In technical analysis, price is constantly changing sometimes moving in a clear direction, sometimes reversing.

One of the most critical decision points for traders is when a trend reversal happens. Recognizing this concept can be the difference between a profitable trader and a risky one.

What Is Trend Reversal?

Reversal trading refers to moments when the prevailing price direction changes.

For example, when the price rises (bullish trend) and then starts falling (bearish trend), a reversal has occurred. This can happen across all timeframes from minute charts to monthly charts.

When Does a Reversal Occur?

Reversals typically form in key zones, where buying or selling pressure peaks and the opposing force takes hold. Main signs of a potential reversal:

- Market Structure Shift (MSS): In an uptrend, if the price fails to make a new high and then breaks the previous low, it’s a strong signal of a reversal;

- Momentum Loss: Slowing momentum or weakening continuation candles often signal an end to the current trend;

- Formation of Consolidation or Reversal Patterns: Patterns like double tops/bottoms, head, and shoulders, or reversal candlesticks such as pin bars and engulfing candles typically form at turning points;

- Indicator Divergence: The divergence between price and indicators like the Relative Strength Index or the MACD indicator is a mismatch between price movement and market strength.

Difference Between Reversal and Pullback

Reversals and pullbacks may look similar, but the key difference is trend continuation:

Criteria | Pullback | Reversal |

Market Direction | Continues | Changes |

Duration | Short-term | Medium to Long-term |

Price Objective | Resumes previous trend | Starts new trend |

Example in Uptrend | Temporary dip | Continuous drop |

What Is a Reference Point in Reversal Trading?

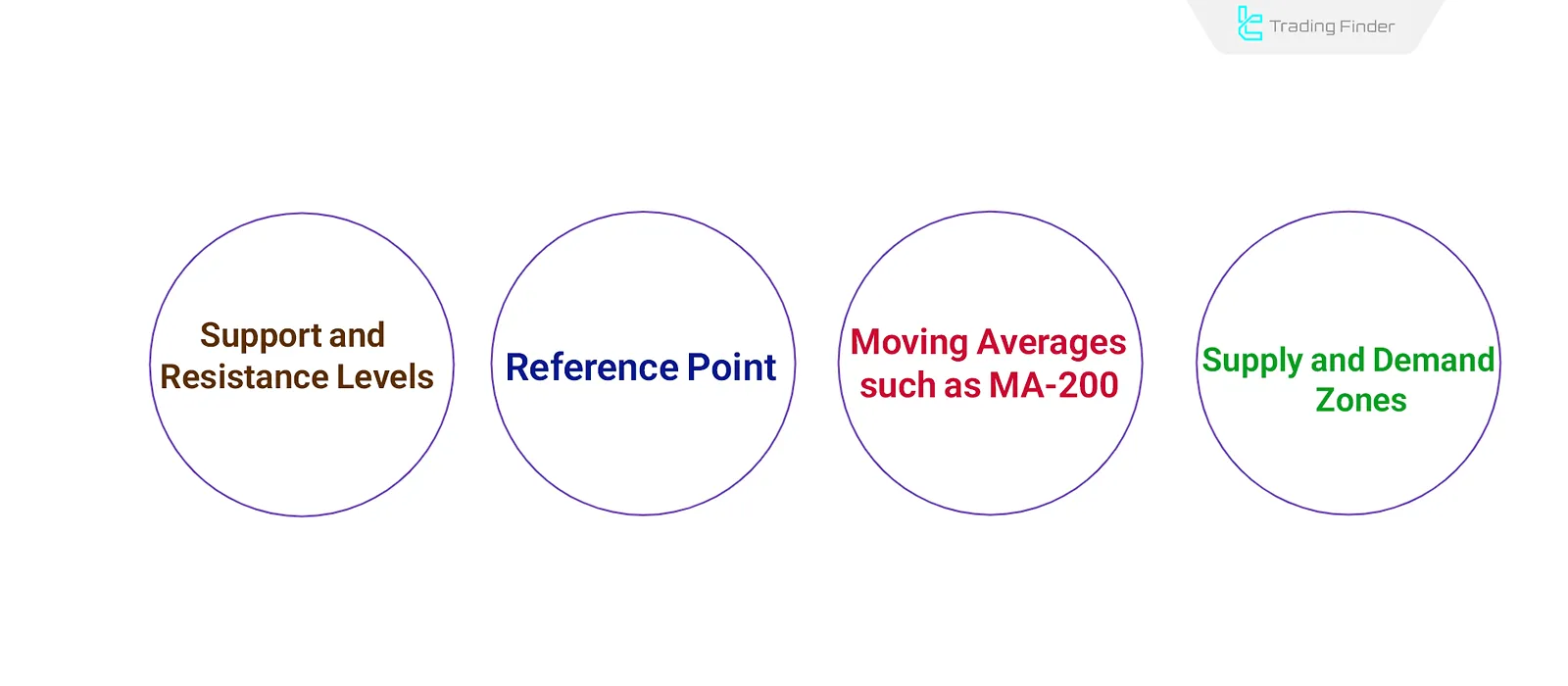

A Reference Point is a key area where traders anticipate a possible trend change. These are often identified based on past price behavior or core technical tools:

- Support and resistance levels

- Trendlines

- Moving Averages (e.g., MA-200)

- Supply and demand zones

Three Methods to Identify a Trend Reversal

Reversals are major entry points for traders. To increase accuracy, professional traders combine structural and multi-timeframe analysis.

- Market Structure Shift (MSS)

- Reversal on Higher Timeframe

- Break of 200 Moving Average (MA200)

Market Structure Shift (MSS)

In healthy trends, the market forms higher highs and higher lows (or lower in downtrends). Failure to create a new high and break the previous low suggests a trend change.

Reversal on Higher Timeframe

Signals on lower timeframes can be misleading. To avoid fakeouts, always check price action on highertimeframes.

Break of MA200

The 200-period moving average is a key trend tool. If the price breaks below MA200, it suggests a shift to a bearish trend; a break above indicates a bullish reversal.

Identifying Fake Reversals

Fake reversals are a major cause of stop-loss hits. Avoid them by analyzing:

- Multi-timeframe confirmation: If a reversal signal appears on a 5m or 15m chart, validate it on 1H or 4H;

- Context matters: If the price is in the middle of a range rather than at key zones, the reversal is likely false;

- Clear candle confirmation: Reversal candles must be strong and high-volume—weak candles can be deceptive.

The best defense is combining multi-timeframe analysis, candlestick reading, and key zone validation.

Example of Short Reversal Trade

On the EUR/USD chart, if the price fails to create a newhigh and then breaks the previouslow, this is an early indication of a potential reversal.

Instead of entering on higher timeframes, wait for confirmation on lower timeframes (15m or 1H) through the formation of supply zones and reversal candles like bearish engulfing or pin bars.

The stop-loss was triggered above the supply zone and targeted previous Support and Resistance Levels.

Example – Long Reversal Trade

After a sharp decline in gold, many expect further decreases. However, if the decline is followed by the Divergence, Reversal candlesticks, and Support zone formation, there could be potential for a bullish reversal.

Wait for a reaction in the support zone, such as a bullish engulfing or volume-backed consolidation. If the price forms a higher low, it confirms a trend shift.

The stop-loss is triggered below the recent low, and the targets are set at the previous resistance levels or based on a risk-reward ratio.

Conclusion

Reversal trades can offer strong opportunities if analyzed correctly. The key to success isn’t spotting any different-looking candle but accurately identifying when and where a reversal is forming.

Without clear evidence, such as structure shift, divergence, or higher-timeframe validation, entering reversals is risky.

Three key tools MSS, higher timeframe context, and MA200 are individually useful but most powerful when combined.