TradingView

MetaTrader4

MetaTrader5

![Footprint Price Action Pro Indicator in NinjaTrader – Free [TradingFinder]](https://cdn.tradingfinder.com/image/683596/2-178-en-footprint-price-action-pro-1.webp)

![Footprint Price Action Pro Indicator in NinjaTrader – Free [TradingFinder] 0](https://cdn.tradingfinder.com/image/683596/2-178-en-footprint-price-action-pro-1.webp)

![Footprint Price Action Pro Indicator in NinjaTrader – Free [TradingFinder] 1](https://cdn.tradingfinder.com/image/683594/2-178-en-footprint-price-action-pro-2.webp)

![Footprint Price Action Pro Indicator in NinjaTrader – Free [TradingFinder] 2](https://cdn.tradingfinder.com/image/683593/2-178-en-footprint-price-action-pro-3.webp)

![Footprint Price Action Pro Indicator in NinjaTrader – Free [TradingFinder] 3](https://cdn.tradingfinder.com/image/683589/2-178-en-footprint-price-action-pro-4.webp)

To receive a free license for this indicator, click on Online Support and get in touch with us via Telegram or WhatsApp through the “Connect with an Experienced Specialist” section.

The Footprint Price Action Pro indicator is a tool for studying market microstructure within the NinjaTrader platform.

This tool processes direct order flow at the Bid and Ask levels after NinjaTrader Registration and reveals the behavioral architecture of buyers and sellers within each price block.

The Volume Indicator uses Order Flow and Delta data to analyze how executed volume is distributed and evaluates the strength of demand or supply in real time; as a result, the nature of this tool is the display of actual trade data.

Footprint Price Action Pro Indicator Table

General specifications of the Footprint Price Action Pro indicator are presented in the table below:

Category | Signal and Forecast – Trading Tool – Volume Trading |

Platform | NinjaTrader |

Skill Level | Advanced |

Indicator Type | Continuation – Reversal |

Timeframe | Multi Timeframe |

Trading Style | Intraday Trading |

Trading Market | All Markets |

Footprint Price Action Pro Indicator at a Glance

The processing engine of the Footprint Price Action Pro indicator breaks down traded volume at each tick and reveals the combined strength of buyers and sellers as printed structure on the chart.

The main process of the tool works as follows:

- Separating executed volume on the Bid and Ask sides and displaying it as distinct numbers in each price block

- Evaluating volume “Imbalances” to identify zones where aggressive buyers or sellers enter the market

- Calculating Delta and Cumulative Delta to observe shifts in order flow during bullish or bearish trends

- Detecting behaviors such as Volume Climax, Absorption, Exhaustion, and Stopping Volume

- Displaying volume structure in areas with liquidity reactions and market directional changes

This collection of data creates a precise framework for understanding smart-money behavior in real time and clearly illustrates the path of order flow within each candle’s structure.

The Footprint Price Action Pro is provided by TradingFinder, officially recognized vendor of NinjaTrader.

Analytical Applications of the Footprint Price Action Pro Indicator in Market Analysis

The application of the Footprint Price Action Pro indicator is based on deep study of volume behavior and order flow, and it holds structural importance for Order Flow traders.

The most important applications are:

- Determining the validity of breakouts at support and resistance zones based on continuous imbalances within price blocks

- Analyzing volume reactions at key levels such as Order Blocks, Fair Value Gaps, and liquidity zones

- Evaluating the entry or exit of large players through absorption patterns or delta changes

- Identifying weakness or strength in price swings when examining Volume Tails at candle highs or lows

- Reconstructing real market behavior during fake breakouts, rejections, and reversal scenarios

This trading tool shifts professional decision-making from a raw-price model to a model based on actual executed volume and order flow data.

Indicator During a Bullish Trend

In the Price Action Pro Footprint Order Volume indicator, buy signals are generated based on the combination of several factors:

- A demand zone or dynamic support zone highlighted in green

- Delta flipping positive along with increased delta-change velocity

- Stair-step growth in Cumulative Delta, breaking previous delta highs, while price is located in a pullback zone

- Clustered buy-side imbalances across multiple price levels near the lows and Ask dominance over Bid

- Sell-side absorption at the low and formation of a Volume Tail on the lower section of the confirmation candle

- Printing of the “DCBS” icon as the final algorithm output directly on the structural low

In the image below, the buy signal is triggered when aggressive buying pressure at the Ask, positive delta rotation, rising cumulative delta, and seller absorption near the low occur simultaneously.

Then, price stabilization within the green zone shows that the low is preserved and buyer entry is structurally confirmed.

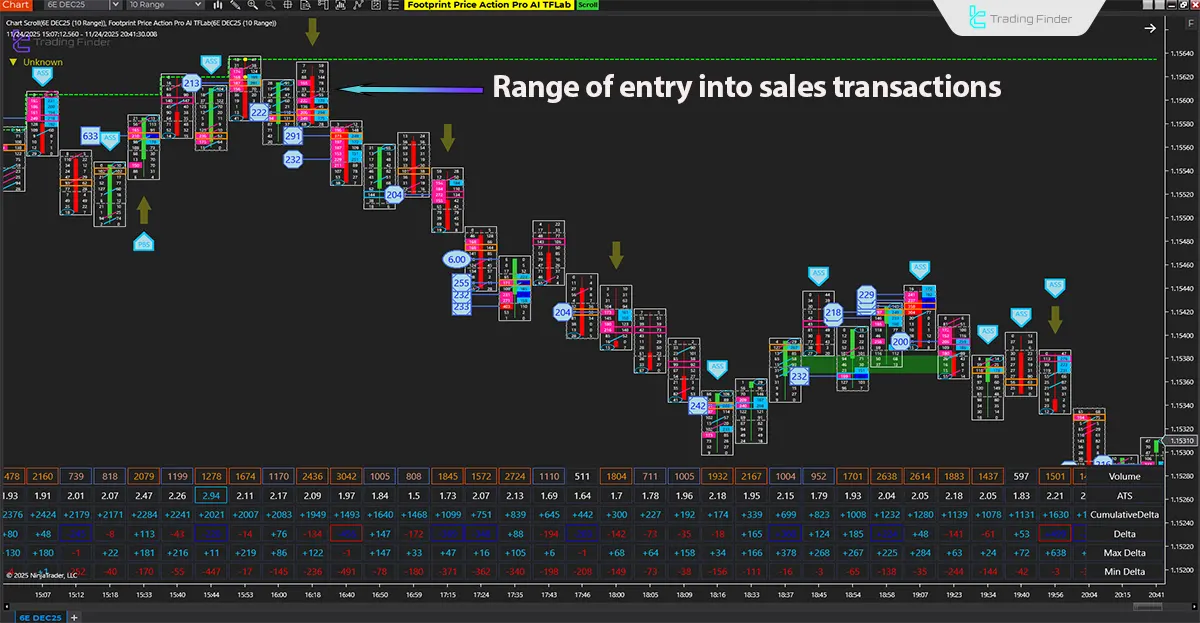

Indicator During a Bearish Trend

The Price Action Pro Footprint indicator activates bearish structure when the majority of executed volume at the top area concentrates on the Bid and sellers create operational dominance across several consecutive blocks.

At this stage, Delta turns negative, and Cumulative Delta, with a downward slope, confirms the shift in order-flow direction.

Simultaneously, a buy-side absorption pattern forms at the structural high, and the indicator issues a bearish signal based on the combination of the following volume clues:

- Volume imbalance on the Bid side and formation of selling pressure in upper layers

- Negative delta rotation and downward Cumulative Delta

- Activation of buy-side absorption at the high and confirmation of buyer structural weakness

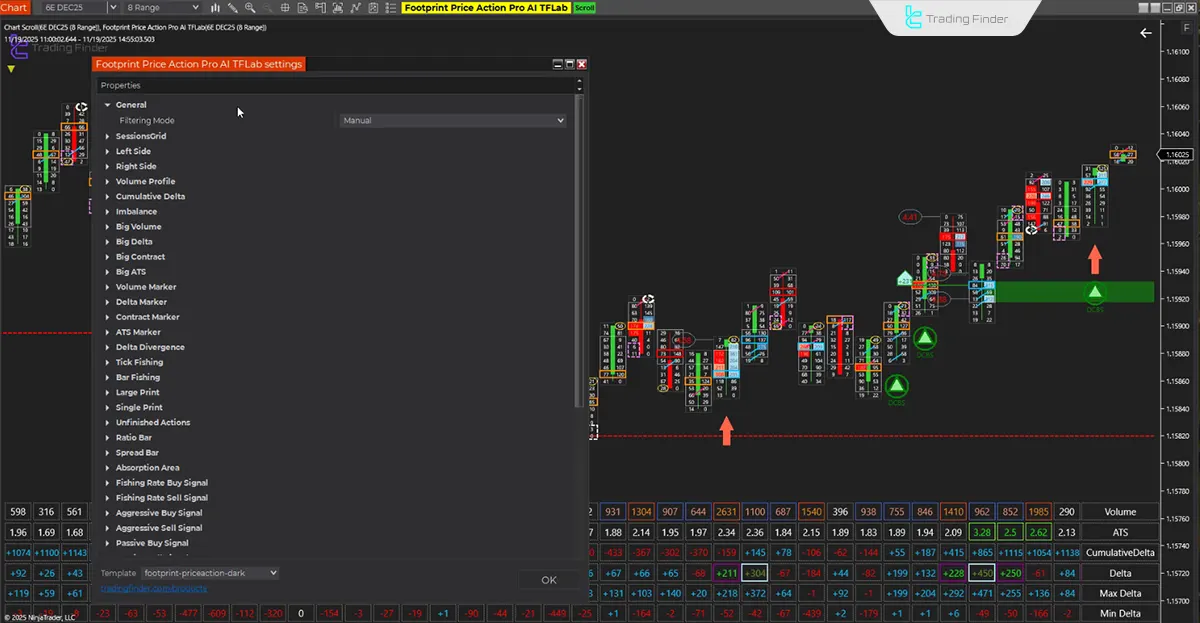

Footprint Price Action Pro Indicator Settings

The following image shows the settings panel of the Trade Volume Indicator on the NinjaTrader platform:

- General: Core Configuration

- SessionsGrid: Trading Session Grid Layout

- Left Side: Left-Panel Parameters

- Right Side: Right-Panel Parameters

- Volume Profile: Executed Volume Profile

- Cumulative Delta: Aggregated Delta

- Imbalance: Volume Imbalance Modules

- Big Volume: High-Volume Prints

- Big Delta: High-Delta Signals

- Big Contract: Large-Contract Executions

- Big ATS: Large Average Trade Size

- Volume Marker: Volume Highlight Marker

- Delta Marker: Delta Highlight Marker

- Contract Marker: Contract Highlight Marker

- ATS Marker: ATS Highlight Marker

- Delta Divergence: Delta Divergence Detector

- Fishing: Liquidity Sweep Detection

- Large Print: Block Trade

- Single Print: Single-Tick Print

- Ratio Bar: Ratio-Analytics Bar

- Spread Bar: Bid-Ask Spread Bar

- Absorption Area: Absorption Detection Zone

- Bar Report: Bar-Level Report

- Table Report: Table-Formatted Report

- Session High/Low: Session Extremes

- Text: Text Formatting

- Menu: Indicator Menu

- Data Series: Data Series Configuration

- Setup: Initialization Settings

- Visual: Visual Appearance Options

Note: In the “General” section, three independent filter-application modes are available, and the user can activate each based on analytical logic:

- AI

- Automatic

- Manual

Conclusion

The Footprint Price Action Pro indicator processes order flow structure at the Bid and Ask levels with micro-analytical precision and reveals buyer and seller behavior within each price block.

By combining volume imbalance, Delta, and Cumulative Delta, it identifies the true architecture of supply and demand at key levels and evaluates the strength or weakness of price movement based on executed-volume data.

Additionally, the Level 2 Data Indicator enables the detection of valid breakouts, structural reversals, and aggressive-money entries by relying on real market execution data.

Footprint Price Action Pro Indicator in NinjaTrader PDF

Footprint Price Action Pro Indicator in NinjaTrader PDF

Click to download Footprint Price Action Pro Indicator in NinjaTrader PDFWhat type of data does the Footprint Price Action Pro indicator process?

This indicator processes tick-level data including executed volume on Bid, executed volume on Ask, Delta, and Cumulative Delta, revealing the precise order-flow structure within each price block.

What is the difference between the Footprint Price Action Pro indicator and a standard candlestick chart?

A candlestick chart only displays open, close, high, and low, whereas Footprint Price Action Pro shows the executed volume of each trade based on its execution side and records the actual behavior of buyers and sellers in real time.

How is Absorption detected in the Footprint Price Action Pro indicator?

The indicator detects absorption when opposing-side volume is absorbed at the high or low, but price fails to create a new high or low; this behavior indicates the presence of a large participant acting against the apparent market pressure.

THE License key pls ?

For receiving a free license, please contact our team on Telegram and WhatsApp.

licencia para el indicador

Para obtener una licencia gratuita, por favor contáctenos a través de Telegram o WhatsApp.