DXtrade is a famous cloud-based trading platform among prop firm traders that offers 8 different chart types, 4 execution models, and various tradable assets, including Forex, commodities, indices, cryptocurrencies, bonds, and more.

The table below contains the best prop firms that offer DXtrade trading platform.

| Alpha Capital Group | |||

| FTMO | |||

| Funded Trading Plus | |||

| 4 |  | Audacity Capital | ||

| 5 |  | FXIFY | ||

| 6 |  | Seacrest Markets | ||

| 7 |  | Lark Funding | ||

| 8 |  | Blueberry Funded |

Trustpilot Scores of Prop Firms that Offer DXtrade

Traders who prefer using DXtrade platform must choose a prop firm that has high trust scores and generally positive reviews from users.

Prop Firm | Trustpilot Rating | Number of Reviews |

4.8/5⭐️ | 36000+ | |

4.7/5⭐️ | 16000+ | |

Funded Trading Plus | 4.5/5⭐️ | 2600+ |

Audacity Capital | 4.5/5⭐️ | 100+ |

Lark Funding | 4.5/5⭐️ | 500+ |

FXIFY | 4.4/5⭐️ | 4500+ |

Seacrest Markets | N/A (Due to breach guidelines) | 2500+ |

Blueberry Funded | N/A (Due to breach guidelines) | 1000+ |

Minimum Challenge Price of Prop Firms that Offer DXtrade Platform

The table below provides a detailed review of the minimum evaluation prices in the best prop firms that offer DXtrade.

Prop Firm | Minimum Challenge Price |

Rebel Funding | $25 |

$39 | |

Nordic Funder | $42 |

DNA Funded | $49 |

$50 | |

Lark Funding | $60 |

$90 | |

FTMO | $155 |

Evaluation Rules of Prop Firms that Offer DXtrade Platform

There are 3 key factors (including minimum profit target, daily, and maximum drawdown) that traders must consider before choosing the best prop firm that supports DXtrade. Here are the trading conditions in the best prop firms.

Prop Firm | First Profit Target | Minimum Daily Drawdown | Minimum Overall Drawdown |

Nordic Funder | 5% | 4% | 5% |

Lark Funding | 5% | 5% | 5% |

Prop Number 1 | 5% | 4% | 8% |

Seacrest Markets | 6% | 4% | 6% |

Goat Funded Trader | 8% | 3% | 5% |

10% | 4% | 6% | |

10% | 5% | 10% | |

FTMO | 10% | 5% | 10% |

Profit Split in Prop Firms that Use DXtrade

To choose the best prop firm that offer DXtrade platform, traders must also consider the profit splits between them and the prop firm.

Prop Firm | Profit Split (For Trader) |

Prop Number 1 | 100% |

Goat Funded Trader | 95% |

Ment Funding | 90% |

FTMO | 90% |

90% | |

FXIFY | 90% |

Audacity Capital | 90% |

Alpha Capital Group | 80% |

Top 6 Prop Firms that Support DXtrade

If you prefer using DXtrade as your primary trading platform instead of TradingView, MetaTrader 4 or 5, Match-Trader, etc, you have access to a wide variety of options.

Traders must evaluate each prop firm based on available evaluations, challenge prices, profit split, trading rules and banned strategies, and more before choosing one.

FTMO

FTMO is the most famous prop firm based in the Czech Republic that offers funded accounts up to $200,000 to traders who pass its evaluations.

The account balance ranges from $10000 to $200000 and the prices vary based on the account size ranging from €155 to €1,080. This prop firm offers MetaTrader 4, MetaTrader 5, DXtrade, and cTrader platforms to suit traders with different trading styles and requirements.

Traders can trade over 93 instruments in this prop firm, including EUR/USD, Gold, USD/JPY, Silver, NASDAQ, DAX, Bitcoin, and many more after completing the FTMO registration.

The maximum trading leverage in FTMO is 1:100; however, Swing trading leverage is capped at 1:30.

FTMO rules are set to create a safe trading environment for traders by allowing VPN or VPS usage, bans news trading 2 minutes before and after significant news, and offer payouts 14 days after the first trade.

This prop firm also offers a scaling program which allow successful traders to receive higher initial balance up to $800,000 after 16 months of profitable trading.

FTMO offers support via live chat (24/7), email, phone call, ticket, FAQ, and messenger.

Minimum Price | $155 |

Maximum Leverage | 1:100 |

Maximum Profit Split | Up to 90% |

Instruments | Forex, Indices, Crypto, Commodities |

Assets | 90+ |

Evaluation Steps | 2 (FTMO Challenge, Verification) |

Trading Platform | MT4, MT5, cTrader, DXtrade |

Payout Frequency | Monthly |

FTMO Pros and Cons

Traders must consider the following pros and cons of trading with the FTMO prop firm before buying any of the challenges.

Pros | Cons |

High profit split of up to 90% with access to funded accounts up to $200,000 and scaling potential beyond this level | Initial evaluation fee is relatively high compared with some newer prop firms |

Well established prop firm founded in 2015 with a strong Trustpilot rating of 4.8/5 and multiple industry awards | Multi phase evaluation process can be demanding and time consuming for short term traders |

Broad range of tradable instruments including Forex, Indices, Commodities, and Crypto with over 90 assets available | Monthly payout schedule may be less flexible than bi weekly or weekly models |

Extensive trader support ecosystem including FTMO Academy, performance coaching, and analytical tools | - |

Alpha Capital Group

Alpha Capital Group is a UK incorporated prop trading firm operating through Alpha Capital Group Limited, established in 2021 and registered at 10 Lower Thames Street, Billingsgate, London (EC3R 6AF).

The firm is led by George Kohler (Founder, CEO, Managing Director) and Andrew Blaylock (Director).

It offers virtual trading accounts with evaluation paths that can be structured as 1 step, 2 step, or 3 step programs, with challenge pricing starting at $40 and account sizes ranging from $5,000 to $200,000.

A scaling framework allows eligible traders to request increases in allocated capital, with a stated ceiling of up to $2,000,000 if profit and drawdown conditions are met.

Key trading parameters include maximum leverage up to 1:100 (with lower caps by asset class and model), profit split up to 80%, and no time limit on trading days across challenges.

Alpha Capital Group rules typically include a maximum daily loss rule and a maximum drawdown rule, with profit targets varying by program. Traders must open an account by following the 3 steps discussed in the Alpha Capital Group registration process to begin trading.

Trading is supported on MetaTrader 5, cTrader, and DXtrade, with instruments spanning Forex, CFDs, and Metals, totaling about 40 to 41 assets.

Payouts are offered on a bi weekly schedule, with an on-demand option referenced, and withdrawals are processed via Wise, Rise, or bank wire transfer. Trustpilot feedback is reported at 4.7 out of 5 based on 16000 plus reviews.

Minimum Price | $40 |

Maximum Leverage | Up to 1:100 |

Maximum Profit Split | 80% |

Instruments | Forex, CFDs, Metals |

Assets | Around 40 to 41 tradable assets |

Evaluation Steps | 1 step, 2 step, 3 step |

Trading Platform | MetaTrader 5, cTrader, DXtrade |

Payout Frequency | Every 2 weeks |

Alpha Capital Group pros and cons

The table below outlines the core benefits and drawbacks of trading with Alpha Capital Group.

Pros | Cons |

No time limit on evaluation across 1 step, 2 step, and 3 step programs, allowing flexible strategy execution and trade management | Strict risk parameters including maximum daily loss and maximum total drawdown can limit aggressive trading styles |

Multiple evaluation models (Alpha One, Alpha Pro, Alpha Swing, Alpha Three) covering different profit targets and drawdown profiles | Tradable universe is limited to roughly 40 to 41 assets compared with multi thousand asset prop firms |

Support for professional trading platforms such as MetaTrader 5, cTrader, and DXtrade, suitable for discretionary and systematic traders | Expert Advisors are only supported on MT5 and require prior approval, with no EA access on cTrader or DXtrade |

Bi weekly and on demand payout options with scaling potential up to $2,000,000 under defined performance rules | News trading restrictions apply on qualified accounts and vary by program |

Funded Trading Plus

Funded Trading Plus is a UK-based proprietary trading firm founded in 2021 under the legal name FTP London Ltd and headquartered in London.

The company provides structured evaluation and instant funding programs designed for traders seeking access to simulated capital across Forex, commodities, indices, and cryptocurrencies.

Account sizes range from $5,000 to $200,000, while the Master Instant Funding plan reaches $100,000. The firm supports major trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, DXtrade, and Match-Trader.

Profit splits can reach up to 100 percent, with leverage capped at 1:30 and weekly payout availability starting from a minimum withdrawal of $50. Evaluation models include One-Step, Two-Step, and Instant Funding programs, all operating without strict time limits.

Funded Trading Plus rules allow the use of Expert Advisors and automated strategies but prohibit arbitrage and grid trading.

The firm operates a performance-based scaling plan that enables capital growth (up to $2.5 million) after achieving defined profit targets.

Funded Trading Plus holds a Trustpilot rating of 4.5 out of 5 and provides customer support through live chat, email, phone, and a dedicated help center.

Minimum Price | $119 |

Maximum Leverage | 1:30 |

Maximum Profit Split | Up to 100% |

Instruments | Forex, Commodities, Indices, Crypto |

Assets | 50+ |

Evaluation Steps | Instant Funding, One-Step, Two-Step |

Trading Platform | MT4, MT5, cTrader, DXtrade, Match-Trader |

Payout Frequency | Weekly |

Pros and Cons of Funded Trading Plus

Traders must consider the following benefits and drawbacks before opening an account with the Funded Trading Plus prop firm.

Pros | Cons |

Profit split up to 100% | Maximum leverage limited to 1:30 |

No minimum trading days | No clear commission structure |

Flexible evaluation programs | Limited public info on VPN/VPS |

Scaling plan up to $2.5M+ | Restricted weekend holding on Instant accounts |

Blueberry Funded

Blueberry Funded is an Australia-based proprietary trading firm launched in 2024 and backed by Blueberry Markets, a brokerage with more than eight years of industry experience.

Operating under VFSC registration (Company No. 700697), the firm offers multiple evaluation and instant funding models with account sizes ranging from $1,250 to $200,000 and scaling potential up to $2 million.

Traders can access major platforms such as MetaTrader 4, MetaTrader 5, DXtrade, and TradeLocker across Forex, cryptocurrencies, metals, energy, and indices.

The standard profit split is set at 80 percent, with bi-weekly payouts and leverage reaching up to 1:100 depending on the challenge type. Pricing starts from $39, making entry relatively accessible compared to many competitors.

Commissions are fixed at $7 per lot for most markets and $2 for stocks, with raw spreads and overnight swap fees applied. While deposits and withdrawals are processed under transparent conditions, accounts may be subject to inactivity-related administrative measures.

Blueberry Funded maintains defined risk controls, restricts news trading, prohibits arbitrage and gambling strategies.

Minimum Price | $39 |

Maximum Leverage | Up to 1:100 |

Maximum Profit Split | 80% |

Instruments | Forex, Crypto, Metals, Energy, Indices |

Assets | Not Specified |

Evaluation Steps | 1-Step, 2-Step, Rapid, Stock, Synthetic |

Trading Platform | MT4, MT5, DXtrade, TradeLocker |

Payout Frequency | Bi-Weekly |

Blueberry Funded Pros and Cons

Like other prop firms, Blueberry Funded has its own pros and cons and they are listed below.

Pros | Cons |

Backed by Blueberry Markets with strong reputation | Limited educational resources |

Multiple challenge models and instant funding | Commission charged on all trades |

Bi-weekly payouts with 80% profit split | Swap fees on overnight positions |

Access to MT4, MT5, DXtrade, and TradeLocker | - |

Lark Funding

Lark Funding is a Canada-based proprietary trading firm founded in 2022 that provides structured access to simulated capital through multiple evaluation and instant funding models.

The company offers 1-Step, 3-Step, and Instant Funding programs, with account sizes reaching up to $200,000 and scalability potential beyond this level.

Traders operate primarily through DXtrade and cTrader, with access to Forex, cryptocurrencies, commodities, and indices. Standard leverage is capped at 1:30, while profit splits range from 80% to a maximum of 90% based on performance.

A distinguishing feature is the Gain Protector system, which enables eligible traders to receive payouts even after breaching daily drawdown limits under specific conditions. Challenge pricing starts from $105, positioning the firm as relatively accessible and all evaluations are supervised under Lark Funding rules.

Commission structures are limited, though additional costs may apply for holding positions over weekends, representing a form of non-trading fee.

Payouts are generally processed on a monthly basis through providers such as Riseworks and Wise after completing the Lark Funding registration and verification process.

Lark Funding maintains transparent trading rules, restricts high-risk strategies, and enforces strict compliance standards. With a Trustpilot rating of 4.5 out of 5, the firm reflects moderate to strong user confidence within the proprietary trading industry.

Minimum Price | $105 |

Maximum Leverage | Up to 1:30 |

Maximum Profit Split | Up to 90% |

Instruments | Forex, Crypto, Commodities, Indices |

Assets | Not Specified |

Evaluation Steps | 1-Step, 3-Step, Instant Funding |

Trading Platform | DXtrade, cTrader |

Payout Frequency | Monthly |

Pros and Cons of Lark Funding

Here are key advantages and disadvantages of trading with the Lark Funding prop firm.

Pros | Cons |

Profit split up to 90% with performance-based tiers | Monthly payout schedule may limit liquidity |

Gain Protector feature for drawdown protection | Weekend holding subject to additional fees |

1-Step, 3-Step, Instant Funding Programs | Limited transparency on commission structure |

Access to DXtrade and cTrader platforms | - |

Seacrest Markets

Seacrest Markets is a Hong Kong-based proprietary trading firm established in 2022 and registered under MyFunded Capital (HK) Ltd, with additional operations in Cyprus.

The company offers structured access to simulated capital through 1-Step and 2-Step evaluation models, with account sizes ranging from $5,000 to $100,000 and scaling potential up to $1 million.

All evaluations are strict Seacrest Markets rules, offering traders a transparent trading environment. Trading is conducted via DXtrade and MatchTrade, covering Forex, metals, indices, cryptocurrencies, and commodities, with more than 175 available assets.

Traders can trade any of the following assets in their desired trading platfrom after completing the Seacrest Markets registration.

Standard leverage is capped at 1:30, while profit splits reach up to 80%, with optional upgrades to 90% through add-ons. Challenge pricing starts from $50, positioning the firm as relatively accessible.

Trading commissions range from $3to $6 per lot for Forex and commodities, while indices and crypto are commission-free. Payouts are processed every two weeks through card and cryptocurrency methods.

Minimum Price | $50 |

Maximum Leverage | Up to 1:30 |

Maximum Profit Split | Up to 80% (90% with Add-on) |

Instruments | Forex, Metals, Indices, Crypto, Commodities |

Assets | 175+ |

Evaluation Steps | 1-Step, 2-Step |

Trading Platform | DXtrade, MatchTrade |

Payout Frequency | Every 2 Weeks |

Seacrest Markets Pros and Cons

Here are the benefits and drawbacks of choosing Seacrest Markets prop firm.

Pros | Cons |

Low entry price starting from $50 | Limited payment methods (No bank transfers) |

Scaling plan up to $1,000,000 | No MetaTrader (MT4/MT5) platform support |

Access to 175+ tradable assets | Restrictions on Expert Advisors (EA) usage |

Bi-weekly payouts with up to 80% profit split | News trading limitations on funded accounts |

What is DXtrade Trading Platfrom?

DXtrade is a web-based trading platform developed by Devexperts, designed to provide brokers and proprietary trading firms with a stable and controlled environment for managing evaluated and funded accounts.

it has positioned itself as a lightweight solution focused on operational discipline and real-time risk supervision rather than advanced charting or automation.

The platform operates entirely through a browser, allowing traders to access markets using secure credentials without software installation.

DXtrade supports trading in Forex, indices, commodities, cryptocurrencies, and CFDs, with direct integration into broker and prop firm servers to enforce drawdown limits, position sizing rules, and leverage controls.

Its interface emphasizes clarity, fast execution, and efficient position management, making it suitable for both beginners and disciplined discretionary traders.

Technical indicators include:

- RSI indicator

- MACD indicator

- ATR indicator

- Moving Average indicator

- Stochastic

- Bollinger Bands

Custom indicators and algorithmic trading are not supported.Due to its low operational cost, transparent performance tracking, and strong compliance framework, DXtrade remains widely used in evaluation programs of famous top-tier prop firms.

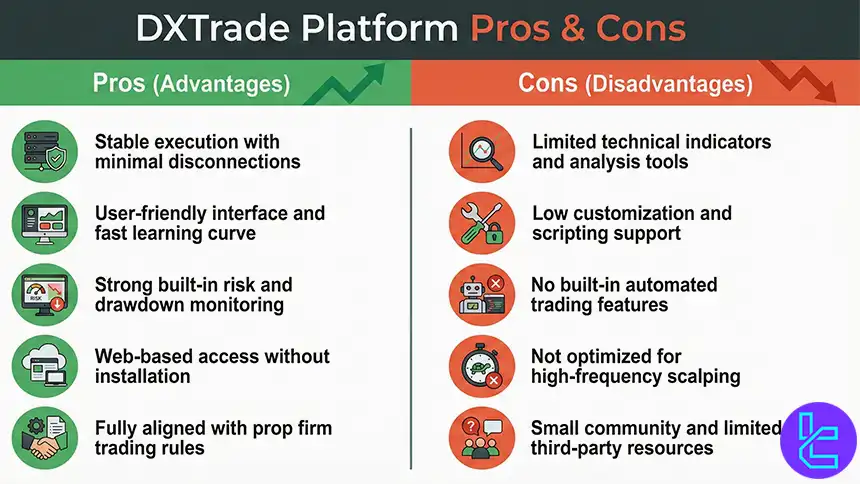

Pros and Cons of DXtrade Platform

The table below showcases some of the most important advantages and disadvantages of trading with DXtrade.

Pros | Cons |

Developed by Devexperts with a strong focus on execution stability, offering fewer disconnections, minimal chart freezing, and consistent order processing during high volatility | Limited built in technical indicators and analytical tools compared with TradingView, MetaTrader, and NinjaTrader |

Simple and intuitive interface with a low learning curve, allowing traders to focus on execution quality, discipline, and risk management | Restricted customization options, with no support for complex scripts, advanced layout design, or deep interface personalization |

Advanced risk control features including real time monitoring of daily drawdown, maximum loss, and open position exposure, suitable for evaluated and funded accounts | No native support for automated trading systems, Expert Advisors, or algorithmic strategies |

Web based platform with browser access, enabling multi device trading without installation and supporting mobile and remote workflows | Less suitable for aggressive scalping and high frequency trading due to structural and execution constraints |

Designed to align with proprietary trading firm rules, including loss limits and operational restrictions, reducing the risk of rule violations | Smaller user community compared with MetaTrader, resulting in fewer third-party indicators, tutorials, and specialized forums |

Understanding the benefits and drawbacks of using this trading platform.

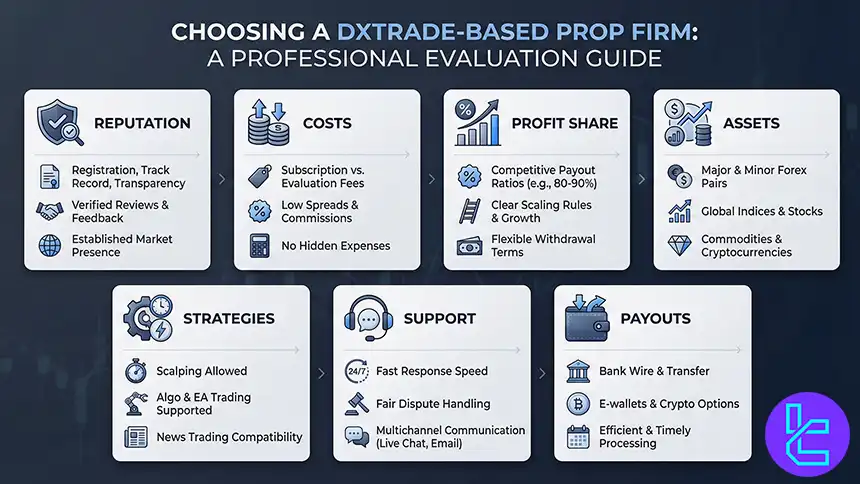

Factors to Choose the Best Prop Firm that Offers DXtrade Platform

Selecting a DXtrade-based prop firm requires more than comparing prices or marketing claims. Traders should evaluate each provider through a structured, data-driven lens that considers operational reliability, trading conditions, and long-term sustainability.

The following key factors provide a practical framework for evaluating DXtrade prop firms:

- Operational Reputation: Assess the firm’s registration status, operating history, public transparency, and presence in professional trading communities. Established firms with multi-year activity records and verifiable user feedback generally indicate stronger operational continuity;

- Cost Structure and Fee Model: Analyze whether the firm uses recurring subscription fees or one-time evaluation payments. Review platform-related expenses, broker-linked trading fees, and disclosure policies to understand the full cost of participation;

- Profit-Sharing Framework: Examine payout distribution models, including standard profit split ratios, scaling conditions, and withdrawal eligibility rules. Higher transparency in profit allocation reduces long-term uncertainty;

- Tradable Asset Coverage: Review the range of supported instruments, including Forex pairs, indices, commodities, and cryptocurrencies, as offered through the DXtrade infrastructure and partner brokers;

- Strategy Compatibility: Verify policy statements regarding scalping, algorithmic trading, news trading, hedging, and high-frequency execution to ensure alignment with the trader’s operational model;

- Client Support Infrastructure: Evaluate response time, technical support availability, dispute resolution procedures, and communication channels used by the firm. Reliable support is essential for account management and payout processing;

- Payout Methods and Processing Speed: Review supported withdrawal channels such as bank transfers, digital wallets, and cryptocurrency networks, along with average internal approval timelines and transaction transparency.

Is DXtrade Available in All Devices?

DXtrade is built around a browser-first and mobile-oriented architecture, prioritizing cross-platform accessibility over traditional desktop software.

Instead of offering standalone applications for Windows or macOS, the platform relies on cloud-based deployment and responsive interfaces to support flexible trading environments.

From an operational perspective, DXtrade delivers multi-device functionality through the following channels:

- Web-Based Trading Platform: Provides full-featured access via standard web browsers on Windows, macOS, and Linux, without requiring local installation;

- Native Mobile Applications: Supports white-label mobile apps for iOS through the Apple App Store and Android via Google Play Store, enabling direct account management and order execution;

- Mobile Web Interface: Offers a touch-optimized browser version designed for performance and usability on smartphones and tablets;

- TradingView Integration: Connects with TradingView to enable in-platform charting, technical analysis, and market monitoring using widely adopted analytical tools.

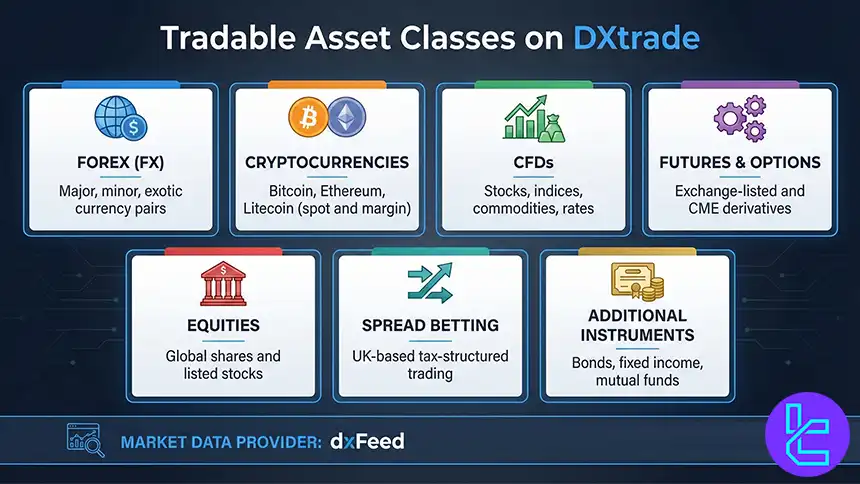

What Instruments Can I Trade in DXtrade?

DXtrade operates as a multi-asset trading platform designed to support diversified market access across multiple financial segments.

Its modular infrastructure allows brokers and prop firms to configure instrument coverage based on regulatory frameworks, liquidity partnerships, and client profiles, enabling flexible exposure to both traditional and digital markets.

The platform’s core tradable asset categories include:

- Foreign Exchange (FX): Provides access to major, minor, and exotic currency pairs, supporting both speculative and hedging strategies in global currency markets;

- Cryptocurrencies: Enables spot and margin trading for leading digital assets such as Bitcoin, Ethereum, and Litecoin, depending on broker configuration and jurisdiction;

- Contracts for Difference (CFDs): Covers equities, stock indices, commodities, and interest rate products through derivative-based trading structures;

- Futures market and Options: Supports selected commodity and exchange-listed derivatives, including CME-related futures and options instruments;

- Equities and Shares: Offers access to listed stocks from major international exchanges, subject to brokerage integration;

- Spread Betting: Facilitates tax-structured spread betting services for eligible UK-based users;

- Additional Instruments: Fixed-income products, bonds, and mutual funds based on institutional partnerships.

Market data and price feeds are delivered through dxFeed, providing real-time pricing, liquidity aggregation, and analytics support for both retail and professional trading environments.

DXtrade Platform in Comparison to Other Trading Platforms

While DXtrade is an all-in-one trading platform for many prop firm traders, it might not be the best available option for all traders since there are great competitors in this space.

The table below offers in sights on the key differences of this trading platform and other notable options.

Comparison Parameter | DXtrade | |||

Primary Use Case | Web-based execution for prop firm evaluations and funded accounts with real-time risk control | Forex & CFD trading | Multi-asset trading | Charting & market analysis |

Tradable Assets | Forex, indices, commodities, cryptocurrencies, CFDs (broker-dependent) | Mainly Forex, CFDs | Forex, stocks, indices, commodities, crypto | Forex, stocks, crypto, futures |

Order Types | Market, Limit, Stop, OCO (One Cancels the Other) | Market, Buy/Sell Limit, Buy/Sell Stop, Trailing Stop | Market, Buy/Sell Limit, Buy/Sell Stop, Buy/Sell Stop Limit, Trailing Stop | Market & Limit (broker-dependent), alerts-based execution |

Algorithmic Trading | No support for EAs, custom indicators, or automated strategies | Yes (MQL4 EAs) | Yes (MQL5 EAs) | Limited (via Pine Script strategies) |

Chart Types | Candle, Bar, Line, Area, Heikin-Ashi, Scatter, Hollow Candles, Histogram, Baseline | Candlestick, Bar, Line | Candlestick, Bar, Line | Candlestick, Heikin Ashi, Renko, Kagi, Line Break, Point & Figure |

Strategy Backtesting | Not supported | Single-threaded | Multi-threaded | Bar Replay (manual) |

Social / Community Features | No | No | No | Yes (ideas, streams, chat) |

Platform Access | Web-based, iOS app, Android app, mobile web (no desktop software) | Desktop, Web, Mobile | Desktop, Web, Mobile | Web, Desktop, Mobile |

Typical User Profile | Prop firm traders focused on rule compliance and disciplined execution | Algorithmic & retail Forex traders | Advanced multi-asset traders | Analysts & discretionary traders |

Price | Provided by broker or prop firm | Free platform (broker-provided) | Free platform (broker-provided) | Free plan + paid subscriptions |

Conclusion

Based on this detailed review of the best prop firms that offer DXtrade platform, FTMO, Alpha Capital Group, Funded Trading Plus, and Lark Funding are some of the best available options.

Besided offering DXtrade, all these platforms have been reviewed and selected based on the cost of their evaluations, profit splits, trading commissions, spreads, leverage, and trading rules.

To learn about TradingFinder prop firm methodology and understand how we evaluate proprietary trading firms, their challenges, costs, reliability, and more.