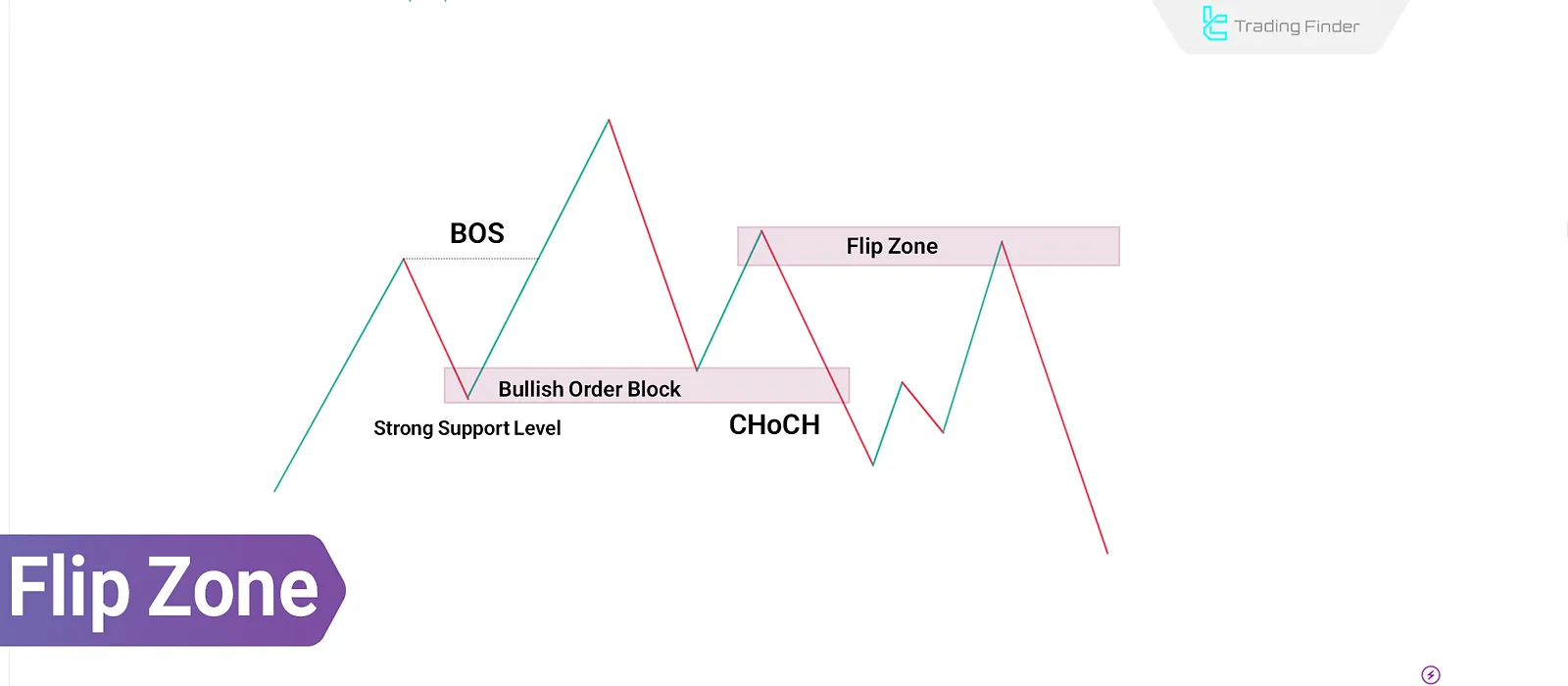

In Smart Money analysis and ICT concepts, a Flip Level in ICT is a price level where supply or demand zones are broken and overtaken by opposing strengths. This break signals a shift in market structure and a transfer of liquidity. Flip is a specialized method for detecting these shifts, and its correct application provides high-probability trade setups.

What Is a Flip?

A Flip refers to a market structure condition where a key supply or demand zone, after initially reacting with price, is decisively broken and flips to its opposite. This is more than a surface-level break—it reflects a shift in power between institutional players and a redirection of liquidity flow.

Unlike a Change of Character (CHoCH), which indicates structural shifts via highs and lows, a Flip focuses on valid zone breaks and the creation of new trading zones, giving deeper insight into Smart Money behavior.

In essence, Every Flip is a CHoCH, But not every CHoCH is a Flip because a valid Flip requires three simultaneous conditions:

- An initial price reaction to a supply or demand zone

- A clear break of that same zone

- Formation of an Imbalance or Fair Value Gap (FVG) at the moment of the break

Types of Flip Patterns in Market Structure

Flip in Price Action are generally divided into two types. In both, the logic revolves around breaking key supply or demand zones and turning them into the opposite type. The difference lies in trend direction and price objectives after the break:

- Reversal Flip Pattern

- Continuation Flip Pattern

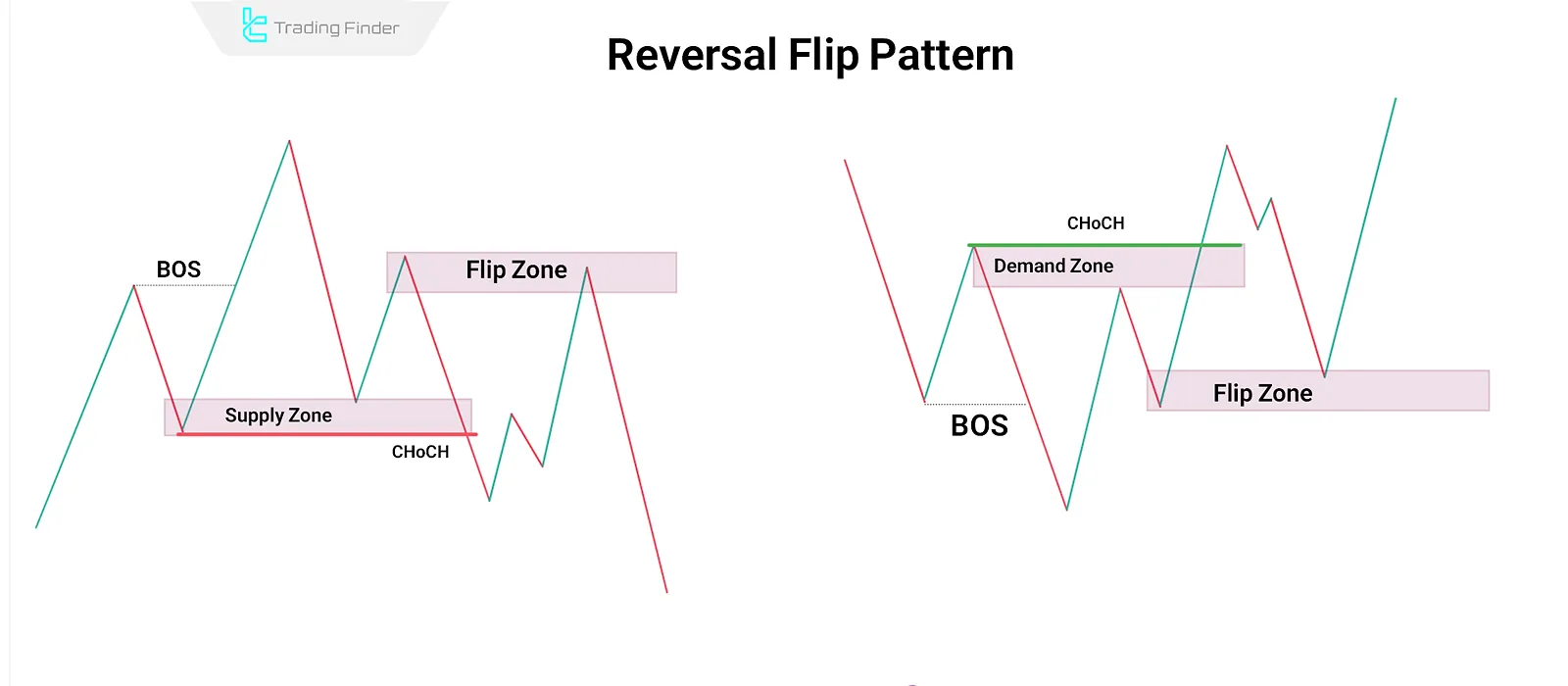

Reversal Flip Pattern

A Reversal Flip indicates the end of a trend and the start of a new one in the opposite direction. Price initially reacts to a key supply or demand zone but then breaks through it with strength, turning it into the opposite type.

Beginning of a Downtrend

Price creates higher highs and higher lows (HH/HL), then enters a higher-timeframe supply zone. After a short reaction, it fails to form a new high and breaks the previous demand zone, creating a new supply Flip Zone. This signals the end of the uptrend and the beginning of a bearish phase.

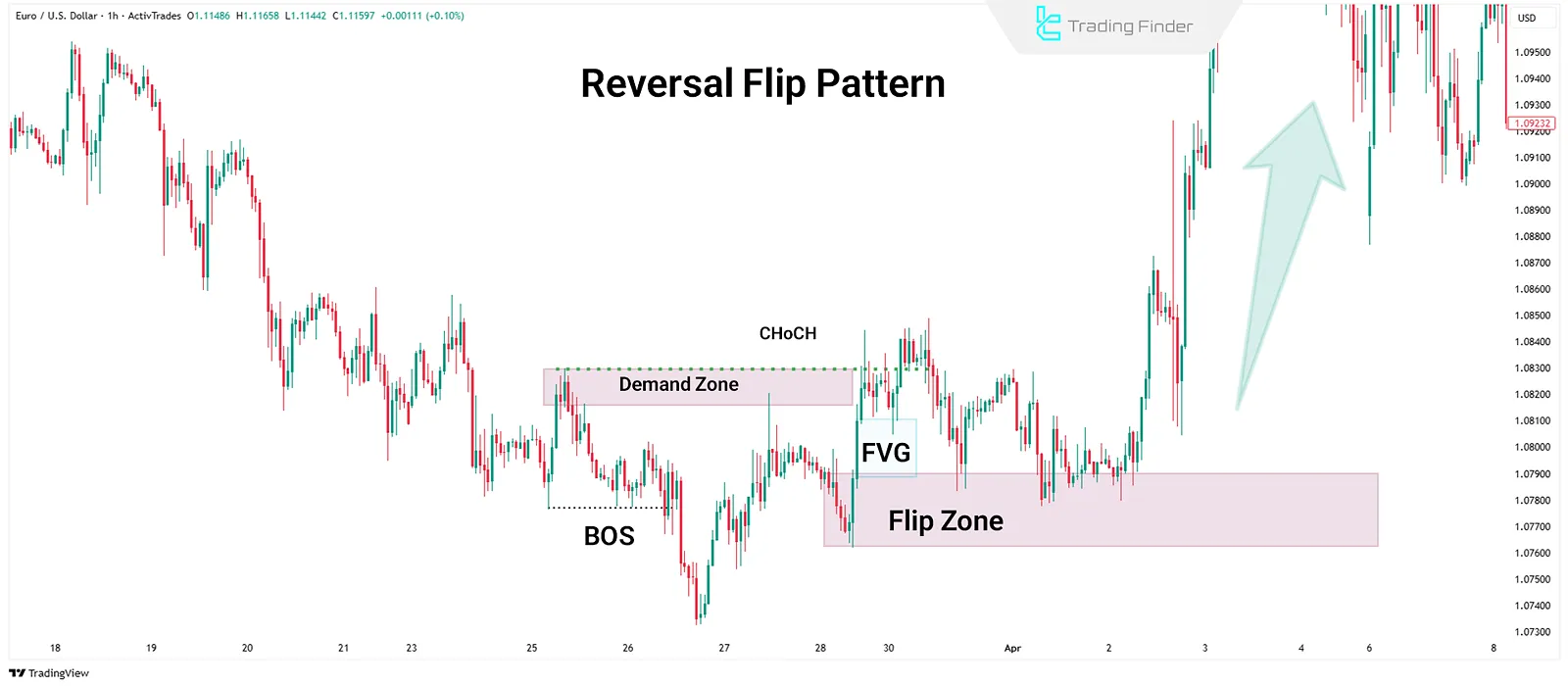

Beginning of an Uptrend

Price points lower lows and lower highs (LL/LH) before entering a higher-timeframe demand zone. After an initial bounce, it fails to make a new low and instead breaks the previous supply zone, forming a new demand Flip Zone. This signals the beginning of a bullish trend.

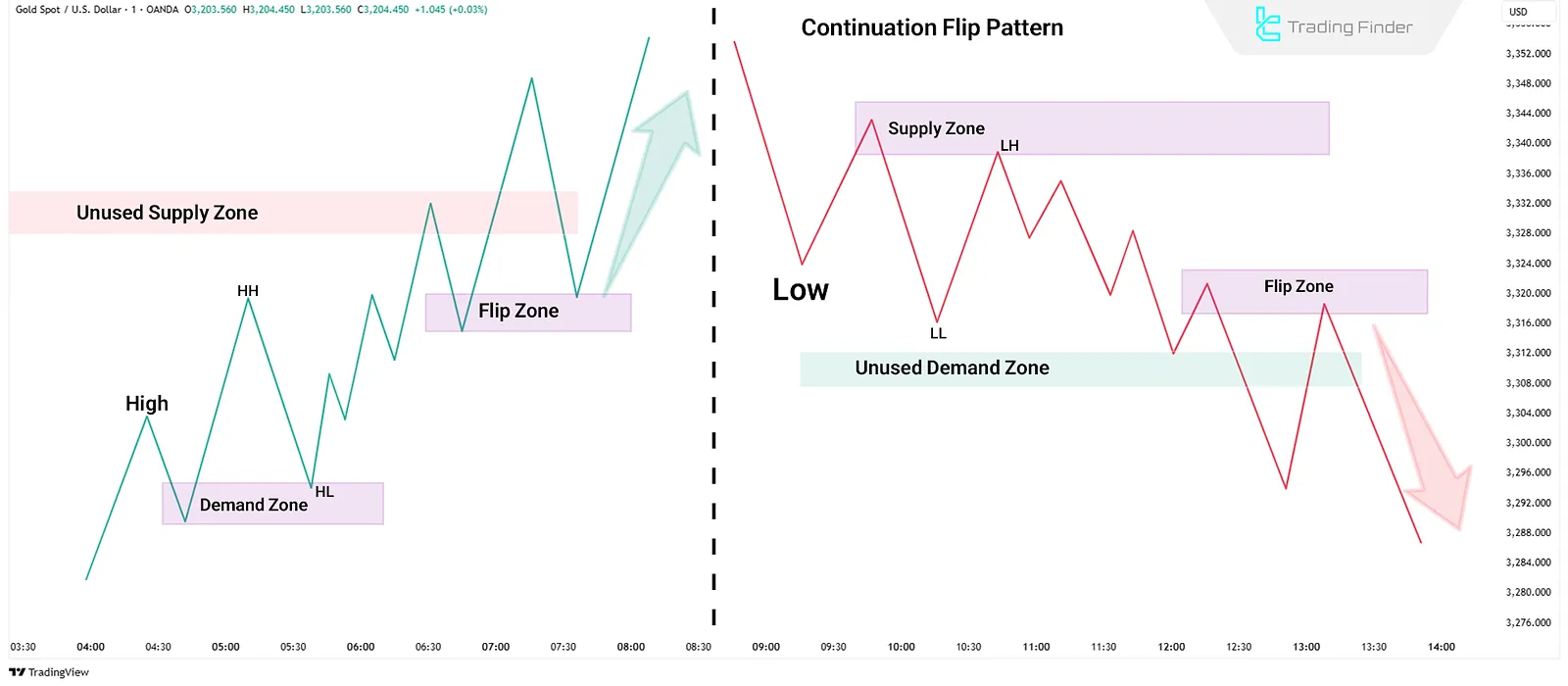

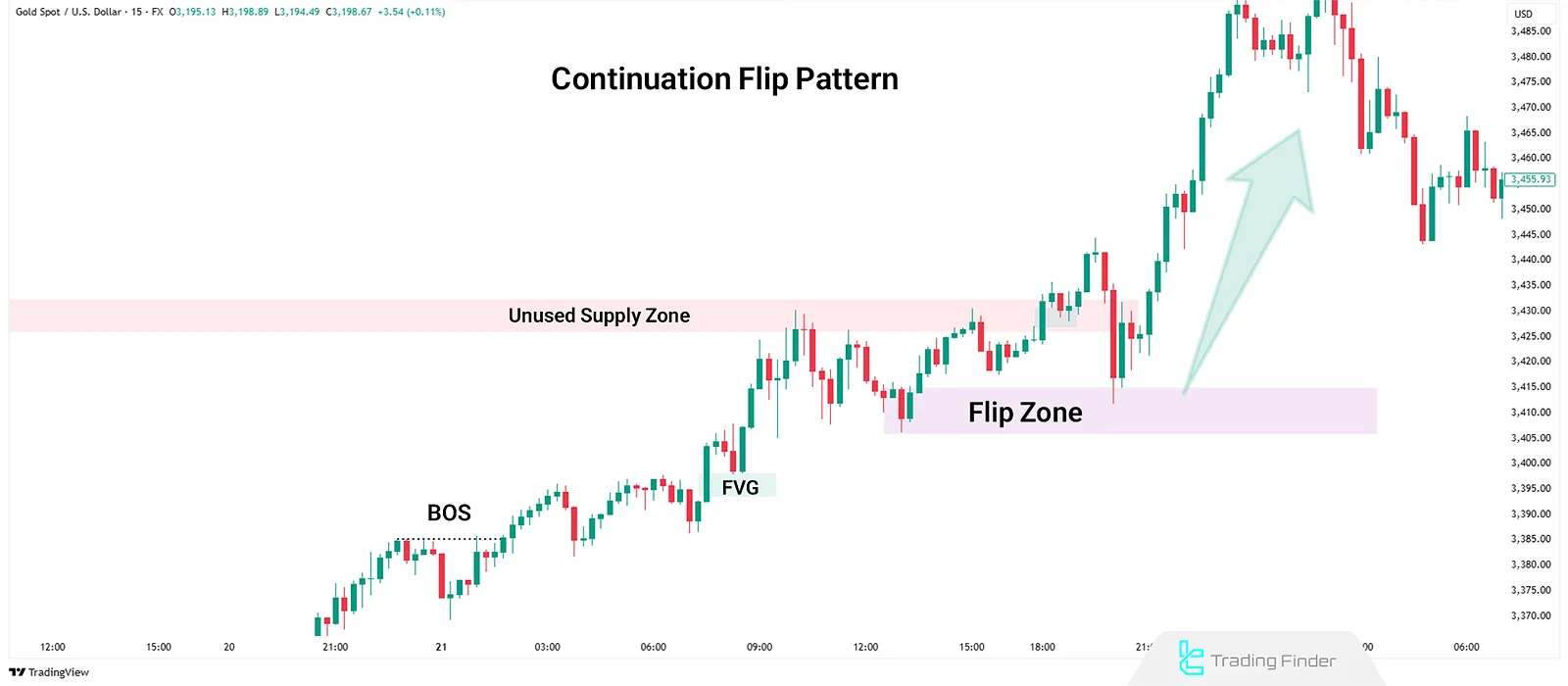

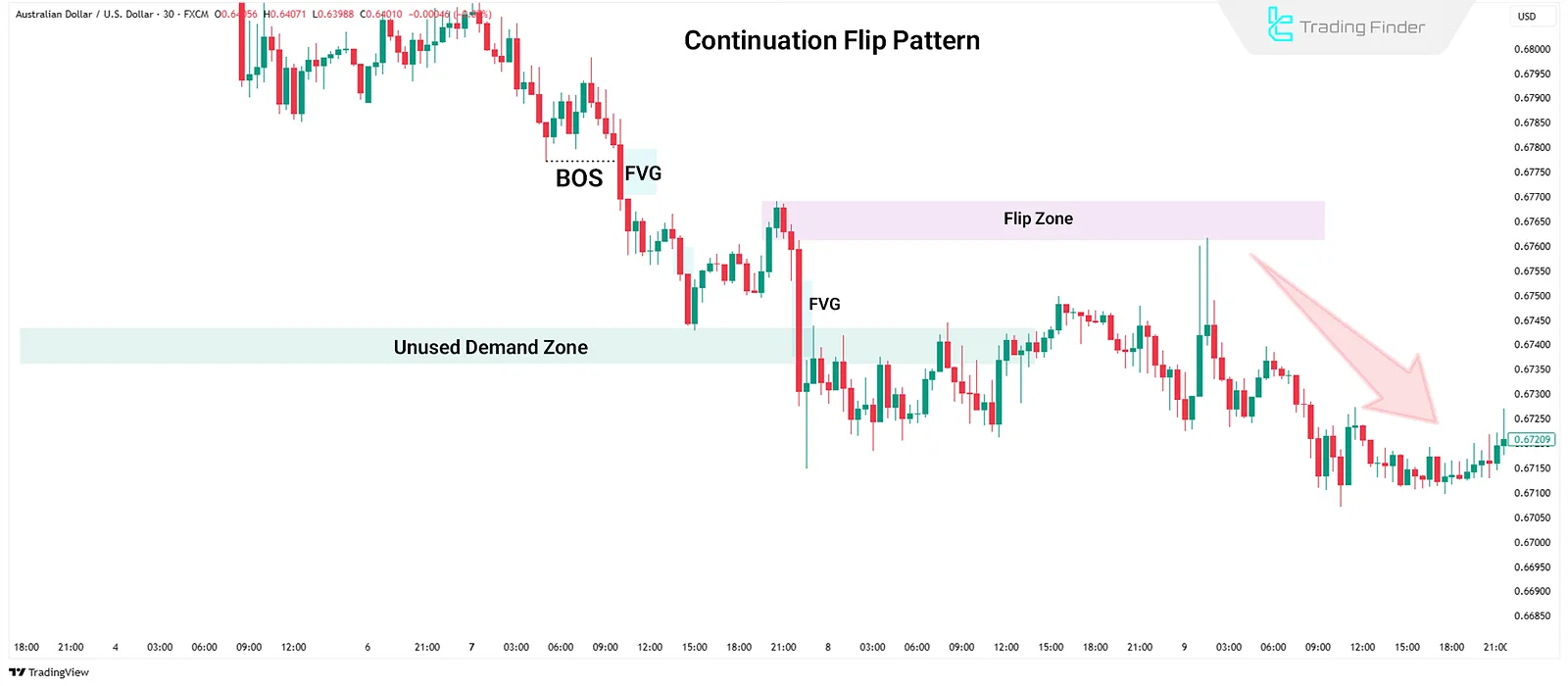

Continuation Flip Pattern

Unlike the reversal Flip, a Continuation Flip signals trend continuation. In this case, the price breaks an opposing zone mid-trend and establishes it as new support or resistance.

Bullish Continuation (Supply to Demand Flip)

In an uptrend, the price reaches a supply zone expected to trigger a pullback. Instead, it breaks through with strength, leaving behind Imbalance or FVG. The breaker candle forms a demand Flip Zone that typically serves as a buy entry area going forward.

Bearish Continuation (Demand to Supply Flip)

In a downtrend, the price enters a demand zone but breaks it without reversing, turning it into a supply Flip Zone. This confirms seller dominance and provides a basis for short setups in line with the trend.

How to Identify Flip Zones

A Flip Level in ICT forms when a key supply or demand level is broken and then established as its opposite type. It often acts as a price return area for institutional re-entry.

#1 Identify the Key Zone in a Higher Time Frame

Begin analysis on higher timeframes, where supply and demand zones are more reliable and reflect institutional decisions.

- If the price enters a demand zone and breaks it, the future Flip Zone is considered a supply zone;

- If the price enters a supply zone and breaks it, the future Flip Zone is considered a demand zone.

#2 Observe Break with Strong Impulse & Imbalance/FVG

The break must be decisive and fast, accompanied by Imbalance or an FVG, confirming large order flow and market ownership change. This increases the chance of price returning to fill the void.

#3 How to Mark a Flip Zone?

After the break, find the candle that triggered the move. This is often at the end of the pullback and start of the impulse leg. To draw the Flip Zone:

- Mark the High and Low of this candle with a rectangle;

- Wait for price to return to this zone.

If the following candle has a large body and clear gap, the Flip Zone’s validity strengthens.

#4 How to Use Flip Zones for Entry

When price returns to the Flip in Price Action (usually to fill the imbalance), the best strategy is to use Limit Orders inside the zone:

- In a Bearish Reversal Flip, Place a Sell Limit in the supply Flip Zone;

- In a Bullish Reversal Flip, Place a Buy Limit in the demand Flip Zone;

- Stop Loss (SL) should be placed just beyond the Flip Zone;

- Take Profit (TP) depends on new structure and target zones.

Note: Flip Zones are single-use only. Once tested, they lose their validity as entry zones.

Conclusion

In the Smart Money Concept (SMC) and ICT, Flip is formed by reaction to supply/demand, its break, and creation of imbalance. Unlike CHoCH, which only reflects structural change, Flip highlights a shift in market control.

There are two types of Flips including Reversal and Continuation. The resulting zone is valid only until the first retest. Accurate analysis of these zones requires a blend of price action, structural confirmation, and liquidity flow understanding.