When buying and selling cryptocurrencies on atrading platform, you must pay transaction fees. Generally, trading fees on crypto exchanges are divided into two categories, orders that incur a Maker Fee and those that incur a Taker Fee.

Typically, Maker and Taker Fees differ in value, with the Maker Fee usually being lower.

The difference between the Maker Fee and the Taker Fee lies in how each order affects the depth of the Order Book.

When a trader places an order outside the current market price, they are considered a Maker because they add liquidity and increase market depth.

In contrast, a Taker executes an order immediately, removing liquidity from the Order Book and therefore pays a higher fee.

Exchanges typically set the Maker Fee lower than the Taker Fee to encourage liquidity and maintain market stability.

What Is a Maker Fee?

AMaker Fee is charged to a trader who adds liquidity to the market. This occurs when a user places a limit order that is not executed immediately and remains in the order book until another party fills it.

In other words, a Maker Fee is applied when the posted order does not get instantly matched with an existing opposite order. Usually, Maker orders do not execute immediately on exchanges.

Many crypto exchanges offer lower Maker Fees than Taker Fees to attract more users. Some platforms charge market makers a discounted rate to incentivize liquidity provision.

The Role of Makers in Market Liquidity and Stability

Makers, by placing pending orders (Limit Orders), expand the depth of the order book and maintain the balance of order flow.

This increased depth reduces the gap between the bid and ask prices (Bid-Ask Spread) and helps prevent sudden price jumps.

The greater the number of makers in the market, the more transparent, fair, and liquid the market structure becomes.

In contrast, an increase in taker activity without a balanced presence of makers can lead to sharp volatility and a significant widening of the spread.

What Is a Taker Fee?

A Taker Fee applies to users who consume liquidity by immediately filling existing orders from the order book.

Simply put, when you place an order that is instantly matched and executed against another order in the market, you are acting as a Taker and must pay the Taker Fee.

Numerical Example of Maker vs Taker Fees

Suppose on Exchange X, the Maker Fee rate is 0.08% and the Taker Fee rate is 0.10%. If Trader A places an order worth $10,000 and is classified as a Maker, their fee will be $8.

However, Trader B, who places a Market Order and acts as a Taker, must pay $10.

At high trading volumes, even this small difference can significantly affect trade profitability and the Risk to Reward Ratio.

For a clearer understanding of Maker and Taker traders in exchanges, refer to the educational video on the hoc-trade YouTube channel.

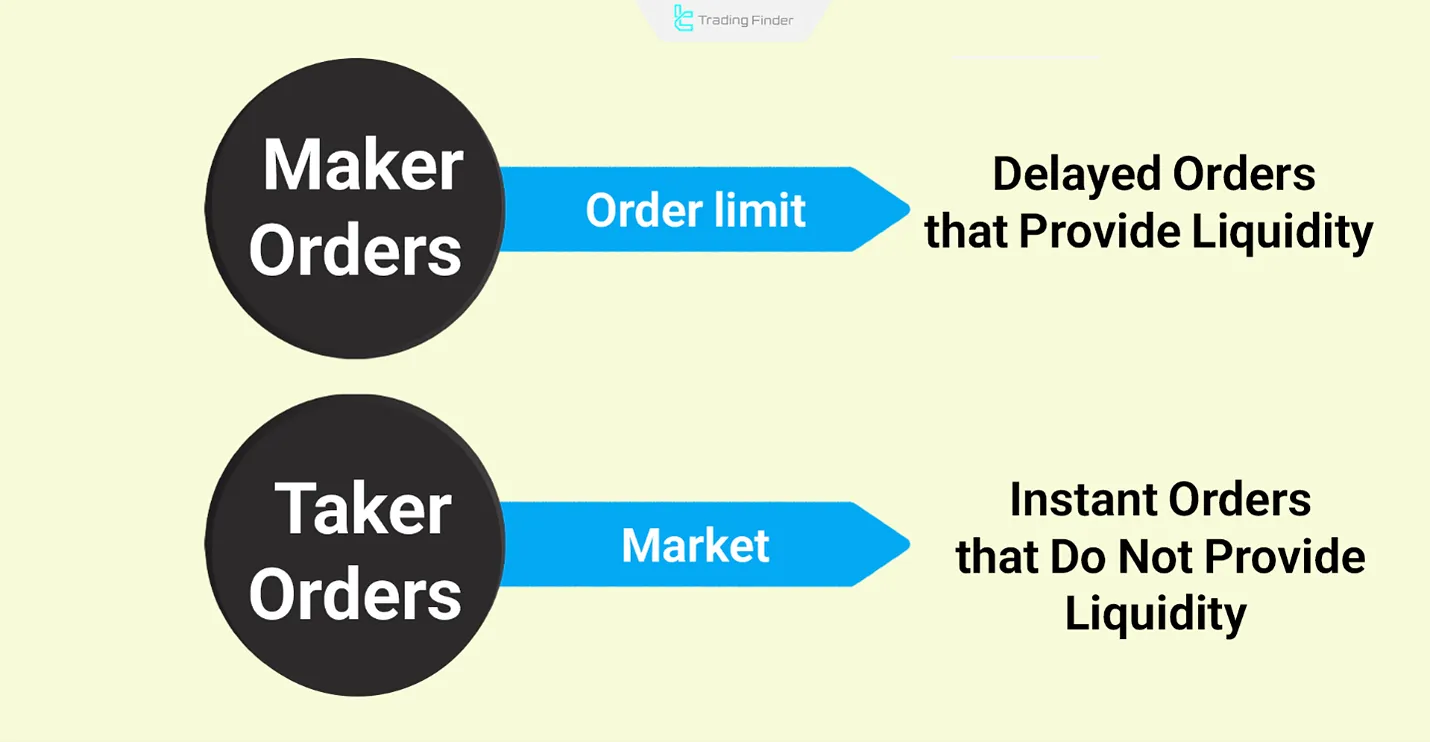

Difference Between Maker and Taker Orders

Both market makers and market takers are essential to an active trading environment. However, Maker and Taker Fees differ across platforms.

Maker orders are typically limit orders that take time to fill, while Taker orders are market orders that execute instantly.

Maker and Taker Orders play a decisive role in determining market liquidity, trading fees, and traders’ entry and exit strategies.

The table below summarizes and compares the key characteristics of each, providing a clearer perspective for choosing a suitable trading style.

Feature | Market Maker | Market Taker |

Role in the Market | Liquidity Provider | Liquidity Consumer |

Trading Fee | Lower fee or even liquidity reward (Maker Fee) | Higher fee due to liquidity consumption (Taker Fee) |

Main Advantage | Control over entry price, contributes to market stability and depth | Fast and guaranteed order execution under any market condition |

Trade Risk | Possibility of order not being filled at the target price | Possibility of price slippage in fast trades |

Typical Use | Suitable for long-term traders and market makers | Suitable for scalpers and fast or news-based trades |

Market Impact | Reduces volatility and price spread | Increases short-term volatility and consumes market depth |

Simple Example | Placing a buy order for BTC at $59,800 | Instant buy of BTC at the current price of $60,000 |

Who Are Market Makers and Market Takers?

In cryptocurrency trading, a Maker refers to orders placed as limit orders, which are executed with a delay; a Taker, on the other hand, refers to orders that are executed instantly and do not create liquidity.

For a better understanding and deeper familiarity with the concepts of maker and taker orders, you can also refer to the maker and taker fee tutorial article, explained on investopedia.com.

Types of Fee Models in Cryptocurrency Exchanges

Cryptocurrency exchanges generally use three distinct fee structures, each directly influencing users’ trading behavior:

- Maker-Taker Model: The most common structure, which sets different rates for order creators (makers) and order executors (takers);

- Flat Fee Model: In this method, all users pay a fixed percentage fee regardless of the type of order;

- Hybrid Model: A combination of the two previous structures, commonly used in derivatives exchanges.

A precise understanding of the exchange’s maker-taker fee model allows traders to align their trading strategies with the platform’s cost structure and liquidity mechanism.

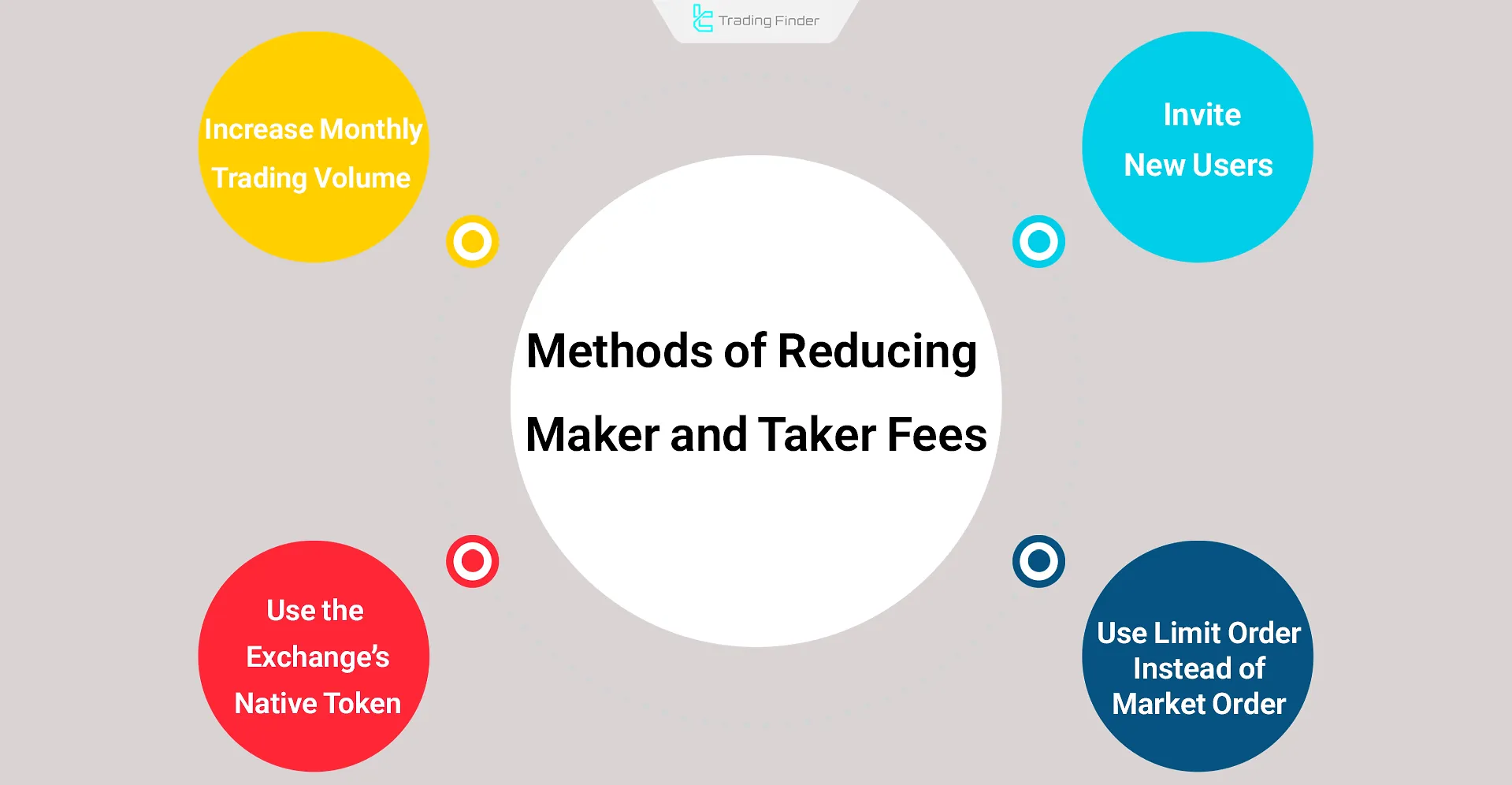

How to Reduce Maker and Taker Fees

Cryptocurrency exchanges offer various methods to reduce maker vs taker fees, each designed based on user activity level and account tier:

- Increase monthly trading volume: Users with higher trading volumes are classified into VIP tiers and receive fee discounts;

- Use the exchange’s native token: Paying fees with native tokens such as BNB, KCS, or CET results in a percentage discount on transaction costs;

- Invite new users (Referral Program): Some platforms return a portion of the referred users’ paid fees to the referrer’s account;

- Use Limit Orders instead of Market Orders: By executing limit orders, the user acts as a maker and pays a lower fee.

Forex Trade Management Expert Advisor for Analyzing Maker and Taker Fees in MetaTrader

The Trade Panel Prop Drawdown Limiter Expert Advisor is designed to provide professional management of risk, capital, and trading costs including Maker vs Taker fees in proprietary trading firm (Prop Firm) accounts, operating on the MetaTrader platform.

With its modular structure and intelligent control panel, this tool enables professional traders to manage trades, volume, profit, loss, and the impact of different fees with precision.

It allows drawdown limitation in both dollar and percentage terms, automatically halting trades when the defined threshold is exceeded.

Additionally, by detecting the order execution type (Limit or Market), it incorporates Taker and Maker fees into profit and loss calculations, providing a realistic view of the trader’s net performance.

Features such as daily loss limits, trade count restrictions, economic news filters, fee impact analysis, and profit/loss boundary alerts make this EA one of the most comprehensive tools for managing risk and trading costs in the Forex market.

- Download the Trade Panel Prop Drawdown Limiter Expert Advisor for MetaTrader 5

- Download the Trade Panel Prop Drawdown Limiter Expert Advisor for MetaTrader 4

The central panel includes tools such as Partial Close, Break Even, multiple Take Profit and Stop Loss levels, and one-click trade execution. Traders can directly manage positions on the chart and visually execute their trading strategies through an advanced graphical interface.

The Account Protector section, with seven specialized tabs, provides settings for trade volume, permitted trading times, daily and weekly profit/loss limits, allowed symbols, and time restrictions.

This structure ensures trading discipline and full capital control in line with the trader’s plan.

Developed by TradingFinder, the Trade Management Expert Advisor supports Forex, Crypto, and Prop accounts, as well as both instant and pending orders.

By displaying candle timing, managing trading emotions, and preventing impulsive decisions, it promotes professional consistency and discipline in strategy execution.

Overall, the Trade Panel Prop Drawdown Limiter is an advanced and structured tool for capital management, risk control, and precise execution of trading strategies in MetaTrader, offering a stable, secure, and fully professional trading experience.

Conclusion

Transaction fees on cryptocurrency exchanges are charged in two ways, depending on the type of order placed.

If a user submits a pending order that does not execute immediately and is added to the Order Book, a Maker Fee is applied, because such orders help add liquidity to the market.

However, suppose an order is matched and executedinstantly against existing orders. In that case, the user is considered a Taker and must pay the Taker Fee, since this type of order removes liquidity from the market.

Maker and Taker Fees vary across different exchanges, but typically, due to the removal of liquidity, Taker Fees are higher than Maker Fees.