AquaFunded processes your payout orders in 1-2 business days, or you’ll be compensated an extra $1000. The Prop firm was founded in 2023 by "Jason Blax, Franco Crean, and Sean Bainton".

It has 118,000+ traders, and payouts are available just after 14 days of the first trade, with add-ons for on-demand and 7-days available for purchase at checkout.

AquaFunded Prop firm (Introduction + Features)

The company aims to empower traders and foster sustainable success. Since its launch in 2023, The UAE-based Prop firm has quickly gained a reputation for its trader-friendly policies and innovative approach.

Key features that make AquaFunded stand out include:

- 90% Profit Split (upgradeable to 100%): The firm offers a 90% standard profit split, allowing traders to keep the bigger share of their hard-earned profits. An upgrade to a 100% profit split is available at checkout;

- Fast Bi-Weekly Payouts (upgradeable to on-demand): Payouts are available just 14 days after the first trade, with add-ons for on-demand and 7-days that are available at checkout;

- Competitive Profit Targets: The profit goal ranges from 5-10%;

- No Hidden Rules: The firm prides itself on transparency, with no restrictive rules hampering traders' strategies;

- 100% Refundable Fees: The one-time challenge fees are fully refundable after the 4th payout;

- Scalable Capital: High-performing traders can see their accounts scaled up to $4 million in trading capital;

- Global Reach: Based in Dubai, the firm leverages its location to provide worldwide access to deep liquidity markets.

The company is headquartered at Dubai Silicon Oasis, DDP Building A2, Dubai, UAE.

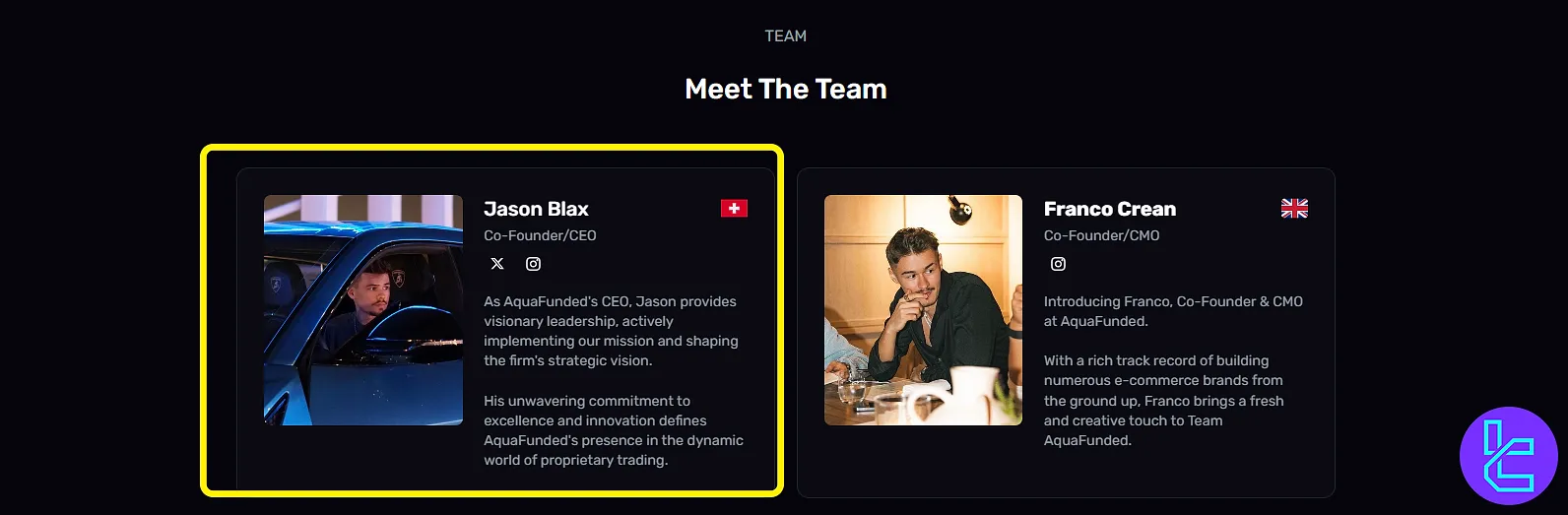

AquaFunded CEO

As the Co-Founder and CEO of AquaFunded, Jason Blax plays a pivotal role in shaping the firm's long-term vision and operational speed. Since launching the firm in 2023, his leadership has started.

AquaFunded Specifications Summary

The Company’s features reflect its commitment to providing traders with a robust and flexible trading environment. The firm's use of reputable brokers and the popular MT5 platform ensures traders have access to reliable tools and deep liquidity.

The generous profit split and frequent payouts are attractive features that set AquaFunded prop apart in the competitive prop firm landscape.

Account currency | N/A |

Minimum price | $39 |

Maximum leverage | Up to 1:100 |

Maximum profit split | Up to 100% |

Instruments | Forex, Commodities, Indices, Crypto |

Assets | Unspecified |

Evaluation steps | 1-phase, 2-phase, 3-phase, Instant Funding |

Withdrawal methods | Bank transfer, Apple Pay, Crypto payouts via Rise |

Maximum fund size | Up to $4M |

First profit target | From 6% |

Max. daily loss | Up to 10% |

Challenge time limit | None |

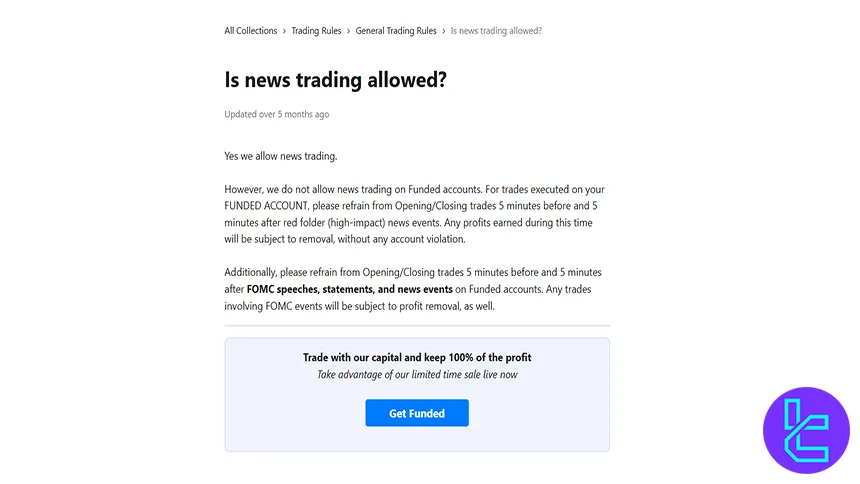

News trading | Prohibited in a 5-minute time frame before and 5 minutes after news releases, as well as FOMC speeches, statements, and news events (only on Funded |

Maximum total drawdown | 6% |

Trading platforms | Match Trade, TradeLocker, Meta Trader 5, cTrader |

Commission | $5 per lot for Forex and Commodities |

TrustPilot score | 3.8 out of 5 |

Payout frequency | Bi-weekly (on-demand or 7-days with an add-on) |

Established country | UAE |

Established year | 2023 |

AquaFunded Pros & Cons

When considering any proprietary trading firm, weighing the advantages and disadvantages is crucial. Flexible evaluation process, high leverage options, and the ability to trade on various markets are some of the firm’s key advantages.

Here's a balanced look at AquaFunded pros & cons.

Pros | Cons |

Exceptional 90% split (with an add-on for 100%) | Relatively new firm (established in 2023) |

Flexible challenges (1-step, 2-step, and 3-step) | Strict drawdown limits |

Generous leverage ratios (up to 1:100 for Forex) | News trading restrictions on funded accounts |

A diverse range of trading instruments | Reports of higher slippage compared to some competitors |

Bi-weekly payouts (with an add-on for on-demand or 7-days) | Reports of delays in receiving credentials after evaluation |

Access to Instant Funding | - |

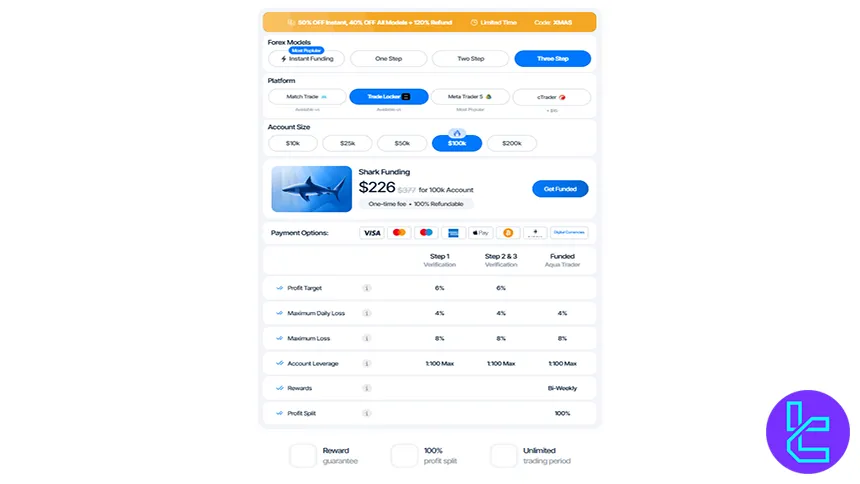

AquaFunded Funding & Price

The next step in the AquaFunded review is Funding. The firm has designed its funding structure to be accessible and scalable, catering to traders with various experience and capital levels.

Here's a breakdown of their funding options and associated pricing.

Account Size | 1 Step | 1 Step Pro | 2 Step | 2 Step Pro | 3 Step | Instant Funding | Instant Funding Pro |

$2.5K | N/A | N/A | N/A | N/A | N/A | $64 | $60 |

$5K | $67 | $59 | $57 | $39 | N/A | $117 | $115 |

$10K | $113 | $99 | $103 | $76 | $77 | $158 | $155 |

$25K | $227 | $199 | $217 | $138 | $157 | $317 | $310 |

$50K | $327 | $289 | $317 | $247 | $237 | $475 | $465 |

$100K | $527 | $459 | $517 | $460 | $377 | $767 | $750 |

$150K | N/A | N/A | N/A | N/A | N/A | N/A | $980 |

$200K | $1,017 | $899 | $997 | $925 | $677 | $1,265 | $1,250 |

$250K | N/A | N/A | N/A | N/A | N/A | $1,560 | $1,540 |

$300K | N/A | N/A | N/A | N/A | N/A | $1,810 | $1,790 |

$400K | N/A | N/A | N/A | N/A | N/A | N/A | $2,449 |

It's worth noting that the company’s pricing is relatively competitive within the prop firm industry, especially considering the high profit split and refundable fee structure.

AquaFunded Account Opening & Verification

AquaFunded registration process is fast and straightforward. Within minutes, you’ll have access to your personal dashboard, ready to explore trading challenges and rules.

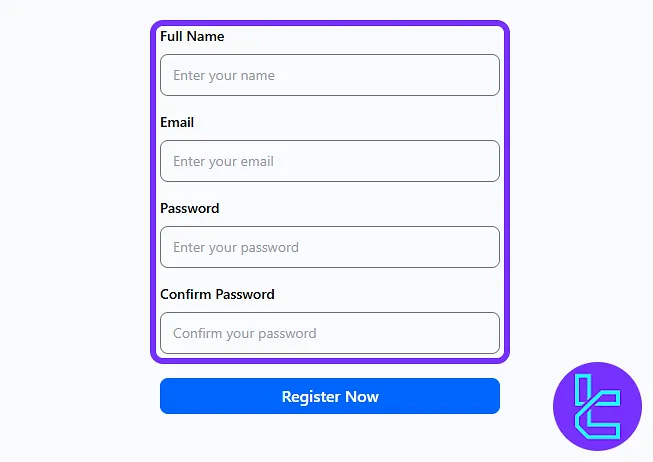

#1 Navigate to the Registration Form

Go to the AquaFunded homepage, click on “Log In”, then select “Create one” to launch the sign-up form.

#2 Enter Your Account Details

Fill in your full name and email address, and set a secure password. Once complete, hit “Register Now” to proceed.

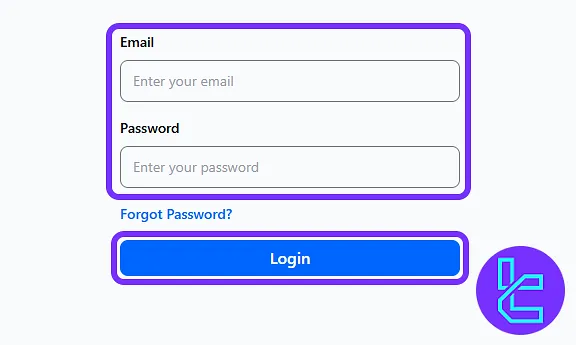

#3 Access Your Trading Dashboard

Return to the login screen, input your credentials, and select “Login”. You’ll be instantly redirected to your AquaFunded dashboard.

#4 Verification

Opening an account with the Prop firm and going through the verification process is designed to be straightforward yet thorough. Here's a step-by-step guide to the AquaFunded prop sign-up process.

Upon purchasing a challenge, you can start the evaluation phase right away. After passing the challenge, you’ll get a real funded account.

But before that, you need to complete the KYC. Use the steps provided in the AquaFunded review to complete the verification process.

- Navigate to the “KYC Verification” in the firm’s dashboard;

- Choose the type of identification.

- Upload a vivid picture of your ID;

- Wait for the confirmation email in your inbox.

Remember, the verification process is crucial for maintaining the program's integrity and ensuring compliance with financial regulations.

AquaFunded Evaluation Steps

The company's evaluation processes, known as "The Wave" and "The Ripple," are designed to identify skilled traders who can consistently generate profits while managing risk effectively.

Here's a breakdown of the AquaFunded evaluation steps.

Features | 1 Step | 1 Step Pro | 2 Step | 2 Step Pro | 3 Step | Instant Funding | Instant Funding Pro |

Trading Period | No time limits | No time limits | No time limits | No time limits | No time limits | No time limits | No time limits |

Profit Target | 9% | 6% | 8% - 5% | 10% - 5% | 6% - 6% | - | - |

Maximum Daily Loss | 3% - 3% | 3% - 3% | 5% - 5% | 5% - 5% | 4% - 4% - 4% | None | 3% |

Maximum Loss | 6% - 6% | 6% - 6% | 8% - 8% | 10% - 10% | 8% - 8% - 8% | 3% | 6% |

Leverage | 1:100 MAX | 1:100 MAX | 1:100 MAX | 1:100 MAX | 1:100 MAX | 1:50 | 1:50 |

Payouts | Bi-Weekly (Add-on 7-days) | Bi-Weekly (Add-on 7-days) | Bi-Weekly (Add-on 7-days) | Bi-Weekly (Add-on 7-days) | Bi-Weekly (Add-on 7-days) | Bi-weekly (Add-on on-demand) | Bi-weekly (Add-on on-demand) |

Profit Split | 90% (100% with an add-on) | 90% (100% with an add-on) | 90% (100% with an add-on) | 90% (100% with an add-on) | 90% (100% with an add-on) | 90% (100%) | 90% (100%) |

The firm has set a "trailing" drawdown type, which is updated daily based on the highest equity or balance reached by 7 PM EST (00:00 UTC).

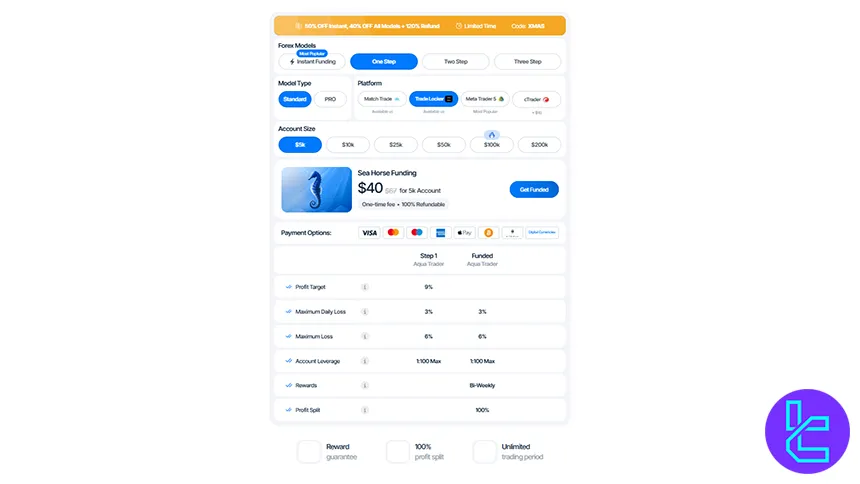

AquaFunded 1 Step

The 1-Step Challenge is built for traders who want funding without long waiting periods or multi-phase evaluations.

With no time limits, a 6-9% profit target (standard vs. pro version), and 90% profit split, which is upgradeable to 100% with an add-on. This model gives you the freedom to focus on performance instead of bureaucracy.

Enjoy bi-weekly payouts (with an add-on for payouts in 7 days), 1:100 MAX leverage, and fair drawdown limits (6% max loss, 3% daily). AquaFunded’s 1-Step plan lets you scale without restrictions or delays.

Features | 1 Step | 1 Step Pro |

Trading Period | Unlimited | Unlimited |

Profit Target | 9% | 6% |

Maximum Daily Loss | 3%-3% | 3%-3% |

Maximum Loss | 6%-6% | 6%-6% |

Leverage | 1:100 MAX | 1:100 MAX |

Payouts | Bi-weekly (7-days with an add-on) | Bi-weekly (7-days with an add-on) |

Profit Split | 90% (100% with an add-on) | 90% (100% with an add-on) |

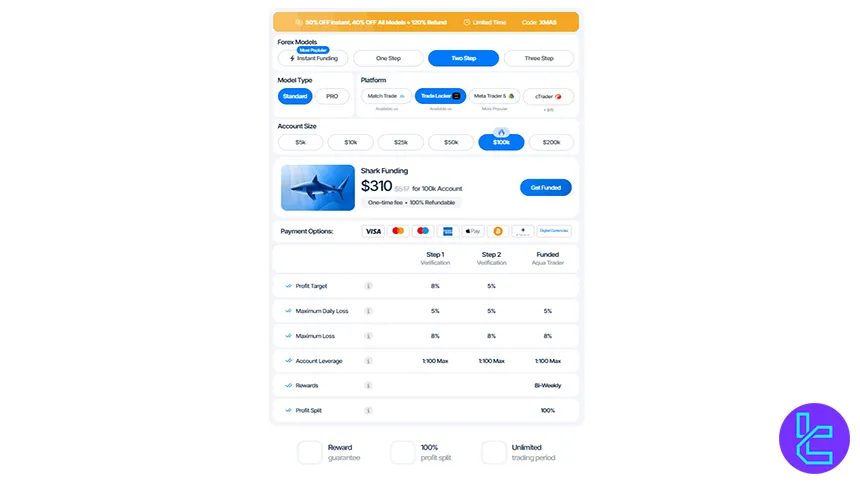

AquaFunded 2 Step

The 2-Step Challenge offers a structured path to funding with clearly defined targets and rules, ideal for traders who thrive under discipline. With unlimited time, the first and second phases require 8% and 5% profit respectively, while the Pro version raises the bar to 10% and 5%.

Both models maintain bi-weekly payouts, a generous 90% profit split (100% with an add-on), and balanced drawdown rules (5% daily, 8–10% overall). Traders benefit from up to 1:100 MAX leverage, depending on the instrument. Whether you choose standard or pro, the 2-Step format gives you time and structure without compromise.

Features | 2 Step | 2 Step Pro |

Trading Period | Unlimited | Unlimited |

Profit Target | 8% - 5% | 10% - 5% |

Maximum Daily Loss | 5% - 5% - 5% | 5% - 5% - 5% |

Maximum Loss | 8% - 8% - 8% | 10% - 10% - 10% |

Leverage | 1:100 MAX | 1:100 MAX |

Payouts | Bi-weekly (7-days with an add-on) | Bi-weekly (7-days with an add-on) |

Profit Split | 90% (100% with an add-on) | 90% (100% with an add-on) |

AquaFunded 3 Step Challenge

The 3-Step Challenge is designed for traders who excel in steady, disciplined performance over time. With three evaluation phases, each requiring a 6% profit target, this model promotes consistency at every level.

Risk parameters remain tight but fair: 4% daily and 8% overall drawdown across all steps. You’ll trade with 1:100 MAX leverage, keep 100% of your profits, and enjoy bi-weekly or 7-day payouts.

If you value structure and long-term growth, the 3-Step plan offers a methodical route to capital, without pressure or compromise.

Features | 3 Step |

Trading Period | Unlimited |

Profit Target | 6% - 6% - 6% |

Maximum Daily Loss | 4% - 4% - 4% - 4% |

Maximum Loss | 8% - 8% - 8% - 8% |

Leverage | 1:100 MAX |

Payouts | Bi-weekly (7-days with an add-on) |

Profit Split | 90% (100% with an add-on) |

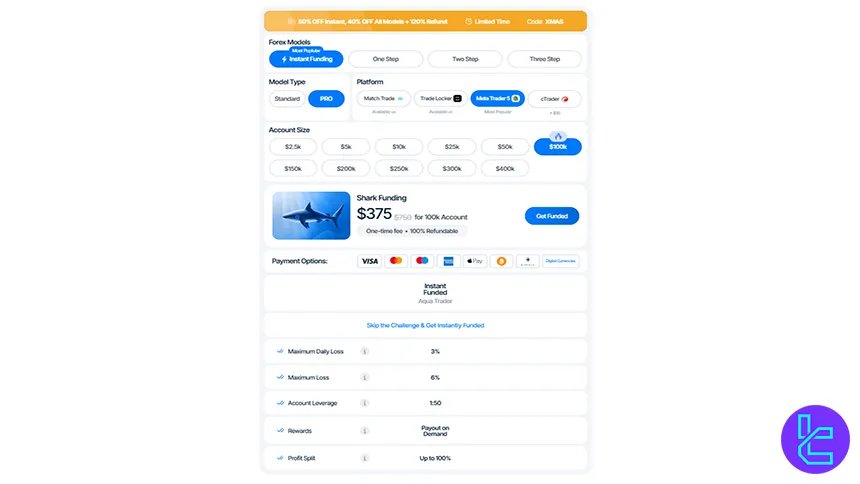

AquaFunded Instant Funding

The Instant Funding model is made for traders ready to go live, without evaluation or delays. Get immediate access to capital with drawdown limits of just 0-3% daily and 3-6% overall, depending on the plan you choose.

Leverage goes up to 1:50, and payouts are processed bi-weekly, with an add-on for on-demand payments available at checkout.

With a profit split of up to 100%, this plan gives experienced traders a direct path to funded trading. No tests, just results. AquaFunded instant funding challenge:

Features | Instant Funding | Instant Funding Pro |

Trading Period | - | - |

Profit Target | - | - |

Maximum Daily Loss | None | 3% |

Maximum Loss | 3% | 6% |

Leverage | 1:50 | 1:50 |

Payouts | Bi-weekly (on-demand with an add-on) | Bi-weekly (on-demand with an add-on) |

Profit Split | 90% (100% with an add-on) | 90% (100% with an add-on) |

Bonus and Promotions in AquaFunded

Bonuses are the incentives that the company uses to attract new customers and reward existing ones for their loyalty.

AquaFunded offers multiple promotional programs, including:

- WELCOME 50%: Get 50% OFF plus $100 towards your first reward on most account types including Instant Pro, 1 Step, 2 Step, and 3 Step challenges (use code: WELCOME at checkout);

- 60% OFF Special: AquaFunded's biggest discount is available exclusively on $5K Two Step accounts (use code: AQUA5 at checkout);

- Buy One Get One Free: Purchase any challenge account and receive a free account of the same size after you complete your first payout. Your initial account includes an automatic 30% discount and 100% fee refund (use code: BOGO at checkout);

- AQUA MAN Challenge: A limited-edition 1 Step challenge with only a 2% profit target. This special offer drops twice per month on random weekends with only 100 accounts available per drop, monitor your email and app notifications to catch the next release;

- Reward Points System: Earn 1 point for every $1 spent on AquaFunded accounts. Redeem 500 points for a free Instant Funded account or use your points for up to 60% off on future challenges;

- Affiliate program: Earn up to 20% commission on all traders you recommend, with bi-weekly payouts and a $100 minimum withdrawal.

To get the latest updates on bonuses and promotion plans, following the firm on social media and checking its website is essential.

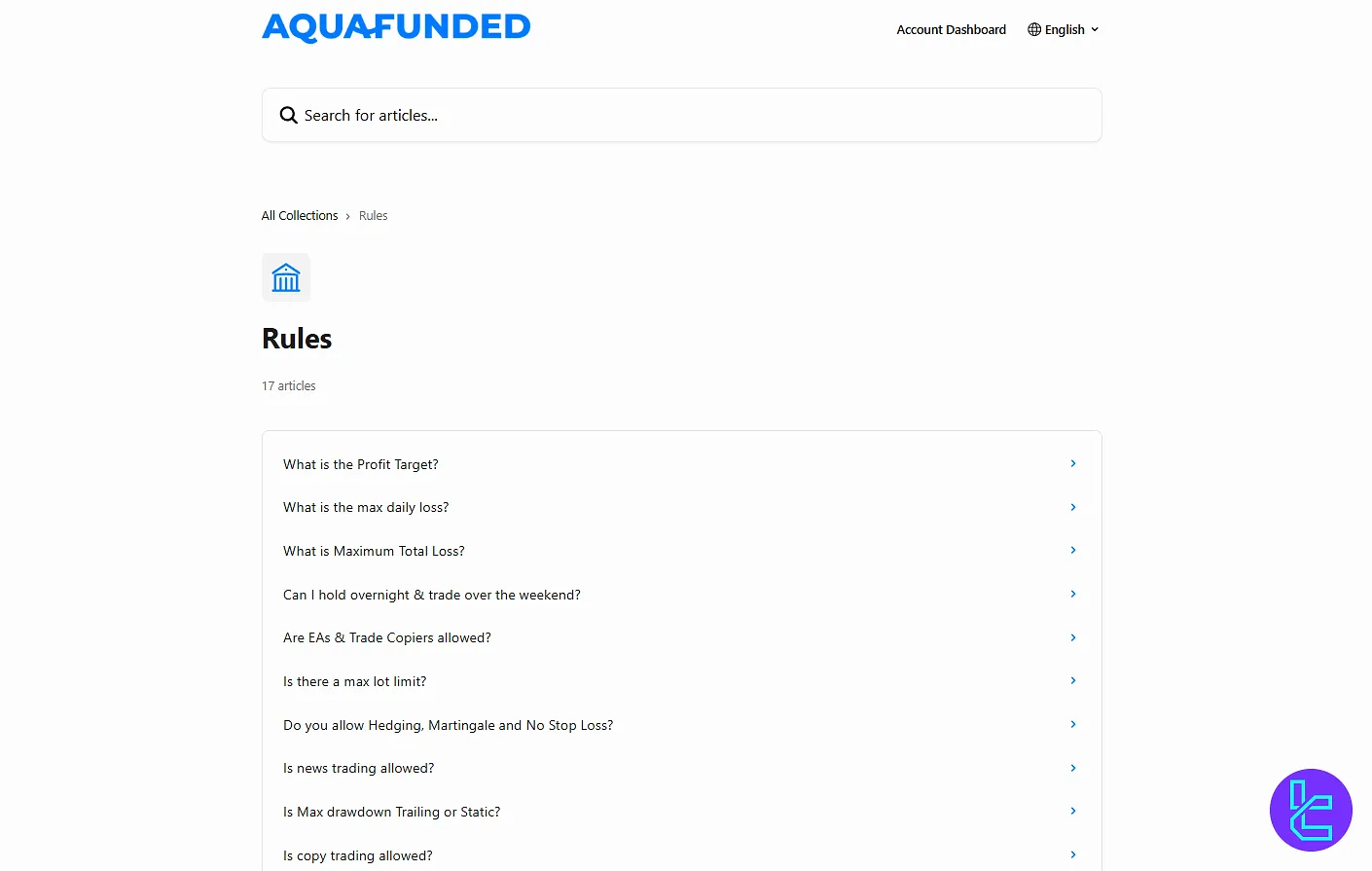

AquaFunded Rules

You must trade by the rules set by the prop firm; otherwise, your account might be closed. A summary of AquaFunded Rules and allowed trading activities:

- Copy Trading: Yes, allowed

- News Trading: Allowed during evaluation; restricted on funded accounts (see below)

- Weekend Holding: Yes, allowed

- EAs (Expert Advisors) and Trade Copiers: Yes, allowed

- Hedging: Allowed within the same account

- Martingale: Allowed

- Hold Overnight: Allowed

- Stop Loss: Not required. Trade according to your own risk management style

- Max Lot Size: No maximum lot limit enforced

Beside allowed trading activities, there are prohibited trading strategies and activities:

- Platform Data Freezing: Exploiting demo server errors is prohibited

- Delayed Data Feed: Prohibited

- Trading Delayed Charts: Prohibited

- Tick Scalping: Prohibited

- High Frequency Trading (HFT): Prohibited

- Arbitrage Bots: All types prohibited, including reverse, latency, and hedge arbitrage

- Emulators: Prohibited

- All-or-Nothing Trading: Margin usage exceeding 80% in a single trade is classified as gambling and prohibited

- Password Changes: Not allowed. You must use the exact password sent via email

News Trading Rules (Funded Accounts Only)

- No opening or closing trades from 5 minutes before to 5 minutes after high-impact red-folder news events;

- Same 5-minute window restriction around FOMC speeches, statements, and events;

- Profits made violating these timing rules may be removed, but the account is not automatically breached.

Payout

Affiliate payouts are processed bi-weekly meaning you’ll receive your commissions every 14 days, as long as you’ve reached the $100 minimum threshold.

Add-ons for on-demand and 7-day payouts are available on checkout, depending on the challenge you choose. To request a payout, simply email your details to affiliates@aquafunded.com.

For amounts under $1,000, payouts are made exclusively in cryptocurrency, supporting:

- Bitcoin (BTC)

- Ethereum (ETH)

- USDC (ERC20)

- Litecoin (LTC)

- USDT (TRC20)

For $1,000 or more, you’ll have access to payouts via Rise in addition to crypto.

When submitting a withdrawal request, include your preferred method and wallet address (if applicable). With flexible options and fast processing, AquaFunded makes sure your earnings reach you—on time and on-chain.

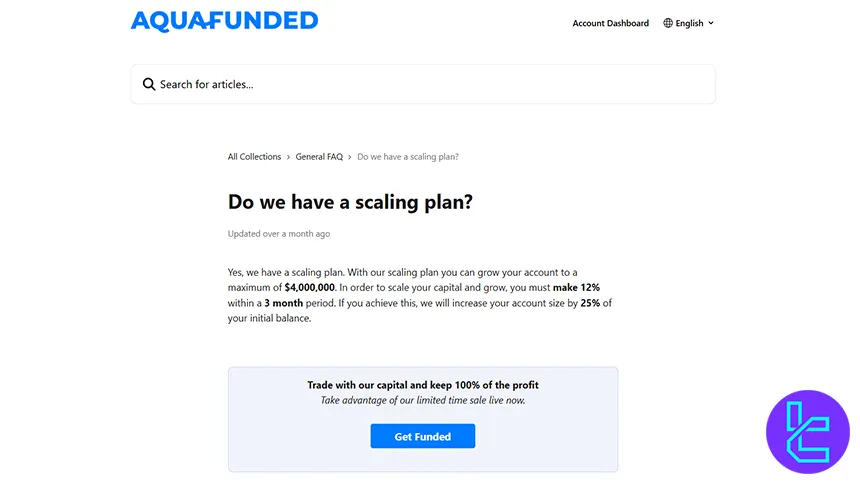

AquaFunded Scaling Plan: Is it Available?

Traders in AquaFunded have the opportunity to gradually increase their account size through a predefined scaling process.

Under this model, the maximum account growth can reach up to $4,000,000. To qualify for an account increase, a trader must generate a 12% return over a 3-month evaluation period.

Once this performance benchmark is met, the account balance is raised by 25% of the original starting capital. This approach allows for measured capital expansion based on consistent trading results.

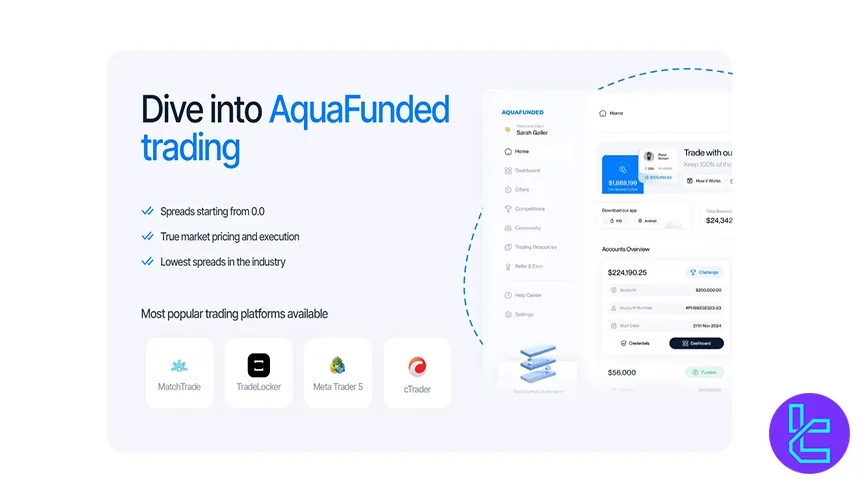

AquaFunded Trading Platforms

Aqua prop firm offers access to robust trading solutions, including MT5, Match Trader, TradeLocker, and cTrader.

Here's a rundown of trading platforms that are worth mentioning in the AquaFunded review:

- MetaTrader 5 (MT5): The most popular platform on the firm, known for its advanced charting, automated trading capabilities, and wide range of technical indicators;

- Match Trader: Multi-device trading solutions with robust features, including economic calendar, 24/7 support, data feed, and many more;

- TradeLocker: Integrated with TradingView, the platform offers real-time market data, risk calculator, trailing stop loss, on-chart trading, and more;

- cTrader: A popular platform among traders, offering fast execution, advanced order types, and a clean interface for technical analysis.

The firm’s commitment to offering multiple platforms reflects its understanding of diverse trader needs and preferences.

Asset Classes and Symbols Available on AquaFunded

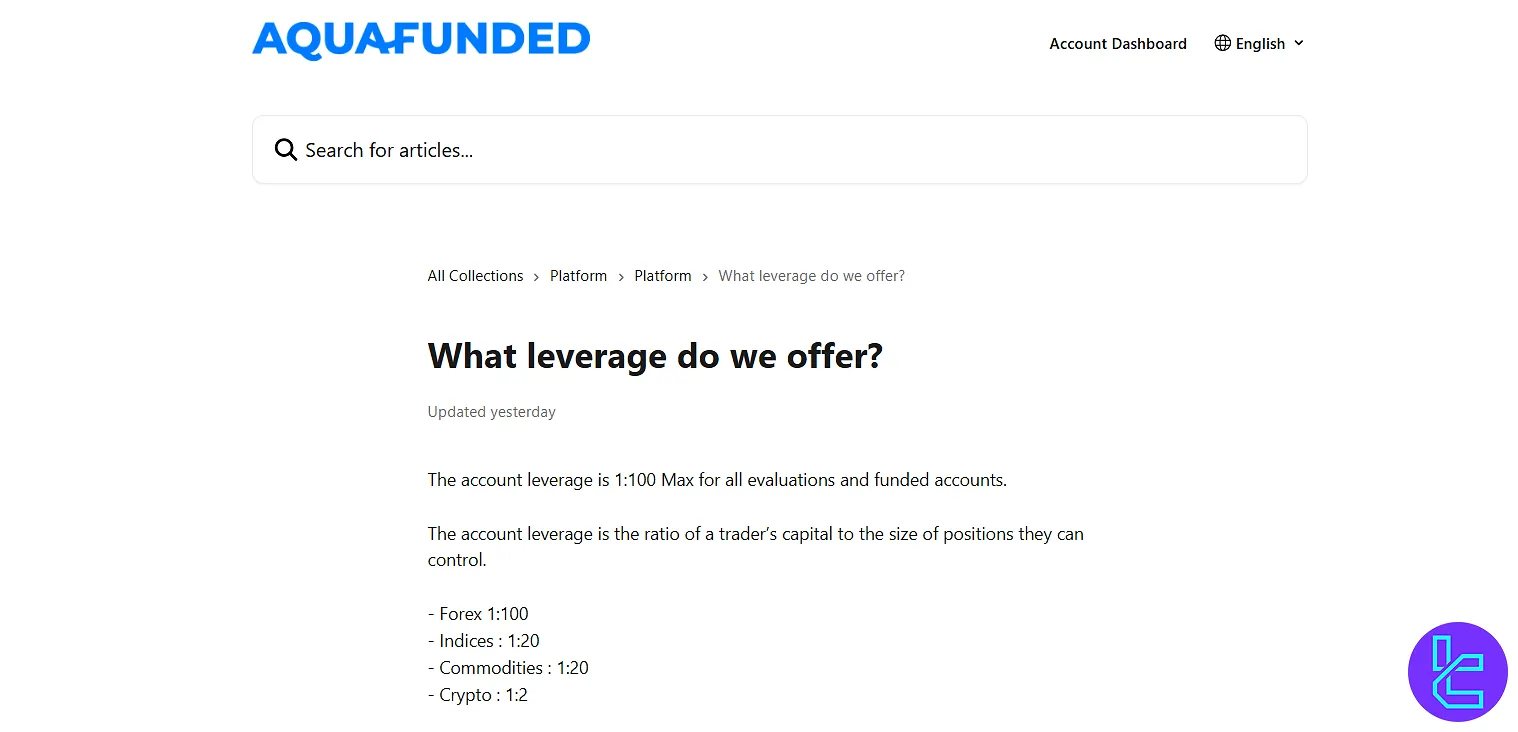

The Prop firm offers various asset classes and symbols, catering to various trading strategies and preferences. You can trade CFDson Forex market, Indices, Commodities, and Crypto with AquaFunded prop. However, each of these instruments comes with a specific leverage limit.

Trading Instrument | Max Leverage |

Forex | 1:100 |

Indices | 1:20 |

Commodities | 1:20 |

Crypto | 1:2 |

AquaFunded Leverage

AquaFunded applies a maximum leverage of 1:100 during all evaluation phases, ensuring traders have the room to manage larger positions with precision.

However, leverage is adapted based on asset class and trading stage to balance opportunity and risk.

Evaluation Phase Max Leverage

- Forex: 1:100

- Indices: 1:20

- Commodities: 1:20

- Crypto: 1:2

Once funded, traders start with reduced leverage to protect capital — Forex: 1:50, Indices & Commodities: 1:10, Crypto: 1:2 — but it can be scaled up again based on risk performance.

Instant Funding Accounts

- Standard: Forex 1:30, Indices/Commodities 1:10, Crypto 1:1

- Pro: Forex 1:50, Indices/Commodities 1:10, Crypto 1:2

This dynamic leverage model helps traders scale responsibly while maintaining high-growth potential in every stage of their journey.

AquaFunded Payment Methods

Understanding the available payment methods and the restrictions that come with each one is crucial when choosing a Prop firm. AquaFunded aims to provide a smooth and efficient payment process for its traders.

Payout Partner | Riseworks.io |

Withdrawal Options | Fiat and Crypto |

Payout Frequency | Bi-Weekly (On-demand or 7 days with an add-on depending on the plan) |

Min. Withdrawal | $100 |

Processing Time | 1-2 Business Days |

Note that to initiate a withdrawal, all open and pending trades must be closed.

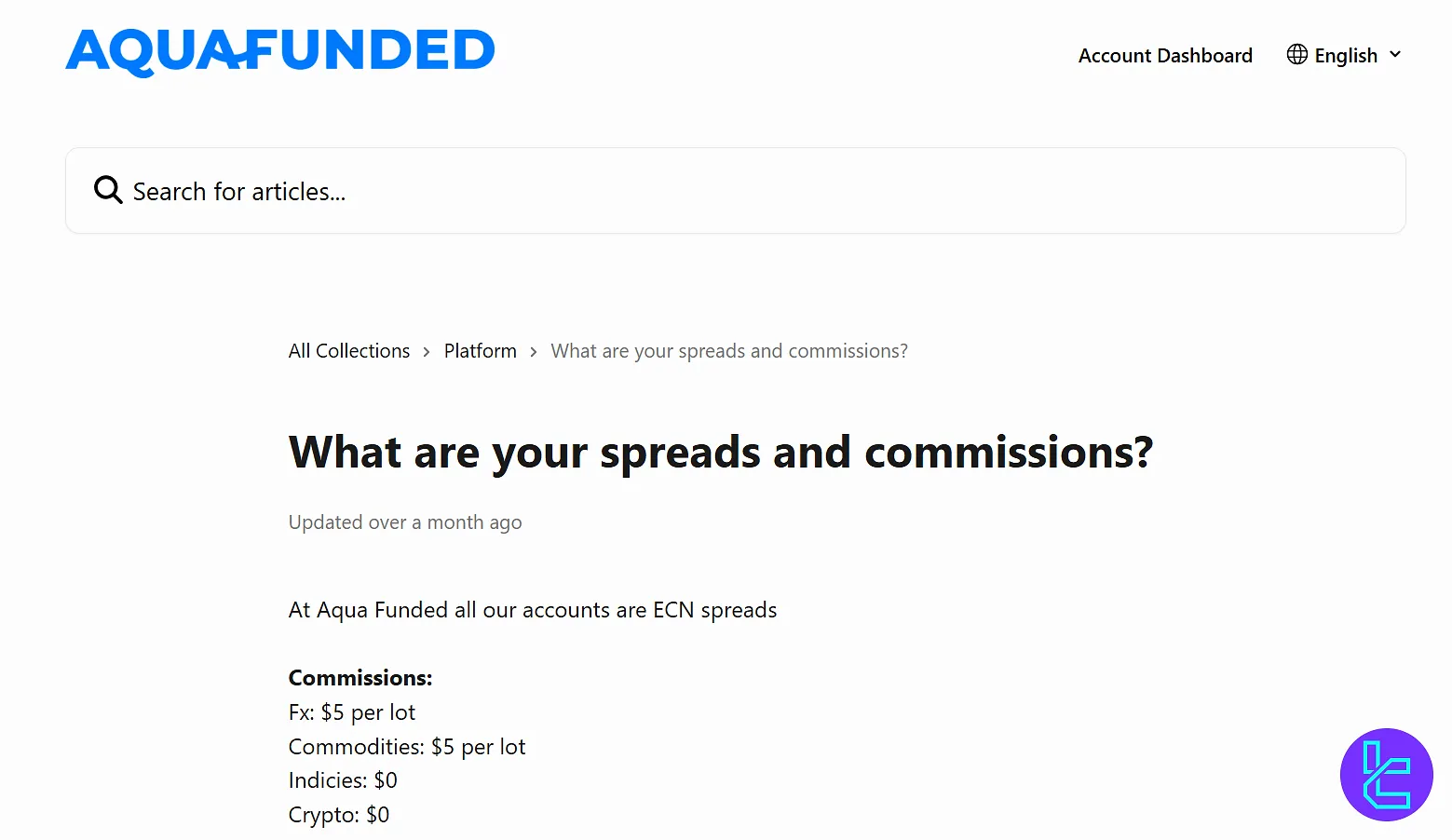

Commission and Trading Fees on AquaFunded

The Prop firm has structured its commission and fee system to be competitive and transparent. AquaFunded offers only ECN spread accounts with fixed commissions.

Trading Instrument | Commission (per lot) |

Forex | $5 |

Indices | $0 |

Commodities | $5 |

Crypto | $0 |

Thus, no matter how big your position is, commission is always the same.

It's worth noting that while the firm’s fee structure is relatively straightforward, the actual trading costs can vary depending on your trading style, frequency, and the specific instruments you trade.

The absence of commissions on indices and cryptocurrencies could be particularly attractive for traders focusing on these markets.

AquaFunded Educational Resources

The firm recognizes the importance of trader education and provides various educational content to support novice and experienced traders.

AquaFunded blog and media offer videos and articles on whatever traders need to know. However, it’s worth mentioning that the firm isn’t much active as it should be.

While the company’s educational offerings may not be as extensive as those of some more established prop firms, they provide a solid foundation for traders to build upon.

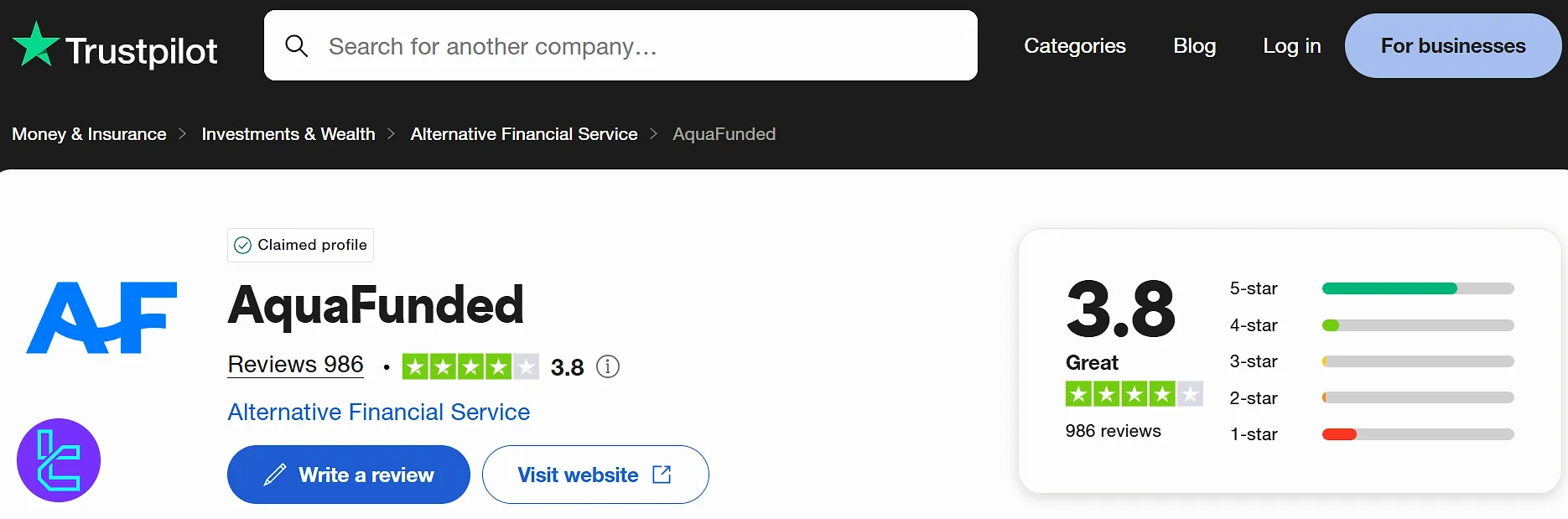

AquaFunded Trust Scores

Trust and reliability are paramount in prop trading, where traders entrust their skills and potential earnings to a firm. While the company is a relatively new entrant in the prop trading space, early indicators suggest a positive reputation among traders.

Here's an overview of the trust factors that we must check in the AquaFunded review.

- ScamAdviser Rating: The firm's website has a 100/100 Trustscore on the mentioned source;

- AquaFunded Trustpilot Score: There are over980 client reviews, which gained the prop firm a score of 3.8 out of 5.

The company doesn’t have a profile on other famous websites like Forex Peace Army. This may be concerning for some traders.

As the company continues to operate and grow, more comprehensive trust scores and third-party reviews will likely become available.

AquaFunded Customer Services

AquaFunded offers four main contact channels, including:

| Support Method | Availability |

| Live Chat | Yes (only available at certain hours of the day) |

| Yes (support@aquafunded.com) | |

| Phone | Yes (+971 43978082) |

| Discord | Yes |

| Telegram | Yes |

| Ticket | Yes (Available on the website) |

| FAQ | Yes |

| Help Center | Yes |

| No | |

| Messenger | No |

Note: AquaFunded support is available 24/7.

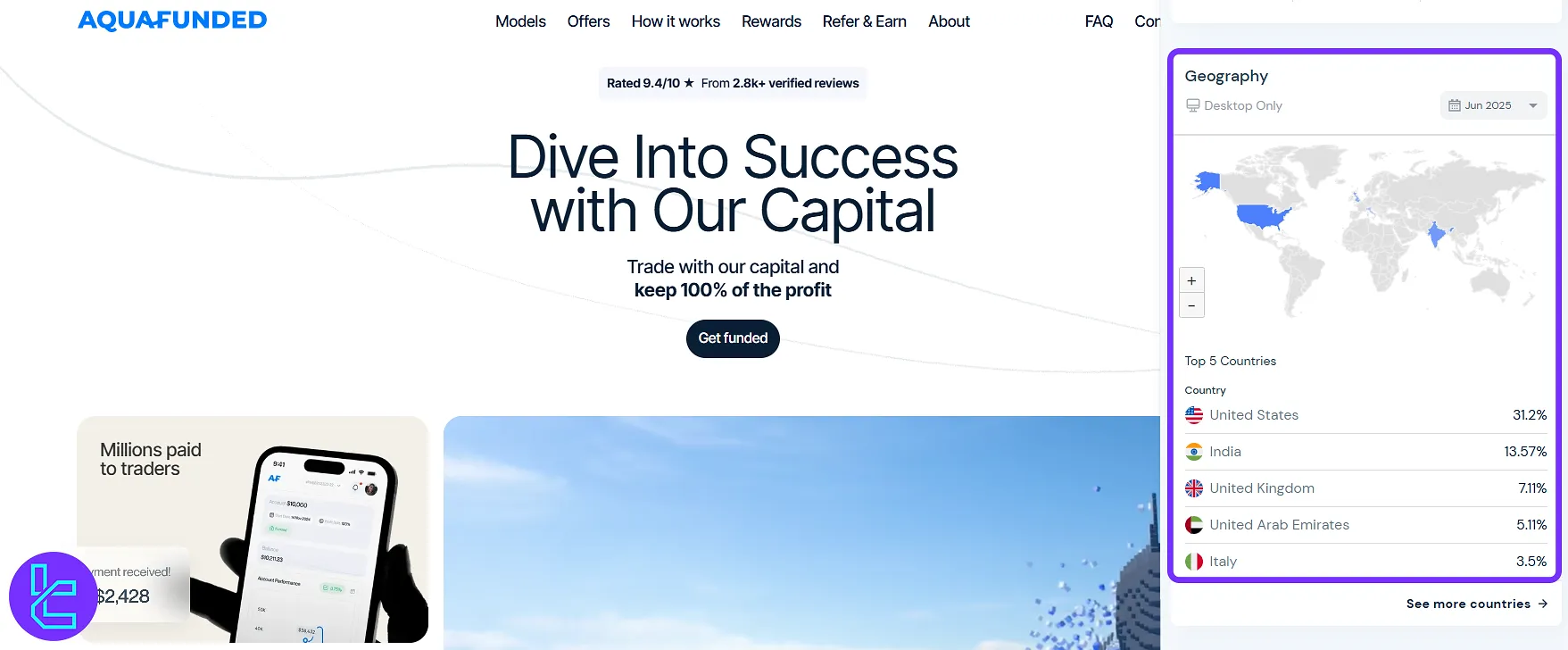

Which Countries Use AquaFunded the Most?

AquaFunded’s global reach is rapidly expanding, with traders from all over the world joining its funding ecosystem. Based on desktop data from June 2025, the United States leads by a significant margin, accounting for 31.2% of total traffic.

Following closely are:

- India with 13.57%

- United Kingdom at 7.11%

- United Arab Emirates contributing 5.11%

- Italy with 3.5%.

AquaFunded Accounts on Social Media

In today's digital age, a strong social media presence is crucial for businesses to engage with their audience and build trust. The Prop firm, recognizing this importance, has established a presence on various social media platforms.

Here's an overview of AquaFunded's social media profiles.

| Social Media | Members/Subscribers |

| Discord | Over 48K |

| Over 26.9K | |

| X (Twitter) | Over 50K |

| Telegram | Over 6K |

| YouTube | Over 5.5K |

AquaFunded in Comparison with Competitors

The table here will go through a comparison between AquaFunded and other major prop firms:

Parameters | AquaFunded Prop Firm | |||

Minimum Challenge Price | $39 | $50 | €55 | $33 |

Maximum Fund Size | $4,000,000 | $2,000,000 | Infinite | $400,000 |

Evaluation steps | 1-Step, 1-Step Pro, 2-Step, 2-Step Pro, 3-Step, Instant Funding, | 1-Step, 2-Step | 2-Step | 1-Step, 2-Step, 3-Step, Instant Funding |

Profit Share | Up to 100% | 90% | 100% | 100% |

Max Daily Drawdown | 5% | 4% | 5% | 7% |

Max Drawdown | 10% | 6% | 8% | 14% |

First Profit Target | 5-10% | 5% | 10% | 6% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:5 | 1:100 | 1:100 |

Payout Frequency | Bi-weekly with add-ons for on-demand and 7-day payouts | Bi-weekly | 14 Days | Weekly |

Number of Trading Assets | N/A | 100+ | 150+ | 40+ |

Trading Platforms | MT5, Match Trader, TradeLocker, cTrader | Proprietary platform | Proprietary platform | MetaTrader 5, Match Trader |

Expert Suggestions

AquaFunded prop has 3 challenges [1-phase, 2-phase, 3-phase] in addition to instant funding models and offers 1:100 maximum leverage. AquaFunded pays its affiliates up to 20% commission (for +250 referrals). On the other hand, it has strict rules, including news trading restrictions.