- TradingFinder

- Education

- Forex Education

Forex Education

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

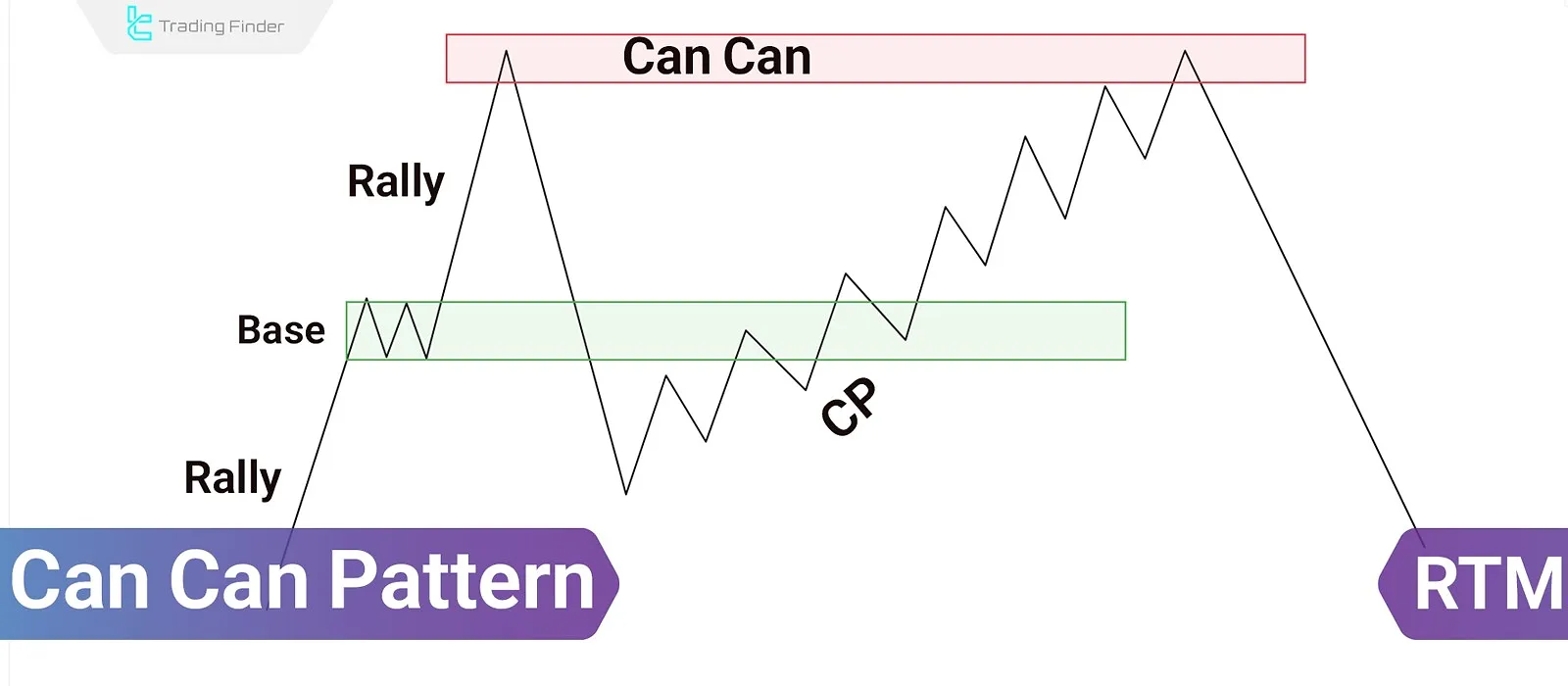

Can Can Pattern in RTM: Compression and Tap to Broken Zone (Caps)

The Can Can pattern in the RTM methodology reflects a smart price behavior designed to trap breakout traders. It is not a...

Stochastic Indicator – Stochastic Indicator Settings and Formula

The stochastic indicator analyzes price momentum by examining price movements over a specific time period. This stochastic oscillator...

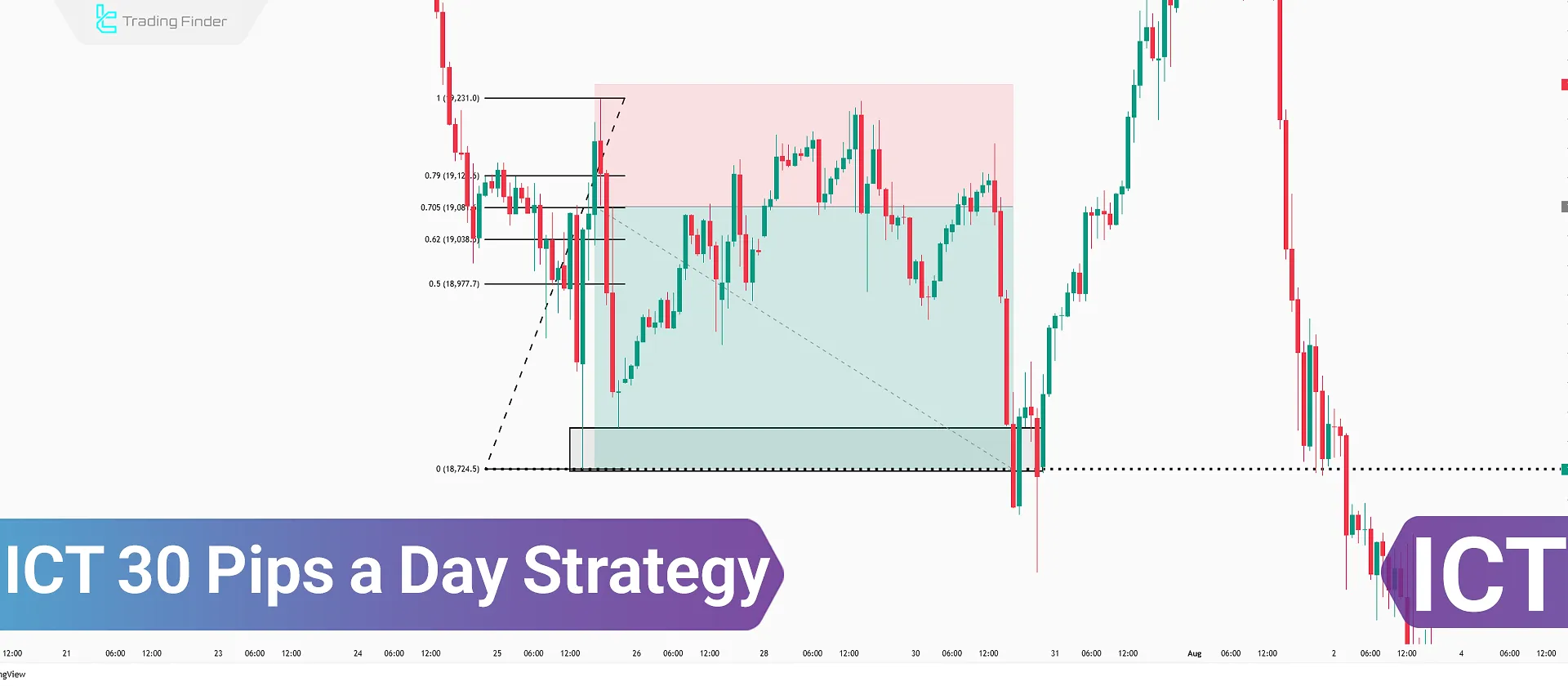

ICT 30 Pips a Day Strategy – Combining OTE & DOL to Identify Entry & Exit Points

The ICT 30 Pips a Day Strategy incorporates various concepts from the ICT Style such as Draw On Liquidity (DOL), Optimal Trade...

OBV Indicator Training in Trading; Analyzing Volume Shifts Before Price Movement

In technical analysis, volume plays a crucial role in identifying the true strength of price movements. The OBV indicator...

What is News Trading? The Most Influential News in the Forex and Crypto Markets

Economic and political news plays a key role in market direction and sentiment. Due to the surge in volume and volatility...

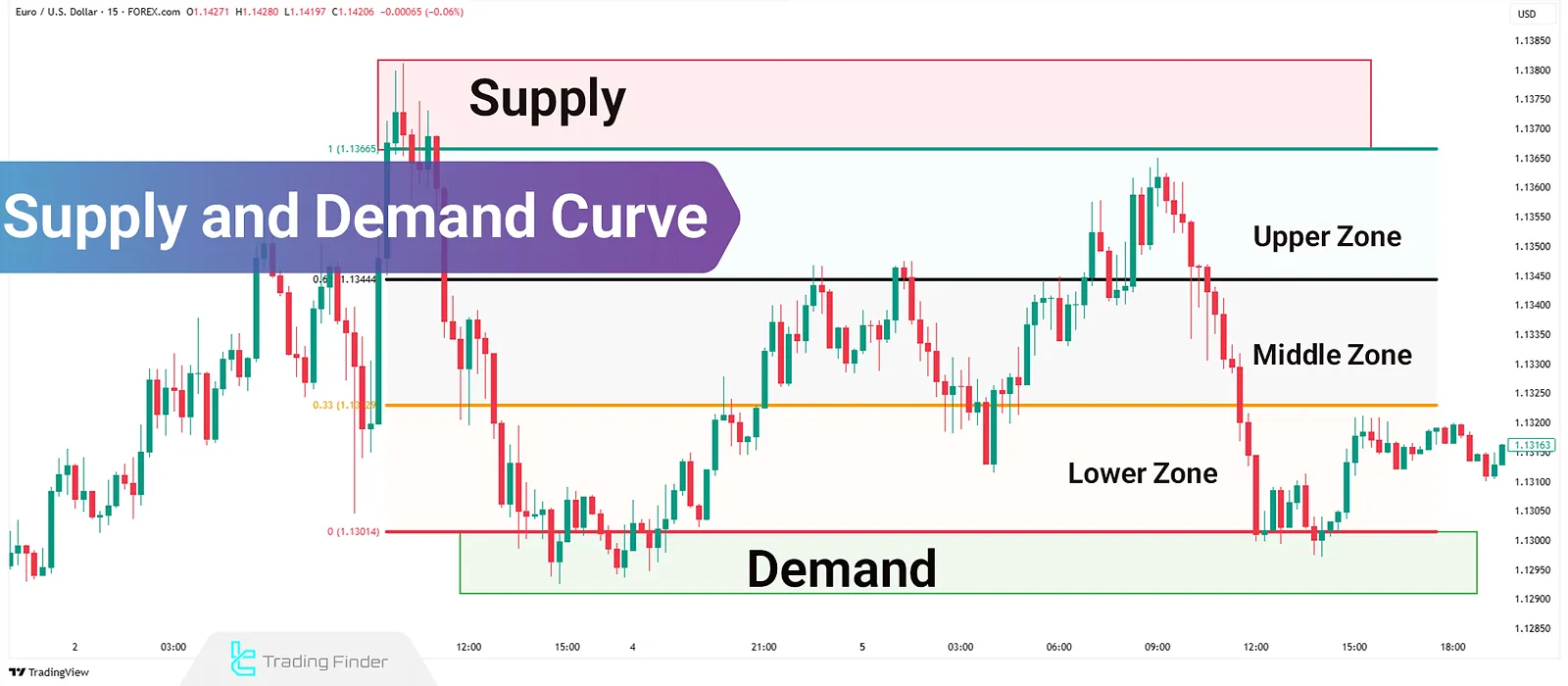

Supply and Demand Curve Training: Trading Setups and Manual/Fibonacci Plotting

When analyzing supply and demand zones in technical analysis, identifying them is not enough; understanding the current price...

What Is Economic Calendar? Applications + Key Events [NFP,CPI,PMI]

The Forex Economic Calendar provides essential economic information related to various forex market assets, including central bank...

ADX Indicator: Average Directional Index for Trend and Range Detection

In technical analysis, identifying the strength of a trend is just as important as recognizing its direction. The ADX Indicator...

Risk Management in Financial Markets: Guide to Effective Risk Control Strategies

Risk management refers to the identification, analysis, and control of harmful factors, applicable in all financial markets such as...

What Is Money Management? How to Implement Money Management in Trading

Money management encompasses a set of rules designed to maximize investment returns while mitigating risk. Therefore, in the long...

Swing Trading - Strategies Based on Price Reversals, Breakouts, & Retracements

In swing trading, traders analyze the overall market trend and various economic data to identify the long-term direction of price...

Refinement Trading Strategy; Capital Management Adjustment

In financial markets, none of the trading strategies is reliable in their initial phase. Changes in market structure, price...

![What Is Economic Calendar? Applications + Key Events [NFP,CPI,PMI]](https://cdn.tradingfinder.com/image/478340/03-36-tf-en-forex-economic-calendar-01.webp)