![Commodity Channel Index Oscillator (CCI) Download MT4 - Free [TFlab]](https://cdn.tradingfinder.com/image/166814/13-6-en-cci-mt4-1.webp)

![Commodity Channel Index Oscillator (CCI) Download MT4 - Free [TFlab] 0](https://cdn.tradingfinder.com/image/166814/13-6-en-cci-mt4-1.webp)

![Commodity Channel Index Oscillator (CCI) Download MT4 - Free [TFlab] 1](https://cdn.tradingfinder.com/image/166816/13-6-en-cci-mt4-2.webp)

![Commodity Channel Index Oscillator (CCI) Download MT4 - Free [TFlab] 2](https://cdn.tradingfinder.com/image/166815/13-6-en-cci-mt4-3.webp)

![Commodity Channel Index Oscillator (CCI) Download MT4 - Free [TFlab] 3](https://cdn.tradingfinder.com/image/166807/13-6-en-cci-mt4-4.webp)

The Commodity Channel Index (CCI) Indicator is a popular technical analysis tool in financial markets, especially in Forex market and Stock markets, and is recognized in Meta Trader 4.

Donald Lambert designed this oscillator measures the deviation of the price from its moving average, helping traders identify entry and exit points and analyze overbought and oversold conditions.

Indicator Specifications Table

Indicator Categories: | Oscillators MT4 Indicators Signal & Forecast MT4 Indicators Currency Strength MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Elementary |

Indicator Types: | Reversal MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Day Trading MT4 Indicators |

Trading Instruments: | Share Stocks MT4 Indicators Forward Market MT4 Indicators Commodity Market MT4 Indicators Stock Market MT4 Indicators Forex MT4 Indicators |

The CCI Indicator helps predict potential market changes by analyzing price volatility, potential reversal points, and divergences between price and the indicator. The buy and sell signals in this oscillator are obtained by examining the high and low values of the CCI.

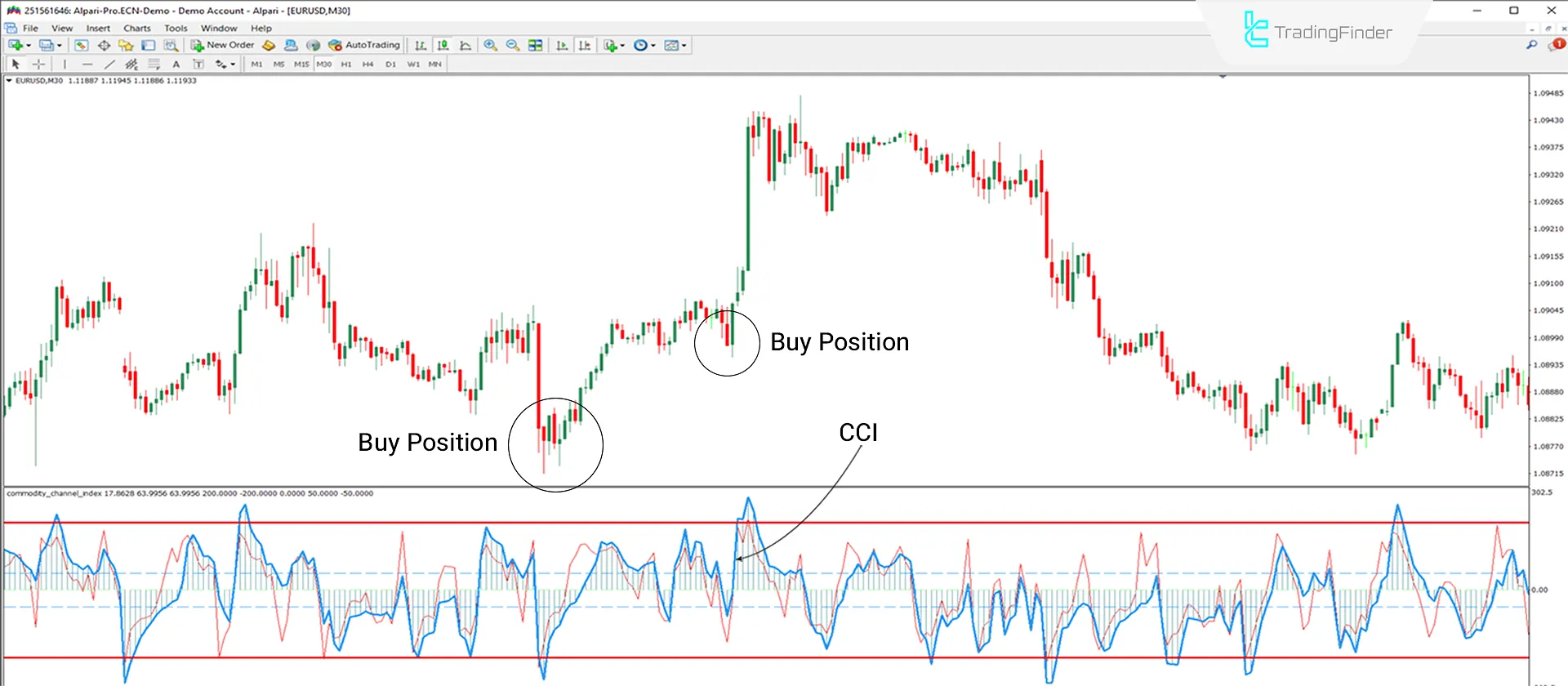

The Commodity Channel Index (CCI) has different lines:

- The middle line is indicated in green and represents the indicator's zero line

- The blue line represents the CCI

- The red line, "Turbo CCI," has a shorter period than the CCI

Uptrend Condition

The 30-minute EUR/USD price chart shows the functionality of the CCI Indicator in an uptrend. Generally, when the blue line (CCI) penetrates levels above +100, it indicates the strength of the uptrend.

To assess the sustainability of the uptrend, the CCI should consistently stay above the +50 range.

One of the key features of the CCI Indicator is its ability to detect divergence; if the price continues to rise but the CCI starts to decline, this divergence can be a warning of weakening upward momentum.

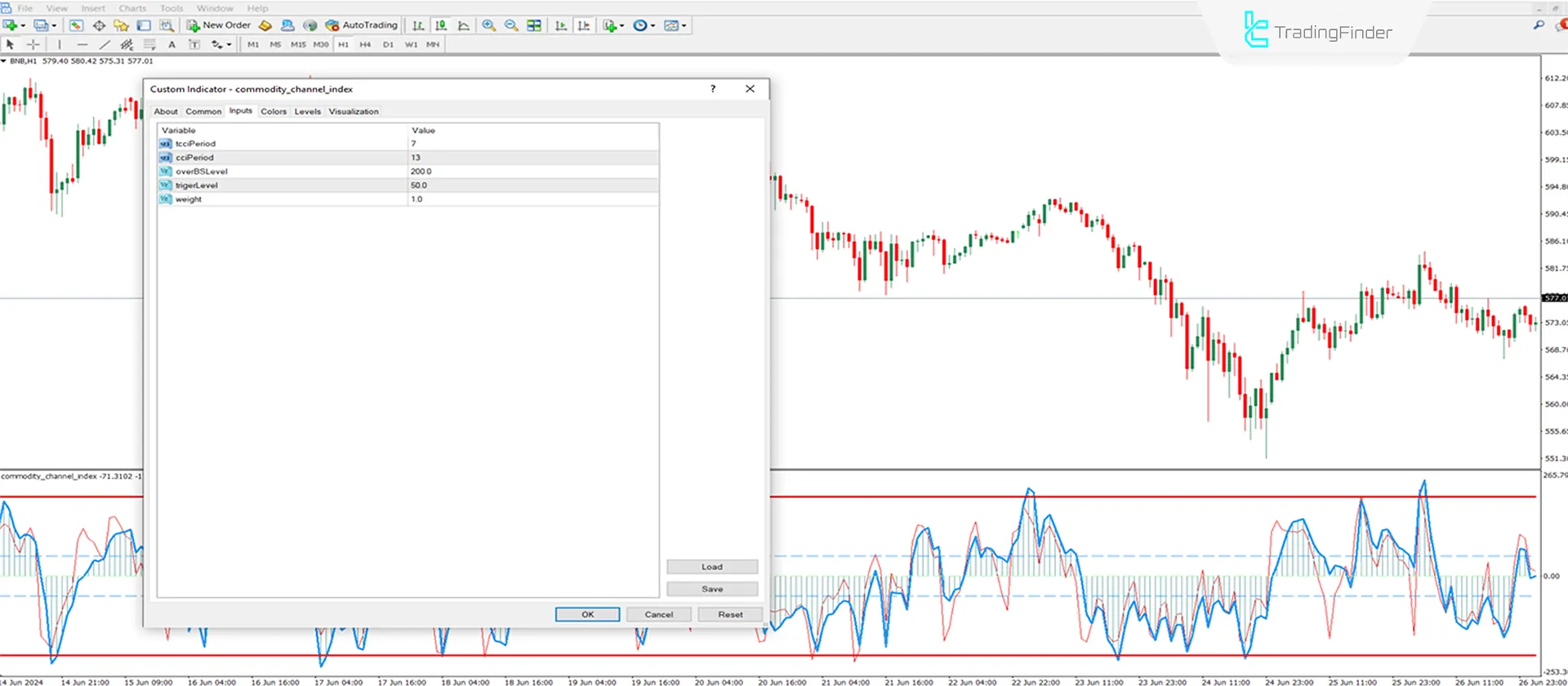

Downtrend Condition

The 1-hour Binance Coin's (BNB) price chart shows how the CCI Indicator functions in a downtrend. When the blue line (CCI) penetrates levels below -100, it indicates the strength of the downtrend.

To assess the sustainability of the downtrend, the "CCI" should consistently stay below the -50 range. The image shows a divergence between price movement and the "CCI" oscillation, where the price is decreasing, but the "CCI" oscillations register higher points.

This divergence can be a warning of weakening downward momentum.

Settings

- Turbo CCI Period (T CCI Period): The period for "Turbo CCI" is set to 7;

- CCI Period: The timeframe for calculating the Commodity Channel Index (CCI) is set to 13;

- Overbought/Oversold Level (Over BS Level): The overbought and oversold level is 200;

- Trigger Level: The trigger level is set to 50;

- Weight: The period for overall calculations is set to 1.

Conclusion

The Commodity Channel Index (CCI) is a signals and forecasts indicator used to identify trends and entry/exit points in financial markets.

By calculating the difference between the average price and the Simple Moving Average (SMA), this indicator enables analysts to identify overbought and oversoldlevels and analyze price fluctuations.

Commodity Channel Index Oscillator MT4 PDF

Commodity Channel Index Oscillator MT4 PDF

Click to download Commodity Channel Index Oscillator MT4 PDFWhen can the CCI Indicator be helpful for traders?

The Commodity Channel Index (CCI) Indicator can be helpful when there is a possibility of a trend continuation or reversal.

What is the required skill level for using the CCI Indicator?

Due to its simplicity, the CCI indicator is suitable for both beginner and professional traders.