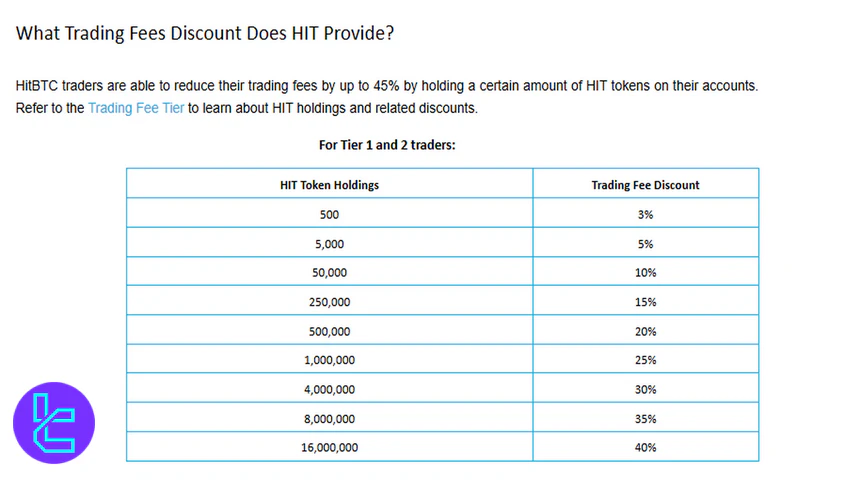

HitBTC offers access to 500+ spot trading pairs with a default maker/taker fee of 0.12%/0.25%. HIT (ecosystem’s native token) holders can enjoy fee discounts ranging from 3% to 45%.

HitBTC exchange supports bank card and eWallet payments (e.g., Google Pay, Apple Pay, and Visa.) It also offers Futures and Margin markets with a liquidation fee of 0.5%.

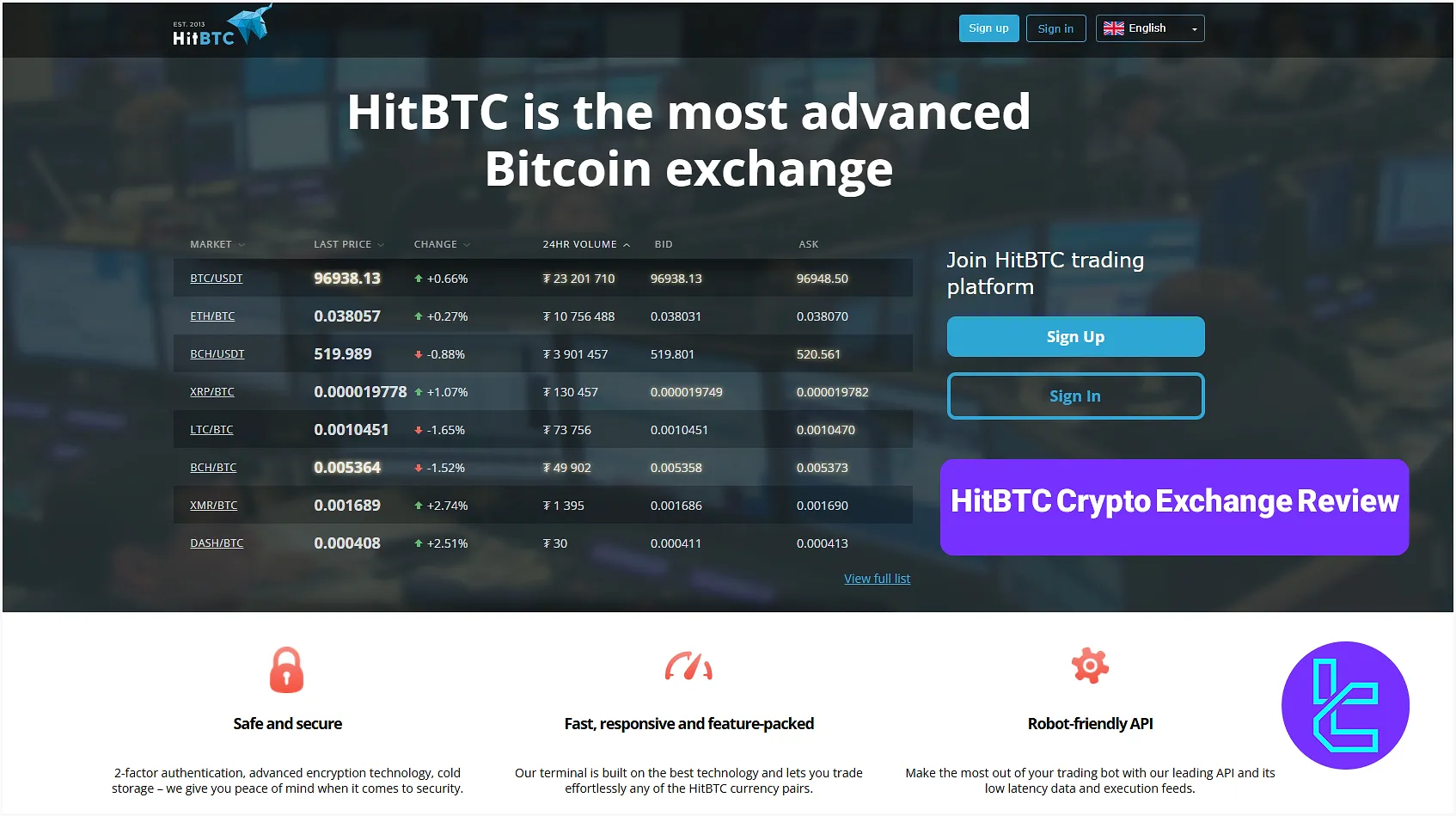

HitBTC (Company Information and Regulation)

Founded in 2013, HitBTC is located in Hong Kong, and it has a representative office in Chile. The company has been funded in two stages, raising a total amount of $11M.

Key facts about HitBTC:

- Service Provider: Htechno Business LTD

- 800+ trading pairs

- 500+ spot instruments

- Not regulated by any financial authorities

- 24/7 support

HitBTC Specific Features

The Crypto exchange was an early innovator, the first to provide reliable and fast REST, WebSocket, andFIX API access for Algo traders.

here’s a quick look at what HitBTC has to offer.

Exchange | HitBTC |

Launch Date | 2013 |

Levels | Level 1 - 10 |

Trading Fees | Spot/Margin Maker/Taker - 0.12%/0.25% Futures Maker/Taker - 0.02%/0.07% |

Restricted Countries | the USA, North Korea, Sudan, Crimea and Sevastopol, Cuba, Syria, United Kingdom, Canada, Belgium, France, Germany, Italy |

Supported Coins | 500+ |

Futures Trading | Yes |

Minimum Deposit | variable based on the currency |

Deposit Methods | Crypto, Bank Cards (3rd party) |

Withdrawal Methods | Crypto |

Maximum Leverage | 1:100 |

Minimum Trade Size | variable based on the trading pair |

Security Factors | 2FA, Cold Storage, White Lists |

Services | Futures, Margin, Fix API, REST, WebSocket |

Customer Support Ways | Ticket, Email |

Customer Support Hours | 24/7 |

Fiat Deposit | No |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | HIT |

HitBTC Exchange Advantages and Disadvantages

To provide a balanced perspective, let's examine the pros and cons of using HitBTC.

Pros | Cons |

User-friendly interface | No regulatory licenses |

Mobile app and crypto wallet | Geo-restrictions |

Demo trading | Lack of live support |

API services | Low trust score |

HitBTC User Levels

The exchange employs a tiered user level system that rewards frequent traders with lower spot and futures trading fees.

Here's an overview of the HitBTC user levels.

Level | 30D Trading Volume (USDT) | Spot / Margin | Futures | ||

Maker | Taker | Maker | Taker | ||

1 | ≥ 0 | 0.12% | 0.2% | 0.02% | 0.07% |

2 | ≥ 100,000 | 0.09% | 0.15% | 0.02% | 0.07% |

3 | ≥ 500,000 | 0.08% | 0.12% | 0.02% | 0.07% |

4 | ≥ 1,000,000 | 0.07% | 0.1% | 0.02% | 0.06% |

5 | ≥ 10,000,000 | 0.06% | 0.08% | 0.01% | 0.06% |

6 | ≥ 50,000,000 | 0.04% | 0.06% | 0.01% | 0.05% |

7 | ≥ 100,000,000 | 0.02% | 0.05% | 0% | 0.05% |

8 | ≥ 500,000,000 | 0% | 0.03% | 0% | 0.05% |

9 | ≥ 1,000,000,000 | -0.01% | 0.02% | 0% | 0.05% |

10 | ≥ 5,000,000,000 | -0.01% | 0.0149% | -0.01% | 0.04% |

HitBTC Exchange Fees Explained

The platform’s fee structure mainly consists of trading commissions and withdrawal fees, since deposits are commission-free.

While the withdrawal costs vary based on the cryptocurrency, the trading fees are calculated based on the user level, which we discussed earlier in this HitBTC review.

Default trading costs on HitBTC:

Market | Maker | Taker |

Spot/Margin | 0.12% | 0.25% |

Futures | 0.02% | 0.07% |

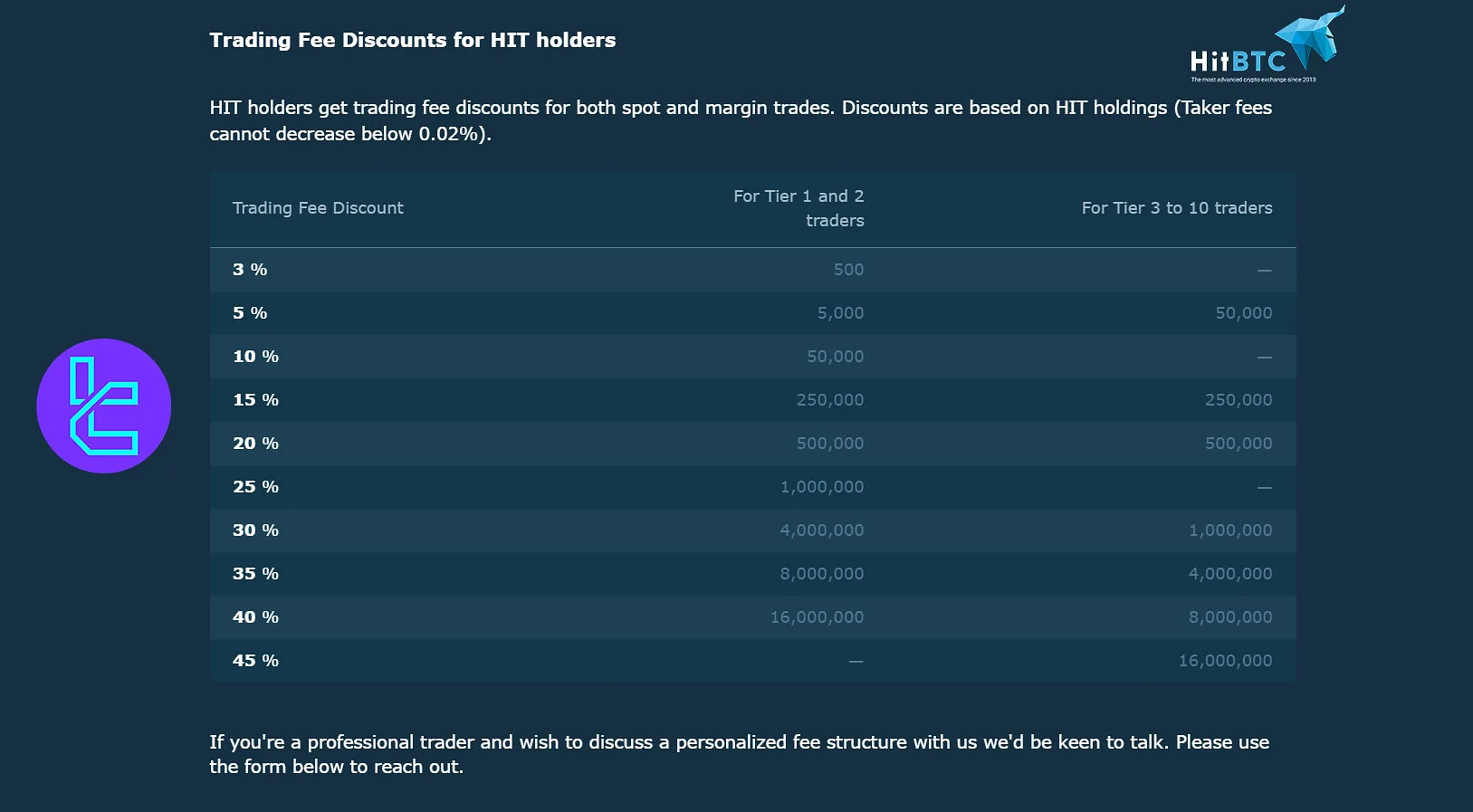

Clients can get additional discounts on trading costs by holding the ecosystem’s native token, HIT. Note that the discount only applies to Spot and Margin fees.

The exchange also charges 0.5% of the position’s value as a liquidation fee for Futures and Margin contracts.

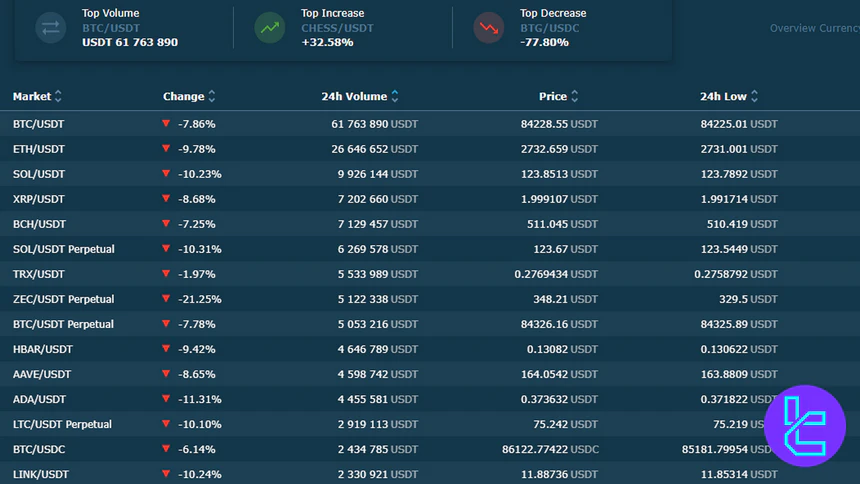

Available Coins on HitBTC

The exchange boasts an impressive selection of cryptocurrencies, including popular tokens and emerging projects.

HitBTC has listed over 500 coins and tokens, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Ripple (XRP)

- Litecoin (LTC)

- Cardano (ADA)

- Polkadot (DOT)

- Uniswap (UNI)

- Chainlink (LINK)

- The Graph (GRT)

- SushiSwap (SUSHI)

HitBTC Futures and Margin Trading

The company offers both futures and margin trading options for users looking to boost their trading power with a leverage of up to 1:100. HitBTC has listed over 800 trading pairs.

Futures

- Up to 100x leverage on select trading pairs

- 34 perpetual futures trading pairs against USDT, including SOL, BTC, SHIB, XRP, EOS, LTC, AVAX, BNB, and ETH

- Useful for speculating on price movements or hedging positions

Margin

- Up to 10x leverage on select trading pairs

- mandatory 2-factor authentication and a separate margin account

- Customizable collateral and position sizes

- 35 BTC, 2 Fiat (BRL and TRY), 3 ETH, 72 USDT, 2 HIT, and 2 USDC

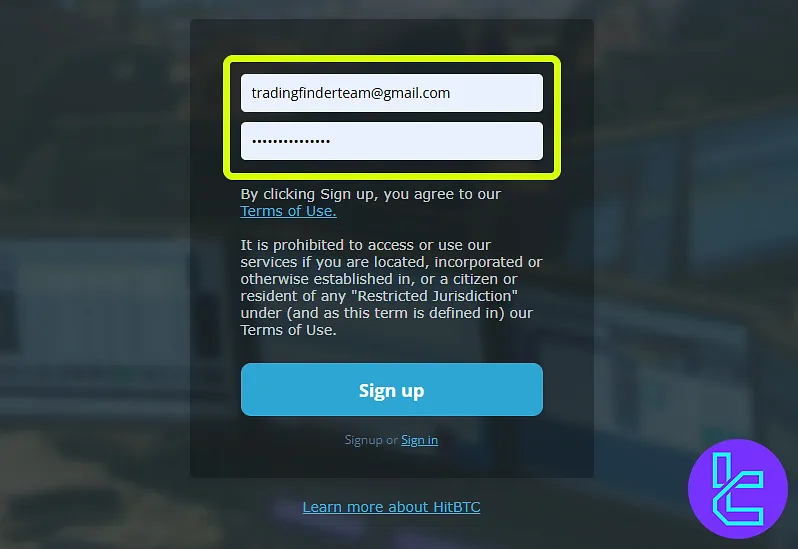

HitBTC Registration and KYC

Traders must open an account with HitBTC to use all the features this centralized exchange has to offer. HitBTC registration:

#1 Enter the HitBTC Website

To open an account with the HitBTC exchange, search for it in your favorite browser. Once you have access to the website, click on the "Sign Up" button.

#2 Enter Your Email, Create a Password, and Agree to the Terms

Now, enter your email address in the designated field and create a new, unique password for your account. After clicking on the "Sign Up" button, the exchange requires you to read and agree to its rules and conditions.

It's worth noting that HitBTC doesn't require traders to verify their accounts.

HitBTC Trading Guide

After registration and verification, you will be directed to the exchange page where you can start trading if you have enough funds in your account. Here are the trading steps you need to follow:

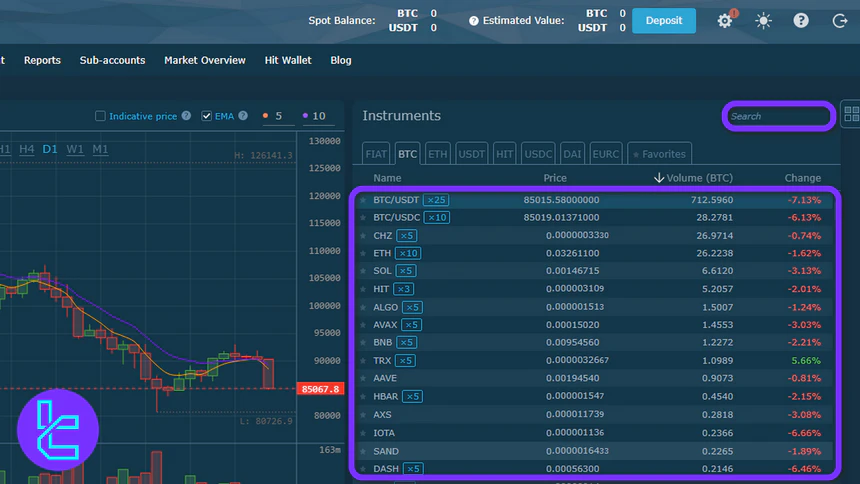

#1 Select a Trading Pair

You can find a list of supported trading pairs on the right side of the page. Choose the market corresponding to the cryptocurrency you want to trade or search for it using the search box.

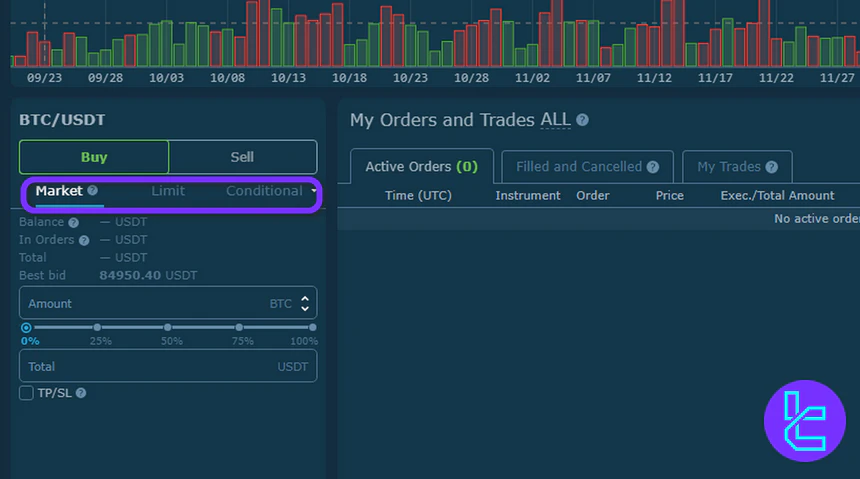

#2 Pick an Order Type

Decide whether to place a market, limit, or conditional order. Market orders execute immediately at the prevailing price, while limit or conditional orders let you set a specific price to buy or sell.

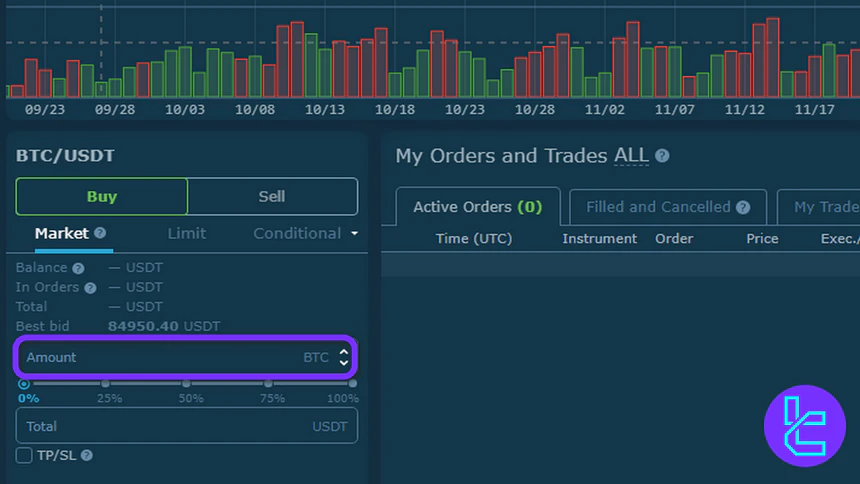

#3 Enter Trade Details

Fill in the amount of cryptocurrency you want to buy or sell in the order form. Double-check the estimated total to make sure it matches your trading strategy.

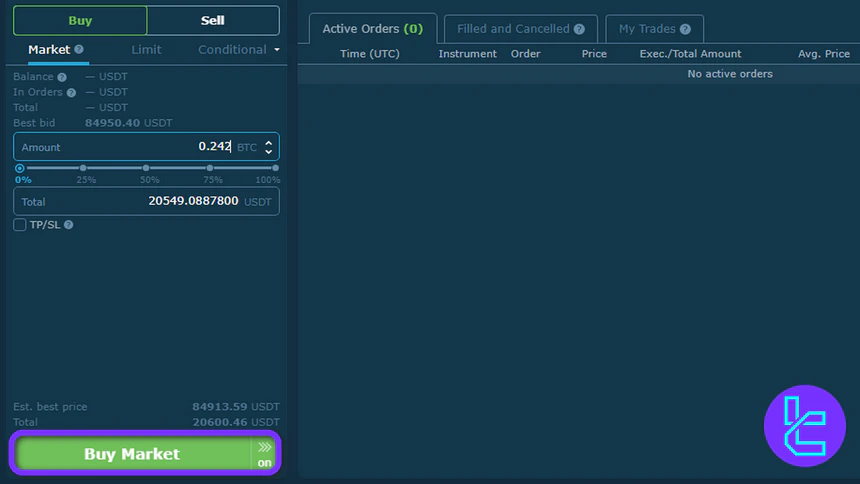

#4 Execute Your Order

After confirming the trading pair, order type, and quantity, click “Buy Market” or “Sell Market” to place your order. You can monitor its progress under open orders until it is fully executed.

HitBTC App and Trading Platform

The exchange offers a web-based trading platform in addition to a proprietary mobile app, available on various devices, including:

The platform offers access to TradingView charts and tools. You can also check our list of TradingView indicators for additional analytical tools.

HitBTC also has developed a cryptocurrency wallet for securely buying, selling, sending, swapping, receiving, and storing digital assets. HitBTC wallet download links:

HitBTC Trading Volume

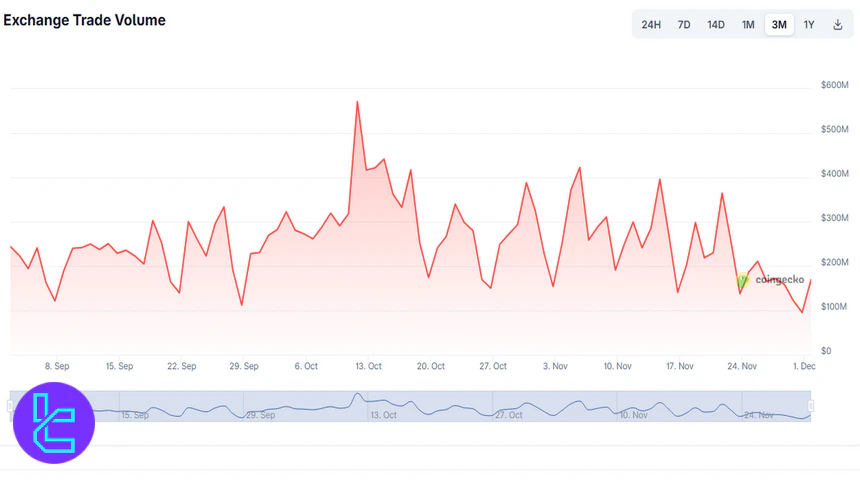

According to the HitBTC CoinGecko chart, over the past three months, HitBTC has shown a highly variable trading volume profile, moving within a broad range that generally fluctuates between roughly $100M and $500M per day.

The chart indicates several sharp spikes, most notably in mid-October, where the exchange briefly pushed toward the upper end of this range, followed by periods of cooling where volumes retreated closer to the $100M–$150M zone.

This pattern suggests a market driven by short bursts of heightened activity, possibly tied to high-impact news cycles, liquidity rotations, or sudden increases in trader participation.

Despite the volatility, HitBTC manages to maintain a consistent baseline of daily volume, signaling stable user engagement even during quieter market phases.

Overall, the exchange continues to demonstrate the kind of liquidity depth expected from a long-standing centralized platform, with daily flows substantial enough to support active spot and derivative traders without major slippage concerns.

HitBTC Services

Let’s check out the availability of the most requested trading services on the HitBTC exchange:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | Yes |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

Yes | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | No |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

HitBTC Exchange Security Measures

Security is paramount in the cryptocurrency space, and HitBTC implements several measures to protect user funds and data, including:

- Cold storage

- Two-Factor Authentication (2FA)

- Physical security key (YubiKey)

- Whitelist wallets

- SSL encryption

- Regular security audits

- Compliance with data privacy regulations, such as GDPR

While HitBTC takes significant steps to ensure platform security, it's important to note that no system is 100% immune to breaches.

Users are advised to practice good security hygiene, such as using strong passwords and enabling 2FA.

HitBTC Security Rankings

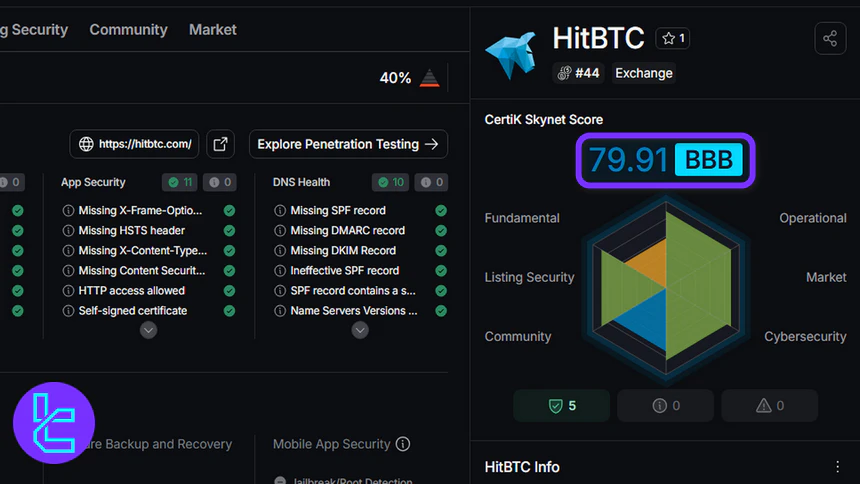

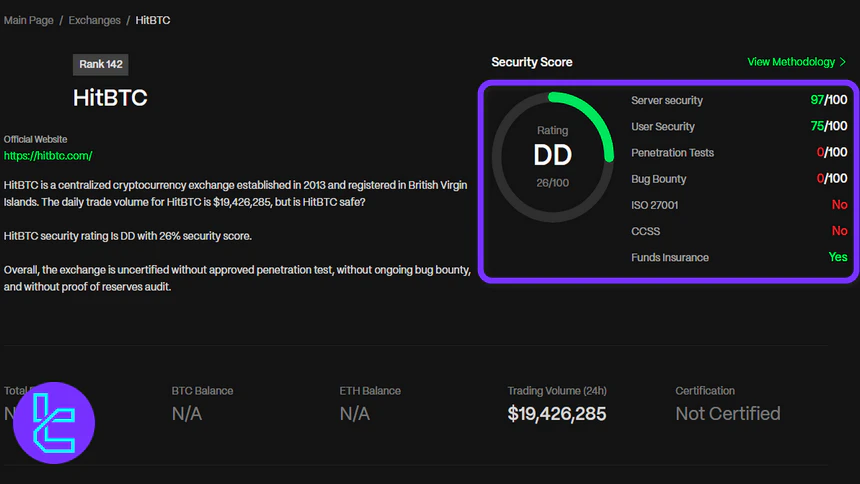

HitBTC’s security profile presents a mixed picture across multiple independent assessments.

According to the HitBTC CertiK Skynet review, the platform achieves an overall score of 79.91/100 (BBB), with particularly strong marks in operational reliability, listing security, and market safety, while fundamental aspects lag behind.

Meanwhile, the HitBTC CER.live evaluation gives HitBTC a lower overall rating of 26% (DD), highlighting strong server and user security but showing gaps in penetration testing, bug bounty programs, and formal compliance standards like ISO 27001 and CCSS.

On the positive side, the exchange does provide funds insurance, offering an added layer of protection for users’ assets.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 79.91 / 100 (BBB) |

Fundamental | 57.40 | |

Operational | 88.69 | |

Listing Security | 88.21 | |

Market | 88.70 | |

Community | 73.12 | |

Cybersecurity | 83.60 | |

CER.live Score | Overall Score | 26% (DD) |

Server Security | 97/100 | |

User Security | 75/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 0/100 | |

ISO 27001 | No | |

CCSS | No | |

Funds Insurance | Yes |

HitBTC Payment Methods

We must discuss the payment options in this HitBTC review. While the company only supports crypto transactions, it uses 3rd party providers to offer bank card payments for crypto purchases.

Bank cards are available only for crypto purchasing using two payment providers, Mercuryo (Visa, MasterCard, and Apple/Google Pay) and Moonpay (Visa and MasterCard).

HitBTC bank card deposit limitations:

Payment Provider | Minimum | Maximum |

Moonpay | $30 | $12,000 |

Mercuryo | $30 | $15,899 |

HitBTC User Satisfaction

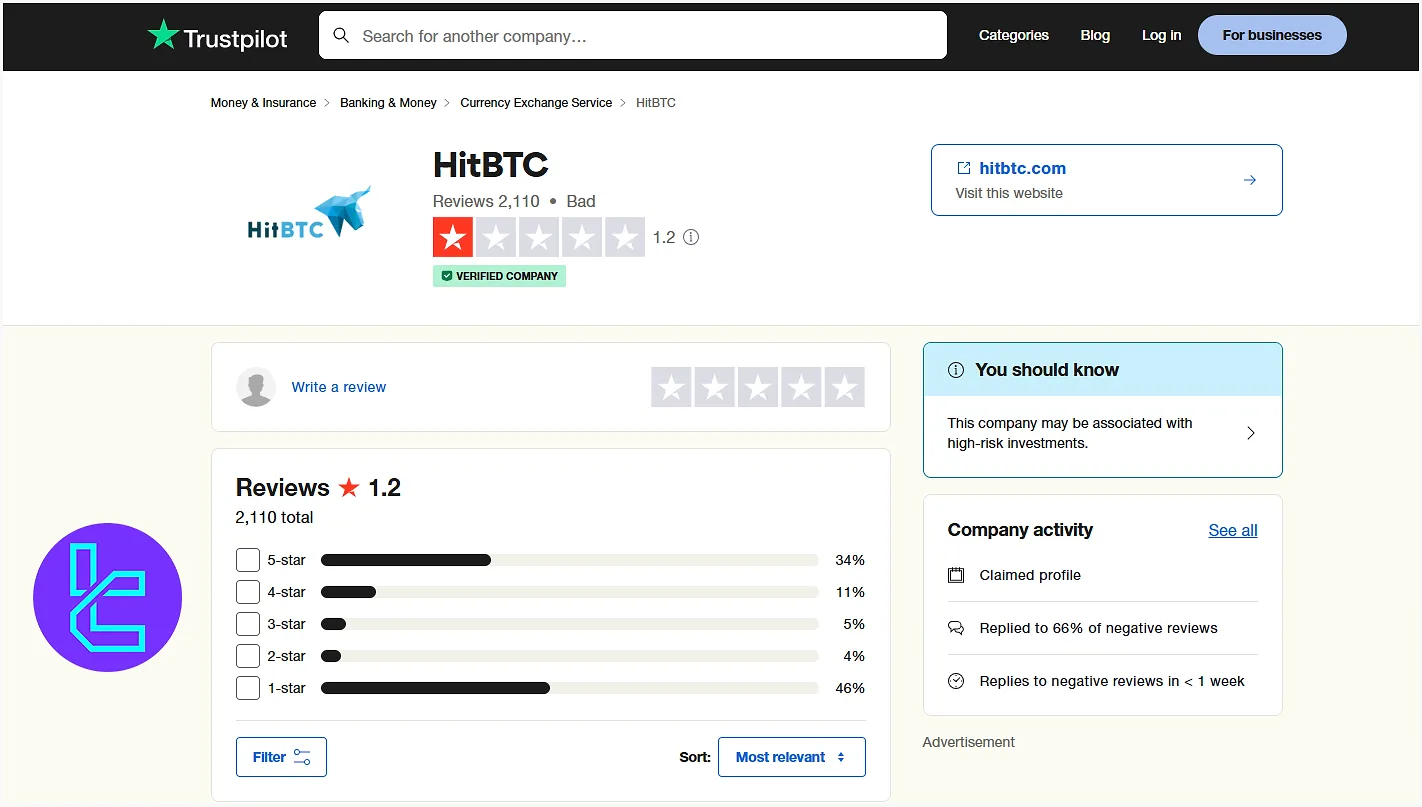

Trust score is one of the most important topics in this HitBTC review. the ecosystem hasn’t performed well in the eyes of users and experts, since it has lower than average ratings.

1.2/5 based on 2,110 reviews | |

CoinGecko | 4 out of 10 |

There are Numerous complaints about withdrawal issues and delays, poor customer support, and account freezes on HitBTC’s TrustPilot profile.

HitBTC Features

The table below displays the availability of specific crypto-related features on the HitBTC exchange.

Feature | Availability |

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Gift Card | No |

HitBTC Promotions

HitBTC provides traders with several opportunities to reduce trading costs and earn rebates through token holdings and active participation in market-making programs.

While there are no deposit or cash bonuses, the exchange rewards committed traders with fee discounts and market-making incentives designed to optimize trading efficiency:

Bonus Type | Description | Key Details |

HIT Token Trading Fee Discount | Reduce your trading fees by holding HIT tokens in your account. | Discounts range from 3% to 45%, depending on account tier and HIT holdings. Fees are calculated daily; verified accounts only; Taker fees cannot go below 0.02% |

Market-Making Program | Earn rebates and enjoy lower fees by acting as a market maker on spot or futures markets. | Maker fees can be negative, Taker fees as low as 0.02%. Automatic enrollment for verified accounts; monthly tier reassessment based on trading volume |

HIT Token Trading Fee Discount

Traders can lower their trading fees by holding HIT tokens in their account. The discount varies depending on the account tier and the number of HIT tokens held, ranging from a few percent up to 45%.

Discounts are calculated daily based on the previous day’s holdings and the trader’s 30-day volume. To qualify, accounts must be verified. Note that Taker fees cannot be reduced below 0.02%.

For example, a Tier 1 trader holding 5,000 HIT tokens would enjoy a 5% fee discount, meaning both Maker and Taker fees are reduced proportionally.

Market-Making Program

HitBTC also offers incentives for liquidity providers through its market-making program on both spot and futures markets. Participants benefit from attractive maker rebates, low taker fees, and access to advanced trading APIs, including REST, FIX, and colocation options.

Verified accounts are automatically enrolled in the entry-level tier, with tier reassessments occurring monthly based on the prior month’s trading volume.

Maker fees can even become negative, while taker fees can go as low as 0.02%, rewarding high-volume, active traders.

HitBTC Exchange Customer Support

While the support team is available 24/7, the lack of a live chat option can be a serious letdown for potential clients. HitBTC support channels:

relations@hitbtc.com | |

Ticket | https://support.hitbtc.com/en/support/tickets/new |

Support Center | A comprehensive guide to Frequently Asked Questions (FAQ) |

Does HitBTC Offer Growth Plans or Copy Trading?

The exchange doesn’t offer any Earn programs (e.g., Staking, and Yield Farming) or copy trading features.

However, it offers a robot-friendly API with low latency data and execution feeds, designed for automated and algorithmic traders.

HitBTC communication protocols:

- Representational State Transfer (REST)

- WebSocket

- Fix API

HitBTC Exchange Geo-Restrictions

The platform doesn’t provide services to certain individuals, including politically exposed persons and their relatives. HitBTC also implements restrictions on certain regions and countries, including:

- the United States of America

- North Korea

- Japan (temporarily banned)

- Sudan

- Crimea and Sevastopol

- Cuba

- Syria

- United Kingdom

- Canada

- Belgium

- France

- Germany

- Italy

HitBTC Compared to Other Well-Established Exchanges

The table below helps you compare HitBTC with other cryptocurrency exchanges.

Parameters | HitBTC Exchange | |||

Number of Assets | 70+ | 400+ | 1300+ | 7800+ |

Maximum Leverage | 1:100 | 1:125 | 1:100 | 1:10 For Margin Trading/1:12 for Futures Trading |

Minimum Deposit | Varies by Cryptocurrency | $1 | Varies by Cryptocurrency | Varies on Payment Method |

Trading Fees | From 0.12% Maker, 0.25% Taker | From 0.02% Maker, 0.04% Taker | From 0.015% Maker, 0.005% Taker | From -0.01% Maker, 0.03% Taker |

Mandatory KYC | No | Yes | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | No | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

HitBTC provides 150 Futures and Margin trading pairs with leverage options of up to 1:100. The default trading fees for futures makers/takers are 0.02%/0.07% on HitBTC exchange.

Despite providing robust API services using three protocols, including REST, WebSocket, and Fix, the lack of Staking and live chat support has caused numerous negative HitBTC reviews on TrustPilot and a bad rating of 1.2 out of 5.