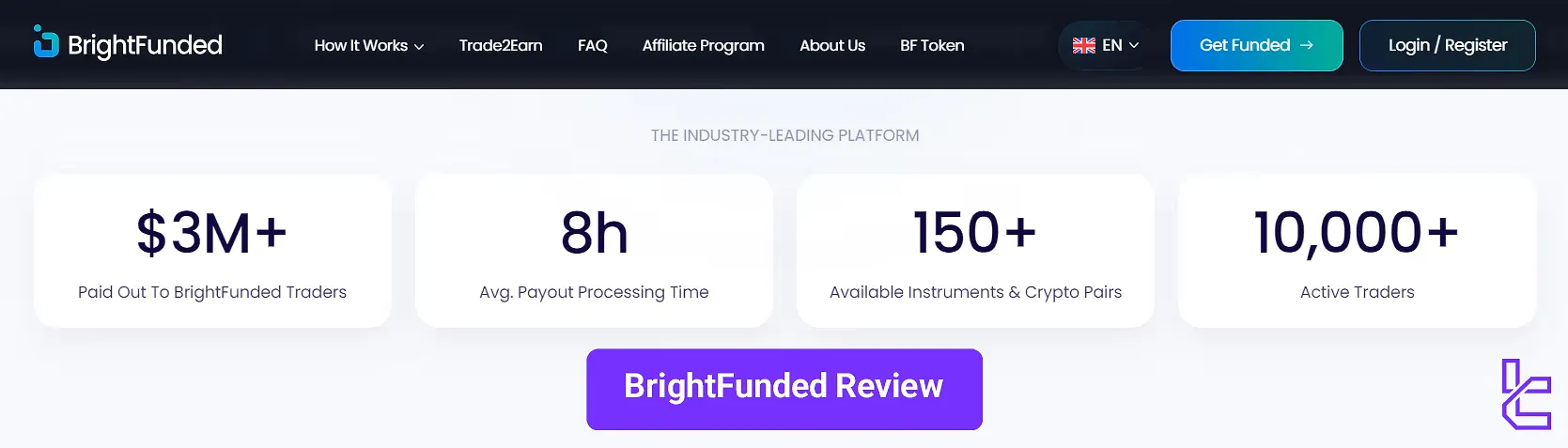

BrightFunded is a prop trading firm with an average payout processing time of 8 hours. These payouts are provided via 2 methods [crypto (USDT), bank transfers].

Evaluation account prices on this company range from 55 EUR to 975 EUR, with sizes ranging from $5,000 to $200,000.

BrightFunded Prop Firm Company Overview

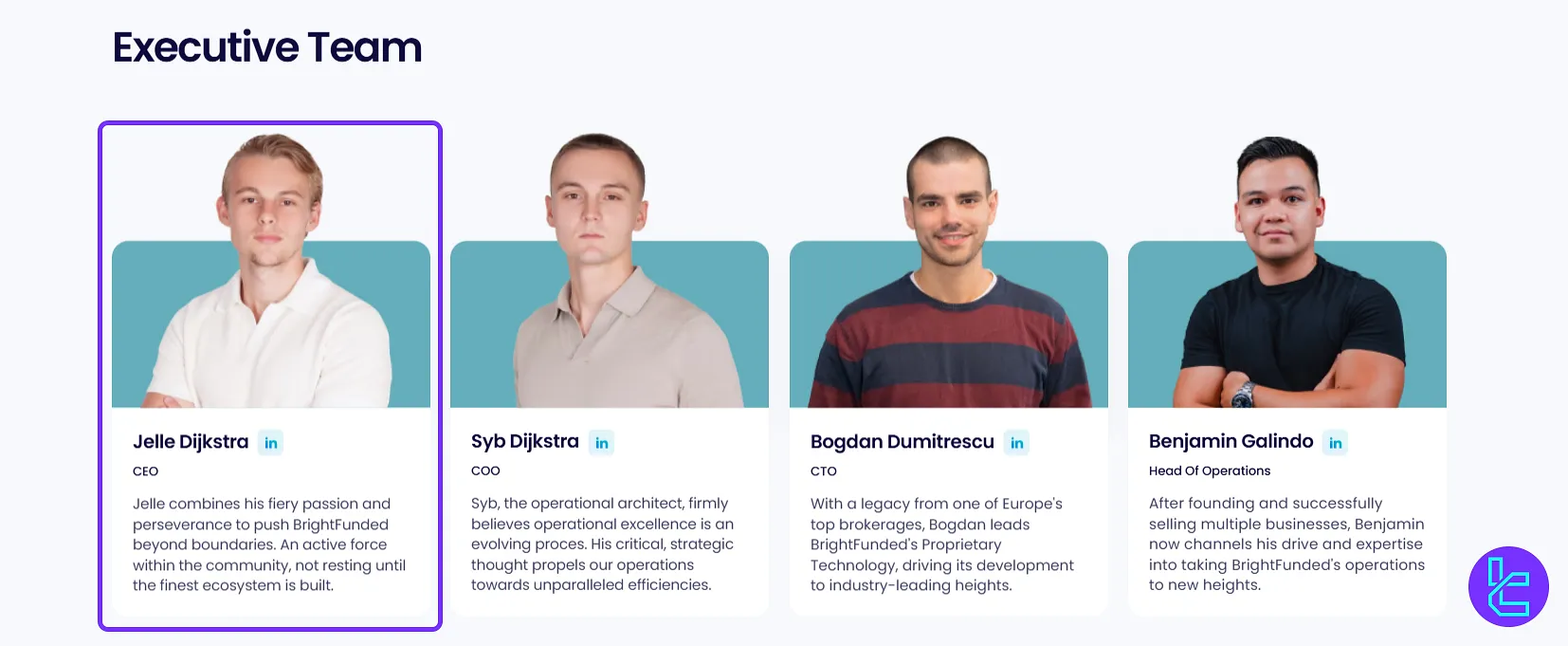

BrightFunded is a cutting-edge proprietary trading firm headquartered in the Netherlands, led by CEO Jelle Dijkstra.

The firm operates under the legal name Bright Global FZCO with company number 89766474.

What sets BrightFunded apart from many competitors is its commitment to providing a truly customized trading experience.

This firm has paid over $3M to its clients as payouts. Currently, it serves more than 10,000 active traders.

The firm also runs a unique Trade2Earn program, rewarding trading volume with tokens redeemable for free evaluations and better profit splits.

More into the BrightFunded CEO

Jelle Dijkstra is a visionary entrepreneur with a strong reputation in the global trading community.

With a background shaped by passion and perseverance, he has been instrumental in driving BrightFunded’s mission to create a superior ecosystem for traders, emphasizing innovation, growth, and long-term sustainability. You can follow and connect with him through the link below:

BrightFunded Specifications Summary

In the table below, you will see a brief overview of the firm's key specifications and features:

Account Currency | USD, EUR, GBP |

Minimum Price | 55 EUR |

Maximum Leverage | 1:100 |

Maximum Profit Split | 100% |

Instruments | Forex, Indices, Crypto, Commodities |

Assets | +150 |

Evaluation Steps | 2 |

Withdrawal Methods | Crypto (USDT), Bank Transfer |

Maximum Fund Size | Infinite |

First Profit Target | 8% |

Max. Daily Loss | 5% |

Challenge Time Limit | Unlimited |

News Trading | Restricted on Funded Star Accounts |

Maximum Total Drawdown | 10% |

Trading Platforms | cTrader, DXTrade |

Commission Per Round Lot | $3 |

Trustpilot Score | 4.4 out of 5 |

Payout Frequency | Bi-Weekly |

Established Country | Netherlands |

Established Year | 2022 |

Benefits & Drawbacks

Let's take a closer look at the advantages and potential drawbacks of trading with BrightFunded in the form of a table:

Benefits | Drawbacks |

Wide Range Of Tradable Instruments | Restrictions On News Trading |

Competitive Leverage Options (Up To 1:100 For Forex) | - |

Structured Scaling Plan With Potential For 100% Profit Share | - |

Clear Two-Step Evaluation Process | - |

Despite a few limitations, BrightFunded offers a compelling package for traders seeking a structured path to becoming funded traders with significant profit potential.

An Overview of the Funding & Price on BrightFunded

The company offers a range of account sizes to suit different trader experience levels and risk appetites. Here's an overview of their funding options:

- Account fundings from $5k to $200k

- Pricing and fees range from 55 EUR to 975 EUR

Here are the details regarding account sizes and initial fees:

| Account Size | Initial Fee |

| $5K | 55 EUR |

| $10K | 95 EUR |

| $25K | 195 EUR |

| $50K | 295 EUR |

| $100K | 475 EUR |

| $200K | 975 EUR |

The firm’s standout feature is its unlimited scaling plan. If traders achieve a 10% total profit over any four-month period, remain profitable in at least two of those months, complete two payouts, and maintain a non-negative balance, their account balance increases by 30%. This process can repeat indefinitely.

Registration and Verification Complete Guide

Account opening is the first thing you need to do if you want to get started. The BrightFunded registration process involves just a few essential steps: visiting the registration page, entering your personal information, and verifying your email.

#1 Begin at the Registration Portal

Go to the official BrightFunded website and click on “Login / Register” at the top-right. Then select “Register” to access the sign-up form.

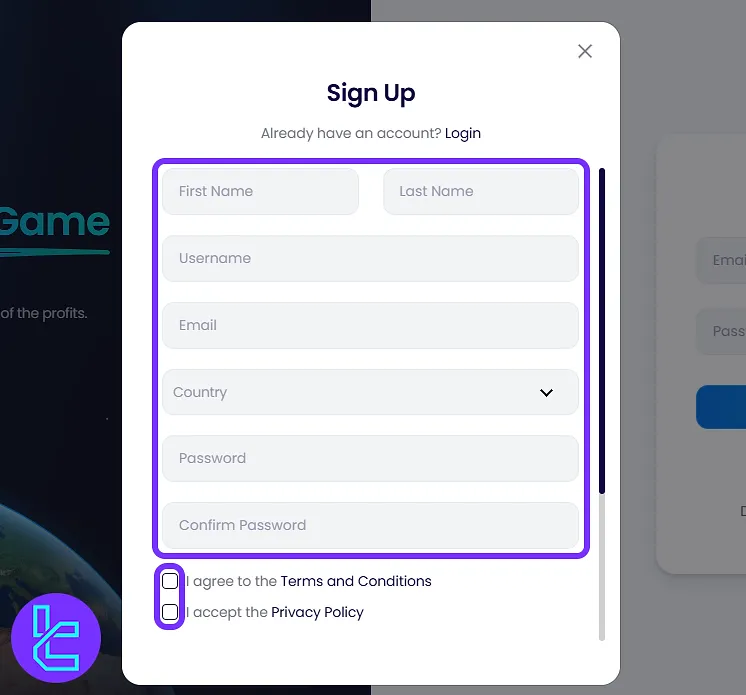

#2 Complete the Account Form

Complete the sign-up form with:

- First and last name

- Username

- Email address

- Country of residence

- A secure password (and confirmation)

Accept the terms of service and privacy policy, then click “Create Account”.

#3 Verify Your Email to Activate

Check your inbox for a verification email from BrightFunded. Click “Verify your Email” in the message.

Once confirmed, you’ll be redirected to your trading dashboard, ready to explore available challenges.

#4 Verify Your Account

Now, you have your account on BrightFunded. For verification, complete your profile and submit the necessary documents and information.

BrightFunded Prop Firm Evaluation Stages

The firm's evaluation process is designed to identify disciplined and profitable traders. The company has only one evaluation model, which is based on two phases. In the table below, we will look into the stages in detail.

- | Step 1 | Step 2 | Step 3 |

Funding | From $5k to $200k | ||

Trading Period | Unlimited | ||

Min. Trading Days | 5 Days | - | |

Max. Daily Loss | 5% | ||

Max. Overall Loss | 10% | ||

Profit Target | 8% | 5% | - |

BrightFunded Tokens | Yes | ||

Fee | From 55 EUR to 975 EUR | None | |

Each section below reviews each evaluation phase separately.

Step One

BrightFunded’s first evaluation phase is designed to test consistency and discipline while keeping traders motivated with realistic targets. The table below includes details:

Evaluation Phase | Step 1 |

Trading Period | Unlimited |

Min. Trading Days | 5 Days |

Max. Daily Loss | 5% |

Max. Overall Loss | 10% |

Profit Target | 8% |

BrightFunded Tokens | Yes |

Step Two

In Phase 2 of BrightFunded’s evaluation, traders move closer to securing a funded account under clear and structured rules. Stage parameters:

Phase | Step 2 |

Trading Period | Unlimited |

Min. Trading Days | 5 Days |

Max. Daily Loss | 5% |

Max. Overall Loss | 10% |

Profit Target | 5% |

BrightFunded Tokens | Yes |

BrightFunded Bonuses And Discount Codes

This firm offers several attractive discount codes to enhance the trading experience. BrightFunded promo codes:

- 25% off on larger account challenges (25K-200K) plus a free 10K challenge when purchasing a 100K or 200K account with the code BFONE25

- 25% off on challenge purchases with BLACKLINK25

- You will receive a 12% discount, bi-weekly payouts, and a free account of the same size upon reaching payout on all challenges via the code MATCH

However, we are not sure if these codes work. These promotions provide traders with significant cost savings and additional opportunities to succeed.

Be sure to check BrightFunded's website or authorized partners for the latest offers and expiration dates.

BrightFunded Rules

This section goes through the BrightFunded rules effective for trading and working with the prop firm:

- VPN Usage: BrightFunded allows the use of VPN/VPS when traveling or accessing accounts from different locations;

- Hedging: Hedging across multiple accounts, different prop firms, or platforms is prohibited; however, within a single account, it’s allowed for risk management purposes;

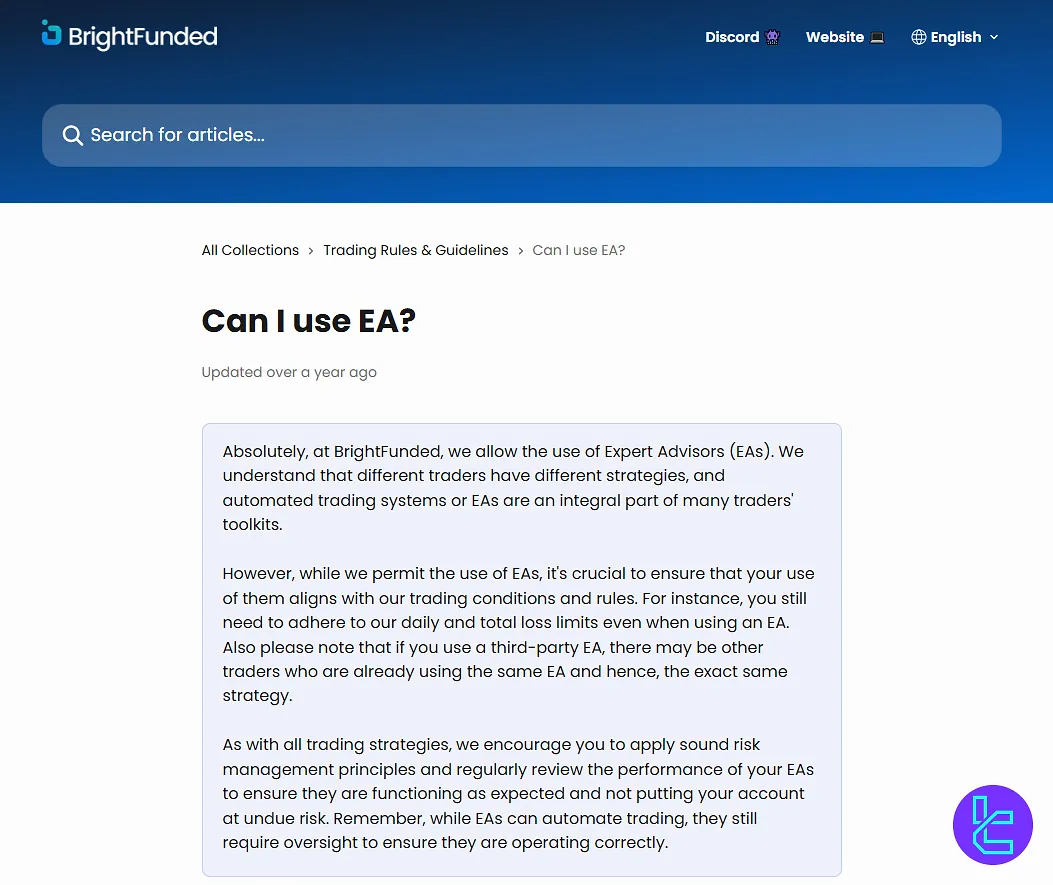

- Using Expert Advisors (EAs): EAs areallowed as long as they comply with BrightFunded's trading conditions;

- Martingale and Arbitrage: Arbitrage strategiesexploiting price differences between markets are prohibited, as they do not demonstrate true trading skills;

- News Trading: No restrictions on news trading in Phases 1 & 2; Funded Star Account prohibits trading within 10 minutes of major news events, with profit deductions;

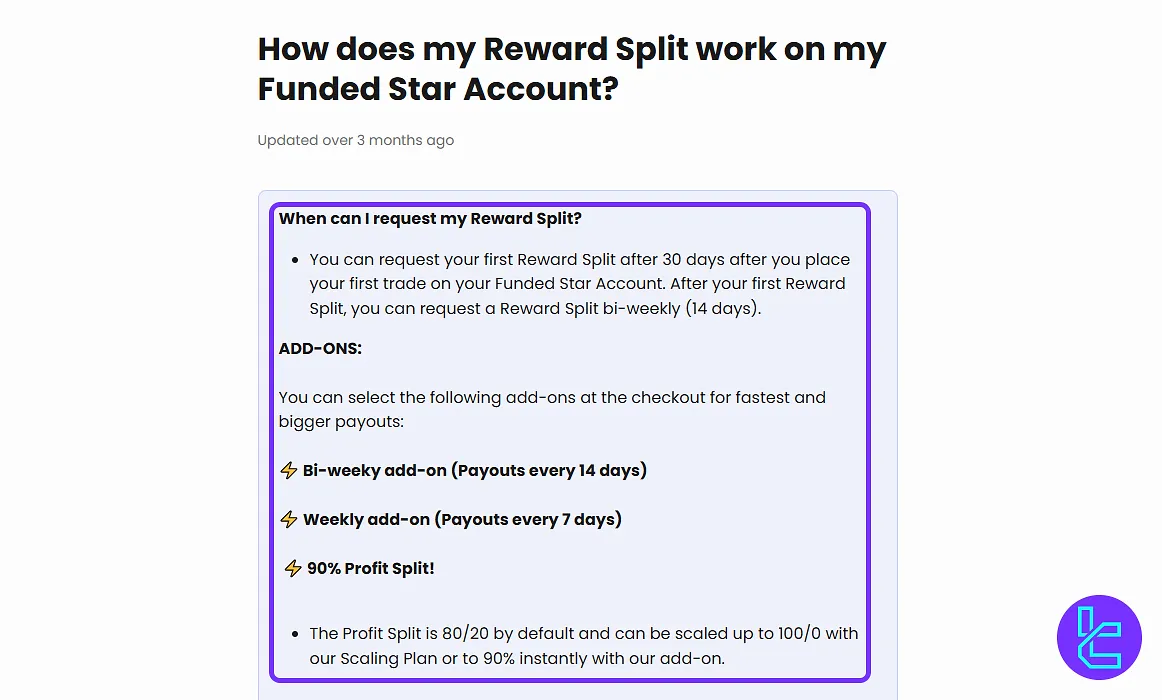

- Payouts: Traders can request their first BrightFunded payout after 30 days, then bi-weekly or weekly with add-ons. Payments are processed within 24 hours via bank transfer (EUR) or crypto (USDC – ERC-20).

VPN Usage

At BrightFunded, traders have the flexibility to use a VPN or VPS, particularly when traveling or accessing accounts from different regions. The use of different IPs is permissible, as long as the account owner is the one actively trading.

It is crucial to note that only the account holder is authorized to use the Challenge or Funded Account. External parties are strictly prohibited from accessing these accounts, even if the IP address is changed.

Hedging

The prop firm has comprehensive rules for hedging, which will all be covered in the following sections.

Across Multiple Accounts

Traders are not allowed to hedge the same instrument across multiple accounts. If detected, the first violation will lead to a Soft Breach, where all open trades will be closed, regardless of profit or loss, and a warning email will be issued.

Any subsequent violations will result in a Hard Breach and permanent account closure.

Within the Same Account

Hedging within a single account is allowed. Traders may open both buy and sell positions for the same financial instrument, such as EUR/USD, to manage risk or lock in profits.

Across Different Prop Firms

Hedging between accounts with different prop firms is strictly prohibited, as it distorts the evaluation process and gives an unfair advantage by avoiding actual market risk.

Cross-Platform Hedging

Trading the same financial instrument across multiple platforms like c Trader and DXTrade, linked to the same BrightFunded account, is not allowed. This can manipulate account performance and violate trading integrity.

Expert Advisors (EAs)

BrightFunded permits the use of Expert Advisors (EAs) as part of a trader's strategy. However, it's important for traders to adhere to trading conditions and risk management limits, including daily and overall loss limits, while using EAs.

It is advised that traders regularly review EA performance to ensure compliance and minimize account risk.

Traders using third-party EAs should also be aware that other traders may be using the same system, potentially leading to similar strategies.

Martingale and Arbitrage

Arbitrage, which involves exploiting small price discrepancies between different markets, is not allowed. This practice undermines the integrity of trading and does not reflect the trader's skills.

While Martingale strategies were not specifically mentioned, they generally fall under manipulative practices and are likely restricted.

News Trading

The following sections will demonstrate the rules for news trading with BrightFunded.

Phase 1 & Phase 2

There are no restrictions on trading around news events during these phases.

Funded Star Account

After transitioning to a Funded Star Account, traders cannot open or close positions within 10 minutes of major news events (5 minutes before and after the event).

Any profits gained within this time window will be deducted from the trader’s account, and losses will not be compensated. This rule is a soft breach and does not lead to account termination.

Swing Traders

Trades held for 48 hours or more are exempt from the news trading restrictions, meaning any take profits from such trades during the news event window will not be deducted.

Payouts

BrightFunded allows traders to request their first payout 30 days after opening a Funded Star Account.

Following that, withdrawals can be made bi-weekly or even weekly with add-ons. Rewards are processed within 24 hours via bank transfer (EUR) or crypto (USDC – ERC-20), with profit splits starting at 80/20 and instantly boostable to 90/10.

Scaling Your BrightFunded Evaluated Account

An evaluated account at BrightFunded enters the scaling program as soon as the first position is opened. If the eligibility criteria are met, the account balance expands by 30% of its initial size. The requirements are:

- Evaluation Period: Each account is reviewed across a cycle of four consecutive months;

- Profitability Standard: Profit must be recorded in at least two months within the cycle, with a minimum cumulative gain of 10%;

- Payout Condition:A trader needs to complete at least two successful withdrawals during the review stage;

- Balance Requirement: At the time of scaling, the account must reflect breakeven or positive equity.

BrightFunded applies no cap on account growth. As long as profitability is sustained, the account may be scaled indefinitely. From the third scale-up onward, traders retain the benefit of a 100% reward allocation.

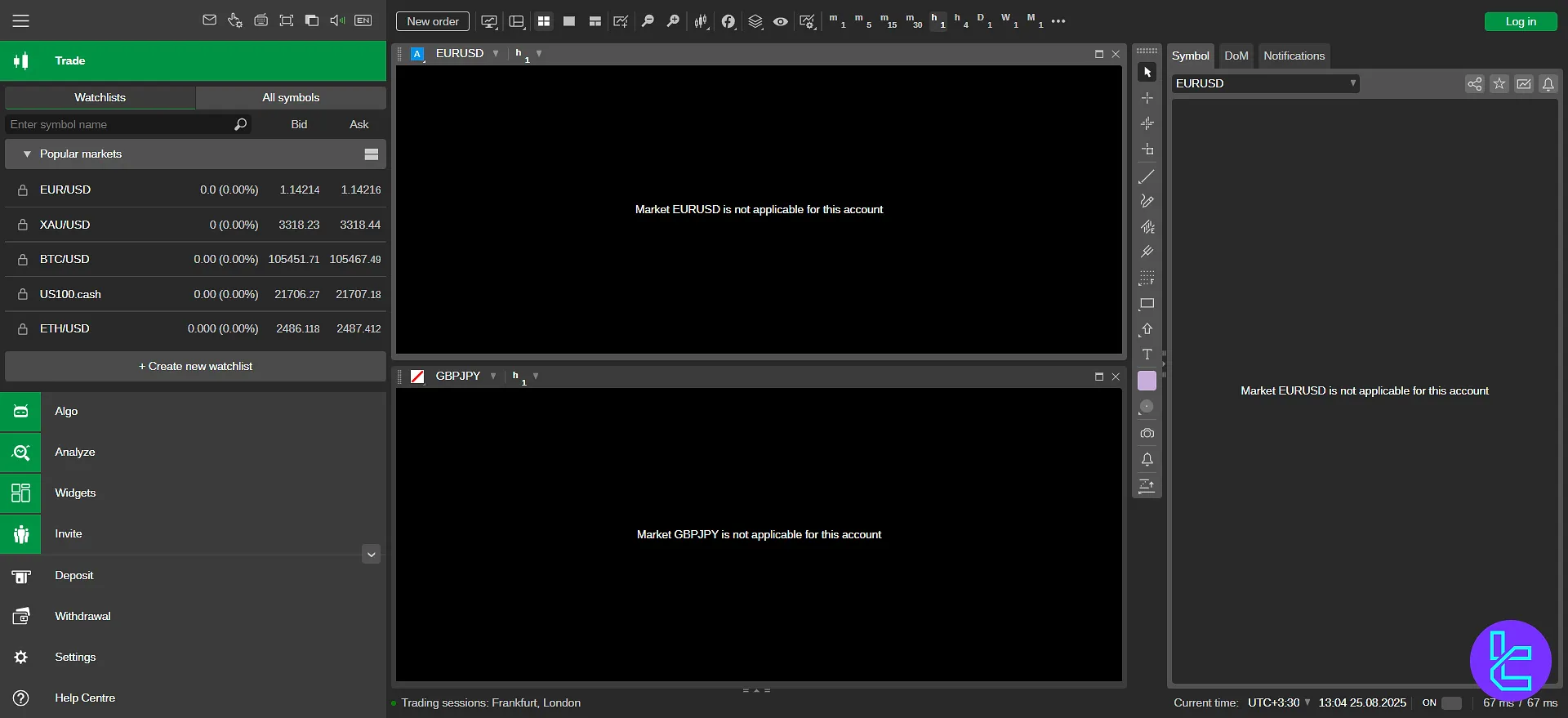

Trading Platforms Used via BrightFunded

BrightFunded supports two professional-grade trading platforms, cTrader and DXtrade, both of which are accessible via mobile and desktop (web).

cTrader

The cTrader platform is designed for advanced users who need precision control, featuring:

- Over 60 built-in indicators and 26 timeframes

- Level II pricing and full Depth of Market (DoM) view

- The ability to automate strategies using C# via cTrader Automate

- Fast order execution infrastructure for latency-sensitive strategies

Download/Access Links:

- BrightFunded cTrader Android

- BrightFunded cTrader Desktop (Web)

- cTrader iOS (Currently unavailable)

DXTrade

This platform caters to discretionary traders and those who prefer a visual, intuitive interface:

- Fully customizable layouts and widgets

- Live margin monitoring and stop-out risk tools

- 80+ indicators and a built-in backtesting environment

- Cloud-synced preferences across all devices

Download/Access Links:

Tradable Instruments and Symbols

BrightFunded offers more than 150 instruments and crypto pairs overall. These assets consist of:

- Cryptocurrencies: Access to popular and emerging crypto pairs

- Forex Market: Major, minor, and exotic symbols

- Indices: Global stock market indices

- Commodities: Hard commodities (e.g., metals)

This wide selection of instruments and flexible leverage options allows traders to diversify their strategies and manage risk according to their preferences.

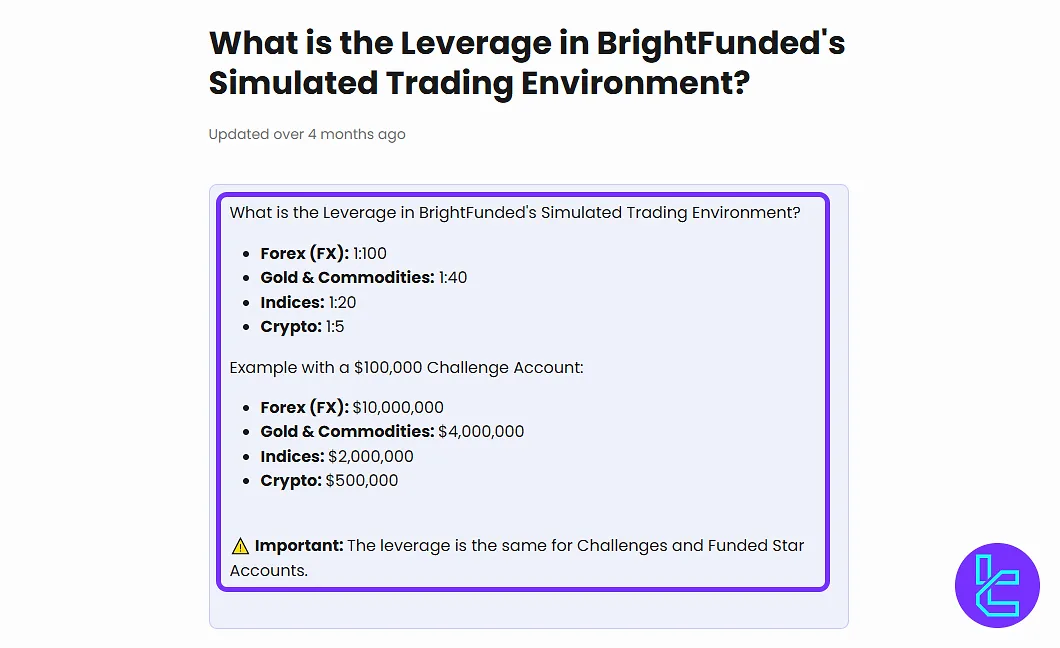

BrightFunded Leverage

BrightFunded offers traders flexible leverage across asset classes, ensuring both growth potential and controlled risk. In its simulated trading environment, the leverage is:

- Forex (FX): 1:100

- Gold & Commodities: 1:40

- Indices: 1:20

- Crypto: 1:5

For example, a $100,000 Challenge Account allows up to $10M in Forex, $4M in commodities, $2M in indices, and $500K in crypto exposure. The same leverage applies to both Challenge and Funded Star Accounts.

Payment Options and Methods Overview

According to the FAQ section on the official website, BrightFunded provides payouts via these 2 options:

- Crypto (USDT)

- Bank transfers

Also, you can pay for challenges using these methods:

- Credit/debit cards

- Crypto

- E-payment platforms

Commission & Costs

Based on our investigations on the platform and the website, BrightFunded provides trading with these fees:

- Currency Pairs: $3 per round lot

- Indices: $0 (zero commission)

- Cryptocurrencies: 0.024% per volume

- Commodities: 0.0010% per volume

These rates are generally in line with industry standards and allow traders to maintain profitable strategies across various instrument types.

The zero commission on indices is particularly attractive for traders focusing on these markets.

Educational Resources on BrightFunded

The company tries to provide some resources for educating traders, but it does not have a dedicated section for this purpose. Education on BrightFunded:

- Blog articles about trading systems, psychology, etc.

- YouTube channel with educational videos and content

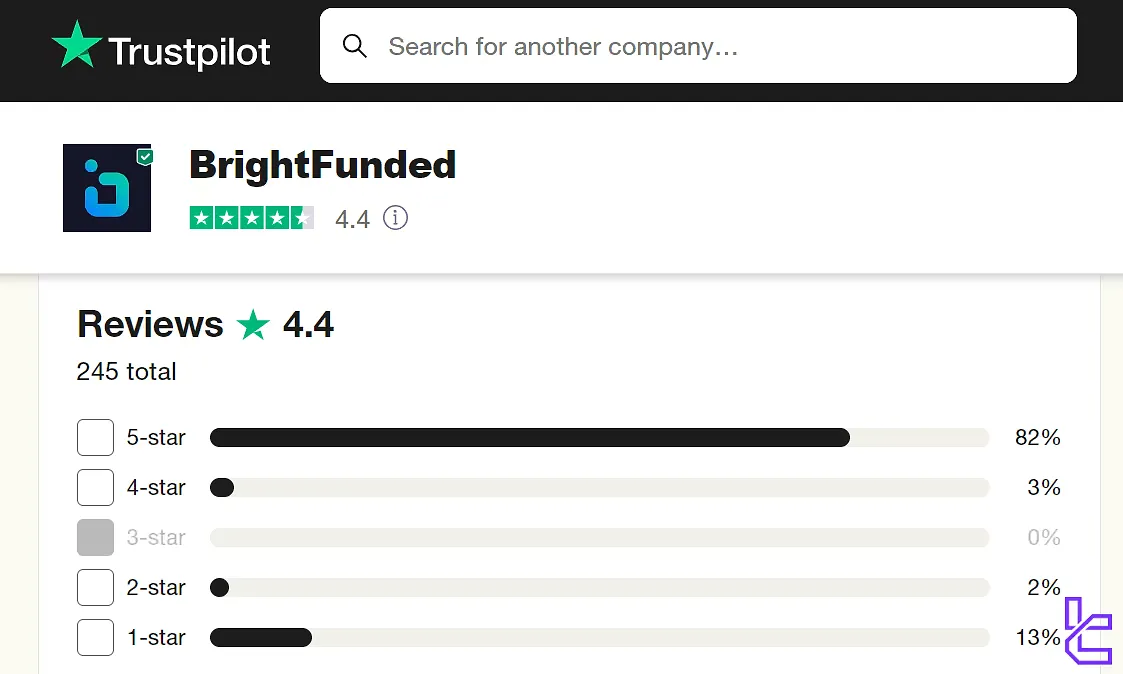

Trust Reviews on Trustpilot

BrightFunded's Trustpilot profile has received mixed reviews, with an overall rating of 4.4 out of 5 stars. Positive reviews often highlight the following:

- Reliable and timely payouts

- Responsive customer support

- User-friendly trading platform

However, some negative reviews mention:

- Issues with withdrawals

- Concerns about account closures

It's worth noting that BrightFunded actively responds to negative reviews, addressing concerns and providing clarifications where necessary.

Customer Support and Services – Contact Info & Schedule

BrightFunded prop firm offers typical methods for support services. In the table below, we will discuss each:

Support Method | Availability |

Live Chat | Yes (Available via the official website) |

Yes (via support@brightfunded.com) | |

Phone Call | No |

Discord | Yes |

Telegram | No |

Ticket | No |

FAQ | No |

Help Center | Yes (on the Website) |

No | |

Messenger | No |

The firm states that it offers 24/7 services through the methods listed above.

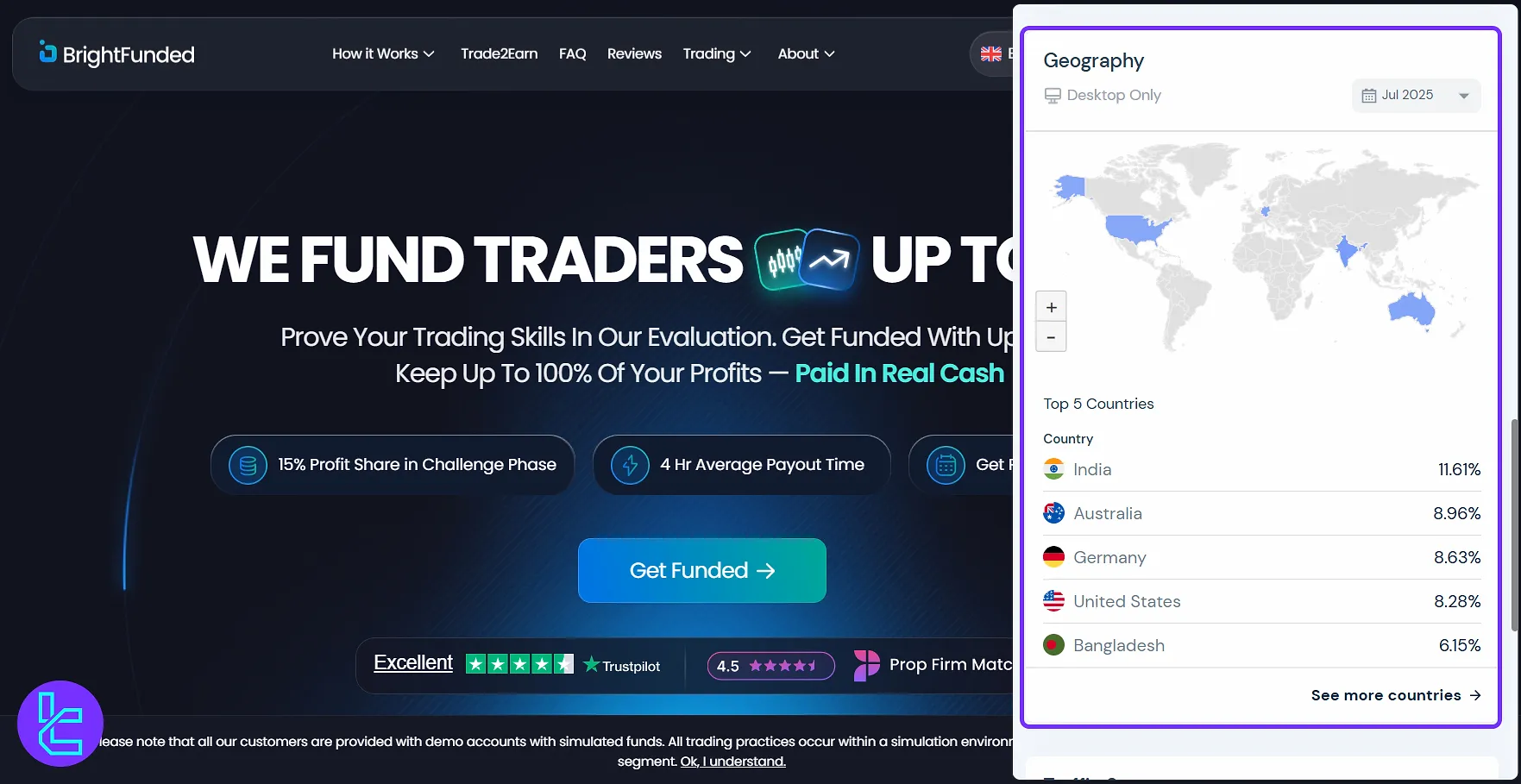

BrightFunded User Base

BrightFunded attracts a global trading community, with its strongest presence in emerging and developed markets. According to recent data, India leads the user base with 11.61%, followed by Australia (8.96%), Germany (8.63%), United States (8.28%), and Bangladesh (6.15%).

This geographic spread highlights the firm’s appeal across diverse regions, from Asia to Europe and North America, reflecting its growing recognition as a trusted prop trading platform.

Social Media Channels and Pages

BrightFunded holds a place on several social media platforms. This helps users to keep up with the latest updates in an easier way. BrightFunded Social Pages:

Social Media | Members/Subscribers |

Over 32K | |

Over 1.2K | |

Over 34.2K | |

Over 1.2K | |

Over 22.6K | |

Over 1.3K |

BrightFunded in Comparison to The Competitors

Here's a table that compares the discussed prop firm with some of the major players in the prop industry:

Parameters | BrightFunded Prop Firm | Crypto Fund Trader Prop Firm | For Traders Prop Firm | FundedNext Prop Firm |

Minimum Challenge Price | 55 EUR | $55 | $49 | $32 |

Maximum Fund Size | Infinite | $200,000 | $1,500,000 | $4,000,000 |

Evaluation steps | 2-Step | 1-phase, 2-phase | 1-Step, 2-Step | 1-Step, 2-Step |

Profit Share | 100% | 80% | 90% | 95% |

Max Daily Drawdown | 5% | 4% | 4% | 5% |

Max Drawdown | 10% | 6% | 8% | 10% |

First Profit Target | 8% | 8% | 6% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:125 | 1:100 |

Payout Frequency | Bi-weekly | 2 Times a Month | 14 Days | From 5 Days |

Number of Trading Assets | 150+ | 200+ | 130 | 78 |

Trading Platforms | cTrader, DXTrade | Metatrader 5, CFT Platform and Crypto Futures | DXTrade, TradeLocker, cTrader | MT4, MT5, cTrader, MatchTarder |

Expert Suggestions

BrightFunded is a prop firm offering infinite funding through scaling. The company has received a 4.4/5 trust score on "Trustpilot," with over 240 reviews.

The maximum total drawdown in the evaluation phases is 10%, while the maximum daily loss falls to 5%.