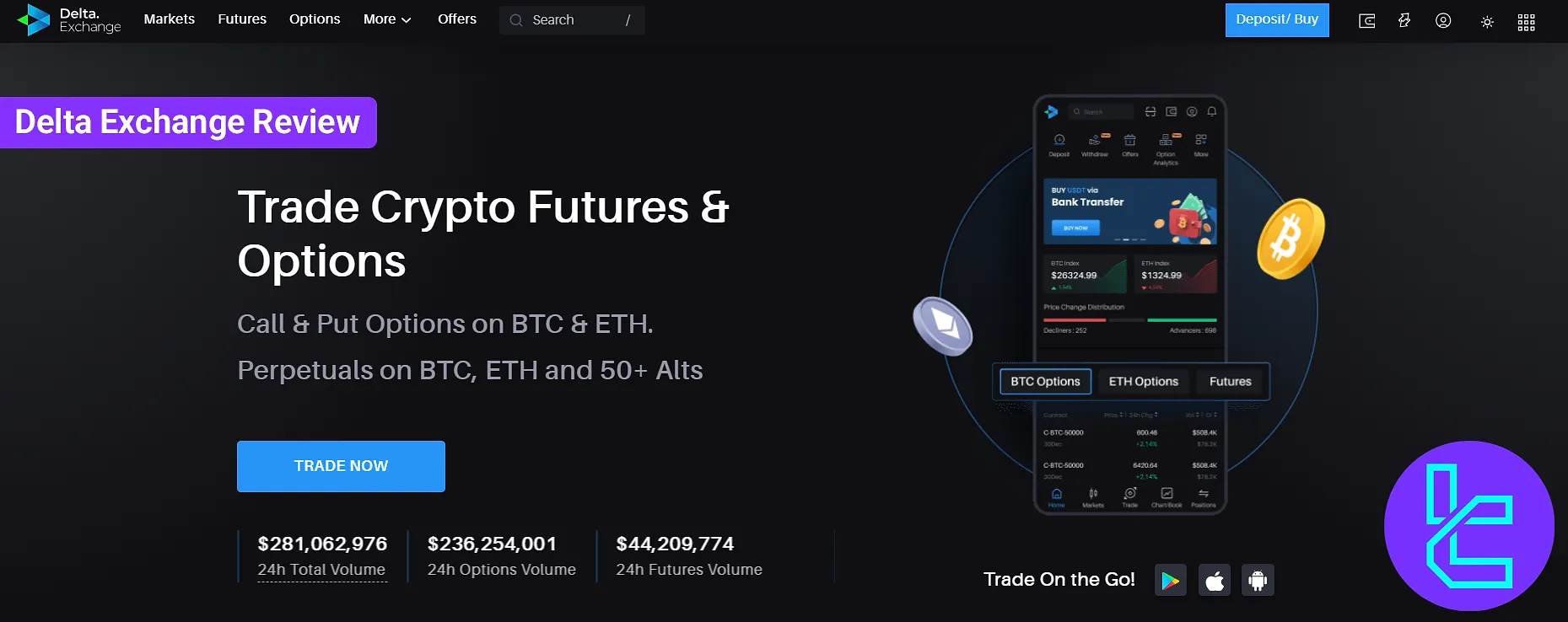

Delta Exchange is aderivatives platform with margin, spot, options and futures [100x maximum leverage] available. They allow Robo strategies, call/put, and straddle. Delta Exchange is founded by “Pankaj Balani” and its headquarters are based in Mumbai, India.

Delta Exchange: Company Information and Regulation

Delta Exchange is a crypto futures and options trading platform registered with the Financial Intelligence Unit (FIU) of India. This registration ensures that the platform is fully compliant with Indian regulations, providing a sense of security for its users. Key points about Delta Exchange:

- Allows traders to speculate on cryptocurrency price movements without directly owning the assets

- Trades are conducted in INR, simplifying tax implications for Indian users

- Offers small minimum contract sizes, making it accessible for new traders

- Provides 24/7 trading with daily, weekly, and monthly expiry options

- Features advanced risk management tools for leveraged trading with less capital

- Supports fiat-only deposits and withdrawals through linked bank accounts

Delta Exchange has experienced rapid growth, boasting over $500 million in trading volume. This impressive figure makes it the largest and fastest-growing crypto derivatives exchange in the Indian market.

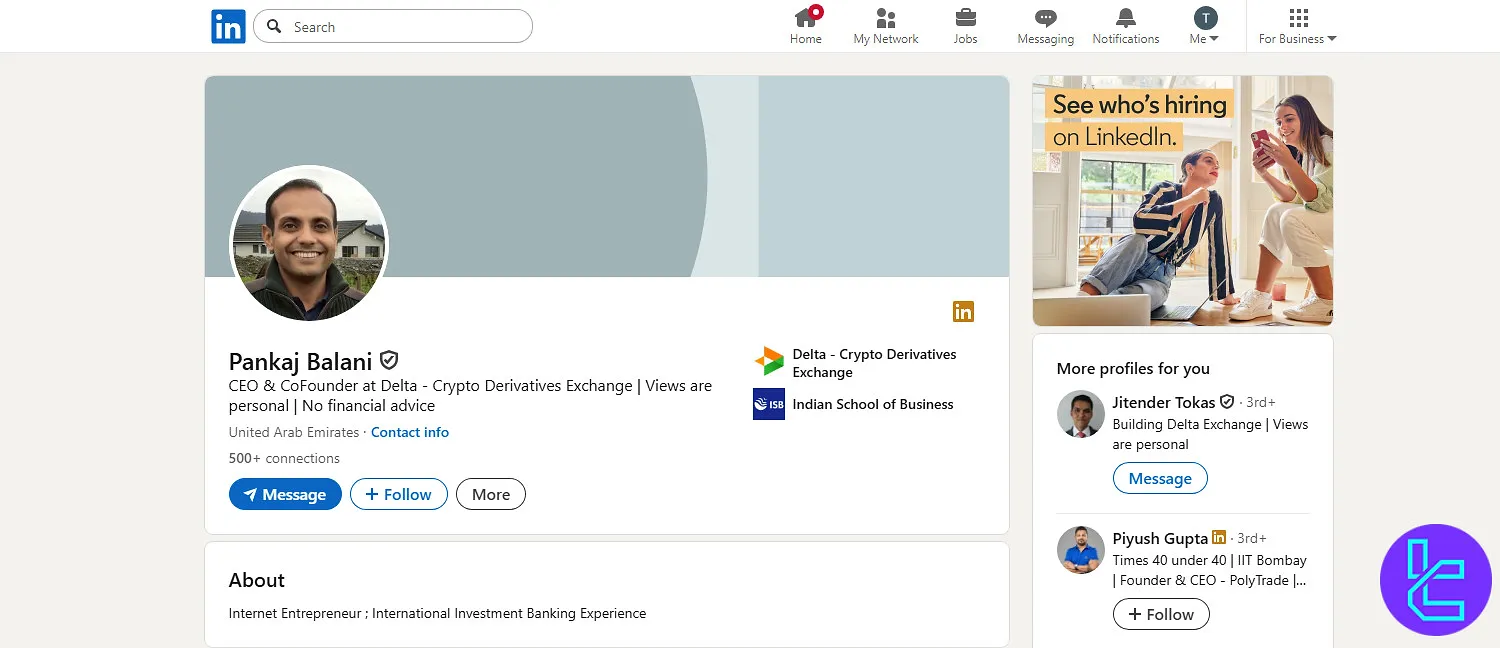

Delta Exchange CEO

According to Pankaj Balanilinkedin, he is the co-founder and CEO of Delta Exchange, and a seasoned professional in derivatives and quantitative finance.

He graduated from IIT Delhi in Engineering Physics and later earned an MBA in Finance and Strategy from the Indian School of Business.

He started his career at UBS as a Sales Trader, supporting hedge funds with volatility and hedging strategies, and later held leadership roles at Edelweiss Asset Management and Elara Capital.

He also gained entrepreneurial experience at Purplle.com and co-founded ZippyBots before launching Delta Exchange in 2018.

Balani emphasizes regulatory compliance and market innovation, introducing INR-settled crypto derivatives for Indian traders while serving international markets.

Summary of Specifications

Delta Crypto Exchange offers a diverse range of cryptocurrency trading products, including futures market, options, and spot trading. Let's break down the key features of their offerings:

Exchange | Delta Exchange |

Launch Date | 2018 |

Levels | None |

Trading Fees | Starts From 0.075% For Spot Trading, 0.06% For Futures Trading |

Supported Coins | 50+ |

Futures Trading | Yes |

Minimum Deposit | $1 |

Deposit Methods | Crypto, VISA/MasterCard, Bank Wired, PayPal, Advcash, Google Pay, Apple Pay |

Withdrawal Methods | Crypto, VISA/MasterCard, Bank Wired, PayPal, Advcash, Google Pay, Apple Pay |

Maximum Leverage | 100 |

Minimum Trade amount | $1 |

Security Factors | Multi-Sig Wallets, Withdrawal Are Processed Only Once a Day |

Services | Call/Put, Straddle, Robo Strategies, Staking |

Customer Support Ways | Ticket, Live Chat, Help Center |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | IOC |

Native Token | DETO |

Restricted Countries | United States of America, Puerto Rico, U.S. Virgin Islands, St. Vincent and the Grenadines, Iran, North Korea, Syria, Crimea, Cuba, Canada, Afghanistan, Cambodia, Pakistan, United Kingdom, Singapore |

Delta Exchange's comprehensive suite of crypto derivatives products caters to the needs of active traders, offering advanced features like high leverage, flexible margin, and diverse settlement options.

Pros and Cons

Delta Exchange seems to cater primarily to experienced crypto traders looking to leverage derivatives. Its unique features and high liquidity make it an attractive option for many, but it has its cons too; Delta Exchange Crypto Advantages and Disadvantages:

Pros | Cons |

Intuitive User Interface | Not Available in Certain Countries (E.G., US) Due to Regulations |

High Leverage (Up To 100x) | May Not Be Suitable for Beginners or Risk-Averse Investors |

Regulated by Financial Intelligence Unit (FIU) Of India | Few Numbers of Coins (50+) Compare to Other Platforms |

Passive Income Opportunities Through Staking | - |

Insurance Fund for Added Protection | - |

Does Delta Exchange have any user-level structure?

While Delta Exchange doesn't have traditional user levels, it offers a powerful sub-account feature that allows traders to have multiple independent accounts. Here's what you need to know:

- Sub-accounts have their own balances, margin, and positions

- Useful for isolating trading activities or for firms with multiple traders

- Can be created with or without separate email addresses

- Inherit verification and VIP levels of the main account

- Instant and free transfers between sub-accounts

- Main account holder has full administrative control

- Limit of 2 sub-accounts per main account

- Sub-accounts cannot claim offers or have trading credits

- Cannot be deleted, but settings can be edited by the main account holder

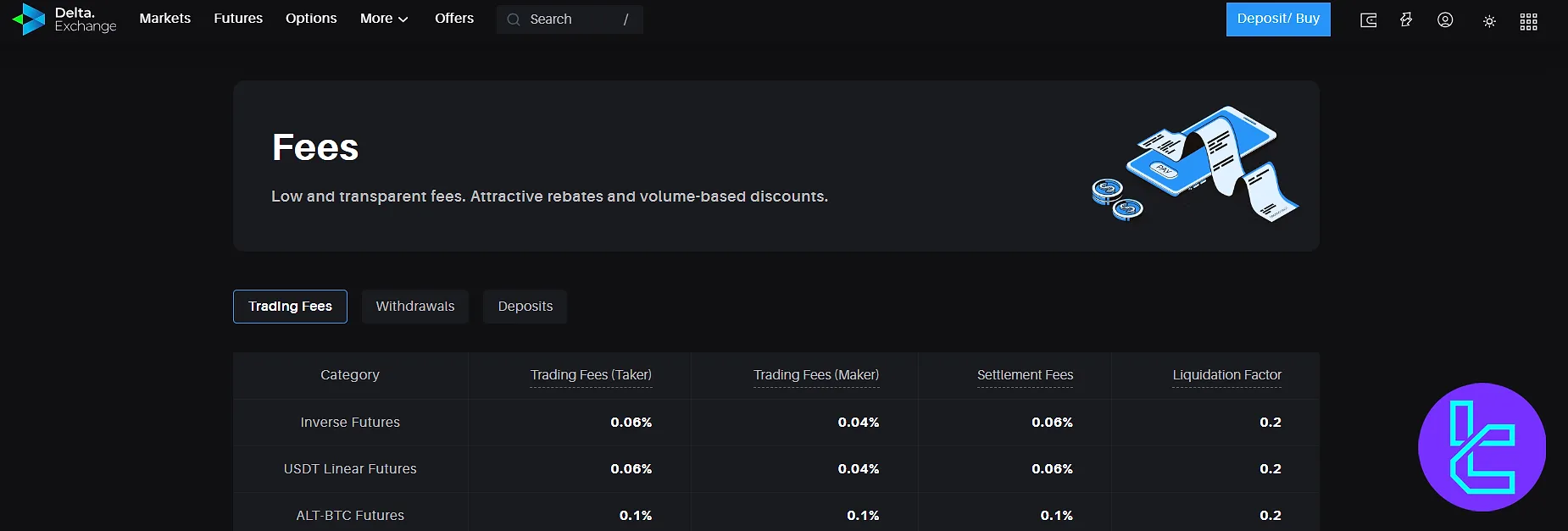

Delta Exchange Fees and Commissions

Delta Exchange employs a fee structure based on markets. Here's a breakdown of their fees:

Market | Taker Fees | Maker Fees | Settlement Fees |

Inverse Futures | 0.06% | 0.04% | 0.06% |

USDT Linear Futures | 0.06% | 0.04% | 0.06% |

ALT-BTC Futures | 0.1% | 0.1% | 0.1% |

Options | 0.0375% | 0.0375% | 0.0375% |

MOVE & Spreads | - | - | - |

Spot | 0.075% | 0.075% | N/A |

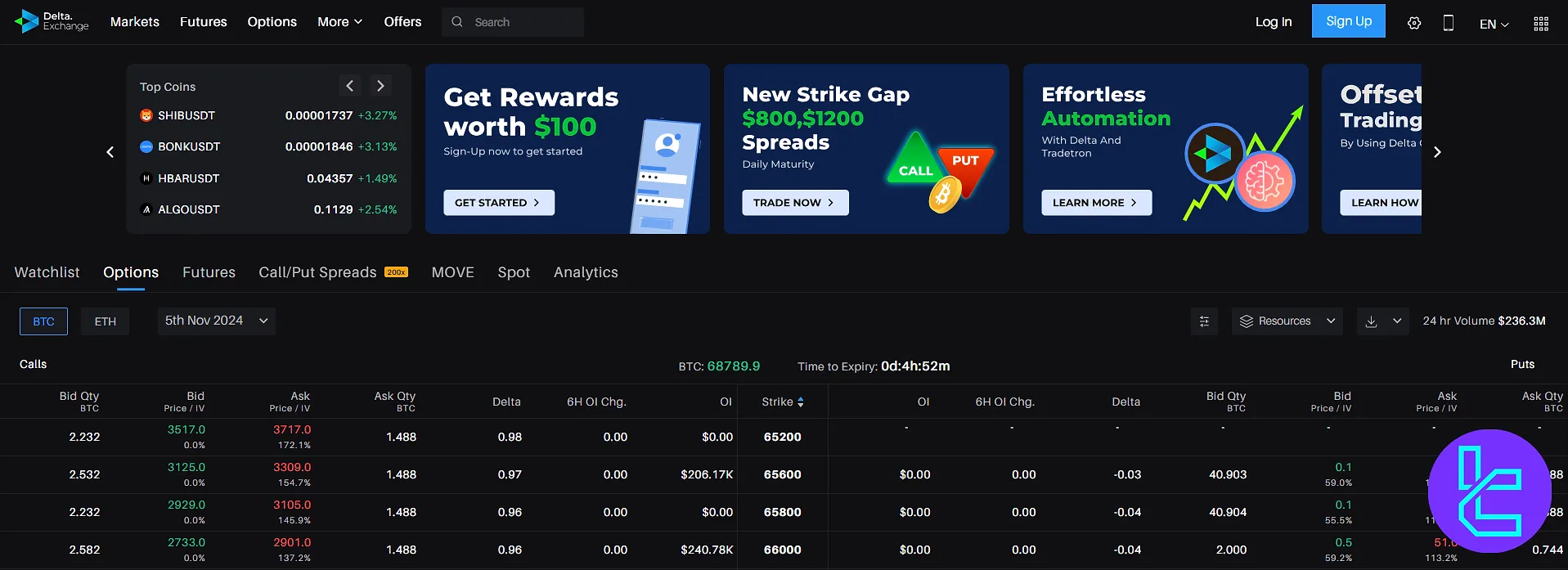

How Many Assets Are Tradable in Delta Exchange?

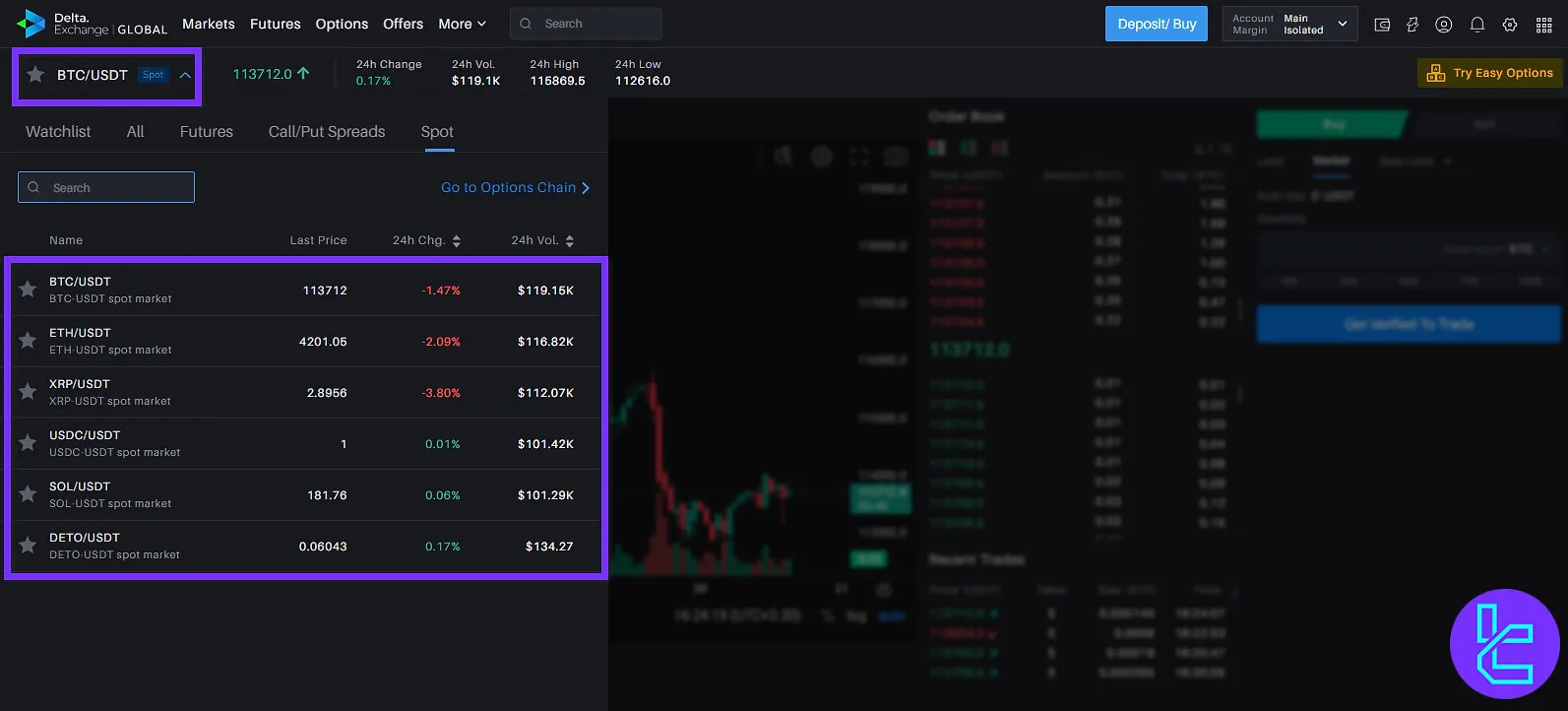

Delta Exchange supports trading on over 50 cryptocurrencies and altcoins, including major assets like BTC, ETH, SOL, XRP, and DOGE. While its spot market is relatively limited, with only six available pairs, the platform excels in derivatives trading, offering broad coverage.

Key market offerings include:

- Over 75 futures pairs available

- Major perpetual contracts include BTC/USDT, ETH/USDT, SOL/USDT, and DOGE/USDT

- Leverage ranges from 20x to 100x, depending on the asset

- Settlements and margins supported in USDT, BTC, and ETH

For spot trading, users can access basic liquidity on core pairs such as BTC/USDT, ETH/USDT, and DETO/USDT (the platform’s native token).

While limited in spot diversity, Delta’s derivatives depth and leverage options make it a strong choice for advanced traders.

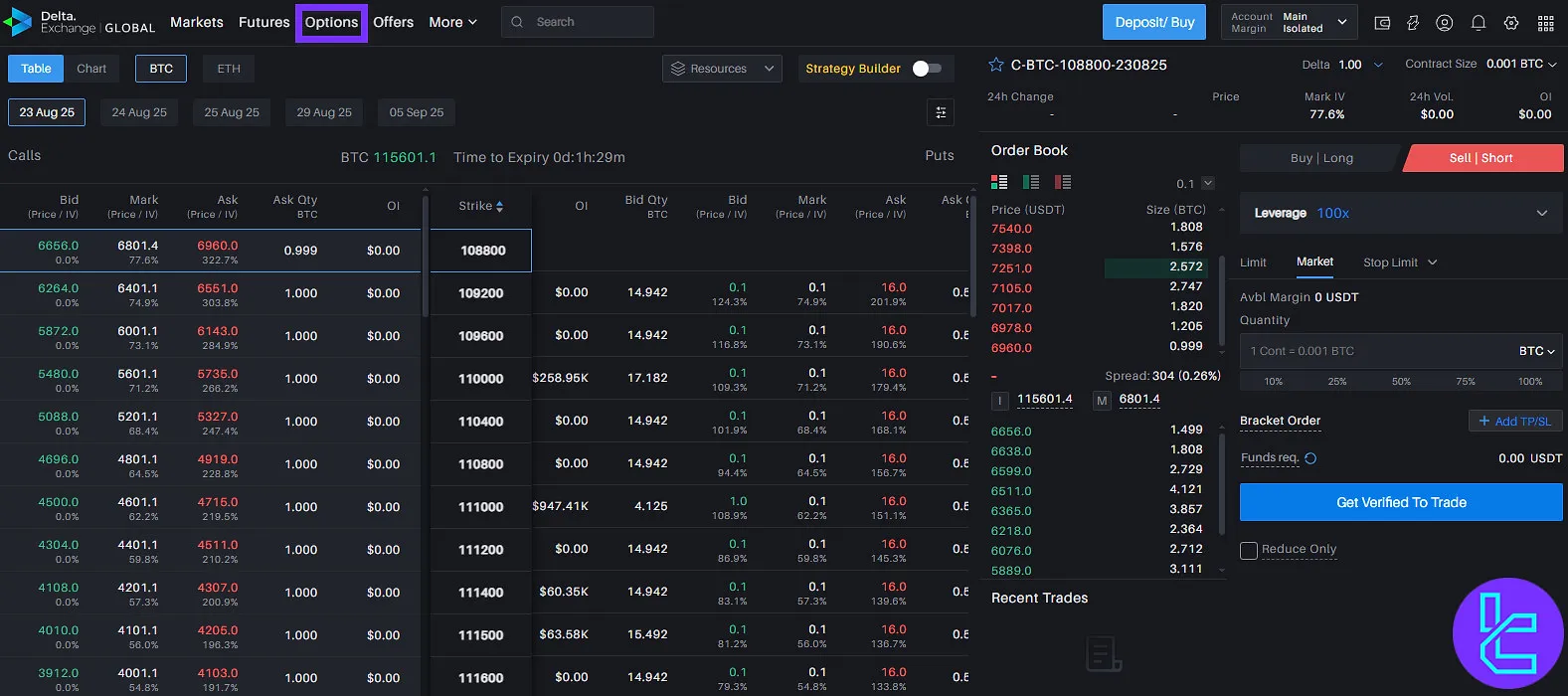

Futures and Margin Trading

This exchange offers a robust platform for futures and margin trading and allow its users to trade in these markets; Delta Exchange Futures and Margin Trading Features:

- Perpetual swap contracts and fixed maturity futures on Bitcoin and50+ altcoins

- Up to 100x leverage available on certain contracts

- USDT-settled European call and put options on BTC and ETH

- MOVE options for volatility speculation

- Spot trading pairs including BTC/USDT, ETH/USDT, and others

- All contracts margined and settled in cryptocurrencies (USDT, BTC)

- Ability to speculate on both rising and falling markets using long and short positions.

Registration and Verification Guide on Delta Exchange: Comprehensive Manual

Creating a new trading account and verifying it on the Delta Exchange platform is easy. Delta exchange registration:

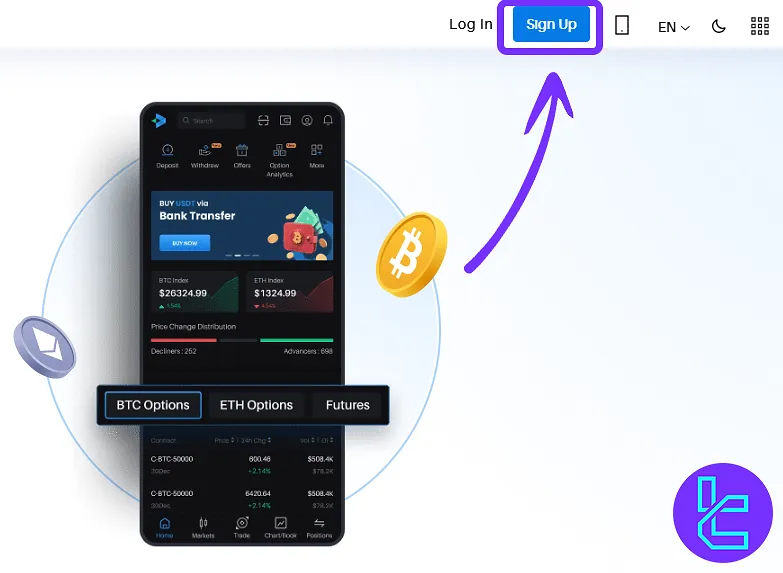

#1 Open the Sign-Up Page

Go to the official Delta Exchange homepage and click "Sign Up" to begin registration. You may also use the “Open an Account” prompt available across the platform.

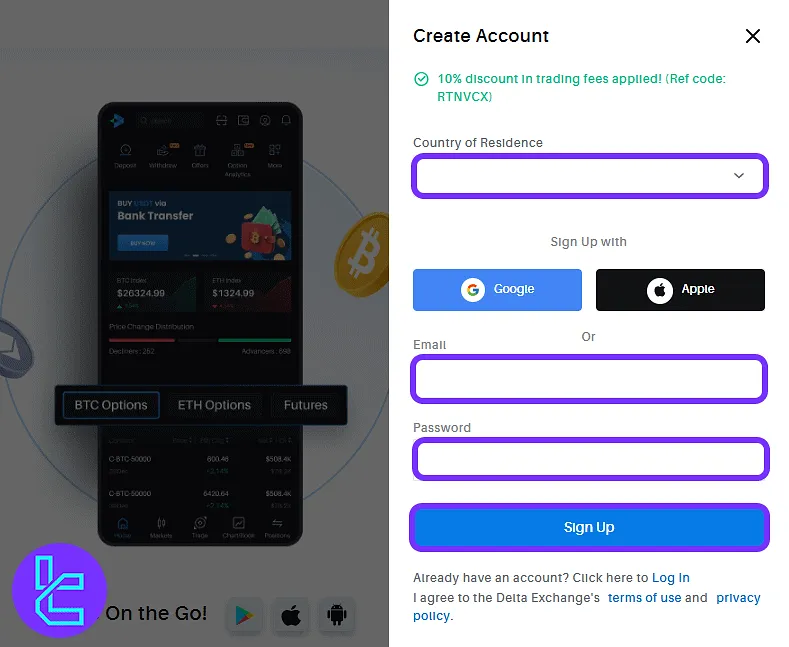

#2 Fill the Registration Form

Select your country of residence, enter a valid email address, and set a strong password (with uppercase, lowercase, numbers, and symbols).

Agree to the terms and click "Sign Up". You may alternatively continue via Google or Apple.

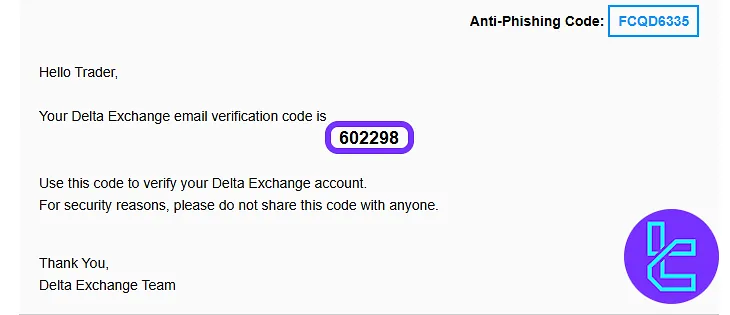

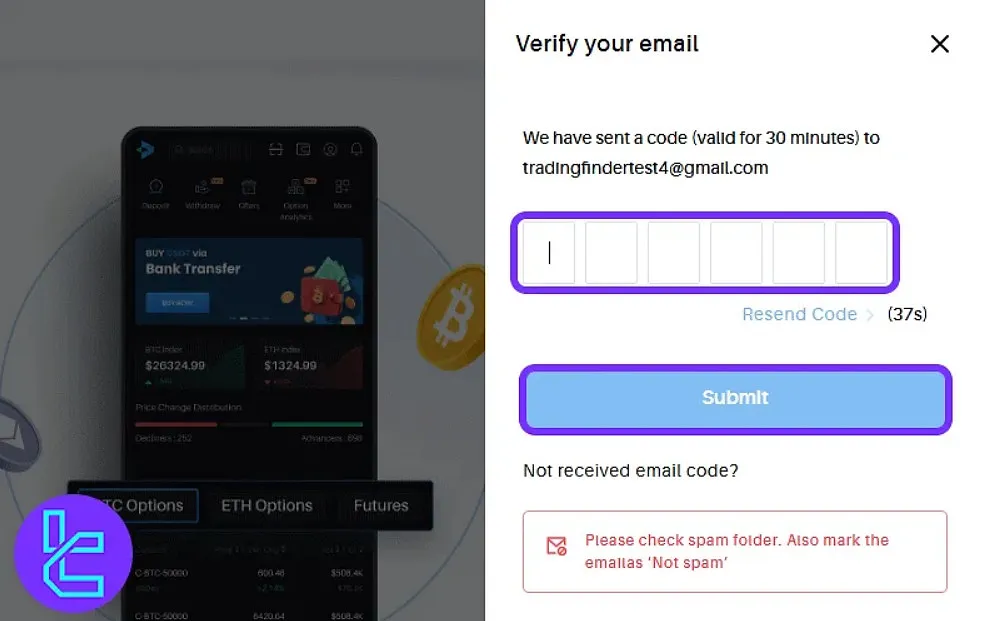

#3 Verify Your Email

Check your inbox for a 6-digit verification code sent by Delta Exchange. Enter it into the platform to unlock your dashboard. If no email arrives, wait 30 seconds to request a new code.

#4 Complete the KYC Process

To verify your Delta Exchange trading account, follow the steps below:

- Enter and verify your phone number

- Provide income and occupation details

- Verify your bank card

- Upload an identity document as proof of identity

- capture a liveness selfie

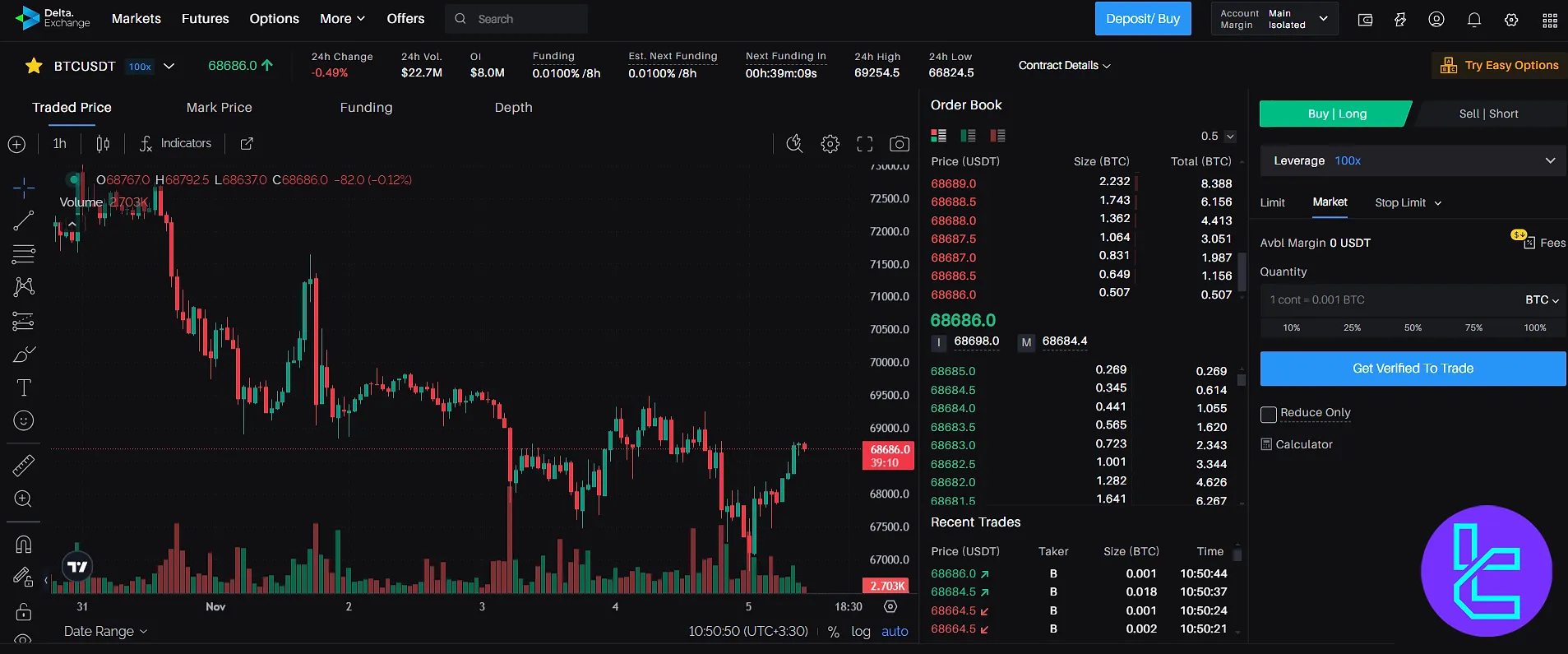

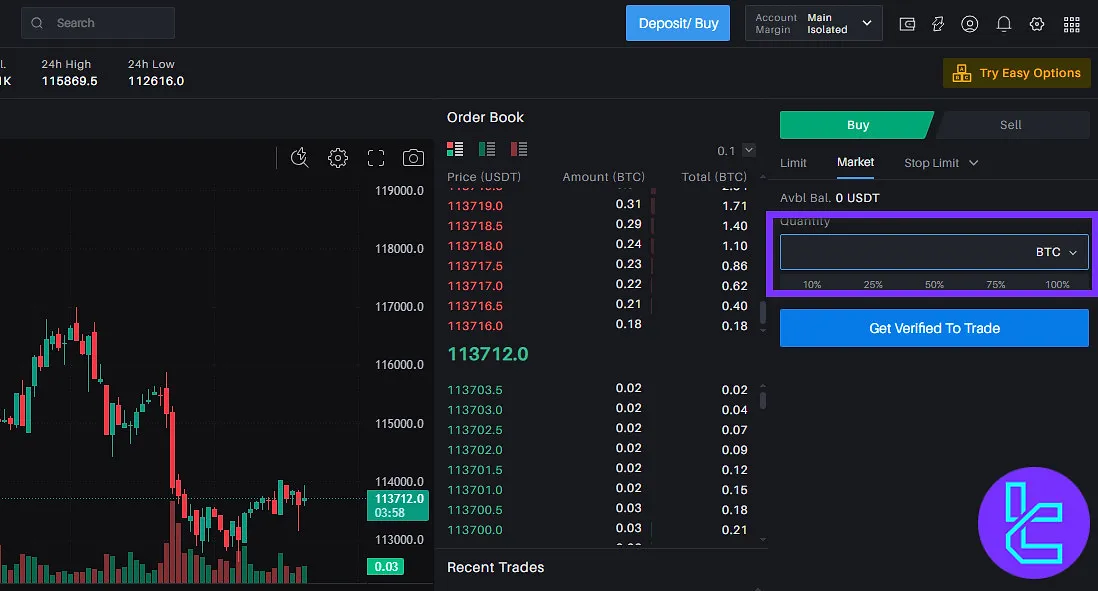

How to Trade on Delta Exchange

Trading on the Delta Exchange is quite straightforward. However, before starting to trade, make sure you are a verified user and have completed the KYC process. If so, follow these steps:

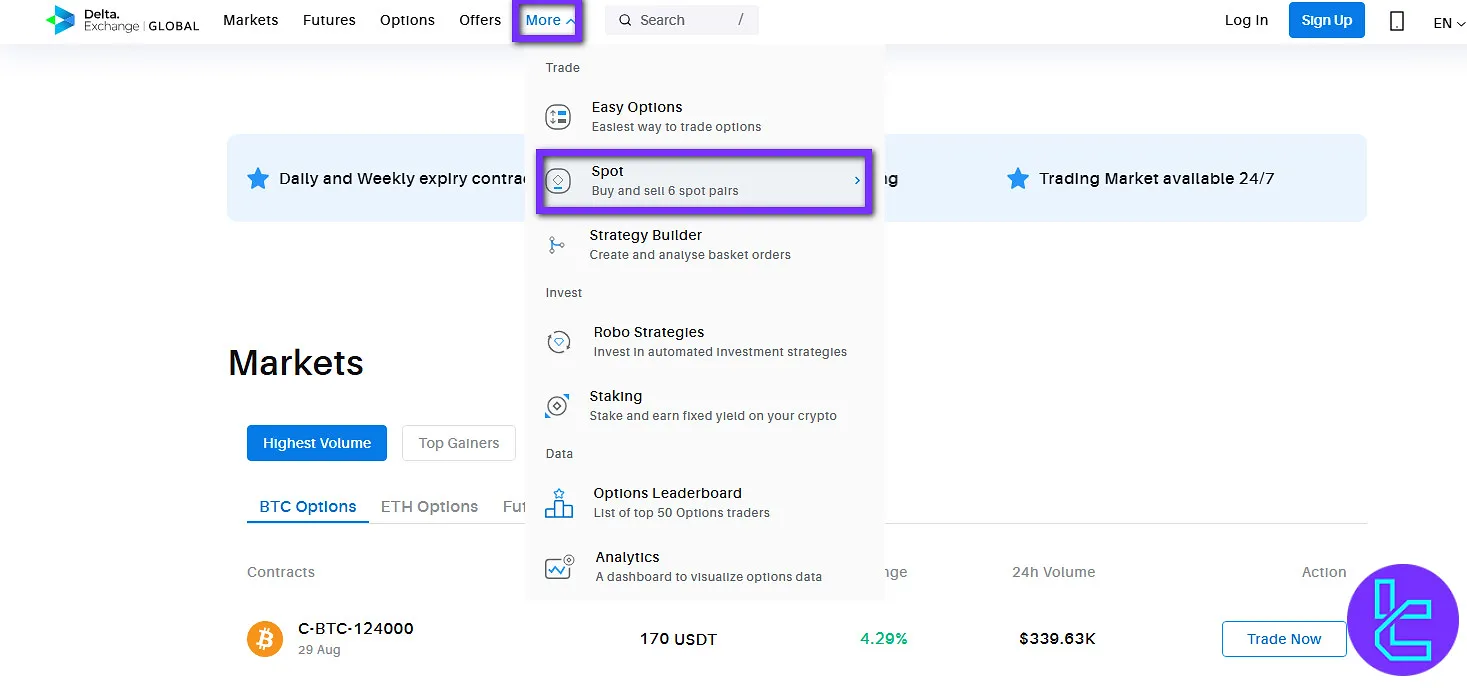

#1 Enter the Trading Page

In this step, you should simply hover your mouse pointer over “More” at the top of the page, then select “Spot”.

#2 Select the Trading Pair

From the left side of the screen, click on the current trading pair to see the list of all pairs. There are only 6 pairs available for spot trading on Delta Exchange. Choose the one you want to trade.

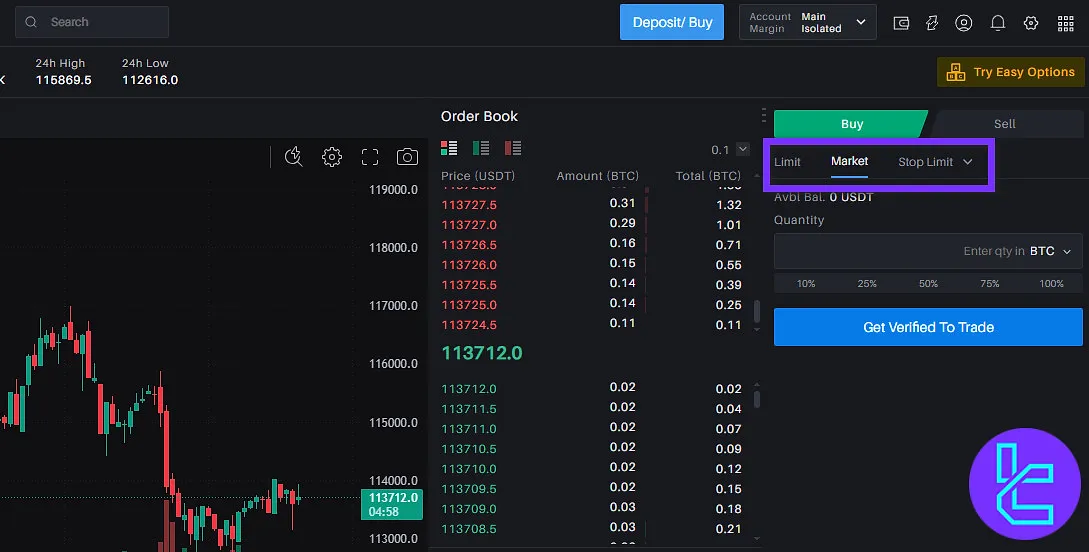

#3 Choose the Order Type

You can choose between 7 order types:

- Limit

- Market

- Stop Market

- Stop Limit

- Trailing Stop

- Take Profit Market

- Take Profit Limit

To do so, simply click on the one you want on the right side of the page. To see more options, click on the icon pointing down to see the dropdown menu.

#4 The Order Volume

Type the amount of the cryptocurrency you want to buy or sell in the quantity bar below order types.

#5 Confirm the Trade

Lastly, you need to make sure that the order details are correct and then click on the Buy/Sell button.

Does Delta Exchange have its Own Proprietary Platform?

Delta offers its mobile apps to Android and iOS users, providing all the features of the web platform. Delta Exchange App Download Link:

Delta Exchange Trading Volume

According to Delta Exchange CoinGecko, this exchange has maintained a steady trading volume over the past three months, from May through August, showing consistent activity without a clear upward or downward trend.

Daily trading volumes fluctuated significantly, with noticeable spikes and dips, reflecting periods of heightened market activity and trader engagement.

The highest recorded volume during this period reached $885K, while the lowest dipped to $271K, illustrating the volatility typical in crypto derivatives trading.

Overall, the volume pattern indicates an active and resilient market, with participation remaining stable across major trading pairs and contract types, providing both liquidity and opportunity for traders at all levels.

Delta Exchange Services

In this section, you can make sure that Delta Exchange is offering your favorite trading service:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | Yes |

API Access | Yes |

P2P Trading | No |

OTC Trading | No |

Demo Account | Yes |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

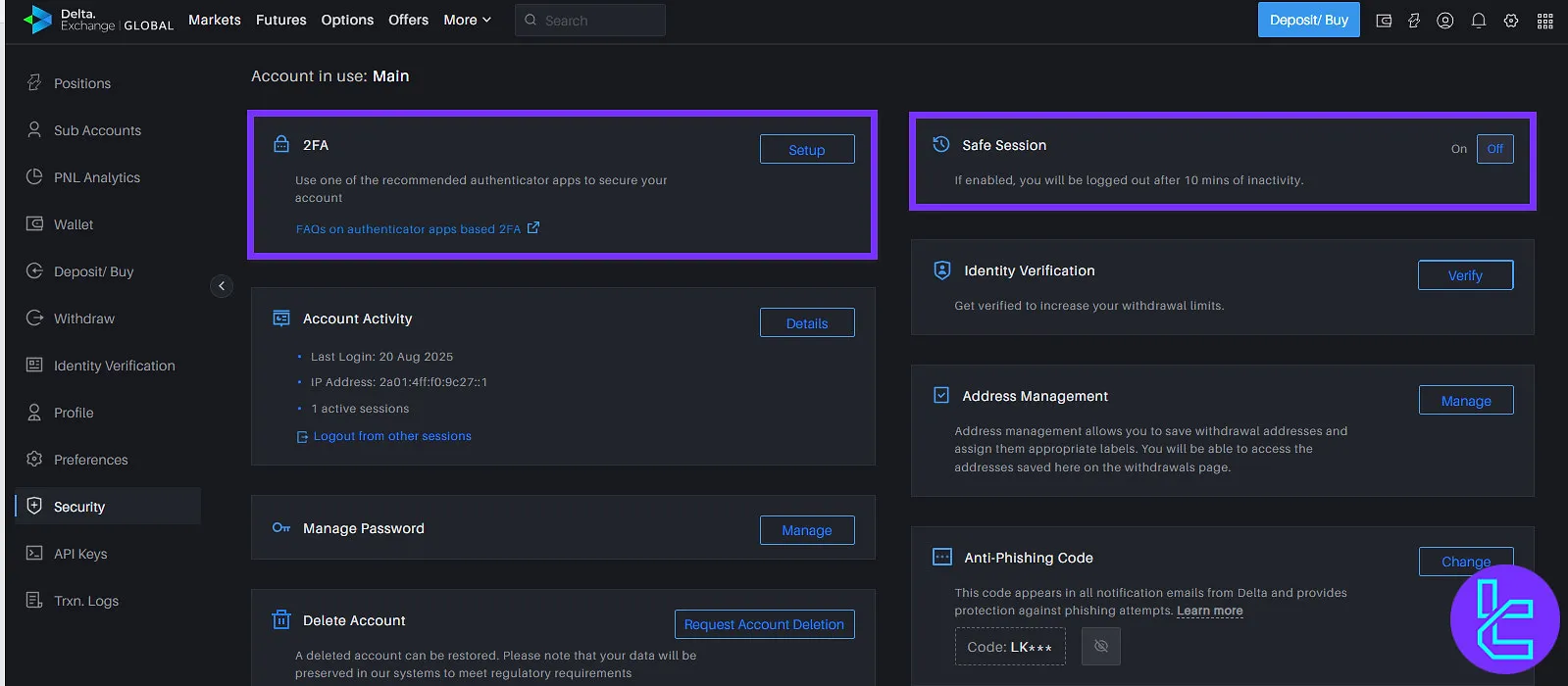

What are The Security & Safety Measures on Delta Exchange?

In this section of the Delta Exchange review article, we check to the security of this exchange, a point where Delta Exchange does not perform very well; They provide only two measurements to ensure the security of users' assets, which are:

- Multi-signature wallets for storing crypto assets;

- Manual review process for withdrawals, processed only once a day.

- 2FA with authenticator apps

- Safe session feature that logs you out after 10 minutes of inactivity

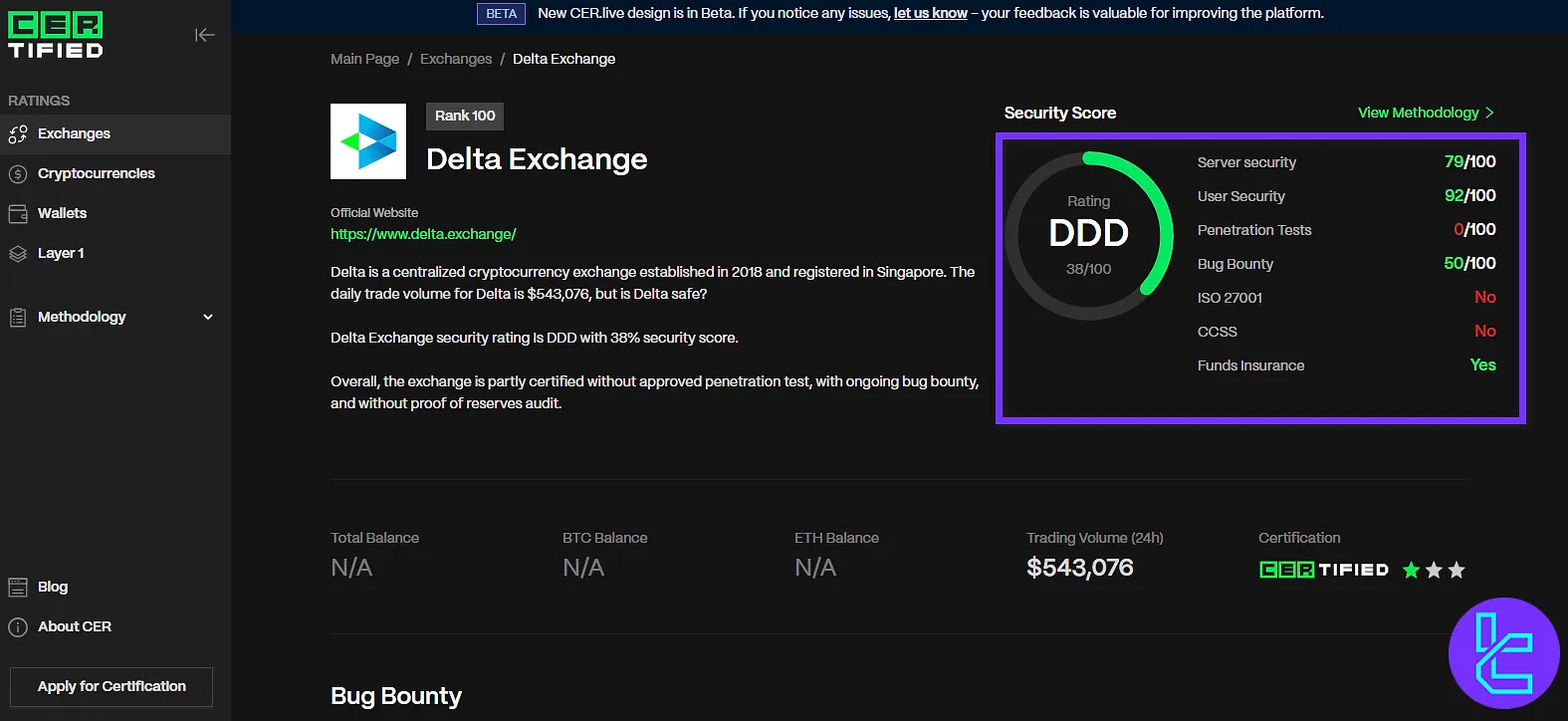

Delta Exchange Security Rankings

Delta Exchange’s security profile reflects a mix of strong operational measures and room for improvement, with high scores in server and user protection, but limited penetration testing and no ISO certification.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 66.45 / 100 (BB) |

Fundamental | 59.94 | |

Operational | 80.55 | |

Listing Security | 50.00 | |

Market | 64.76 | |

Community | 68.10 | |

Cybersecurity | 81.84 | |

CER.live Score | Overall Score | 38% (DDD) |

Server Security | 79/100 | |

User Security | 92/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 50/100 | |

ISO 27001 | No | |

CCSS | No | |

Funds Insurance | Yes |

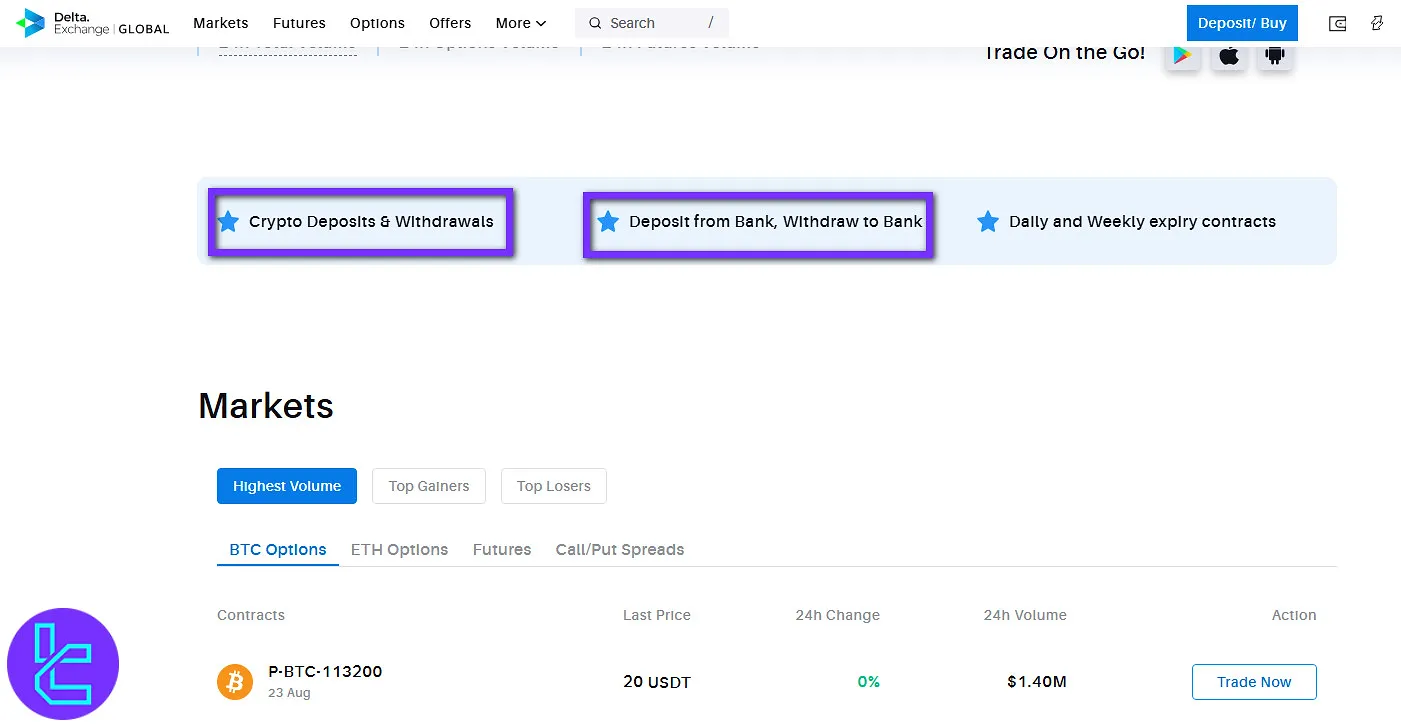

What are the Payment Methods on Delta Exchange?

Delta Exchange supports a variety of payment methods to cater to different user preferences; but note that they support USD deposit and withdrawals as of now; Delta Payment Methods:

- Crypto: Bitcoin, Ethereum, and various Stablecoins

- Bank Wire Transfers: For both deposits and withdrawals

- Credit/Debit Card Payments: VISA and Mastercard

- E-Payment Methods: PayPal, Advcash, Google Pay, and Apple Pay

This diverse range of payment options ensures that users can easily fund their accounts and access their funds when needed, contributing to a seamless trading experience.

Trust Scores and Evaluations

Delta Exchange has received mixed reviews from users and rating platforms such as Trustpilot and the Delta Exchange CoinGecko page; Delta Exchange Crypto Trust Scores:

- Trustpilot Score: 2.6 out of5 (based on 20+ reviews)

- CoinGecko Rating: 7 out of 10

Positive aspects mentioned by users:

- Wide range of derivatives offerings

- Good trading experience for both beginners and experienced traders

Concerns raised by users:

- High trading fees

- Unreliable stop loss orders

- Issues with withdrawals and account access

- Potential association with high-risk investments

While Delta Exchange offers a comprehensive cryptocurrency derivatives trading platform, prospective traders should carefully consider these user concerns before using the exchange. The support for various cryptocurrency blockchains is another strong point of trading with Delta Exchange.

Delta Exchange Features

Delta Exchange offers a range of features beyond trading to cater to the diverse needs of all market participants. Delta Exchnage features:

Feature | Availability |

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Gift Card | No |

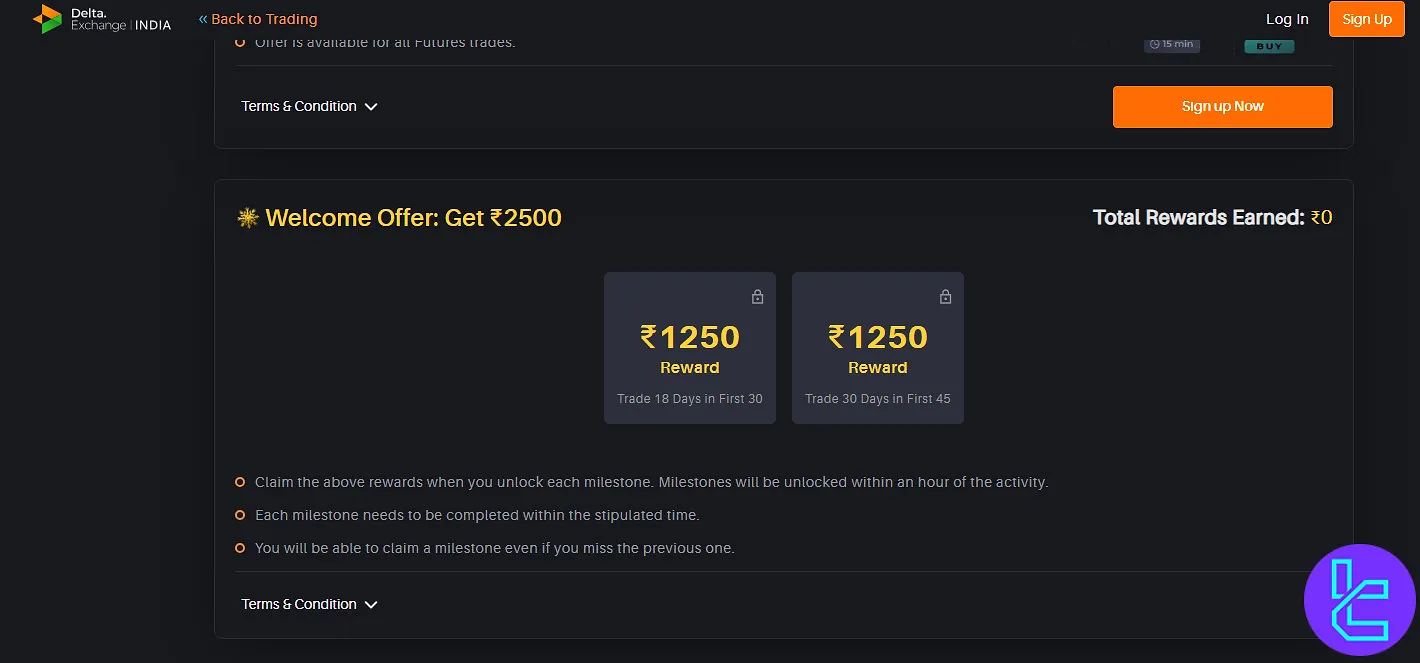

Delta Exchange Bonus

Delta Exchange offers a variety of bonuses and promotions designed to enhance trading activity and reduce trading costs.

Bonus Program | Details |

Welcome Bonus – Up to $30 | New users can earn up to $30 in Delta Cash by trading for certain days. Delta Cash can cover 15% of trading fees |

Referral Program – 15% Commission | Earn 15% commission on friends’ trading fees. Referred users get 10% off fees for six months |

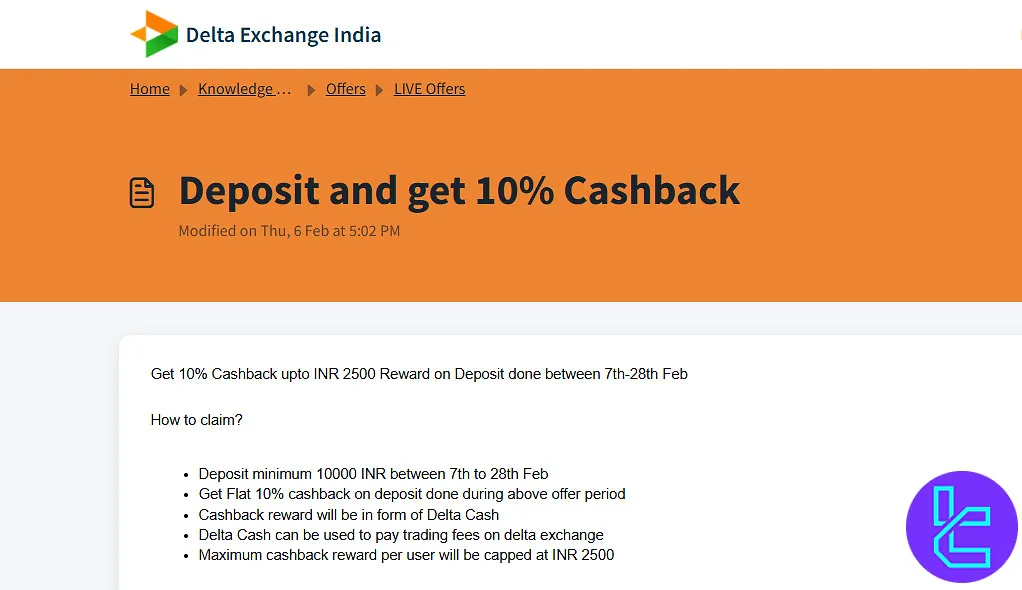

Deposit Bonus – 10% Cashback | Get 10% cashback on deposits during promotions, usable to pay trading fees |

Welcome Bonus – Up to $30

New users can earn up to$30 in Delta Cash by completing specific trading milestones. For example, trading for 18 days within the first 30 days unlocks $15, and trading for 30 days within the first 45 days unlocks an additional $15.

Delta Cash can be applied to offset 15% of trading fees per trade, providing an immediate boost to new traders.

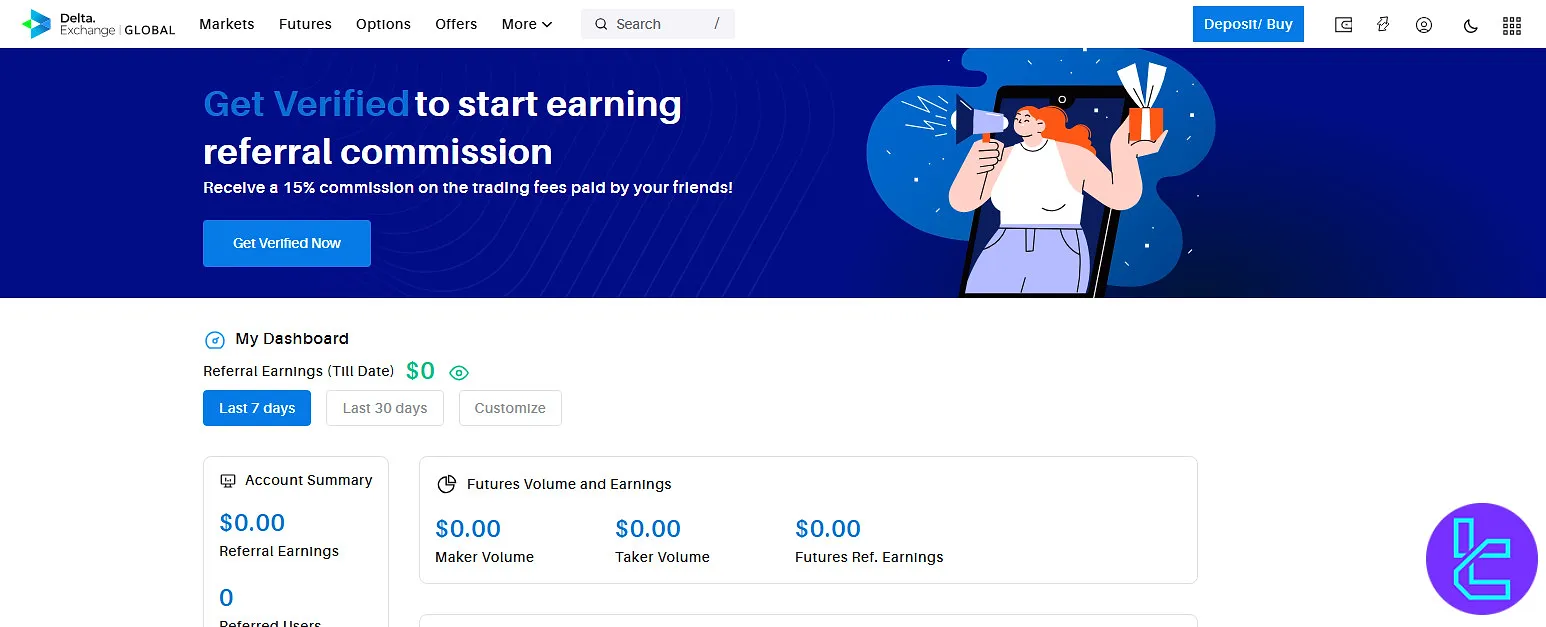

Referral Program – 15% Commission

Delta Exchange’s referral program allows users to earn a 15% commission on thetrading fees paid by friends or contacts they refer for a full year.

Additionally, referred users receive a 10% discount on trading fees for the first six months, making it a mutually rewarding program for both parties.

Deposit Bonus – 10% Cashback

Traders who deposit a minimum amount during specific promotional periods are eligible for a 10% cashback on deposits, credited as Delta Cash.

This bonus can then be used to pay trading fees, effectively reducing the cost of active trading and incentivizing larger deposits.

Customer Support

Delta Exchange provides round-the-clock (24/7) customer support to assist users:

- 24/7 customer support available

- Live chat, email, and ticket support options

- Quick query resolution (90% resolved in less than 24 hours)

- Comprehensive support center with user guides and FAQs

- Reliable technical support for API integration and trading bot setup

The exchange's focus on responsive customer service aims to enhance the overall user experience and address any issues promptly.

What Investment Option Does Delta Exchange Offers?

Delta Exchange offers a variety of trading and investment options:

- Cryptocurrency Options Trading: Call and put options on top cryptocurrencies with 200xmaximum leverage

- Robo Strategies: Algorithmic trading strategies for automated investing

- Cryptocurrency Staking: Earn up to 10% APY by staking crypto assets

- Straddle (Move) Derivatives: Volatility-based derivatives for price movement speculation

These diverse offerings cater to a wide range of trading preferences and risk appetites, but this exchange doesn’t provide social and copy trading features for its users.

Delta Exchange Restricted Countries

Delta Exchange does not offer its services to residents of several countries, including:

- United States of America

- Puerto Rico

- S. Virgin Islands

- Vincent and the Grenadines

- Iran

- North Korea

- Syria

- Crimea

- Cuba

- Canada

- Afghanistan

- Cambodia

- Pakistan

- United Kingdom

- Singapore

Users from these restricted countries are prohibited from using this platform or participating in its affiliate program.

The exchange reserves the right to decline any user, suspend or terminate accounts, and prohibit residents of restricted jurisdictions from acting as affiliates.

Comparing Delta Exchange and Other Cryptocurrency Exchanges

Let's review the key aspects of trading with Delta Exchange compared to other cryptocurrency exchanges.

Parameters | Delta Exchange | |||

Number of Assets | 50+ | 2800+ | 2800+ | 400+ |

Maximum Leverage | 1:100 | 1:200 | 1:100 | 1:125 |

Minimum Deposit | $1 | $1 | Varies by Payment Method | $1 |

Spot Maker Fee | 0.075% | 0.05% | From -0.005% | 0.02% - 0.1% |

Spot Taker Fee | 0.075% | 0.05% | From 0.025% | 0.04% - 0.1% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Trading Finder Expert Conclusion

Delta exchange is regulated by FIU India, offering50 cryptocurrencies to trade. Delta trading volume is beyond $500M [ranked 81 in daily trading volume according to CoinGecko.] The exchange governance token is “DETO” and you can lower the fees with it [default: from 0.075% for spot trading, 0.06% for futures trading.]