Blink Funding provides up to $500,000 of trading capital through 1-Step, 2-Step, and 3-Step evaluation plans with no time limits.

The firm offers up to 90% profit split with real trading money.

Blink Funding; What Do We Know about the Company?

Blink Funding is a US-based proprietary trading firm under the legal name Blink Investments LLC that allows traders to access significant capital under real market conditions. The company is located in the city of Sugar Land, Texas, and is led by President Zion L. Key features of Blink Funding:

- A comprehensive evaluation program with 1-Phase, 2-Phase, and 3-Phase challenge plans

- Up to 90% profit share

- No time limit for accounts

- A wide range of trading platforms

- Leverage options up to 1:10 (1:30 with add-on purchase)

- EAs are allowed

Blink Funding Table of Specifications

This table provides a quick overview of Blink Funding's key features and specifications, helping traders understand what they can expect when engaging with the prop firm.

Account currency | USD |

Minimum price | $50 |

Maximum leverage | 1:30 |

Maximum profit split | Up to 90% |

Instruments | FOREX pairs, CFD Indices, Metals, Equity Shares, US Stocks, Cryptocurrencies |

Assets | N/A |

Evaluation steps | 1-Step, 2-Step, 3-Step |

Withdrawal methods | Deel |

Maximum fund size | $500,000 |

First profit target | 5% |

Max. daily loss | 5% |

Challenge time limit | Unlimited |

News trading | Prohibited |

Maximum total drawdown | 8% (Static Drawdown) |

Trading platforms | MT4, MT5, Match Trader, DXTrade, cTrader |

Commission | Only for FX and Equity Share CFDs |

TrustPilot score | 4 |

Payout frequency | Monthly |

Established country | United States |

Blink Funding Prop Firm Pros & Cons

Blink Funding, like any proprietary firm, has advantages and disadvantages. Understanding these can help traders make an informed decision about whether to purchase test challenges from the company.

Pros | Cons |

Access to substantial trading capital without personal risk | Strict drawdown rules |

Evaluation process with no time limits | Low leverage options (up to 1:30) |

Support for various trading platforms | Lack of educational resources |

Potential for high profit splits | Lack of transparency about the company background |

Flexibility on trading strategies like EAs | No scaling program |

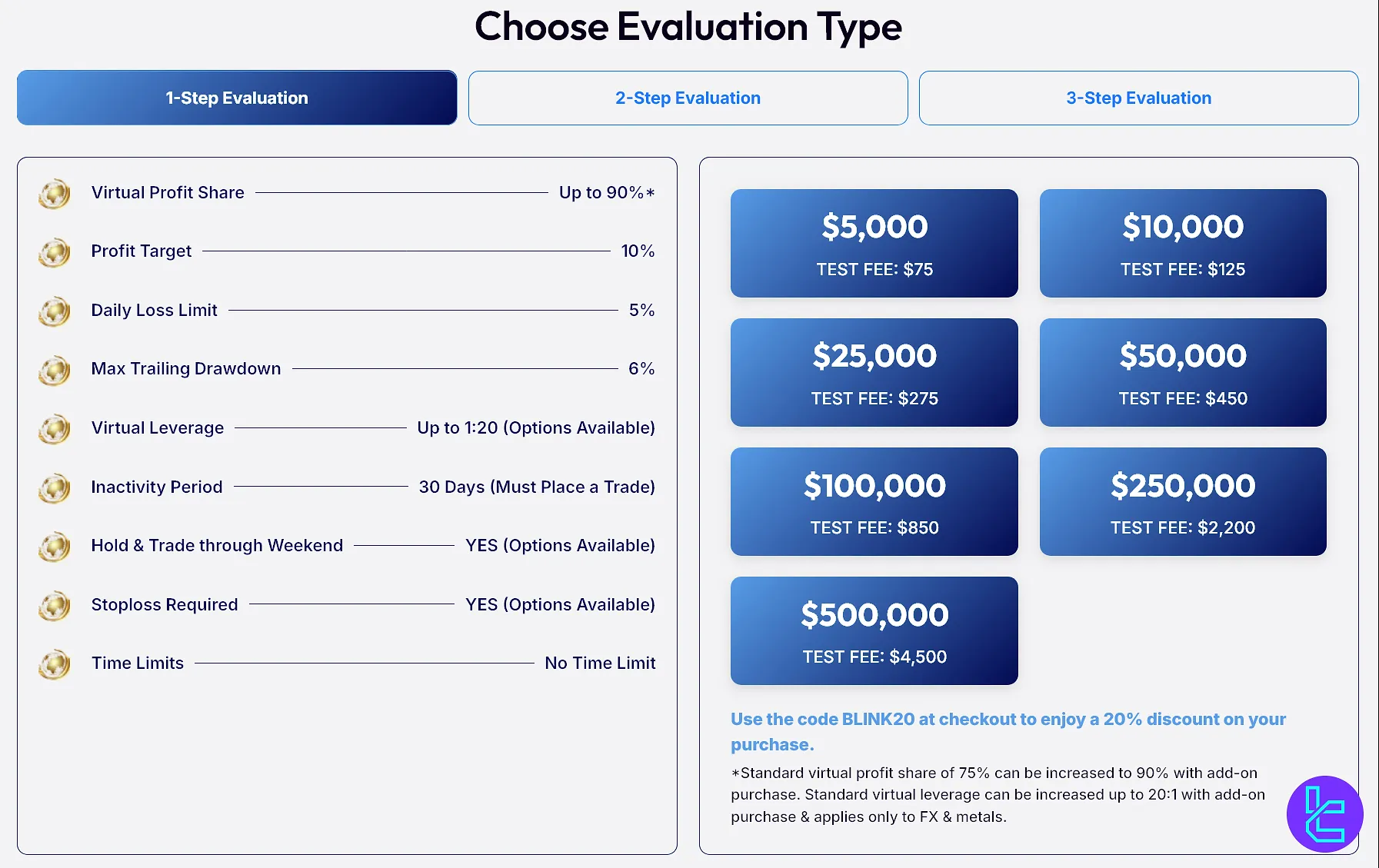

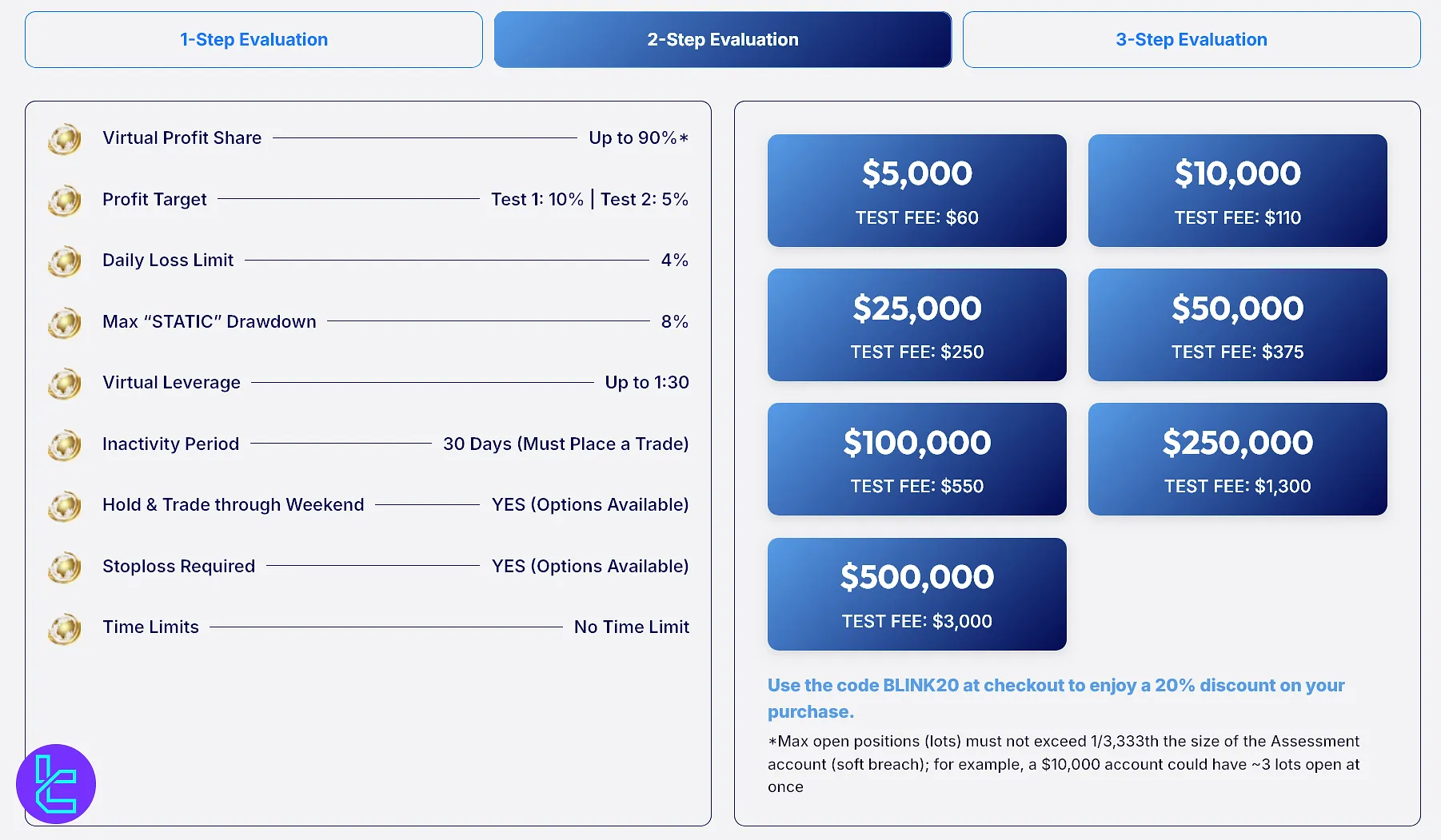

Blink Funding Account Size and Pricing

The firm offers a range of account sizes, from $5,000 to $500,000, to cater to traders at different experience levels and with varying capital requirements. The pricing structure is designed to strike a balance between accessibility and the potential for significant returns.

Funded Account | 1-Step | 2-Step | 3-Step |

$5,000 | $75 | $60 | $50 |

$10,000 | $125 | $110 | $80 |

$25,000 | $275 | $250 | $175 |

$50,000 | $450 | $375 | $350 |

$100,000 | $850 | $550 | $375 |

$250,000 | $2,200 | $1,300 | $900 |

$500,000 | $4,500 | $3,000 | $1,800 |

Currently, no scaling program is offered by the prop firm.

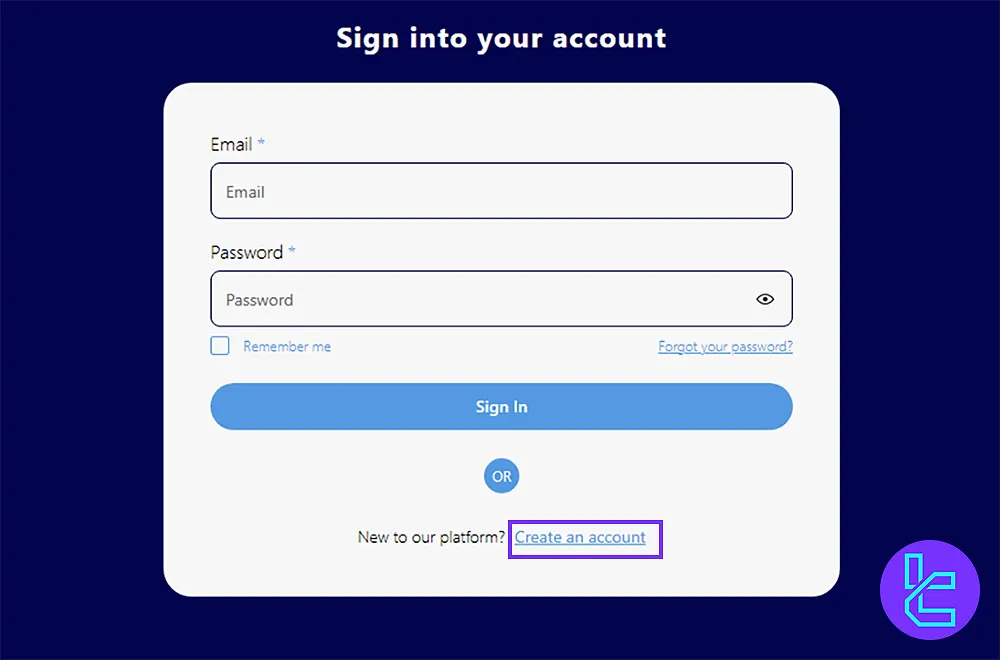

Blink Funding Registration and KYC Verification

Blink Funding registration and completing theKnow Your Customer (KYC) verification process is a straightforward but essential step in starting your journey with the prop firm.

#1 Open the Registration Form

To start:

- Visit the official Blink Funding website;

- Click on Dashboard, and then Create an Account.

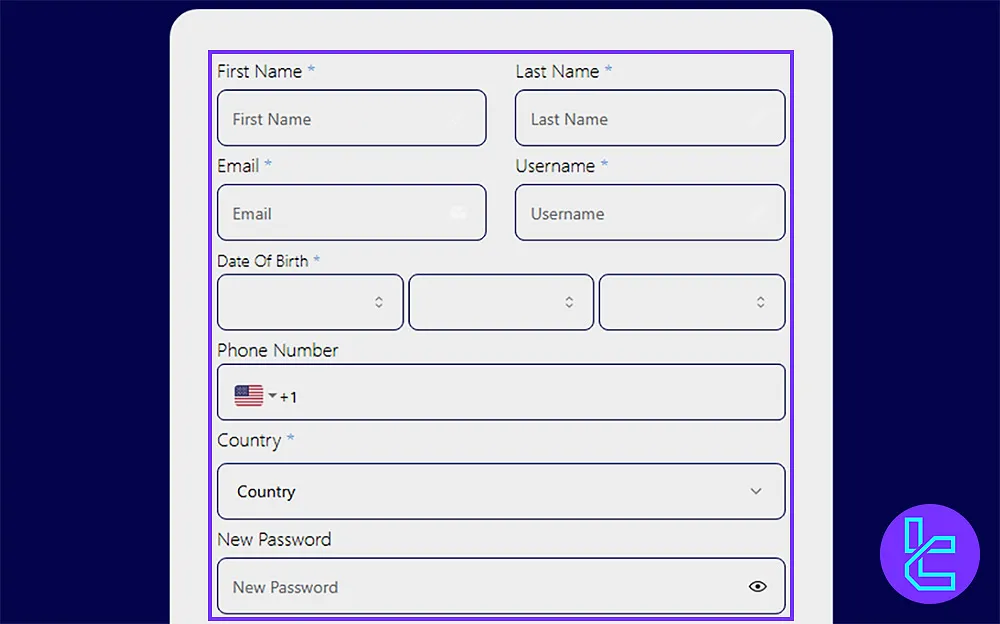

#2 Fill Out the Signup Details

Provide the following required info:

- First & Last Name

- Email Address & Username

- Mobile Number

- Country of Residence

- Date of Birth

- Password & Confirm Password

Tick the terms and conditions box, then hit "Register" to complete the process.

#3 Verification

Prop firms usually require traders to complete the KYC process upon successfully completing the evaluation steps and before getting a live account. Required documents for Blink Funding Verification:

- Proof of Identity: Passport or Driver’s license

- Proof of Address: Utility bill or Bank statement

Blink Funding Evaluation Details and Conditions

The challenge rule is one of the most important topics in Blink Funding reviews. The firm’s evaluation process is designed to identify disciplined and skilled traders by evaluating their trading style and performance consistency.

1-Step Plan

Blink Funding’s 1-Step program is designed for traders who want fast access to funded accounts with straightforward rules.

With a profit share of up to 90%, participants can maximize their returns once they hit the 10% profit target.

Program Parameters:

Conditions | 1-Step |

Profit Share | Up to 90% |

Profit Target | 10% |

Daily Loss Limit | 5% |

Max Drawdown | 6% (Trailing Drawdown) |

Up to 1:20 (Add-on) | |

Inactivity Period | 30 Days |

Time Limit | Unlimited |

2-Step Account

The Blink Funding 2-Step challenge is built for traders who prefer a structured evaluation with clear milestones.

This model provides a profit share of up to 90% once funded, while traders must first meet the two-phase profit target of 10% and 5%.

Plan Details:

Conditions | 2-Step |

Profit Share | Up to 90% |

Profit Target | 10% / 5% |

Daily Loss Limit | 4% |

Max Drawdown | 8% (Static Drawdown) |

Leverage | Up to 1:30 (Add-on) |

Inactivity Period | 30 Days |

Time Limit | Unlimited |

3-Step Challenge

The Blink Funding 3-Step Challenge is tailored for traders who prefer a gradual evaluation with lighter targets per phase.

Offering a profit share of up to 90%, this program requires traders to achieve 5% profit in each of the three phases.

3-Step Evaluation Specifics:

Conditions | 3-Step |

Profit Share | Up to 90% |

Profit Target | 5% / 5% / 5% |

Daily Loss Limit | None |

Max Drawdown | 5% (Static Drawdown) |

Leverage | Up to 1:10 (Add-on) |

Inactivity Period | 30 Days |

Time Limit | Unlimited |

Blink Funding Prop Firm Bonus and Promotional Programs

The firm occasionally offers bonus programs and promotions to attract new traders and reward existing ones. While these can provide additional value, it's important to understand their terms and conditions.

- Affiliate Program: Earn credits or discounts for referring new traders to Blink Funding;

- Seasonal Discounts: Enjoy holiday or special event discounts on evaluation fees (at the time of writing this article, the firm offers a 20% discount via the coupon code “Discount20”).

Blink Funding Rules

These are the trading rules that must be obeyed by the traders partnering with the prop firm. Blink Funding Rules:

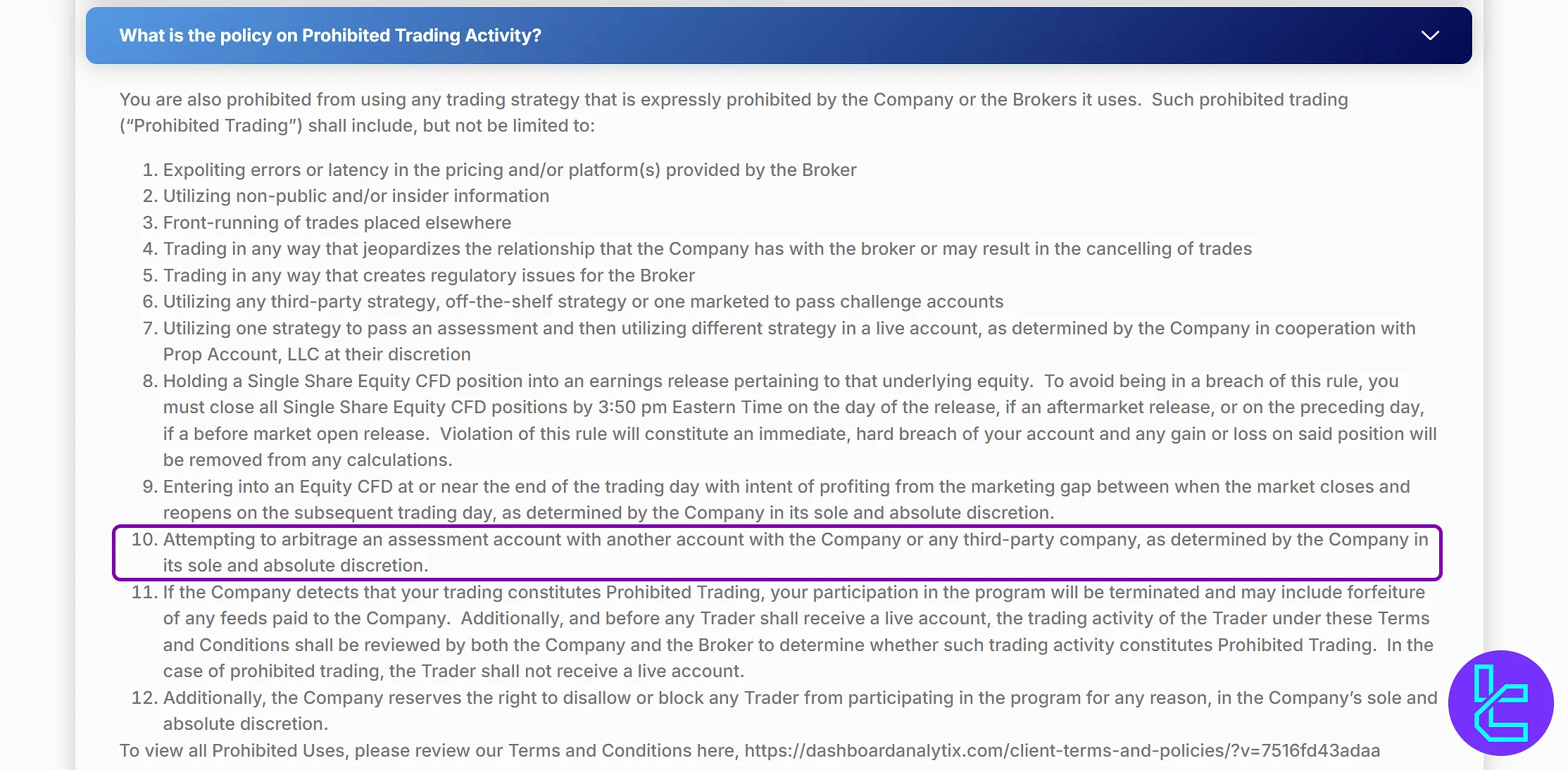

- Expert Advisors (EAs) are conditionally allowed unless they violate prohibited trading terms;

- Arbitrage between accounts is strictly forbidden;

- Trading within a three-minute window before or after a major news event is prohibited;

- The firm defines “News Events” at its own discretion and may revoke profits or restrict accounts if the rule is breached;

- Payouts are allowed anytime (then every 30 days), but the Maximum Trailing Drawdown stays locked at the starting balance, and a full profit withdrawal will forfeit the live account.

VPN Usage

The company has not issued any specific guidelines or restrictions regarding the use of Virtual Private Networks (VPNs). Traders should exercise caution and remain compliant with general platform access protocols, even in the absence of an explicit VPN policy.

Hedging Rules

There is currently no information available indicating whether hedging strategies are permitted or restricted.

Use of Expert Advisors (EAs)

Automated trading via Expert Advisors is generally permitted, provided the strategy adheres to the firm’s Prohibited Trading Policy.

While the use of bots is allowed, any behavior resembling abusive, manipulative, or exploitative trading may result in penalties, including disqualification from funding eligibility.

Arbitrage and Martingale

The company enforces a clear prohibition on arbitrage between evaluation accounts and other accounts, whether internal or with external entities.

This restriction is enforced solely at the discretion of the firm, which reserves the right to interpret and act on suspected arbitrage activity. No official position has been stated on the use of martingale strategies.

News Event Trading Policy

Opening positions within a three-minute window on either side of a high-impact news release is not allowed.

If trades are placed during this restricted timeframe, the firm may take corrective action, including forced position closure, removal of profits, reduction in leverage, or full account breach.

What qualifies as a “News Event” is defined entirely by the firm, which holds exclusive authority in identifying and enforcing these occurrences.

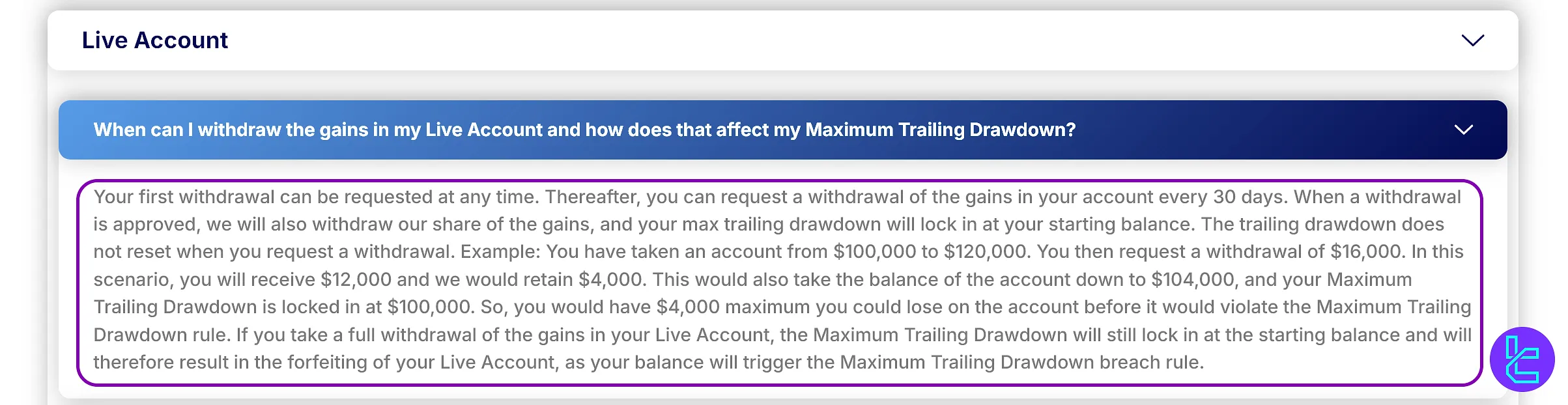

Payouts

Blink Funding allows traders to request their first withdrawal at any time, followed by withdrawals every 30 days.

Once a payout is approved, both the trader’s share and the firm’s share of profits are distributed, while the Maximum Trailing Drawdown remains locked at the account’s initial balance.

Here's an example; if an account grows from $100,000 to $120,000 and the trader requests a $16,000 withdrawal, Blink Funding pays $12,000 to the trader and keeps $4,000. The account balance then resets to $104,000, but the Maximum Trailing Drawdown stays fixed at $100,000. This means the trader can only risk $4,000 before violating the rule.

Important Note: Taking a full withdrawal of all gains will immediately cause the account balance to breach the Maximum Trailing Drawdown, leading to forfeiture of the live account.

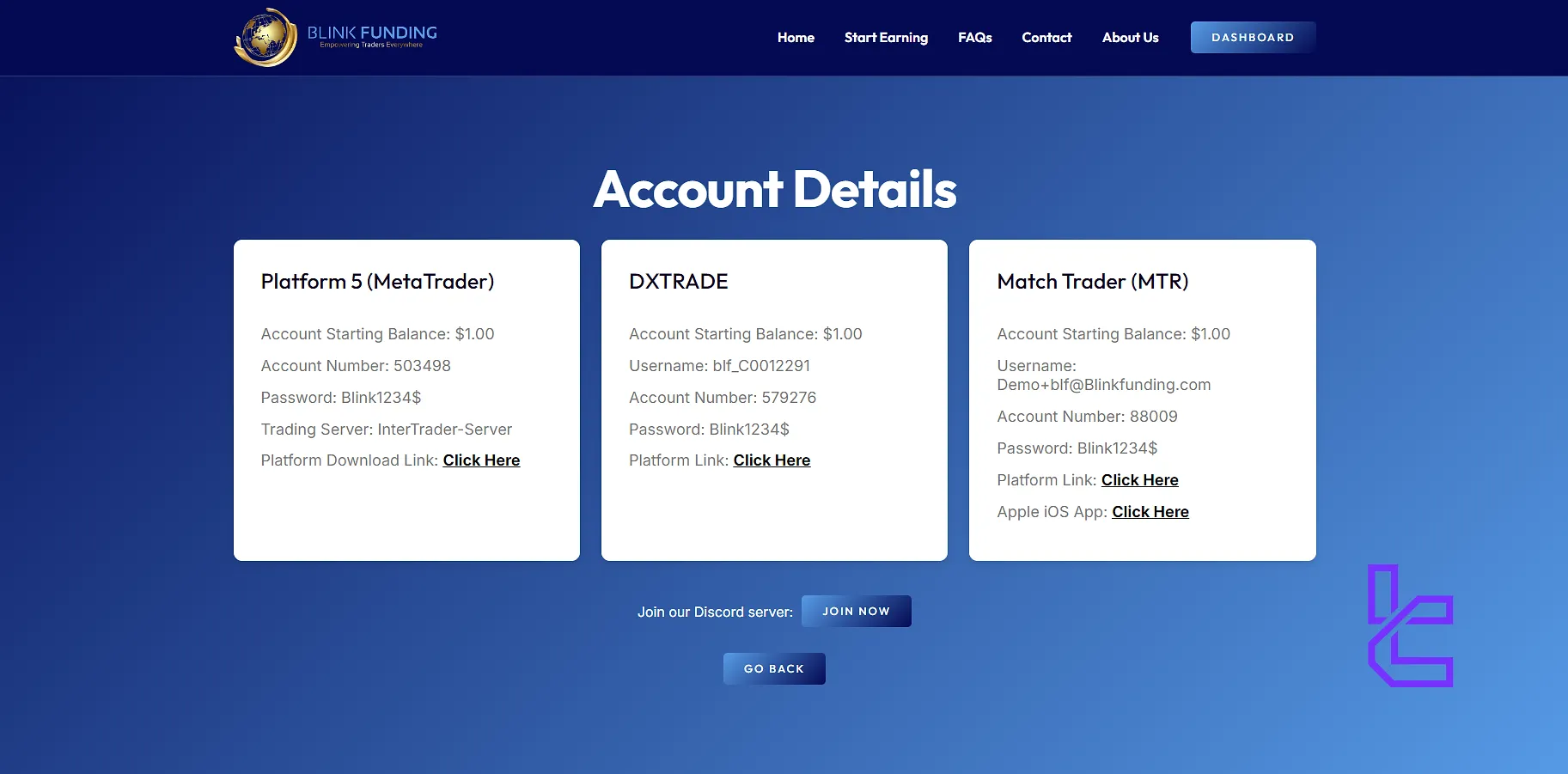

Available Trading Platforms on Blink Funding

The firm performs exceptionally in regard to trading applications. It offers a full suite of trading solutions, from the robust MT4 and MetaTrader 5 to the popular cTrader, to cater to diverse trader preferences. Blink Funding Platforms:

- MetaTrader 4/5 (MT4/5): InterTrader broker MetaTrader platform across various devices, including Windows, macOS, Android, and iOS

- DXTrade: GooeyTrade DXTrade, a web-based platform offering a user-friendly interface and advanced charting tools

- Match Trader: Known for its speed and reliability, ideal for high-frequency traders

- cTrader: Popular among algorithmic traders for its extensive customization options integrated with the GoeeyTrade platform

Blink Funding Financial Markets

The financial market is one of the topics that must be discussed in all of the Blink Funding reviews. While the available instruments vary based on the broker you’re trading with, overall, the markets include:

- Forex Market: Major, minor, and exotic currency pairs

- Cryptocurrencies: Bitcoin, Ethereum, and other major cryptocurrencies

- Metals: Gold, silver, platinum, and other popular precious metals

- Indices: CFDs on major global stock indices

- Stocks: CFDs on popular US and European stocks

- Commodities: Oil, natural gas, and agricultural products

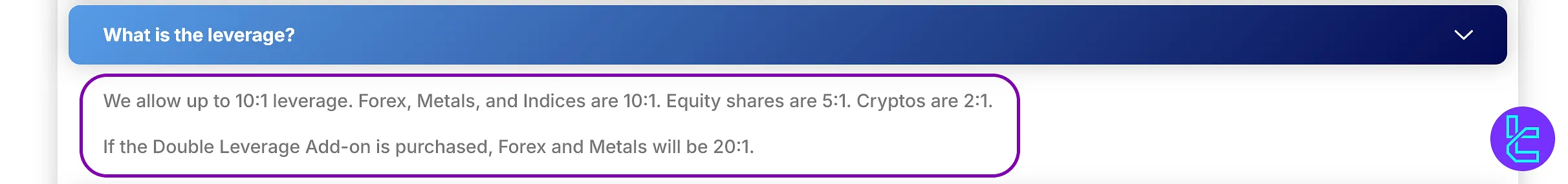

Blink Funding Leverage

Blink Funding offers traders controlled leverage options tailored to each asset class. Standard accounts provide up to 10:1 leverage on Forex, Metals, and Indices, while Equity shares are capped at 5:1 and Cryptos at 2:1.

For those seeking more flexibility, the Double Leverage Add-on is available, boosting Forex and Metals leverage up to 20:1, allowing higher exposure and advanced trading opportunities while maintaining disciplined risk management.

What are the Payment Methods on Blink Funding?

While the firm offers several payment methods to facilitate easy deposits, it only offers Deel (an Israeli-American payroll solution platform based in San Francisco, California) for profit withdrawals. Blink Funding prop firm payment methods:

- Credit/Debit Cards

- Coinbase Commerce

- PayPal

Blink Funding Trading Costs (Commission and Spread)

The firm has partnered with the ThinkMarkets broker and uses their Raw account named ThinkZero, which has commission charges and spreads. Blink Funding fee structure:

Commission | $3.50 per side on Forex and Equity Share CFDs |

Floating from 0.0 pips |

Blink Funding Prop Firm Educational Materials

While education is one of the most important aspects of every proprietary trading firm, since a trader’s win equals the firm’s profit, Blink Funding doesn’t provide any dedicated educational materials.

You can use TradingFinder's Forex education to access comprehensive learning materials.

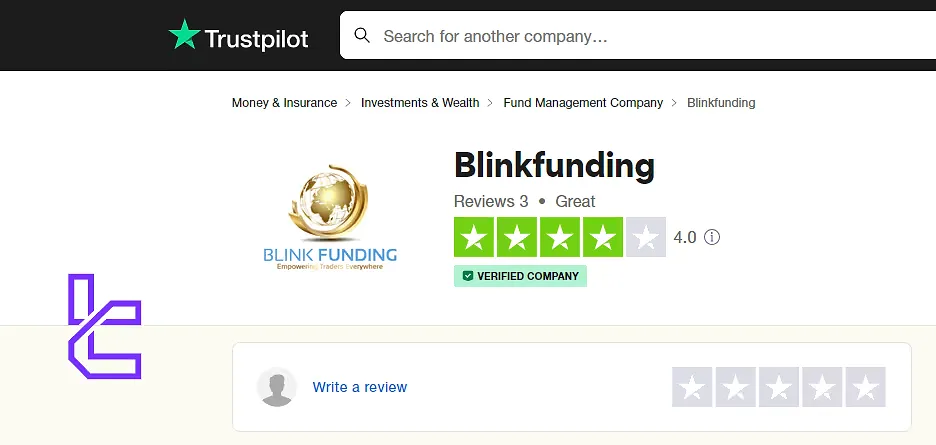

Is Blink Funding Legit? (Trust Scores)

User satisfaction may be the most important topic in Blink Funding reviews. The firm is new and doesn’t have a strong presence in the market or among traders.

The firm has received a score of 4.0 out of 5.0 from TrustPilot users

The firm has received a score of 4.0 out of 5.0 from TrustPilot users

Thus, it doesn’t have profiles on reputable websites like Reviews.io, and the Blink Funding Trustpilot profile has only three reviews which can’t be a reliable source to evaluate the firm’s legitimacy.

However, the lack of transparency in introducing the founding and managing team and poor regulatory status hint that potential clients must tread carefully and conduct thorough research before committing any funds.

How to Reach Blink Funding Customer Support?

The company seems to not take the importance of customer support to the heart since it doesn’t offer a live chat feature or phone support. Blink Funded support channels:

Support Method | Availability |

Live Chat | No |

| Yes (through info@blinkfunding.com) | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | Yes (Accessible on the “Contact” page) |

FAQ | Yes (on the Website) |

Help Center | No |

No | |

Messenger | No |

Blink Funding Social Media Handles

The last topic in this Blink Funding review is social media presence. The firm is active on various social platforms, including the ones outlined in the table below:

Social Media | Members/Subscribers |

Over 32K | |

Over 5.5K | |

Over 1.2K | |

Over 22.6K | |

Over 34.2K |

The prop firm is well-known on these social channels.

Blink Funding in Comparison to the Other Prop Firms

The table below makes a comparison between the discussed prop firm and its competitors:

Parameters | Blink Funding Prop Firm | The5ers Prop Firm | Breakout Prop Firm | BrightFunded Prop Firm |

Minimum Challenge Price | $50 | $39 | $50 | €55 |

Maximum Fund Size | $500K | $250,000 | $2,000,000 | Infinite |

Evaluation steps | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step | 2-Step |

Profit Share | 90% | 100% | 90% | 100% |

Max Daily Drawdown | 5% | 5% | 4% | 5% |

Max Drawdown | 8% | 10% | 6% | 8% |

First Profit Target | 5% | 5% | 5% | 10% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:30 | 1:100 | 1:5 | 1:100 |

Payout Frequency | Monthly | Bi-weekly | Bi-weekly | 14 Days |

Number of Trading Assets | N/A | 3000+ | 100+ | 150+ |

Trading Platforms | MT4, MT5, Match Trader, DXTrade, cTrader | Metatrader 5 | Proprietary platform | Proprietary platform |

Expert Suggestions

Blink Funding offers funded accounts with leverage options of up to 1:30 for trading FX, Stocks, and Crypto with profit split of up to 90% and monthly payout frequency.

Blink Funding prop firm offers MT4/5, cTrader, and DX Trade. The payment methods include PayPal and Coinbase Commerce, and withdrawals are processed through Deel payroll solution.