TradingView

MetaTrader4

MetaTrader5

![SMT Double Div TradingFinder Indicator in NinjaTrader – Free [TradingFinder]](https://cdn.tradingfinder.com/image/698917/2-180-en-smt-double-div-tradingfinder-1.webp)

![SMT Double Div TradingFinder Indicator in NinjaTrader – Free [TradingFinder] 0](https://cdn.tradingfinder.com/image/698917/2-180-en-smt-double-div-tradingfinder-1.webp)

![SMT Double Div TradingFinder Indicator in NinjaTrader – Free [TradingFinder] 1](https://cdn.tradingfinder.com/image/698915/2-180-en-smt-double-div-tradingfinder-2.webp)

![SMT Double Div TradingFinder Indicator in NinjaTrader – Free [TradingFinder] 2](https://cdn.tradingfinder.com/image/698905/2-180-en-smt-double-div-tradingfinder-3.webp)

![SMT Double Div TradingFinder Indicator in NinjaTrader – Free [TradingFinder] 3](https://cdn.tradingfinder.com/image/698895/2-180-smt-double-div-tradingfinder-4.webp)

To receive a free license for this indicator, click on Online Support and get in touch with us via Telegram or WhatsApp through the “Connect with an Experienced Specialist” section.

The SMT Double Div TradingFinder Indicator by TradingFinder is designed for the simultaneous analysis of price behavior across two correlated markets, highlighting structural discrepancies between highs and lows.

By processing price data from both the primary market and the reference market in real time, this indicator reveals inconsistencies in the flow of institutional liquidity—available immediately after NinjaTrader registration.

When one market reaches a new extreme while the other fails to confirm it, the indicator flags this as a weakness in order flow.

By connecting major price points in both markets, the indicator draws divergence lines and emphasizes key pivot levels, helping traders identify meaningful structural imbalances and potential trade opportunities.

SMT Double Div TradingFinder Indicator Table

The general specifications of the SMT Double Div TradingFinder Indicator are presented in the table below:

Category | Smart Money – Trading Tool – ICT |

Platform | NinjaTrader |

Skill Level | Advanced |

Indicator Type | Continuation – Reversal |

Timeframe | Multi Timeframe |

Trading Style | Intraday Trading |

Trading Market | All Markets |

SMT Double Div TradingFinder Indicator at a Glance

Signals generated by the Smart Money Double Divergence Indicator by TradingFinder are displayed on the chart as connected lines between key price points.

This visual structure keeps the analyst’s focus directly on real price behavior and market structure logic and ties the decision making process to accurate analysis and reading of liquidity flow.

In this trading tool, circles act as markers of valid high and low pivots and form the basis for analyzing behavioral discrepancies between two correlated markets.

Additionally, the dashed line between these circles clearly illustrates the inability of one market to confirm a new high or low.

This visual combination makes the formation of Smart Money divergence identifiable without introducing additional noise, as follows:

- Connecting simultaneous pivots in two markets

- Displaying divergence through clearly defined colored line

- Precise differentiation between regular divergence and double divergence

- Ability to filter signals through indicator setting

Indicator in an Uptrend

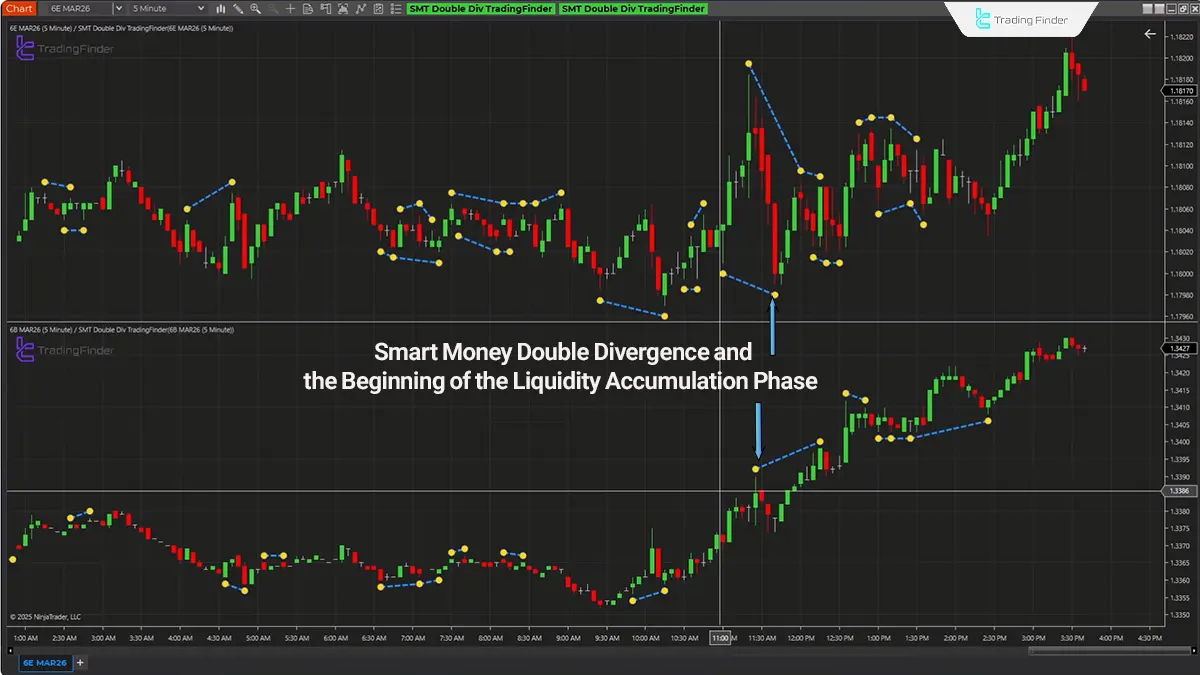

According to the image below, a bullish scenario based on Smart Money Double Divergence becomes active when the upper market records a lower low while the lower market fails to confirm a new low within the same time window.

The low pivot circles and the bullish dashed line display the behavioral discrepancy between the two correlated markets and reveal weakness in institutional selling pressure.

The alignment of this divergence with liquidity grabs below previous lows and price entry into the discount zone increases the validity of the bullish scenario.

Following this structure, continuation of price movement in the reference market signals the beginning of an accumulation phase and creates conditions for the formation of a controlled bullish leg.

Indicator in a Downtrend

In a bearish scenario, the indicator becomes active when the primary market records a higher high but the correlated market fails to confirm that high.

The high pivot circles and the bearish dashed line illustrate the behavioral discrepancy and reveal weakness in institutional buying flow.

The formation of this divergence in the premium zone or after draw on liquidity has previous highs increases the validity of the analysis.

This structure indicates that the market has entered a distribution phase and that the probability of the start of a controlled bearish move increases.

SMT Double Div TradingFinder Indicator Settings

The image below displays the settings panel of the Smart Money Double Divergence Indicator by TradingFinder on the NinjaTrader platform:

- Show SMT Pivots: Display valid high and low pivots

- Show SMT Divergence: Configure the drawing of Smart Money divergence structures

- Secondary Instrument: Reference market or correlated asset

- SMT Pivot Color: Adjust the display color of pivot circles

- SMT Divergence Line Color: Color of divergence lines

- Show Only Double Divergences: Activate advanced filtering for Smart Money double divergences

- Pivot Window: Pivot identification window

- Check Pivot On Secondary: Validation of pivots on the reference market

- Data Series: Price data management and time frame synchronization

- Setup: Basic indicator settings

- Visual: Visual display settings of the indicator

- Plots: Management of indicator drawing elements

Conclusion

The SMT Double Div TradingFinder Indicator is an advanced analytical tool for identifying behavioral misalignment between correlated markets.

By using valid pivots, dashed lines, and divergence structures, this indicator reveals traces of institutional order flow and shifts in liquidity phases.

When this tool is used alongside market structure, liquidity, and key zones, the accuracy of trading decision making increases significantly.

SMT Double Div PDF

SMT Double Div PDF

Click to download SMT Double Div PDFWhat is the difference between regular SMT and the Smart Money Double Divergence Indicator by TradingFinder?

In regular SMT, a single non confirmation is observed, while in SMT Double this non confirmation occurs consecutively, increasing the validity of the analysis.

Which markets are best for using the Smart Money Double Divergence Indicator by TradingFinder?

This indicator performs best in correlated markets such as “EURUSD” and “GBPUSD” or “NASDAQ” and “S&P 500”.

What is the relationship between the Smart Money Double Divergence Indicator by TradingFinder and Order Blocks?

In this indicator, divergence forming near institutional Order Blocks strengthens the probability of a price reaction.