Scaling in trading refers to the process of increasing or decreasing the position size of a trade based on market conditions and the trading plan. This approach is one of the most common risk management techniques in financial markets such as Forex or cryptocurrency.

Proper use of scaling in and out techniques improves trade entry and exit points over time, contributing to steady account growth. By placing multiple orders for the desired asset, the average entry and exit prices can be optimized, simplifying overall risk management.

What is Scaling in Trading?

Scaling is a risk and capital management method in which position size is adjusted — increased or decreased — to reduce potential losses and maximize potential gains. In this approach, the total position size is divided into multiple parts, and both entries and exits are executed in several stages.

When applied correctly, this method results in the most optimal average entry and exit prices, improving the overall performance of the trading account.

Advantages and Disadvantages of Scaling in Trading

Using scaling in trading simplifies risk management and optimizes entry and exit points. However, lack of experience or poor emotional control during scaling may lead to a margin call.

Advantages | Disadvantages |

Improves risk and emotional management | Requires high experience and skill |

Reduces psychological pressure in trading | Full control over emotions is necessary |

Optimizes trade entry and exit points | Risk of margin call if applied incorrectly or emotionally |

Increases profit potential and reduces loss potential | Time-consuming |

Types of Scaling in Trading

In general, there are two types of scaling in trading, each separately addressing gradual entry (Scale In) into trades and gradual exit (Scale Out) from trades:

- Scale In: Gradual entry into trades

- Scale Out: Gradual exit from trades

Scaling When Entering a Trade (Scale In)

There are two main scenarios for scaling during trade entry:

- Price movement toward the profit zone

- Price movement toward the loss zone

Price Movement Toward the Profit Zone

In this scenario, a portion of the planned capital is entered at the identified entry point. If price moves as forecasted, the remaining capital is added in one or several orders at different price levels in the direction of the trade.

Each order must have a separate stop loss and take profit to ensure complete risk and capital management. The safest stop loss placement is at the entry price of each order, reducing potential losses if the market reverses.

Price Movement Toward the Loss Zone

If the price moves against the initial forecast and enters the loss zone, a strong technical reason and clear reversal signal must exist before adding the remaining capital. Without it, further additions will accelerate capital loss and increase the risk of a margin call.

Scaling When Exiting a Trade (Scale Out)

The exit strategy for scaling differs depending on whether the price moves toward profit or loss. In both cases, scaling out reduces the final loss, but also decreases the final profit.

Price Movement Toward the Loss Zone

When scaling out in a loss, potential reversal zones must be identified in advance. If these zones break, part of the position is closed to slow down equity drawdown. If price later reverses toward profit, the remaining position can recover part of the previous loss.

Price Movement Toward the Profit Zone

Here, key support and resistance levels such as Fibonacci retracements, swing highs, and swing lows are identified along the profit path. Depending on the trading strategy, portions of the position are closed at these levels, locking in gains and adding realized profit to account margin.

By partially taking profit and moving the stop loss to breakeven, the trade becomes risk-free. While this reduces the final profit potential, it also reduces trading risk and supports long-term account growth.

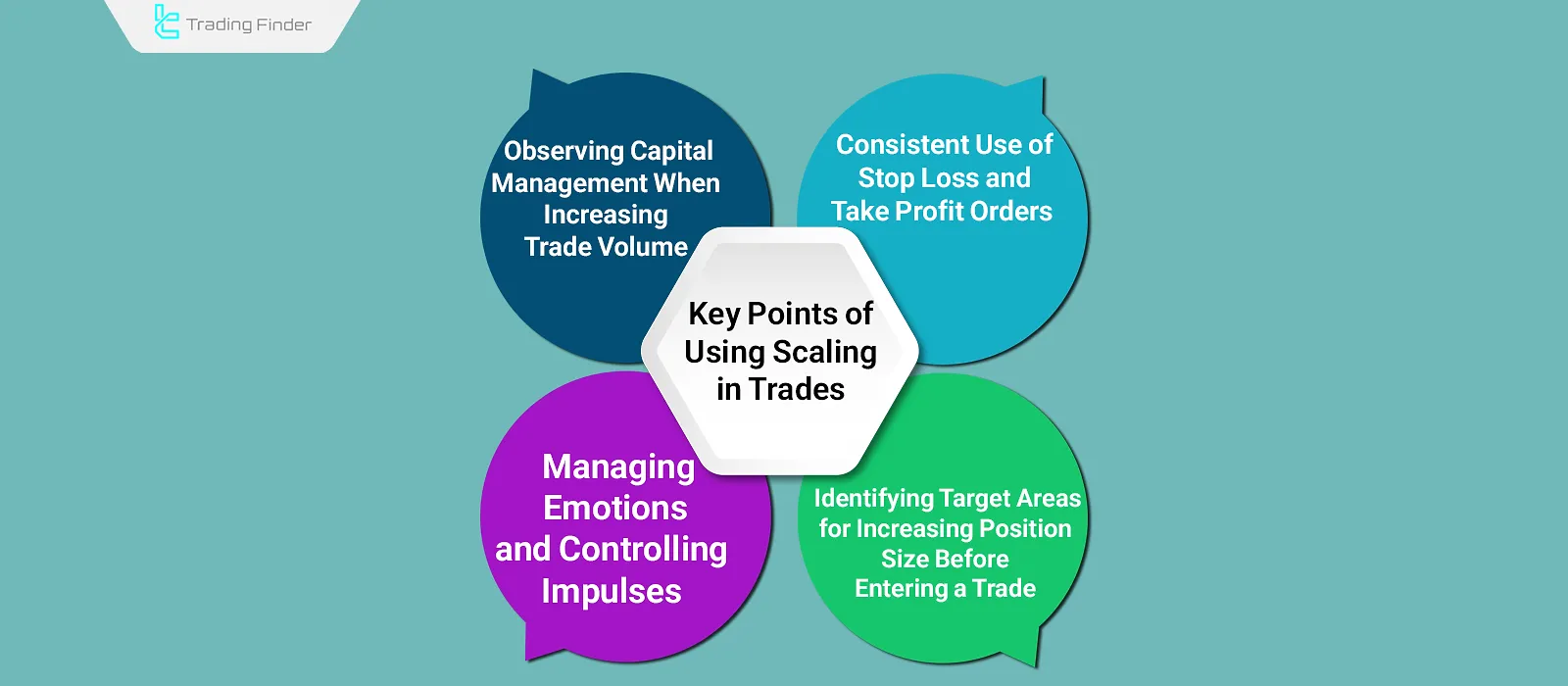

Key Points in Using Scaling in Trading

Applying scaling as a risk management technique carries multiple risks. Ignoring these may increase the likelihood of a margin call.

Conclusion

The scaling technique in trading helps achieve the best possible average entry and exit prices. When applied correctly, it can also enhance profit potential from individual trades.

In volatile markets, traders face higher psychological pressure and an increased risk of emotional decision-making.

Therefore, using scaling in trading in such conditions requires substantial experience and strong emotional control. To reduce risks, traders should determine in advance the zones for increasing or reducing position size.