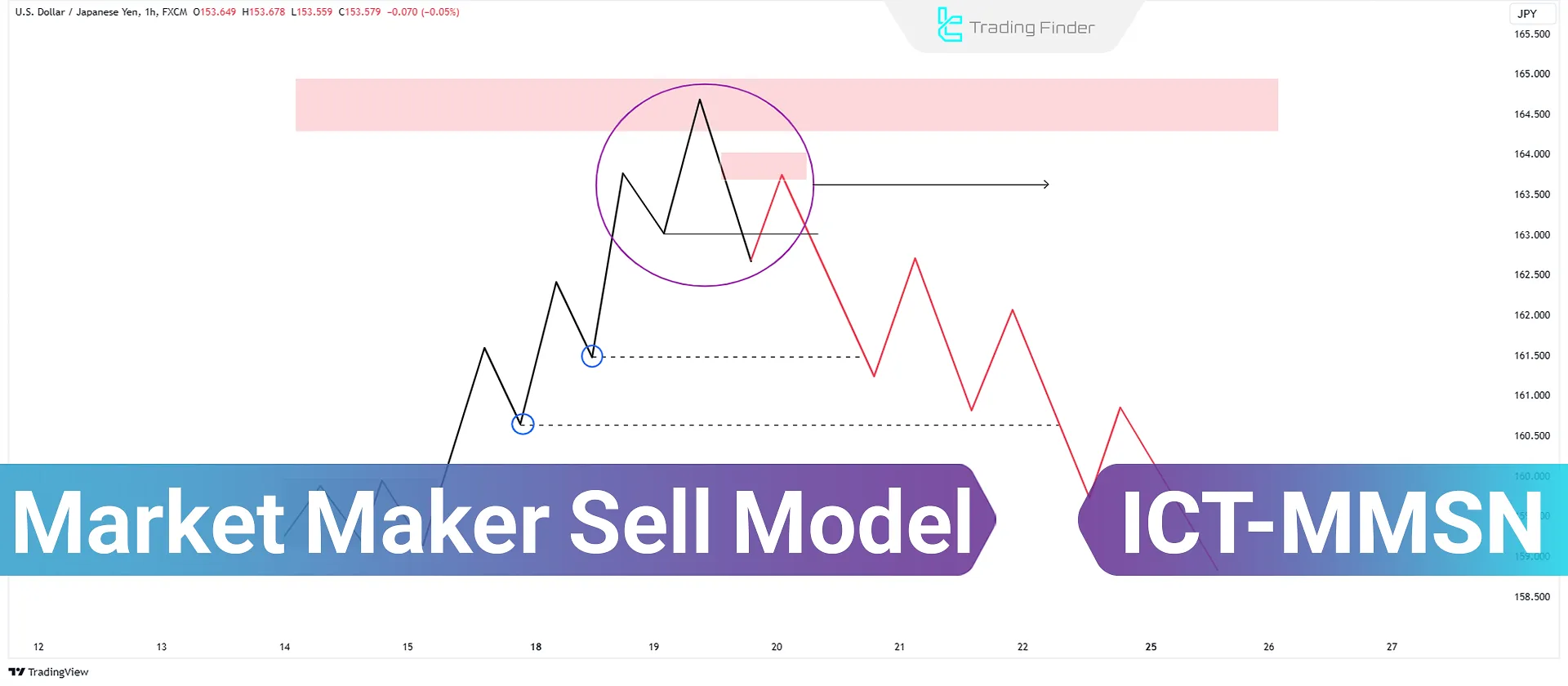

Market Maker Sell Model (MMSM); Trading the MMSN Setup in ICT Style

ICT Market Maker Sell Model (ICT MMSM) is a trading structure that explains how price transitions from one key bearish PD Array...

What Is a Breaker Block? A Guide to Identifying, Support & Resistance in ICT

The Breaker Block is one of the concepts in the ICT trading style. This method focuses on the break of Order Blocks(OB) and...

Advanced Market Structure in ICT Style - STH & ITH & LTH - STL & ITL & LTL

Advanced Market Structure concept in ICT style is based on the categorization of highs and lows. This categorization can serve as...

What Is the Killzone? London, New York, and Asian Killzones in Forex

ICT Kill Zones in Smart Money are key time intervals in financial markets when the highest volatility and trading volume occur....

Premium and Discount Arrays (PD Arrays); How to Identify PD Arrays in the ICT Trading

The ICT PD Array inSmart Moneyor "Premium and Discount Zones" is a structured approach used to identify optimal entry points in...