- TradingFinder

- Education

- Forex Education

Forex Education

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

Market Structure Shift vs Liquidity Grab – Application in ICT Style Trading

Market Structure Shift (MSS) indicates a genuine trend change that occurs when key support or resistance levels are completely...

Who is Forex Market Maker? How Does it Work?

Market makers refer to traders or financial entities such as central banks, large commercial companies and banks that significantly...

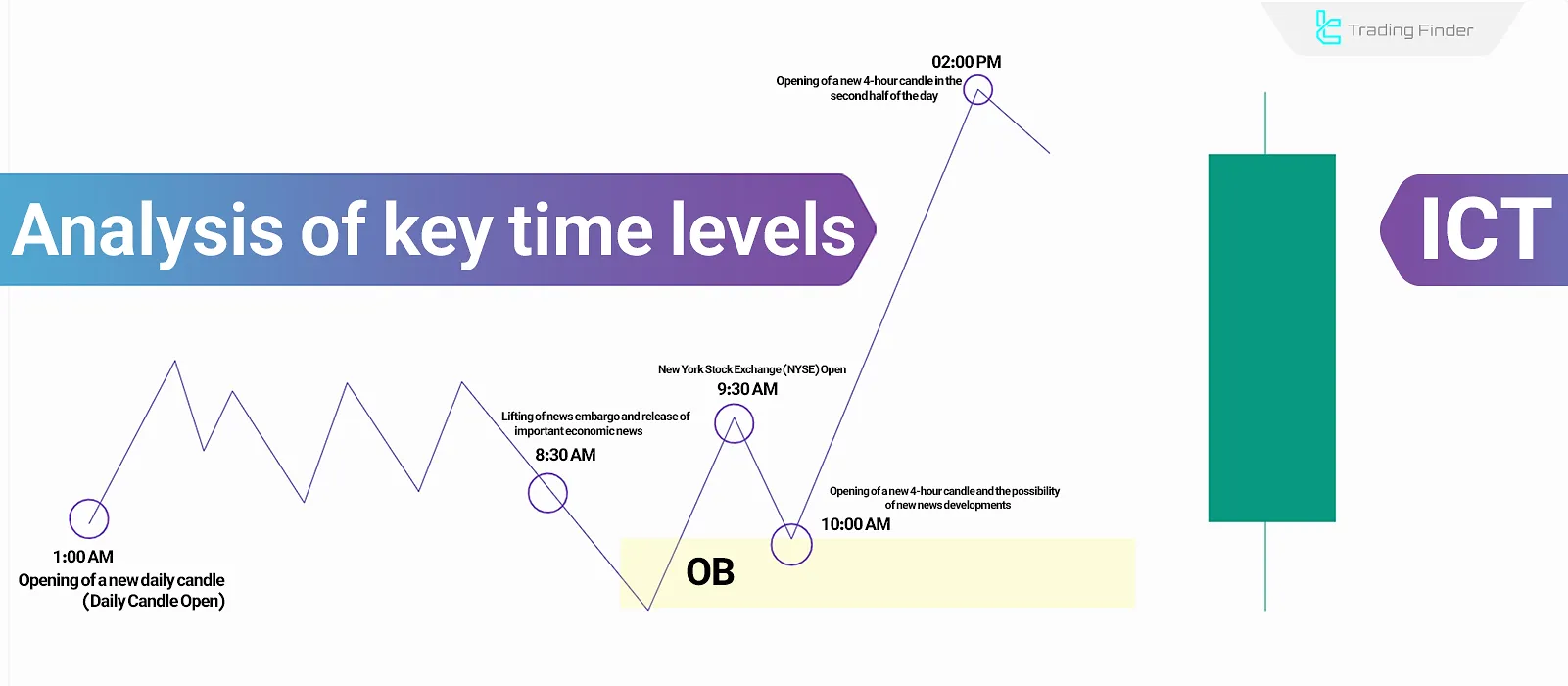

Learning to analyze important time levels and bullish & bearish candles in ICT

Analyzing ICT time levels, such as market openings, major news releases, and candlestick formations, is crucial in predicting...

What is Inflation? [Examining the PPI, CPI, and PCE Indices]

Inflation is an economic concept introduced in the early 20th century by the German economist “Heinrich Von”. It refers to...

How Do Interest Rates Affect Financial Markets? Its Effects on Economy

Interest rates are a key tool for central banks to implement monetary policy, and changes ininterest rates create significant...

Sentiment in Financial Markets [Risk On and Risk Off]

Fear or greed among traders are Fundamental analysis factors that shape price trends. Risk-averse sentiment refers to...

Reversal vs Pullback in Market Structure – Trend Recognition in HTF

By using the concepts of retracement and pullback in ICT style and Smart Money styles, long-term market trend changes and...

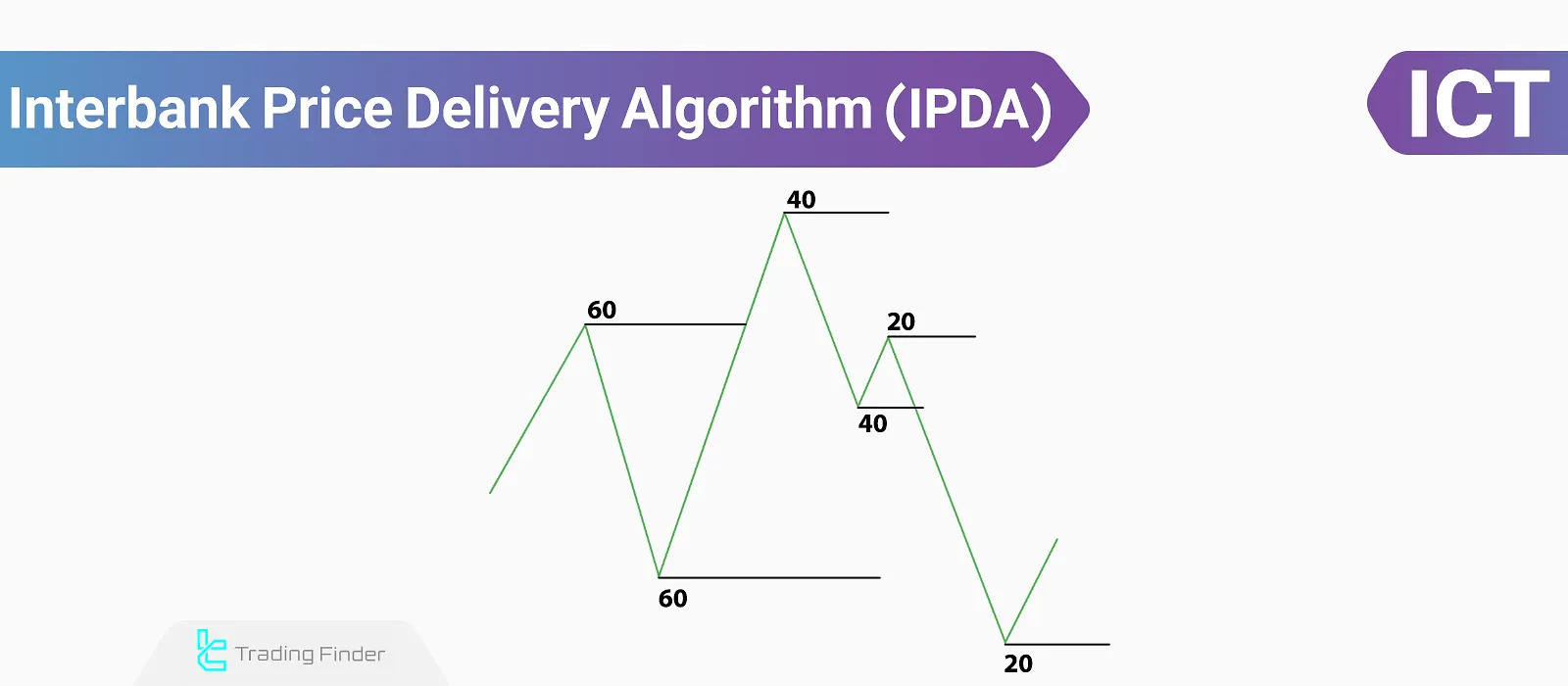

Interbank Price Delivery Algorithm (IPDA), A Guide to ICT-Style Trading Concepts

The Interbank Price Delivery Algorithm or IPDA is one of the liquidity concepts in the ICT style. This concept...

Learn IRL & ERL in ICT; Internal and External Range Liquidity

In the ICT Style, price movement in financial markets like Forex market is shaped solely towards liquidity; In this context,...

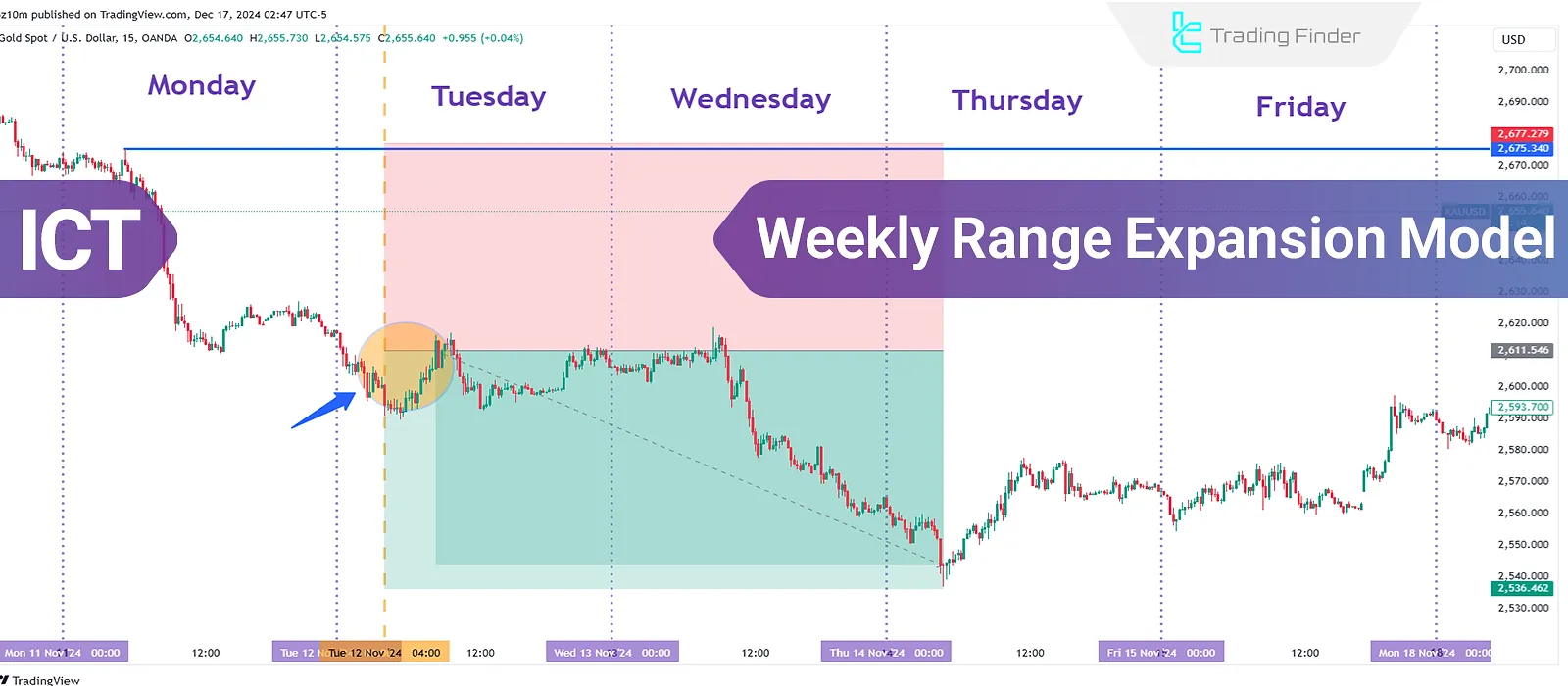

ICT Weekly Range Expansion Model - Stages of Weekly Range Execution

The ICT Weekly Range Expansion Model is an analytical approach used in short-term trading to identify price...

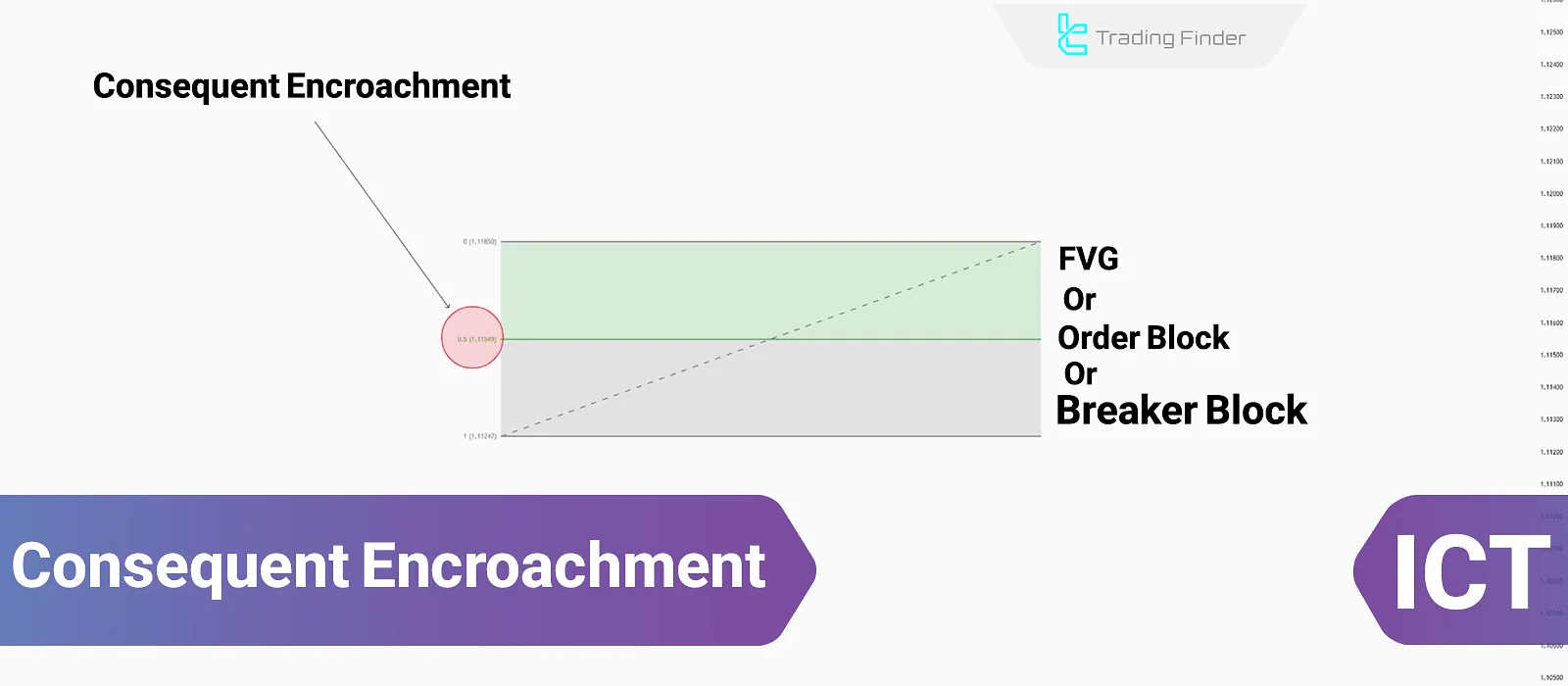

Consequent Encroachment in ICT: The Reason CE is Important in ICT

Consequent Encroachment (CE) focuses on a level where the price is highly likely to react. This concept is crucial, especially...

Buy side and Sell side Imbalance and Inefficiency (SIBI) and (BISI); ICT Style

Sell-Side Imbalance and Buy-Side Inefficiency (SIBI) and Buy-Side Imbalance andSell-Side Inefficiency (BISI) in the ICT...

![What is Inflation? [Examining the PPI, CPI, and PCE Indices]](https://cdn.tradingfinder.com/image/310401/16-005-tf-en-what-is-inflation-01.webp)

![Sentiment in Financial Markets [Risk On and Risk Off]](https://cdn.tradingfinder.com/image/309724/16-004-tf-en-sentiment-in-financial-markets01.webp)