Bitbuy offers Spot trading on 60 cryptocurrencies with a maker/taker fee of 0.50%/0.50%. The minimum trade size and minimum deposit are CAD 20.

The exchange offers a Staking service with up to 11.57% annual rewards.

Bitbuy stands out in 2025 as one of the most established cryptocurrency exchanges in Canada, with nearly a decade of operation.

Since its founding in 2016, it has processed billions in trading volume and positioned itself as a reliable gateway for Canadian crypto investors.

The platform has over 900,000 registered users nationwide, making it one of the largest regulated exchanges in the country.

Bitbuy; One of the Oldest Crypto Exchanges in Canada

Bitbuy is a Canadian cryptocurrency exchange founded by Adam Goldman on June 1, 2016. The company has a total funding amount of CAD 1.7M.

The company is owned by WonderFi and is registered with multiple regulatory bodies through multiple legal entities, including:

- Coinsquare Capital Markets Ltd registered with FINTRAC and regulated by CIRO

- Bitbuy Technologies Inc. registered with the Ontario Securities Commission (OSC) and the Canadian Securities Administrators (CSA)

Bitbuy was originally launched in 2013 under the name “InstaBT” by founders Adam Goldman and Ademar Gonzalez, with the mission of simplifying Bitcoin purchases for Canadians.

As the exchange grew, it rebranded to Bitbuy and expanded its range of supported cryptocurrencies beyond Bitcoin.

Today, Bitbuy operates out of Toronto and functions as a subsidiary of First Ledger Corporation, a blockchain-focused company that also offers merchant crypto solutions and consulting services.

Over the years, Bitbuy has built a solid reputation as one of Canada’s most trusted crypto exchanges, with a strong regulatory framework and consistent focus on user security and compliance.

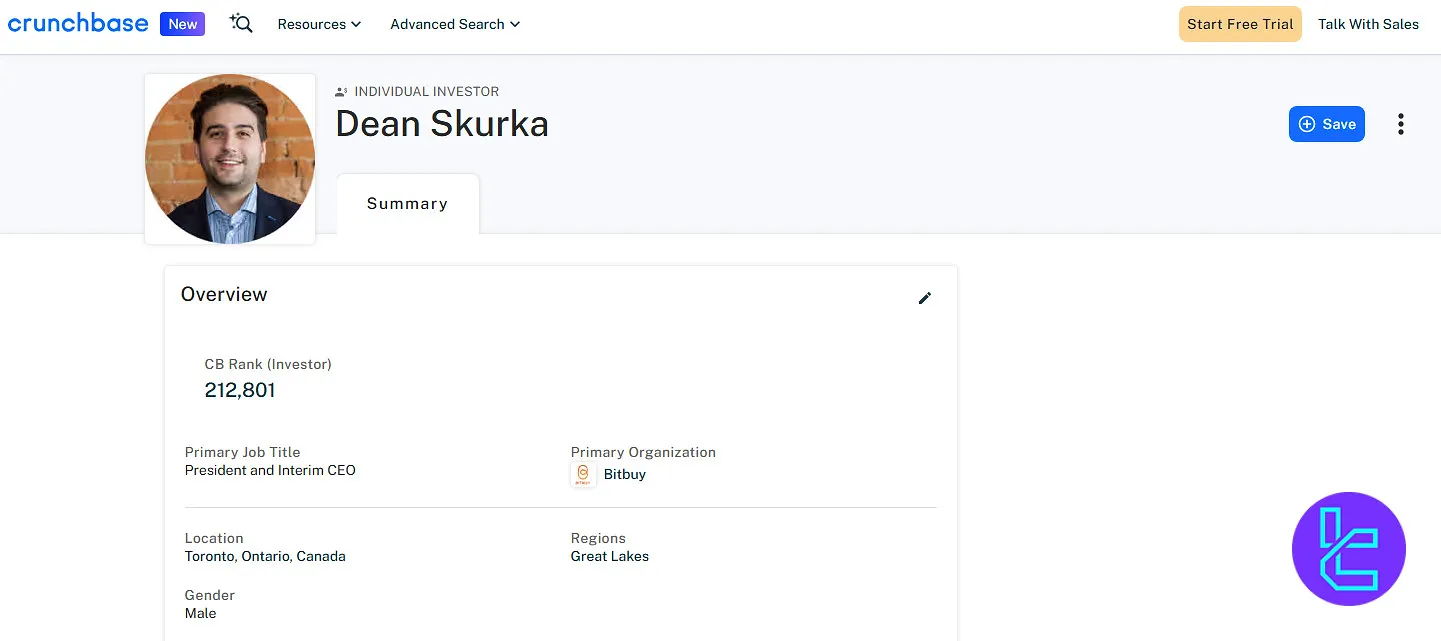

Bitbuy Interim CEO and President

Dean Skurka currently serves as the President and Interim CEO of Bitbuy. He has been a key figure in the company’s leadership, guiding strategic initiatives and operational growth.

Based on the Dean Skurka Crunchbase profile, he attended Ryerson University, where he built the foundation for his career in finance and digital asset management.

Under his direction, Bitbuy continues to strengthen its position as one of Canada’s leading regulated cryptocurrency platforms.

Bitbuy Exchange Table of Specifications

Bitbuy offers various services, including Express Trade for beginners, Pro Trade for advanced users, staking opportunities, and corporate solutions.

The wide range of services and commitment to the regulatory framework make Bitbuy one of the top Crypto exchanges inCanada.

Exchange | Bitbuy |

Launch Date | 2016 |

Levels | N/A |

Trading Fees | 0.50% |

Restricted Countries | Only available to residents of Canada |

Supported Coins | 60 |

Futures Trading | No |

Minimum Deposit | CAD 20 |

Deposit Methods | Crypto, Bank Wire, Interac e-Transfer |

Withdrawal Methods | Crypto, Bank Wire, Interac e-Transfer, Direct Bank Deposits |

Maximum Leverage | 1:1 |

Minimum Trade Size | CAD 20 |

Security Factors | 1 to 1 Crypto Holding, Cold Storage, BitGo Custodian Solution, $1M Insurance Scheme |

Services | Staking, Express Trade, Pro Trade, OTC, API, Payment Solution (SmartPay) |

Customer Support Ways | Ticket, Email |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | No |

Bitbuy Pros and Cons

The company has a trade volume of over CAD 7B, a3-year revenue growth rate of 3,378%, and $192M assets under custody. Let’s list some of its upsides and downsides.

Pros | Cons |

Regulated and compliant with Canadian authorities | Limited to Canadian users only |

Competitive staking rewards | No live chat or phone support |

User-friendly interface | No margin or futures trading |

Transparent fee structure | Lack of user levels |

Does Bitbuy Offer User Levels?

The company doesn’t offer a tiered user level structure for volume-based fee discounts. The lack of user levels is considered a disadvantage in this Bitbuy review.

Fees Explained

Bitbuy offers a wide range of products with different fee structures. For example, it charges a spread markup of 0.5% – 1.85% on Express Trades.

- Express Trade: 0.5% – 1.85% spread markup with up to 2% extra in low-liquidity conditions

- Pro Trade: A Maker / Taker fee of 0.50% / 0.50%

- Deposit: No charges

- Withdrawal: 1.5% for direct bank deposits and wire transfers

- Staking: Ranging from 25% to 30%, based on the asset

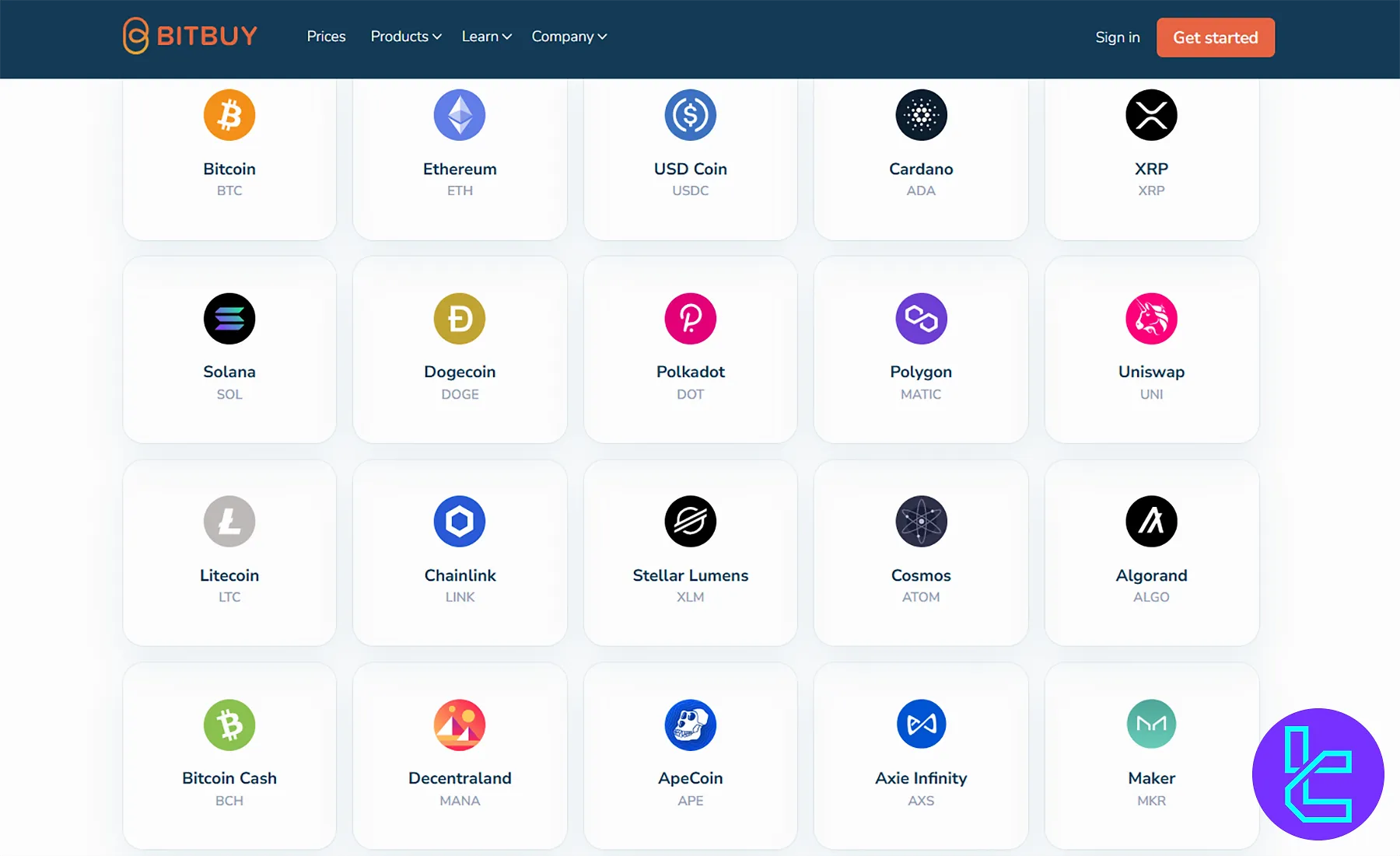

Listed Digital Assets on Bitbuy Exchange

The company has listed60 cryptocurrencies on its platform and allows trading with a budgeto as low as $20. Sme of the assets include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Cardano (ADA)

- Dogecoin (DOGE)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Polkadot (DOT)

- USD Coin (USDC)

Note that some listed assets, including1Inch Network (1INCH), Algorand (ALGO), and Arbitrum (ARB), are trade-only.

While the selection covers the most commonly traded assets, Bitbuy’s crypto listing remains limited compared to global platforms.

The platform prioritizes stability and ease of use, making it ideal for users who want exposure to major cryptocurrencies but may need to rely on external exchanges to access niche altcoins or DeFi tokens.

Leveraged Trading on Bitbuy

Bitbuy does not provide Margin or Futures market trading options. All trades must be fully funded in advance, requiring users to deposit sufficient funds into their accounts before executing any transactions on the platform.

Bitbuy Account Opening and KYC

Bitbuy, as a regulated Money Services Business (MSB) in Canada, requires all users to be 18 or older and complete a full KYC (Know Your Customer) process to ensure compliance with FINTRAC regulations. The Bitbuy registration is secure and identity-focused, ensuring platform integrity.

#1 Visit the Official Bitbuy Website

Head to the Bitbuy official website and click on “Get Started” to initiate the account creation process.

#2 Confirm Your Email Address

Enter your email address, then check your inbox and input the verification code received.

#3 Complete the Sign-Up Form

Fill in the application form with the following information:

- Full name

- Account password

- Phone number

#4 Verify Your Mobile Number

Enter the One-Time Code (OTC) sent via SMS to your mobile number to continue.

#5 Provide Personal Information

As part of the KYC compliance process, fill out the personal information form with your personal details, including:

- Full legal name

- Date of birth

- Residential address

#6 Upload Identity Documents

To verify your identity, upload one of the following Canadian government-issued photo IDs:

- Passport

- Provincial/Territorial Driver's License

- Photo ID Card

- Permanent Residence Card

Upon verification, your Bitbuy account will be ready for trading and funding.

Users in British Columbia, Newfoundland and Labrador, New Brunswick, Nova Scotia, Northwest Territories, Yukon, and Nunavut must be at least 19 years old to use the platform.

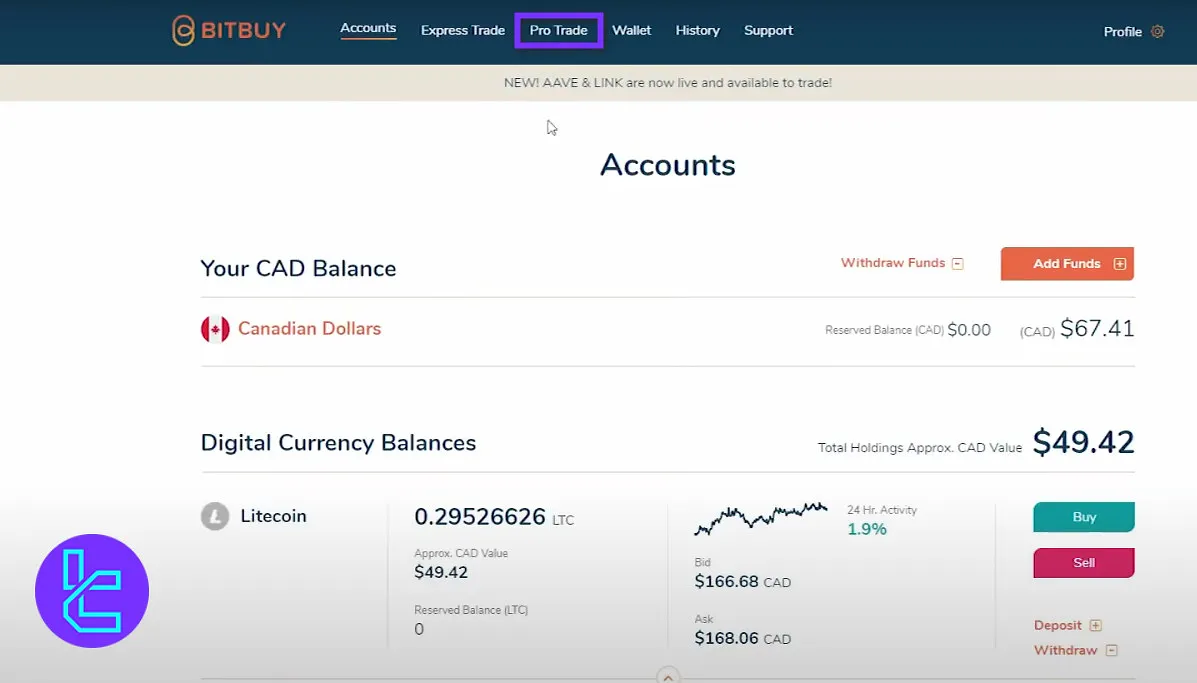

How to Trade on Bitbuy

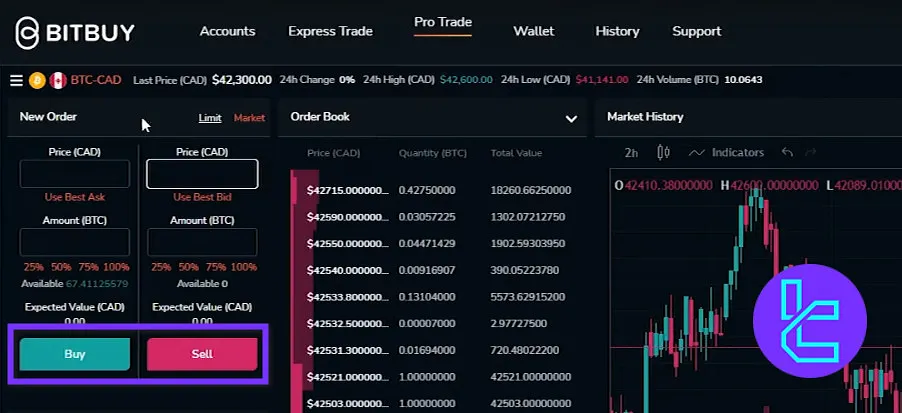

Trading on Bitbuy is simple and user-friendly. Follow these steps to execute your trades efficiently and confidently.

#1 Access the Exchange

From the Bitbuy homepage, click on “Pro Trade” in the top menu.

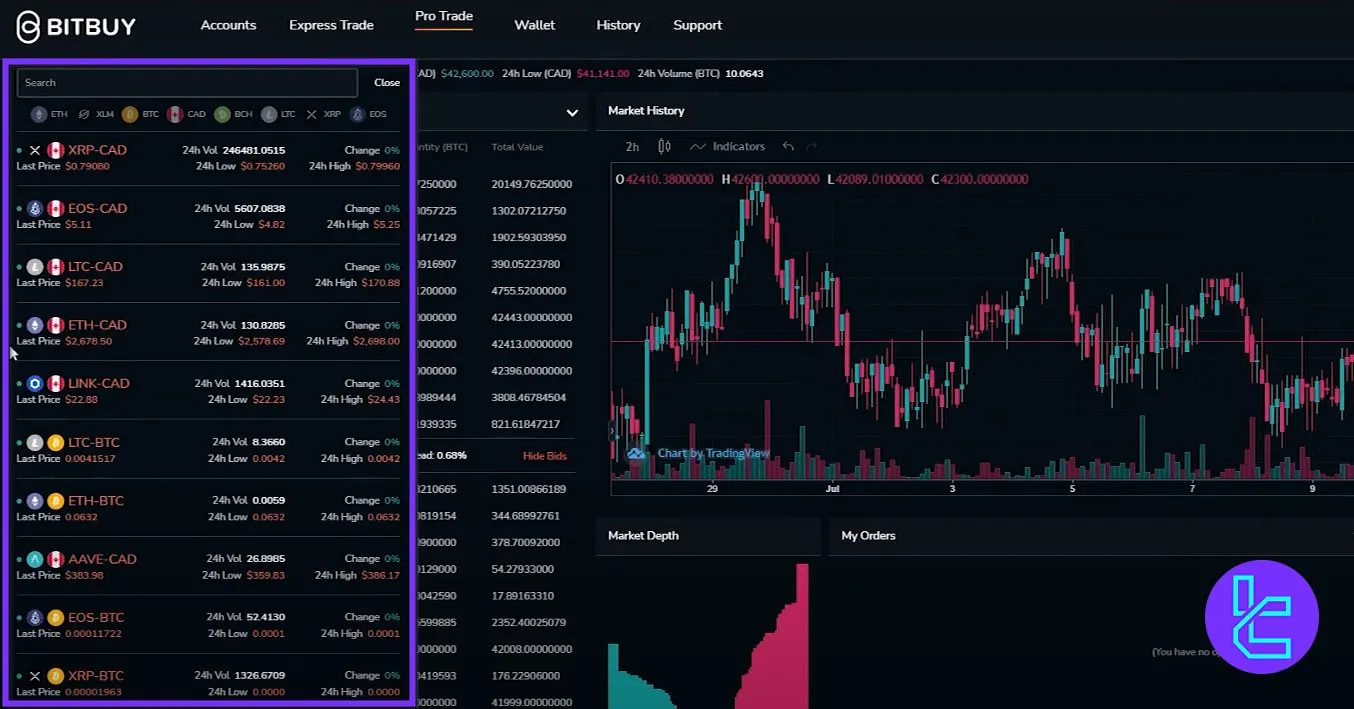

#2 Pick Your Trading Pair

Click the currently displayed trading pair at the top left of the trading interface. A drop-down menu will appear where you can search for and select the pair you want.

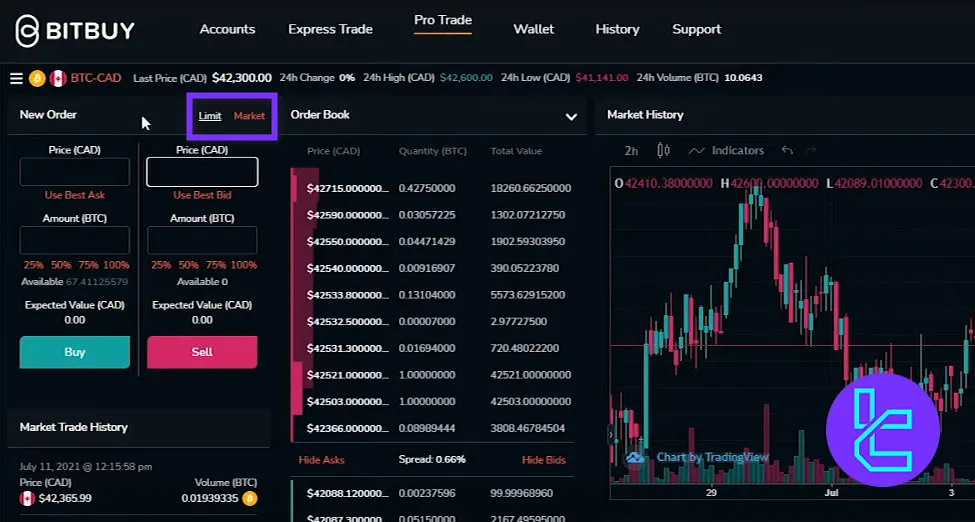

#3 Select the Order Type

Choose which order type you want to place. Bitbuy offers market and limit order options.

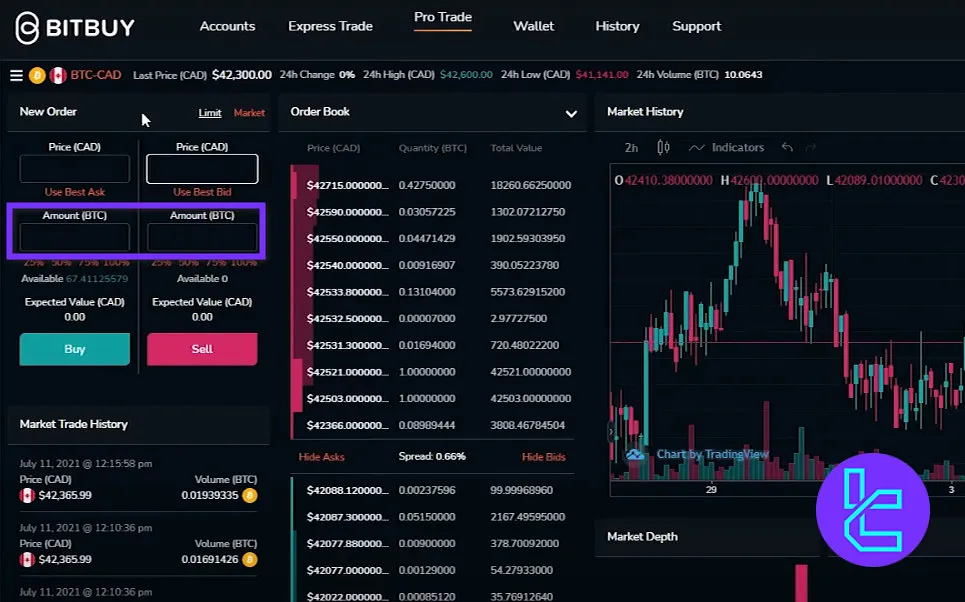

#4 Set Trade Amount

Enter the amount you want to trade in the “Amount” field.

#5 Finalize Your Trade

Click “Buy” or “Sell” to execute and confirm your trade.

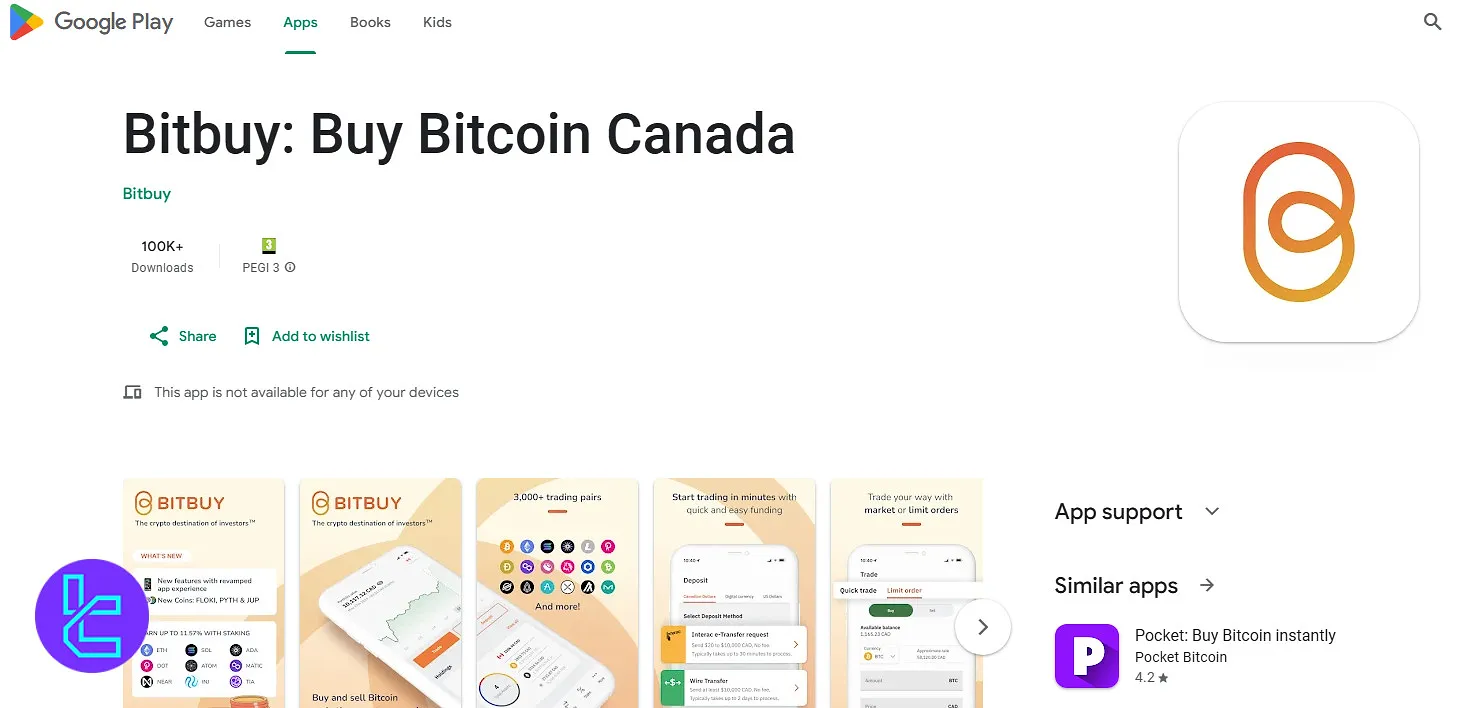

Application and Platform

In this Bitbuy review, we must mention that the exchange has developed a proprietary mobile application and a web-based platform with access to Trading View charts.

To access additional analytical tools, check TradingFinder’s list of TradingView indicators.

Bitbuy Services

Using the table below, you can check out the availability of trading services in Bitbuy:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

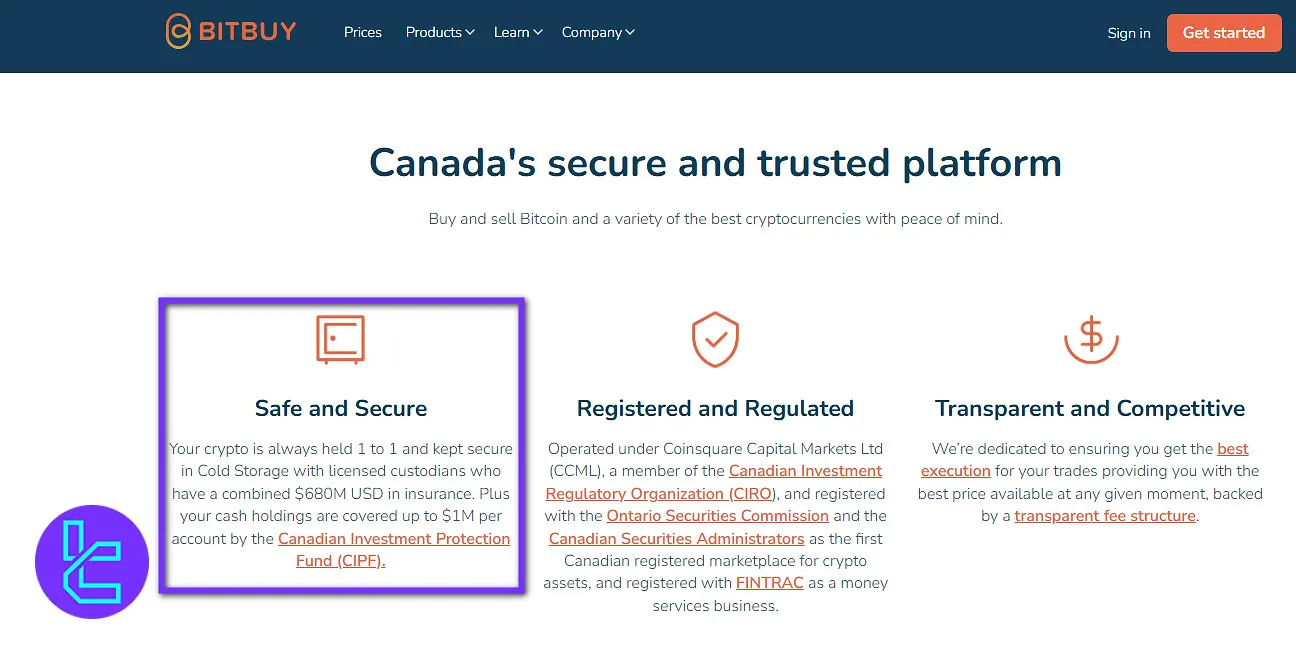

Security and Safety

Bitbuy exchange's commitment to security is evident in holding over 90% of customer assets in insured cold storage vaults and conducting annual Proof of Reserves audits to demonstrate a 1:1 backing of customer funds. It also has implemented:

- Licensed Custodians: Partners with BitGo offering $680M USD in insurance coverage

- CIPF Protection: Cash holdings covered up to $1M per account by the Canadian Investment Protection Fund

- Two Factor Authentication: 2FA to add a layer of security to clients’ accounts

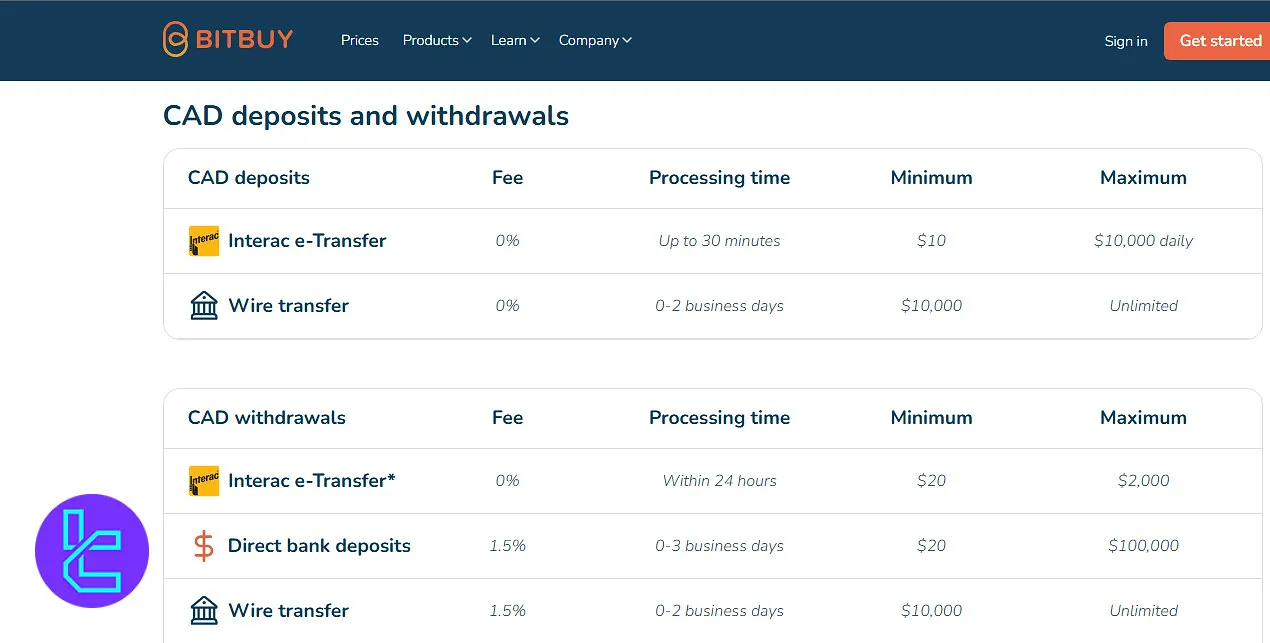

Bitbuy Deposit and Withdrawal

While the exchange supports Crypto payments, it also offers several methods for depositing and withdrawing Canadian dollars (CAD), including:

Payment Method | Min Deposit | Min Withdrawal |

Interac e-Transfer | $20 | $20 |

Bank Wire | $10,000 | $10,000 |

Direct Bank Deposit | Not Available | $20 |

Note that Bitbuy doesn’t accept Dash (DASH) token deposits.

Crypto deposits have no minimums, although network fees may apply. Trading begins at a minimum purchase threshold of CAD 20.

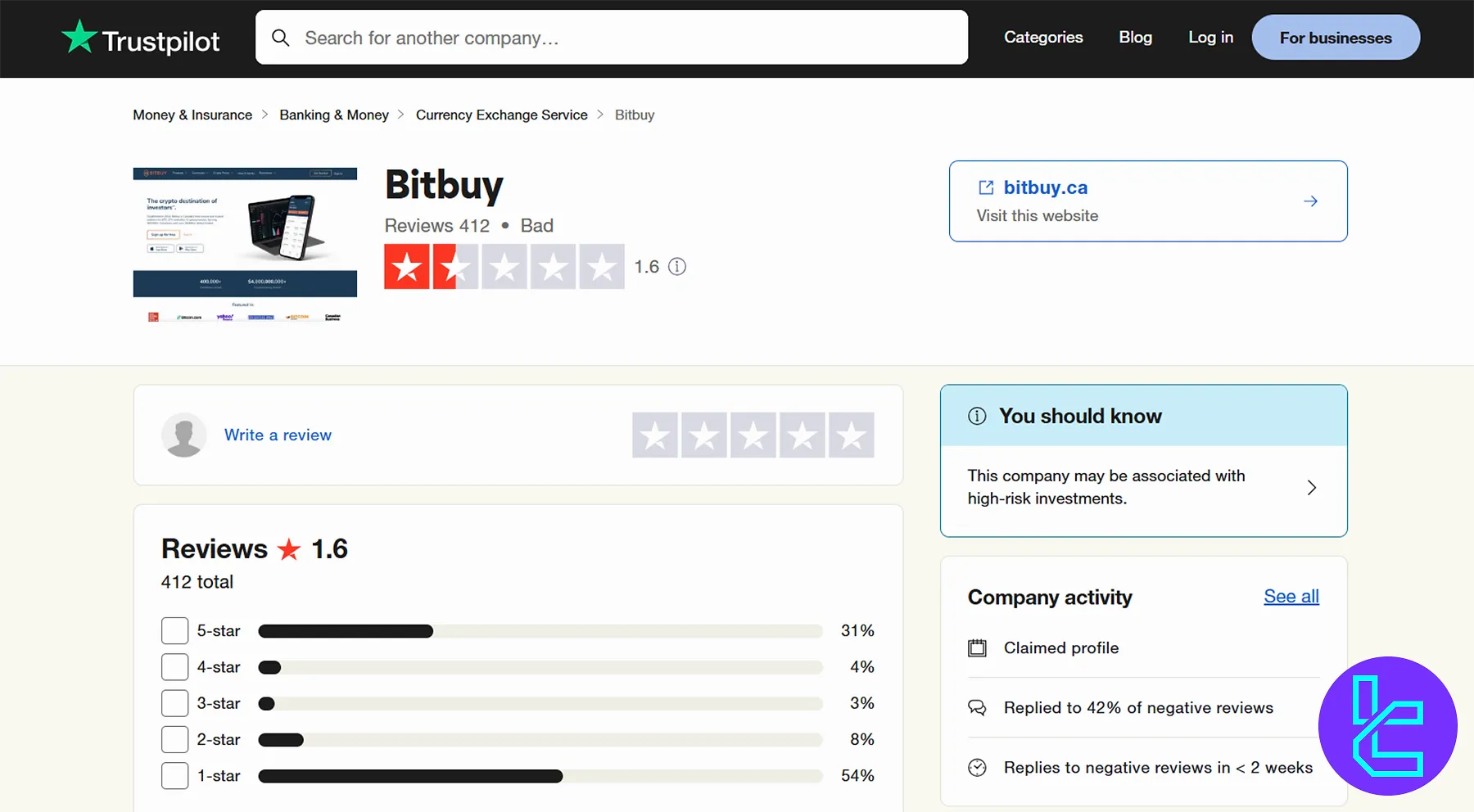

User Experience

The exchange doesn’t perform well when it comes to user experience. There are 412 comments on the Bitbuy TrustPilot profile, resulting in a bad 1.6/5 score.

Bitbuy Features

While Bitbuy supports crypto staking on proof-of-reserve tokens, it doesn't offer copy trading services.

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | Yes |

Crypto Cards | No |

Bitbuy Bonus

Bitbuy offers multiple ways for users with various trading strategies to boost their trading experience through bonuses:

Bonus | Who Can Get It | Reward | Notes |

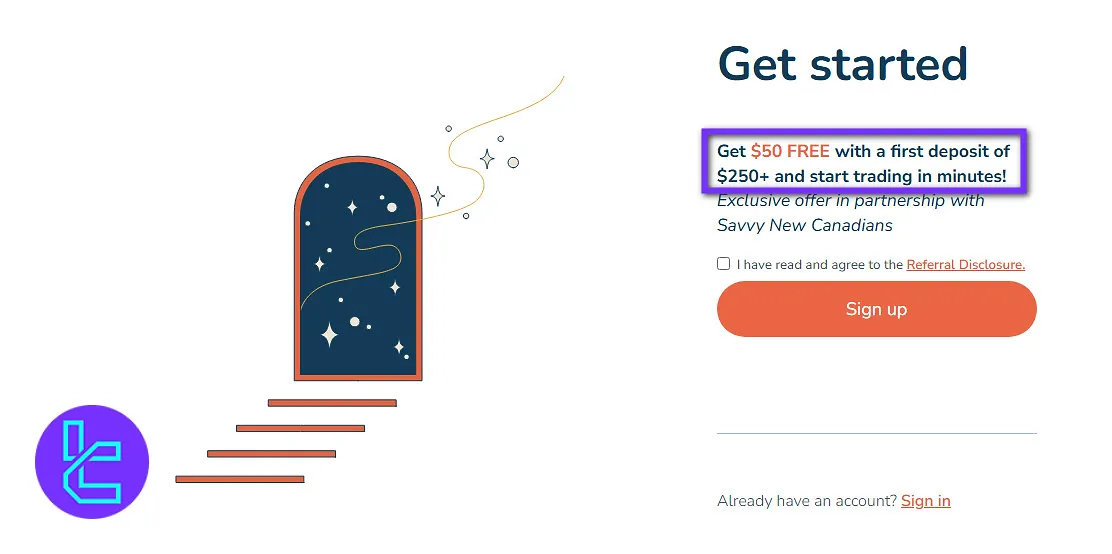

Welcome Bonus | New users signing up via a referral link | $50 CAD after first deposit of $250 CAD | Automatically applied, no promo code, one per user |

Referral Program | Referral partners and their referred clients | Partners earn $25–$200 per deposit; clients get standard service | All clients are charged the same fees; the service level is equal |

Welcome Bonus

New users signing up via an official Bitbuy referral link can receive a deposit bonus to kickstart their trading journey.

Welcome Bonus Details:

- Eligibility: New users creating a Bitbuy account;

- Reward: $50 CAD bonus credited after the first deposit of at least $250 CAD;

- Notes: The bonus is automatically applied; no promo code is required. Only one welcome bonus per user is allowed.

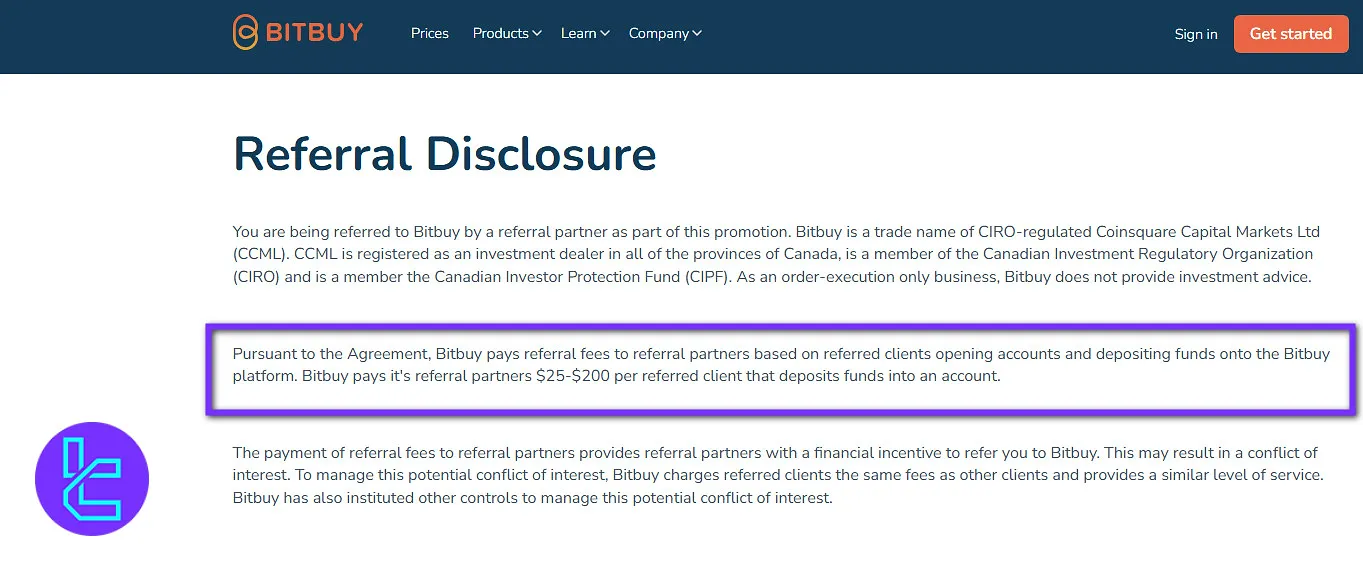

Referral Program

Bitbuy also rewards users who refer friends to the platform. Referral partners earn fees based on clients who open accounts and deposit funds.

Referral Bonus Details:

- Eligibility: Referral partners who successfully bring new clients; referred clients automatically receive standard service;

- Reward: $25–200 per referred client who deposits funds;

- Notes: To prevent conflicts of interest, all referred clients are charged the same fees and receive the same level of service as other users.

Bitbuy Support Channels

One of the biggest letdowns in this Bitbuy review is the lack of live chat support and a phone center. However, the exchange provides 24/7/365 support through a dedicated ticket system and email.

- Bitbuy Email: support@bitbuy.zendesk.com

- Ticket: Available through the “Contact Form”

Bitbuy Exchange Staking and Copy Trading

Bitbuy has paid overCAD 1M in crypto staking rewards. The platform offers up to 11.57% annual rewards on various cryptocurrencies, including:

Cryptocurrencies for Staking | Annual Interest Rates |

Polkadot (DOT) | 10.73% |

Ethereum (ETH) | 2.89% |

Polygon (MATIC) | 2.96% |

Solana (SOL) | 6.26% |

Cardano (ADA) | 1.87% |

NEAR Protocol (NEAR) | 5.74% |

Cosmos (ATOM) | 11.57% |

Injective (INJ) | 7.2% |

Celestia (TIA) | 6.61% |

Geo-Restrictions

As a FINTRAC and CIRO-regulated company, Bitbuy is primarily designed for Canadian users and only provides services to this country's residents.

Bitbuy Comparison Table

Let's compare Bitbuy's features and services with popular crypto exchanges.

Features | Bitbuy Exchange | Deribit Exchange | Cex.io Exchange | BitMEX Exchange |

Number of Assets | 60 | 30+ | 166+ | 110+ |

Maximum Leverage | 1:1 | 1:100 | 1:10 | 1:100 |

Minimum Deposit | CAD 20 | $5 / 0.00001 BTC | $5 | 10 USDT |

Spot Maker Fee | 0.5% | 0% | 0.0% - 0.15% | 0.045% - 0.1% |

Spot Taker Fee | 0.5% | 0% | 0.01% - 0.25% | 0.045% - 0.1% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | No | Yes | No | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | No | Yes | No |

Staking | Yes | No | Yes | No |

Copy Trading | No | No | No | Yes |

Writer's opinion and conclusion

Bitbuy provides Canadian users access to the Cryptocurrency market with spread markups ranging from 0.50% to 1.85% and no additional costs for OTC trading.

The exchange has a bad TrustPilot score of 1.6 out of 5. It supports CAD deposits and withdrawals via Interac e-Transfer and Bank Wire.

Its staking program has distributed more than CAD 1 million in rewards, with APYs reaching up to 11.57% depending on the asset. The platform safeguards $192 million worth of client assets under custody, supported by a 1:1 reserve policy verified through audits.

Bitbuy’s business growth is equally impressive, achieving a 3,378% revenue increase over just three years, alongside more than CAD 7 billion in processed trading volume.