- TradingFinder

- Education

- Forex Education

Forex Education

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

What is the Deep Crab Pattern? – Guide to Trading the Harmonic Deep Crab Pattern

Harmonic pattern traders use the Deep Crab Pattern to anticipate price reversals. By calculating and identifying points B, A, X,...

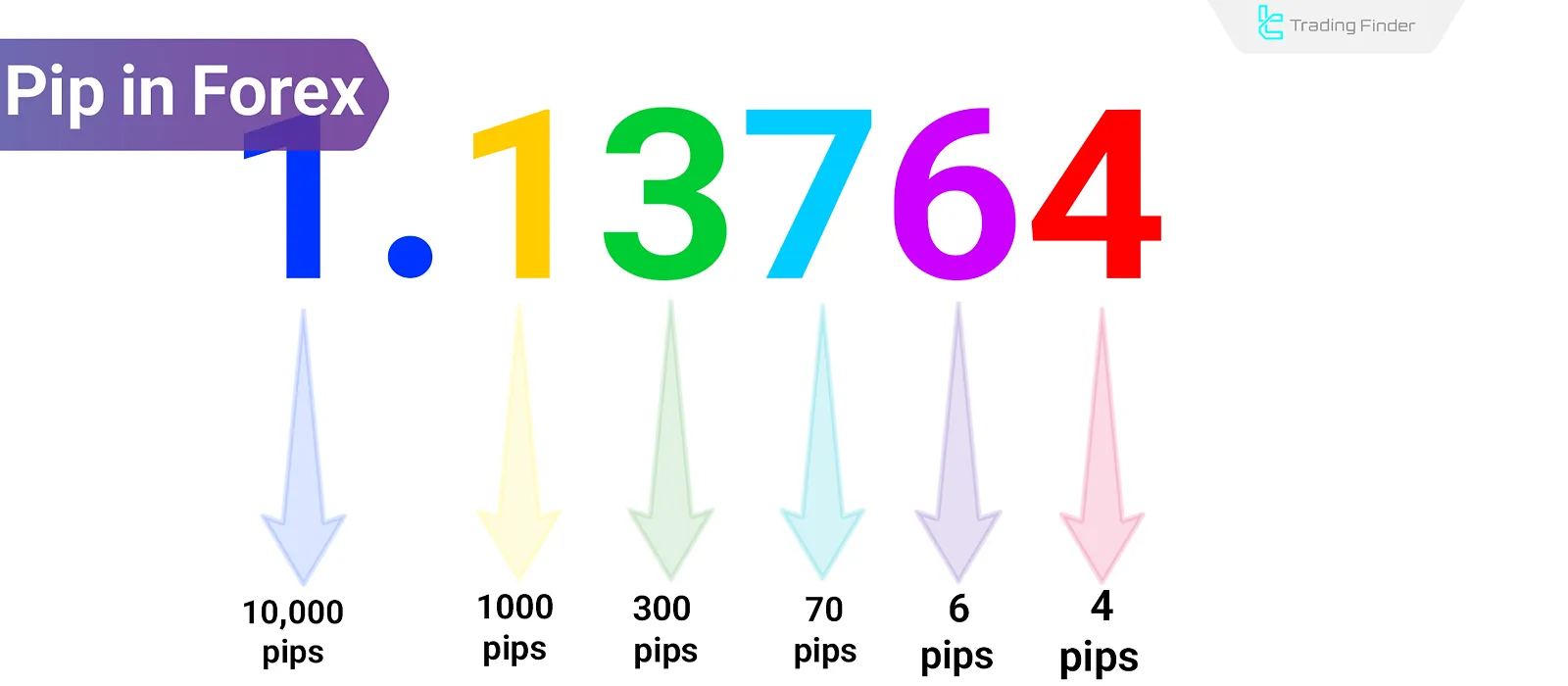

Pip in Trading: Applications in Capital & Risk Management + Calculation Formula

A pip (PIP) is the standard unit of measurement for price changes in currency pairs and serves as the main basis for...

What Is Trading Volume? 9 Indicators for Market Volume Analysis

Trading volume in financial markets is considered a benchmark for assessing liquidity, price momentum, and the validity of ongoing...

What Is Social Trading? Copy Trading, Mirror Trading, and Signal Trading

Social trading refers to leveraging the experience and skills of other individuals in your trading strategy. Onsocial trading...

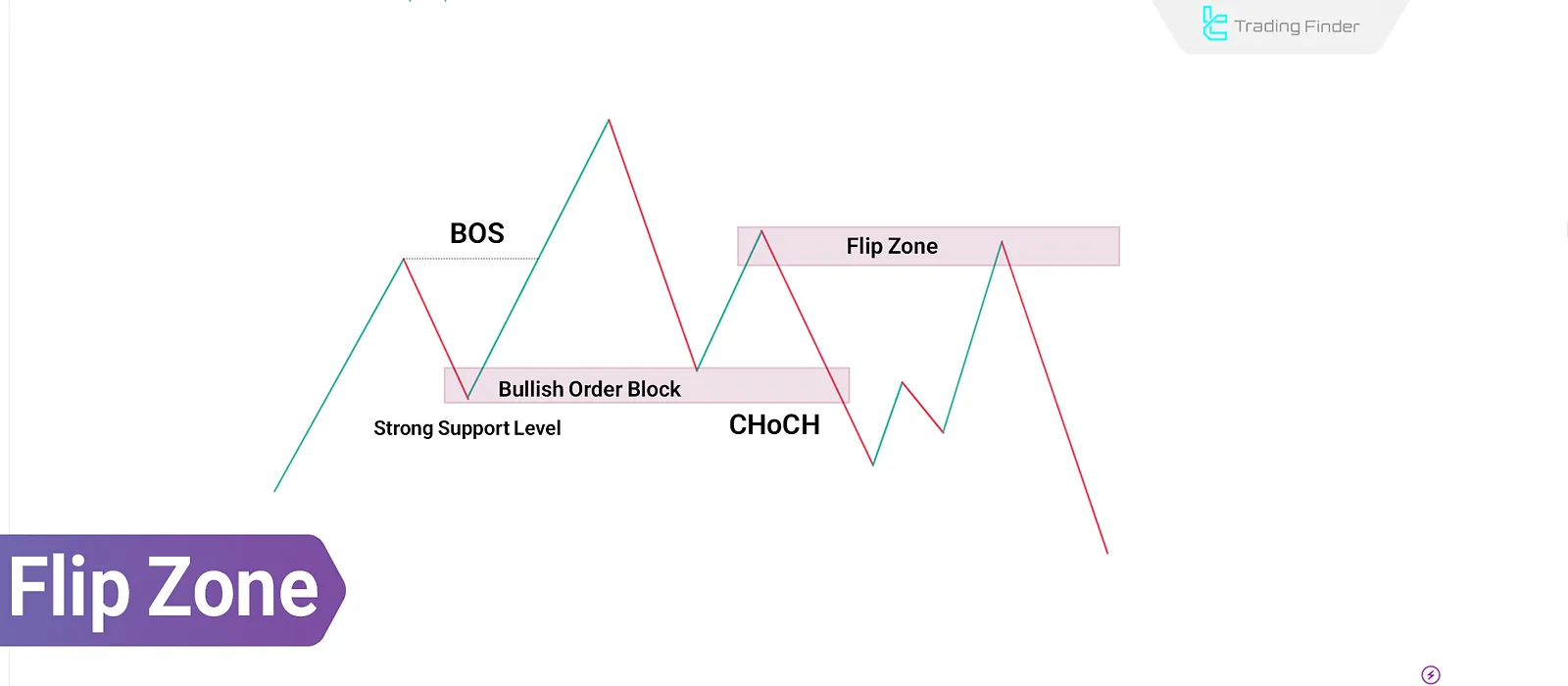

Smart Money Flip Zone & ICT Concept: Using Supply and Demand Levels

In Smart Money analysis and ICT concepts, a Flip Level in ICT is a price level where supply or demand zones are broken and...

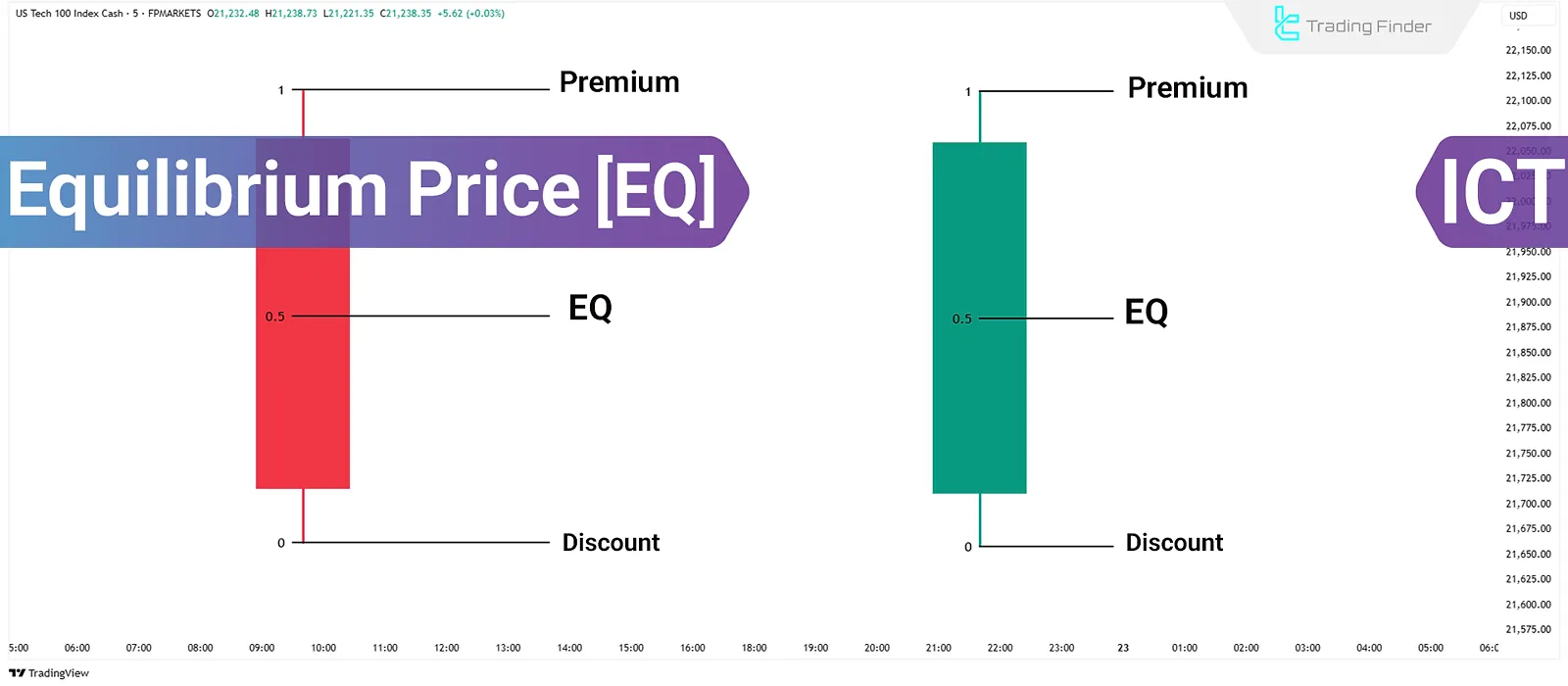

ICT Style Price Equilibrium: How to Calculate & Use It with PD Array Components

In the ICT methodology, price equilibrium refers to the midpoint between the highest and lowest wick of a...

Pivot Point Indicator: Calculation Via Floor, Camarilla, Woodie, and Fibonacci

In technical analysis, trading requires defined levels where price behavior is predictable. The Pivot Point Indicator is designed...

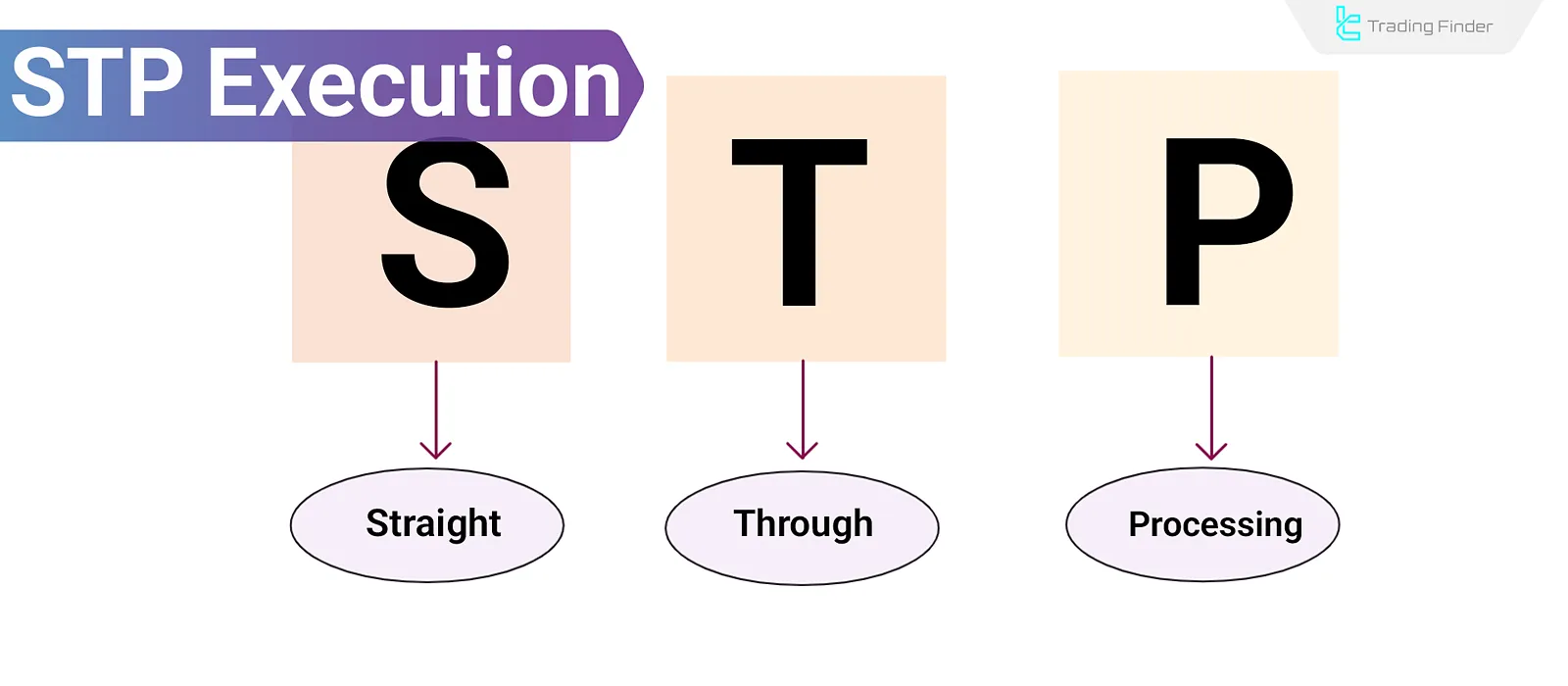

STP Execution Model: Routing Trade Orders Directly to Liquidity Providers

In the Straight Through Processing (STP) model, the broker routes the client's order to a Liquidity Provider (LP) without internal...

What is a Trading Plan? A Guide to Building a Trading Plan for Different Markets

Atrading plan is a set of rules that governs all activities of a trader. A properly written trading plan helps mitigate the...

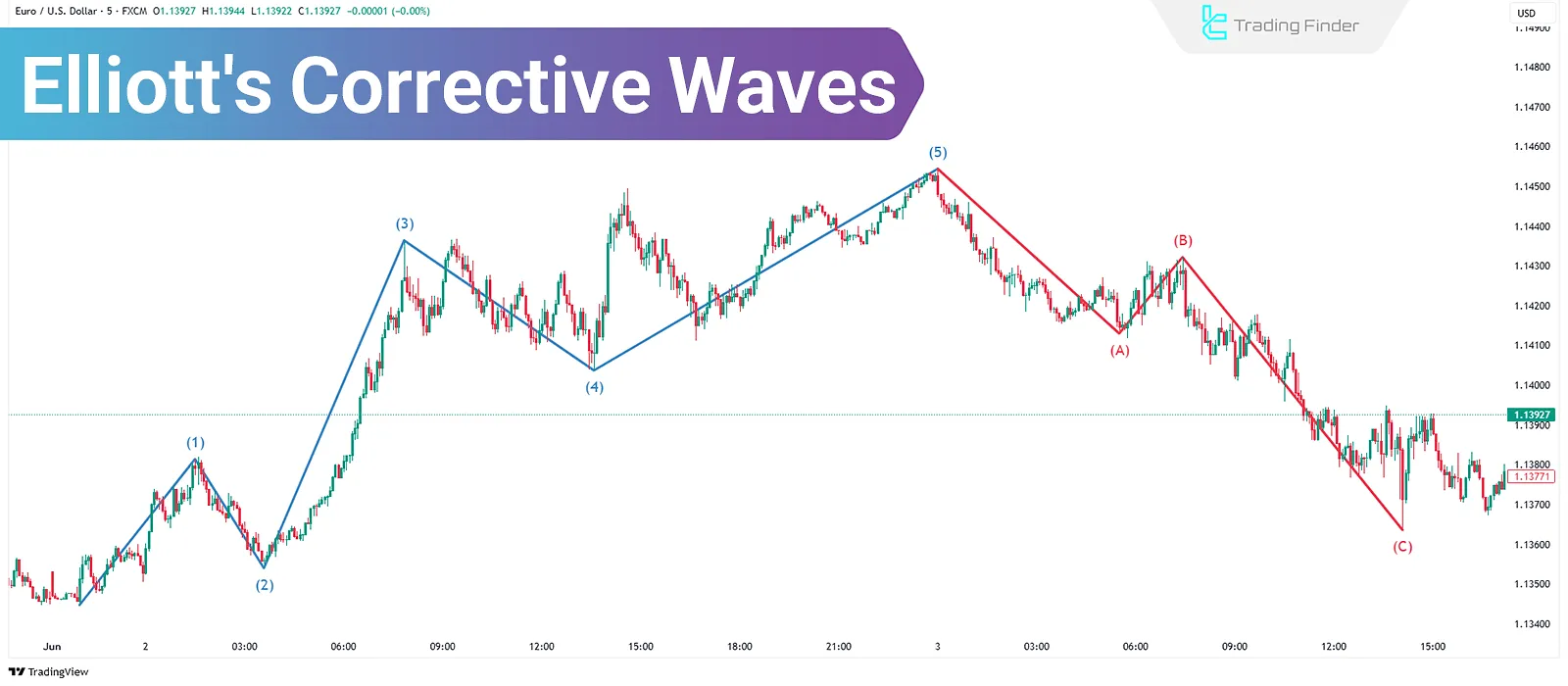

Corrective Waves in Elliott Theory; Training on the Rules of Corrective Waves

Corrective Waves in Elliott Wave Theory are composed of three sub-waves and move against the prevailing trend. Unlike motive...

Reversal Trading in Price Action: Candlestick Confirmation and Divergence

In technical analysis, price is constantly changing sometimes moving in a clear direction, sometimes reversing. One of the most...

Fractal & Inversion Strategy in ICT: 1-Hour, 5-Minute, and 1-Minute [Free Guide]

The Fractal model in ICT style is a method for aligning price structure across timeframes and entering reactive market zones. This...

![Fractal & Inversion Strategy in ICT: 1-Hour, 5-Minute, and 1-Minute [Free Guide]](https://cdn.tradingfinder.com/image/444830/7-94-en-fractal-model-in-ict-01.webp)