Quant Tekel provides access to 3 programs [QT Instant, QT Prime, QT Power] and enables retail traders to access up to $2,000,000 in funds for just $1,166.67. You can trade news and use Expert Advisors to achieve the evaluation program’s profit target.

Quant Tekel Prop Firm (Company Information)

Quant Tekel Ltd, founded in October 2023 by Scott Flook, a former investment banker, is a UK-based proprietary trading firm. The company provides retail traders with up to $2,000,000 in virtual funds through its prop firm, QT Funded, to trade and get a 90% profit split.

The prop firm's head office is located at 1 Canada Square, Level 39, Canary Wharf, East London, England, E14 5AB.

But it's not just about the numbers; the firm prides itself on creating an environment conducive to trading success, with features like:

- No time constraints on trading

- Two- and three-phase evaluation programs with achievable profit targets

- Access to instant funding via the QT Instant plan

Previously, the prop firm was known as "Ascendx Capital", but then it was rebranded to Quant Tekel.

Quant Tekel CEO

Based on our investigations and research, there is no certain information regarding the identity of the prop firm's director or chief executive officer. The person is not publicly known.

Quant Tekel Specifications

In-depth account metrics, advanced trading journal, market news, and 24/7 customer support are some of the features that await you in Quant Tekel. But before that, let’s see some specific details.

Account currency | USD |

Minimum price | $26 |

Maximum leverage | Up to 1:100 |

Maximum profit split | Up to 90% |

Instruments | Forex, Commodities, Indices, Crypto |

Assets | N/A |

Evaluation steps | 2-Phase, 3-Phase, Instant Funding |

Withdrawal methods | VISA, MasterCard, UPI, PayPal, Crypto, Local Payment Solutions |

Maximum fund size | $2,000,000 |

First profit target | 6% |

Max. daily loss | 4% |

Challenge time limit | Unlimited |

News trading | Unlimited |

Maximum total drawdown | 10% |

Trading platforms | MT5, cTrader, TradeLocker |

Commission | $2 per lot and $4 per round lot |

TrustPilot score | 4.5 out of 5 |

Payout frequency | Bi-Weekly, On Demand |

Established country | UK |

Established year | 2023 |

Why Quant Tekel (Advantage and Disadvantage)

Choosing the right prop firm is a crucial decision for any trader. Quant Tekel offers a compelling proposition, but like any trading opportunity, it comes with its own set of advantages and disadvantages.

Pros | Cons |

High Profit Share | Relatively New Firm |

No time limits | - |

Relatively Low Profit Targets | - |

Fast payout processing | - |

Funding for Quant Tekel and Related Costs

The firm’s funding model is designed to provide traders with significant capital while maintaining a focus on risk management and trader development.

The account sizes and prices differ based on the selected plan.

Funding and Pricing for QT Instant

QT Instant programs start at a very low account size:

Funding | QT Instant |

1.25K | $26 |

2.5K | $52 |

5K | $84 |

10K | $132 |

25K | $250 |

50K | $460 |

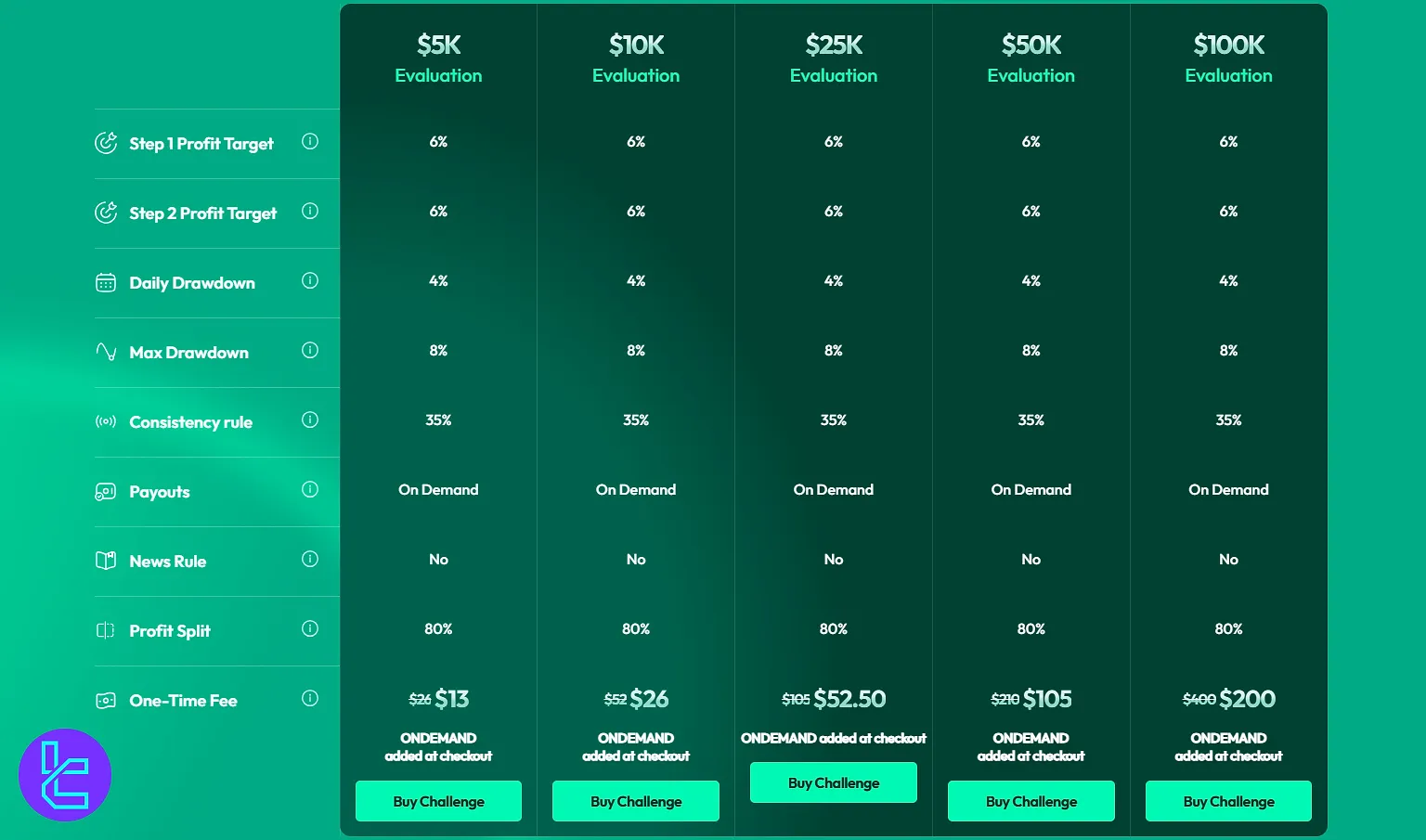

QT Power Sizes and Fees

QT Power accounts go up to a higher limit than the instant funding plans:

Funding | Fees |

5K | $26 |

10K | $52 |

25K | $105 |

50K | $210 |

100K | $400 |

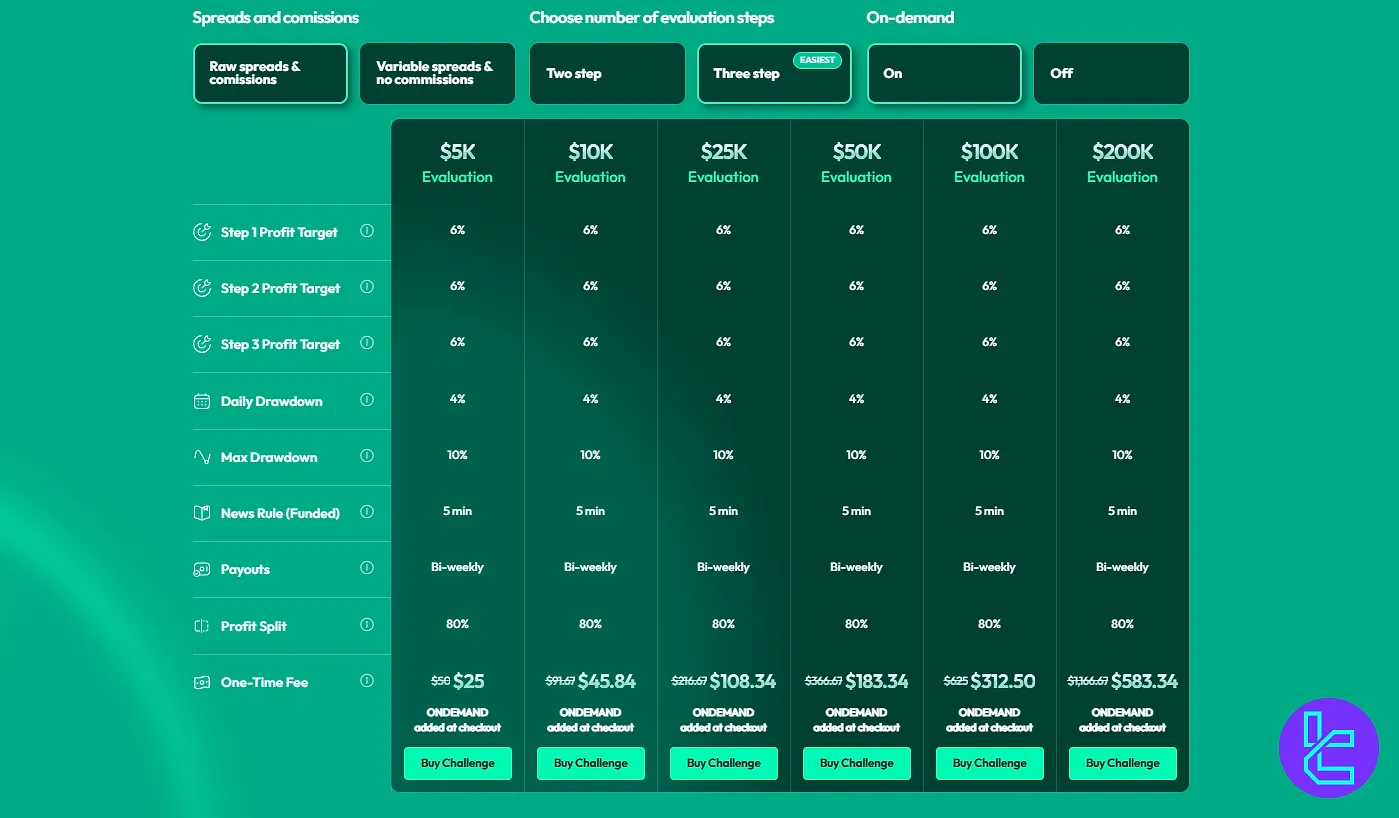

Funding and Pricing for QT Prime

The plans in this model are divided into two-step and three-step categories:

Funding | Two Step | Three Step |

$5K | $60 | $50 |

10K | $110 | $91.67 |

25K | $230 | $216.67 |

50K | $360 | $366.67 |

100K | $680 | $625 |

200K | $1,300 | $1,166.67 |

Note that Quant Tekel allows traders to increase their funding up to $2M through the scaling program.

Registration and Verification on Quant Tekel

To get funded up to $2,000,000 and enjoy a 90% profit share, you need to create an account. Stages of the Quant Tekel registration are explained in the following sections.

#1 Go to the Website

Navigate to the prop firm's official website at its genuine URL. From there, find the "Sign up" button at the top of the page and click on it.

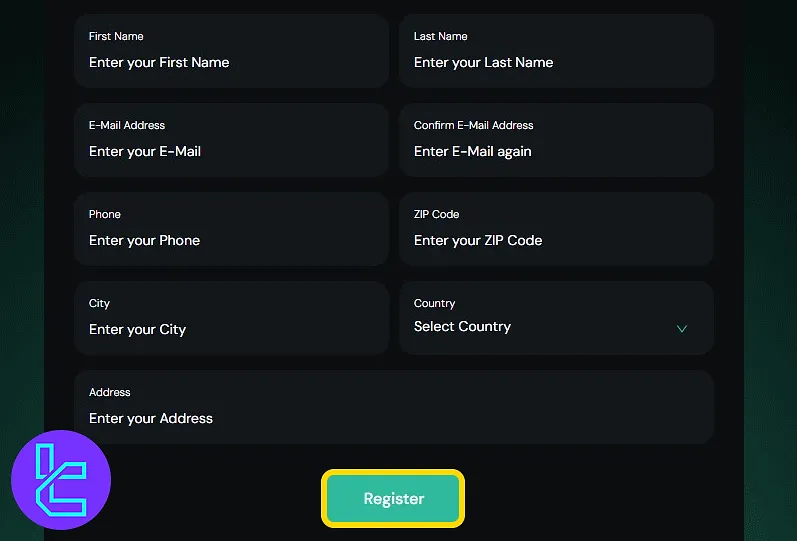

#2 Fill Out the Form

The prop firm's sign-up form requires you to provide these details:

- First Name

- Last Name

- Email Address

- Phone Number

- ZIP Code

- City

- Country

- Residence Address

Afterwards, click on "Register" and check your inbox to verify your email address.

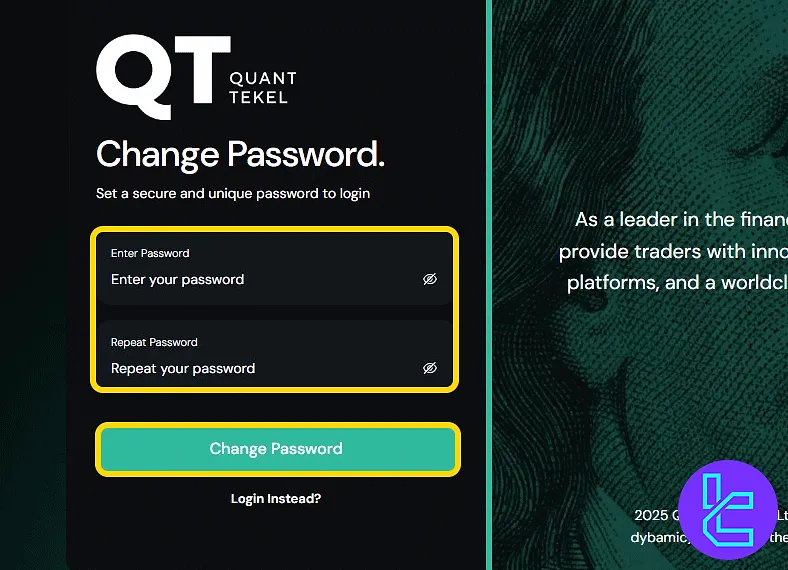

#3 Set Your Password

After the email verification, a password resetinstruction will be sent to your email address. Follow it to set a password for your account.

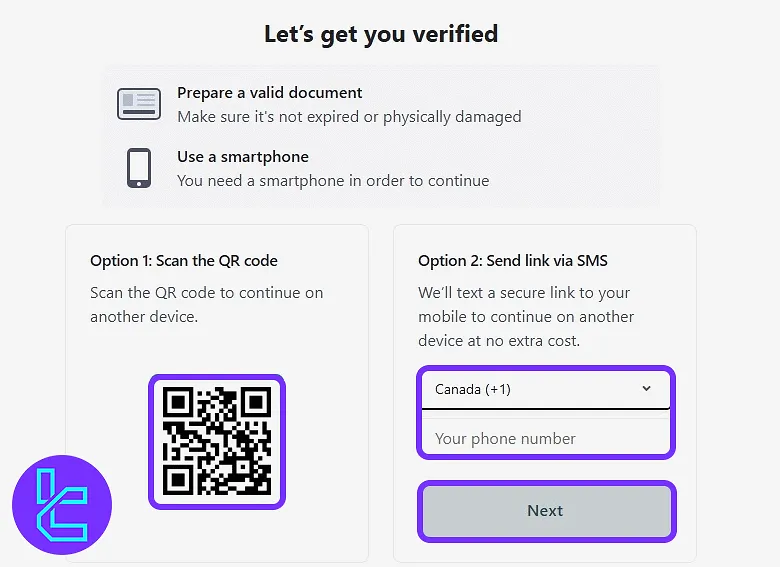

#4 Start the Verification Process

For Quant Tekel verification, from your Quant Tekel dashboard, click on “Verification” and choose “Get verified now”. You’ll be prompted to connect a mobile device via QR scan or secure SMS link to continue the KYC on mobile.

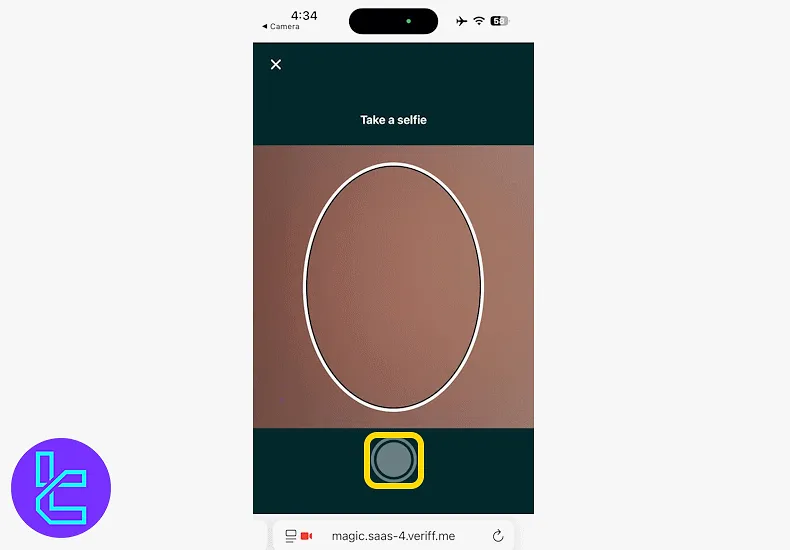

#5 Upload Your ID & Complete the Selfie Check

Use your smartphone to capture both sides of a valid document (ID card, driver’s license, passport, or residence permit). Then, perform a liveness scan by aligning your face within the frame and following the real-time prompts to match your ID photo.

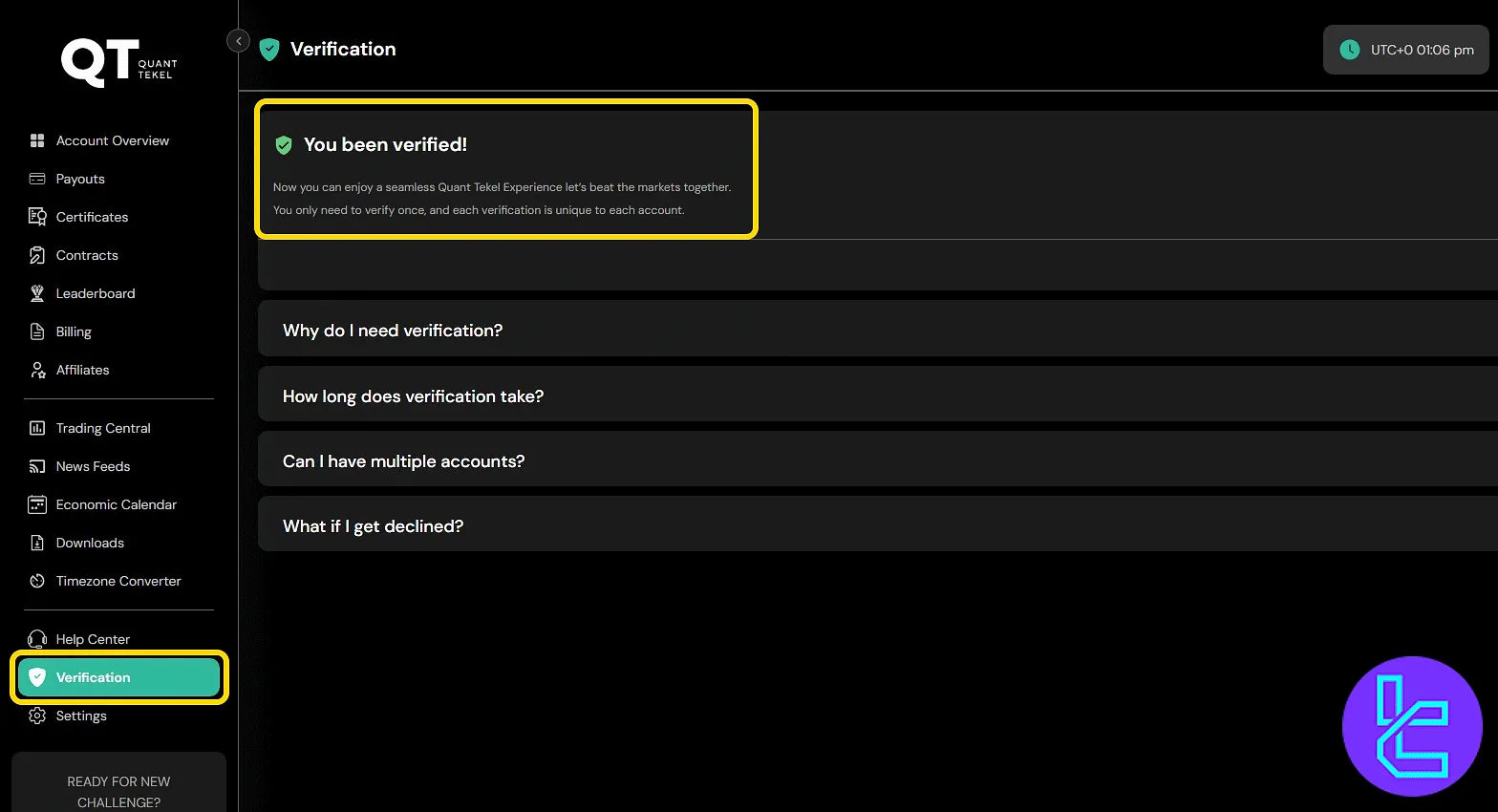

#6 Check Your Verification Status

Once the documents and selfie are submitted, revisit the Verification section to track the status. Upon approval, your account gains full platform access, including prop trading evaluations, account dashboard features, and trading tools.

Quant Tekel Evaluation Programs

The firm enables access to funds through four different programs via instant funding or 2- and 3-step evaluation plans. Quant Tekel Evaluation Programs Details:

Parameters | QT Instant | QT Prime - Two/Three Step | QT Power |

Profit Target | N/A | 8-5% for Two Step 6-6-6% for Three Step | 6-6% |

Daily Drawdown | 3% | 4% | 4% |

Max. Drawdown | 6% | 10% | 8% |

Min. Withdrawal (First Payout) | 5% | - | - |

Consistency Rule | 25% | - | 35% |

Profit Split | 80% | 80% | 80% |

Min. Trading Days | None | None | None |

The payout frequency is bi-weekly for QT Prime and on-demand for QT Power traders.

QT Instant Parameters

The QT Instant program by AquaFunded offers an efficient and trader-friendly path to success.

QT Instant program specifics in Quant Tekel

QT Instant program specifics in Quant Tekel

The table below demonstrates the plan's specifications:

Parameters | QT Instant |

Profit Target | N/A |

Daily Drawdown | 3% |

Max. Drawdown | 6% |

Min. Withdrawal (First Payout) | 5% |

Consistency Rule | 25% |

Profit Split | 80% |

Min. Trading Days | None |

QT Prime Details

The QT Prime challenges offer traders two flexible evaluation paths: Two-Step and Three-Step, each designed to meet varying trader needs.

For a summary of parameters, look at the table below:

Parameters | QT Prime - Two/Three Step |

Profit Target | 8-5% for Two Step 6-6-6% for Three Step |

Daily Drawdown | 4% |

Max. Drawdown | 10% |

Min. Withdrawal (First Payout) | - |

Consistency Rule | - |

Profit Split | 80% |

Min. Trading Days | None |

QT Power

The QT Power accounts are designed to challenge traders with high standards for profitability and risk management in two phases.

This table goes through the parameters and numbers of the evaluation model:

Parameters | QT Power |

Profit Target | 6-6% |

Daily Drawdown | 4% |

Max. Drawdown | 8% |

Min. Withdrawal (First Payout) | - |

Consistency Rule | 35% |

Profit Split | 80% |

Min. Trading Days | None |

Does Quant Tekel Offer Promotional Programs?

The firm offers promotional programs, primarily through its Affiliate Program. This initiative allows individuals to earn commissions by referring new clients to the company. Key features of Quant Tekel Prop firm affiliate program:

- 10% fixed commission income

- You can balance the discount for your friends with your commission rate

- Effortless payouts

- No registration required

Furthermore, Quant Tekel applies discounts on its programs from time to time. Currently, the company has a 50% discount on all its account prices via the code "NEXT50".

Quant Tekel Rules

The Quant Tekel rules mentioned in this section must be obeyed by traders to ensure compliance:

- VPN Usage: The use of VPNs is allowed; however, account credentials must remain secure at all times;

- Hedging: Reverse trading or group hedging is not allowed;

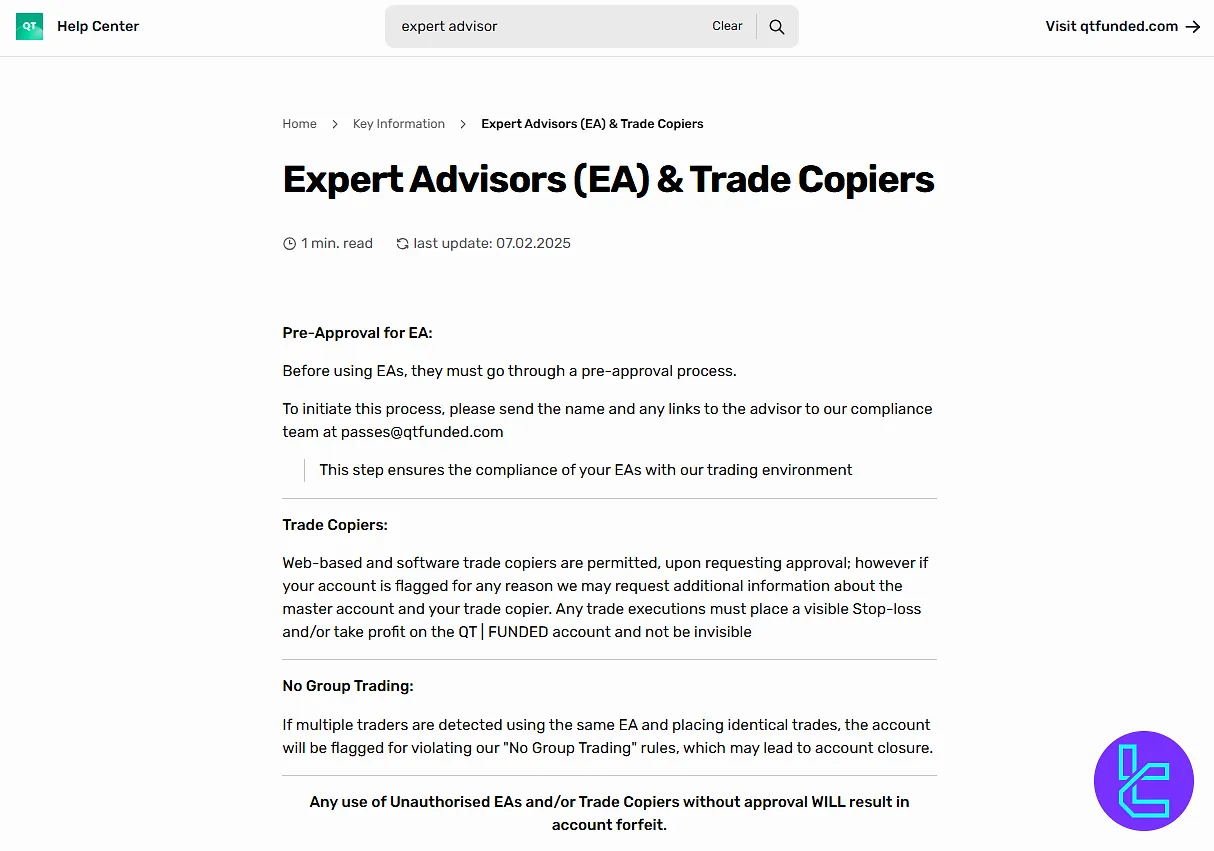

- Expert Advisors (EAs): Before using EAs or bots, they must go through a pre-approval process by the compliance team to ensure they are suitable for the trading environment;

- Arbitrage: Arbitrage trading isprohibited;

- News Trading: Trades cannot be initiated within 5 minutes before or after high-impact economic news releases in QT INSTANT and QT PRIME funded stages;

- Payouts: Payout requests can be made every two weeks from the first trade, with subsequent payouts processed within 3 business days. Ensure all trades are closed before making a request.

VPN Usage

The use of VPNs and VPS services is allowed, provided that account credentials are kept secure at all times. Trading activity must exclusively be conducted by the account holder who has completed the KYC process.

Group trading, where multiple individuals access the same account, is strictly prohibited and may result in account termination.

Hedging

Reverse trading or group hedging strategies are prohibited within the platform.

Expert Advisors (EA)

Before utilizing any Expert Advisors (EAs) or automated trading bots, they must undergo a pre-approval process.

To begin this process, traders should submit the EA's name and links to the advisor to the compliance team at passes@qtfunded.com. This ensures that the EAs comply with the platform's trading guidelines.

Martingale and Arbitrage

Arbitrage trading is strictly prohibited. No additional information is available regarding the use of martingale strategies.

News Trading

These rules are explained in separate sections in this part of the Quant Tekel review. Note that these rules only apply to QT INSTANT and QT PRIME funded stages.

General Restrictions

Trades should not be opened within 5 minutes before or after high-impact economic news releases. Positions opened more than 5 minutes before the release can remain open through the event. Limit orders set with predefined stop loss (SL) and take profit (TP) more than 5 minutes before the release are permissible.

Editing or canceling limit orders, as well as adjusting SL or TP during this time, is also forbidden. Violating these rules results in a hard breach.

Forex Factory is used as the source for news releases, based on the MT5 server time.

Red Folder News Events

Trading restrictions apply to all pairs related to red folder news events on ForexFactory. For example:

- USD-Related Events: Major economic news releases like Non-Farm Payrolls and FOMC meetings affect all USD-related pairs and indices (e.g., USD/JPY, EUR/USD, DJ30);

- Geopolitical Events: Events like presidential announcements, war outbreaks, or sudden economic shocks can cause extreme market volatility, which affects all currency instruments.

Black Swan Events

During black swan events, the market can experience unpredictable volatility, which may lead to slippage, wider spreads, and erratic price movements.

These conditions can cause substantial losses, and while they are not considered typical news-related breaches, such events can lead to trades being voided due to market irregularities.

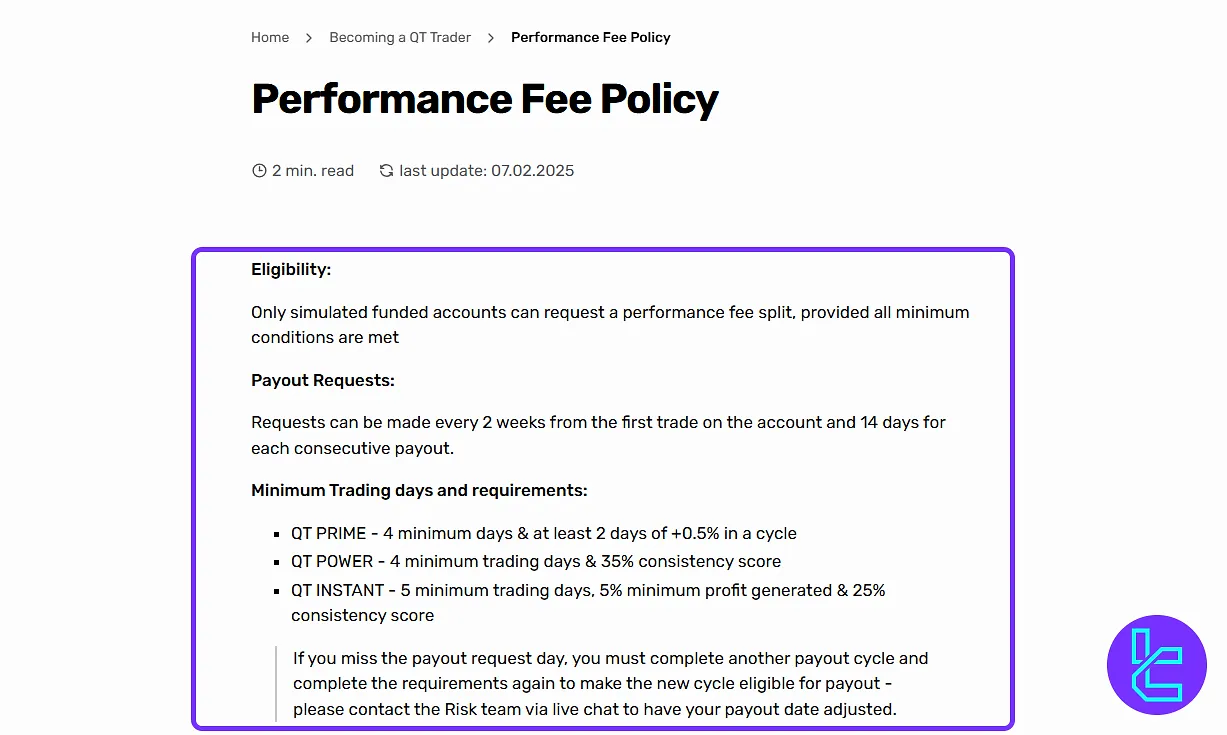

Payouts

Quant Tekel has established clear guidelines for processing payout requests:

- Eligibility: Only simulated funded accounts that meet all minimum conditions can request a performance fee split;

- Payout Frequency: Requests can be made every two weeks from the first trade and 14 days for each consecutive payout.

Here are the minimum trading days for each program:

- QT PRIME: Requires 4 minimum trading days and at least 2 days of +0.5% within a cycle;

- QT POWER: Needs 4 minimum trading days with a 35% consistency score;

- QT INSTANT: Demands 5 minimum trading days, a 5% minimum profit, and a 25% consistency score.

Failure to meet these criteria results in a non-eligible payout request.

- Processing Time: All payout requests are processed within 3 business days, excluding the day of request;

- Account Status: Ensure all trades are closed before submitting a request;

- Payment Methods: Payments are made via Crypto, Wire, or QT Card, with associated fees being the recipient’s responsibility.

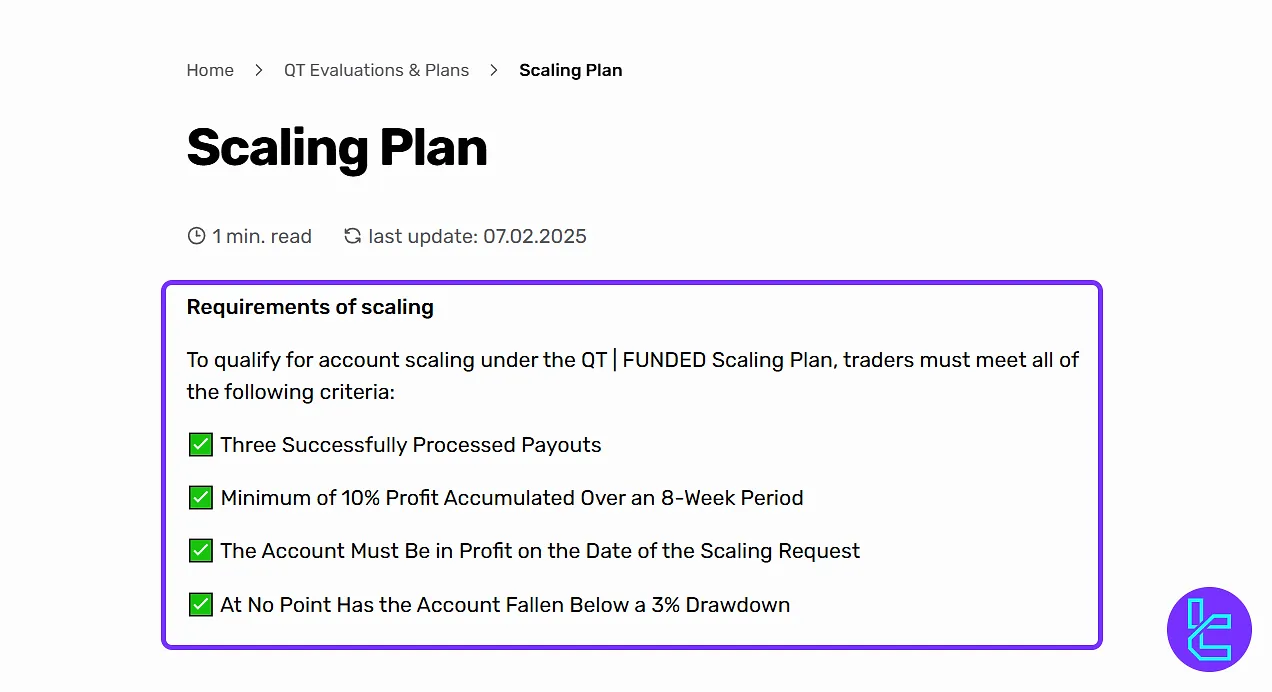

Scaling Plan

Traders enrolled in the QT | FUNDED Scaling Program must satisfy all of the following conditions before being considered for capital increases:

- Three verified and completed payouts must have been processed;

- At least 10% net profit must be generated over the most recent 8-week period;

- The trading account must show a positive balance at the time the scaling request is submitted;

- The maximum drawdown throughout the account’s lifecycle must not exceed 3% at any point.

These strict requirements are designed to assess long-term consistency and disciplined risk management before scaling is approved.

Example Progression: From Initial Allocation to Higher Tiers

The table below illustrates a possible trajectory for a trader who receives an initial $200,000allocation after passing the Quant Tekel Evaluation Phase and continuously meets the scaling criteria:

Duration | Scaled Capital | Additional Privileges |

Week 8 | $220,000 | – |

Week 16 | $240,000 | +1% to Maximum Drawdown Profit Split increased by 5% +10% Lot Size Allocation |

Week 24 | $260,000 | Eligible for salary proposal |

Week 32 | $280,000 | +1% to Daily Drawdown Physical office access available |

Week 40 | $300,000 | Annual salary potential up to $120,000 |

What Trading Platforms Are Available on Quant Tekel?

The firm provides access to three of the popular trading platform options in the industry, including the famous MetaTrader 5. These terminals offer a modern interface, order management tools, seamless execution, and other features essential for a trader.

Download the prop firm's platform applications through the links below:

MetaTrader 5:

cTrader:

TradeLocker:

Quant Tekel Asset Offerings

The firm offers traders a diverse range of assets across four main categories, catering to various trading styles and preferences. Available Markets on Quant Tekel Prop Firm:

- Forex Market: Over 60 symbols of major, minor, and exotic currency pairs

- Indices: Global stock market indices

- Commodities: Including precious metals, energy, and agricultural products

- Cryptocurrencies: A selection of popular digital assets

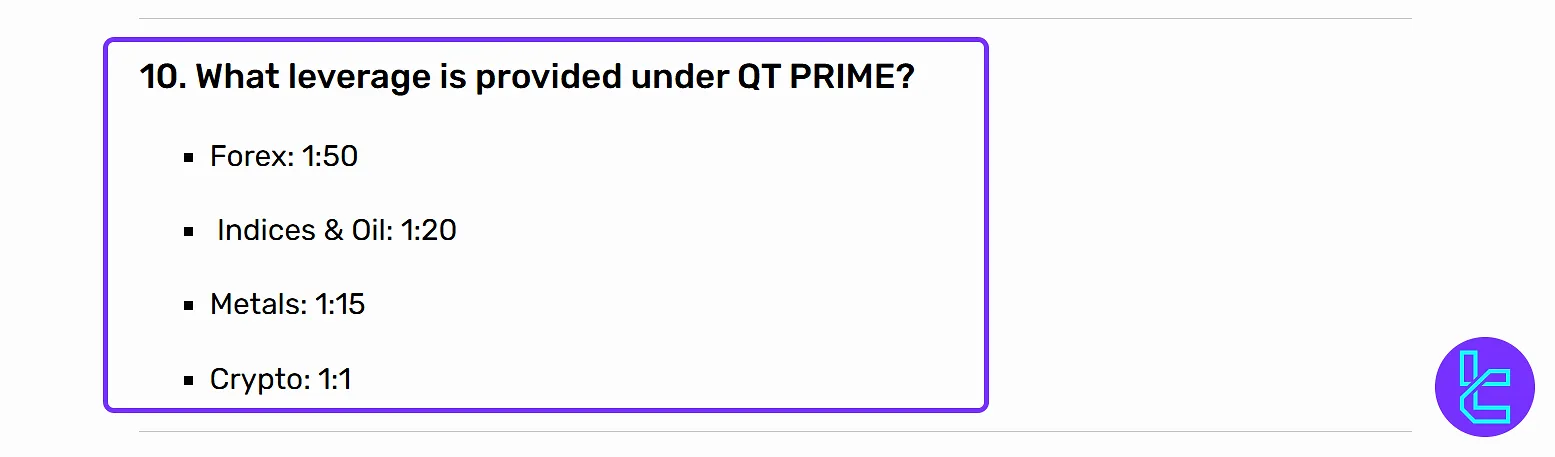

Quant Tekel Leverage Details

Quant Tekel provides competitive leverage and transparent commissions tailored to each account type.

- QT Instant Plan Leverage: Forex 1:50, Indices & Oil 1:20, Metals 1:15, Crypto 1:1

- QT Power Account Leverage: Forex 1:100, Indices & Metals 1:35, Crypto 1:2.5

- QT Prime Program Leverage: Forex 1:50, Indices & Oil 1:20, Metals 1:15, Crypto 1:1

Payment Methods on Quant Tekel

The prop firm offers a decent range of payment methods for challenges, including electronic systems and blockchain transactions:

- VISA

- MasterCard

- PayPal

- UPI

- Cryptocurrencies

- Local payment solutions

No information is provided about the systems used for payouts by the prop firm.

Quant Tekel Fee Structure

The discussed prop firm provides 2 different choices regarding the trading costs:

- Raw spreads & commissions

- Variable spreads & no commissions

The firm charges a fixed commission of $2 per lot and $4 per round lot on all instruments but indices and oil; however, spreads and swaps might still apply.

No details exist regarding the market spread amounts and other costs.

Does Quant Tekel Provide Educational Materials?

Training traders and sharpening their skills are very important matters in Prop firms, since they’re trading with the company’s money. However, Quant Tekel hasn’t set much budget for this purpose, only offering a Blog page.

QT Tekel's blog consists of a few articles on these topics:

- Financial markets

- Trading terms

- Prop trading

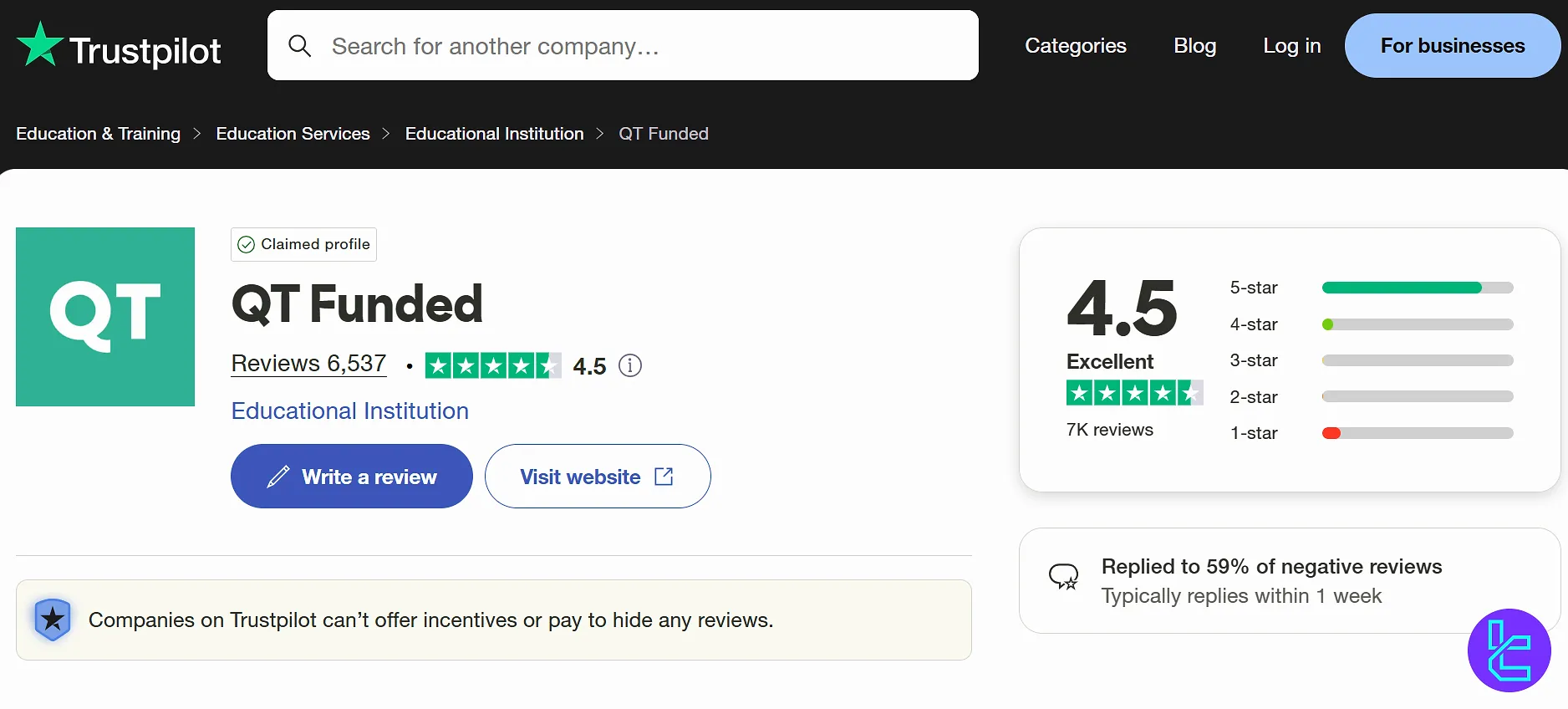

Is Quant Tekel Reliable? (Trust Scores)

Assessing the reliability of the firm is an important task that we should cover in the Quant Tekel review. It requires a balanced look at trader experiences and the firm's operational transparency. The reviewed prop firm hasn't received ratings on many sources. Quant Tekel Trust Scores:

- Quant Tekel Trustpilot: 4.5 out of 5 based on 6,500+ reviews

- ScamAdviser: 1/100 Trustscore

5-star reviews account for over 80% of the ratings submitted on the Trustpilot website. However, the prop firm has replied to less than 60% of the negative reviews.

ScamAdviser has named the "suspiciously high number of reviews" despite theshort track record of the website as one of the reasons for its low trust score. Also, it states that "Gridinsoft" has reported Quant Takel's website as possible malware.

Customer Support on Quant Tekel Prop Firm

Customer support is the heart of any business. Quant Tekel offers a set of common channels for contacting the support department. The table below is an overview of the options:

Support Method | Availability |

Live Chat | Yes (on the Dashboard) |

Yes (support@qtfunded.com) | |

Phone Call | No |

Discord | Yes (on the Official Server) |

Telegram | No |

Ticket | Yes (on the "Contact" Page) |

FAQ | Yes (with a Search Option) |

Help Center | No |

No | |

Messenger | No |

The prop firm claims to offer 24/7 support services to its clients.

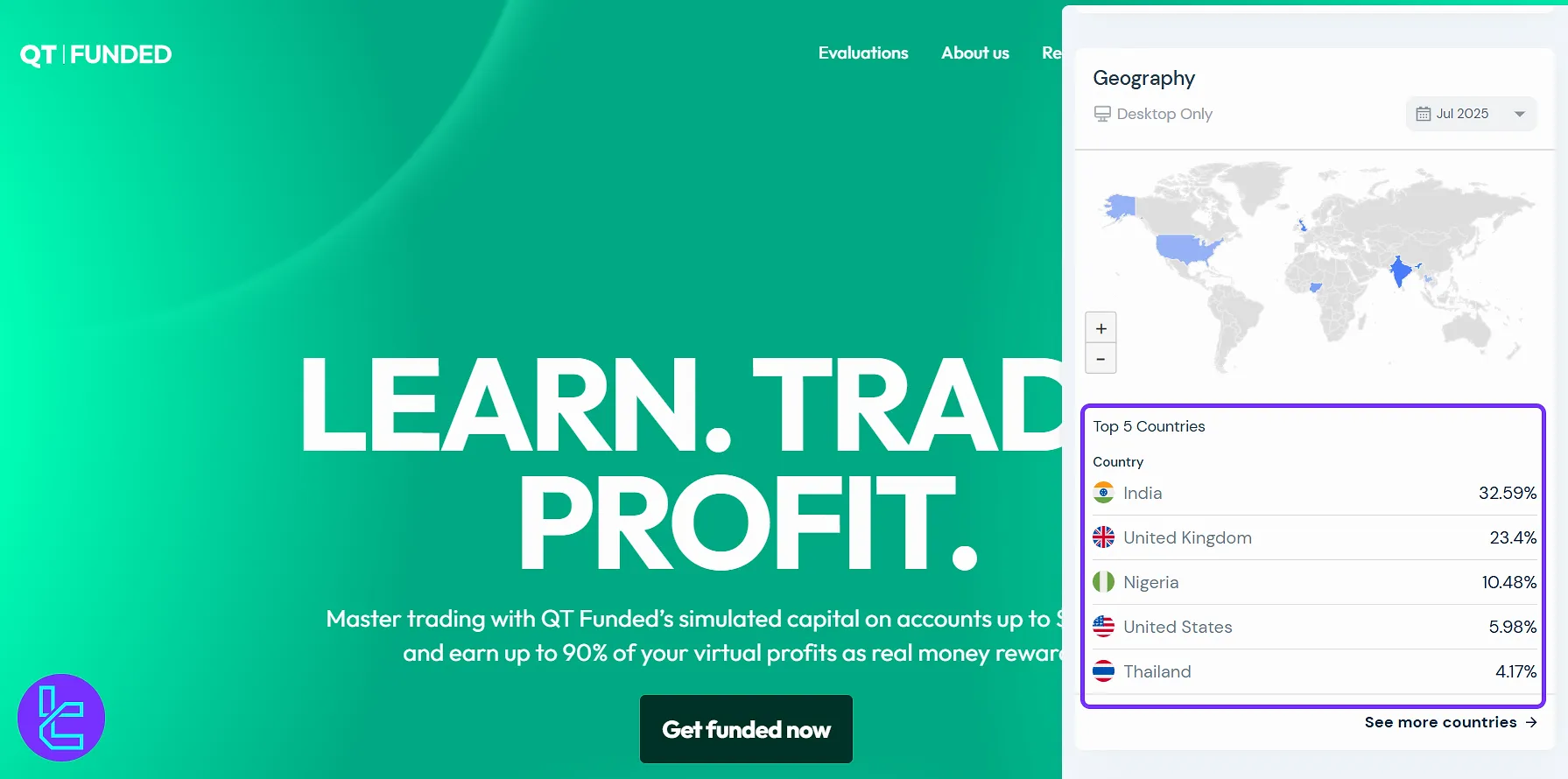

Quant Tekel User Regions Variety Investigation

In July 2025, Quant Tekel saw a highly diverse geographic user base, with significant traction across Asia, Europe, Africa, and North America.

The platform’s reach reflects its growing global relevance in the prop trading space.

Top 5 Desktop User Regions:

- India – 32.59%

- United Kingdom – 23.4%

- Nigeria – 10.48%

- United States – 5.98%

- Thailand – 4.17%

This data highlights Quant Tekel’s penetration in emerging and mature markets alike, especially its strong appeal to Indian and UK-based traders.

Quant Tekel on Social Media

The firm is active on various social platforms and maintains contact with its community. Quant Tekel on social media:

Social Media | Members/Subscribers |

Over 32K | |

Over 34.2K | |

Over 22.6K | |

Over 1.2K |

Comparison With Other Prop Firms

Here's a comprehensive comparison between QT Funded and other companies in the proprietary trading industry:

Parameters | Quant Tekel Prop Firm | Alpha Capital Group Prop Firm | E8 Markets Prop Firm | Maven Trading Prop Firm |

Minimum Challenge Price | $26 | $97 | $33 | $15 |

Maximum Fund Size | $2,000,000 | $200,000 | $400,000 | $100,000 |

Evaluation steps | 2-Phase, 3-Phase, Instant Funding | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step |

Profit Share | 90% | 80% | 100% | 85% |

Max Daily Drawdown | 4% | 5% | 7% | 4% |

Max Drawdown | 10% | 10% | 14% | 8% |

First Profit Target | 6% | 5% | 6% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:100 | 1:75 |

Payout Frequency | Bi-Weekly, On Demand | Bi-weekly | Weekly | 10 Days |

Number of Trading Assets | N/A | 40 | 40+ | 400+ |

Trading Platforms | MT5, cTrader, TradeLocker | MetaTrader 5, cTrader, Dxtrade | MetaTrader 5, Match Trader | Match-Trader, cTrader |

Expert Suggestions

Quant Tekel offers a wide range of funded accounts from $1.25K to $200K with low profit targets ranging from 5% to 8%. However, the cherry on top is the generous 90% profit split that the prop firm offers.

You can start trading with just $26 and enjoy robust trading platforms, including cTrader, TradeLocker, and MT5, with leverage up to 1:100 for Forex pairs and 1:2.5 for Crypto.