BTC-Alpha offers access to 10 cryptocurrencies for spot trading with a default maker/taker fee of 0.0950%/0.1500%.

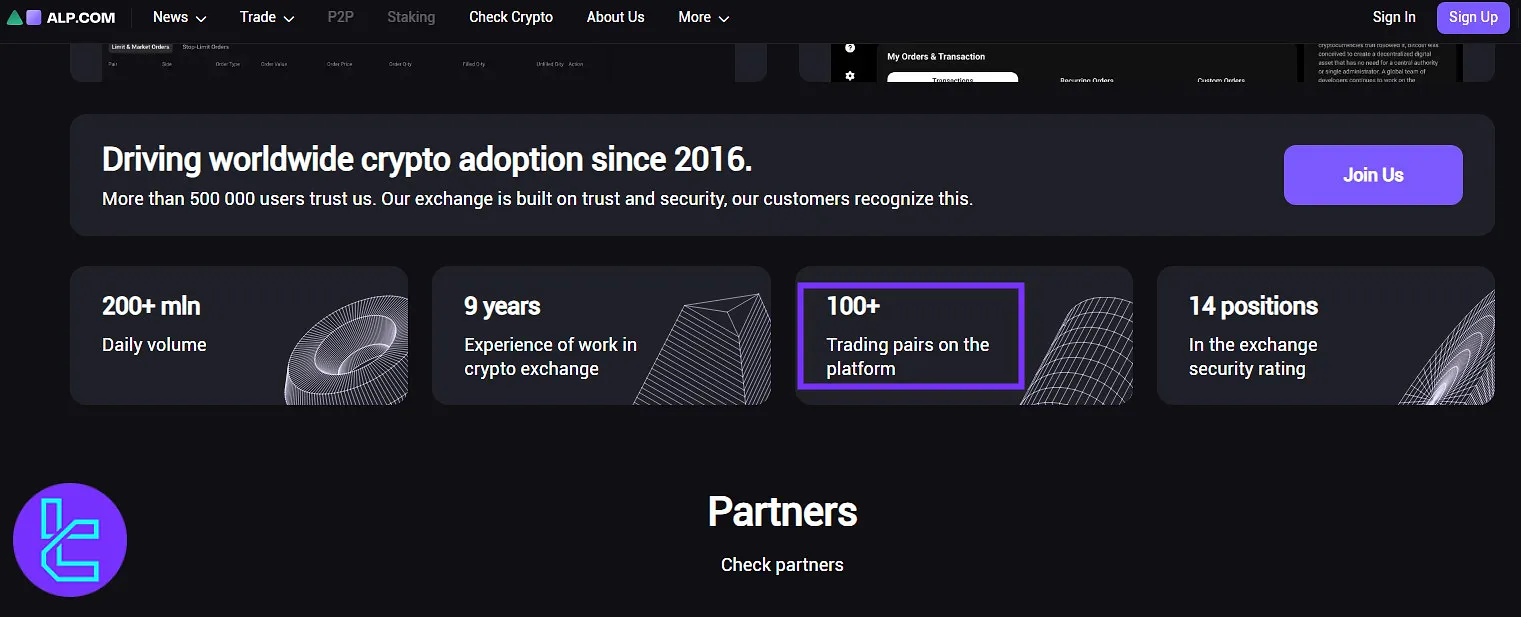

The exchange has an average daily trading volume of $200M. It has partnered with CoinPedia, Crypto News Point, and Infinox.

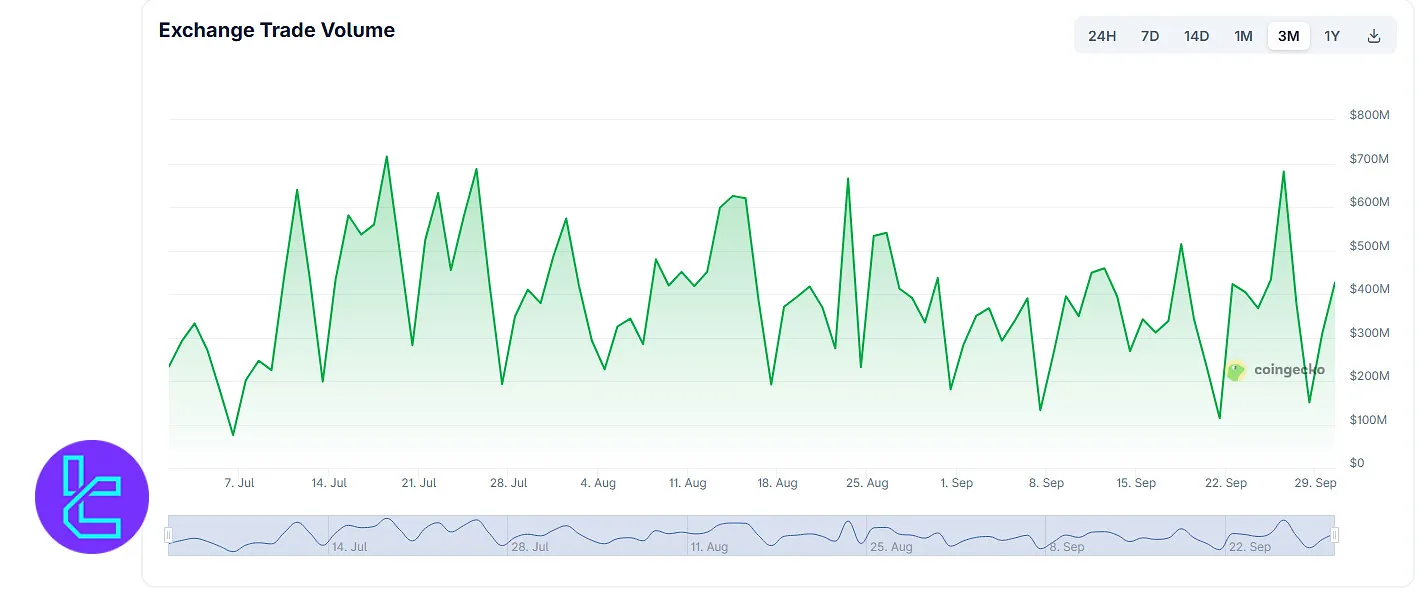

The platform has steadily accumulated over 500,000 registered users and records an average daily trading volume of $200M, with peak activity reaching as high as $800M in September 2024, according to CoinGecko.

These numbers may not rival the likes of Binance, which processes over $65B per day, but they put BTC-Alpha on par with other European mid-tier exchanges such as WhiteBIT and LBank, both of which also handle volumes in the $200M–$500M range.

BTC-Alpha; An Introduction to the Crypto Exchange

BTC-Alpha was launched by the Ukrainian entrepreneur Vitalii Bondar on November 1, 2016. The company was registered in Warwickshire, United Kingdom (company No. 09951778).

The crypto exchange acquired a financial license from the Republic of Estonia in 2019. Key features of BTC-Alpha:

- 24/7 support

- Minimum order size: $5

- Support for two fiat currencies: EUR and USD

- ALP Coin (the platform’s native token) launched on 10/10/2019

Operating under Lithuanian jurisdiction, BTC-Alpha is a centralized exchange primarily focused on spot trading.

Although it does not support derivatives or margin trading, BTC-Alpha makes up for this with robust security measures, KYC verification protocols, and a functional mobile app.

Advanced users also benefit from API integration options.

BTC-Alpha CEO

Vitalii Bodnar is the driving force behind BTC-Alpha’s growth and stability in the competitive crypto exchange market.

With years of expertise in fintech and blockchain innovation, he has positioned BTC-Alpha as a reliable platform for traders worldwide.

Under his leadership, the exchange has expanded its user base, strengthened its security infrastructure, and maintained consistent trading volumes that often surpass hundreds of millions of dollars daily.

According to Vitalii Bodnar Crunchbase profile, his focus on transparency, client trust, and long-term development ensures BTC-Alpha remains a recognized player in the global digital asset ecosystem.

BTC-Alpha Table of Specifications

The platform boasts over 500,000 users worldwide. It has partnered with CoinPedia, ForkLog, Digital Notice, and Wallet Investor.

Exchange | BTC-Alpha |

Launch Date | November 1, 2016 |

Levels | 13 levels from Regular to PRO-3 |

Trading Fees | Maker from 0.0300% to 0.0950% Taker from 0.0450% to 0.1500% |

Restricted Countries | USA, Bolivia, Ecuador, Cuba, North Korea, Iran, Hong Kong, Sudan, Malaysia, Syria, Bangladesh, Kyrgyzstan, State of Wa, Pridnestrovian Moldavian Republic, Nagorno-Karabakh Republic, Somaliland, Shan State, Waziristan |

Supported Coins | 10 |

Futures Trading | No |

Minimum Deposit | $5 |

Deposit Methods | AdvCash (Volet), Perfect Money, PAYEER, NIXMoney, Mercuryo |

Withdrawal Methods | Fiat, Crypto |

Maximum Leverage | 1:1 |

Minimum Trade Size | $5 |

Security Factors | Bug Bounty Program, 2FA |

Services | OTC Market, Spot Trading, Mobile Trading |

Customer Support Ways | Email, Ticket, Telegram |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | ALP |

BTC-Alpha Exchange Pros & Cons

While the exchange is licensed and reliable as a European crypto exchange, the limited digital asset offerings and services are big letdowns in this BTC-Alpha review.

Pros | Cons |

Competitive trading fees | Limited cryptocurrencies (10) |

User-friendly interface | No live chat support |

Fiat currency support | Geographical restrictions |

Referral program | No Android app |

Although the platform does not feature a live chat, it offers 24/7 support through Telegram.

BTC-Alpha User Levels

The exchange has implemented a volume-based fee structure that offers fee reductions based on 30-day trading volume or account balance.

User Level | 30-Day Trading Volume (USDC) | Account Balance (USDC) | Maker Fee | Taker Fee |

Regular | >= 0 | >= 0 | 0.0950% | 0.1500% |

VIP-1 | >= 50K | >= 100K | 0.0850% | 0.1000% |

VIP-2 | >= 200K | >= 250K | 0.0780% | 0.0900% |

VIP-3 | >= 500K | >= 500K | 0.0675% | 0.0850% |

VIP-4 | >= 1M | >= 1M | 0.0650% | 0.0800% |

VIP-5 | >= 2M | >= 3M | 0.0625% | 0.0750% |

VIP-6 | >= 5M | >= 5M | 0.0500% | 0.0600% |

VIP-7 | >= 10M | >= 8M | 0.0400% | 0.0550% |

VIP-8 | >= 20M | >= 10M | 0.0400% | 0.0500% |

VIP-9 | >= 50M | >= 20M | 0.0300% | 0.0450% |

PRO-1 | >= 100M | >= 100M | 0.0500% | 0.0600% |

PRO-2 | >= 300M | >= 300M | 0.0400% | 0.0500% |

PRO-3 | >= 500M | >= 500M | 0.0300% | 0.0450% |

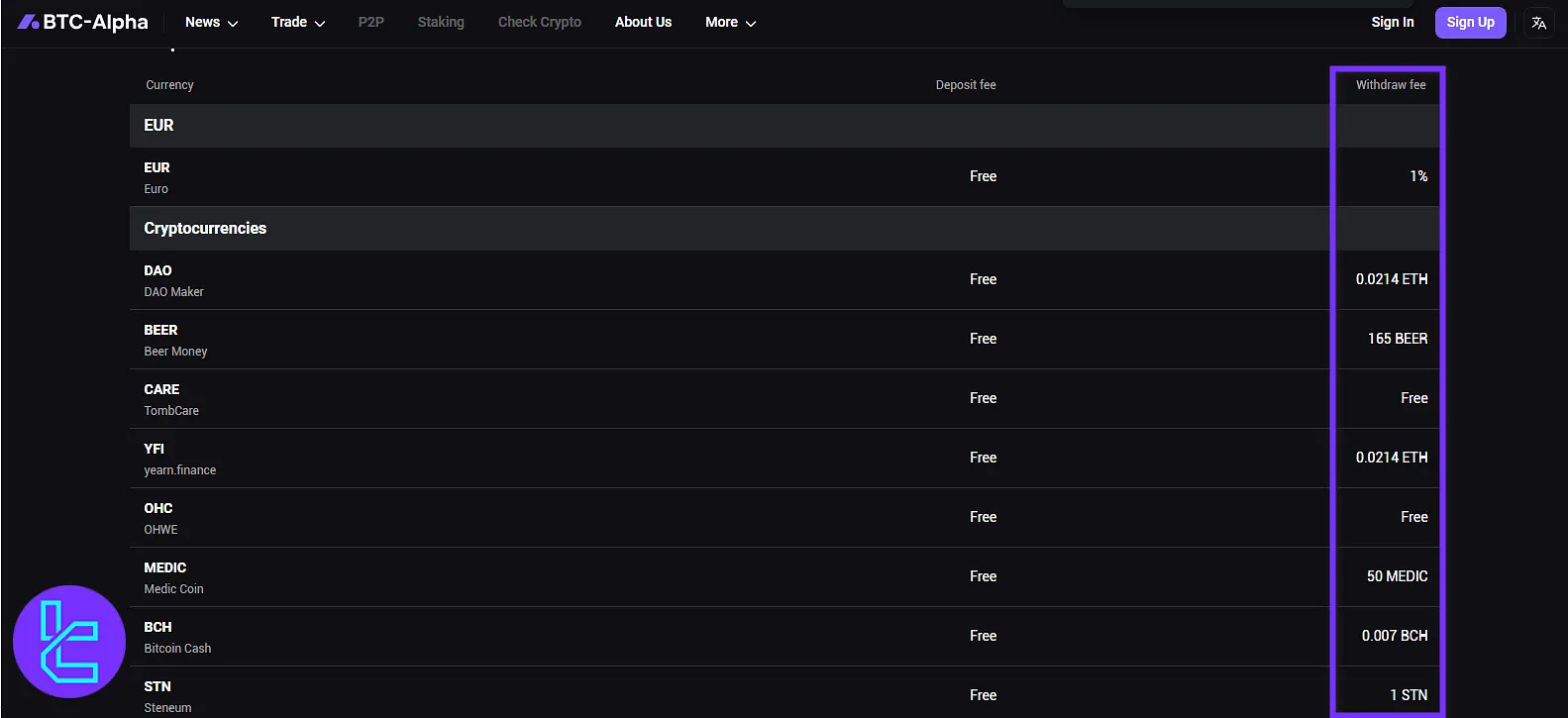

BTC-Alpha Fees Explained

As mentioned earlier, the default trading fees are 0.0950% for makers and 0.1500% for takers. While deposits are all free of charge, withdrawals incur commissions, including:

Withdrawal Method | Fee |

EUR | 1% |

Cryptocurrency | Network fee (variable) |

The withdrawal costs vary based on the asset type and the blockchain network.

BTC-Alpha maintains a static rate, which may appear steep compared to the industry average of 0.10%–0.15%. This fee structure makes it less competitive for high-frequency traders.

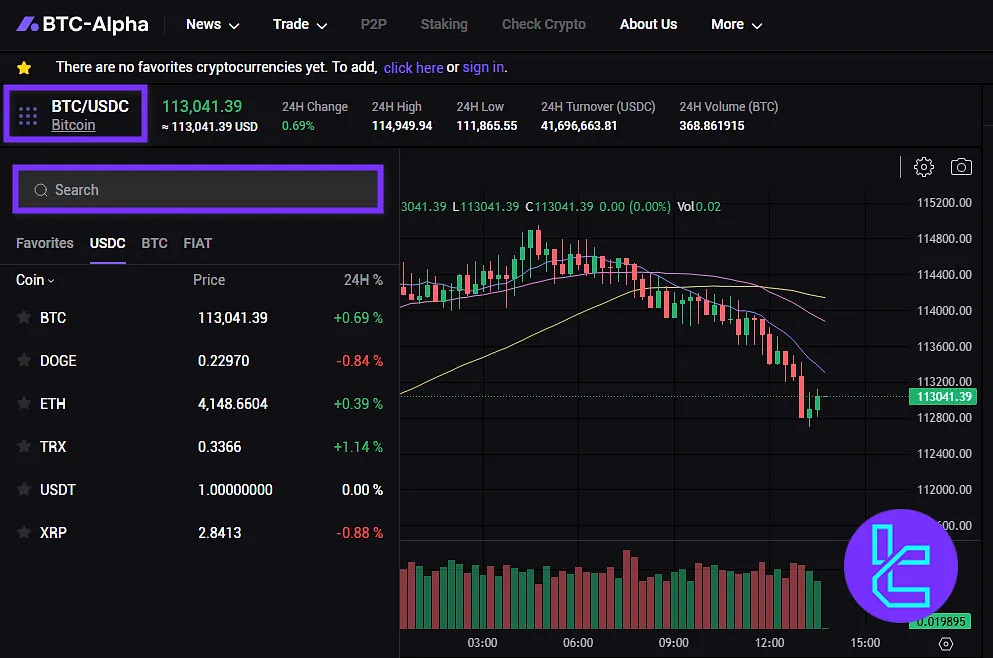

Available Digital Assets on BTC-Alpha Exchange

While the exchange claims to support over 100 trading pairs, its trading platform currently offers only 10 cryptocurrencies and 15 trading pairs in four markets, including USDC, BTC, EUR, and USD. Available digital assets on BTC-Alpha:

- BTC

- DOGE

- ETH

- TRX

- USDT

- XRP

- BDX

- ETC

- LTC

- USDT

The overall number of listed assets remains moderate compared to larger global exchanges.

BTC-Alpha Futures Market

While the exchange doesn't offer leverage options at the time of writing this BTC-Alpha review, it plans to introduce the futures market soon.

BTC-Alpha Registration and KYC

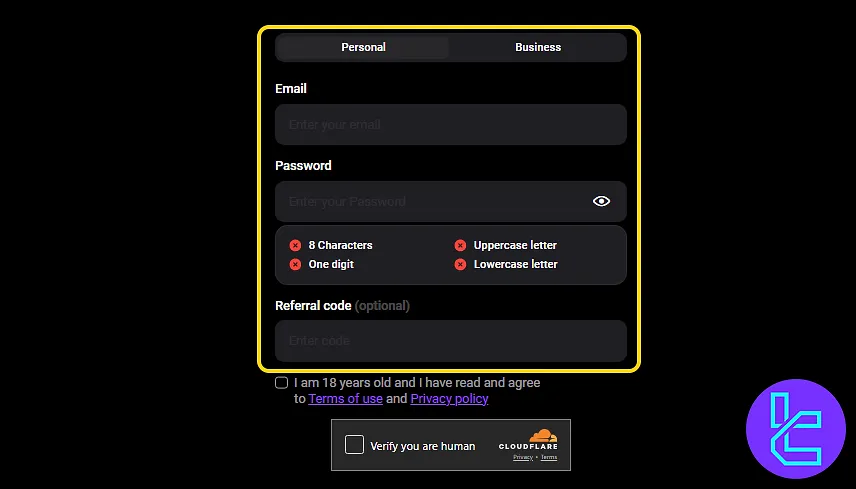

The BTC-Alpha registration is a streamlined process for digital asset traders. To access your personal dashboard, all you need is a verified email and a few basic identity details.

The exchange supports both individual and business accounts, with a process optimized for fast onboarding and secure access to trading features.

#1 Start Registration

Go to the official BTC-Alpha website and click “Open an Account”. Enter your email address, create a strong password, and if applicable add your referral code.

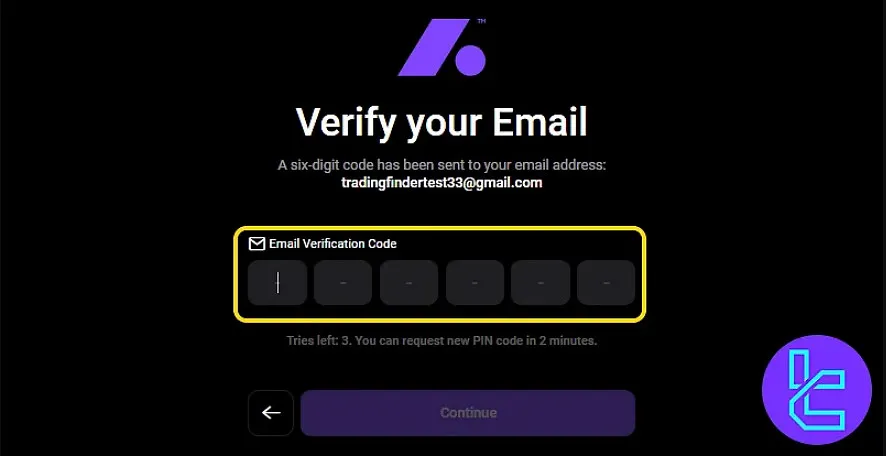

#2 Verify Your Email

Check your inbox for a code from BTC-Alpha. Enter the verification code in the sign-up form to activate your account.

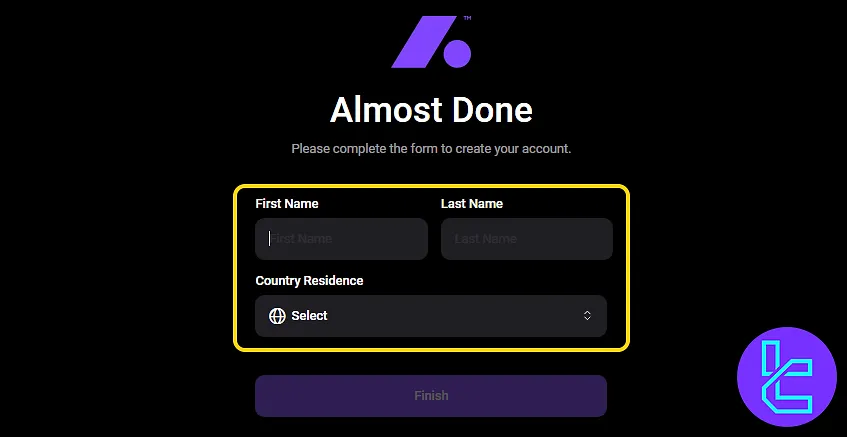

#3 Enter Personal Details

Complete the final step by submitting your personal information, including:

- First name

- Last name

- Country of residence

Click “Finish” to finalize your registration and gain access to the platform.

#4 Proceed with the KYC Procedure

To access the platform's full features, navigate to the Verification menu through the BTC-Alpha dashboard and submit the following documents:

- Proof of Identity: Passport or Driver's license (daily withdrawal limit up to 1M USDT)

- Proof of Address: Utility bill or Bank statement (daily withdrawal limit up to 2M USDT)

This approach aligns the exchange with regulatory norms but may discourage privacy-focused users.

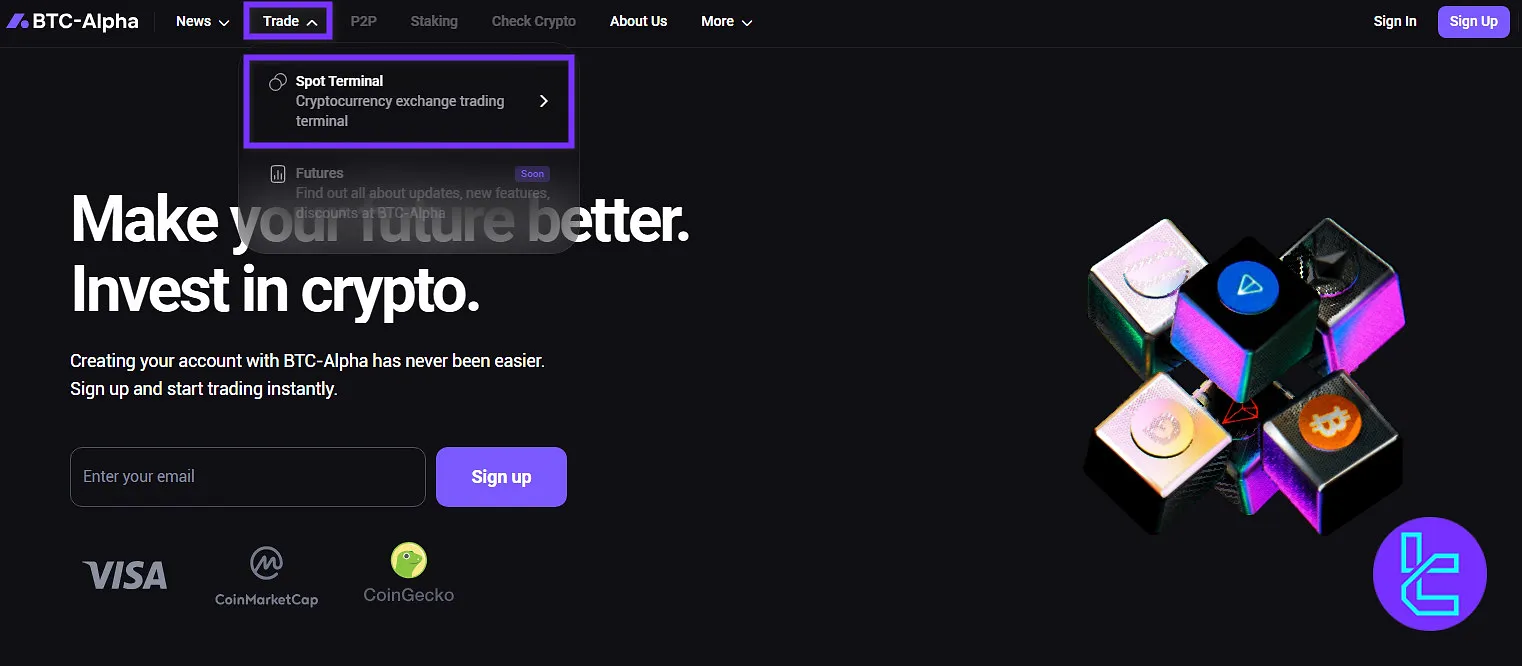

How to Trade on BTC-Alpha

Trading on BTC-Alpha is quite straightforward, and you only need to follow these steps after registration and verification:

#1 Start Trading

To begin, on the homepage of BTC-Alpha, click on “Trade” from the main menu and choose “Spot Trading” to access the trading interface.

#2 Choose a Trading Pair

From the trading dashboard on the left side, click on the current pair displayed at the top and select your preferred trading pair from the dropdown list or search for it using the search box.

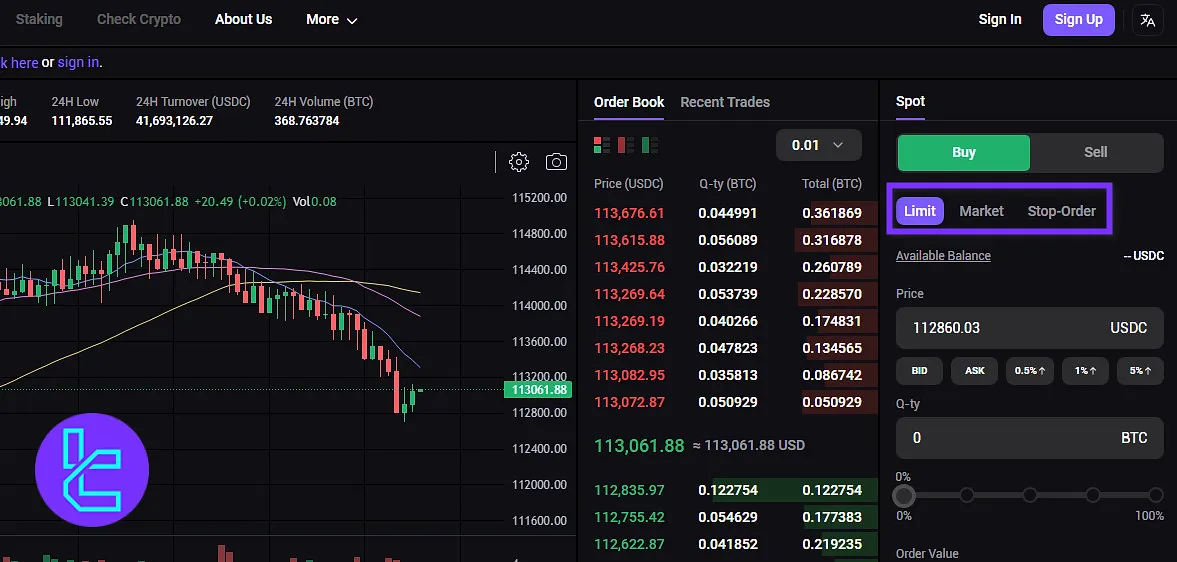

#3 Pick an Order Type

Next, choose your order type. BTC-Alpha supports limit, market, and stop orders.

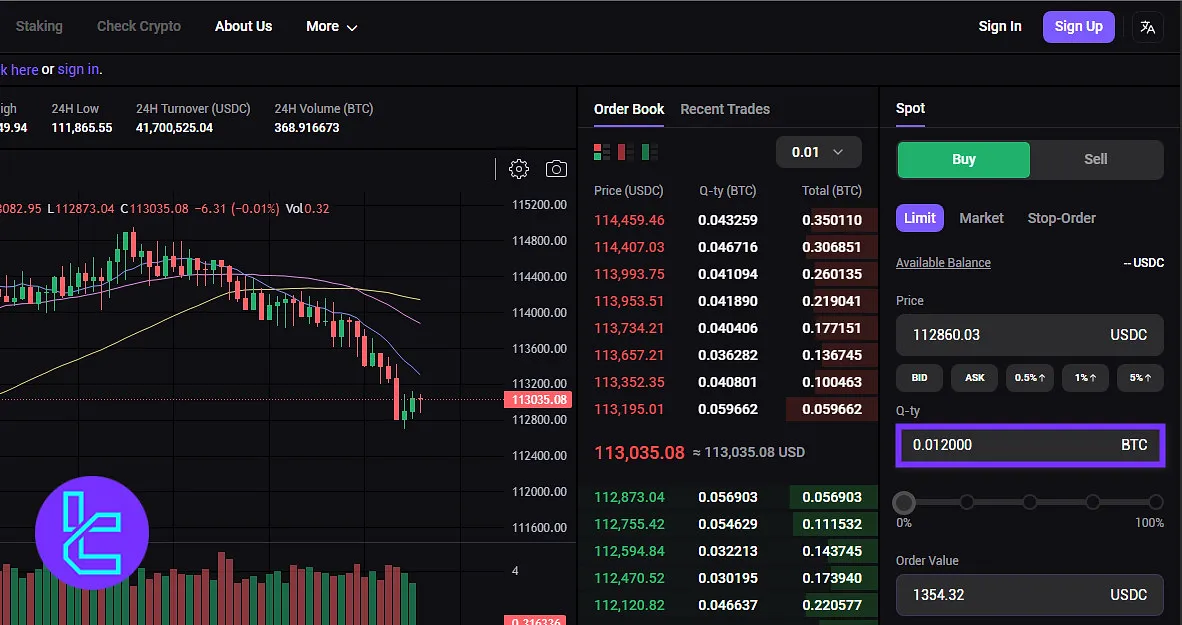

#4 Specify the Amount

Enter the trading volume based on how much you wish to buy or sell.

#5 Confirm the Trade

Finally, click on “Buy” or “Sell” to complete your transaction.

BTC-Alpha App and Trading Platform

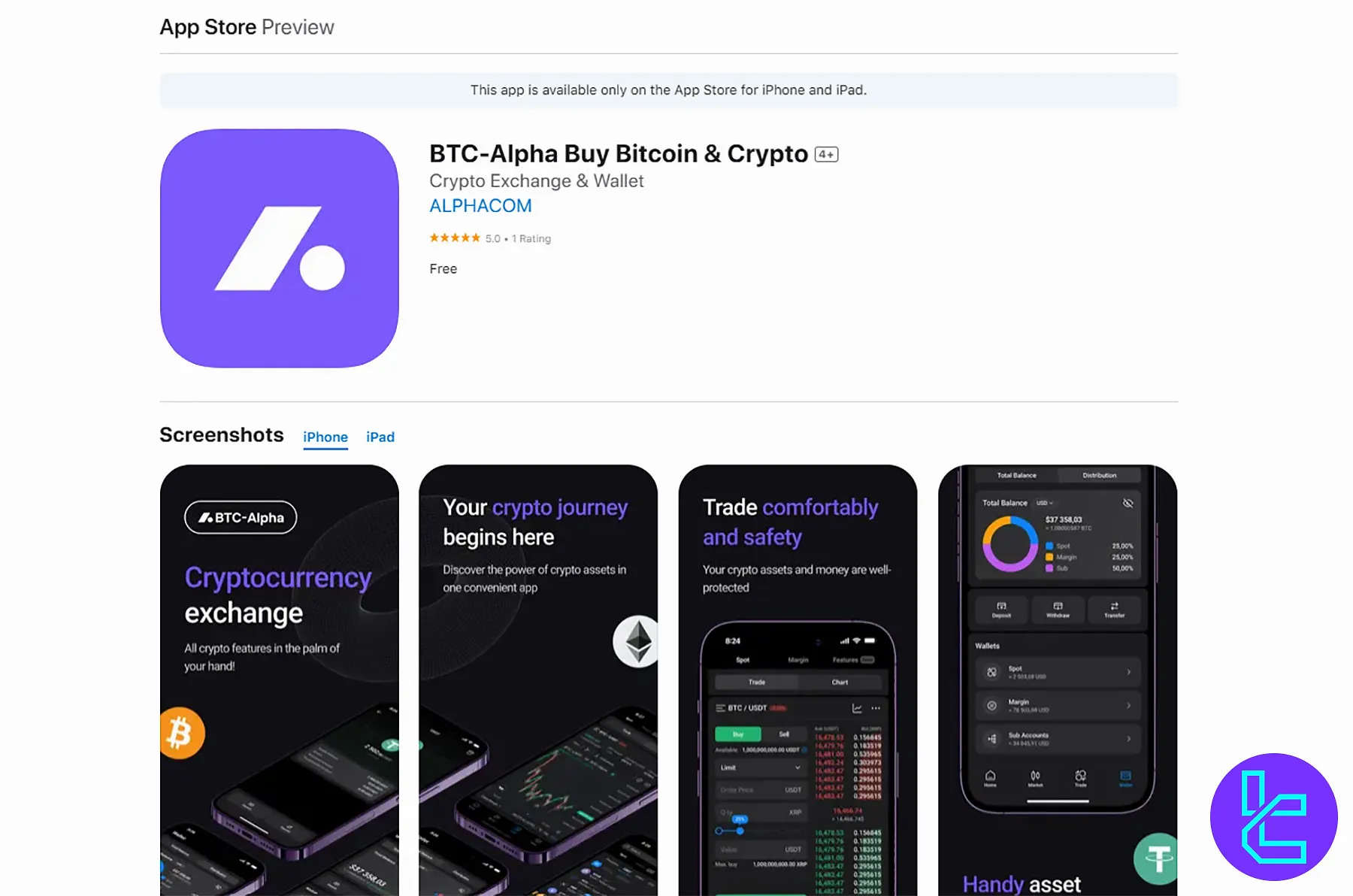

The exchange provides services through a web-based platform and a dedicated iOS application. However, the Android app has not been launched yet.

The platforms offer integration with TradingView.

According to the official website, the Android version must have been published in 2024. However, the link is not available on the BTC-Alpha platform.

TradingFinder has developed a wide range of TradingView indicators that you can use for free.

BTC-Alpha Trading Volume

Based on the BTC-Alpha CoinGecko chart, over the past three months, BTC-Alpha has demonstrated consistent activity in its trading volume, ranging between $100M and $700M on most days.

The data shows strong fluctuations, with several notable peaks pushing the exchange’s daily volume close to the $800M mark.

From early July to the end of September, the average trading volume remained steady in the $300M–$500M range, highlighting a healthy level of liquidity and trader engagement.

Despite occasional sharp dips toward the $100M–$150M levels, BTC-Alpha has quickly rebounded, signaling resilience and sustained user participation.

This dynamic trading activity indicates that BTC-Alpha maintains a competitive position in the market, supporting both retail and institutional traders with sufficient liquidity.

The spikes in August and late September suggest moments of heightened market activity, likely driven by Bitcoin volatility or increased altcoin movements on the platform.

BTC-Alpha Services

The table below shows the availability of trading services on BTC-Alpha:

Service | Availability |

TradingView Integration | No |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | No |

Demo Account | No |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

BTC-Alpha Exchange Safety and Security

The platform has no records of previous security breaches. It has a score of 8.75 according to Hacken security rating and 10 according to the Server Security level.

- Participation in the bug bounty program from HackerOne

- Two-factor authentication (2FA)

- Offline cold crypto wallet storage

Since its launch in 2016, the exchange has not reported any major security breaches, contributing to its reputation as a reliable platform.

However, users must remain cautious, as crypto exchange risks persist.

BTC-Alpha Security Rankings

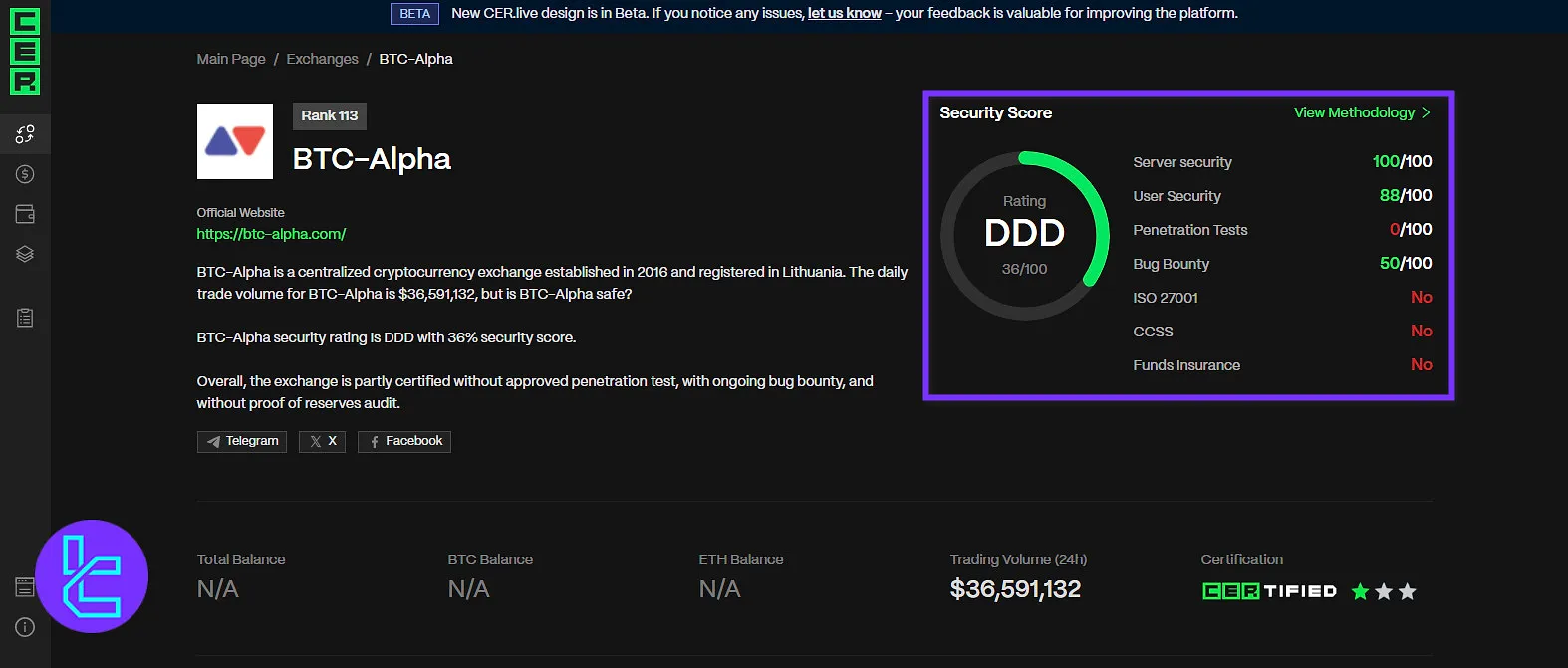

BTC-Alpha’s security profile, as evaluated by CER.live, reflects a mixed performance across different categories.

The exchange holds an overall score of 36% (rated DDD), showing room for improvement in certain critical areas.

Based on the BTC-Alpha CER.live review, while BTC-Alpha achieves a perfect 100/100 in Server Security and an impressive 88/100 in User Security, it lags behind in penetration testing, scoring 0/100, and does not hold certifications such as ISO 27001 or CCSS.

Additionally, the platform provides only partial coverage in bug bounty programs (50/100) and lacks funds insurance, which is a key factor for risk-averse traders.

Overall Score | 36% (DDD) |

Server Security | 100/100 |

User Security | 88/100 |

Penetration Tests | 0/100 |

Bug Bounty | 50/100 |

ISO 27001 | No |

CCSS | No |

Funds Insurance | No |

BTC-Alpha Payment Methods

The exchange accepts both fiat transactions and cryptocurrencies. It supports EUR and USD payments via various methods, including:

- AdvCash (Volet)

- Perfect Money

- PAYEER

- NIXMoney

There are no fees for deposits, and users can start trading with as little as $5. Users looking for P2P transfers, PayPal, or mobile wallets like Google Pay may find the platform lacking in convenience.

BTC-Alpha Ratings

There are 66 reviews on the BTC-Alpha Trustpilot profile, with a majority of them being positive. The exchange is also featured on the CoinGecko platform.

- Trustpilot: 4.3 out of 5

- CoinGecko: 5 out of 10

BTC-Alpha Crypto Services

Let's check the availability of special crypto services, such as crypto staking and gift cards, on BTC-Alpha:

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | No |

BTC-Alpha Bonus

BTC-Alpha provides users with two main types of bonuses: a Referral Program that allows traders to earn passive income, and Trading Competitions that reward active participation with valuable prizes. Here’s an overview:

Bonus Type | Details | Prize/Rewards |

Referral Program | Earn 50% of your referral’s trading fees for 30 days | Passive Income |

Competitions | Competition for top traders and large-scale trading contests | Up to 20000 USD |

Referral Program

BTC-Alpha’s Referral Program is designed for users who want to build an extra source of passive income.

By inviting friends or acquaintances through a unique referral link, you can earn 50% of their trading fees for the first 30 days after they register.

This incentive not only rewards community growth but also ensures that loyal users benefit from expanding the BTC-Alpha network.

Trading Competitions

BTC-Alpha has a strong tradition of hosting exciting trading competitions, offering traders the chance to win big while showcasing their skills. Among the completed events were:

- Maximum Trading Volume with a 20,000 ASH prize fund

- Aeneas Trading Competition with a 20,000 USD prize pool

- SPUTNIK Trading Competition with a 1,000 USDT prize fund

These competitions attracted global participation, adding energy and competitiveness to the platform while rewarding the most engaged traders.

Support Channels

BTC-Alpha provides 24/7 support through email, a ticket system, and Telegram. Users can also contact the managing team directly through Telegram.

- Email: support@btc-alpha.com

- Ticket System: Available in the support center

- Telegram English Community: https://t.me/btcalpha

- BTC-Alpha Support Manager

Although there is no live chat support, the exchange attempts to compensate with an active social media presence.

Does BTC-Alpha Offer Growth Plans?

While the exchange doesn't offer staking services or copy trading at the time of writing this BTC-Alpha review, it plans to introduce the feature soon.

However, the platform supportsAPI trading with the following features:

- Web Sockets and HTTP protocols

- Support for trading

- Support for deposits and withdrawals

The platform has also implemented an Affiliate program with commissions of up to 50% within 30 days of the referral registration.

Users seeking passive income opportunities from their digital assets will need to look elsewhere, as the platform strictly focuses on trading functionality.

Prohibited Countries on BTC-Alpha Exchange

The platform imposes restrictions on users from certain countries. BTC-Alpha does not provide services to citizens of the following nations:

- USA

- Bolivia

- Ecuador

- Cuba

- North Korea

- Iran

- Hong Kong

- Sudan

- Malaysia

- Syria

- Bangladesh

- Kyrgyzstan

- State of Wa

- Pridnestrovian Moldavian Republic

- Nagorno-Karabakh Republic

- Somaliland

- Shan State

- Waziristan

BTC-Alpha Compared to Other Exchanges

Let's check BTC-Alpha's standing among the top crypto exchanges:

Features | BTC-Alpha Exchange | BitMart Exchange | Deribit Exchange | Cex.io Exchange |

Number of Assets | 10 | 1700+ | 30+ | 166+ |

Maximum Leverage | 1:1 | 1:100 | 1:100 | 1:10 |

Minimum Deposit | $5 | $1 or 0,0001 in BTC | $5 / 0.00001 BTC | $5 |

Spot Maker Fee | 0.03% 0 - 0.095% | From 0.04% | 0% | 0.0% - 0.15% |

Spot Taker Fee | 0.045% - 0.15% | From 0.045% | 0% | 0.01% - 0.25% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | No |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | No | Yes | No | Yes |

Copy Trading | No | Yes | No | No |

Writer's Opinion and Conclusion

With 15 trading pairs across four fiat and crypto markets (BTC, USDC, EUR, and USD), the exchange is considerably smaller than competitors like Gate.io, which offers over 2,000 markets, or KuCoin, with more than 700 pairs.

Its limited selection of 10 cryptocurrencies restricts trader diversity, but this narrower focus contributes to smoother liquidity management and fewer delistings compared to larger platforms that often rotate assets.