- TradingFinder

- Education

- Forex Education

Forex Education

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

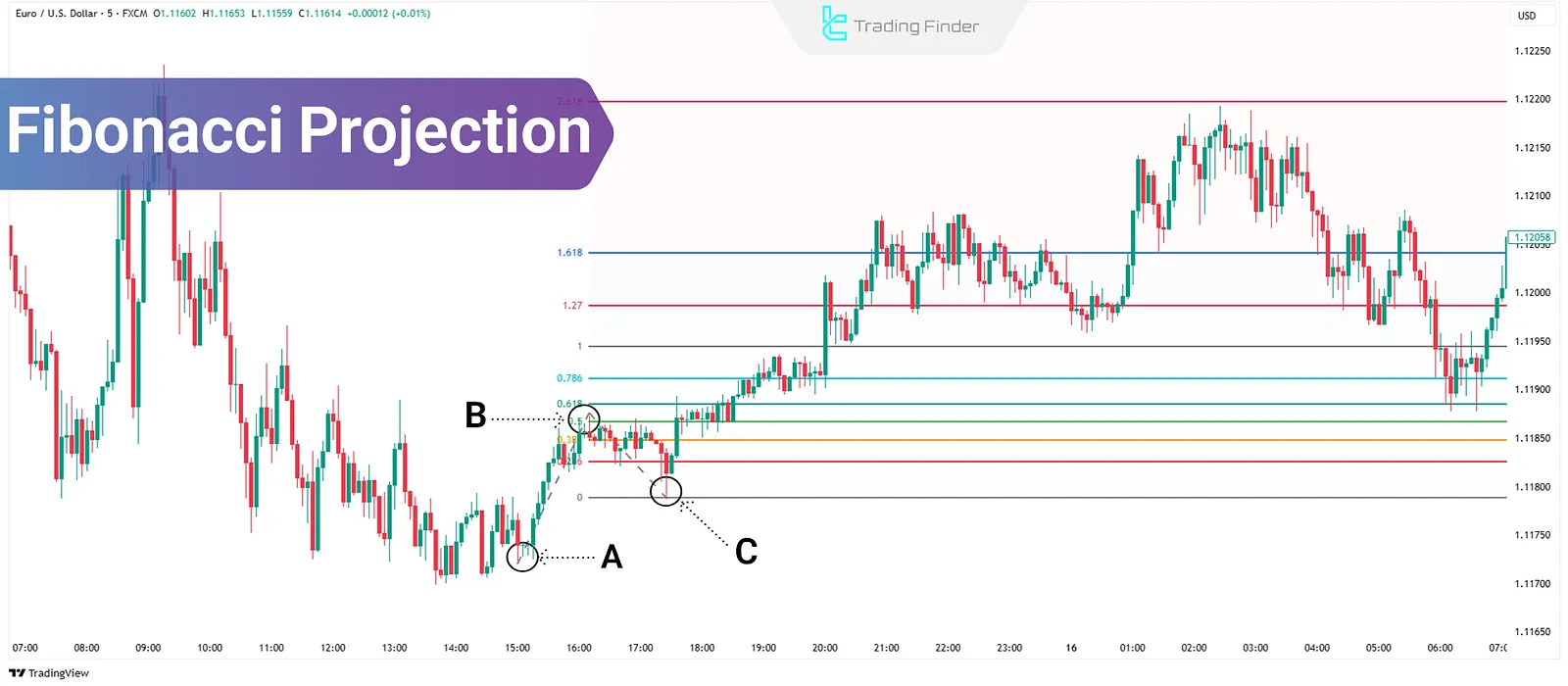

Fibonacci Projection Levels in Technical Analysis: Target Determination

Fibonacci Projection in technical analysis is a tool used to calculate price targets in the direction of a trend. By selecting...

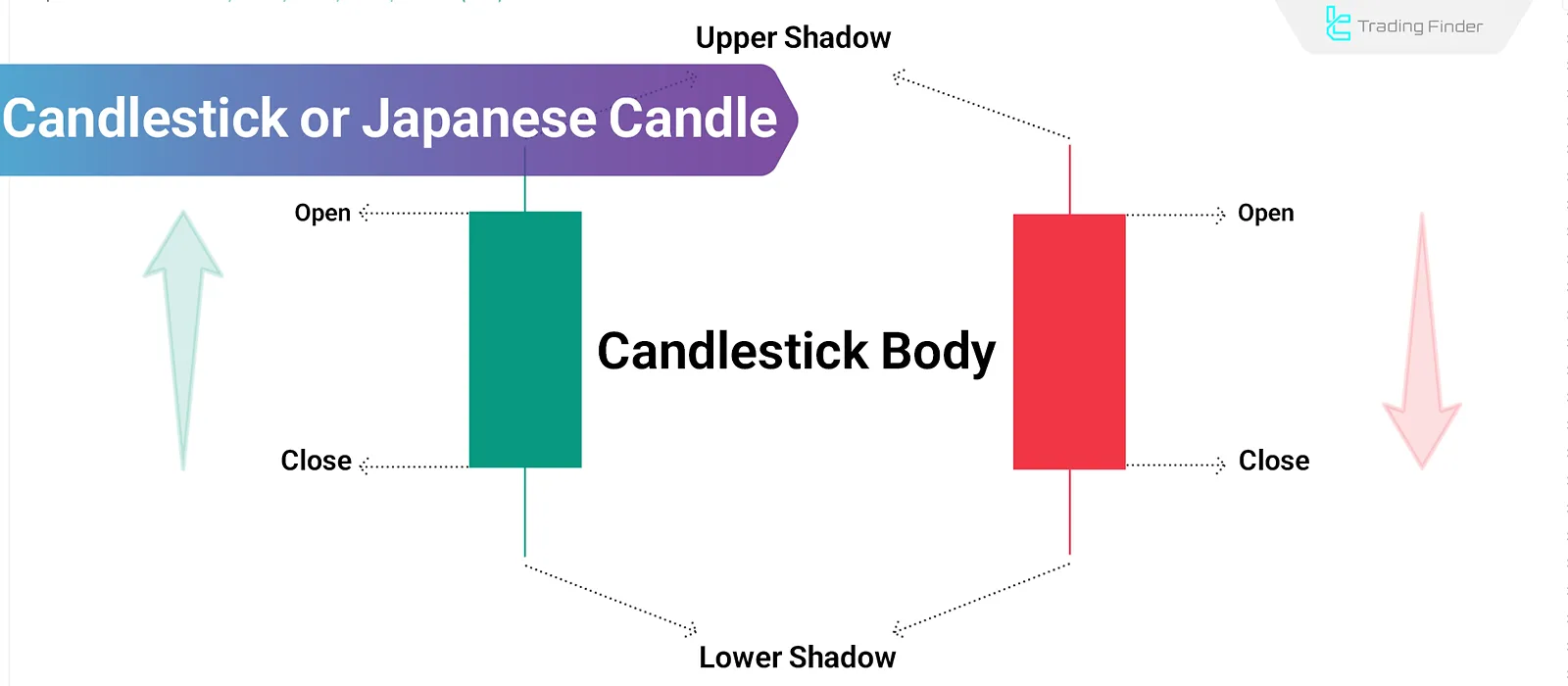

Candlestick or Japanese Candlestick Chart: Visual Language of Financial Markets

Candlesticks or Japanese Candlestick Charts are the foundation of technical analysis in financial markets. These charts visually and...

ICT Bread and Butter Buy-Setup – Scalping Strategy in Bullish Bias

When the Daily Bias in a higher time frame (HTF) is bullish, the ICT Bread and Butter Buy-Setup provides signals to enter buy...

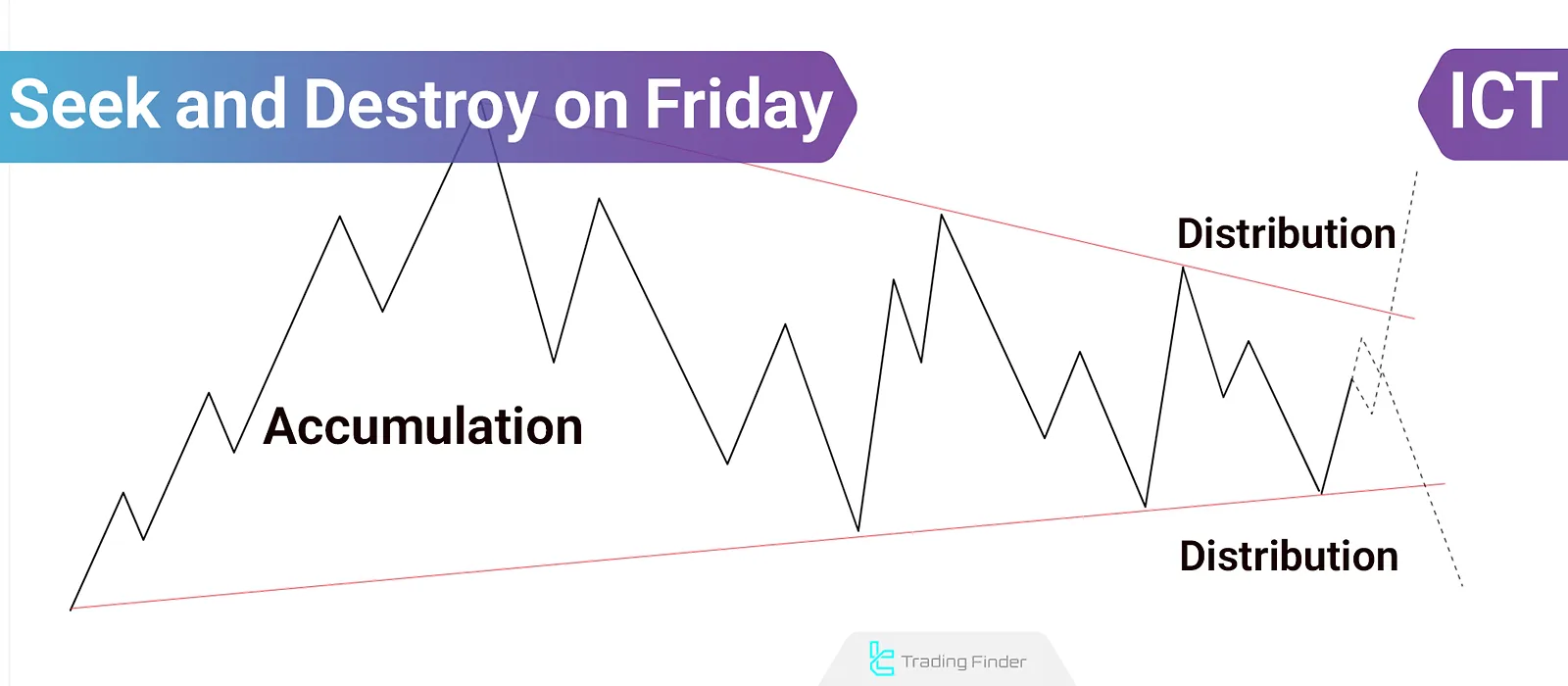

Friday Seek and Destroy Strategy in ICT: Accumulation and Distribution Explained

In the Friday Seek and Destroy strategy within the ICT methodology, the market typically enters an accumulation or distribution...

Exponential Moving Average (EMA): How to Use & The Best Settings

The Exponential Moving Average (EMA) indicator is a lagging indicator that responds quickly to price movements in financial...

What Is the RTM Diamond Pattern? Trading the Diamond Pattern in the RTM Style

The RTM Diamond Pattern is one of the main patterns in the RTM style that deceives both buyers and sellers. This pattern appears...

What Are Maker and Taker Fees? Difference Between Maker and Taker

When buying and selling cryptocurrencies on atrading platform, you must pay transaction fees. Generally, trading fees on crypto...

Bearish Bread and Butter Trading Strategy – Ideal ICT-Style Scalping Setup

The ICT Bread and Butter Sell-Setup, when aligned with a bearish Daily Bias, offers opportunities to enter short-term sell trades....

Types of Price Gaps in Technical Analysis – 4 Major Types of Price Gaps

Types of price gaps refer to discontinuities on a price chart where no trading activity has occurred. These types of gaps in...

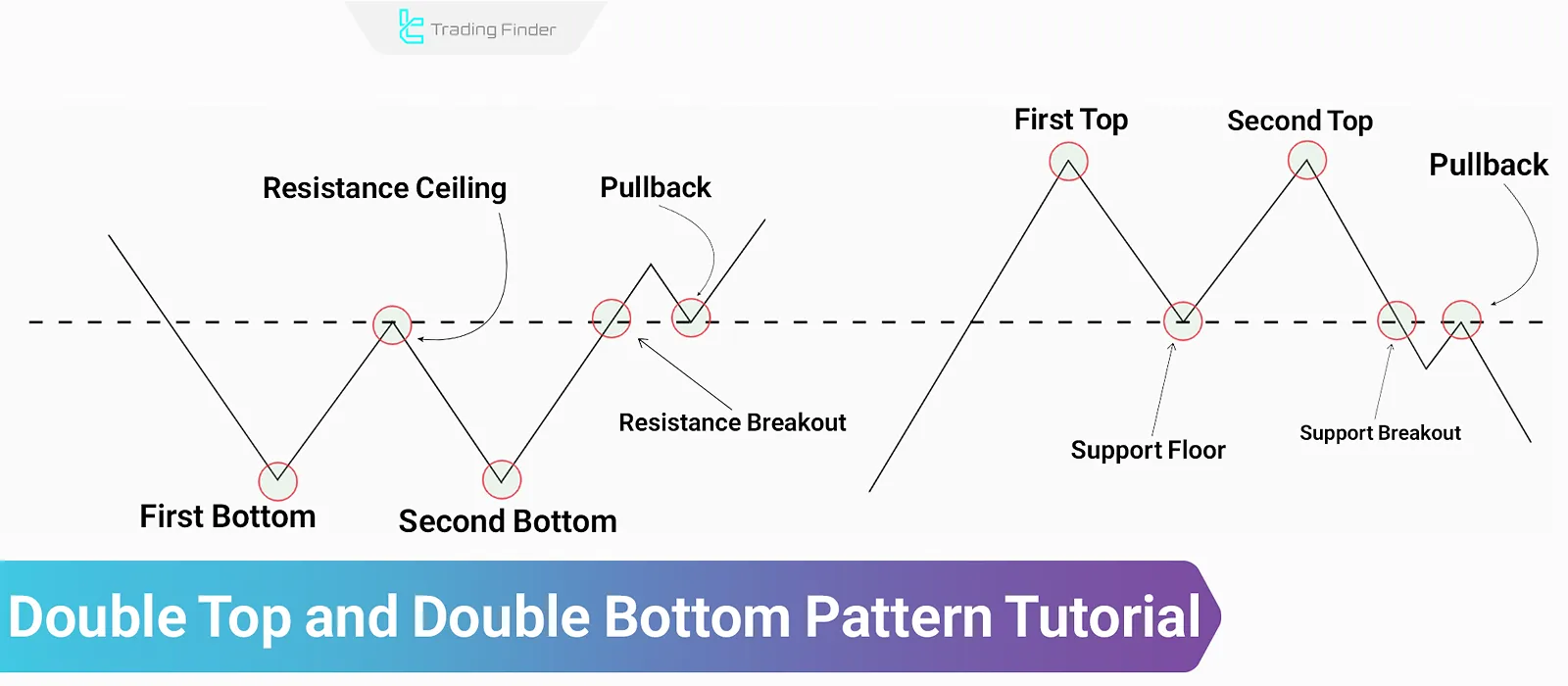

Double Top and Double Bottom – Classic Reversal Pattern

The double top and double bottom patterns are classified under classic reversal patterns in technical analysis. These patterns are...

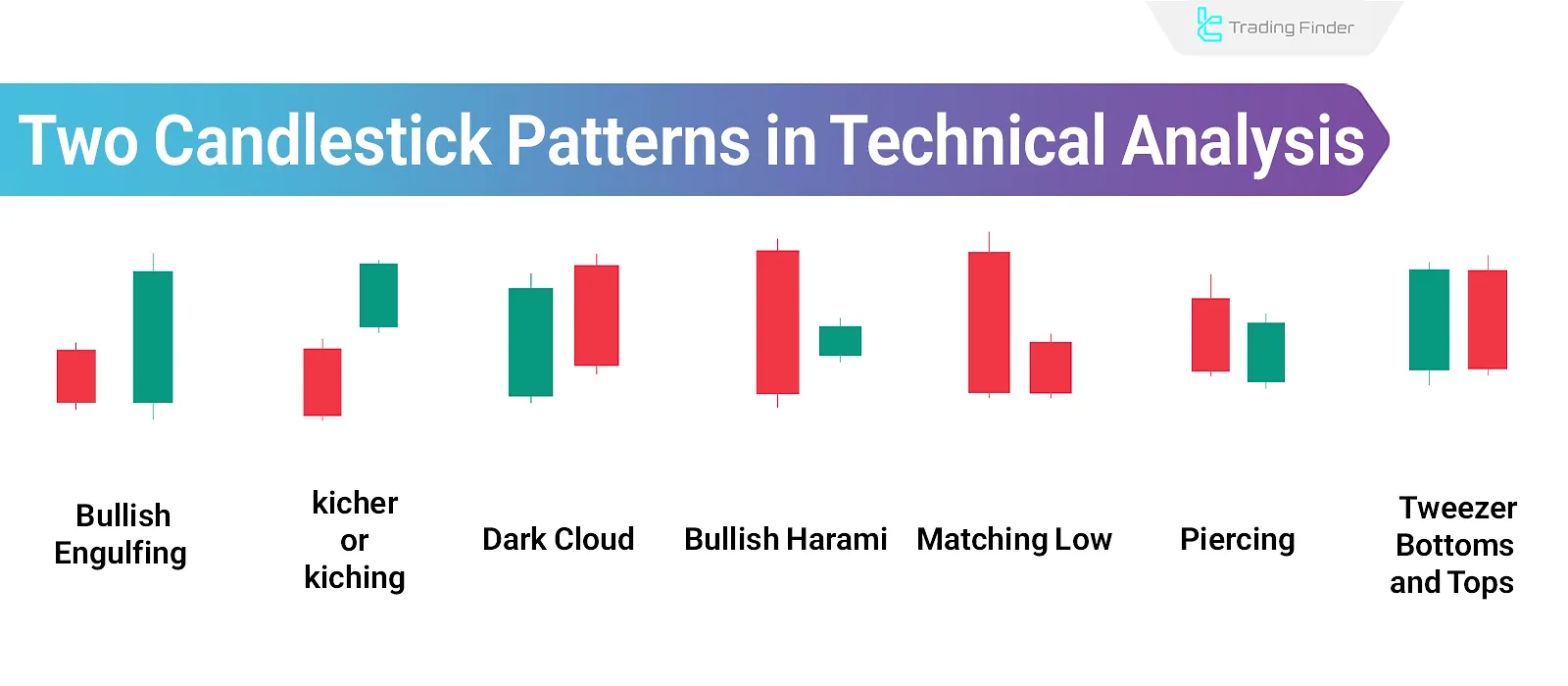

Dual Candlestick Patterns; 9 Important Two-Candle Patterns in Technical Analysis

Dual Candlestick Patterns represent potential trend reversals in the market based on the relationship between two adjacent candles....

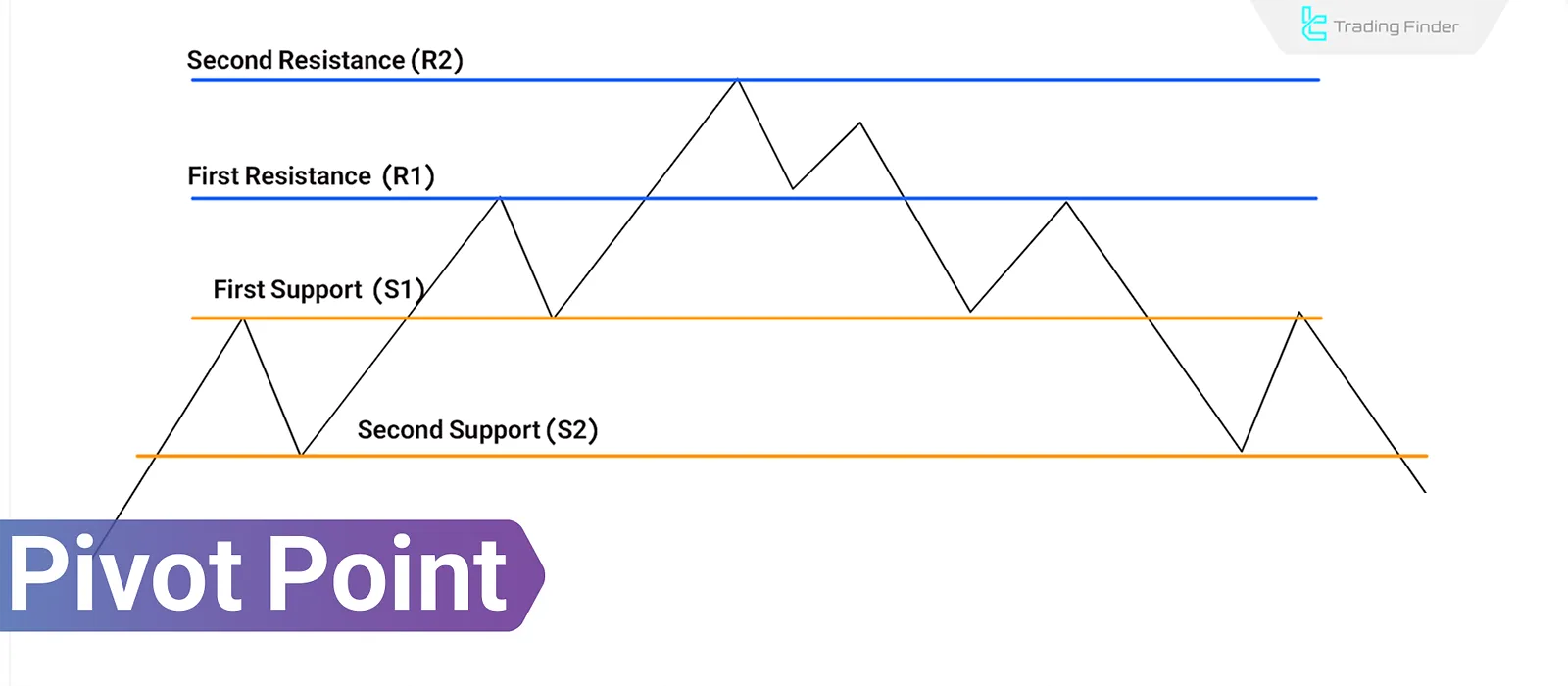

Pivot Point in Technical Analysis: Entry, Exit, Stop-Loss, and Price Targets

A Pivot Point in Technical Analysis is a computational method that identifies key market levels for the next trading day based on...