- TradingFinder

- Education

- Forex Education

Forex Education

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

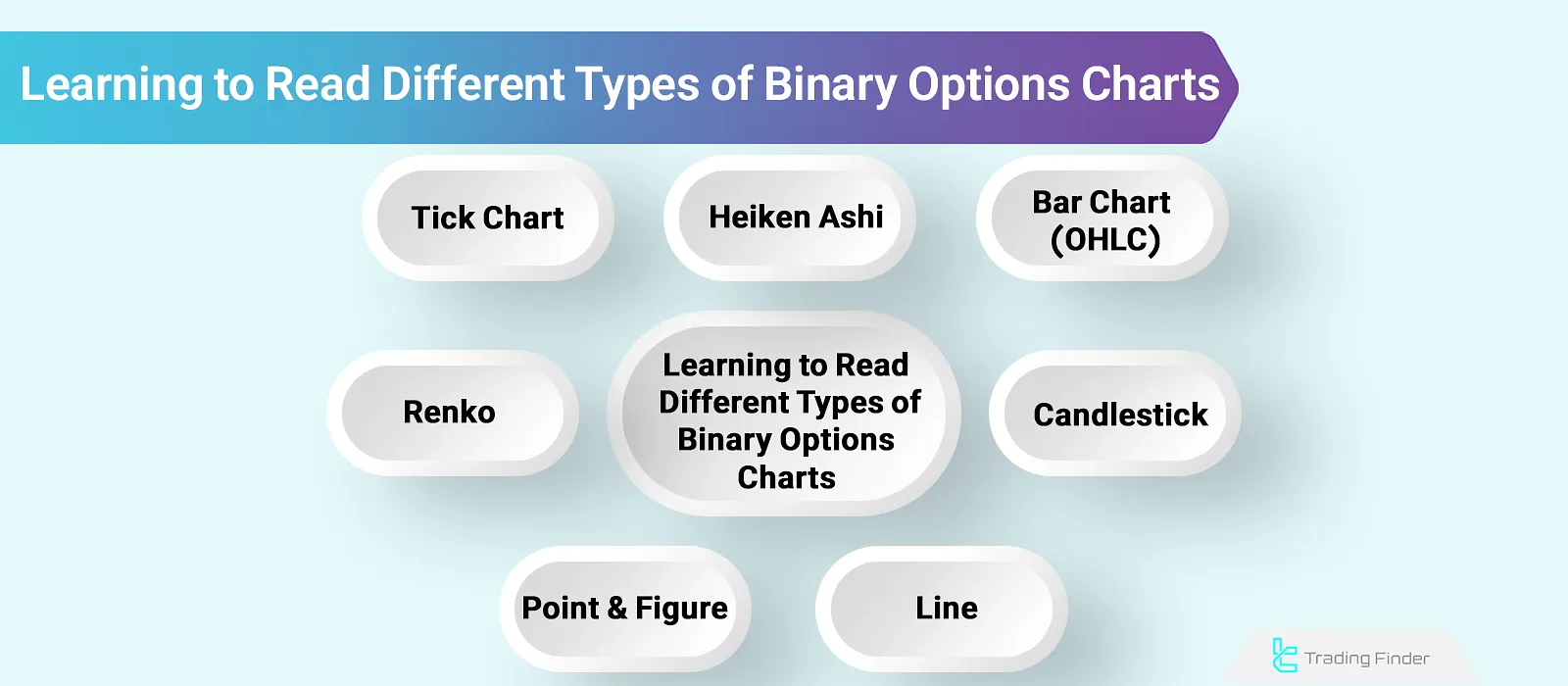

Types of Binary Options Charts (Line, Bar, Heikin Ashi, Tick, and Renko)

In binary options trading, entry and exit timing has a direct impact on profit and loss. Since the trade outcome is simply yes...

The Best Price Action Strategies in Binary Options; No Delay in Signal Generation

Price action, by directly analyzing price behavior without using lagging indicators, holds a significant position in binary options...

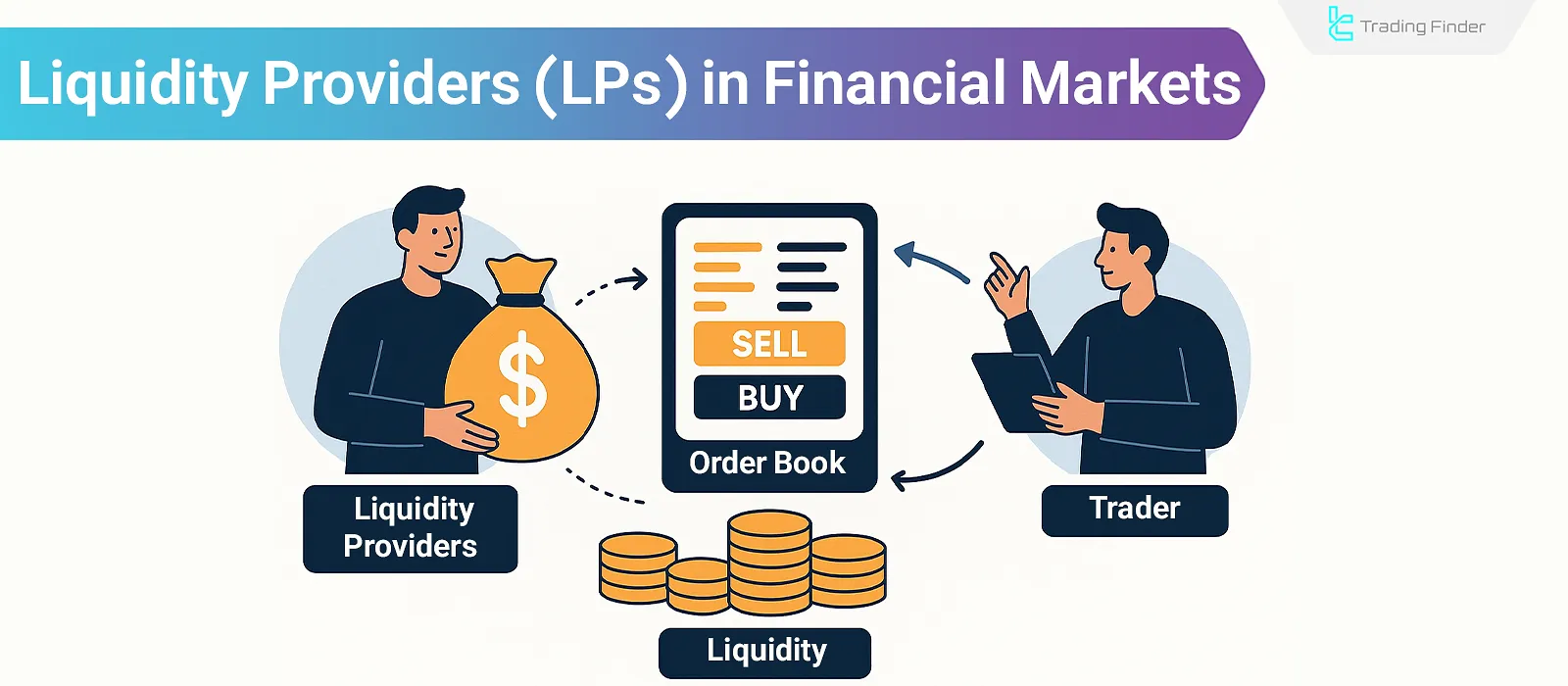

Liquidity Providers: How They Work and Why They Matter in Financial Markets

Liquidity Providers supply the required capital for trading in Forex, cryptocurrency, stock markets, and other markets. Liquidity...

Learn RSI Divergence: Hidden & Regular Divergence

RSI Divergence is a tool for identifying potential price reversal points in the market. Detecting RSI Divergence is one of the...

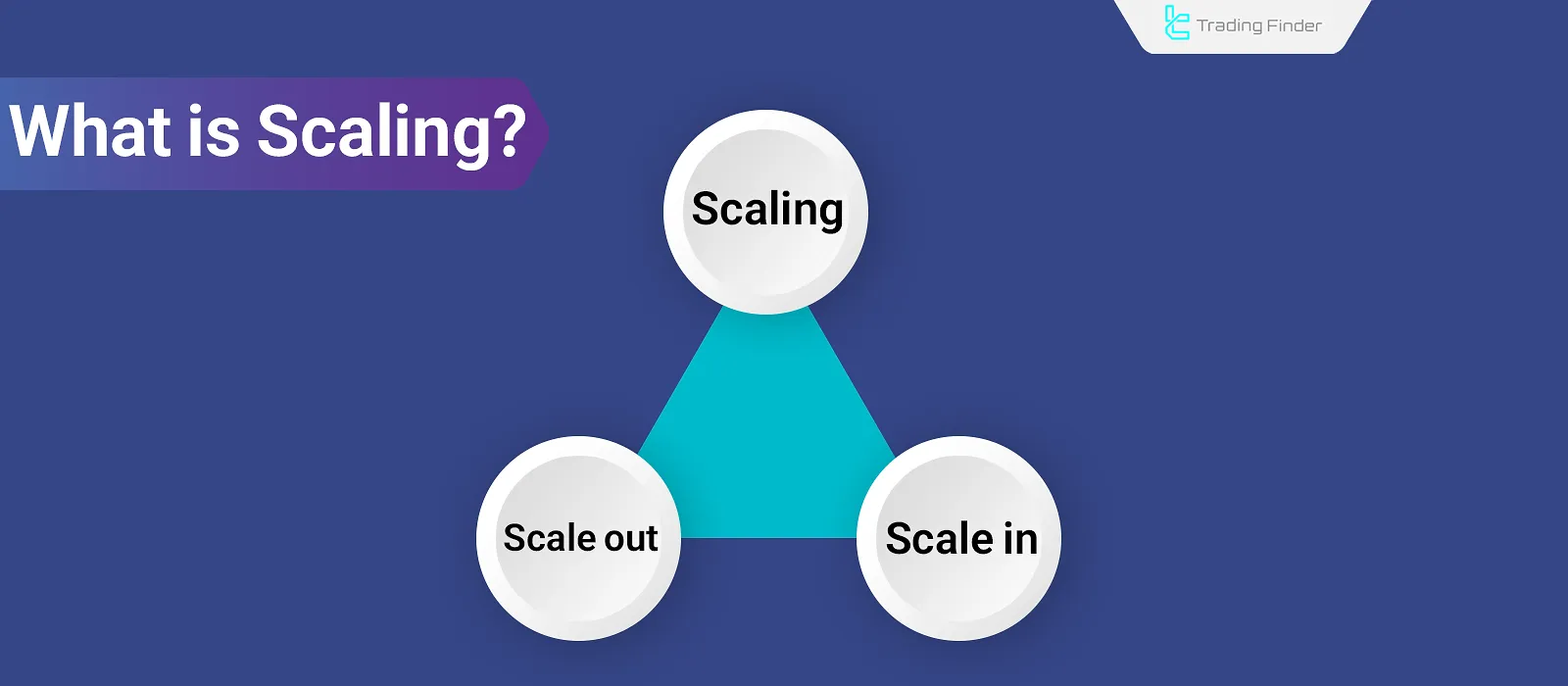

Scaling in Trading: Multi-Stage Entry and Exit with Position Size Adjustments

Scaling in trading refers to the process of increasing or decreasing the position size of a trade based on market conditions and...

Learn the Concept of POI in ICT– Entering a Trade Using Points of Interest (POI)

In financial market analysis using the ICT style, Points of Interest (POI) in higher timeframes are used to analyze the ongoing...

Bearish Order Block: Explained the Ultimate ICT Smart Money Trading Guide

One of the foundational concepts in ICT trading is the Bearish Order Block (OB-), which represents the zones where smart money’s...

Win Rate; How to Calculate Win Rate and Its Importance in Forex

Win Rate in Trading represents the percentage of successful trades out of the total number of trades. By analyzing and...

Combining Fibonacci and Candlestick – Best Candlestick Patterns for Fibonacci

The Fibonacci tool offers high compatibility with other technical analysis concepts such as support and resistance, classic...

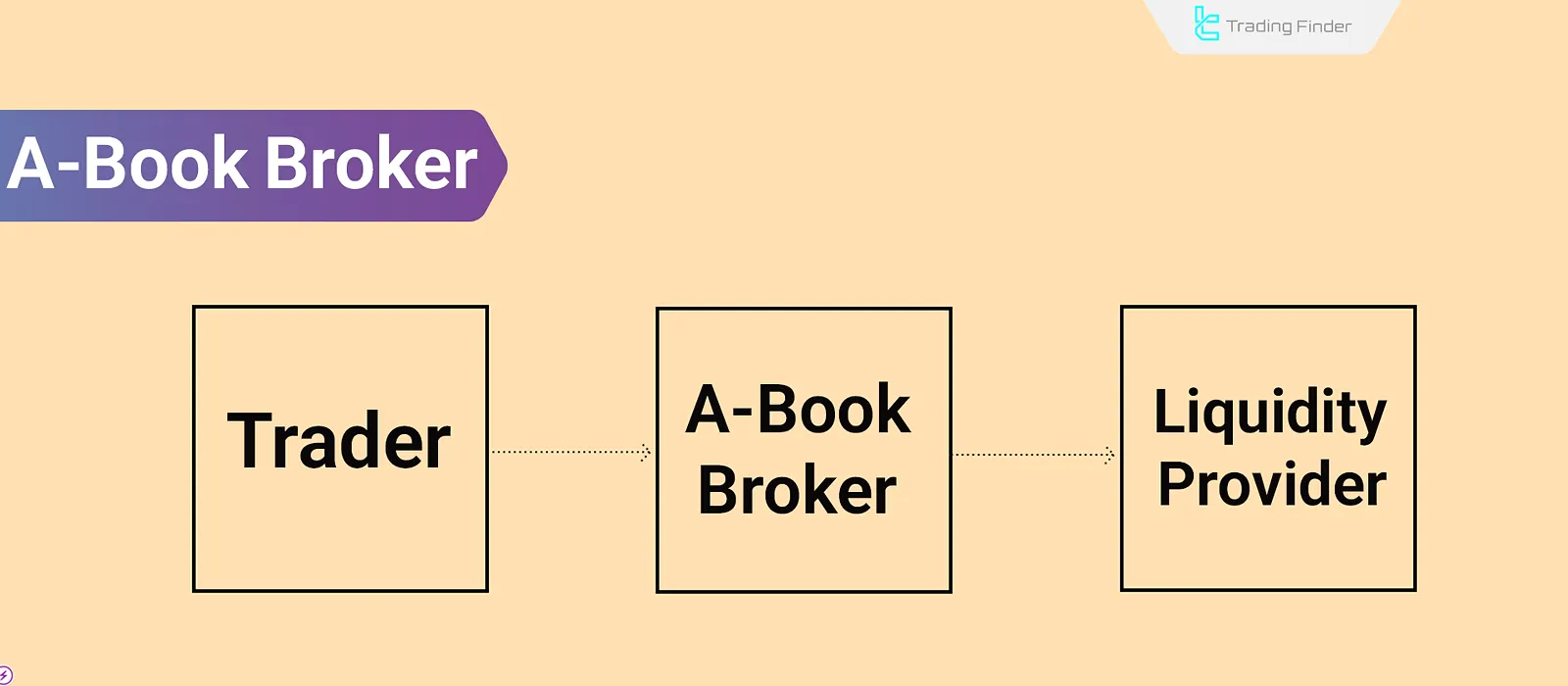

What is an A-Book Broker? Risk Transfer to Liquidity Provider (LP) and Hedging

There are different models for trade execution in the forex market, each with a unique structure and impact on the trading...

What Is the Martingale Strategy and How Does It Work? (Full Guide + Types)

The Martingale strategy, originally designed in the 18th century for gambling purposes, is now widely used as a capital management...

What is Margin Trading? A Guide to Margin Trading

Margin Trading is a form of leveraged trading that allows traders to operate with capital exceeding their available balance. In...