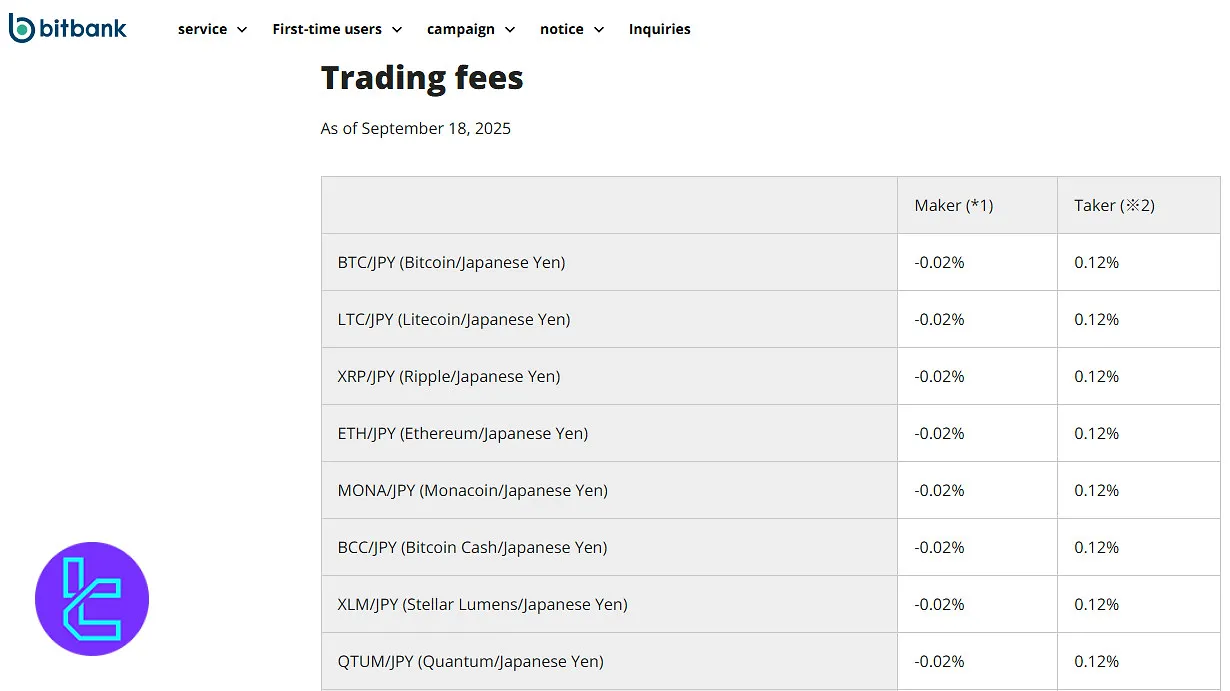

Bitbank offers access to 42 Crypto/JPY trading pairs with a maker fee of -0.02% and a taker fee of 0.12% (except for TRX/JPY and LPT/JPY).

It offers a JPY 1,000 bonus on deposits above JPY 10,000. Margin trading is available on BTC, XRP, and ETH.

The platform processes fiat deposits via GMO Aozora and Sumishin SBI Net Banking, while crypto deposits have no minimum limit.

For withdrawals, fees are blockchain-based, such as 0.0001 BTC or 0.001 LTC per transaction. Security is a major strength, with cold storage, multi-sig hot crypto wallets, and ISO/IEC 27001:2013 certification in place.

Bitbank; The Company's Background and Information

Bitbank, established in 2014, was founded by Noriyuki Hirosue and Minematsu Hiroki in Japan.

The company is a member of the Japan Virtual and Crypto Assets Exchange Association (JVCEA) and Japan Financial Services Association (No. 006169). Key features of Bitbank, Inc:

- Registered with the Kanto Regional Finance Bureau in Japan (Registration NO. 00004)

- English and Chinese support

- Global institutional accounts and individual accounts for Japanese

- Support for JPY

The platform enables users to trade Bitcoin and other digital assets directly against the Japanese yen and also supports crypto-to-crypto pairs.

With its clean interface and ease of navigation, Bitbank has gained popularity among beginner traders and those seeking exposure to Japan’s regulated crypto environment.

Bitbank CEO and Co-Founder

Noriyuki Hirosue is the CEO and Co-Founder of Bitbank. He founded the cryptocurrency exchange in 2014.

Before launching Bitbank, Hirosue worked at companies such as Nomura Securities, GMO Internet, Gala, and Comuca. He recognized the potential of digital currency technology in 2012, which led him to start Bitbank.

Based on Noriyuki Hirosue LinkedIn page, in 2022, he founded the Japan Digital Asset Trust Preparatory Company (JADAT) to enter the digital asset custody business.

Hirosue currently owns about 31% of Bitbank, and the company is planning an IPO in 2025. In 2024, he also launched Bitbank Ventures LLC to invest in blockchain and AI projects.

Bitbank Exchange Table of Specifications

The company’s main investors are Ceres and MIXI. Let’s take a brief look into its offerings to see if it fits among crypto exchanges.

Exchange | Bitbank |

Launch Date | 2014 |

Levels | N/A |

Trading Fees | Maker -0.02% Taker 0.12% (Except for TRX/JPY and LPT/JPY trading pairs) |

Restricted Countries | Only available to Japanese residents |

Supported Coins | 42 |

Futures Trading | Yes |

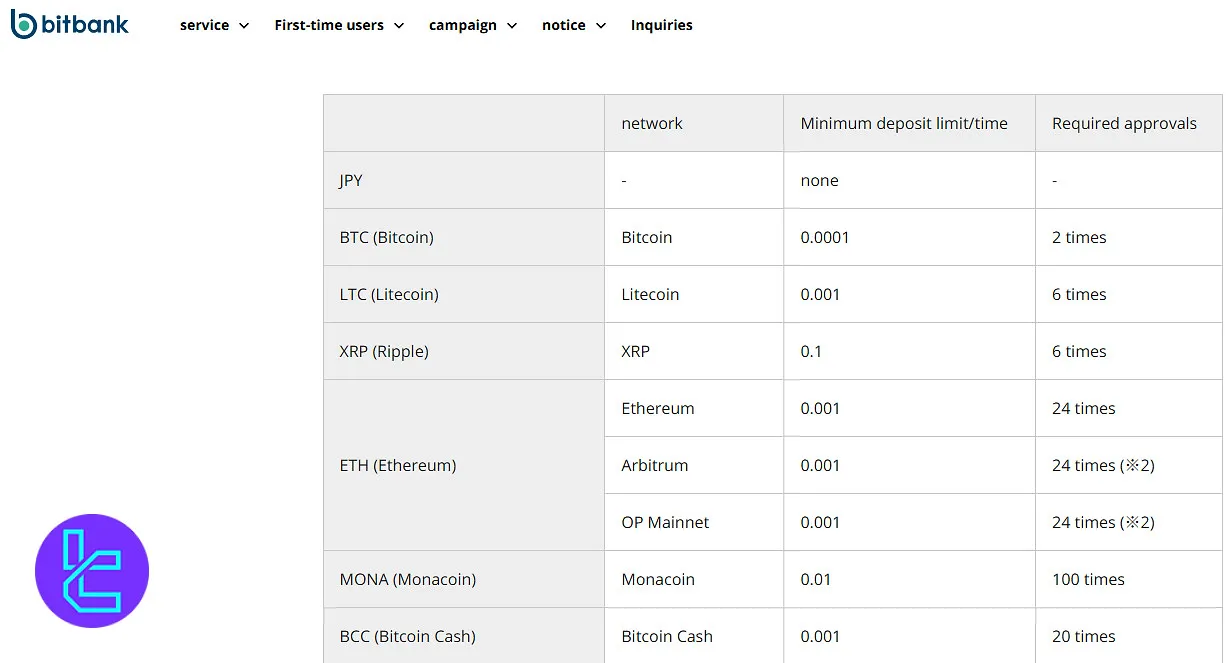

Minimum Deposit | No limit for JPY Variable for cryptocurrencies (0.0001 BTC) |

Deposit Methods | Crypto, JPY |

Withdrawal Methods | Crypto |

Maximum Leverage | 1:2 |

Minimum Trade Size | 0.0001 of the underlying crypto asset |

Security Factors | Cold Storage, Multi-Sig System, Physical and Virtual keys for Hot Wallets, Bug Bounty Program, ISMS Certification (ISO/IEC 27001:2013) |

Services | Spot Trading, Margin Trading, Crypto Lend, Bitbank Plus Knowledge Hub |

Customer Support Ways | Ticket, Chatbot |

Customer Support Hours | N/A |

Fiat Deposit | Yes |

Affiliate Program | No |

Orders Execution | Market |

Native Token | No |

Bitbank Advantages & Disadvantages

Led by CEO Noriyuki Hirosue, the company has developed an API connectivity for obtaining quotes, chart data, and trading history.

However, the API doesn’t support automated trading. Let’s make a list of the company’s upsides and downsides.

Pros | Cons |

Strong regulatory framework | Limited access for non-Japanese clients |

Competitive fees | Limited asset offerings |

User-friendly interface | Limited support channels |

Advanced features like Margin trading and crypto lending | Low leverage options (1:2) |

Bitbank Exchange User Levels

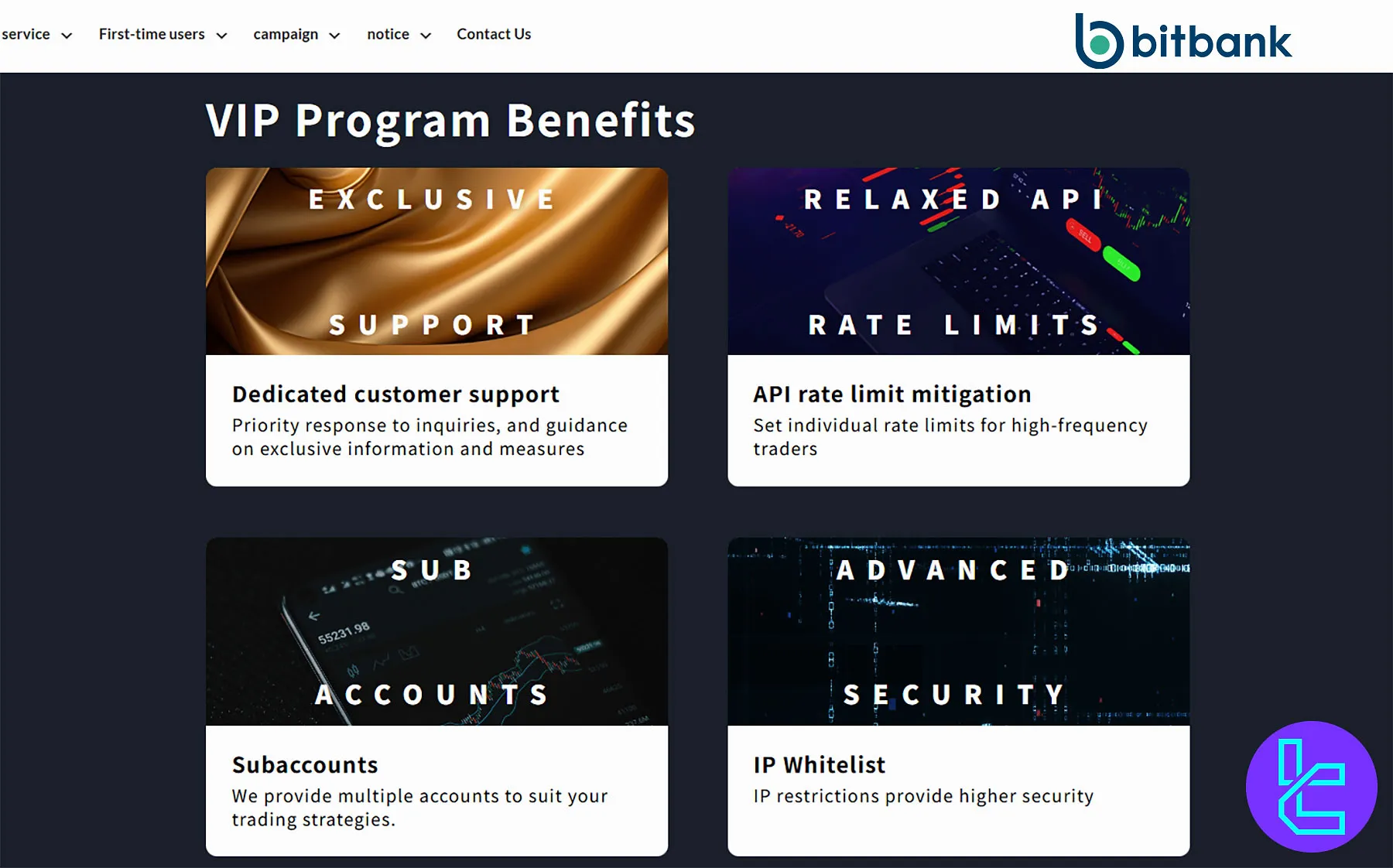

The platform offers a VIP program for high-volume traders with certain benefits, including dedicated customer support, IP whitelist, and invitations to exclusive events.

However, the website doesn’t disclose the program’s specific information.

Bitbank Commission Rates

In this Bitbank review, we must mention that the company offers very lucrative fees for crypto trading, no commissions on deposits, and variable rates for crypto withdrawals. Bitbank fee structure:

- Maker fee: -0.02%

- Taker fee: 0.12%

- Account opening: Free

- Account maintenance: Free

Note that trading commissions for TRX/JPY and LPT/JPY pairs are 0% for both makers and takers. The negative rate will be credited to your account as cashback.

Bitbank features a zero-fee model for both deposits. However, withdrawal transactions incur blockchain network-based charges, for instance, 0.0001 BTC or 0.001 LTC, making it appealing to high-frequency and low-volume traders alike.

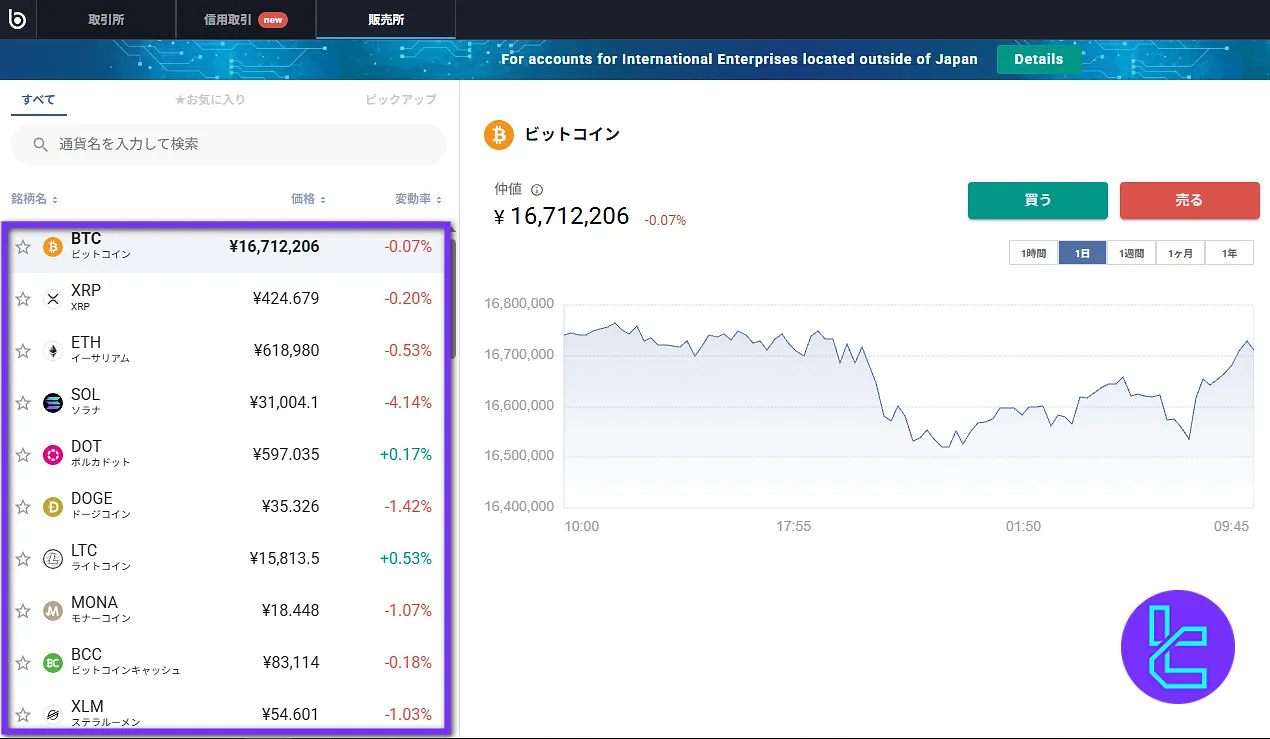

Listed Digital Assets on Bitbank

The exchange has listed42 cryptocurrencies forspot trading and simple buy/sell, including:

- BTC (Bitcoin)

- XRP (Ripple)

- LTC (Litecoin)

- ETH (Ethereum)

- MONA (Monacoin)

- BCC (Bitcoin Cash)

- XLM (Stellar Lumens)

- BAT (Basic Attention Token)

- LINK (Chainlink)

All crypto pairs are quoted primarily in JPY, reflecting the exchange’s domestic market orientation.

With consistently high trading volumes in Japan, Bitbank offers strong liquidity for its supported assets and enables round-the-clock deposit processing in fiat (JPY), even during weekends.

Does Bitbank Offer Leveraged Trading?

The company provides Margin trading with a 1:2 leverage option on selected trading pairs, including:

- BTC/JPY

- XRP/JPY

- ETH/JPY

Account Opening and Verification

Creating an account on Bitbank is quick and user-friendly, requiring email verification and identity confirmation to unlock full access.

#1 Begin Registration

Visit the Bitbank official website and click on “Sign Up” to reach the application form.

#2 Verify Your Email Address

Enter your email address and confirm it by clicking the verification link sent to your inbox. Then, click on the “Register with Password” option and create a secure password.

#3 Complete Identity Verification (KYC)

Log in to the exchange's client dashboard and click “Verification by Mail” to initiate the KYC process.

Fill out the personal information form accurately and upload a valid proof of ID, such as:

- Government-issued ID

- Passport

Once these steps are completed, your Bitbank account will be ready for use with full platform access.

How to Trade on Bitbank

To start trading on Bitbank, first make sure you are using the English version of the site. Use Google Translate for parts of the website that remain in Japanese.

Following these steps, you can start trading on Bitbank:

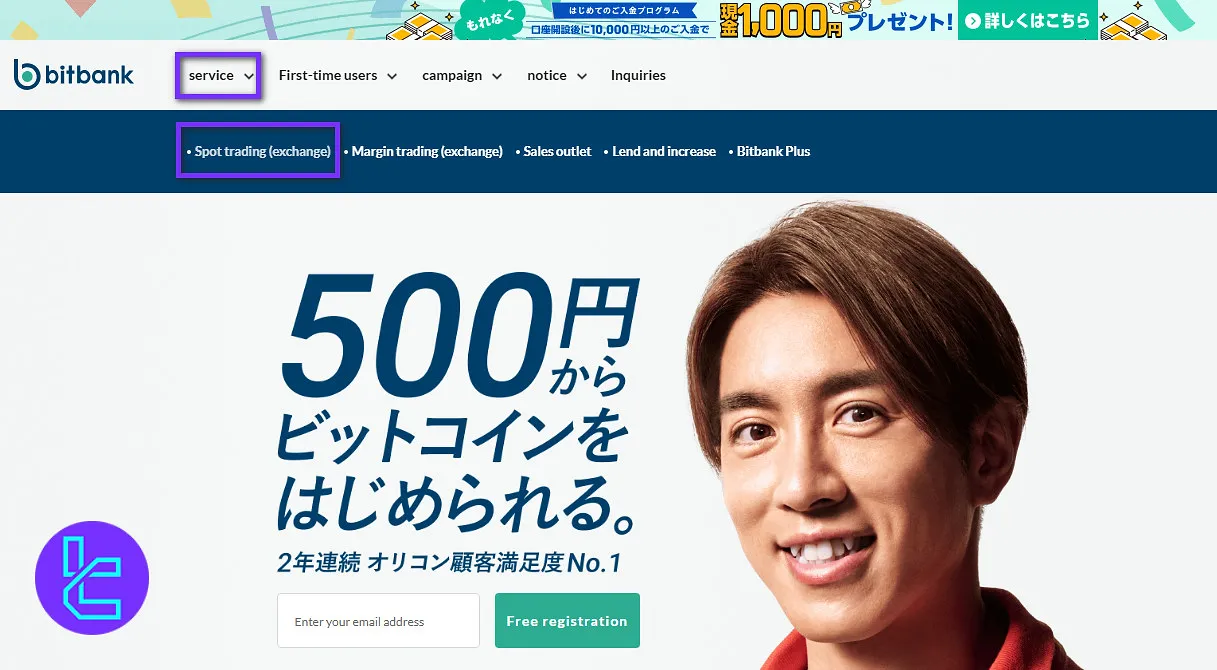

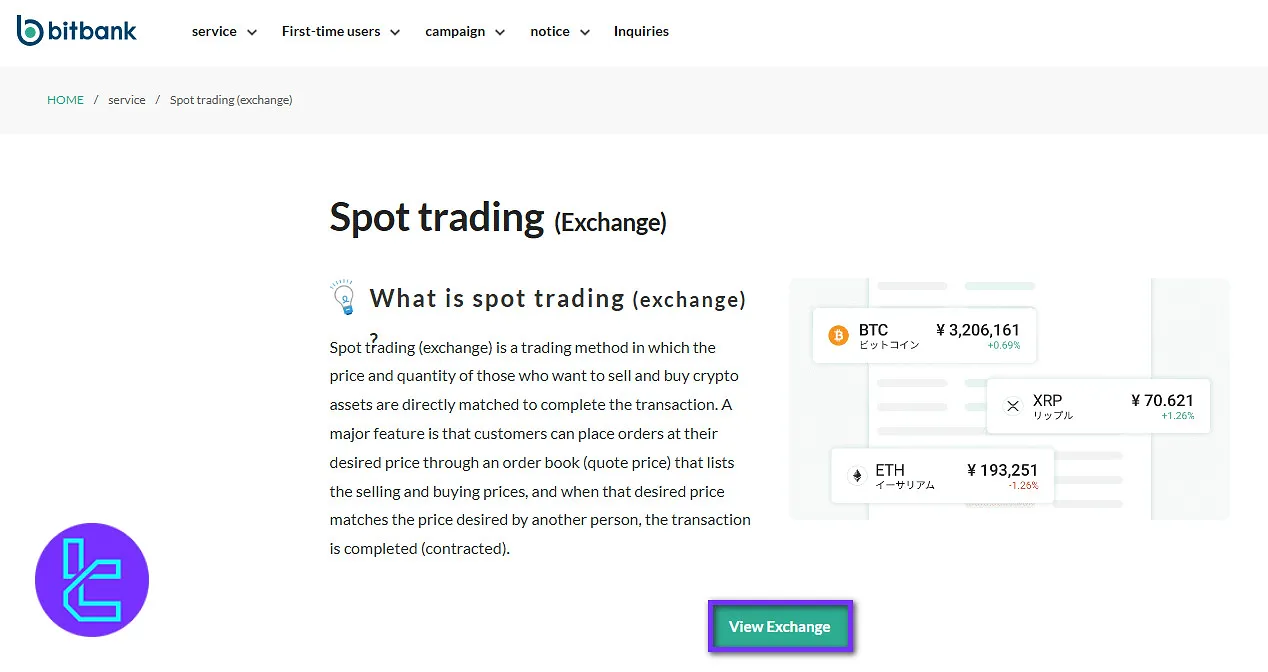

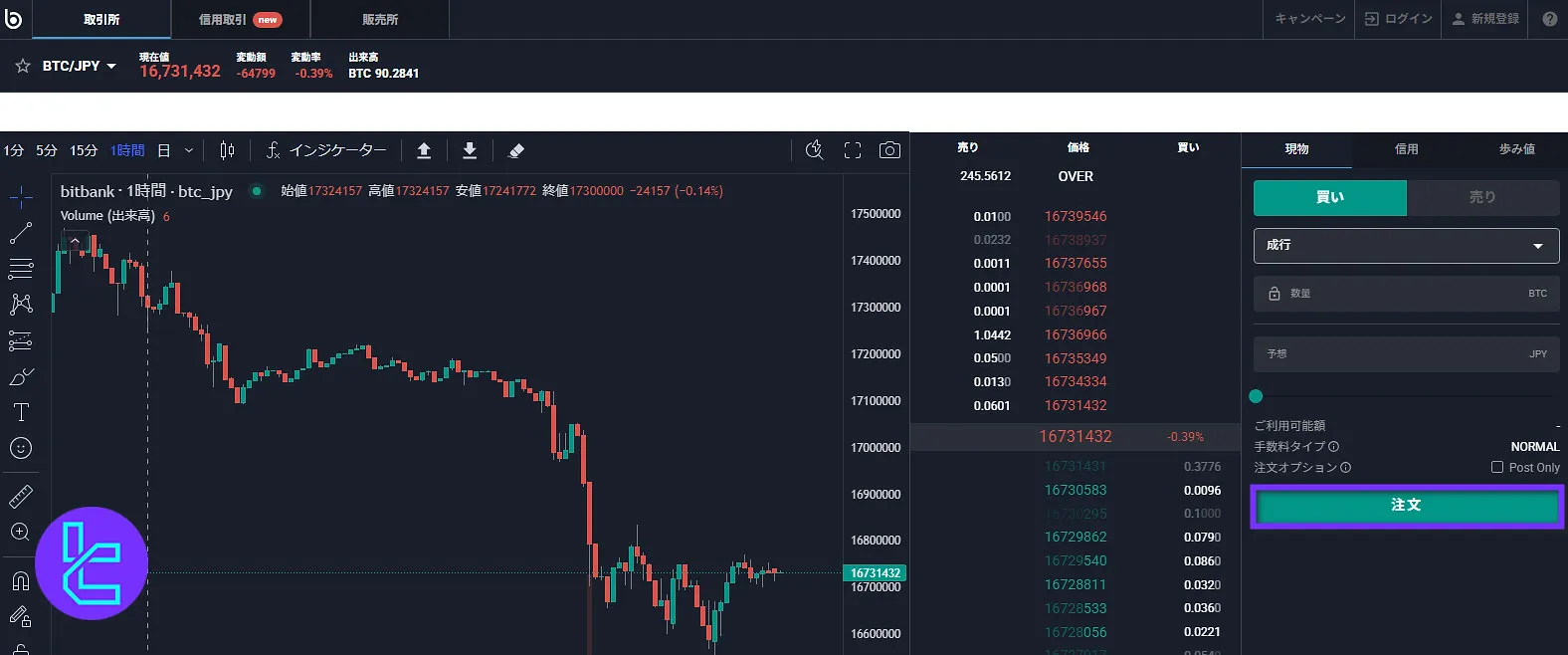

#1 Find the Exchange

First, you need to select “Service” at the top of the homepage, and then click on “Spot Trading (Exchange)”.

#2 View Exchange

On the next page, simply click on “View Exchange”.

#3 Choose a Trading Pair

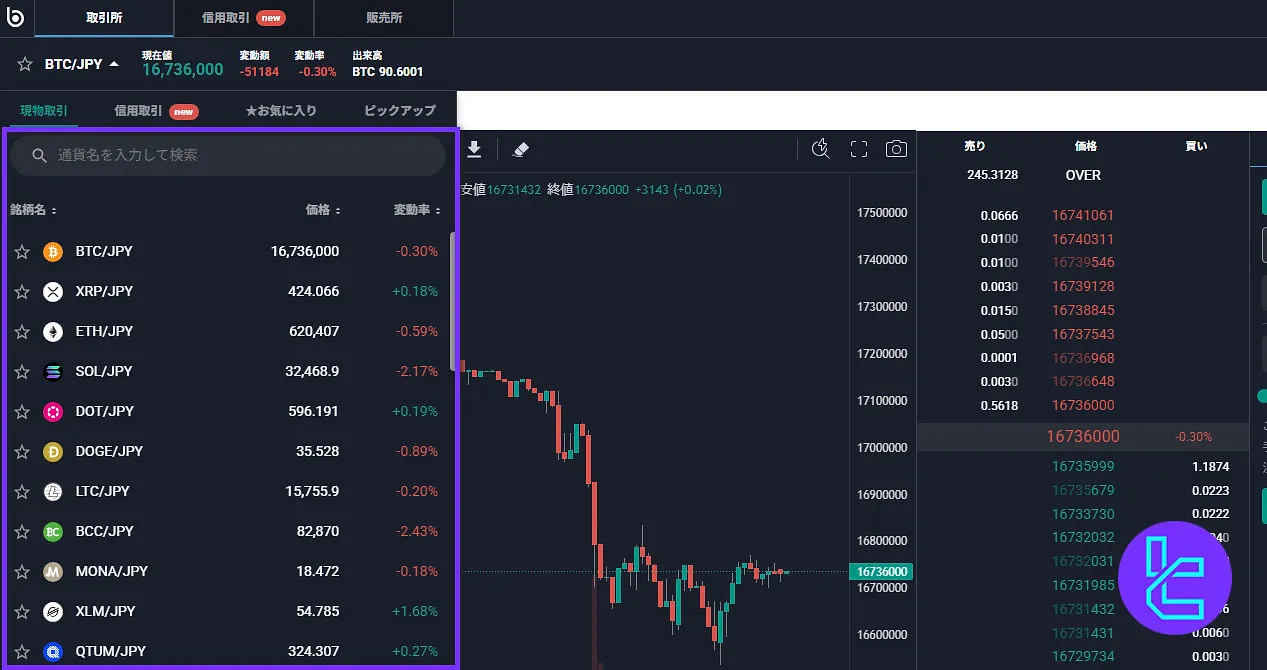

Now, from the left side of the screen, search for your preferred trading pair or click on one available in the list.

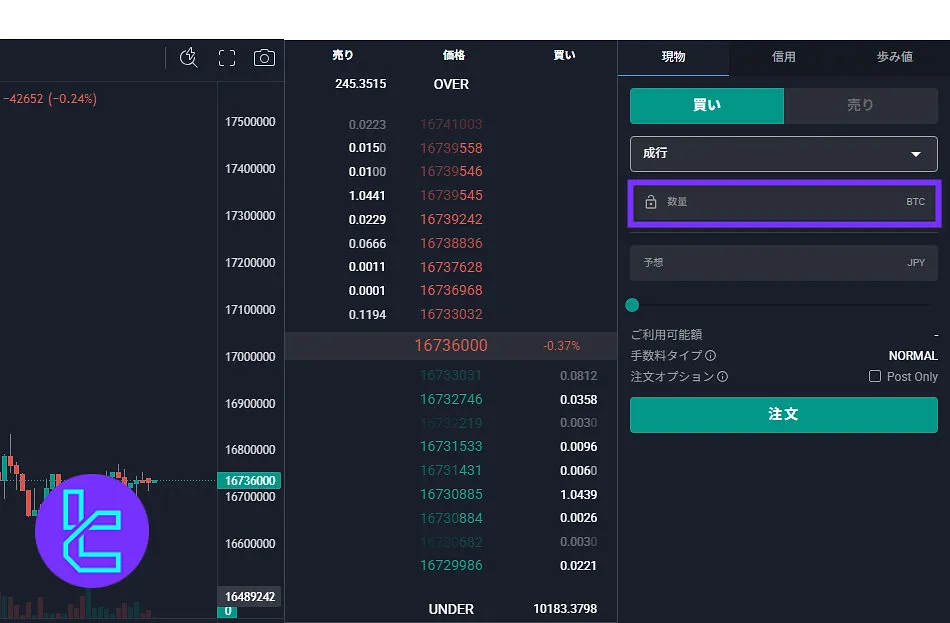

#4 Enter the Amount

From the menu on the right side of the screen, enter the amount of cryptocurrency you want to buy or sell.

#5 Confirm the Trade

Now you only need to click on the green button at the bottom right side of the screen to confirm the trade. If you are selling, the button will be red.

Bitbank App and Trading Platform

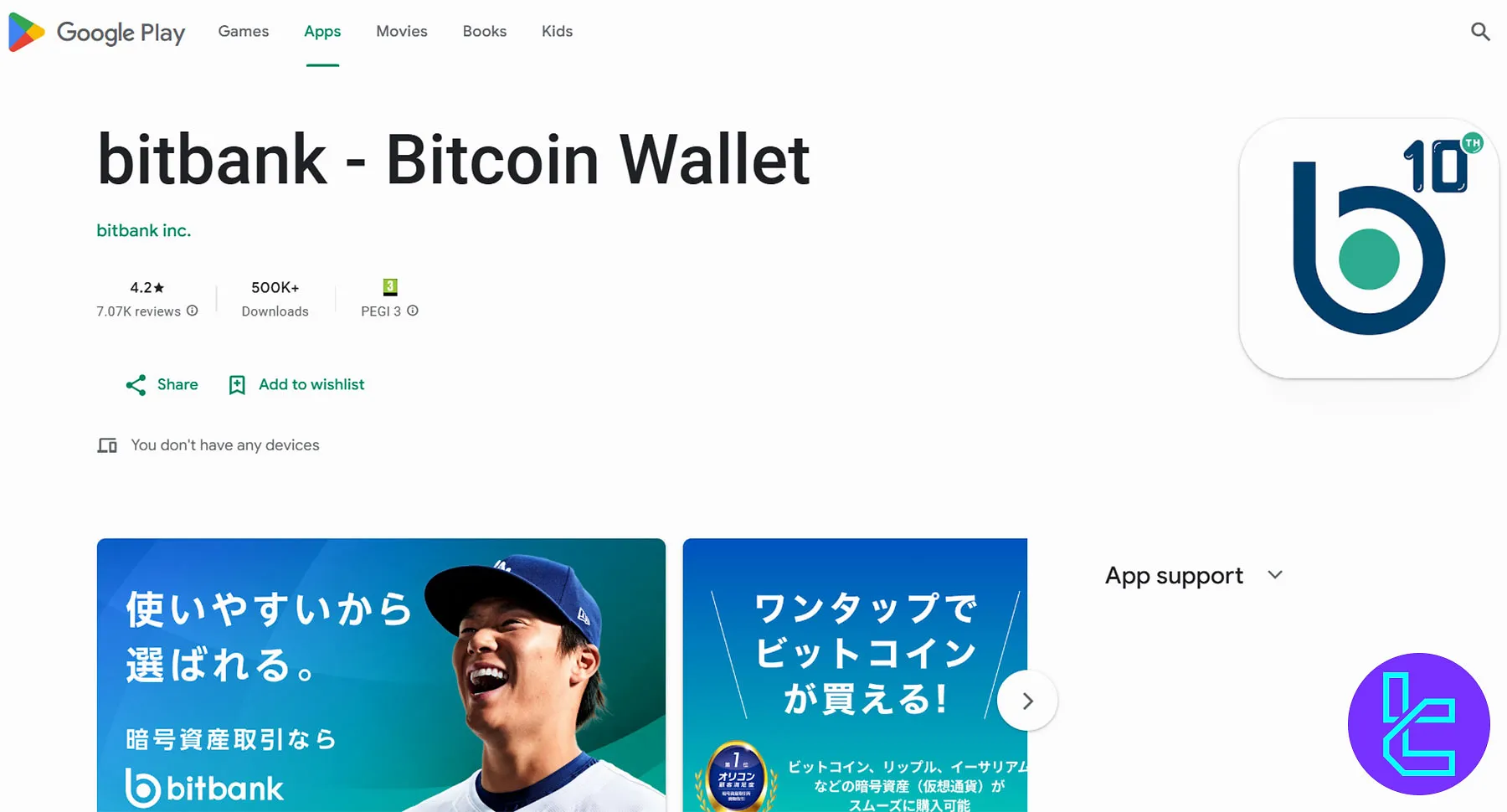

Bitbank provides a comprehensive trading interface accessible via both desktop and mobile.

The exchange includes over 60 technical analysis tools, real-time chart updates, responsive trade execution, and TradingView charts.

Designed with mobile-first usability in mind, Bitbank offers a native app that allows users to trade on-the-go with high stability and data speed. Bitbank app download links:

TradingFinder has developed various TradingView indicators that you can use for free.

Bitbank Trading Volume

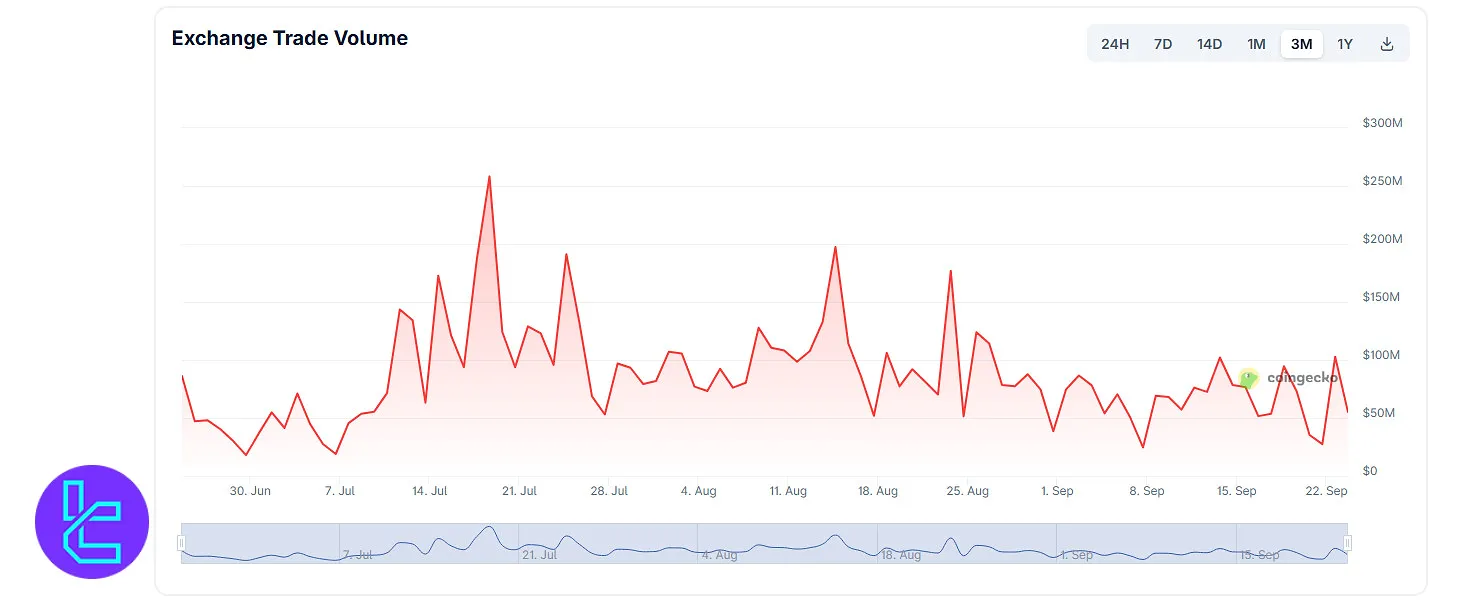

According to the Bitbank CoinGecko chart, over the past 3 months, Bitbank’s trading volume has shown noticeable volatility, ranging from below $20 million on quieter days to peaks approaching $280 million.

The chart highlights strong spikes around mid-July and late August, with several days consistently crossing the $100M–$150M threshold.

From early September onwards, volume activity stabilized in a lower range, mostly between $40M–$90M daily, suggesting a cooling-off period compared to the high surges seen in July.

Despite fluctuations, Bitbank still maintains a healthy liquidity profile, with consistent daily volume above $30M, making it a solid mid-tier exchange in terms of activity.

This pattern indicates that while Bitbank experiences bursts of intense trading, it has managed to sustain a steady baseline level, reflecting ongoing trader participation and market relevance.

Bitbank Services

In the table below, you can check out the availability of trading services on Bitbank:

Service | Availability |

TradingView Integration | No |

Auto Trading (Bots) | Yes |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | No |

DEX Trading | No |

Auto-Invest (Recurring Buy) | Yes |

Security Factors

The company is still hack-free at the time of writing this Bitbank review. The company meets the standards of “ISO/IEC 27001:2013” and has acquired an ISMS certification.

The exchange protects client assets through multi-signature cold wallet storage, 2FA (two-factor authentication), and encrypted communication protocols (SSL).

Operating under Japanese Financial Services Agency (JFSA) supervision, the exchange implements various security measures, including:

- Cold storage

- Multi-Sig system

- Physical and virtual key management system for hot wallets

- Bug bounty program

- Information Security Management System (ISMS) based on the ISO/IEC 27001:2013 standard

Bitbank Security Rankings

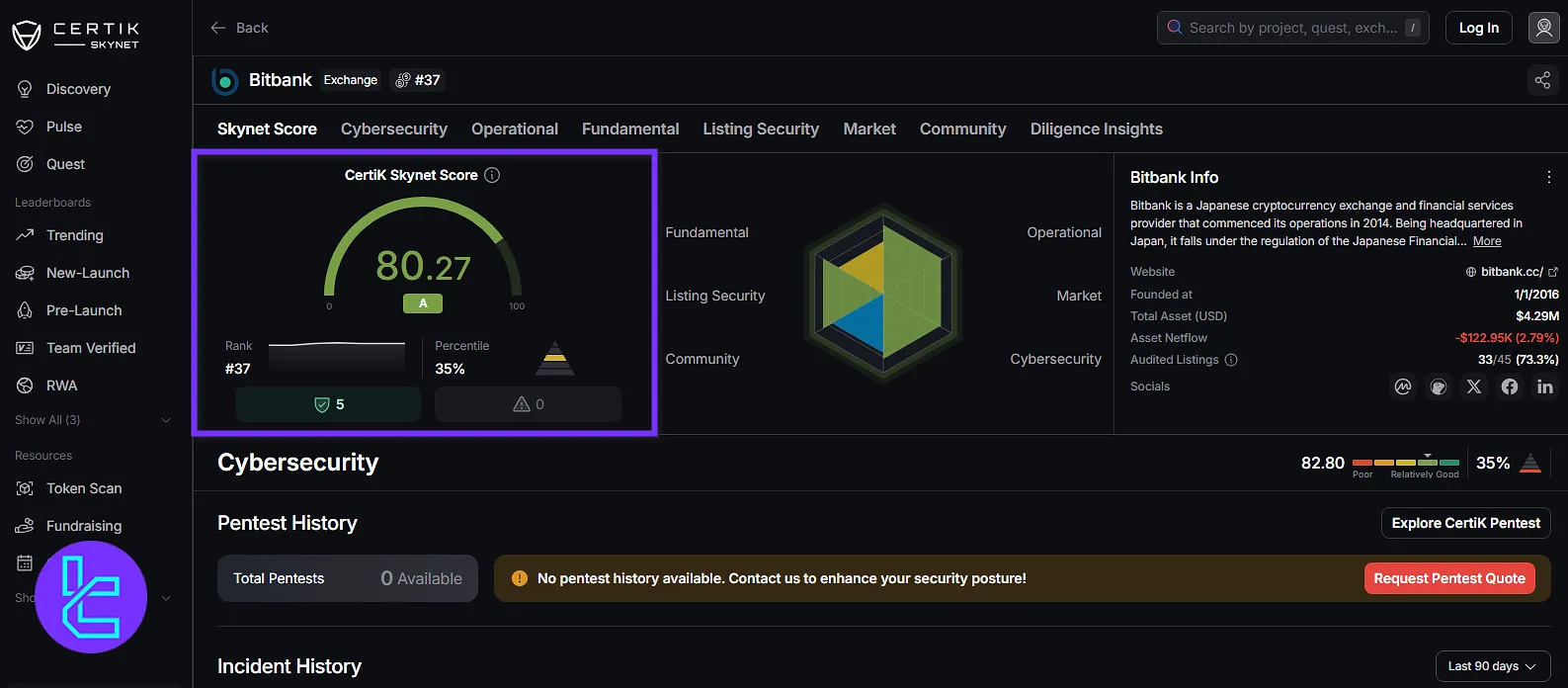

Bitbank’s security profile has been rigorously evaluated across multiple independent platforms, providing traders with a clear picture of the exchange’s safety standards.

According to the Bitbank CertiK Skynet review, the exchange achieves an impressive overall score of 80.27/100 (grade A), reflecting strong operational practices, listing security, and cybersecurity measures.

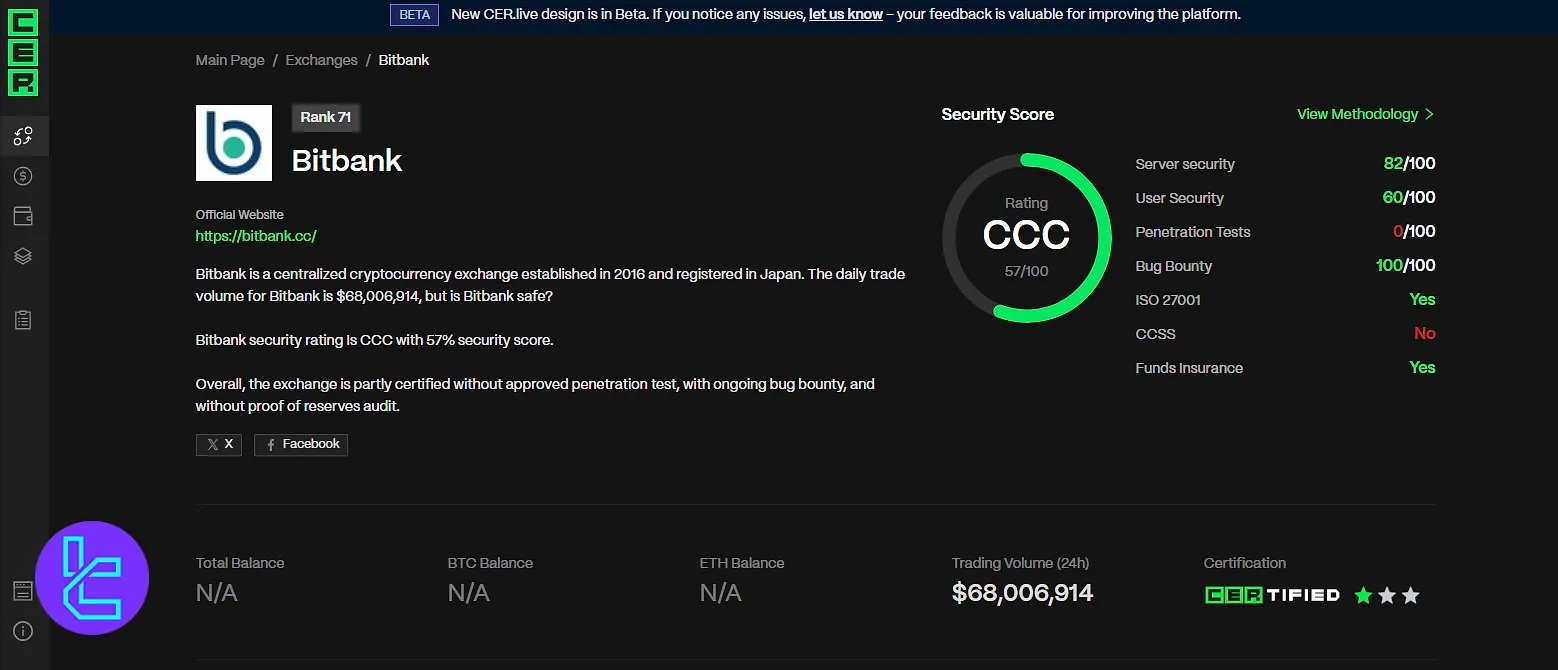

Meanwhile, based on the Bitbank CER.live review, CER.live assigns the platform a more cautious rating of 57% (CCC), highlighting areas such as penetration testing and user security as potential improvement points.

Despite these variations, Bitbank maintains ISO 27001 certification and funds insurance, ensuring a robust foundation for secure trading.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 80.27 / 100 (A) |

Fundamental | 65.86 | |

Operational | 86.75 | |

Listing Security | 88.09 | |

Market | 84.31 | |

Community | 75.05 | |

Cybersecurity | 82.80 | |

CER.live Score | Overall Score | 57% (CCC) |

Server Security | 82/100 | |

User Security | 60/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 100/100 | |

ISO 27001 | Yes | |

CCSS | No | |

Funds Insurance | Yes |

Bitbank Exchange Deposit & Withdrawal

While the platform supports JPY deposits, withdrawals are processed only via cryptocurrencies. Note that to make a deposit you must verify your identity first. Key points about Bitbank payments:

- No deposit limits

- JPY deposits via bank transfer, ATM transactions, and Net Banking (GMO Aozora and Sumishin SBI)

- All supported cryptocurrencies are available

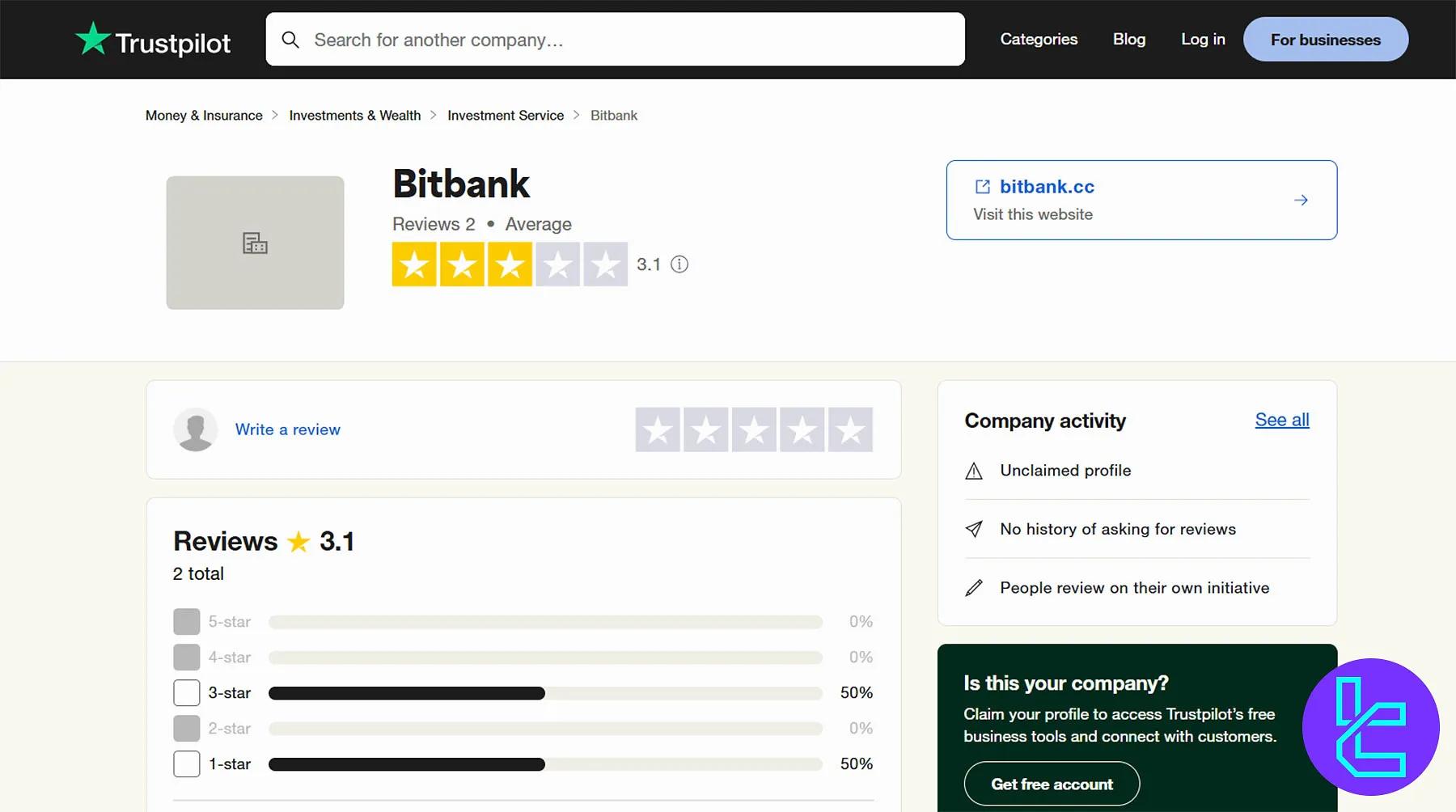

Bitbank Trust Score

The platform has performed well in the eyes of CoinGecko experts. However, there are only 2 comments on the Bitbank Trustpilot profile.

CoinGecko | 7 out of 10 |

Trustpilot | 3.1 out of 5 |

None of the Bitbank reviews on TP are 4-star or 5-star. There is one 3-star and one 1-star review on this platform.

Bitbank Features

Does Bitbank provide special crypto features like crypto copy trading software or staking?

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | Yes |

Crypto Cards | No |

Bitbank Bonus

Unlike many exchanges that focus only on trading conditions, Bitbank also runs two ongoing bonus programs designed to reward new and active users.

These bonuses are straightforward, Japan-focused, and provide real cash incentives rather than temporary credits:

Bonus Program | Eligibility | Requirement | Reward | Frequency |

First-time Deposit Program | New users who have never deposited JPY into Bitbank | Register + Deposit 10,000 yen or more in the entry month | 1,000 yen | One-time |

Daily Challenges | All registered users | Buy crypto ≥ 500 yen at sales office or trade ≥ 5,000 yen on exchange | 1,000 yen (lottery) | Daily |

First-time Deposit Program

This is a welcome bonus aimed at new depositors. Anyone who has never deposited Japanese Yen into their Bitbank account can enter this program.

After registering through the dedicated entry button, a deposit of 10,000 yen or more made within the same month qualifies the user for a chance to win 1,000 yen in cash.

This is a permanent program with no announced end date, though participation requires prior registration and certain conditions (such as not having an inactive email account older than 180 days).

Daily Challenges

For active traders and buyers, Bitbank offers a daily lottery system. Customers who enter every day and either purchase crypto worth 500 yen or more at the sales office or trade 5,000 yen or more on the exchange are automatically entered into a draw to win 1,000 yen in cash.

This system rewards consistent engagement with the platform and adds an extra incentive for daily activity.

Support Channels

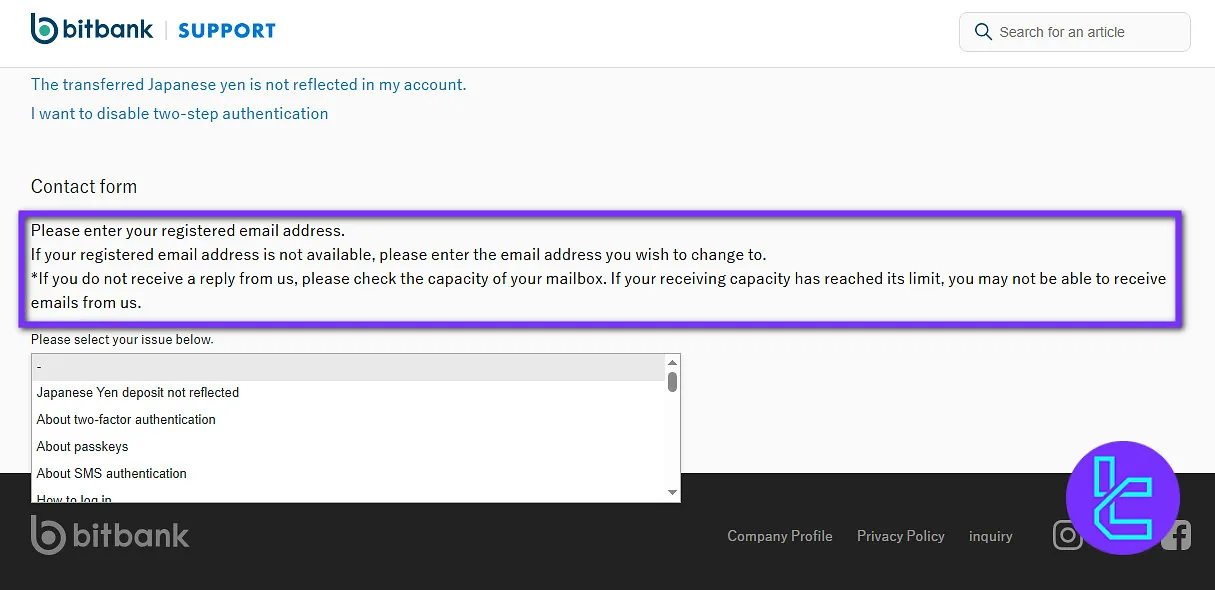

The exchange only offers a chatbot and a ticket system as support channels. The chatbot only supports the Japanese language.

However, you can communicate with the support team in English and Chinese languages through the ticket system.

Copy Trading and Growth Plans on Bitbank Exchange

While the platform doesn’t offer a crypto staking feature, it has developed acrypto lending platform with the following key features:

- Up to 5% annual returns

- Available for all the listed cryptocurrencies, such as BTC, XLM, ETH, and DOGE

Bitbank Exchange Geo-Restrictions

The company provides institutional and API services for global corporations. However, retail services are only available for Japanese residents.

Bitbank vs Other Exchanges

Let's check Bitbank's standing in the crypto world in comparison with other platforms:

Features | Bitbank Exchange | Gate.io Exchange | Bitget Exchange | MEXC Exchange |

Number of Assets | 42 | 2800+ | 10000+ | 2800+ |

Maximum Leverage | 1:2 | 1:100 | 1:125 | 1:200 |

Minimum Deposit | 1 JPY | Varies by Payment Method | $15 | $1 |

Spot Maker Fee | -0.02% | From -0.005% | 0.10% | 0.05% |

Spot Taker Fee | 0.12% | From 0.025% | 0.10% | 0.05% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | No | Yes | Yes |

Staking | Yes (Liquidity Pool) | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

Bitbank provides access to Crypto Spot and Margin trading with leverage options of up to 1:2.

The exchange only provides services to Japanese residents and supports GMO Aozora and Sumishin SBI Net Banking as payment methods.

With over 550,000 users, a daily trading baseline above $30 million, and a CEO (Noriyuki Hirosue) who owns 31% of the company, the exchange is positioned as a serious contender in the Japanese market.

Planned milestones include an IPO in 2025 and growth initiatives like Bitbank Ventures LLC, which invests in AI and blockchain projects.