DeepCoin is a centralized cryptocurrency exchange founded in 2018. In recent years, it has reached 10 million users from over 30 countries and offers the possibility of trading more than 500 currencies.

Beside these, Deepcoin offers ultra-fast matching engine for instant trade execution and COBO custody with bank-grade security.

Deepcoin Company Information + Regulation

Deepcoin, founded in 2018 under the leadership of Eagle Huang (Also known as Ego Huang), presents a complex picture regarding its regulatory and geographical status.

While the company asserts that it holds licenses from the U.S. NFA, U.S. MSB, and Canadian MSB, the clarity of these regulatory claims is limited.

Geographically, the crypto exchange initially launched inSingapore, but its LinkedIn profile lists Denver, Colorado as its headquarters.

Contradictorily, its official website cites Singapore as the main base, with branches in Japan, Canada, South Africa, and other global locations.

Beyond regulation, Deepcoin offers attractive features for crypto traders:

- Comprehensive Risk Management Tools

- Split & Merge Position

- K-Line Quick Trading

- Super Spot Trading

- Fast Matching Engine

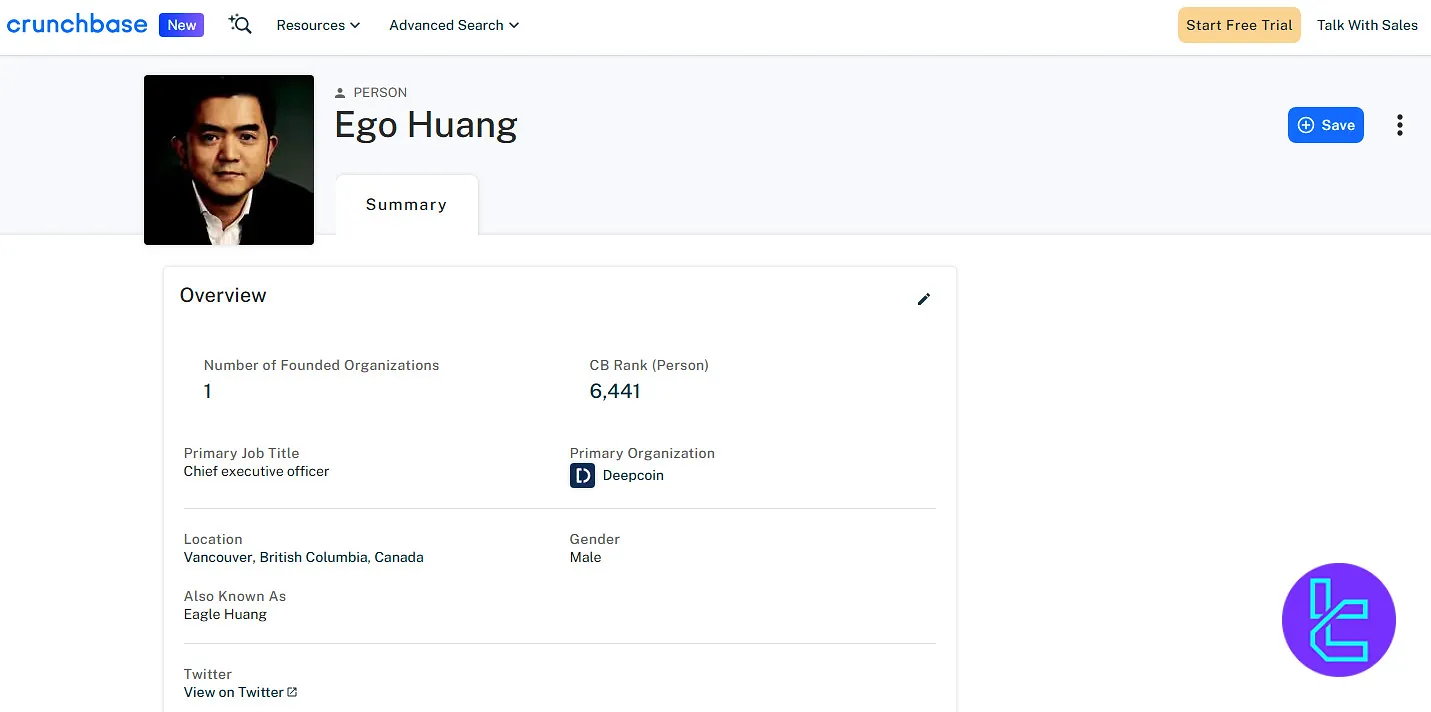

Deepcoin CEO and Founder

Ego Huang is the founder and CEO of Deepcoin. Before establishing Deepcoin, he managed a wealth management firm overseeing assets worth over $7 billion.

Huang has been recognized among the “Top 10 Crypto Innovators” by FinTech Magazine.

Based on the Ego Huang Crunchbase profile, he has a strong background in finance and technology, with experience managing large-scale investment portfolios before entering the cryptocurrency space.

Known for his strategic vision, Huang has been recognized for innovation in digital finance and blockchain technology.

He emphasizes building secure, user-focused trading platforms and has been influential in bridging traditional finance with crypto markets.

Summary of Specifics Table

Deepcoin crypto exchange stands out in the crowded cryptocurrency exchange landscape with its focus on derivatives trading and high leverage options.

The following table will help you get a better perspective of it:

Exchange | Deepcoin |

Launch Date | 2018 |

Levels | - |

Trading Fees | 0.0% in spot for Maker and Taker |

Supported Coins | 500+ |

Futures Trading | Yes |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Card, Cryptocurrency, Bank Transfer |

Withdrawal Methods | Credit/Debit Card, Cryptocurrency, Bank Transfer |

Maximum Leverage | 1:125 |

Minimum Trade amount | Variable based on coin |

Security Factors | Cold Storage, Multi-signature, 2FA, SSL Encryption, Regular Security Audits, Anti-Phishing Measures, IP Whitelisting, Withdrawal Confirmation, Insurance Fund, COBO Custody |

Services | Copy Trading, API Management, Affiliate, Demo Trading |

Customer Support Ways | Live Chat, Email Support, Help Center |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Limit Order, Market Order |

Native Token | DC |

Restricted Countries | Hong Kong, Cuba, North Korea, Iran, Sudan, Crimea, Malaysia, Samoa, Northern Mariana Islands, Guam, Syria |

The exchange's native token, DC Coin, adds another layer of functionality, offering lower fees and potential benefits for active traders.

What are Deepcoin Pros and Cons?

Deepcoin offers a unique value proposition in the cryptocurrency exchange market; But what are its pros and cons? Deepcoin Exchange Advantages and Disadvantages:

Pros | Cons |

High leverage (up to 125x) for derivatives trading | Regulatory status not fully clear |

No mandatory KYC for basic trading | Some customer support complaints reported |

Wide range of supported cryptocurrencies (500+) | Limited fiat currency support |

Competitive trading fees | No staking option |

Mobile app available for iOS and Android | - |

Native token (DC Coin) with staking options | - |

Offers both spot and derivatives trading | - |

Partial fiat-crypto support through third-party providers | - |

However, these advantages come with certain caveats. The unclear regulatory status and limited fiat support may deter some users, especially those in jurisdictions with strict cryptocurrency regulations such as US.

Additionally, while the high leverage options can lead to significant gains, they also expose traders to substantial risks, particularly for those new to derivatives trading.

Deepcoin User Levels

Deepcoin operates on a flat account structure offering the same access to trading features for all users, regardless of experience or volume.

There are no account tiers or level-based perks, making the platform straightforward for beginners and non-professional traders.

The minimum deposit is set at $100, with funding options including cryptocurrencies, credit/debit cards, and bank transfers.

While identity verification is not required for basic trading, users who wish to unlock advanced tools or increase withdrawal limits may need to complete KYC verification.

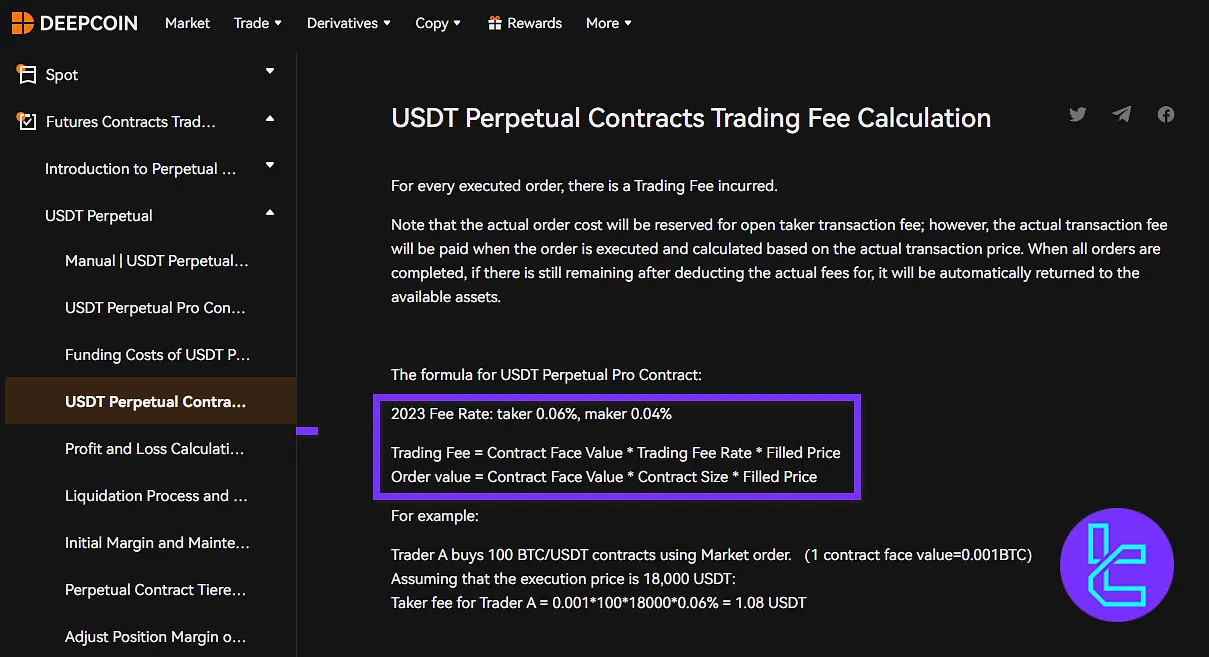

What are Fees and Commissions on Deepcoin?

On many exchanges, fees are set based on user levels or trading volume. However, on Deepcoin, the rate is fixed and is as follows:

Specifics | Spot | USDT Perpetual | Inverse Perpetual |

Maker | 0.0% | 0.04% | 0.04% |

Taker | 0.0% | 0.06% | 0.06% |

Beside this table, deposit Fees are free for cryptocurrency deposits. Also, withdrawal Fees vary depending on the asset. For example, withdrawal fee for Bitcoin equals to 0.0005 BTC.

What Coins does Deepcoin Offers?

Deepcoin provides over 500 trading pairs to cater to various trading preferences. Deepcoin Tradable Assets:

- AI: WLD, SHELL, FARTCOIN

- Layer1/Layer 2: BTC, ETH, XRP, SOL, DOGE, FIL

- Deepcoin Native Token: DC Coin

- Meme: Doge Coin (DOGE), Shiba Inu (SHIB)

- De Fi: UNI, LINK, AAVE

- DePIN: IO, BDX, GRASS

- Game Fi: B3, NOT, APE, CATI

- Storage: FIL

Does Deepcoin support Futures and Margin Trading?

Deepcoin has established itself as a go-to platform for derivatives trading, offering margin trading and futures trading. Deepcoin Futures and Margin Features:

- Contract Types: Perpetual USDT contracts and Inverse perpetual contracts (margin in cryptocurrencies)

- Leverage: Up to 125x leverage available

- Risk Management: Liquidation prevention mechanisms

- Trading Interface: Multiple order types (market, limit, stop-loss, take-profit)

- Available Coins: Over 280+ pairs available for derivatives trading

- Funding Rates: Periodic payments between long and short positions

- Cross-Margin Mode: Allows sharing of margin across multiple positions

- Isolated Margin Mode: Limits risk to individual positions

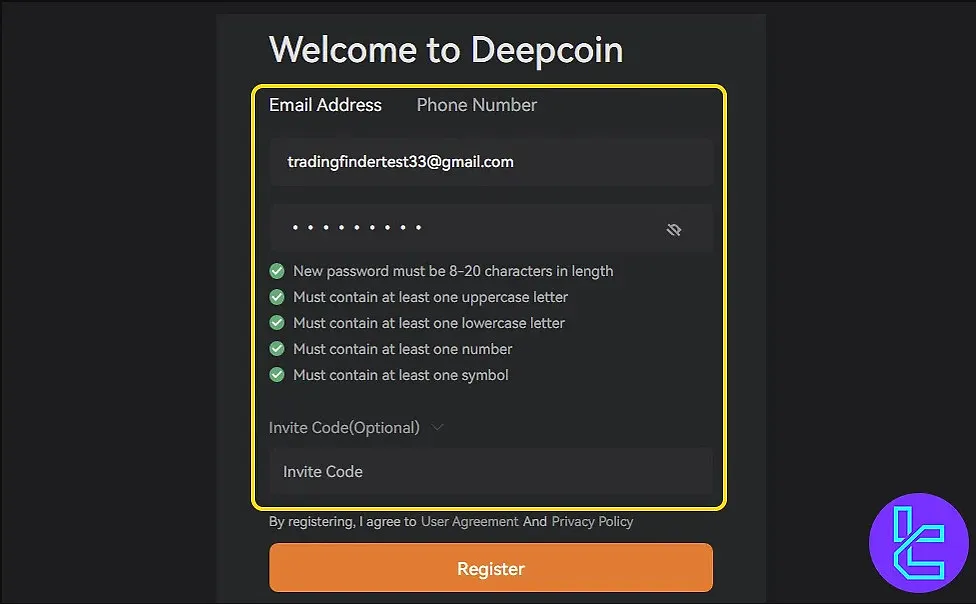

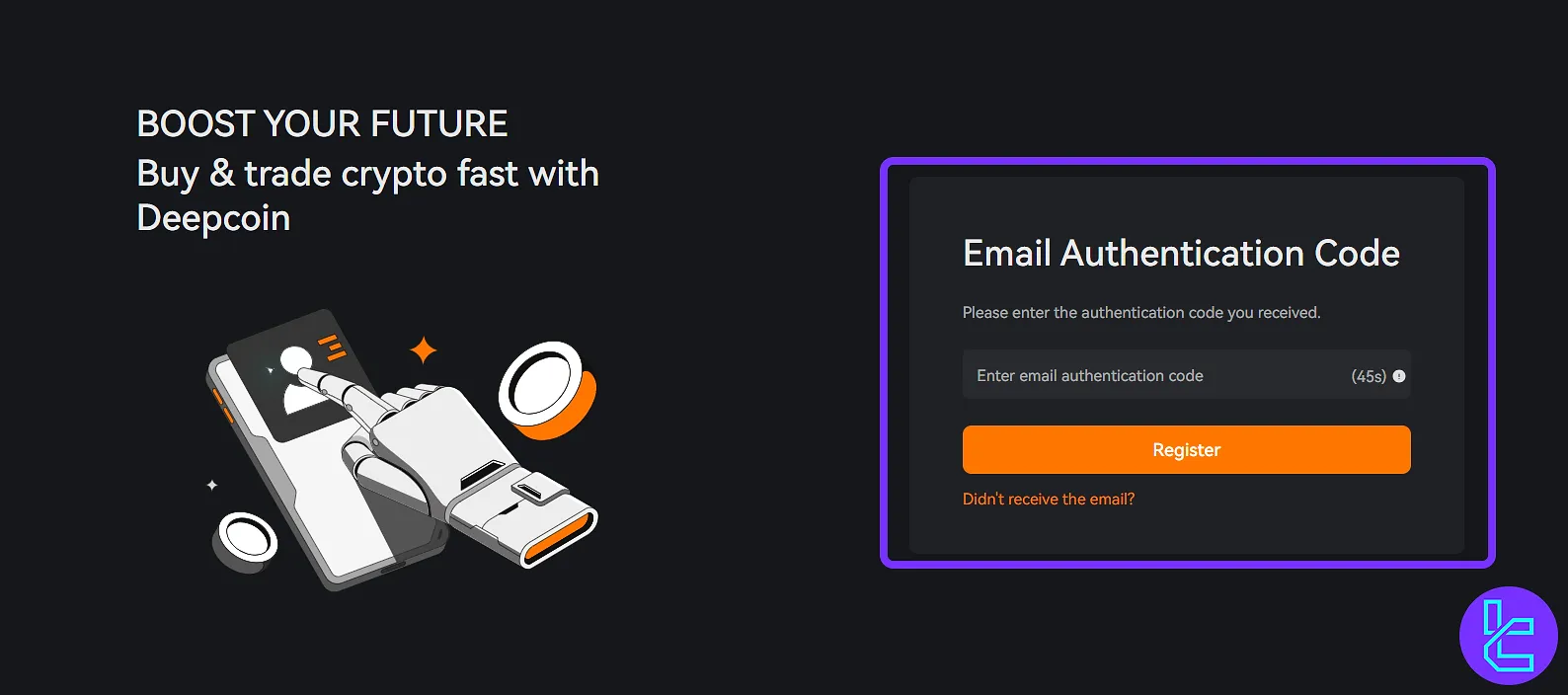

How to Register in Deepcoin? Step-by-Step Guide!

Deepcoin registration, a leading cryptocurrency derivatives exchange, is fast and straightforward.

While basic trading doesn’t require full identity verification, completing KYC enables access to advanced features and security tools like AML checks and 3D liveness detection.

#1 Open the Website

Visit the official Deepcoin homepage and click the “Register” button.

#2 Create Login Credentials

Enter your email or mobile number and set a strong password.

Then, verify using the code sent to you.

#3 Optional Identity Verification

To unlock more tools, go to “Account” section and click on “Identity Verification”.

#4 Complete KYC Requirements

Upload and pass the followings to complete account verification:

- ID OCR Scan

- Face Match

- 3D Liveness Check

- Global ID Verification

- AML Monitoring

#5 Fund & Start Trading

After funding your account, you're ready to access Deepcoin’s trading platform.

How to Trade on Deepcoin

Spot trading on Deepcoin is relatively simple. You only need to follow these steps:

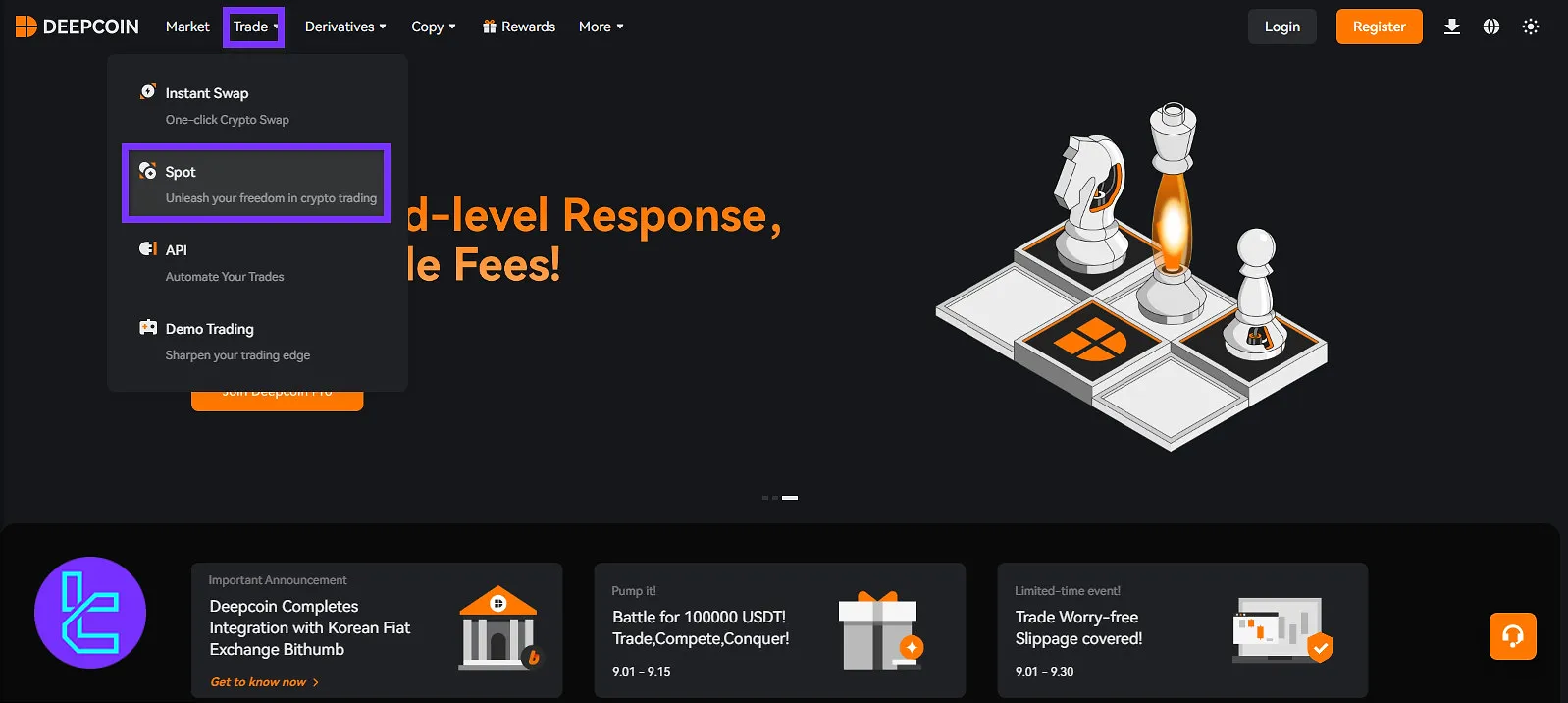

#1 Find the Spot Trading Page

On the homepage of the exchange, from the top menu, select “Trade”, then click on “Spot”.

#2 Choose Trading Pair

Now, on the left side, click on the current trading pair and use the search bar to find your preferred trading pair and select it.

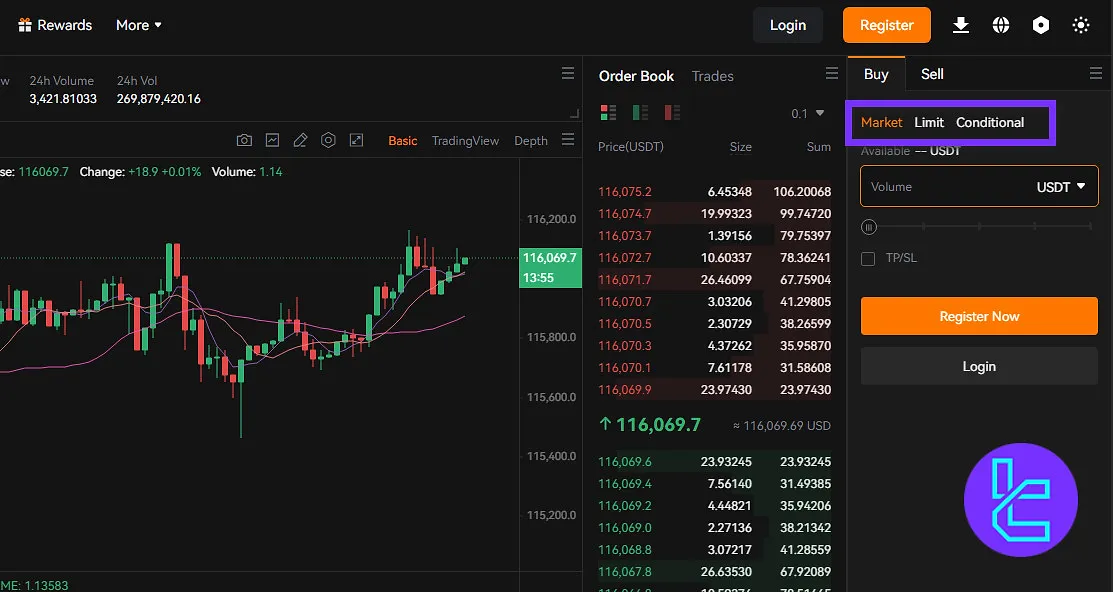

#3 Select Trading Order

You can select a trading order from the right side menu. Deepcoin offers Market, Limit, and Conditional orders.

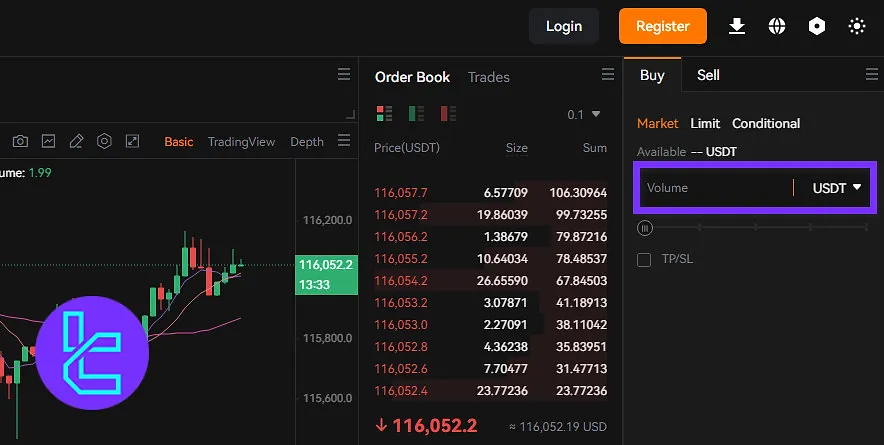

#4 Enter the Trading Amount

Next, under the trading orders section, you need to enter the trading volume.

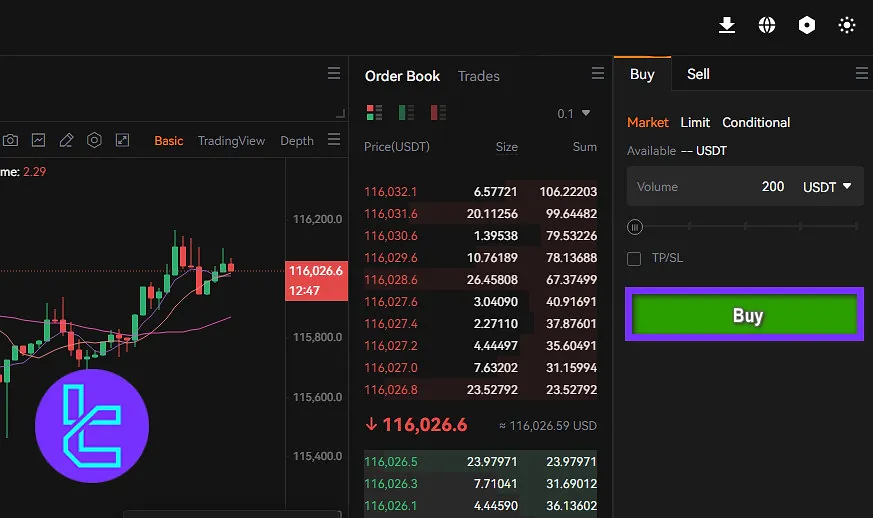

#5 Confirm the Trade

Finally, make sure everything is correct and click on “Buy” or “Sell” to confirm the trade.

Platforms and Applications

At its establishment, DeepCoin launched its application so that users could trade in the application and the browser. The platform is available on the web, iOS, and Android. DeepCoin app download links:

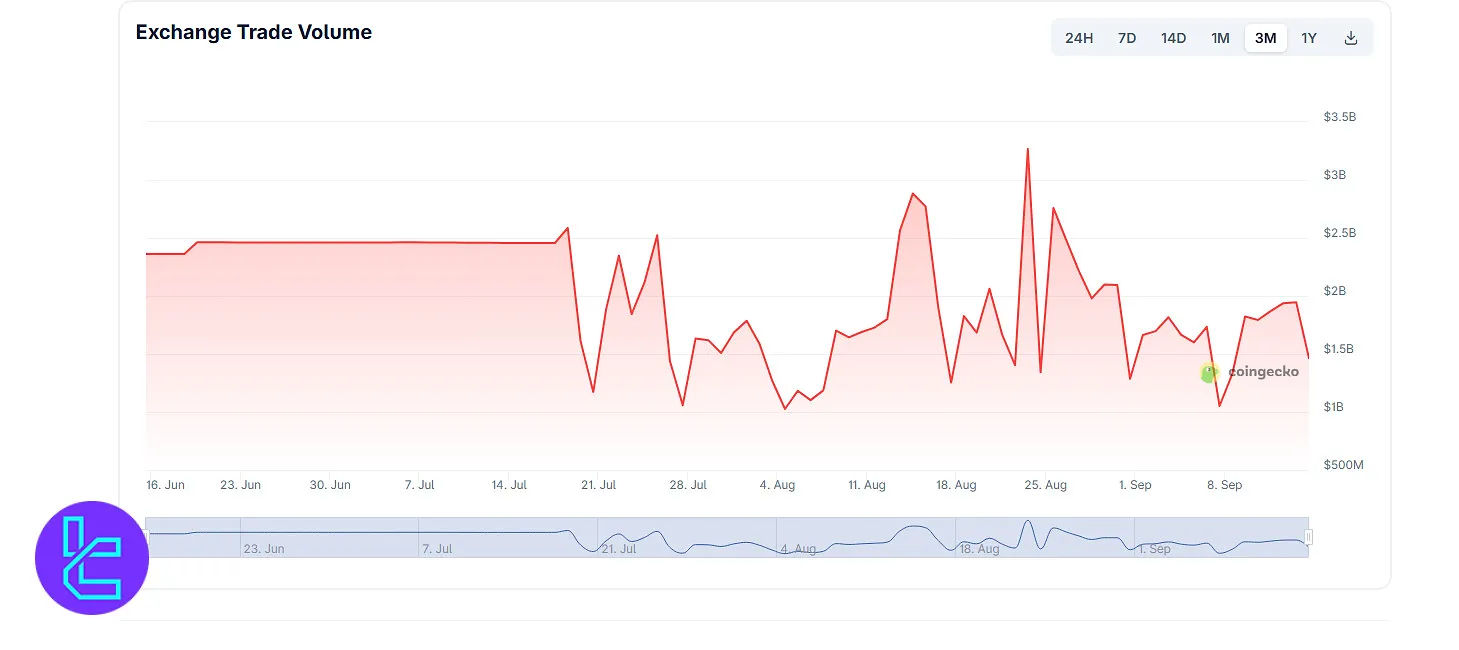

Deepcoin Trading Volume

Based on the Deepcoin CoinGecko page, over the past three months, Deepcoin’s exchange has recorded consistent trading activity with volumes fluctuating between $1 billion and $3.5 billion.

After a relatively stable phase in late June, activity showed higher volatility from late July through September, with several sharp spikes above $3 billion in daily volume.

Despite short-term fluctuations, Deepcoin has maintained a strong average daily volume of over $1.5 billion, positioning itself among the active players in the global crypto exchange market. This level of liquidity provides traders with reliable execution and competitive spreads across major trading pairs.

Deepcoin Services

In the table below, you can check out the availability of trading services on Deepcoin exchange:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | No |

Yes | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

Security & Safety Measures

Security is a critical concern for any cryptocurrency exchange, and Deepcoin implements several measures to protect user funds and data:

- Cold Storage: Majority of user funds stored in offline, cold wallets

- Multi-signature: Needed for fund transfers

- Two-Factor Authentication (2FA): Mandatory 2FA for all withdrawals

- SSL Encryption: Protects against man-in-the-middle (MitM) attacks

- Regular Security Audits: Third-party security firms conduct regular audits

- Anti-Phishing Measures: Email confirmation for account changes

- IP Whitelisting: Option torestrict account access to specific IP addresses

- Withdrawal Confirmation: Email confirmation required for all withdrawal requests

- Insurance Fund: Protects users against socialized losses in leveraged trading

- COBO Custody: Secure custody with COBO wallet infrastructure

While Deepcoin implements these security measures, it's important to note that no system is completely impenetrable.

Users should always practice good security hygiene, such as using strong, unique passwords and enabling all available security features on their accounts.

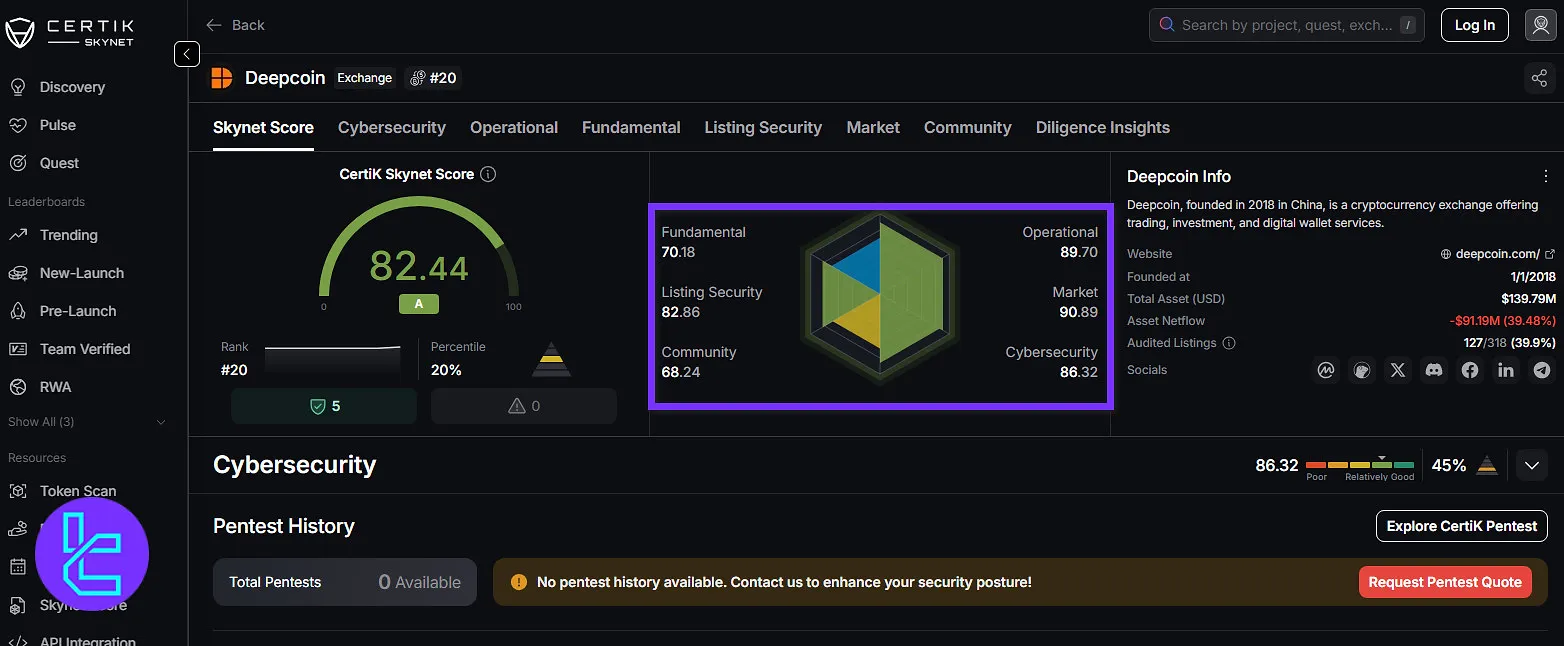

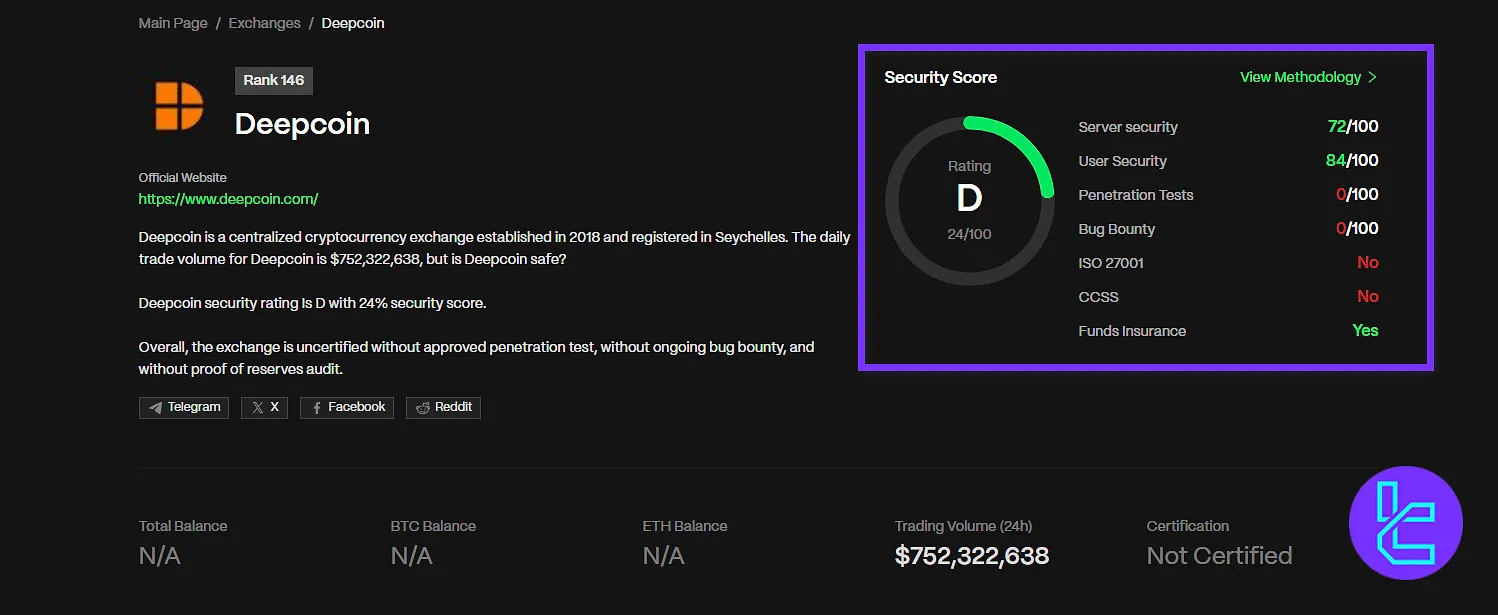

Deepcoin Security Rankings

Deepcoin has undergone a comprehensive evaluation by CertiK through its Skynet security framework, achieving an overall score of 82.44/100 (Grade A).

Based the CertiK Skynet Deepcoin review, the platform demonstrates strong performance in areas such as Market (90.89) and Operational resilience (89.70), alongside a robust Cybersecurity score (86.32).

While its Community trust score (68.24) and Fundamentals (70.18) show room for improvement, the high overall rating indicates that Deepcoin maintains a generally secure and reliable infrastructure, aligned with industry best practices.

In contrast, CER.live rated Deepcoin with an overall score of 24% (Grade D), reflecting stricter evaluation standards.

Based on the CER.live Deepcoin review, the exchange shows decent results in Server Security (72/100) and User Security (84/100), but scored 0/100 in both Penetration Testing and Bug Bounty programs, indicating a lack of proactive security testing measures.

Additionally, Deepcoin does not currently hold ISO 27001 or CCSS certifications, though it does provide funds insurance, offering some protection for users.

This assessment highlights areas where Deepcoin can strengthen its security posture to match leading industry benchmarks.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 82.44 / 100 (A) |

Fundamental | 70.18 | |

Operational | 89.70 | |

Listing Security | 82.86 | |

Market | 90.89 | |

Community | 68.24 | |

Cybersecurity | 86.32 | |

CER.live Score | Overall Score | 24% (D) |

Server Security | 72/100 | |

User Security | 84/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 0/100 | |

ISO 27001 | No | |

CCSS | No | |

Funds Insurance | Yes |

Payment Methods

Deepcoin offers various payment methods to accommodate different user preferences and regional requirements:

- Cryptocurrency: Instant crediting of funds (after required confirmations)

- Bank Transfers: Available in some regions

- Credit/Debit Card: Subject to daily and monthly limits

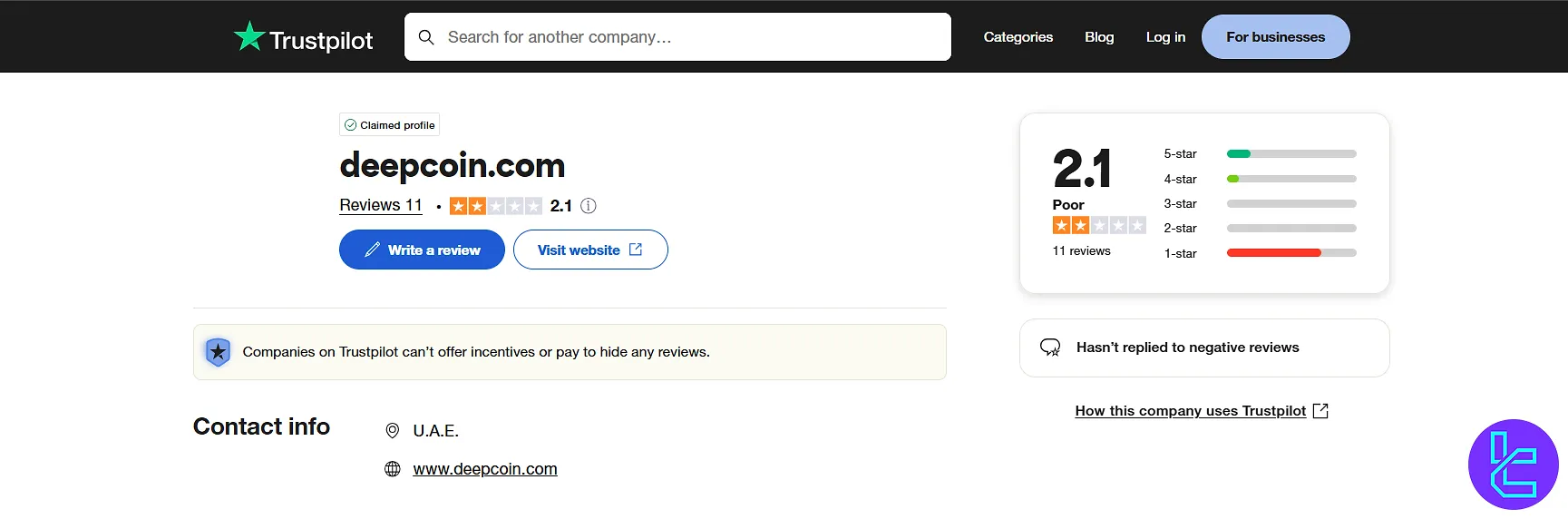

Trust Scores and Evaluations

User reviews and trust scores for Deepcoin are concerning:

- Coin Gecko: 6 out of 10

- Trustpilot: 2.1 out of 5 stars from 10+ reviews

Deepcoin exchange score in Trustpilot

As scores indicates, there are reports of unresponsive customer support and Concerns about the platform's legitimacy.

Deepcoin Features

What services and features are available on Deepcoin? Deepcoin features:

Feature | Availability |

Staking | No |

Yield Farming | No |

Yes | |

Liquidity Pool | Yes |

Gift Card | No |

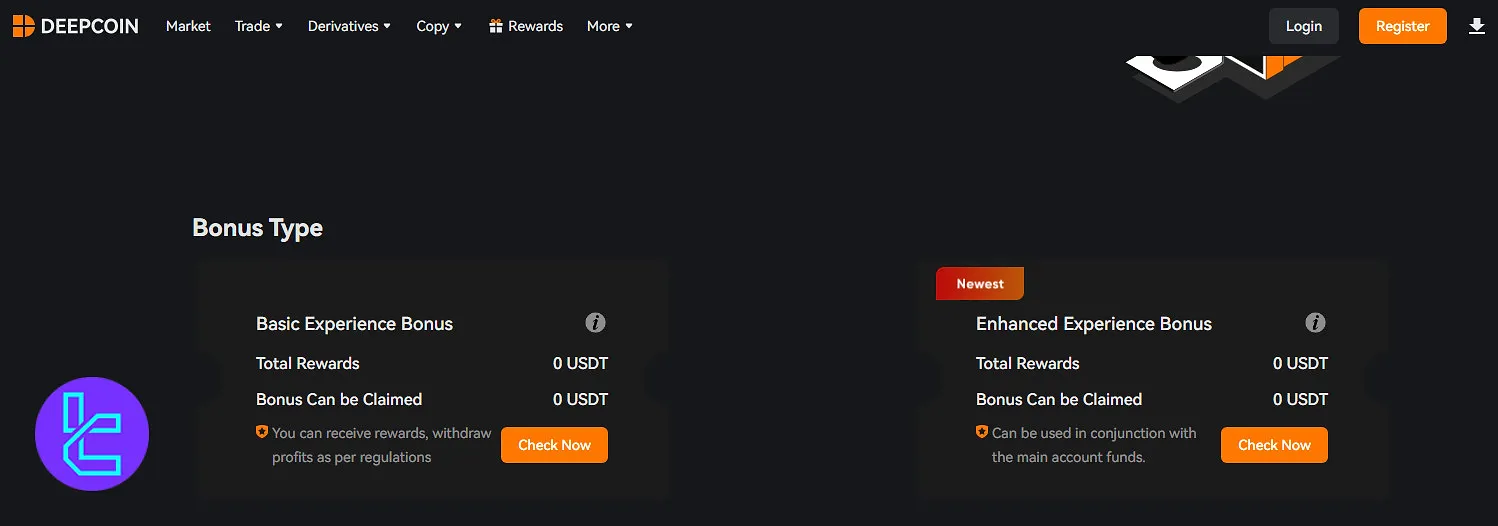

Deepcoin Bonus

Deepcoin offers a couple of bonuses designed to enhance the trading experience. Here's a detailed overview of the available bonuses:

Program | Description | Eligibility / How to Participate | Reward / Benefit |

Referral Program | Invite friends to Deepcoin and earn bonuses based on their trading activity | Share your referral link with friends; they must register and trade | Bonus credited based on referred users’ trading fees |

Rewards Hub | Complete tasks and earn various bonuses to enhance trading experience | Tasks include account verification, trading milestones, and platform campaigns | Trial bonuses, deposit bonuses, task completion rewards, or reduced trading fees |

Deepcoin Referral Program

Deepcoin's referral program allows users to earn passive income by inviting others to the platform.

Affiliates can earn up to 30% commission based on the trading fees generated by their referrals, along with access to marketing materials and account management assistance.

Deepcoin Rewards Hub

The Rewards Hub offers various bonuses for completing specific tasks:

- Basic Experience Bonus: A trial bonus provided by Deepcoin, covering types like deduction bonus, gift bonus, and trial bonus;

- Enhanced Experience Bonuses: Additional bonuses for users who complete advanced tasks;

- Futures Trading Bonuses: Bonuses for users who engage in futures trading;

- Sign-Up Bonuses: Bonuses for new users upon registration and initial trading activities.

Deepcoin Exchange Support: Working Hours and Contact Info

Deepcoin claims to offer 24/7 customer support:

- Live Chat: Provided on the website

- Email support: support@deepcoin.com

- Help Center: Available for common user questions

However, user reviews indicate that response times and quality of support may be inconsistent.

Copy Trading Services and Investment Options

Deepcoin offers copy trading features for contracts and spot trading; Deepcoin's Contract Trading platform offers three dynamic modes to elevate your trading experience:

- Copy: Instantly replicate the trades of top-performing traders;

- Lead: Use the Lead feature to let others follow your trades. Earn commissions as your strategies bring profits to followers;

- Strategy: Design and launch your own trading strategies using advanced tools. From manual setups to algorithmic executions, the Strategy tab allows you to monitor, modify, and create high-performance systems.

Beside contracts, “Copy” and “Lead” features are also available on spot trading.

Unfortunately, copy trading is the only way to invest in DeepCoin. This exchange does not support other methods such as staking, yield farming, and loans.

Restricted Countries Full List

Like all crypto exchanges, DeepCoin does not offer its services to all countries of the world. Deepcoin Restricted Countries:

- Hong Kong

- Cuba

- North Korea

- Iran

- Sudan

- Crimea

- Malaysia

- Samoa

- Northern Mariana Islands

- Guam

- Syria

It's crucial for users to check their local regulations before using Deepcoin.

Deepcoin Vs Other Exchanges

What Deepcoin brings to the table compared to other crypto exchanges?

Parameters | Deepcoin Exchange | |||

Number of Assets | 500+ | 700+ | 2800+ | 50+ |

Maximum Leverage | 1:125 | 1:125 | 1:200 | 1:1 |

Minimum Deposit | $100 | Varies by Cryptocurrency | $1 | $10 |

Spot Taker Fee | 0.0% | 0.02% | 0.05% | From 0.04% |

Spot Maker Fee | 0.0% | 0.02% | 0.05% | From 0.05% |

Mandatory KYC | No | No | Yes | No |

Futures Trading | Yes | Yes | Yes | No |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | Yes | Yes | Yes | No |

TradingFinder Writer's opinion and conclusion

DeepCoin has significant advantages, such as 125x leverage, copy trading [spot and contracts] and occasional deduction fees bonuses on limited time.

On the other hand, they do not offer features such as staking and yield farming.