- TradingFinder

- Education

- Forex Education

Forex Education

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

How to Identify Daily Bias Using Internal (IRL) & External (ERL) Liquidity

Recognizing "Daily Bias" using the concepts of Internal Range Liquidity (IRL) and External Range Liquidity (ERL) is essential for...

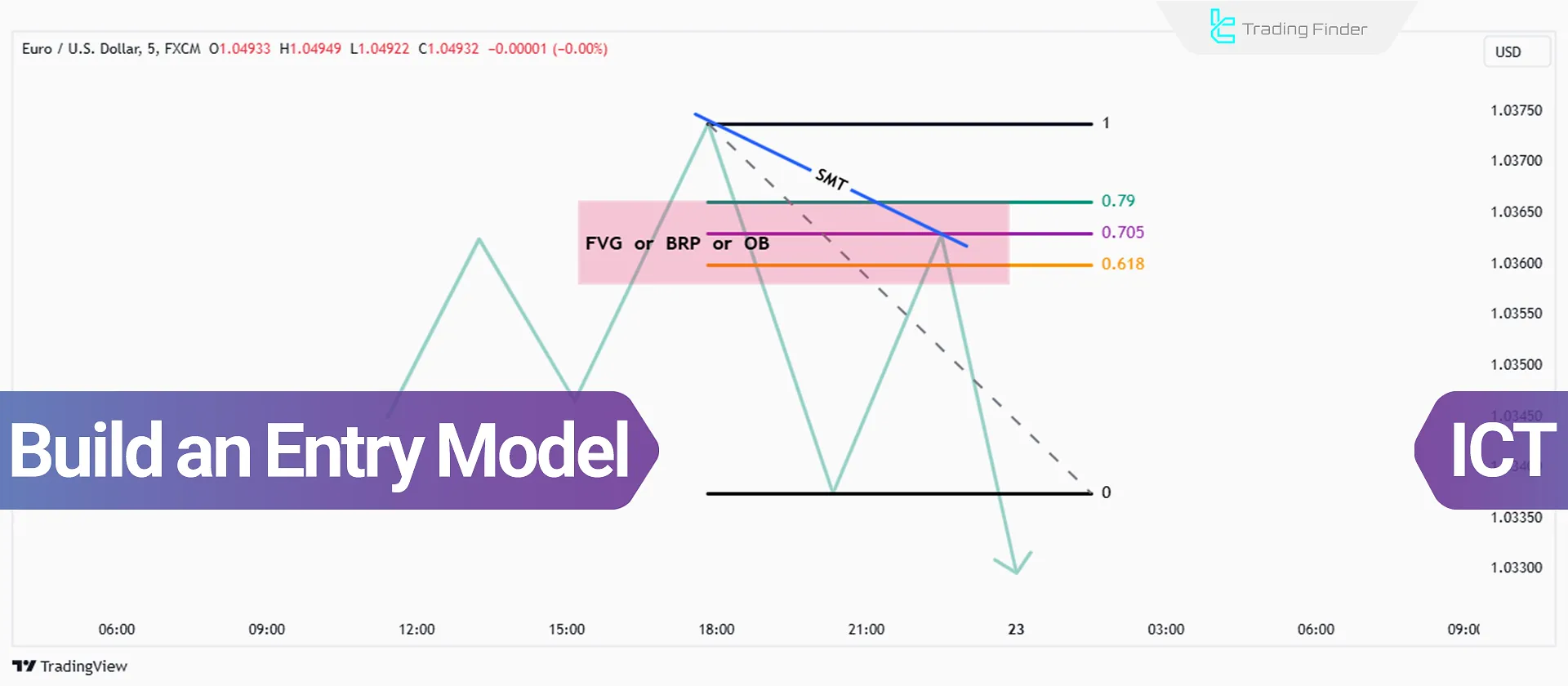

Build an Entry Model in ICT - Select a Model Based on FVG, IRL, OTE, and BPR

To design an entry model using ICT concepts, the primary focus is on shorter timeframes and entry tools, including Fair Value Gap...

Margin Call – Methods to Prevent Margin Calls in Different Markets

When the account balance is not sufficient to cover open losses, the broker or exchange issues a call margin alert. This warning...

Futures Trading: How It Works Across Forex and Crypto Markets

Futures contracts are tools for trading and speculation or risk hedging; futures contracts allow retail traders and large companies...

4 Factors Influencing Forex Fundamental Analysis [Economic Reports and GDP]

The most significant factors influencing Forex Fundamental Analysis are economic reports, Gross Domestic Product...

Stocks vs Forex Trading - Which Market Is Better for You?

The stock market and Forex market differ in terms of nature, trading hours, leverage, fees, and fundamental analysis...

What Is Equity in Forex? Calculation, Impact on Margin, and Capital Management

Equity in the forex market represents the real-time value of a trader's Account. It is the sum of the account...

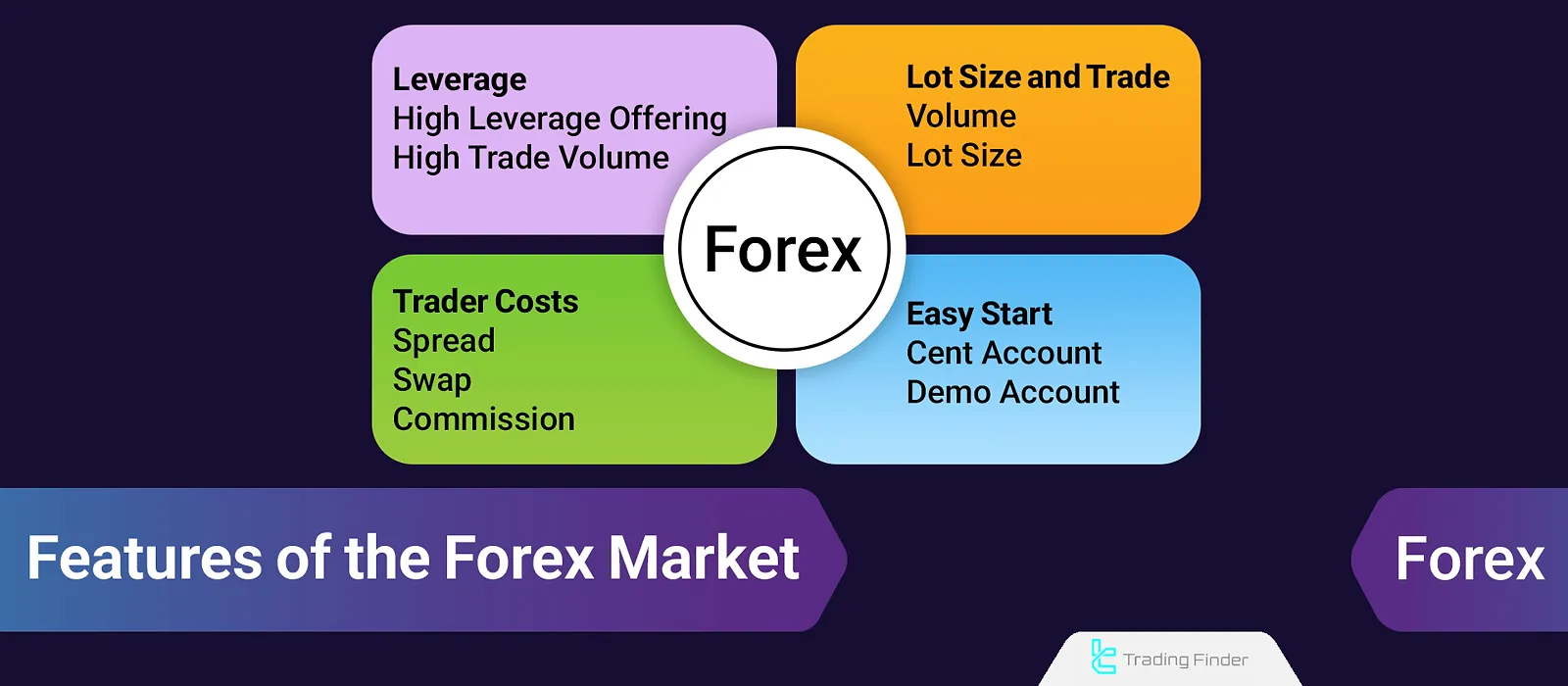

Features of Forex Market: Definition, How It Works & Market Participants

A daily trading volume of around $7 trillion, a 24-hour decentralized market, high leverage, and an easy start witha demo account...

Used Margin in Forex; Avoiding Margin Call and Stop Out

The concept of Used Margin in the forex market refers to the portion of a trader's funds that is locked by the...

Previous Weekly High & Low (PMH & PML); Key Price & Liquidity Zones

In advanced technical analysis, Previous Weekly High and Low (PWH & PWL) refer to the highest and lowest price points a...

Classic Patterns – The Use of Different Classic Patterns in Technical Analysis

From the alignment of several candlesticks on the price chart, shapes are formed that are known as classic chart pattern in...

Trading Strategy; Entry and Exit Levels, Capital Management, and Risk Control

A trading strategy is a set of predetermined rules that define the timing of entries, exit conditions, and capital management. In...

![4 Factors Influencing Forex Fundamental Analysis [Economic Reports and GDP]](https://cdn.tradingfinder.com/image/303741/16-002-tf-en-factors-influencing-forex-fundamental-analysis-01.webp)