City Traders Imperium is a prop trading company with a profit split of up to 100% and an option to skip the evaluation phases.

CTI charges $5 per lot for trading forex and commodities and $0.5 per lot for indices.

City Traders Imperium Company Overview

City Traders Imperium is a prop firm founded in 2018 and headquartered in the United Kingdom. However, based on the official website, this firm is owned by CTI FZCO, which is a limited company registered in the United Arab Emirates.

CTI has quickly established itself as a leading player in the prop trading industry. Their mission? To identify and nurture trading talent through innovative funding programs.

Get to Know City Traders Imperium CEO

City Traders Imperium is guided by Daniel Martin, one of its co-founders and current CEO. With over 20 years of trading expertise, Martin has built a reputation as a seasoned professional across indices, commodities, forex, stocks, and cryptocurrencies.

His vision, alongside co-founder Martin Najat, has been to create a platform that equips traders with the tools, discipline, and strategies required to achieve consistent profitability in the markets.

Table of Specifications

Learning about the specifics of a firm gives us an overall understanding of its different aspects. CTI's key features:

Account Currency | USD, GBP |

Minimum Price | $29 |

Maximum Leverage | 1:30 |

Maximum Profit Split | 100% |

Instruments | Forex, Indices, Commodities |

Assets | 50+ |

Evaluation Steps | 1-Step, 2-Step |

Withdrawal Methods | Crypto, Bank Transfer |

Maximum Fund Size | $4M |

First Profit Target | 8% |

Max. Daily Loss | 5% |

Challenge Time Limit | Unlimited |

News Trading | Allowed |

Maximum Total Drawdown | Up to 10% |

Trading Platforms | MetaTrader 5 |

Commission Per Round Lot | $5 on Forex & Commodities $0.5 on Indices |

Trustpilot Score | 4.5/5 |

Payout Frequency | Weekly |

Established Country | United Kingdom |

Established Year | 2018 |

Benefits & Drawbacks

Every prop firm has its unique advantages and disadvantages. Let's examine CTI's:

Benefits | Drawbacks |

High Profit Split | Relatively Low Variety In Tradable Symbols |

Unlimited-Time Challenges | - |

Flexible Trading Conditions (EAs, News Trading Allowed) | - |

Quick Payouts | - |

Opportunity To Earn A Monthly Salary | - |

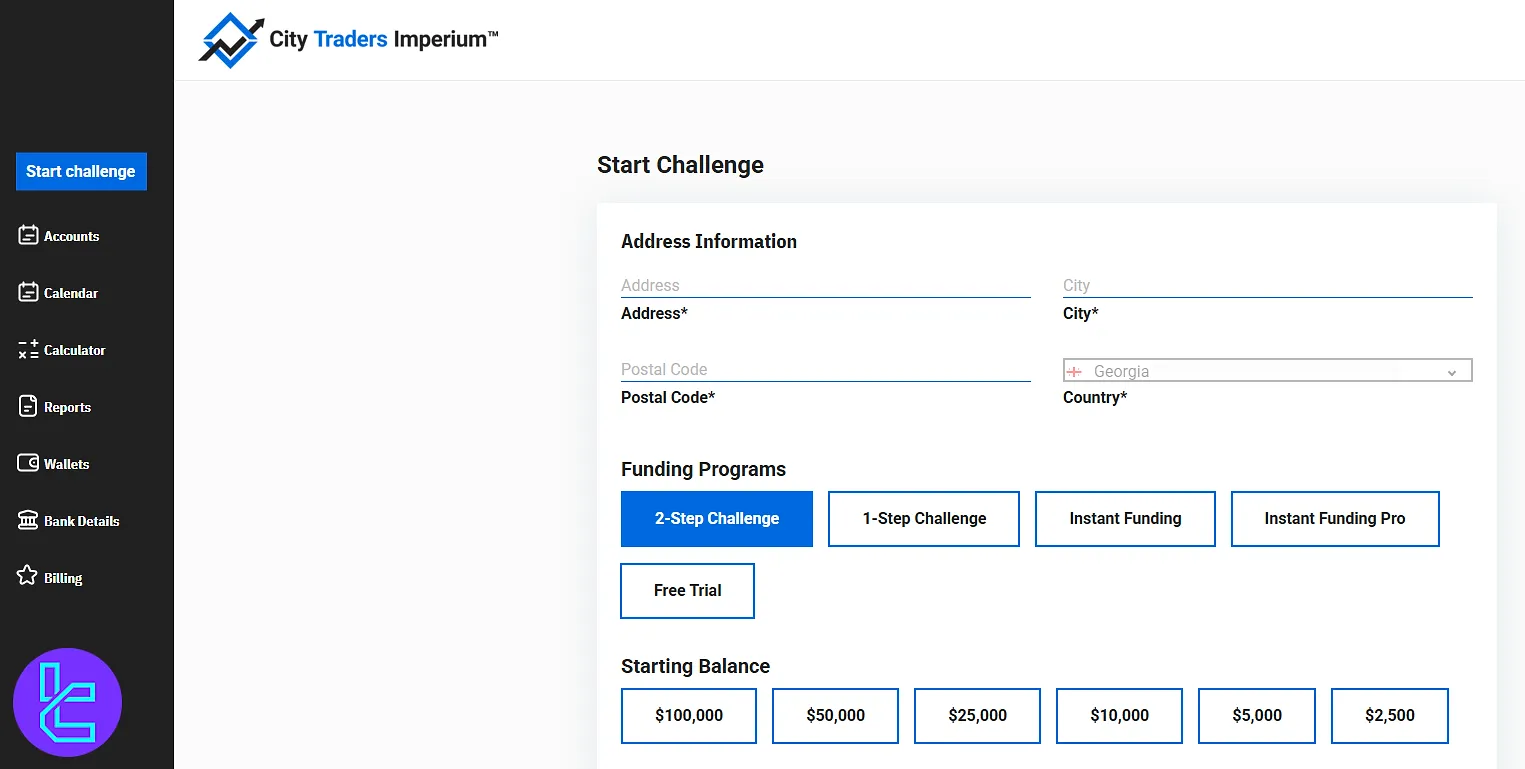

An Overview of the Funding & Price of the CTI

The firm offers a range of funding options to cater to different trader preferences and skill levels. In the list below, we will have a brief look at the funding and prices:

1-Step Challenge:

- Account Sizes: $2.5K to $100K

- Fees: $29 to $469

2-Step Evaluation:

- Funding: $2.5K to $100K

- Prices: $39 to $549

Instant Funding:

- Account Funds: $2.5K to $80K

- Fees: $69 to $1,499

Instant Funding Pro:

- Funding: 5K to $80K

- Prices: $299 to $4,799

Here is a table going through the details:

| Account Size | 1 Step Fee | 2 Step Fee | Instant Funding Fee | Instant Funding Pro Fee |

| $2.5K | $29 | $39 | $69 | N/A |

| $5K | $49 | $59 | $129 | $299 |

| $10K | $89 | $109 | $249 | $599 |

| $20K | N/A | N/A | $449 | $1,199 |

| $25K | $159 | $199 | N/A | N/A |

| $40K | N/A | N/A | $849 | $2,399 |

| $50K | $269 | $359 | N/A | N/A |

| $80K | N/A | N/A | $1,499 | $4,799 |

| $100K | $469 | $549 | N/A | N/A |

The prop firm offers up to $4,000,000 through its scaling program to the traders.

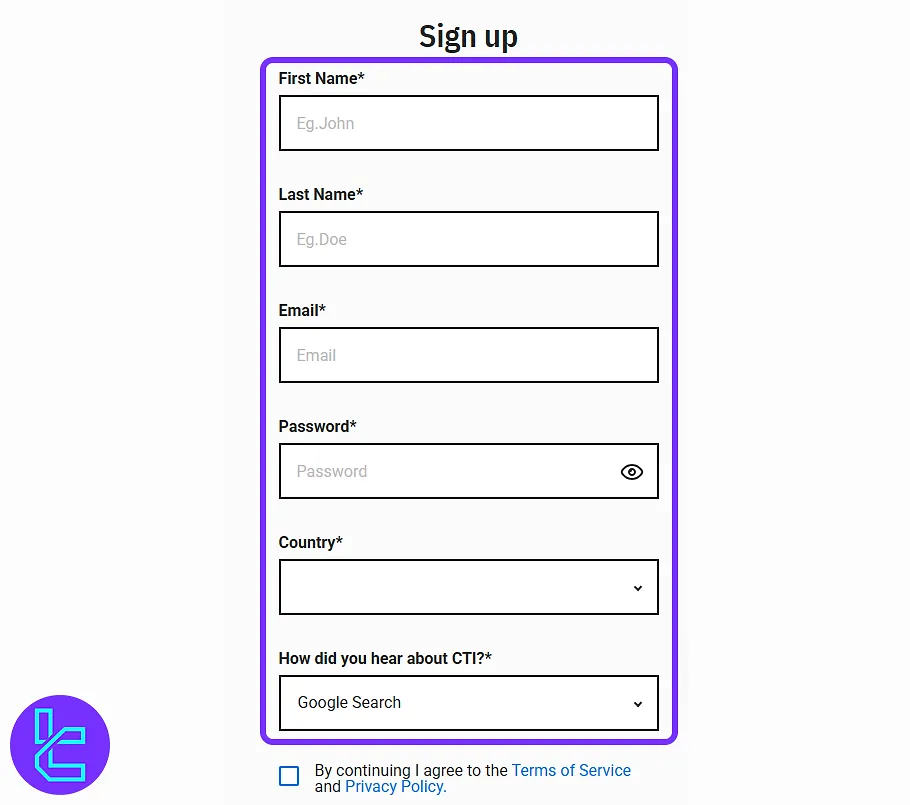

City Traders Imperium Registration and Verification

Opening an account with CTI is done in a short timeframe and does not require complex details. City Traders Imperium registration and verification will be explained in 3 phases.

#1 Navigate to the Registration Page

Head over to the official City Traders Imperium website and click on the "Open an Account" button. This will lead you directly to the sign-up form.

#2 Submit Your Basic Details

Fill out the form with the following:

- Full Name

- Email Address (must be unique)

- Secure Password (include symbols, upper/lowercase)

- Country of Residence

- Referral Source (how you found CTI)

Accept the terms, and click "Sign Up for Free". You’ll be redirected immediately to your personal dashboard.

#3 Verify Your Account

To pass the KYC verification procedure, complete your profile with the required information and upload the required photos of your documents.

Evaluation Phases, Specifics, and Conditions

Understanding CTI's evaluation process is crucial for success. Here's a breakdown of the 1-step, 2-step, and instant funding models.

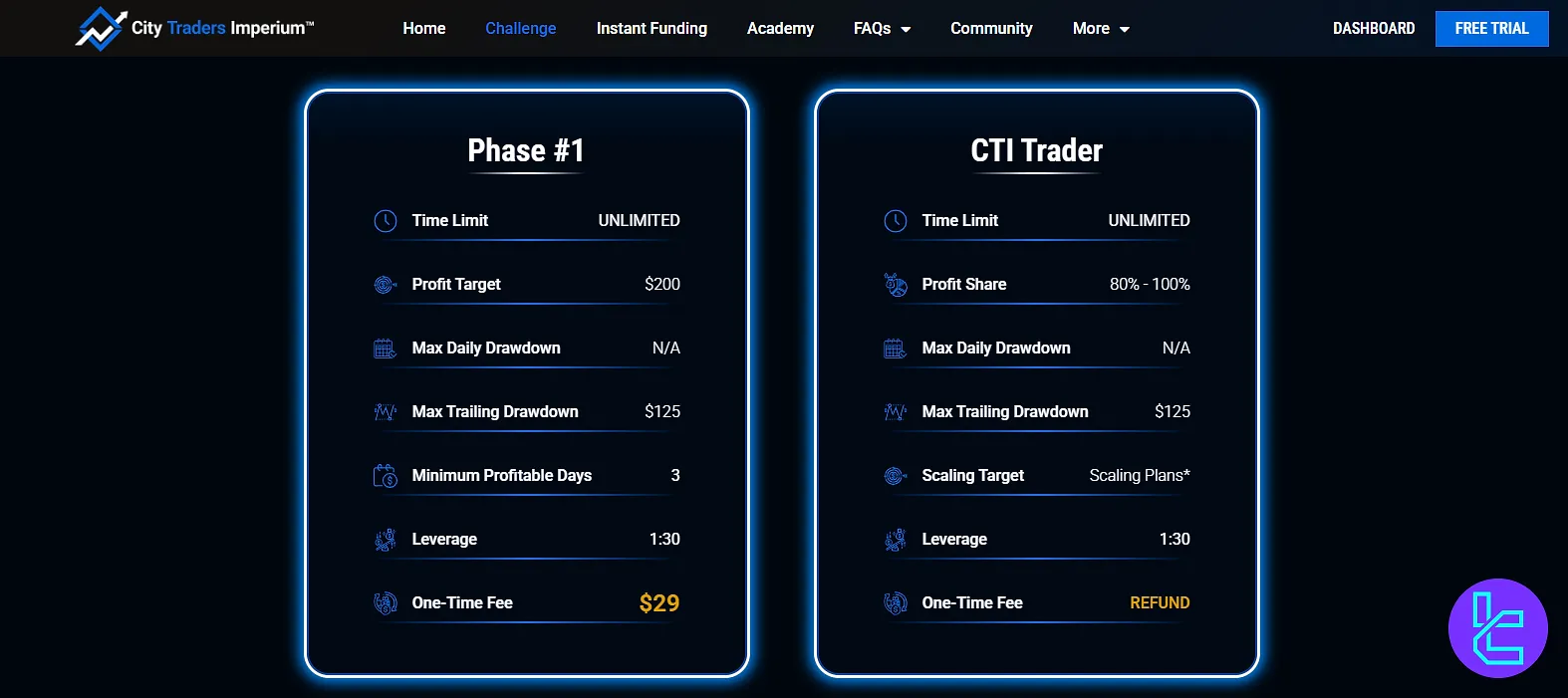

City Traders Imperium 1-Phase Evaluation

CTI provides a 1-phase evaluation program designed for traders who want a direct and flexible path to funded accounts. The table below demonstrates the details:

| Account Size | $2,500 | $5,000 | $10,000 | $25,000 | $50,000 | $100,000 |

Time Limit | Unlimited | |||||

Profit Split (After Passing The Challenge) | Up to 100% | |||||

Profit Target | 8% | |||||

Max. Daily Loss | None | |||||

Max. Total Drawdown | 5% | |||||

Monthly Salary (After Passing The Challenge) | $12.5/Month | $25/Month | $50/Month | $100/Month | $200/Month | $400/Month |

Leverage | 1:30 | |||||

Fee | $29 | $49 | $89 | $159 | $269 | $469 |

You can also see the parameters in the screenshot below:

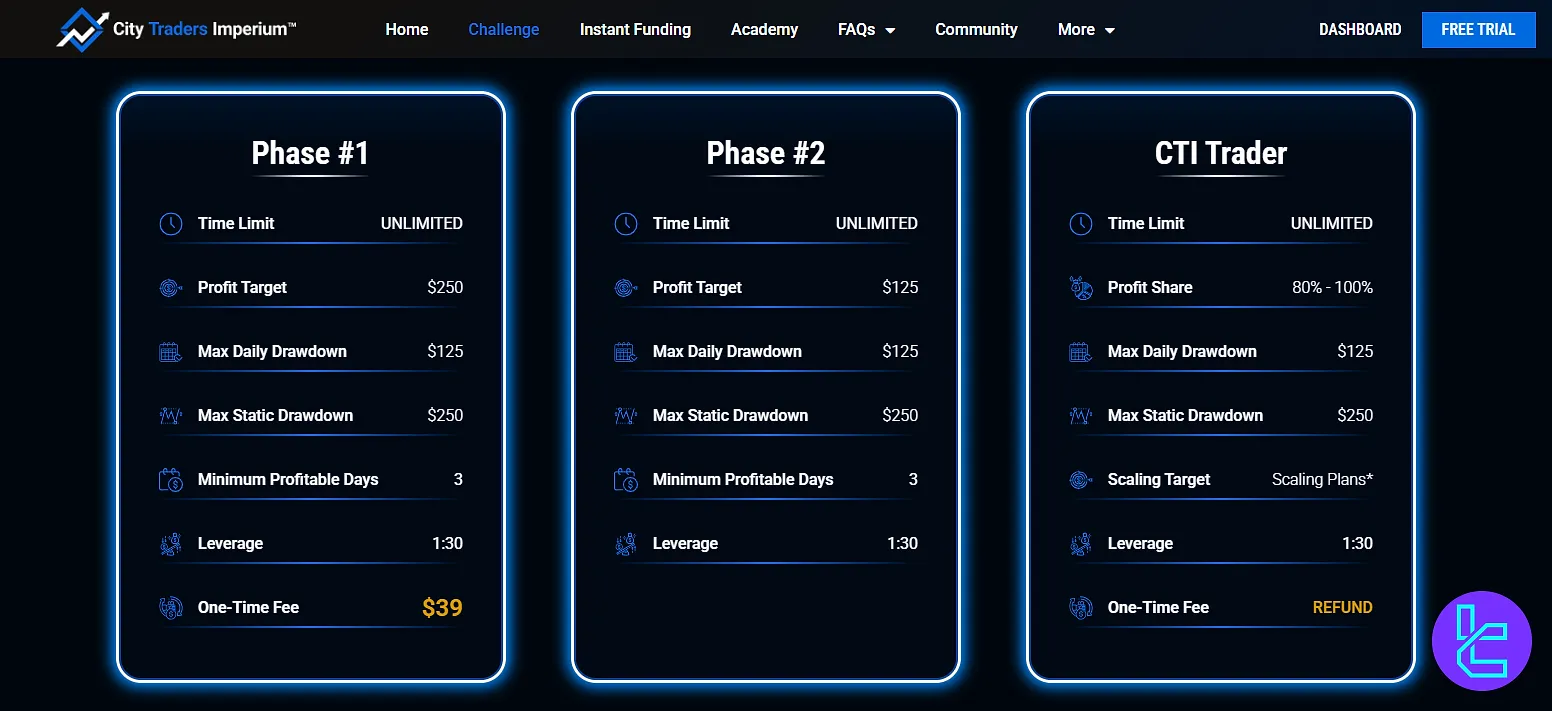

City Traders Imperium 2-phase evaluation

City Traders Imperium offers a 2-stage evaluation model designed for traders who want to prove their consistency under real market conditions. Parameters and details:

| Account Size | $2,500 | $5,000 | $10,000 | $25,000 | $50,000 | $100,000 |

Time Limit | Unlimited | |||||

Profit Split (After Passing The Challenge) | 80%-100% | |||||

Profit Target | 10%-5% | |||||

Max. Daily Drawdown | 5% | |||||

Max. Total Drawdown | 10% | |||||

Monthly Salary (After Passing The Challenge) | $12.5/Month | $25/Month | $50/Month | $125/Month | $250/Month | $500/Month |

Leverage | 1:30 | |||||

Fee | $39 | $59 | $109 | $199 | $359 | $549 |

Here's a screenshot of the website indicating the values and numbers of the challenge:

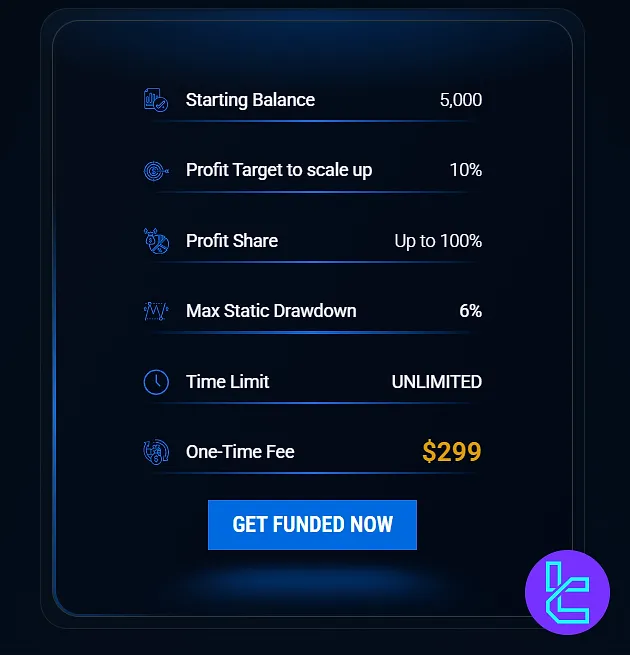

City Traders Imperium Instant Funding

City Traders Imperium offers Instant Funding accounts designed for traders who want to bypass evaluations and start trading live capital immediately. The table below reviews the plan:

Account Size | $2,500 | $5,000 | $10,000 | $20,000 | $40,000 | $80,000 |

Time Limit | Unlimited | |||||

Profit Split | Up to 100% | |||||

Profit Target for Scaling Up | 10% | |||||

Max. Total Drawdown | 6% | |||||

1:10 | ||||||

Fee | $69 | $129 | $249 | $449 | $849 | $1,499 |

This is how the official website demonstrates the account:

City Traders Imperium Instant Funding Pro

City Traders Imperium’s Instant Funding Pro program is designed for traders who want immediate access to funded accounts without evaluation delays. More details in the table below:

Account Size | $5,000 | $10,000 | $20,000 | $40,000 | $80,000 |

Time Limit | Unlimited | ||||

Profit Split | Up to 100% | ||||

Profit Target for Scaling Up | 10% | ||||

Max. Total Drawdown | 6% | ||||

Leverage | 1:10 | ||||

Fee | $299 | $599 | $1,199 | $2,399 | $4,799 |

You can find the program's parameters on the official website in such a format:

Bonuses And Discount Offers

You can find discount codes on the internet via third-party websites. These promotions offer you a lower price for challenges. Here's a promo code for CTI:

- "MATCH" for 15% off all challenges

Always check the firm's website or authorized affiliate sites for the latest offers before signing up.

City Traders Imperium Rules

There are trading rules set by City Traders Imperium that must be adhered to by the traders. CTI Rules:

- VPN Usage: Traders may use a VPN or VPS, but under certain conditions;

- Group Hedging: This practice is prohibited. If this is detected, it will be treated as manipulation;

- Expert Advisor (EA): Traders cannot use any third-party EAs unless you own the source code;

- Martingale & Arbitrage: Strategies like Martingale are prohibited. Additionally, exploiting price delays or differences between platforms (latency arbitrage) is considered unfair and unethical;

- News Trading: News bracketing strategies and using bots to scalp news events are prohibited;

- Payouts: City Traders Imperium payouts require a first withdrawal after meeting profit/day conditions, followed by structured schedules: monthly (1-Step & 2-Step) or bi-weekly (Instant Funding).

VPN Usage

While traders are allowed to use a VPN or VPS, it is essential that their IP address region stays consistent with the country they registered with. Any changes in the region may raise ared flag, and they may be required to confirm the reason.

Proof, such as an invoice under their name or confirmation that the VPN/VPS uses a static IP address (which can be whitelisted for easier access), may be required.

For the best performance, it is recommended that traders use a London-based VPS, as the server is also based in London.

Group Hedging

Group hedging involves multiple traders coordinating to place opposing trades on the same asset, using different accounts either within the same prop firm or across others. This technique guarantees a win on at least one account, regardless of market direction, and manipulates the system.

This practice is prohibited, and any signs of coordinated risk sharing will be flagged as group hedging.

Expert Advisor (EA) Usage

Traders are not allowed to use any third-party Expert Advisors (EAs) unless they own the source code. Without the source code, it is impossible to verify what the EA does, which creates a risk of manipulation.

If an EA is detected, traders must submit the source code to ensure transparency. If they cannot provide it, the EA will be considered a third-party EA and will not be permitted.

Trade managers and calculators are permitted as long as they don’t manipulate the trading process.

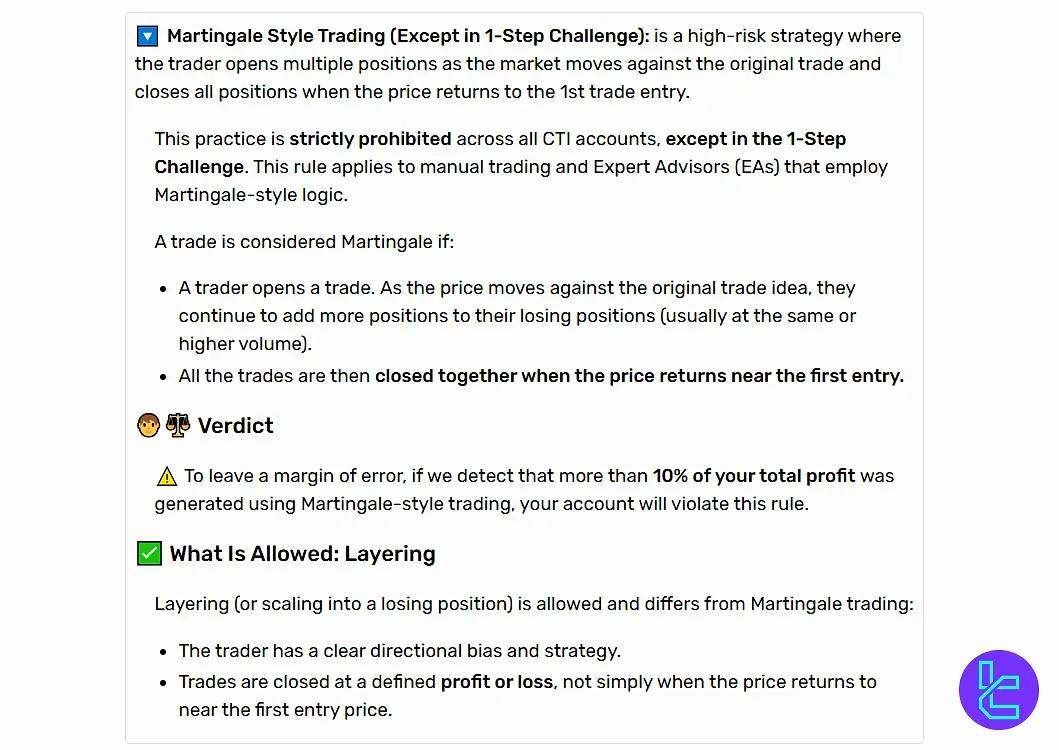

Martingale & Arbitrage Strategies

- Martingale Strategy:Adding positions to a losing trade and closing them when the price returns is prohibited, except in the 1-Step Challenge. Accounts violating this rule with over 10% profit from Martingale will be flagged;

- Latency Arbitrage: Exploiting price delays or discrepancies between platforms is unethical and will be flagged as arbitrage.

News Trading

- News Bracketing: Placing Buy-Stop and Sell-Stop orders around the market price before major news events to profit from volatility is prohibited;

- Gaps or News Scalping EAs: Using bots to scalp news events or price gaps is forbidden due to their reliance on unpredictable price movements and low liquidity.

Payouts

The prop firm has different rules for Instant Funding and Challenge programs.

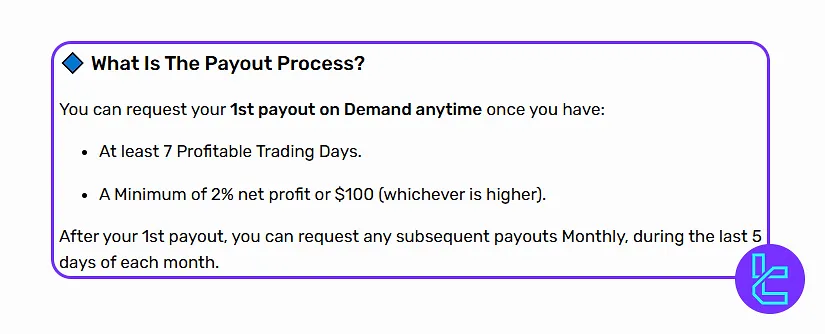

City Traders Imperium Payouts in 1-Step and 2-Step Challenges

City Traders Imperium allows traders to request their first payout on demand once two key conditions are met: completing at least 7 profitable trading days and achieving a minimum of 2% net profit or $100 (whichever is higher).

After receiving the first withdrawal, all subsequent payouts can be requested on a monthly basis, specifically within the last 5 days of each month. This structured system ensures consistency and transparency across both 1-Step and 2-Step Challenges, giving traders reliable access to their profits.

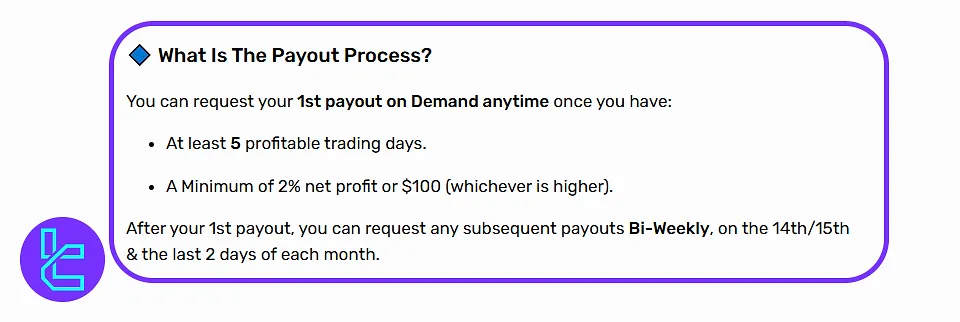

City Traders Imperium Payouts in Instant Funding Programs

The first payout can be requested on demand, provided certain conditions are met:

- Completion of at least 5 profitable trading days

- Achievement of a minimum 2% net profit or $100 (whichever is higher)

After the first withdrawal, traders gain access to a bi-weekly payout schedule, with requests available on the 14th/15th and the last two days of each month.

City Traders Imperium Scaling Plans

The prop firm has different scaling programs for each of its evaluation models. Each following section will go through each plan.

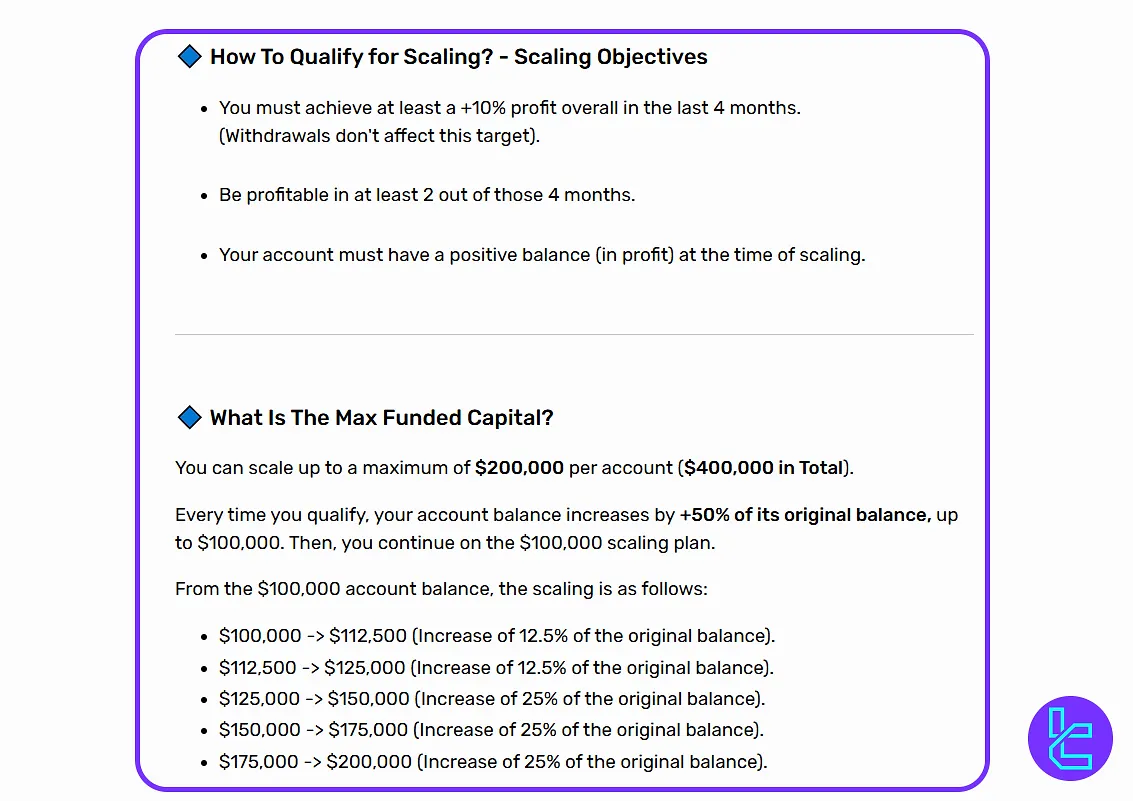

City Traders Imperium Scaling in 1-Step and 2-Step Accounts

To qualify for scaling in the mentioned plans, traders must demonstrate at least 10% overall growth within a four-month cycle, remain profitable in two out of those four months, and hold a positive balance at the point of review. Withdrawals during the period do not impact eligibility.

Once the criteria are met, the account balance increases progressively. Each scaling stage represents a percentage gain from the original balance, with allocations extending up to $200,000 per account and a total cap of $400,000 across multiple accounts.

Typical progression from a $100,000 funded account includes:

- $100,000 to $112,500 (12.5% of the original balance)

- $112,500 to $125,000 (12.5% of the original balance)

- $125,000 to $150,000 (25% of the original balance)

- $150,000 to $175,000 (25% of the original balance)

- $175,000 to $200,000 (25% of the original balance)

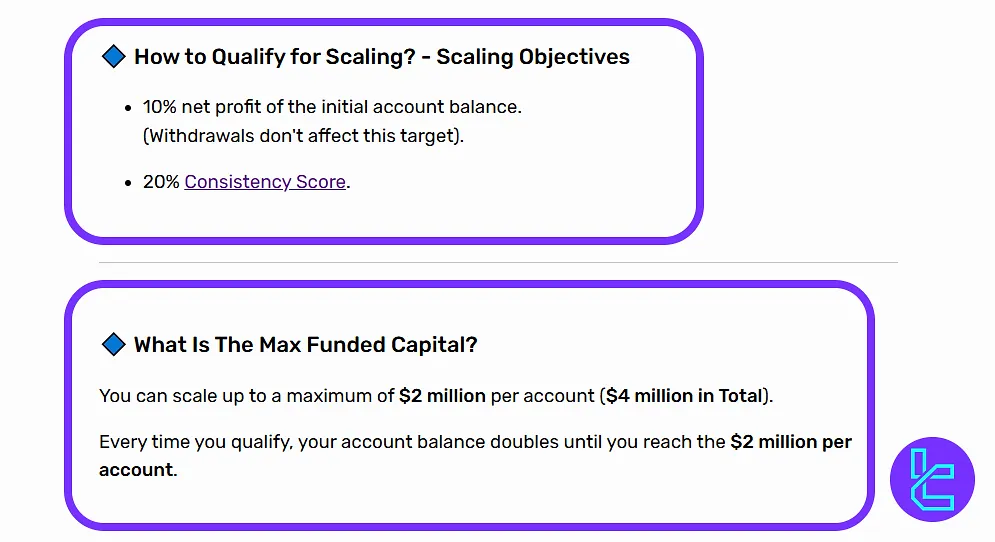

City Traders Imperium Scaling in Instant Funding Programs

For funding growth in Instant Funding and Instant Funding Pro accounts, participants must achieve 10% net profit on the initial balance and maintain a 20% Consistency Score, with withdrawals not impacting the target.

Once eligible, account sizes are doubled progressively until they reach the ceiling of $2 million per account (up to $4 million in total across accounts). This approach enables traders to expand capital gradually while adhering to predefined performance benchmarks.

What Trading Platforms Are Offered by CTI?

A trading platform could be important for traders because of its features and user interface. CTI offers trading via MetaTrader 5, which includes these specifications:

- Real-time quotes

- Interactive charts

- Expert Advisors (EAs) support

- Economic calendar embedded on the platform

- Access to trading signals and copy trading options

- Strategy tester tools

- Market depth data feed

Tradable Markets and Assets

CTI offers a mediocre range of tradable instruments consisting of popular assets:

- Forex Market: 28 currency pairs

- Cryptocurrency: BTC, ETH, LTC, ADA, and XRP

- Commodities: Gold, silver, and oil

- Indices: 9 major global stock indices

Most other prop firms offer more variety in terms of trading markets.

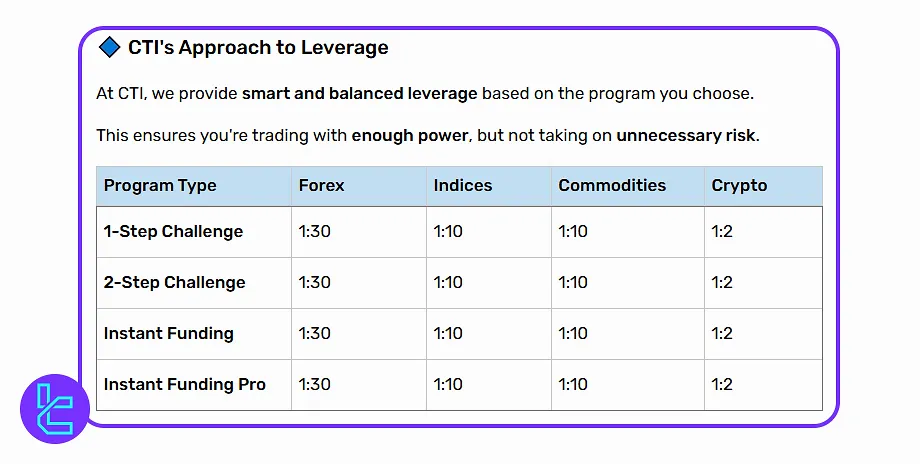

City Traders Imperium Leverage

City Traders Imperium offers smart and balanced leverage across all programs, ensuring traders access enough market power while avoiding excessive risk. The leverage structure is tailored by asset class, supporting a disciplined and sustainable trading experience.

- Forex: 1:30 across all programs

- Indices: 1:10 standard leverage

- Commodities: 1:10 for stable exposure

- Crypto: 1:2 to manage volatility effectively

Which Methods Are Available for Payments on CTI?

Getting paid is a crucial aspect of prop trading. CTI covers the typical platforms and tools for payments, including:

- Credit/Debit Cards: Visa & Mastercard

- Crypto: BTC, ETH, USDT, etc.

- Bank: Wire transfers

The firm has set a $100 minimum for making withdrawal requests. The process may take up to 2 business days.

City Traders Imperium Commission & Costs

Understanding CTI's fee structure is essential for calculating your potential profits. The costs of this firm in all phases are as follows:

- Forex and Commodities: $5 per lot flat

- Indices: $0.5 per lot flat

- Crypto: $0 commission

This transparent commission model allows traders to easily calculate their costs and potential profits.

Educational Resources on City Traders Imperium Prop Firm

CTI goes beyond just providing capital; they provide dedicated sections for education on their website:

- Academy: Courses covering trading strategies, risk management, and psychology

- Webinars: Live sessions with experienced traders and market analysts

- Trading Tools: Account analytics, trading journal, and risk management calculators

- Community: Engage with fellow traders on the Discord server to share insights and strategies

You might find these resources useful, whether you are an experienced trader or a beginner.

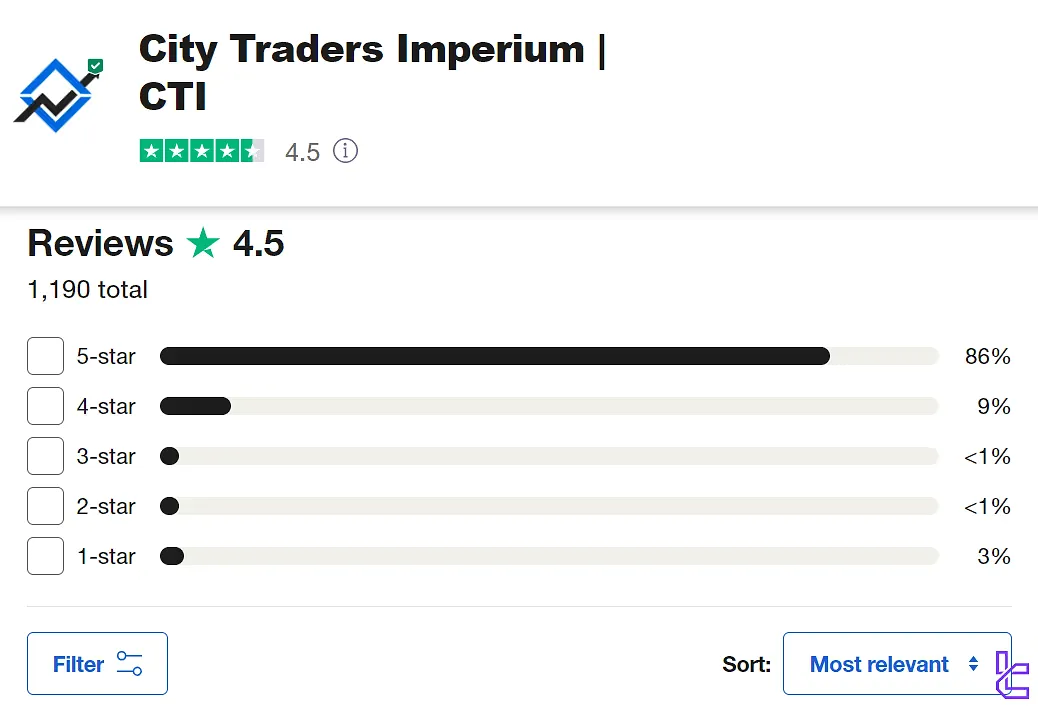

Trust Scores on Trustpilot & ForexPeaceArmy

Trust ratings of prop firms on credible websites usually indicate the level of users' satisfaction with them. CTI's Trust Scores:

- CTI Trustpilot: 4.5/5 based on over 1,150 reviews

- ForexPeaceArmy: 5/5 based on 2 scores

Overall, it seems to be a reliable firm, judged by these scores.

Customer Support and Services

The customer support department can play a vital role in a financial company, including prop firms. CTI Support Contact Methods:

Support Method | Availability |

Live Chat | Yes (Live chat on the website) |

Yes (through support@citytradersimperium.com) | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | Yes (Submittable on the homepage) |

FAQ | No |

Help Center | No |

No | |

Messenger | No |

The support team at this firm does not offer 24/7 services and answers your inquiries on these schedules:

- Monday to Friday from 08:00 to 18:00 GMT

- Saturday and Sunday from 09:00 to 15:00 GMT

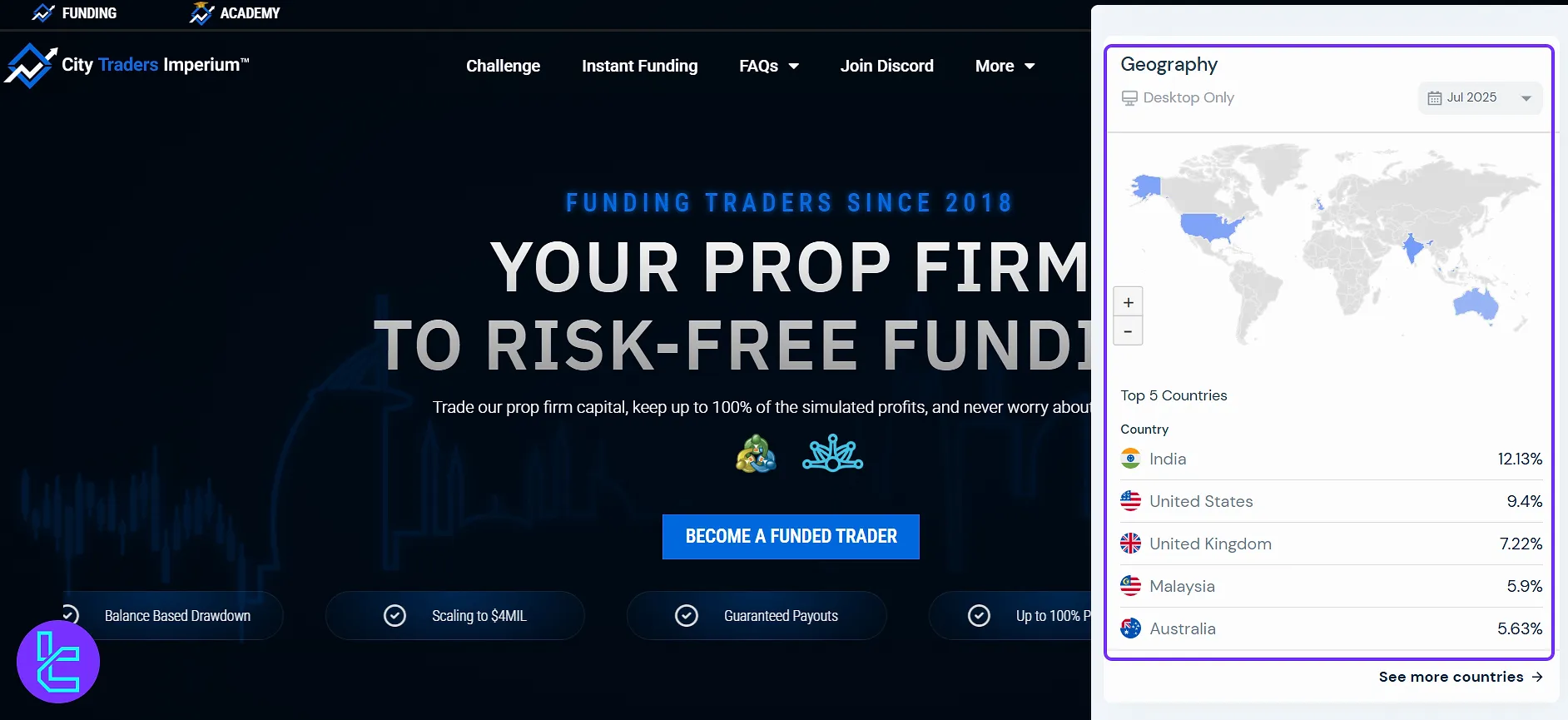

City Traders Imperium Demography of Users

City Traders Imperium attracts a diverse trading community with a strong global footprint. The platform’s user base spans developed and emerging markets, highlighting its wide international reach and balanced demographic distribution.

- India leads with 12.13% of total users;

- United States follows at 9.4%;

- United Kingdom holds 7.22%;

- Malaysia represents 5.9% of traders;

- Australia accounts for 5.63%.

What Channels Does CTI Have on Social Media?

You can stay connected with the prop firm through these channels on social media platforms:

Social Media | Members/Subscribers |

Around 15K+ | |

Over 32K | |

Around 10K+ | |

Over 34.2K | |

Over 1.2K | |

Over 22.6K |

Following CTI on social media can provide valuable insights and keep you updated on the latest offerings and promotions.

City Traders Imperium Compared to Top Prop Firms

This section is a comparison between CTI and other prop firms, considering several significant parameters:

Parameters | City Traders Imperium Prop Firm | |||

Minimum Challenge Price | $29 | $50 | €55 | $97 |

Maximum Fund Size | $4M | $2,000,000 | Infinite | $200,000 |

Evaluation steps | 1-Step, 2-Step | 1-Step, 2-Step | 2-Step | 1-Step, 2-Step |

Profit Share | 100% | 90% | 100% | 80% |

Max Daily Drawdown | 5% | 4% | 5% | 5% |

Max Drawdown | 10% | 6% | 8% | 10% |

First Profit Target | 10% | 5% | 10% | 5% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:30 | 1:5 | 1:100 | 1:100 |

Payout Frequency | Weekly | Bi-weekly | 14 Days | Bi-weekly |

Number of Trading Assets | 50+ | 100+ | 150+ | 40 |

Trading Platforms | MetaTrader 5 | Proprietary platform | Proprietary platform | MetaTrader 5, cTrader, Dxtrade |

Expert Suggestions

City Traders Imperium provides a monthly salary ranging from $12.5 to $500 in 1-phase and 2-phase evaluation accounts.

The leverage provided in the instant funding accounts is 1:10; it goes up to 1:30 in the other programs. The first profit target across all models is 8%.